Key Takeaways

-

Stablecoins power over 70% of crypto trades in 2025, offering stability for trading, DeFi, and payments.

-

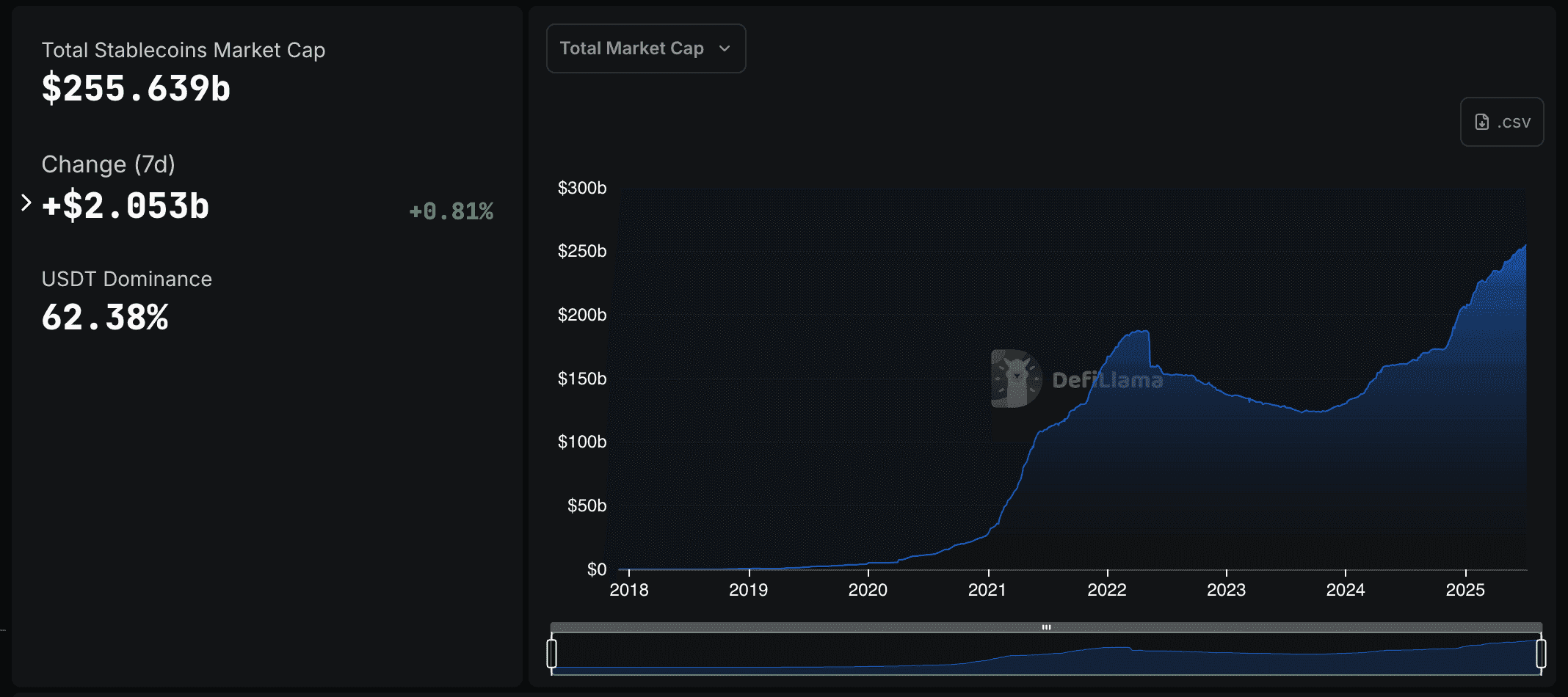

The stablecoin market exceeds $265 billion, with top coins like USDT ($158.6B), USDC ($62.2B), and DAI ($3.6B).

-

Phemex provides 0.1% spot fees and staking options for secure stablecoin trading.

-

US regulations (GENIUS and STABLE Acts) enhance transparency, making stablecoins safer.

Stablecoins power over 70% of crypto trades in 2025, making them essential for trading, decentralized finance (DeFi), and global payments. This Phemex Academy guide dives deep into what stablecoins are, how they work, their types, use cases, regulations, and how to trade them on Phemex, a leading exchange with low fees and robust security. Ready to explore stablecoins? Let’s dive in.

What Are Stablecoins?

Stablecoins are cryptocurrencies designed to hold a stable value, typically pegged to assets like the US Dollar, Euro, or gold. Unlike Bitcoin, which can swing 10% in a day, stablecoins aim to stay steady, making them ideal for everyday transactions, trading, or storing value in crypto markets. Think of them as digital cash: fast, borderless, and programmable, but without the price rollercoaster.

