Summary

- SushiSwap is a decentralized exchange (DEX) that uses liquidity pools and automated market makers to create liquid markets for ERC-20 token swaps.

- SushiSwap enables traders to swap Ethereum (ETH) and over 300,000+ other ERC-20 tokens. The liquidity for these exchanges is submitted by users using liquidity pair (LP) tokens.

- SushiSwap currently supports all major EVM-compatible networks including Ethereum, Polygon, Fantom, Arbitrum, and Avalanche.

In a centralized exchange (CEX) model, there’s an order book that matches buyers and sellers. The exchange employs market makers to ensure that there are counterparties to each order, keeping liquidity flowing through markets.

Decentralized exchanges (DEXs) use a different model. In a DEX, users create liquidity pair tokens (LPs) by submitting their own Ethereum or coins such as AVAX. For example, if we want to add $1000 worth of liquidity for Shiba Inu (SHIB) on Sushi, we can deposit $500 worth of SHIB and $500 worth of ETH or USDT. Traders can draw from each side of the pool and the LP provider gets a percentage of the fees.

SushiSwap is one such DEX.

What is SushiSwap?

SushiSwap (SUSHI) is a decentralized exchange that leverages liquidity pools and automated market makers (AMM) to create liquid markets for decentralized trading. It’s currently one of the most popular DEXs, with over $1.5 billion locked and $170 billion in annual trade volume.

SushiSwap was launched in 2020 as an Ethereum-exclusive crypto exchange. The main issue in decentralized trading, however, is that networks can experience congestion and gas fees (network fees for miners) can become prohibitively expensive for market makers, resulting in price slippage. In some cases, users can pay hundreds of dollars per trade.

As such, many competing L1s have emerged in recent years to compete with Ethereum and offer lower gas fees for users. Exchanges like SushiSwap that were built to cater to Ethereum users soon started supporting these newer L1s.

SushiSwap has since expanded to provide multi-chain support and is compatible with Polygon (MATIC), Fantom (FTM), Arbitrum, and Avalanche (AVAX). Users can quickly trade, buy and sell tens of thousands of tokens on the platform, and trade cross-chain using the same wallets such as MetaMask.

How Does SushiSwap Work?

SushiSwap works similarly to Uniswap. In a centralized exchange model, there’s an order book that matches buyers and sellers. The exchange employs market makers to ensure that there is always a counterparty to the order, keeping liquidity flowing through markets.

However, this model doesn’t work on a decentralized exchange. Ethereum‘s gas fees make it prohibitively expensive for market makers, and slow block times can result in price slippage.

How Does SushiSwap Yield Farming Work?

SushiSwap yield farming involves contributing liquidity and producing Liquid Pair (LP) tokens. Anyone can contribute liquidity to a pool that contains two evenly distributed tokens. Head to “Analytics -> Pools” to get an overview for pools you can join:

The top yield farming pools on SushiSwap.

Select any pair, such as SUSHI-WETH and you’ll be taken to the overview page:

Overview of the SUSHI/WETH pair for yield farming.

