Total Value Locked (TVL) in crypto refers to the aggregate value of digital assets that are currently locked or staked in decentralized finance (DeFi) protocols. In simpler terms, it measures how much capital is deposited in a DeFi application’s smart contracts at a given time. TVL includes all the coins and tokens users have deposited into a protocol’s pools – for example, tokens staked for rewards, funds supplied to lending or borrowing platforms, or liquidity provided to decentralized exchanges. It does not count yields or future interest, only the current value of those deposited assets. TVL has emerged as a key indicator of DeFi’s growth and usage, analogous to how market capitalization is used to gauge the size of a cryptocurrency’s market. As of late 2025, tracking TVL has become as common as tracking market caps when assessing the health of the crypto DeFi ecosystem.

How Is TVL Calculated?

Calculating TVL is relatively straightforward: sum up the value of all assets locked in a given protocol (or across all protocols) denominated in a base currency (usually USD). This involves multiplying the quantity of each type of token locked by its current market price, then adding them together. Because crypto asset prices fluctuate, TVL values continuously change even if no one deposits or withdraws funds – a rising token price will increase TVL, while a price drop will decrease TVL, even if the underlying token amount is the same. For instance, if a DeFi platform has 10,000 ETH locked and the price of ETH jumps, the USD-denominated TVL of that platform will also jump, and vice versa.

Different types of DeFi applications might calculate TVL in slightly different ways, but the concept is consistent. TVL generally counts all active liquidity in the protocol’s smart contracts – this can include funds in lending pools, decentralized exchange liquidity pools, staking vaults, insurance funds, and so on. It’s a broad measure intended to capture how much user value is currently entrusted to the platform. An important nuance is that some value can be counted multiple times across protocols (for example, a token deposited in Protocol A that then automatically invests in Protocol B could be counted in both A’s and B’s TVL). Despite such caveats, TVL is useful for a high-level view of capital flow in DeFi.

