Key Takeaways

Decentralized Finance (DeFi) is an umbrella term for a movement that recreates traditional financial services -such as lending, trading, and insurance - on blockchain networks without the need for centralized intermediaries like banks.

Technological Foundation: The sector is powered by smart contracts, which are self-executing code on the blockchain that automatically enforce agreement terms.

Radical Transparency: Unlike traditional finance, all DeFi transactions and smart contract codes are publicly viewable on-chain, enabling users to verify funds and audit protocol activity in real-time.

Real-World Asset (RWA) Integration: A major 2026 trend is the tokenization of traditional assets like U.S. Treasuries and real estate, allowing institutions to access crypto liquidity and offering users safer, non-crypto yields.

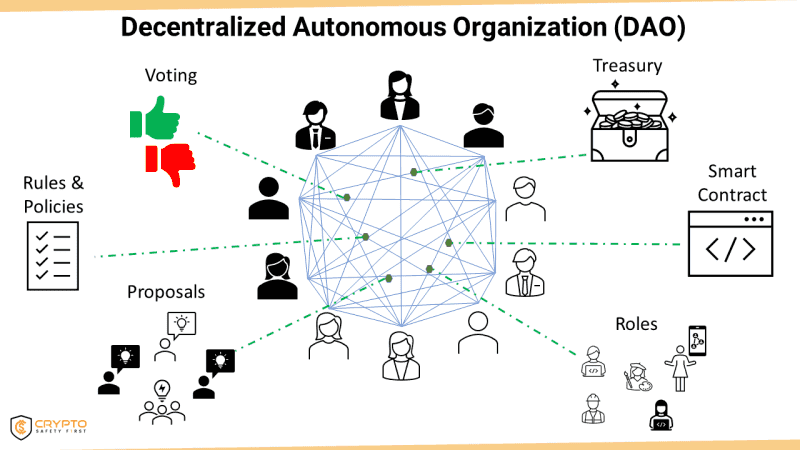

Governance via DAOs: Many protocols are governed by Decentralized Autonomous Organizations (DAOs), where community members use governance tokens to vote on key proposals and platform updates.

Decentralized Finance, or DeFi, is an umbrella term for a broad movement to recreate and transform traditional financial systems – like lending, trading, insurance, and more – on the blockchain. Instead of relying on banks or intermediaries, DeFi uses smart contracts and decentralized protocols to provide financial services in a peer-to-peer, open, and permissionless manner. In simpler terms, DeFi is finance by the people, for the people - powered by code and accessible to anyone with an internet connection.

In this comprehensive guide, we’ll explore what DeFi is, how it works, its key applications and platforms (from decentralized exchanges to lending to liquid staking), the benefits and risks, and the latest trends shaping DeFi through 2026. By the end, you’ll have an up-to-date understanding of why DeFi is often called the future of finance and how it’s impacting both the crypto world and traditional finance.

DeFi in a Nutshell: Key Features and How It Works

At its core, DeFi refers to a collection of financial applications built on blockchain networks – predominantly Ethereum initially, though now also on others like Binance Smart Chain, Solana, Polygon, and more. These applications (often called dApps – decentralized apps) perform financial functions but without centralized institutions. Instead, they utilize smart contracts, which are self-executing code on the blockchain that enforce the terms of an agreement automatically.

Key Characteristics of DeFi:

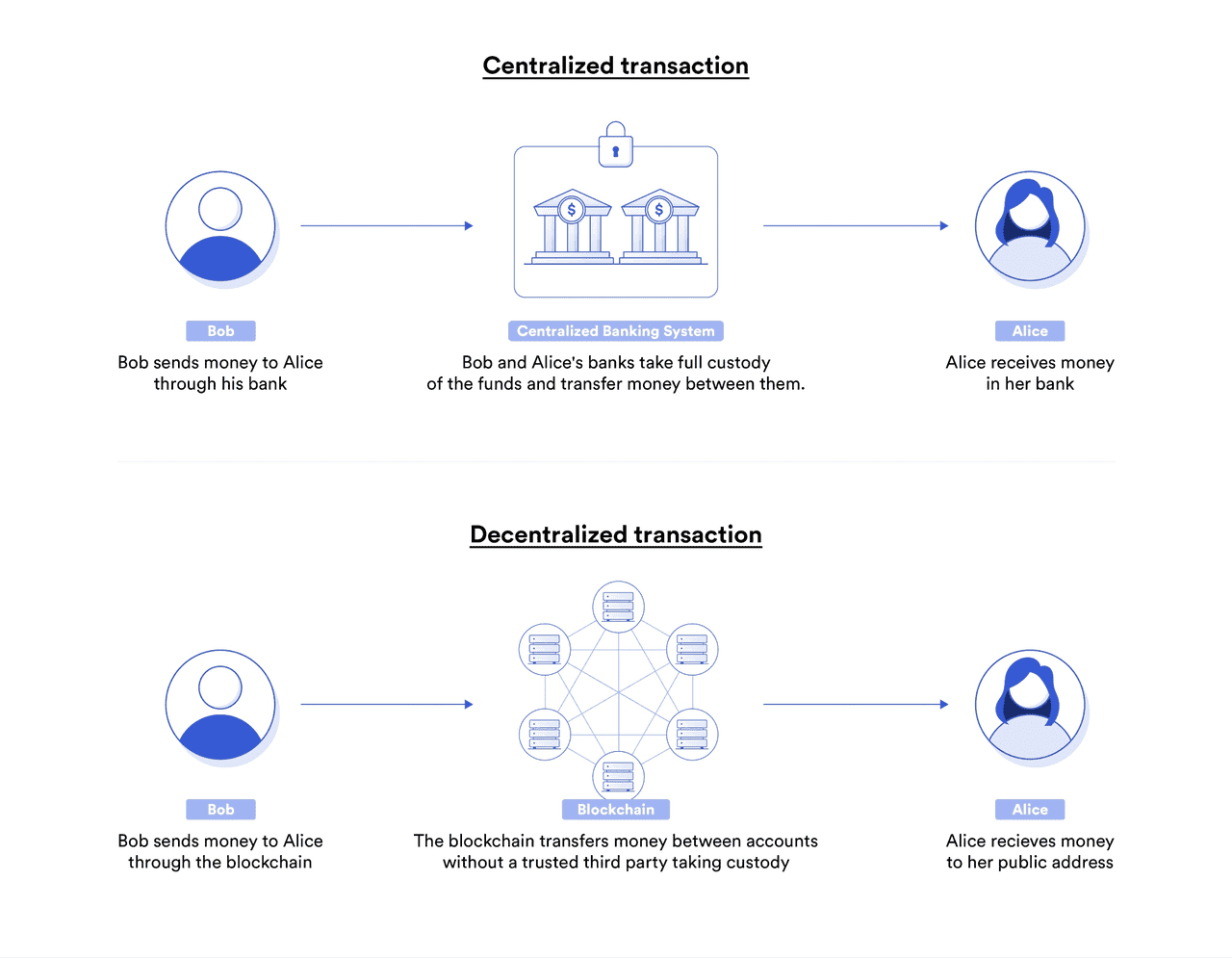

Decentralized and Trustless: No single company or authority controls a DeFi protocol; it’s typically governed by code or by a distributed network of users (often via governance tokens and DAOs). Users don’t have to trust a middleman – they trust the code and network consensus. For example, if you lend money on a DeFi platform, a smart contract holds and manages that loan, not a bank clerk.

Permissionless Access: DeFi platforms are generally open to anyone in the world. You usually just need a crypto wallet to connect – no credit checks, no KYC (though that’s evolving in some cases), no need to be a certain type of investor. This means DeFi is accessible to the unbanked or those restricted from traditional finance. As long as you have internet and crypto collateral, you can participate.

Transparency: All transactions and smart contract codes on public blockchains are transparent and viewable by anyone. This fosters a level of openness; for instance, you can verify how a protocol is using funds, or track large transactions (everything is on-chain). Smart contracts are often open-source, and activities are logged on the blockchain ledger for auditability. Contrast this with traditional finance where a lot happens behind closed doors.

Composability: Sometimes called “money legos.” DeFi protocols are often designed to integrate with each other like pieces of Lego. For example, you could use a token you earned from one platform (say a liquidity provider token from Uniswap) as collateral in another platform (like Aave) to borrow funds. This stackability allows rapid innovation and the creation of complex financial products by combining simpler ones. It’s akin to being able to plug any fintech service into another seamlessly, which in TradFi is very hard.

Non-Custodial: In DeFi, you typically remain in control of your assets. You interact via your wallet (MetaMask, Ledger, etc.), and unless you explicitly lock assets in a contract, you can withdraw anytime. You’re not depositing into a bank that holds your money; you’re putting tokens into a contract you can monitor. However, one caveat: when you put assets into a smart contract, you are trusting that contract’s code not to have bugs or malicious logic (so “trustless” in terms of human intermediaries, but you must trust the technology or at least the community of users and auditors that vouch for it).

