Bitcoin mining is the process by which new Bitcoin is created and transactions are verified and added to the public ledger (blockchain). In simple terms, mining involves using powerful computers to solve complex mathematical puzzles that secure the Bitcoin network. Successful miners are rewarded with newly minted bitcoins and transaction fees, which makes mining the economic engine that incentivizes network security. Mining is absolutely central to Bitcoin’s operation: it ensures that transactions are confirmed in a trustless, decentralized manner and that no single entity can control the ledger.

When Bitcoin was introduced in 2009, anyone with a normal computer could participate in mining. However, as Bitcoin’s popularity and price grew, mining became increasingly competitive. Today, Bitcoin mining is a highly specialized industry, dominated by professionals using dedicated hardware and cheap energy sources. This article will explain what mining is, how it works, and how it has evolved, as well as cover the current state of mining up to 2025 – including the latest developments, environmental considerations, and whether mining is still profitable for the average person.

What Exactly Is Blockchain Mining?

To understand mining, we first need to understand the blockchain, which is the foundational technology behind Bitcoin. A blockchain is essentially a distributed ledger that is shared among nodes (computers) in the network. Instead of a central authority updating balances, the blockchain relies on the collective agreement of participants. Transactions are grouped into blocks, and each block is cryptographically linked to the previous one, forming a chain (hence block-chain). This design makes the ledger tamper-evident: if someone tried to alter a past transaction, it would break the chain continuity, and the network would reject it.

Mining is the process that does two main things simultaneously:

-

Verifies transactions: Miners take pending transactions from the mempool and bundle them into a candidate block. They ensure that each transaction follows the rules (the sender has sufficient balance, the signatures are valid, etc.). In doing so, miners act as auditors – filtering out invalid or double-spend transactions before they are added to the ledger.

-

Secures the network through proof-of-work: To add their candidate block to the blockchain, miners must solve a computational puzzle (finding a hash below a certain target). This requires significant computing power and energy. The first miner to find a valid solution proves they did the necessary work. The solved block is then broadcast to the network, and other nodes verify that it’s correct. If valid, the block is added to the blockchain, and the miner earns the block reward.

This mechanism is known as Proof-of-Work (PoW). It’s the original consensus algorithm that Bitcoin uses to achieve trustless agreement. PoW makes it expensive to add a new block (in terms of electricity and hardware costs) but easy for anyone to verify the block’s validity. This asymmetry deters bad actors: to rewrite history or insert fraudulent transactions, an attacker would need to expend enormous resources to outcompete honest miners, which is prohibitively costly.

In summary, mining turns Bitcoin’s security into an economic competition. By following the rules and spending resources, miners are economically incentivized to maintain the blockchain’s integrity (they earn rewards) rather than attack it (which would require even more resources with no guarantee of success). The result is a self-sustaining, decentralized network where participants collectively enforce the rules and keep the ledger accurate.

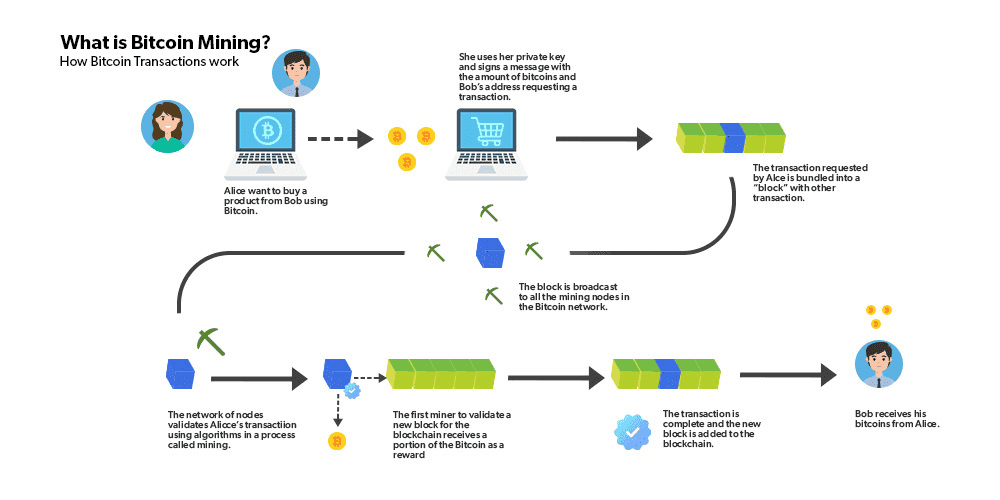

How Bitcoin Mining Works (Step by Step)

