Key Takeaways

-

DYOR Defined: "Do Your Own Research" (DYOR) is the golden rule of crypto investing, urging traders to independently verify a project's potential rather than relying on hype or rumors.

-

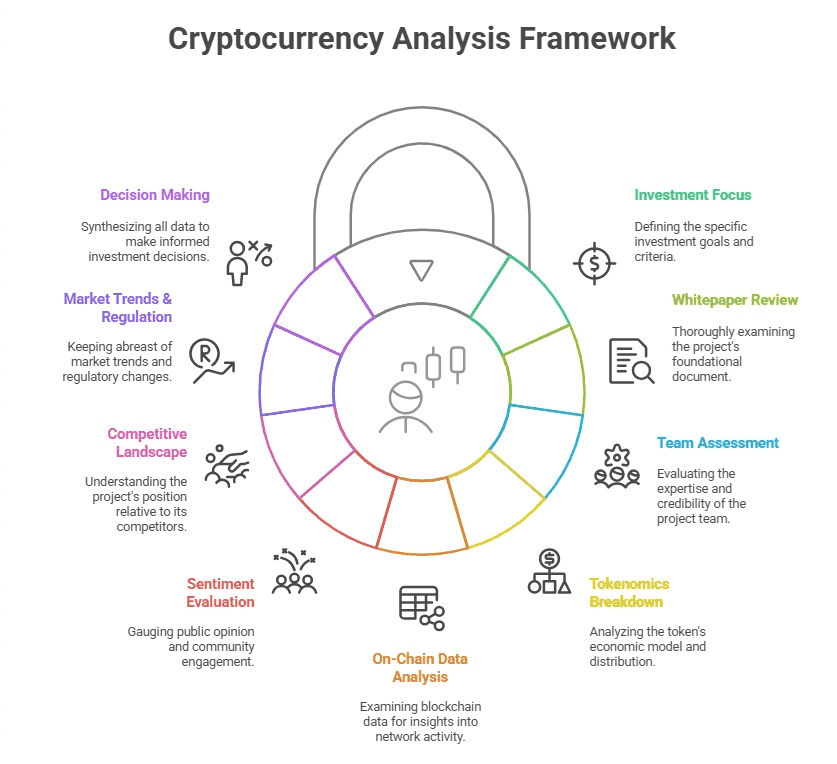

The Three Pillars of Analysis: A comprehensive research strategy combines Fundamental Analysis (assessing intrinsic value), Technical Analysis (studying price charts), and On-Chain Analysis (evaluating blockchain data).

-

Risk Management: Thorough research is the most effective defense against common industry risks, including rug pulls, Ponzi schemes, and sophisticated phishing attacks.

-

Empowered Investing: By using professional tools and spotting red flags early, investors can identify undervalued opportunities and take full accountability for their financial decisions.

In the vast and fast-moving world of cryptocurrency, “DYOR” (Do Your Own Research) has become a golden rule for investors and traders alike. DYOR means taking the initiative to thoroughly research and understand a crypto project before investing – rather than relying on hype or tips from others. This principle is essential because the crypto market is largely unregulated and rife with both high-reward opportunities and high-risk pitfalls. By doing your own research, you can make informed decisions, reduce risks, and avoid falling prey to scams.

In this comprehensive guide, we’ll explain why DYOR is so crucial in crypto investing, discuss the types of research you should conduct (fundamental, technical, and on-chain analysis), recommend useful tools and resources for crypto research, and outline how to spot red flags and avoid scams. Whether you’re a beginner or intermediate crypto enthusiast, this guide will empower you to independently evaluate crypto projects with confidence – a vital skill in 2026’s dynamic crypto landscape.

What Does DYOR Mean and Why Is It Important in Crypto?