Centralized vs. Decentralized Transactions (source)

Key DeFi Sectors and Top Platforms

DeFi can be categorized by the type of service. Let’s break down major categories, explaining what they do and mentioning notable platforms (as of 2025):

How they work: DEXs typically use Automated Market Maker (AMM) designs. Users provide token pairs to pools, becoming liquidity providers (LPs) who earn fees from trades (e.g., Uniswap's 0.3% fee distribution).

Benefits: Anyone can create a pool to list a token, and it's non-custodial, meaning funds stay with the user. DEXs operate globally, 24/7, without KYC.

Risks/Downsides: LPs face impermanent loss when token values fluctuate. Arbitrage traders can profit at LPs' expense, and large trades may cause slippage due to limited liquidity.

Top Platforms: Key DEXs include Uniswap (Ethereum), Curve Finance (stablecoins), SushiSwap, PancakeSwap (BSC), and Balancer (multi-asset pools). By 2025, DEXs expanded to Layer 2s (like Optimism) and other Layer 1s (like Solana’s Serum) and introduced aggregators like 1inch for better pricing.

Real example: Swapping ETH for a new token on Uniswap adjusts the pool’s balances automatically, affecting the token's price based on the trade.

Lending and Borrowing

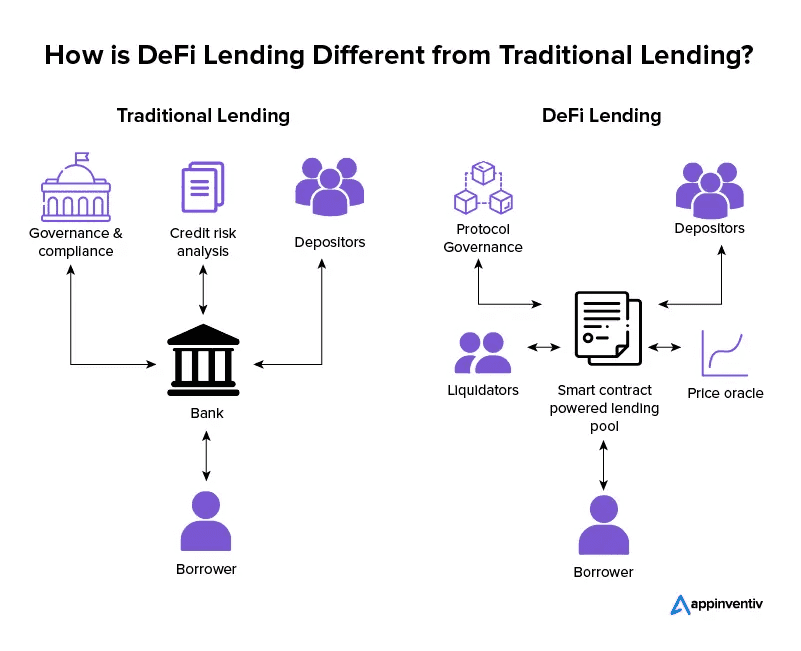

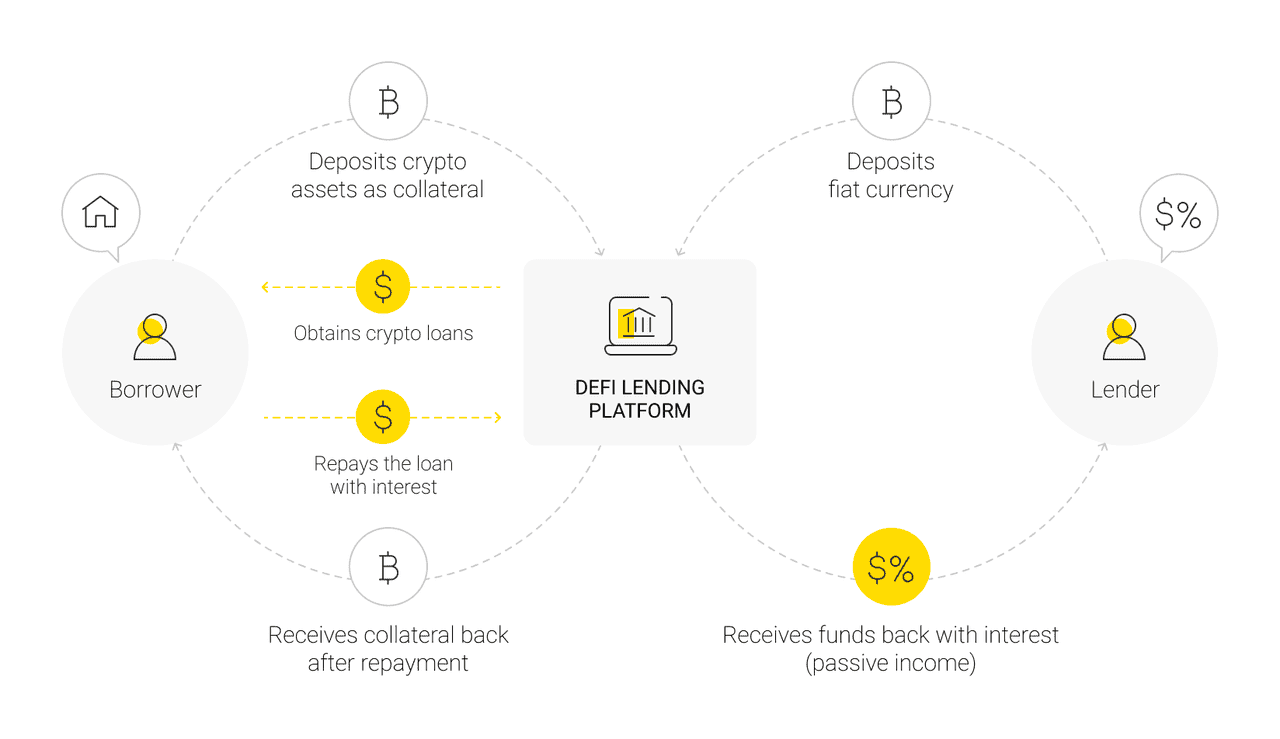

How it works: Users deposit assets into lending pools. Borrowers provide collateral exceeding the loan amount. Interest rates vary based on asset utilization.

Over-collateralization: Borrowers lock up about 150% of the loan value as collateral, which can be liquidated if its value drops near the loan amount.

Use cases: Borrowing enables liquidity without selling assets (e.g., using ETH as collateral to borrow stablecoins for trading).

Top Platforms: Notable platforms include MakerDAO (DAI loans), Compound, Aave (generalized money markets), and Liquity (interest-free loans). Other chains feature platforms like Benqi (Avalanche) and Solend (Solana).