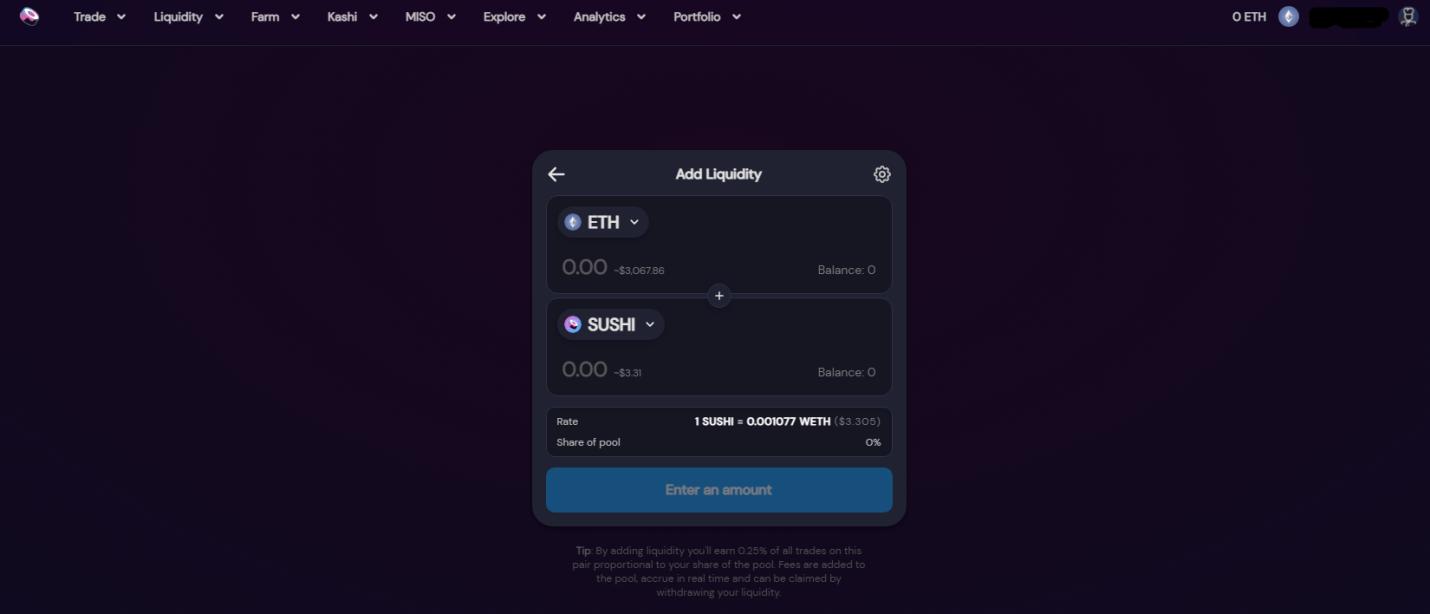

If you locate an interesting pair to provide liquidity, head to “Liquidity -> Add” at the top-left of the SushiSwap interface. This will allow you to add two-sided liquidity by depositing funds:

Add liquidity to get an LP token for farming.

Once the liquidity is deposited, the protocol outputs an LP token, representing the user’s stake in the pool. This token is similar to an ERC-20 token. Users can send their LP tokens to other wallets or burn them by sending them to the burn wallet.

When someone does use the pool to make a token swap, the existing liquidity ensures that their order can always be fulfilled instantly. Yield farmers are eligible for a share of 0.25% of transaction fees for everyone who swaps tokens using that pool.

A smart contract determines the price of the asset based on the balance of tokens in the pool. If the prices on SushiSwap deviate significantly enough from the market price on Uniswap or Phemex, arbitrage bots move in to start profiting from the difference and bring the price back to its market level.

How to remove liquidity from Sushiswap?

If a liquidity provider wants to return their stake from the liquidity pool, all they have to do is press the “Remove Liquidity” button and their tokens are returned to them. The LP token is then sent to the burn address and removed from existence–but the user is free to deploy another one.

There are risks to yield farming. If the price of one token moves faster than another (i.e. SUSHI rises from $3 to $10 while ETH stays at $2,500), the liquidity providers can experience losses. This is known as “impermanent loss” wherein yield farmers might receive less than they initially put in once they withdraw their tokens.

SushiSwap Sushi Bar

SushiSwap offers a feature called the Sushi Bar, where users can stake SUSHI crypto tokens for a share of even more SUSHI in rewards. Each transaction on the exchange incurs a 0.3% trading fee, where 0.25% goes to liquidity providers.

The remaining 0.05% goes into the Sushi Bar in the form of pool tokens. Each day, all of these Sushi crypto pool tokens are liquidated and used to purchase SUSHI tokens, which are then distributed to everyone staking SUSHI in the Sushi Bar.

The SushiSwap-Uniswap connection

SushiSwap’s close competitor is Uniswap, arguably the largest and most famous decentralized exchange. SushiSwap in fact started as a fork of Uniswap. However, unlike a straightforward fork, SushiSwap’s was a controversial one.

Before Uniswap had its own token, SushiSwap took the code of the Uniswap V2 protocol, and amended it to include its own token, SUSHI, that could be farmed by anyone providing liquidity to the Sushi exchange. The V2 protocol allowed any ERC-20 pairings without forcing each token to be paired with Ethereum (ex. SUSHI/USDT instead of SUSHI/ETH).

Even before the SushiSwap exchange had launched, the exchange founders used Uniswap’s liquidity pools to bootstrap liquidity for the SUSHI token using existing Uniswap pools. Once the exchange went live, the liquidity was migrated from Uniswap to SushiSwap. The SushiSwap exchange launch drained liquidity out of the Uniswap exchange in what is termed a “vampire attack.”

But before the “attack” completed, SushiSwap’s pseudonymous co-founder, Chef Nomi, sold off his SUSHI tokens for 38,000 ETH, worth around $14 million at the time, causing the price of SUSHI to crash. In order to save the project, the FTX exchange CEO and founder Sam Bankman-Fried was called on, who stepped into the fray and saved the day.

The control of SushiSwap was turned over to the community after that, who chose nine well-respected “multisig” users to make key decisions like approving changes and expenditures going forward. As for Chef Nomi, he later returned the tokens and made an apology via Twitter.