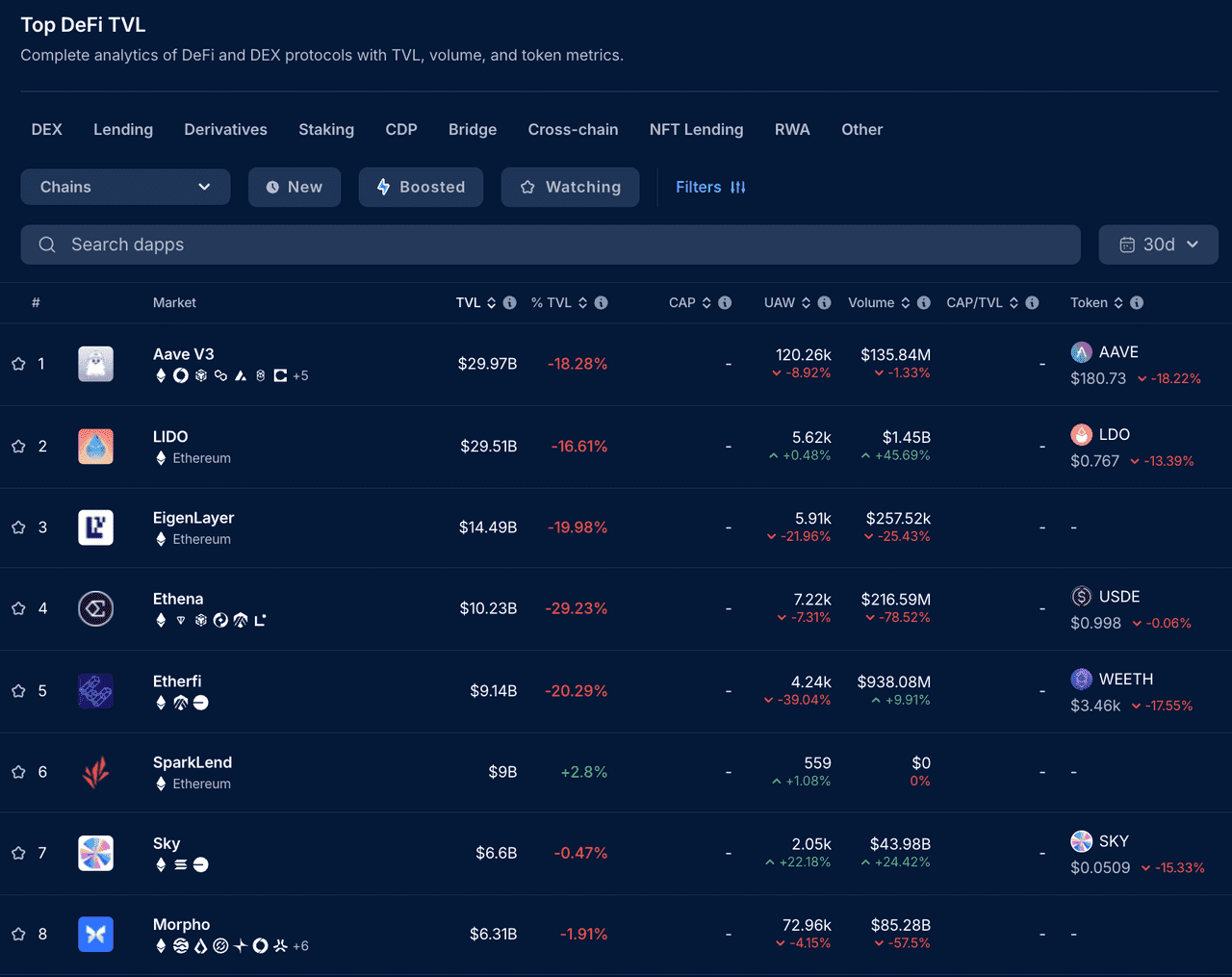

Top DeFi Protocols by TVL (source)

Why Does TVL Matter in DeFi?

TVL is often seen as a barometer of a DeFi project’s popularity and trustworthiness among users. A higher TVL means more users are willing to lock up their assets in the protocol, indicating confidence in the platform’s yield opportunities, security, and utility. In essence, TVL answers the question: How much money is the world willing to commit to this DeFi application right now? A rising TVL over time signals that a project is attracting new deposits (either from new users or existing users adding more funds), which suggests growing adoption and liquidity. High liquidity, in turn, benefits the platform’s users – for example, deeper liquidity pools on a decentralized exchange mean traders can execute large swaps with less slippage, and big lending pool reserves mean borrowers have ample funds to borrow against.

Another reason TVL matters is that it helps compare DeFi projects. Investors and analysts frequently look at TVL alongside other metrics to evaluate protocols. For example, by comparing a project’s market capitalization to its TVL (often called the MC/TVL ratio or simply TVL ratio), one can gauge how the market values the project relative to the actual funds it controls. This TVL ratio is computed as Market Cap ÷ TVL. A lower ratio (especially well below 1.0) can indicate the protocol’s token might be undervalued relative to the amount of value locked in the system, whereas a very high ratio could imply overvaluation. In DeFi, a TVL ratio below 1 is often seen as favorable (similar to a low price-to-book ratio in stock analysis), suggesting the project’s token price is low compared to the value of assets in its contracts. However, this is just a heuristic and must be considered alongside other factors like the project’s revenue, risk, and token economics.

TVL also provides insight into user engagement quality. While metrics like market cap can be boosted by speculative token buying (which might include many passive investors who hold the token but don’t use the platform), TVL reflects active usage. If a DeFi platform’s token has a high market cap but the protocol itself has a very low TVL, it means relatively few holders are actually using the token within the platform – a potential red flag. Conversely, a high TVL indicates that many token holders or users are actively utilizing the platform’s services (staking, lending, providing liquidity, etc.), which often signals a more robust and sticky user base.

TVL in Different Types of DeFi Platforms

TVL is a versatile metric used across various categories of DeFi, and its interpretation can differ slightly by context:

-

Lending/Borrowing Protocols: In platforms like Aave or Compound, users deposit assets into liquidity pools that borrowers can draw from. TVL in this context represents the total supply of assets deposited in the protocol’s pools (which equals the sum of all outstanding loans plus remaining liquidity). A high TVL means lots of assets are available to borrow, indicating user trust in the protocol’s lending services. For example, Aave – one of the largest lending protocols – historically has had a TVL in the tens of billions of dollars.