Risks: Risks include smart contract vulnerabilities and collateral volatility. Price crashes can lead to rapid liquidations, as seen with MakerDAO in March 2020.

Interest Rates in 2025: DeFi lending rates for stablecoins range from low to double digits, potentially higher than traditional savings. Borrowers can expect rates around 5-15%. Some platforms allow variable versus stable rates.

Liquid Staking as Collateral: In 2024-2025, liquid staked assets (like stETH) can be used as collateral, allowing users to earn staking rewards while borrowing against their holdings.

DeFi Lending vs. Traditional Lending (source)

Stablecoins are crucial for DeFi, with DAI (MakerDAO) being the leading decentralized option, backed by crypto collateral (now including USDC, though that adds some centralization risk). By late 2025, DAI's supply exceeded $5B. USDC and USDT, centralized stablecoins from Circle and Tether, are widely used in DeFi for trading and lending. UST (Terra) collapsed in 2022, highlighting the risks of algorithmic stablecoins, while newer models like FRAX combine collateral and algorithms. Major players have entered the space; for example, PayPal launched PYUSD in 2023, and BlackRock's subsidiary tokenized money market funds in 2024. By 2025, tokenized cash equivalents grew significantly.

Stablecoins facilitate stable asset parking and DeFi lending and are used for cross-border value transfers, particularly in inflationary regions. In 2024, they settled over $27 trillion in transactions, surpassing Visa and Mastercard combined.

DeFi Derivatives and Synthetic Assets

Decentralized perpetual futures exchanges like dYdX and GMX allow leveraged trading in a decentralized manner, gaining traction by 2025. They offer funding rates similar to traditional perps and provide user-driven liquidity.

Protocols like Opyn and Hegic enable options trading, though volumes are lower than perpetuals. Synthetix allows users to create synthetic tokens that track asset prices, broadening exposure beyond crypto.