DYOR stands for “Do Your Own Research.” In simple terms, it’s a reminder not to blindly trust third-party advice or “hot tips” about coins or tokens. Instead, you are encouraged to verify information yourself and analyze a project’s merits before investing. This concept emerged early in crypto circles as a response to rampant misinformation and speculative frenzy. Here’s why DYOR is especially important in crypto investing:

Empowerment and Risk Reduction: Conducting your own research puts knowledge and control in your hands, reducing reliance on rumors or the opinions of others. The more you understand a project, the better you can assess its strengths, weaknesses, and risks. This helps avoid uninformed bets on projects that turn out to be fraudulent or fundamentally flawed. Essentially, DYOR minimizes the chance of getting caught in scams or poor investments by ensuring you know what you’re getting into.

Informed Decision-Making: With thorough research, you make well-informed investment decisions based on evidence and analysis rather than hype. You can critically evaluate a project’s technology, team, and market before committing funds. This often leads to more confidence in your decisions and less anxiety, since you understand why you’re investing in something. In the long run, informed decisions contribute to better outcomes and a more sustainable investment strategy.

Identifying Hidden Opportunities: DYOR can help you discover promising projects early – sometimes before they become widely known. By diving deep into research and forming your own criteria for what makes a project valuable, you might spot undervalued gems that others overlook. Many successful crypto investors attribute their big wins to doing independent analysis rather than following the crowd. In a market where the next big thing often starts as an obscure project, this is a significant edge.

Protection Against Scams: Unfortunately, crypto has seen countless scams – from Ponzi schemes to rug pulls – especially in past years. DYOR is your best defense. With good research practices, you can recognize warning signs of scam projects and avoid them. Common red flags include anonymous teams, guaranteed returns, vague or plagiarized whitepapers, low liquidity, and excessive hype (we’ll explore these more in a later section). Being diligent can save you from losing money to fraudulent schemes.

Long-Term Success and Accountability: By consistently researching your investments, you become more knowledgeable and adaptable to market changes. You’ll be better at spotting trends, rebalancing your portfolio, and timing entries or exits. Moreover, DYOR instills a sense of personal accountability – you take responsibility for your choices instead of blaming bad tips or market “manipulation”. This mindset fosters discipline and continual learning, which are key to long-term success in the volatile crypto market.

In short, DYOR in crypto means empowering yourself with knowledge. It’s about taking control of your financial decisions and not outsourcing your thinking to others. The crypto realm moves quickly, and misinformation or FOMO (fear of missing out) can lead to costly mistakes if you’re not careful. By doing your own research, you become a savvy participant who can seize opportunities and steer clear of traps. As the saying goes, “Invest in knowledge before investing in coins.”

Types of Crypto Research: Fundamental, Technical, and On-Chain

Effective crypto research isn’t one-dimensional – it spans multiple disciplines. Primarily, investors examine projects from fundamental, technical, and on-chain perspectives. Each type of research offers different insights:

1. Fundamental Analysis (Project Fundamentals)

Fundamental analysis involves evaluating the core intrinsic qualities of a crypto asset to judge its long-term viability or true value. Rather than looking at price charts, you delve into the project’s business and technology. Key aspects to research include:

Project Vision and Use Case: Identify the problem the project solves and its need in the market. A solid use case signals potential, while vagueness raises concerns.

Whitepaper and Documentation: Read the whitepaper for clarity on goals and technology. A well-written whitepaper is crucial; lack of documentation is a red flag.

Team Background: Investigate the project's team. Transparency and relevant experience are important. An anonymous team raises warnings, although exceptions exist.

Tokenomics: Analyze the token’s supply, issuance, and utility. Tokenomics is crucial; high concentration of ownership can signify risks, while unclear purpose may indicate a lack of fundamental value.

Market Metrics: Consider market capitalization, trading volume, and network usage. Metrics like Total Value Locked (TVL) are crucial for assessing platform viability, especially in DeFi.

Community and Adoption: Assess community engagement and partnerships. Active interest on platforms like Reddit and Telegram reflects genuine support, while lack of users may signify weak fundamentals.

The goal of fundamental research is to decide whether a project is undervalued or overvalued relative to its actual potential. By understanding the fundamentals, you can avoid chasing purely hyped projects with no substance, and instead focus on those with strong teams, technology, and use cases that might thrive long-term.

