DeFi Llama is a free analytics platform used to track decentralized finance (DeFi) activity across thousands of protocols and hundreds of blockchains. Since its launch in 2020, it has provided data on total value locked (TVL), protocol rankings, and chain performance, helping users analyze market trends and platform activity. This Phemex Academy guide explains DeFi Llama’s features, how to navigate its tools, and its role in monitoring DeFi markets.

What is DeFi Llama?

DeFi Llama is an open-source platform that aggregates data from thousands of DeFi protocols across hundreds of blockchains. It focuses on:

-

Total Value Locked (TVL): Assets staked or locked in DeFi protocols, indicating ecosystem scale.

-

Protocols: Rankings of platforms like Uniswap, Aave, or Curve Finance by TVL or category (e.g., decentralized exchanges, lending).

-

Chains: Metrics for Layer 1 (e.g., Ethereum, Solana) and Layer 2 (e.g., Arbitrum, Optimism) blockchains.

-

Oracles and NFTs: Usage of price feed services and non-fungible token trading volumes.

The platform is free, ad-free, and open to all, with a public API for integrating data into other tools. Its transparency makes it a reliable choice for analyzing DeFi.

Why Use DeFi Llama in 2025?

DeFi Llama helps users navigate DeFi markets in 2025 through:

-

Broad Coverage: Tracks thousands of protocols, covering nearly all DeFi activity.

-

Real-Time Data: Updates instantly to reflect market changes.

-

Open-Source Accuracy: Sources data from blockchains, verifiable via explorers like Etherscan.

-

Cross-Chain Insights: Includes both established and emerging chains, such as Layer 2 solutions.

These features support analysis of trends, protocols, and blockchain performance.