New Transactions Broadcast: When Bitcoin users make transactions (e.g., Alice sends 0.5 BTC to Bob), these transactions are broadcast to the network and sit in a pending state (the mempool) until miners pick them up.

- Miners Construct a Block: Miners, often in pools, select transactions from the mempool based on highest fees to form a block, which typically holds a few thousand transactions. The first transaction, called the coinbase, creates new bitcoins as a reward for the miner.

- Proof-of-Work Puzzle: Miners then perform proof-of-work, hashing the block header repeatedly to find a hash below the network's target. This process is trial and error, and difficulty is adjusted approximately every two weeks to ensure a block is mined roughly every 10 minutes.

- A Block Is Mined: When a miner finds a valid hash, they broadcast the block. Other nodes validate the block by checking the proof-of-work and transactions, and if everything is valid, the block is added to the blockchain.

- Reward and Confirmation: The miner receives a reward of new bitcoins (block subsidy) and transaction fees. As of 2025, the block subsidy is 3.125 BTC, and once the block is confirmed, all transactions included are also confirmed.

- Repeat the Process: Miners then start again for the next block, using the latest block's hash as input, continuously growing the blockchain. This process secures Bitcoin by making it nearly impossible to alter confirmed transactions without immense computational power.

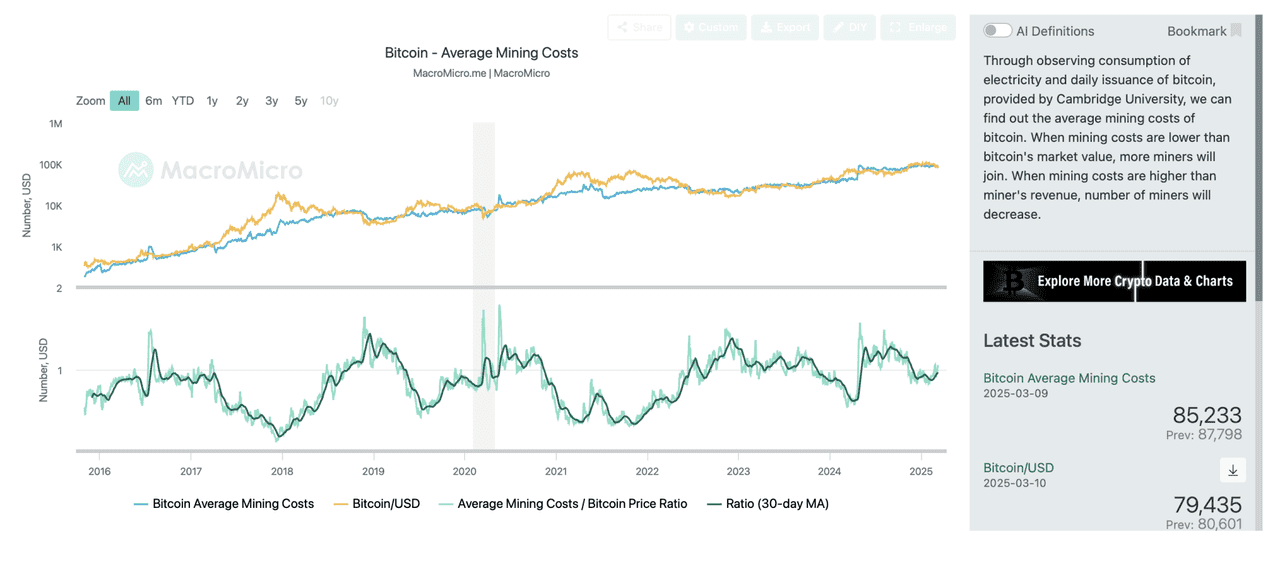

Bitcoin Mining Costs (source)