2. Technical Analysis (Price and Trend Analysis)

Technical analysis (TA) involves examining price charts and statistical indicators to identify patterns or trends, aiming to predict future price movements. This type of research doesn’t consider what a coin should be worth (intrinsic value), but rather focuses on market sentiment and momentum as reflected in the chart. Key elements of technical analysis include:

Identifying Trends: Traders assess various time frames to determine market trends: uptrend (higher highs and lows), downtrend (lower highs and lows), or sideways movement (range-bound). Understanding trends helps inform trading decisions, such as buying dips in an uptrend or avoiding long positions in a downtrend.

Chart Patterns: Analysts recognize recurring patterns (e.g., triangles, head-and-shoulders) that may indicate potential breakouts or reversals, reflecting the psychology of buyers and sellers.

Technical Indicators: There are many mathematical indicators applied to price and volume data to generate trading signals. Some widely used indicators for crypto trend analysis are:

-

Moving Averages (MA): Help identify trend direction, with crossovers signaling potential trend shifts.

-

MACD (Moving Average Convergence Divergence): A momentum indicator showing the relationship between two moving averages, signaling bullish or bearish momentum.

-

RSI (Relative Strength Index): Measures price changes to determine if an asset is overbought (above 70) or oversold (below 30), with implications for trend confirmation and potential reversals.

Volume Analysis: Volume signals conviction behind price movements; high volume during price changes suggests stronger trends. Tools like On-Balance Volume (OBV) help track volume’s impact on price.

Other indicators and tools (like Bollinger Bands, trend lines, Fibonacci retracement levels, etc.) are also part of technical analysis, each giving different insights into volatility, support/resistance, and potential price targets.

The aim of technical analysis is to find optimal entry and exit points for trades by reading the market’s “body language,” so to speak. Unlike fundamental analysis, TA assumes all known fundamentals are already reflected in the price; thus, by analyzing price/volume patterns, one can anticipate what traders might do next. In crypto, where speculation often drives short-term price swings, technical analysis is extremely popular. However, it’s important to remember that no indicator or pattern is right 100% of the time – TA deals in probabilities, not certainties. Good technical analysts also practice risk management (like setting stop-loss orders) because even the best analysis can be invalidated by unexpected market moves.

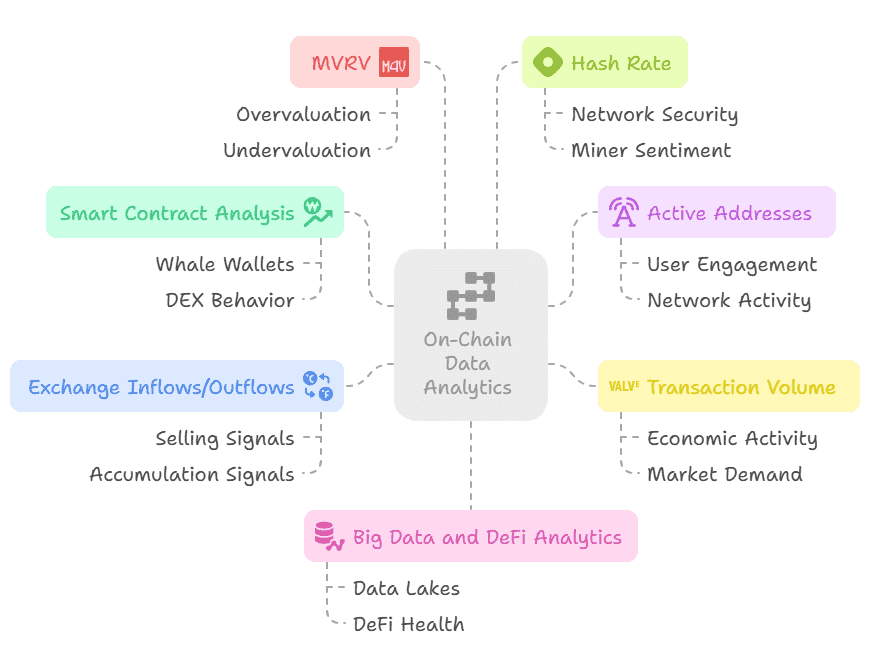

3. On-Chain Analysis (Blockchain Data Insights)

On-chain analysis is a relatively new but powerful form of research unique to crypto. It involves examining data recorded on the blockchain itself – such as transactions, wallet holdings, miner activities, etc. – to glean insights about network usage and investor behavior. Since blockchains like Bitcoin and Ethereum publish all transactions on public ledgers, savvy analysts can track how coins are moving in real-time.