-

Decentralized Exchanges (DEXs): DEXs such as Uniswap, Curve, or SushiSwap have liquidity pools funded by users (liquidity providers). Here, TVL refers to the total value of tokens locked in all the exchange’s pools. Higher TVL means deeper liquidity for trading pairs, which generally leads to better trade execution and lower slippage for traders. It also reflects that many users are willing to lock their funds to earn trading fees. Major DEXs often account for a significant share of overall DeFi TVL.

-

Yield Aggregators and Vaults: These are platforms like Yearn.Finance or Convex that automatically deploy user deposits across various strategies to earn yield. TVL for yield aggregators indicates how much capital is being entrusted for automated yield farming. A large TVL suggests users find the service’s strategies competitive and trust the smart contracts to manage their funds.

-

Staking and Liquid Staking Protocols: An emerging category since 2021-2022 is liquid staking (e.g., Lido, Rocket Pool, EtherFi), where users stake cryptocurrency (like ETH) to secure networks and receive a derivative token. These protocols’ TVL is the total staked assets. By late 2025, liquid staking platforms have grown huge – for instance, Lido Finance’s TVL (mostly staked ETH) is on the order of tens of billions of dollars, making it one of the top DeFi platforms by TVL. This growth underscores how proof-of-stake blockchain yields have attracted enormous deposits.

-

Derivatives and Others: Some newer platforms, like certain derivatives trading protocols or reserve-backed stablecoins, also report TVL to indicate collateral locked. For example, a synthetic asset platform might show TVL as the total collateral backing the synthetic assets.

It’s important to note that TVL is specific to DeFi. Traditional layer-1 blockchains or tokens without DeFi functionality don’t have a TVL figure (unless one calculates the total value locked in their entire ecosystem’s DeFi apps). TVL is best used to compare DeFi apps within the same category or to gauge one chain’s DeFi activity versus another. For instance, you might compare the TVL of two decentralized lending protocols to see which one users entrust more value to, or sum up the TVL of all DeFi apps on Ethereum vs. on Solana to compare DeFi adoption across blockchains.