Mining Hardware and Evolution

In Bitcoin’s early days, mining was performed using CPUs (central processing units), but they were quickly outpaced by GPUs (graphics processing units) that offered faster hashing by parallelizing tasks. By 2010, hobbyists shifted to high-end gaming graphics cards, followed by FPGAs (field-programmable gate arrays) around 2011, and the introduction of ASICs (Application-Specific Integrated Circuits) in 2013. ASICs are purpose-built for SHA-256 hashing, making them significantly more efficient than CPUs or GPUs.

Today, Bitcoin mining predominantly utilizes ASIC miners, like the Bitmain Antminer and MicroBT Whatsminer, with modern models achieving hash rates of 100–150 terahashes per second (TH/s) at relatively low power consumption. This evolution has led to industrial-scale operations, moving mining from home setups to large warehouses, often located in areas with cheap electricity and cooler climates.

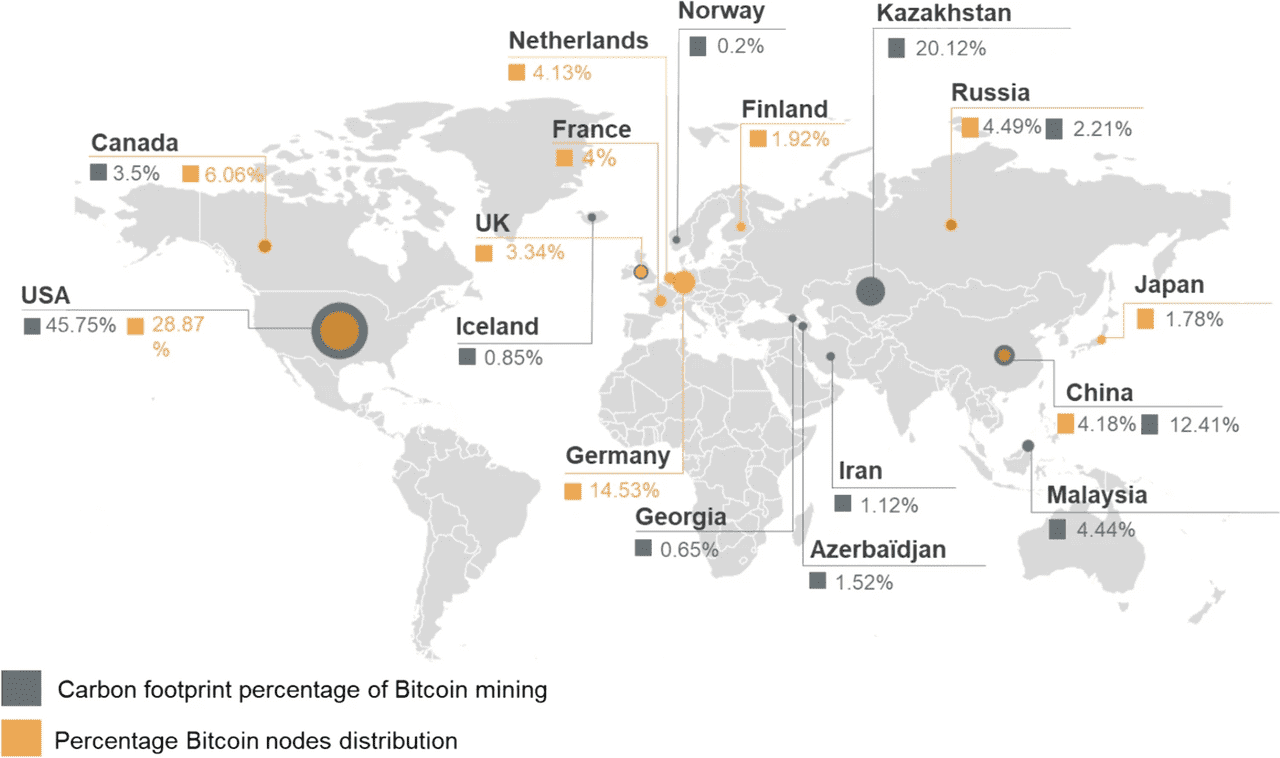

China was once a mining hotspot, but after banning cryptocurrency mining in 2021, many miners migrated to the U.S., particularly to states with favorable regulations and low energy costs. By early 2022, the U.S. held around 35-40% of the global hash rate, while China's share fluctuated due to covert operations. As of 2025, North America remains a major hub for Bitcoin mining, with a Cambridge study indicating that about 75% of reported activity is in the U.S. and 7% in Canada.

Mining pools: Due to the variance in mining (finding a block is probabilistic, like a lottery), miners – big and small – often join forces in mining pools. A mining pool is a cooperative group wherein miners share their hash power and split rewards pro-rata when any of them finds a block. This provides a steadier payout for participants. The pool operator typically takes a small fee. The majority of Bitcoin’s hash rate is aggregated in a dozen or so major pools (examples include Foundry USA, Antpool, F2Pool, ViaBTC, etc.). No single pool consistently has more than 25–30% of the hash power; the distribution changes, but to maintain decentralization and trust, both the community and pool operators have incentives not to let any one pool grow too dominant.

Mining Rewards and the Halving

Miners are rewarded for securing the network, but the reward is not fixed – it follows a preset trajectory defined by Bitcoin’s code. The block reward consists of two parts:

-