A significant trend by 2024-2025 is Real World Asset (RWA) tokenization, with projects like Ondo Finance offering tokenized U.S. Treasury yields and Maker facilitating loans as collateral for DAI. By Q3 2025, tokenized RWAs surpassed $30 billion, attracting institutional interest due to efficiency benefits.

While prediction markets like Augur and Polymarket offer decentralized betting on outcomes, they face challenges in usage due to regulatory concerns and complexity.

This practice surged in the 2020 “DeFi Summer,” where new projects reward users with governance tokens for providing liquidity or using the platform. For instance, Compound's liquidity mining in June 2020 allowed users to earn COMP tokens alongside their interest, attracting significant liquidity. This trend, known as yield farming, involves users chasing the best token rewards.

Governance Tokens: These tokens provide voting rights for protocol decisions, fostering community governance, though initial distributions often favor founders and VCs. By 2025, major DeFi platforms like Uniswap (UNI) and Aave (AAVE) have tokens, but voter participation remains low and large holders can sway outcomes. Nevertheless, governance gradually decentralizes control, aligning user interests with the platform's success.

Trends: Initially, liquidity mining led to short-term strategies, but projects have refined their models. For instance, Curve's vote-escrow (veCRV) incentivizes long-term holding. The “real yield” trend has emerged, focusing on rewarding users from actual protocol revenue rather than inflationary tokens, with some protocols sharing a portion of fees with token stakers.

Liquid Staking and Restaking: Liquid staking tokens like Lido’s stETH offer staking rewards while keeping funds liquid. By early 2024, Lido boasted a TVL of nearly $40B. Restaking, introduced by EigenLayer, allows staked ETH to secure other networks for extra yield, though it introduces additional risks.

Decentralized Autonomous Organizations (DAOs)

Many DeFi projects are governed by DAOs, where communities vote on proposals using governance tokens. For example, MakerDAO manages DAI’s collateral types. Challenges include voter apathy and low turnout, but some DAOs, like Maker, have established effective governance processes. Token governance is a defining feature of DeFi, contrasting with centralized financial systems, and aligns with decentralization principles.

How DAOs Work (source)

Benefits of DeFi

Accessibility & Inclusion: DeFi offers global access through smartphones and the internet, eliminating the need for bank accounts or IDs. This is especially empowering in regions with unstable financial systems, enabling users, like those in Argentina, to convert local currency to stablecoins and earn yields—essentially providing a U.S. dollar savings alternative.

Transparency: On-chain activities provide radical transparency, revealing total loans, collateral, and wallet addresses, which can help reduce corruption and improve risk visibility. In contrast to traditional finance, where hidden risks can lead to crises, DeFi allows for clearer oversight of risk.

Censorship Resistance: Decentralized DeFi protocols are resistant to shutdowns and censorship, offering users in countries with strict capital controls a way to bypass these issues. Despite potential website blocks, users can still access services directly through smart contracts.

Efficiency and Innovation: DeFi operates 24/7 with near-instant settlement, automating functions that lower costs. It has become a hub for financial innovation, introducing concepts like flash loans and various new financial products at a rapid pace, unlike slower-moving traditional finance.

Ownership and Autonomy: Users retain control of their assets, avoiding reliance on institutions that can freeze funds. DeFi often aligns user incentives through governance tokens, rewarding early users with substantial token airdrops, akin to receiving equity in a service.

Interoperability: DeFi services can be combined easily, allowing seamless actions like taking loans and swapping assets with just a few clicks, in stark contrast to the lengthy processes in traditional finance.

Financial Innovation and Experimentation: DeFi acts as a testing ground for new economic models. Experiments in algorithmic stablecoins and governance tokens foster innovative community structures. Although some initiatives may fail, successful ones can significantly transform finance.

Risks and Challenges of DeFi

Despite its promise, DeFi comes with significant risks:

Smart Contract Bugs and Hacks: Code governs DeFi, and flaws can be exploited by hackers, leading to significant fund losses. Notable incidents include the DAO hack (2016, ~$60M), Poly Network ($600M), and Ronin bridge ($600M). Audits help, but they’re not foolproof. Engaging with DeFi means accepting some risk of bugs or exploits.

Impermanent Loss and Market Risks for Liquidity Providers: Providing liquidity can result in impermanent loss, where token balances may be worth less than if held separately, especially during price divergence. While trading fees can offset this loss, it often becomes permanent if prices don’t revert.

Liquidation and Volatility Risks for Borrowers: Borrowers must closely monitor their collateral; a rapid price drop could lead to liquidation. Events like a sudden market crash can further complicate this, impacting liquidation prices and causing interest rates to spike.