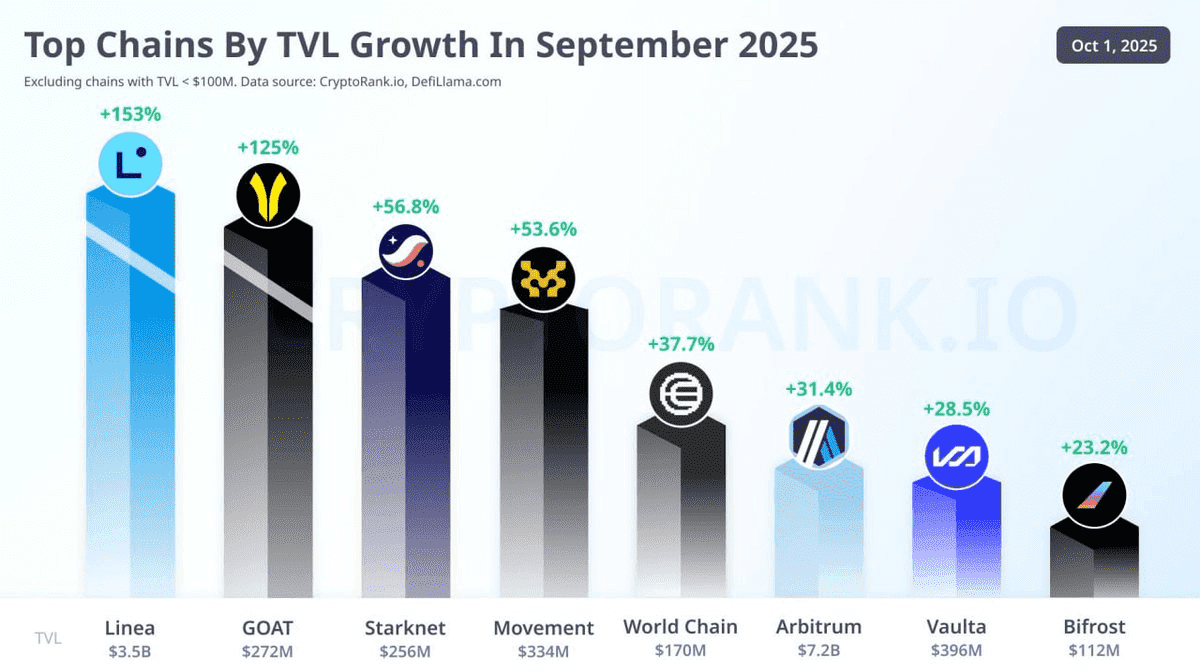

TVL Percentage Growth in September 2025

Trends in TVL: Growth and Fluctuations (2017–2025)

TVL as a metric came into use around 2017-2018 when the first DeFi projects (like MakerDAO) launched. Back in 2017, the entire DeFi ecosystem’s TVL was extremely small – roughly $100–200 million by some estimates. As DeFi started gaining traction (often cited as starting mid-2020 in the “DeFi summer”), TVL skyrocketed. At the start of 2020, combined DeFi TVL was only about $0.6 billion (600 million USD). One year later, by early 2021, it had grown to tens of billions, and by the end of 2021 the total TVL across all DeFi protocols reached the hundreds of billions. According to analytics firm DeFiLlama, DeFi TVL soared from roughly $16 billion in January 2021 to an all-time high around $200 billion by late 2021. This explosive growth was driven by the bull market in crypto prices and a massive influx of users seeking yields on platforms like Uniswap, Aave, Curve, and others.

However, TVL is not guaranteed to rise forever – it can shrink just as dramatically. In May 2022, a major stress test occurred: the collapse of the Terra/LUNA ecosystem. Terra’s Anchor protocol had attracted a huge TVL (over $15 billion at its peak) by offering ~20% APY on the UST stablecoin – but this model proved unsustainable. When Terra’s algorithmic stablecoin UST imploded, it triggered a chain reaction of capital flight across DeFi. Roughly $100 billion in TVL was wiped out almost overnight in May 2022 as panicked investors withdrew funds from many platforms. By October 2022, total DeFi TVL bottomed out around $42 billion (down nearly 80% from the peak) amid the broader crypto bear market. This episode underscored that TVL can be very volatile – it depends on both crypto asset prices (which were falling in 2022) and user confidence (which was shaken by protocol failures and insolvencies).

After the 2022 crash, TVL gradually recovered alongside crypto markets. Throughout 2023 and 2024, DeFi quietly rebuilt. Notably, new innovations like liquid staking gained traction, and several layer-2 networks and alternative layer-1 blockchains started capturing DeFi activity. By mid-2025, DeFi TVL had rebounded robustly. In fact, in the third quarter of 2025, DeFi TVL surged about 41% as crypto markets rallied, crossing $160 billion in total value locked for the first time since the 2022 crash. By September 2025, combined DeFi TVL reached approximately $170 billion, essentially erasing the losses from the Terra-era bear market. This recovery has been more measured and organic compared to the heady rush of 2021, with a focus on sustainable yields rather than unsustainable incentives.