Block subsidy: New bitcoins minted with each block. This subsidy started at 50 BTC per block in 2009 and is programmed to halve roughly every 210,000 blocks (approximately every 4 years) in an event called the Halving. The subsidy dropped to 25 BTC in 2012, 12.5 BTC in 2016, 6.25 BTC in May 2020, and most recently to 3.125 BTC in the April 2024 halving. This will continue until it eventually reaches 0 (around the year 2140), at which point no more new bitcoins will be created (capped at 21 million BTC in total).

-

Transaction fees: Every transaction can include a fee paid by the sender. These fees incentivize miners to include transactions (especially when the block space is limited and there’s competition). Fees are variable; during times of congestion (for example, periods of high demand or during phenomena like NFT ordinals or meme coin crazes on Bitcoin in 2023), fees can spike and contribute significantly to miner revenue. In quiet periods, fees might be a small portion of the reward. Currently, fees usually make up a small percentage of the block reward, but at times they’ve spiked — for instance, in May 2023, fees temporarily accounted for a large portion of rewards as users bid up transaction costs.

After each halving, the block subsidy reduction means miners earn less BTC for the same work. This is by design – it controls Bitcoin’s supply inflation. However, halving also tends (historically) to be associated with bitcoin price increases, which can offset the lower reward in BTC terms. For example, in the year following the 2020 halving, Bitcoin’s price rose dramatically, which helped mining remain profitable even though the subsidy was 6.25 instead of 12.5 BTC. The 2024 halving cut rewards to 3.125 BTC; whether price increase will compensate is a major topic for miners. It does mean that mining margins often get squeezed right after a halving if the price doesn’t adjust upward quickly.

Bitcoin Mining Process (source)

The Environmental Impact and Energy Use

Bitcoin mining’s energy consumption is a contentious issue due to its energy-intensive nature, essential for network security. As of mid-2025, the Bitcoin network is projected to use about 10 gigawatts of continuous power, equating to 130–150 terawatt-hours (TWh) annually, similar to the electricity consumption of a medium-sized country. This represents approximately 0.4–0.6% of global electricity demand.

Criticism arises from concerns about carbon emissions related to the energy mix; in the early 2020s, much mining relied on coal, increasing CO₂ emissions. However, post-China’s mining ban in 2021 led to a shift towards more sustainable energy. A Cambridge study found that by 2025, sustainable energy sources constituted 52.4% of Bitcoin mining, with renewables and nuclear sources increasing significantly. Coal use dropped to about 9%, with natural gas becoming the primary energy source (38%).