The stablecoin market exceeds $265 billion, accounting for over 70% of crypto trade volume. With the US government advancing stablecoin regulations, they’re becoming a trusted bridge between traditional finance and crypto.

Stablecoins vs. Fiat: What’s the Difference?

Stablecoins offer unique advantages over fiat currencies:

-

Speed: Transactions settle in seconds, unlike bank wires that take days.

-

Cost: Near-zero fees for global transfers vs. 2–5% bank fees.

-

Access: Available 24/7 on blockchain, no bank account required. However, fiat is still more widely accepted for everyday purchases like groceries. Stablecoins excel in crypto ecosystems, making them a powerful tool for traders and global users.

How Do Stablecoins Work?

Stablecoins aim to maintain a consistent value, similar to how a fixed-income bond provides steady returns despite market fluctuations. Here’s how they achieve this:

-

Fiat-Collateralized: Each coin is backed by $1 in a bank account (e.g., $1 USDT = $1 USD in reserve). Audits ensure the reserves are real.

-

Crypto-Collateralized: Backed by cryptocurrencies like Ethereum, with extra collateral (e.g., $2 of ETH for $1 of DAI) to absorb price swings.

-

Algorithmic: Smart contracts adjust the coin’s supply to keep the price stable.

-

Asset-Backed: Pegged to assets like gold or real estate, offering diversification.

For example, if you hold 100 USDC, you can trust it’s worth ~$100 because Circle, its issuer, holds $100 in reserves. These mechanisms make stablecoins reliable for trading or payments.

Types of Stablecoins

Stablecoins are divided into four main categories, each with unique strengths:

-

Fiat-Collateralized: Backed by fiat currencies (e.g., USD, EUR) in audited bank accounts. Example: USDT, where Tether Limited holds $1 for every coin issued. These are the most popular due to simplicity but rely on issuer transparency.

-

Crypto-Collateralized: Secured by cryptocurrencies, often over-collateralized to handle volatility. Example: DAI, backed by ETH on MakerDAO’s platform. These are decentralized, reducing reliance on banks, but carry smart contract risks.

-

Algorithmic: Use algorithms to adjust supply, like a thermostat controlling room temperature. Example: USDe by Ethena Labs. They’re innovative but risk depegging if algorithms fail, as seen in past collapses like Terra’s UST.

-

Asset-Backed: Pegged to commodities (gold, oil) or real estate. Example: PAX Gold, tied to gold. These are gaining traction in 2025 for investors seeking diversified exposure.

Each type suits different needs—fiat-backed for simplicity, crypto-backed for decentralization, and so on.

Top 5 Stablecoins in 2025

Here are the top 5 stablecoins by market cap as of July 2025, including their issuers:

|

Stablecoin |

Type |

Issuer |

Market Cap |

Main Use |

|

Tether (USDT) |

Fiat-Collateralized |

Tether Limited |

$158.6B |

Trading, DeFi |

|

USD Coin (USDC) |

Fiat-Collateralized |

Circle |

$62.2B |

Payments, Remittances |

|

Dai (DAI) |

Crypto-Collateralized |

MakerDAO |

$3.6B |

DeFi, Lending |

|

USDS |

Fiat-Collateralized |

Sky (formerly MakerDAO) |

$7.4B |

Emerging Use Cases |

|

Ethena USDe |

Algorithmic |

Ethena Labs |

$5.3B |

DeFi, Yield Farming |

Sources: Coingecko, CoinMarketCap

These stablecoins dominate due to liquidity, adoption, and trust. USDT and USDC lead for their fiat backing, while DAI and USDe appeal to DeFi users for decentralization.

Why Are Stablecoins Important in 2025?

Stablecoins are the glue of the crypto economy, enabling:

-

DeFi: They’re the preferred collateral and trading pairs in protocols like Aave, handling billions in loans.

-

Payments: Fast, cheap global transfers, bypassing slow bank rails.

-

Tokenized Assets: Trading real-world assets (RWA), for example, real estate, on blockchain.

-

Trading: A safe haven during crypto price swings.

-

CBDC Integration: Interoperating with central bank digital currencies, like digital USD pilots.

Stable cryptocurrencies drive 70% of crypto transactions, per Deloitte 2025 Report. With the US pushing stablecoin laws, their role in mainstream finance is expanding, making them a must-know for 2025.