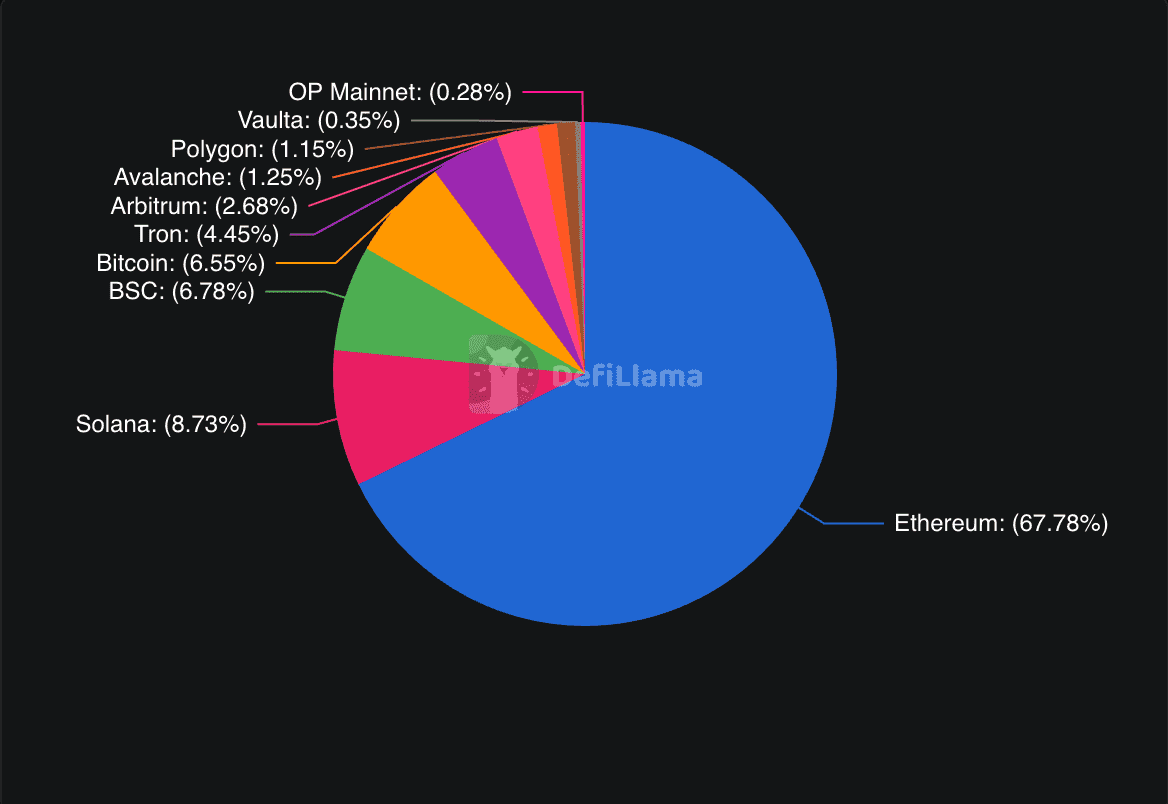

Which blockchains and protocols lead in TVL? Ethereum has consistently maintained the lion’s share of DeFi TVL. As of late 2025, Ethereum accounts for roughly 50–60% of all DeFi capital by itself. Ethereum’s dominance comes from its rich ecosystem of DeFi apps – many of the largest protocols (Maker, Aave, Uniswap, Lido, etc.) run primarily on Ethereum. But other chains have grown their piece of the pie. Solana is now the second-largest DeFi ecosystem, recently hosting around $14.4 billion in TVL, thanks to its high-speed network attracting lending and NFT liquidity. BNB Chain (formerly Binance Smart Chain) is another major player with roughly $8 billion TVL spread across its DeFi apps. Tron, Avalanche, Arbitrum (Ethereum’s layer-2), and newer chains like Base and Sui also contribute significant TVL, each in the low-single-digit billions or higher. This indicates a multi-chain DeFi world – while Ethereum is still king, users are willing to lock value in various ecosystems offering unique advantages (be it faster transactions or specific program incentives).

On a protocol level, the top DeFi dApps by TVL in 2025 include: Aave (a lending platform which at one point held over $30 billion in TVL); Lido (liquid ETH staking, ** ~$28B TVL**); MakerDAO (which issues the DAI stablecoin against locked collateral); EigenLayer (an innovative “restaking” protocol); and DEXs like Curve and Uniswap. In fact, by mid-2025 Aave and Lido together made up a substantial portion of the total TVL, reflecting how much ETH and other assets users have staked or lent on those platforms. The DeFi industry remains top-heavy – a handful of the largest protocols command a majority of the total TVL. Back in 2021, it was noted that the top 10 projects held over 80% of all DeFi TVL, and a similar concentration persists today (though new leaders have emerged). This concentration underscores that user trust and network effects accrue strongly to the leading DeFi platforms.