Key aspects of on-chain research include:

Network Activity Metrics: These metrics measure blockchain usage, such as active addresses, transaction counts, and on-chain transaction volume. A rise in active addresses often signals increasing adoption, while high transaction volumes indicate strong demand.

Ownership Distribution: On-chain data reveals coin ownership concentration. Analysts track movements from cold wallets to exchanges (suggesting selling pressure) versus transfers to personal wallets (indicating accumulation). A historical trend shows Bitcoin becoming more decentralized as it shifts to everyday investors.

Mining and Network Health: For proof-of-work coins like Bitcoin, metrics like hash rate and miner revenues indicate network security and sentiment. An increasing hash rate suggests mining confidence, while rising sales from miners can put downward price pressure.

DeFi and Smart Contract Analytics: On-chain analysis is crucial for DeFi projects and smart contracts, utilizing metrics like Total Value Locked (TVL) to gauge crypto locked in protocols, along with NFT transfer data and other blockchain-specific statistics.

Sentiment and Behavioral Indicators: Higher-level indicators like MVRV (Market Value to Realized Value) and NVT (Network Value to Transactions) measure market sentiment, with MVRV indicating profit/loss among holders and NVT assessing network valuation relative to transaction volume.

On-chain analysis is powerful because it provides real-time transparency into what’s happening with a crypto asset under the hood. It’s like peering into the flow of money in the economy of a cryptocurrency. For example, if on-chain data shows that a huge number of BTC is being withdrawn from exchanges during a price dip, it suggests big players are buying and taking possession, which could be bullish. Or if stablecoin inflows to exchanges spike, it might mean people are ready to buy crypto with those stablecoins – another bullish sign.

However, interpreting on-chain data can be complex and often requires context. It’s an evolving field, and analysts sometimes disagree on what certain trends mean. The data is also vast – which is why specialized on-chain analytics tools (like Glassnode, Nansen, etc.) have become popular to help parse it (we’ll list some in the Tools section). Used in conjunction with fundamental and technical analysis, on-chain analysis can complete the 360° research view of a crypto asset. Savvy investors often combine all three types of analysis – fundamental, technical, and on-chain – to form high-conviction investment theses.