Scams and Rug Pulls: Not all DeFi projects are legitimate. Some developers establish fraudulent tokens or contracts to steal funds. Users need to conduct due diligence, as the lack of regulation allows bad actors to operate freely.

Usability Issues: DeFi can be challenging for average users due to private key management and high transaction fees, particularly on Ethereum. While layer-2 solutions are improving usability, fragmentation and associated risks remain.

DeFi and Traditional Finance Integration Challenges: Tokenizing real-world assets brings both opportunities and complications, reintroducing counterparty risk and regulatory oversight. While some prefer crypto-collateral only, stable value often requires real assets, as seen with projects like MakerDAO diversifying to earn yield for stablecoins.

Systemic Risks: DeFi’s composability can lead to significant issues if a major stablecoin like USDC or USDT collapses, potentially breaking protocols like Maker and Curve. For instance, the 2022 Terra UST collapse wiped out $40B of its ecosystem and incurred losses for platforms like Curve. Additionally, economic attacks, such as oracle manipulation or flash loan exploits, pose risks to protocols.

Key Management & Irreversibility: Losing access to your wallet or sending funds incorrectly means there’s no means of recovery, which can be daunting for newcomers. Poor security practices, like approving malicious contracts through phishing, can lead to significant losses. To promote mainstream adoption, education on security and alternatives like social recovery wallets must improve.

Scalability and Performance: Public blockchains often experience congestion, impacting DeFi during peak events. To accommodate more users, scalability must enhance. Solutions include Ethereum’s Layer 2 rollups, alternative blockchains like Solana, and upcoming upgrades aimed at reducing costs and increasing throughput.

DeFi Workflow (source)

2026 Trends and Developments in DeFi

We’ve mentioned some throughout, but let’s consolidate key trends up to 2026:

Real-World Assets (RWA) and Institutional DeFi: Tokenizing real assets is a key trend, allowing institutions to access crypto liquidity while offering crypto users safer yields. By 2024, MakerDAO earned millions from U.S. Treasury bonds and other DeFi treasuries followed suit. Ondo's products enabled stablecoin holders to indirectly hold T-bills, bridging TradFi and DeFi. A BCG report predicted $2-4 trillion in assets could be tokenized by 2030. By 2025, private credit firms and real estate markets were also embracing tokenization, with favorable regulatory frameworks in the US and EU.

Liquid Staking Dominance: Following Ethereum's shift to Proof of Stake, liquid staking gained traction with Lido dominating the market. By 2025, ETH staking yields could be around 4-5%, integrating staking with DeFi products. This duality enhances efficiency but also presents risks if major providers falter.

Layer 2 Adoption and Better UX: DeFi activity increasingly moved to L2s like Arbitrum and Optimism, with seamless bridging becoming standard. Improved wallets and Account Abstraction on Ethereum have streamlined user experiences, making DeFi feel more accessible by 2025.

Security and Insurance: With rising hacks, security is crucial. Projects are focusing on audits and risk mitigation measures, cultivating a culture of thorough testing and user awareness by 2025.

Regulatory Compliance Tools: To deal with regulations, DeFi platforms are introducing compliance features, like address blocking. This could lead to a bifurcation of decentralized and permissioned platforms to facilitate institutional participation.

Decentralized Social and Web3 Integration: Web3 social platforms and NFTs are merging with DeFi—using NFTs as loan collateral and potentially creating "super apps" for trading, messaging, and NFT galleries by 2025.

Conclusion

DeFi has evolved from a niche experiment in 2018-2019 to a multi-billion-dollar sector by 2025, gaining mainstream awareness. It has navigated market cycles, addressed some challenges like high fees with Layer 2 solutions, but still faces security and regulatory hurdles. The sector continues to innovate, offering new ways to conduct finance that are open and efficient.

Similar to the early days of e-commerce, which was chaotic but is now trusted and regulated, DeFi may follow a similar path toward normalization. While it may not completely replace traditional banking, many predict that banks will incorporate DeFi technology, allowing users to engage with it unknowingly through neobanks or brokers.

For now, DeFi remains a thrilling frontier in crypto and fintech, showcasing the potential for a more inclusive financial system. However, anyone interested should do thorough research, start small, and be aware of the significant risks involved. For those who want the unrivaled user experience of a top-tier centralized exchange, Phemex offers a leading crypto trading experience.