Limitations and Risks of Relying on TVL

While TVL is a useful metric, it is not a holistic indicator of a project’s value or risk. First, TVL says nothing about how those locked assets are being used or what returns they earn – it’s purely a static snapshot of deposits. A protocol might have high TVL but low actual usage efficiency or profitability (for example, a yield farm that attracts “hot money” with high rewards might stack up TVL that leaves as soon as rewards dry up). Always consider other metrics like trading volume, number of users, and protocol revenue in conjunction with TVL to assess engagement.

TVL can be gamed or inflated under certain circumstances. Protocols sometimes offer aggressive liquidity mining incentives (rewarding users with new tokens for depositing funds) which can temporarily boost TVL. These incentive-driven deposits may not represent long-term user commitment – they are often referred to as “mercurial” or sticky only as long as rewards last. If a project’s TVL spiked due to token rewards, it could just as quickly evaporate when those rewards end or if the token price crashes.

Another limitation is the price dependency of TVL. A large portion of DeFi TVL is denominated in volatile assets (ETH, BTC, etc.). A broad crypto market downturn can shrink TVL dramatically even if users don’t withdraw, simply because asset prices fall. Thus, not all TVL changes indicate users adding or removing funds – some is just market fluctuation. It also means comparing TVL over time needs to account for price differences (one technique is to measure TVL in a stablecoin like USD or to normalize by market cap).

Security risks are a major caveat when interpreting TVL. Paradoxically, a high TVL can make a protocol a lucrative target for hackers. If too much value is concentrated in a single platform, a single exploit could lead to outsized losses. Unfortunately, the DeFi sector has seen many hacks and rug-pulls. In the first half of 2025 alone, over $2.5 billion was lost to DeFi hacks and scams. A high TVL doesn’t guarantee a protocol is safe – sometimes it can be the opposite, painting a bigger bullseye on it. Always evaluate whether the platform’s code has been audited and how battle-tested it is. Similarly, consider decentralization and admin controls – if a single team can potentially change the code or access funds, the trust assumptions are very different than a truly decentralized protocol. TVL as a number won’t reflect these qualitative security factors.

Finally, TVL doesn’t account for liability or leverage. For example, if users deposit one asset to borrow another, TVL counts the deposit but not the debt. Some protocols might “double count” value (e.g., a yield aggregator’s TVL might include funds that are also counted in the lending protocol it invested in). And TVL isn’t useful for comparing to traditional companies – it’s more like “assets under management” rather than revenue or profit. A project with lower TVL could still generate more fees and be more profitable than a higher-TVL rival if it uses capital more efficiently.

TVL by Networks (source)

The Current State of TVL in 2025 and Outlook

As of November 2025, TVL is once again near all-time highs in absolute terms, reflecting a broad resurgence of interest in DeFi. Ethereum’s upcoming network upgrades and a more optimistic regulatory climate have contributed to renewed capital inflows. DeFi platforms today emphasize sustainable yield (for instance, major lending protocols offer single-digit APYs that are more reasonable and stable, instead of the unsustainable 20%+ yields of the 2021 era). This suggests that the TVL now may represent “stickier” long-term investments rather than purely speculative farming.

That said, challenges remain. Security is still the elephant in the room – the industry knows that one more major exploit or collapse could erode confidence and send TVL plunging again. Additionally, TVL growth might plateau unless new use cases emerge to attract the next wave of users. There’s also an increasing discussion of alternative metrics beyond TVL. Some propose looking at metrics like “total active users,” protocol revenues, or total transaction volume to get a fuller picture of DeFi platform health. For lending protocols, utilization rate (how much of the TVL is lent out) can matter, and for DEXs total trading volume or fees might be more directly tied to value.

In summary, TVL remains a crucial metric for DeFi that provides an instant sense of how much value is flowing into or out of decentralized apps. It has proven useful for comparing platforms and tracking the growth of the ecosystem as a whole. From virtually nothing in 2017 to over $170 billion in 2025, the rise of TVL tells the story of DeFi’s emergence. But anyone using TVL to inform decisions should remember its context and limitations. It is one piece of the puzzle – best used in combination with other indicators and sound research on what a protocol is doing with all that locked value. As the space matures, we may see more nuanced metrics, but for now, TVL is likely to remain as commonly cited as market cap when discussing the vibrancy of crypto networks.