Despite the increased use of clean energy, Bitcoin mining still generates significant carbon emissions, estimated at 40 million tonnes of CO₂ annually in 2025. Some mining operations utilize excess renewable energy, while others tap into stranded energy sources. In Texas, miners participate in demand response programs to stabilize the grid.

The environmental debate highlights that while Bitcoin's energy use is high, a growing proportion comes from renewable or wasted sources, directly tied to network security. Critics argue for alternative energy uses, whereas proponents see potential for investments in renewables. Regulatory scrutiny has emerged in response to energy concerns, with some jurisdictions imposing bans or restrictions on mining. Conversely, some regions, like El Salvador, promote mining for economic growth, utilizing geothermal power.

How to Start Mining Bitcoin (Can You?)

Mining Bitcoin as an individual is technically possible, but it's often not profitable without access to low-cost electricity and specialized ASIC hardware. Here’s a brief overview of what you need to start:

-

Hardware: You'll need one or more ASIC miners, which can cost hundreds to thousands of dollars. Newer models are more efficient, while older ones may be cheaper but less profitable due to higher electricity consumption. Additional infrastructure like power supplies, cooling systems, and a reliable internet connection is essential.

-

Electricity: Assess your electricity costs, as they can severely impact profitability. Many profitable miners pay around $0.05/kWh or less. Higher retail rates can lead to higher power costs than earnings from mining.

-

Mining Pool: Joining a mining pool is advisable since solo mining has very low chances of success. Pools share rewards based on contributions to block discoveries, offering a steadier income.

-

Mining Software: ASICs often come with firmware for configuration via a web interface. If using different hardware, software like CGMiner or BFGMiner can be utilized.

-

Setup and Maintenance: Set up your miner in a well-ventilated area to manage heat and noise. Regular maintenance, dust removal, and monitoring are crucial for optimal performance.

-

Wallet: Ensure you have a secure Bitcoin wallet to receive your earnings from the mining pool.

For many, cloud mining is a more accessible option, but caution is necessary as the industry has its share of scams. Always research providers thoroughly to avoid unprofitable contracts or potential scams. If a deal seems too good to be true, it probably is.

Bitcoin Global Environmental Impact (source)

Is Bitcoin Mining Profitable in 2025?

Bitcoin mining profitability is influenced by several factors, including Bitcoin's price, mining difficulty, equipment efficiency, and electricity costs. The 2022–2023 crypto winter saw a significant drop in Bitcoin’s price and rising hash rates, leading to the collapse of inefficient miners. By 2023, a recovery in Bitcoin’s price and newer, more efficient ASICs allowed profitable mining for well-managed operations. The April 2024 halving reduced miners' BTC revenue, but subsequent price increases helped stabilize earnings.

Larger mining operations, like Marathon Digital and Riot Blockchain, benefit from economies of scale and can negotiate better power deals. In contrast, small or home miners face challenges due to higher electricity costs, which can exceed the market price of BTC. Many find it simpler to buy Bitcoin directly rather than mine it.

Mining profitability also depends on external factors, such as network difficulty and hash rate. As more miners enter the space, competition increases, typically squeezing margins. By mid-2025, while mining difficulty is high, the value of Bitcoin has also risen, benefiting those with low operational costs and modern equipment.

Ultimately, Bitcoin mining can be profitable if approached efficiently and at scale, but it requires substantial investment and expertise. For individual enthusiasts, it may be more beneficial to focus on buying Bitcoin or investing in mining companies instead of direct mining.

Bottom line: Bitcoin mining has transformed from a hobbyist activity to a global industry. In 2025, it’s characterized by large-scale operations, sophisticated strategies, and a trend toward cleaner energy use – all underpinned by the incentive structure Satoshi set in motion. For the average person, mining is usually not the easiest way to obtain Bitcoin due to the competition and cost, but it remains the only way new bitcoins come into existence and is vital to Bitcoin’s decentralized enforcement of its rules. As Bitcoin continues to thrive, mining will continue to adapt, ensuring that the blockchain remains secure and robust for years to come.