The story of SushiSwap has generated much debate about vampire attacks and centralized vs. decentralized control in the still nascent DeFi sector.

Read our head-on comparison of Ethereum’s most-popular DEXs:

How to Trade On SushiSwap?

Trading on SushiSwap starts with a three-step process:

- Get a wallet. MetaMask is the most used decentralized trading wallet.

- Buy crypto. Send Ethereum or other crypto to your MetaMask wallet to start trading.

- Swap coins. Head to the SushiSwap marketplace and exchange your ETH for coins on the platform.

The process is seamless and fast. Users around the world can trade on SushiSwap without registering–all they need is a wallet and crypto to get started. Head to the “Buy Crypto” page on Phemex, purchase crypto, and send it to your decentralized wallet.

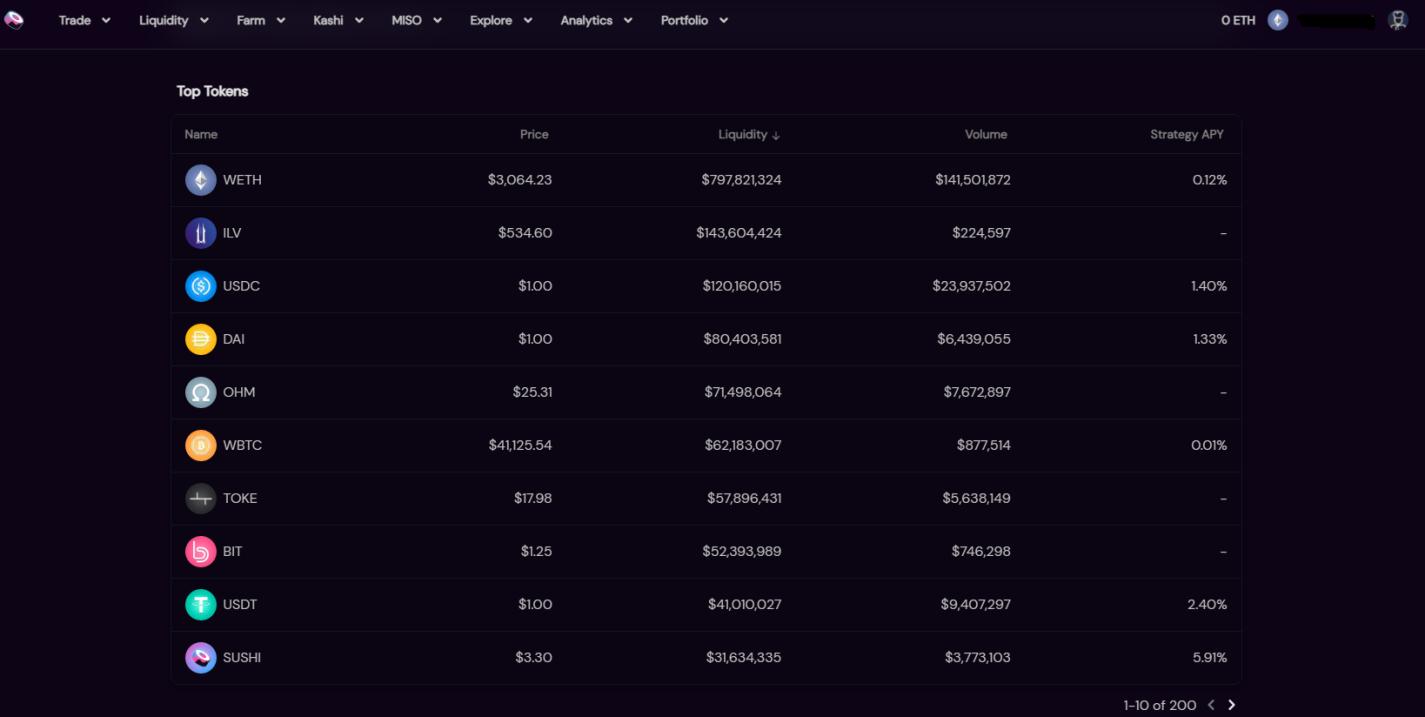

Visit the SushiSwap App page and head to “Analytics -> Tokens”. Here you can view the top ERC-20 coins and swap them for Ethereum and other networks:

The most traded coins on the SushiSwap exchange.

Left-click on a coin such as SUSHI and you’ll be taken to the exchange page:

Easily swap between coins on the exchange.

Connect your wallet at the top-right of the page and input your desires purchase amount in the parameter box. At the current exchange rate, 1 ETH gets us 829 SUSHI tokens. Approve the transaction and your tokens will be deposited in your wallet.