How DeFi Llama Works

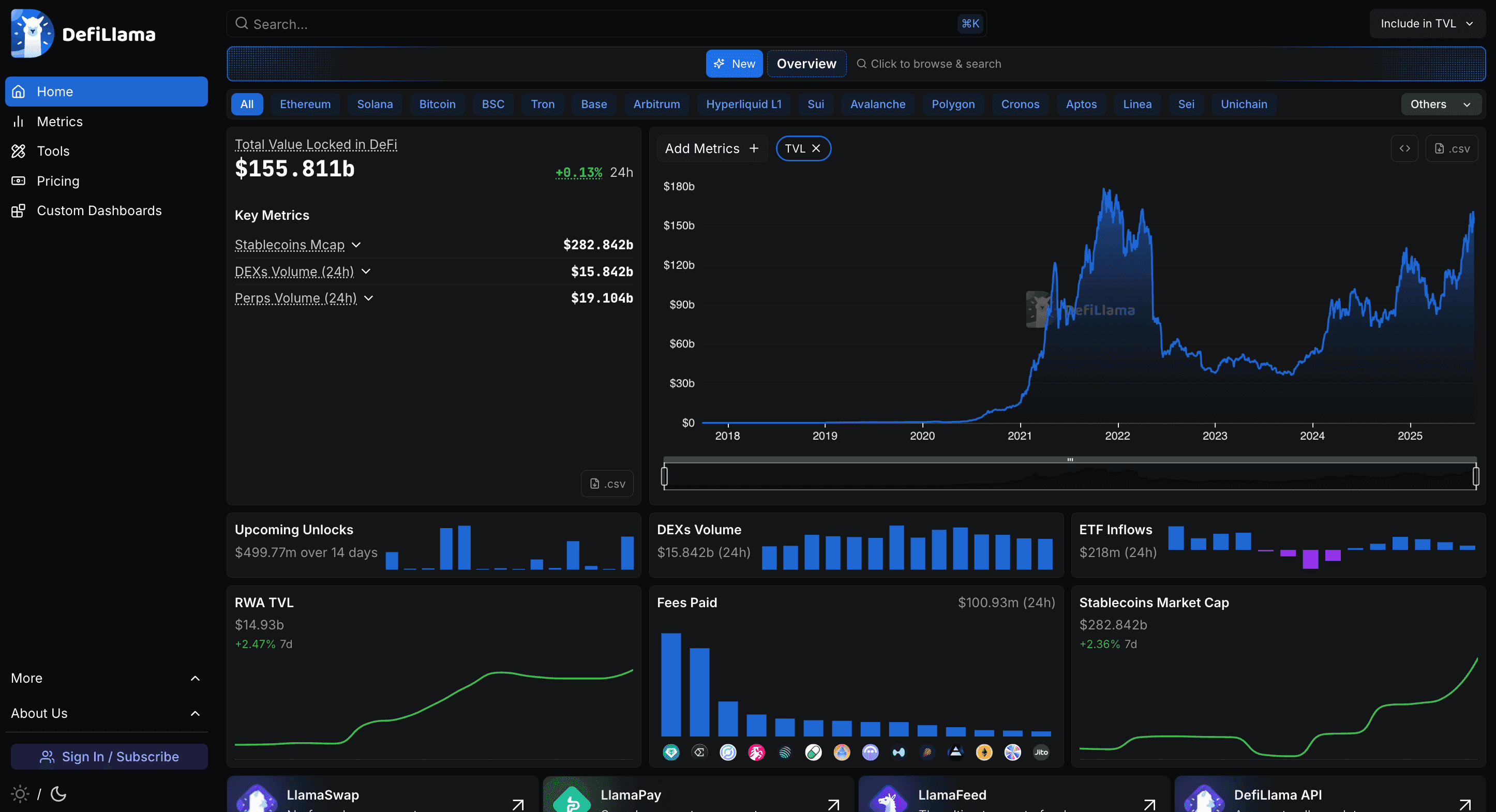

DeFi Llama collects data directly from blockchain protocols, ensuring reliability. It aggregates metrics from hundreds of Layer 1 and Layer 2 chains and thousands of decentralized applications (DApps), such as Uniswap for trading or Aave for lending. The platform’s dashboard and API provide access to TVL, protocol rankings, and yield data. Since its launch in 2020, DeFi Llama has tracked DeFi’s growth, with TVL reaching a peak of $255 billion in November 2021, per defillama.com, before stabilizing in 2025 due to market consolidation and increased Layer 2 adoption.

How to Use DeFi Llama: A Step-by-Step Guide

Navigating DeFi Llama is straightforward. Here’s how to use its tools:

-

Visit the Dashboard: Go to defillama.com for an overview of DeFi metrics, including TVL, protocols, and chains.

-

Explore TVL Rankings:

-

Select “Protocols” to view top platforms, sorted by TVL or category (e.g., DEX, lending).

-

Example: Check Uniswap’s TVL to assess its role in decentralized trading.

-

-

Analyze Chains:

-

Click “Chains” to compare TVL across blockchains like Ethereum or Solana.

-

Filter by Layer 1 or Layer 2 to focus on specific ecosystems.

-

-

Review Yield Data:

-

Use the “Yields” tab to explore returns from staking or farming pools.

-

Note risks, such as impermanent loss, when evaluating pools.

-

-

Study Historical Trends:

-

Within “Protocols” or “Chains,” select a platform or blockchain to view historical TVL and track performance over time.

-

-

Export Data:

-

Download CSV files for detailed analysis in spreadsheets or other tools.

-

Example: To compare decentralized exchanges, go to “Protocols,” filter by “DEX,” and sort by TVL to see which platforms lead in trading volume.

DeFi Llama Dashboard

The dashboard provides a snapshot of DeFi activity, showing:

-

TVL Rankings: Protocols ranked by assets locked, sortable by category or chain.

-

Chain Metrics: TVL distribution across blockchains, highlighting dominant networks.

-

Yield Insights: Returns from high-yield pools, useful for comparing opportunities.

In 2025, decentralized exchanges and lending platforms remain prominent. The dashboard’s filters help users focus on specific sectors or chains.

DeFi Llama Chains (Layer 1s and Layer 2s)

DeFi Llama tracks smart-contract-compatible chains that support DeFi applications. In 2025:

-

Ethereum: Hosts the largest DeFi ecosystem, with platforms like Uniswap and Aave.

-

Solana: Known for fast transactions and growing DeFi activity.

-

Layer 2s: Arbitrum and Optimism gain popularity for low-cost transactions.

Users can sort by chain to see which protocols operate across multiple networks, simplifying ecosystem analysis.

DeFi Llama Oracles

Oracles provide blockchains with external data, such as price feeds. DeFi Llama tracks their usage:

-

Chainlink: The leading oracle, supporting protocols like Aave with reliable price data.

-

Others: Band Protocol and API3 serve smaller platforms.

Oracles are critical for automated DeFi functions, such as lending or trading systems.

DeFi Llama Forks

Forks are modified versions of existing DeFi protocols. DeFi Llama tracks their TVL:

-

Uniswap: Frequently forked, with clones like SushiSwap and PancakeSwap.

-

Aave: Inspires forks for lending and borrowing platforms.

Forks often replicate successful features, offering alternatives for users to explore.

DeFi Llama Airdrops

Airdrops distribute free tokens to early users, a common DeFi practice. DeFi Llama lists potential airdrops by TVL:

-

Historical Examples: Uniswap and Ethereum Name Service (ENS) distributed significant token value.

-

2025 Potential: Protocols like LayerZero may launch tokens, based on TVL rankings.

This section helps users identify platforms with upcoming token distributions.

DeFi Llama NFTs

Non-fungible tokens (NFTs) are a key part of DeFi. DeFi Llama tracks their trading volume:

-

Leading Collections: Bored Ape Yacht Club and CryptoPunks dominate in 2025.

-

Market Trends: NFT trading volume stabilized after a 2024 peak, driven by platforms like OpenSea.

This data helps users understand NFT market dynamics within DeFi.

Frequently Asked Questions

What is DeFi Llama used for?

DeFi Llama tracks TVL, protocol rankings, chain activity, yields, oracles, and NFT volumes across thousands of protocols and hundreds of chains.

Is DeFi Llama free to use?

Yes, it’s fully free, ad-free, and requires no account or wallet connection.

How accurate is DeFi Llama’s data?

Data is sourced directly from blockchains and verified, ensuring high reliability.

What’s new on DeFi Llama in 2025?

Improved Layer 2 tracking and yield analytics enhance its functionality.

Conclusion

DeFi Llama is a comprehensive tool for monitoring decentralized finance in 2025, offering real-time data on thousands of protocols and hundreds of chains. Whether exploring DeFi trends or evaluating platforms, DeFi Llama equips users with reliable insights to understand the evolving DeFi landscape. For additional resources on blockchain analytics, visit Phemex Academy.