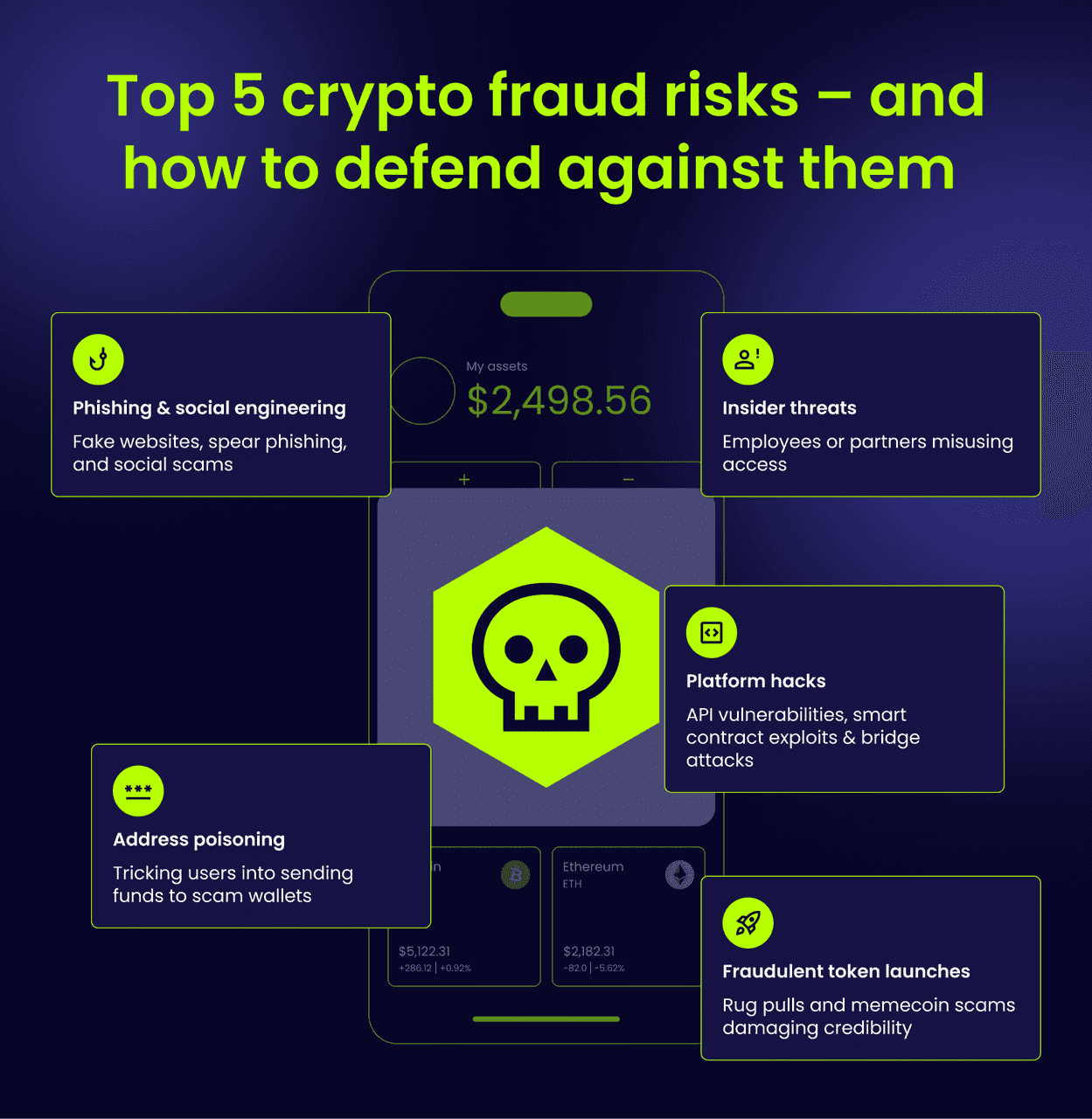

How to Spot Crypto Scams and Red Flags (Avoiding the Pitfalls)

One of the most important reasons to DYOR is to protect yourself from scams. The crypto boom has, unfortunately, been accompanied by a boom in fraudulent schemes. In 2024, crypto scam revenue hit record highs – an estimated $10–12 billion – as scammers used ever more sophisticated tactics, including social engineering like “pig butchering” and even AI deepfakes. It’s critical to stay vigilant. Here are common red flags and how to recognize a potentially unsafe crypto project:

Anonymous or Unproven Team: Be wary if the team behind a project is not publicly identifiable. Lack of transparency can indicate fraud. Research their experience—unknown teams or those with a history of scams are risky. Conversely, credible teams with positive references are reassuring.

Unrealistic Promises of Returns: Be skeptical of projects boasting guaranteed profits with no risk. Claims of “guaranteed 10x” are red flags. Legitimate projects clarify that returns are not guaranteed and often include disclaimers about risks.

Poor or Plagiarized Documentation: Evaluate the quality of a project’s documentation. If the whitepaper is vague, error-ridden, or plagiarized, it's a warning sign. Legitimate projects invest effort in clear explanations and detailed documentation.

Aggressive Marketing and Hype-Only Focus: Excessive promotion, especially without substance, is a red flag. Be cautious of projects that focus on marketing rather than product development.