What Is SushiSwap Kashi Markets?

Kashi markets are SushiSwap’s native crypto borrowing and lending markets. This is a unique feature that allows users to lend and borrow similar to Aave (AAVE) or Compound (COMP). Users can earn APR (Annual Percentage Yield) by depositing their crypto and lending it to other users on the platform.

Navigate to “Kashi -> Lend” to get an overview of the most traded assets:

The Kashi Markets with supply and borrow APRs.

The total value locked (TVL) indicates how much money is tied up in those assets on the platform. The “Supply APR” is the annual profit a trader can make if they lend their crypto on the platform, and the “Borrow APR” is the interest rate a trader would pay if they lend on the platform.

Left-click on any asset and you’ll be taken to the Kashi exchange where you can borrow/lend and conduct other activity:

Decentralized lending & borrowing on the SushiSwap exchange.

The process is similar to swapping coins on the network. Once the user approves a transaction, their money will be sent to the community pool and they can withdraw their assets at will.

SushiSwap Coin (SUSHI) Price Analysis

The SushiSwap crypto coin is the governance coin of the platform. It is used to vote on feature proposals on the SushiSwap DAO (Decentralized Autonomous Organization). Users who hold SUSHI are similar to shareholders and their share of the tokens provides them higher voting power.

The value of the SUSHI token has largely followed the rollercoaster ride of the SushiSwap platform. It skyrocketed immediately upon being released, only to nosedive amid fears of a pump-and-dump scheme when Chef Nomi sold his share of SUSHI tokens in late 2020.

The SUSHI coin price performance since its initial launch.

Since December 2020, as demand for DEXs grew, so did the value of SUSHI. News of the Yearn Finance (YFI) merger and their cross-chain roadmap plans lead to further price appreciation in Q1 2021. SUSHI tripled in value in January 2020 and reached an all-time-high of $22.50 in March.

However, the SushiSwap price went sideways throughout 2021 and hovered in the $10 to $20 range for the rest of the year, before entering a bear market in Q1 2022. This price collapse can be attributed to a general downturn in the crypto markets, and the fact that governance tokens are not as needed as main layer-1 network tokens. These tokens tend to peak during strong bull markets.

SUSHI is currently trading at $1.21 with a market cap of $154 million and a circulating supply of 127 million.

How to Buy/Trade SUSHI?

Phemex offers both spot and contract trading for investors to choose from. However, for beginning crypto buyers, spot trading is recommended. To buy SUSHI on Phemex, follow the instructions below.

- The first step to buying cryptocurrency on Phemex is to go to the Phemex homepage, register for an account, and select Markets.

- On the Markets tab enter SUSHI into the search bar on the top right, immediately after, the SUSHI/USDT trading pair will appear below – select Trade to move on to the next step.

- You will then be redirected to the Phemex trading platform for the SUSHI/USDT pair. To do a simple spot trade we recommend doing a market order where you can buy SUSHI at the market price. To do so, select Market, enter the amount of USDT you want to buy of SUSHI, and click Buy SUSHI.

Conclusion

SushiSwap has a reputation for being the largest Uniswap competitor since it gained traction in the DEX market after its initial release in 2020. In December 2020, SushiSwap merged with Yearn Finance, combining development resources and integrating liquidity pools.

In 2021, SushiSwap implemented features that made it a cross-chain DEX using Moonbeam, which is a bridge parachain to the Polkadot ecosystem, and introduced algorithmic stablecoins. With that, SushiSwap went from being an all-Ethereum exchange to a cross-chain exchange. Sushi developers implemented features that made other L1’s compatible with the exchange such as Fantom, Arbitrum, and more.

Along the way, the team has improved on its functionality by adding new DeFi features such as farming, lending, and borrowing. The SushiSwap development team is anonymous, but notably, they’ve retained their reputation as a top-tier decentralized exchange and the coin is highly sought after. It seems likely that they’re going to remain a top player in the DeFi exchange even if Ethereum is replaced by other blockchains because they’ve demonstrated they can adapt to the growing competition.

Read More

- UniSwap vs. SushiSwap: Which Is the Better DEX Platform?

- What is Uniswap (UNI): A decentralized exchange

- What is PancakeSwap: A DEX and Automated Market Maker

- What is QuickSwap: A Scalable DEX and AMM

- What Are Atomic Swaps and Why Do They Matter?

- What is BakerySwap: A DEX and NFT Marketplace

- What Is A Decentralized Exchange (DEX) in Crypto?

- What is dYdX: An Order Book Decentralized Exchange (DEX)