Stablecoin Use Cases

DeFi

Stablecoins are DeFi’s lifeblood. In protocols like Aave, you can deposit USDC to earn 5–10% annual yield or borrow against DAI to leverage investments. Yield farmers stake stablecoins in liquidity pools, earning rewards that often outpace bank savings accounts.

Payments

Merchants and platforms like Stripe accept USDC for instant, low-fee transactions. Example: In Southeast Asia, freelancers use USDC to receive payments from US clients, saving 5–10% vs. bank fees, per Chainalysis. Businesses use USDC for payroll, cutting costs by 3–5% compared to bank transfers. This is a game-changer for the underbanked.

Tokenized Assets

Stablecoins enable trading of tokenized real estate or bonds on platforms like Centrifuge. For instance, a $100,000 property can be split into 1,000 tokens, with USDC settling trades instantly, making investments accessible to all.

How Does Phemex Support Stablecoin Trading?

Phemex is your go-to platform for stablecoin trading, offering:

-

High Liquidity: Deep markets for USDT, USDC, DAI, and more.

-

Low Fees: 0.1% spot, 0.01% maker/0.06% taker futures—the lowest in the industry. Explore Phemex Fees.

-

Tools: Spot, perpetual, and grid trading for all levels.

-

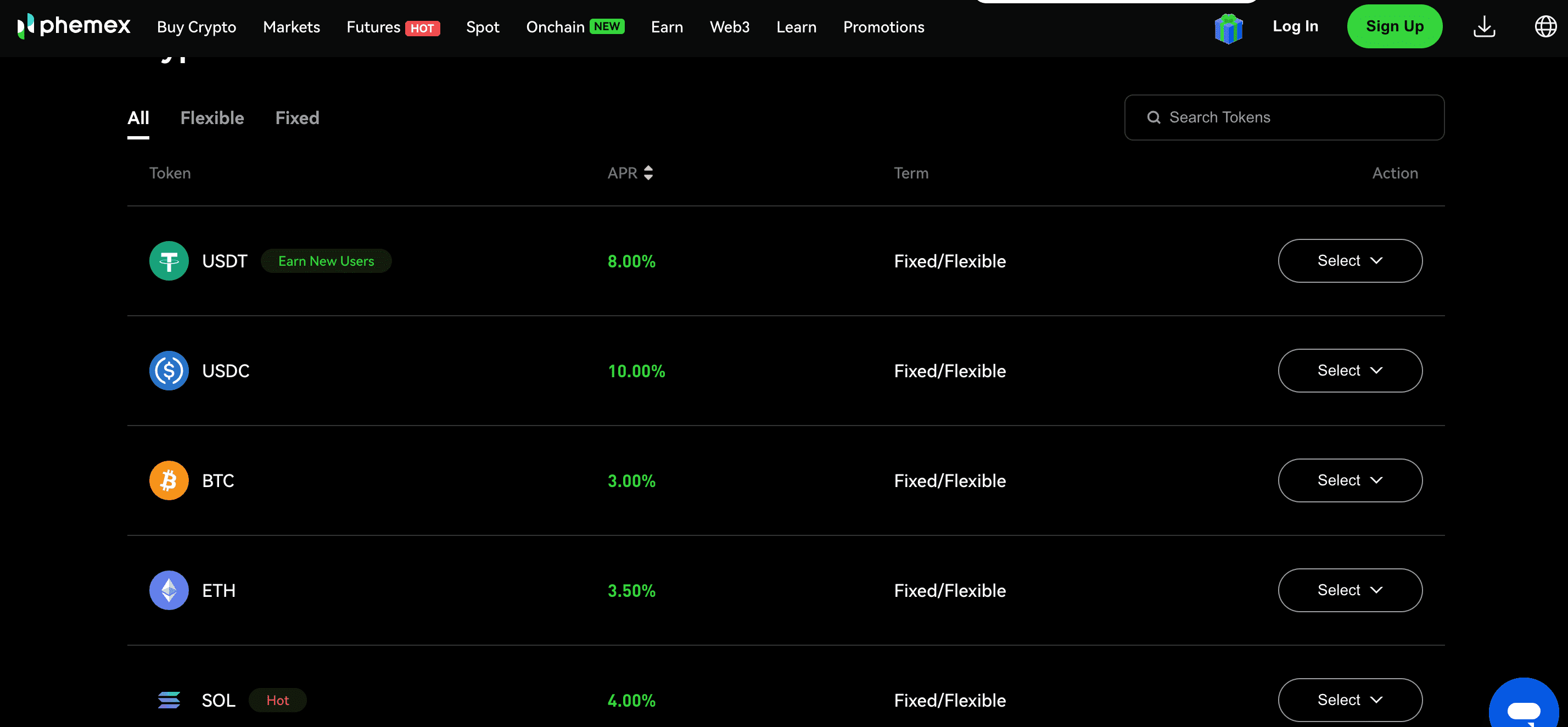

Staking: Earn passive income via Phemex Savings.