Lack of Public Code or Audit: For projects involving smart contracts, check if their code is open-source and if they've undergone reputable security audits. Missing audits can indicate potential risks.

Low Liquidity and Suspicious Trading Patterns: Be cautious of tokens with low liquidity trading on obscure exchanges. Unnatural price spikes or restrictions on selling are significant warning signs.

Overemphasis on Referrals or MLM Structure: Projects that push referral bonuses or resemble multi-level marketing schemes can be scams. If the value lies in recruiting rather than providing a real product, it’s likely a pyramid scheme.

Context of the Market: Sometimes, timing can be a red flag. If a flurry of nearly identical projects appear overnight (for example, dozens of “AI token” projects launching in the wake of an AI hype wave, or innumerable food-themed DeFi tokens during DeFi summer), a large number of them could be opportunistic cash grabs.

Another contemporary scam method is the “pig butchering” scheme , which often plays out individually rather than via a project. In pig butchering, scammers (usually via social media or dating apps) build a fake relationship with someone and gradually convince them to invest in a fake crypto platform or token, often even showing fake profit dashboards to lure more money, until they rug everything. The defense here is to never trust random “investment opportunities” or “brokers” who approach you online, no matter how friendly or successful they appear. Always use reputable, known platforms for buying crypto and treat unsolicited offers as suspect.

Finally, stay updated on scam trends. New fraud tactics emerge all the time. For instance, by 2024 scammers started using AI to clone voices or create deepfake videos of crypto founders to trick people. The U.S. FTC and other agencies regularly issue alerts about common crypto scams (like phishing emails, fake tech support scams involving crypto ATMs, etc.). The more you know about what’s out there, the better you can avoid it.

Crypto Scams (source)

Conclusion: Empower Yourself Through Research

In the cryptocurrency world of 2026, knowledge truly is power. “DYOR – Do Your Own Research” isn’t just a catchphrase; it is a crucial practice that can spell the difference between investment success and disaster. By researching thoroughly, you take control of your financial decisions rather than getting carried away by hype or misinformation. You learn to evaluate each project on its merits – scrutinizing fundamentals, analyzing price trends, and even peering into blockchain data – to build a well-rounded understanding before putting your money at risk.

Remember that no matter how many experts you follow or how many “surefire tips” you hear, ultimately you are responsible for your investments. The crypto market can be extremely rewarding, but it’s also unforgiving to the complacent. Scams and shaky projects will always exist, but by applying the DYOR principles we’ve outlined – checking teams, reading whitepapers, using reliable data sources, and staying alert to red flags – you can avoid the traps and focus on opportunities that align with your risk tolerance and goals.

To summarize some actionable DYOR tips:

-

Always verify claims made by a project via multiple sources (don’t take things at face value).

-

Use the tools at your disposal: coin trackers, explorers, analytics platforms, forums – they provide the data and context you need.

-

Keep learning: The crypto space evolves quickly. What’s cutting-edge today may be outdated next year. Continuous learning through reputable educational content (like this article and others) will keep your knowledge fresh.

-

Don’t succumb to FOMO: If you miss one opportunity, don’t worry – the crypto market regularly presents new ones. It’s better to miss a rally in a coin you don’t understand than to jump in blind and get burned.

-

Trust but verify – even if a friend or influencer you trust likes a project, do your own due diligence to see if it truly checks out.

By following the DYOR mindset, you’ll invest with more confidence and peace of mind. Crypto will always have an element of volatility and speculation, but solid research tilts the odds in your favor by ensuring you’re not going in blind. In essence, invest in understanding before investing your money. The time and effort you put into researching will pay dividends in helping you navigate the exciting yet complex crypto landscape.

In the end, whether you’re evaluating the latest DeFi protocol, a new layer-1 blockchain, or a meme coin, don’t forget: do your own research! Armed with knowledge, you stand a much better chance at reaping the rewards of the crypto revolution while sidestepping its hazards. Stay curious, stay skeptical, and stay informed – your future crypto self will thank you.