-

Security: Cold wallet storage and 2FA protection.

Phemex Savings: Earn Passive Income

Phemex Savings lets you earn up to 10% annual yields on stablecoin deposits, far surpassing bank savings rates. Choose flexible terms for daily access or fixed terms for higher returns. It’s like a digital savings account, but with crypto’s flexibility. Visit the Phemex Savings page for details.

Stablecoin Regulation in 2025

Stablecoin regulations are tightening, boosting trust:

-

The GENIUS Act, passed May 20, 2025, requires issuers to hold audited reserves and obtain federal licenses.

-

The STABLE Act, nearing House approval, emphasizes consumer protections, like ensuring 1:1 reserve backing.

-

The EU’s MiCA framework mandates transparency, with monthly reserve reports for USDC and others.

These laws make stablecoins safer, encouraging adoption. For example, audited reserves ensure your USDT is truly worth $1, reducing risks seen in past scandals.

Risks and Challenges

Stablecoins aren’t perfect. Key risks include:

-

Transparency: Some issuers (e.g., Tether) faced scrutiny over reserve audits. Always check reports on Coingecko.

-

Smart Contract Bugs: Crypto-backed coins like DAI rely on code, which can have vulnerabilities. Stick to battle-tested protocols.

-

Regulatory Shifts: New laws could limit certain stablecoins. Phemex only lists compliant coins to minimize this risk.

-

Depegging: Rare but possible, as seen with Terra’s UST in 2022. Diversify across USDT, USDC, and DAI to stay safe.

Are Stablecoins a Good Investment? USDT vs. USDC, and Are They Safe?

Is a Stablecoin a Good Investment?

Stablecoins aren’t traditional investments like stocks or Bitcoin, as they’re designed to hold a steady $1 value, not appreciate. However, they’re excellent for:

-

Preserving Capital: During crypto market dips, traders move to USDC or USDT to avoid losses, like parking cash in a safe.

-

Earning Yield: Platforms like Phemex Savings provide up to 8% annual yields on USDC deposits and up to 10% on USDT deposits, surpassing traditional bank rates.

-

Liquidity: Stablecoins let you quickly enter or exit trades without fiat conversion delays.

For low-risk investors, stablecoins are a strong choice for stability and passive income. High-risk investors may prefer volatile assets like BTC and ETH for growth.

USDT vs. USDC: Which Is Better?

-

USDT (Tether):

-

Pros: Largest market cap ($158.6B), highest liquidity, widely accepted across exchanges and DeFi.

-

Cons: Tether Limited faced past scrutiny over reserve transparency, though 2025 audits have improved trust.

-

Best For: Traders needing liquidity and DeFi users.

-

USDC (Circle):

-

Pros: Highly transparent, with monthly audits by top firms like Grant Thornton. Regulated by US authorities, aligning with GENIUS Act standards.

-

Cons: Smaller market cap ($62.2B), slightly less liquidity than USDT.

-

Best For: Risk-averse users and institutional investors.

Verdict: USDC offers greater transparency and regulatory compliance, with monthly audits and US licensing. USDT provides higher liquidity and broader acceptance. Holding both can balance transparency and liquidity needs, depending on user priorities.

Are Stablecoins Safe?

Stablecoins are among the safest crypto assets, but risks remain:

-

Fiat-Backed (USDT, USDC): Safe if reserves are audited and issuers comply with laws. USDC’s audits and Circle’s US licensing make it a top choice. Tether’s improved audits in 2025 boost its safety.

-

Crypto-Backed (DAI): Safe for decentralized fans, but smart contract risks exist. MakerDAO’s long track record adds confidence.

-

Algorithmic (USDe): Riskier due to potential depegging, as seen with past failures like UST.

To stay safe:

-

Choose audited coins (USDC, USDT, DAI).

-

Use trusted platforms like Phemex, with cold wallet security.

-

Monitor news for regulatory or depegging risks.

Stablecoins are safe for most users, especially with 2025’s stricter regulations, but never invest more than you can afford to lose.

Frequently Asked Stablecoin Questions

What Are the Safest Stablecoins in 2025?

USDC, USDT, and DAI, with frequent audits, are safest. Check reports on Coingecko.

How Do Stablecoins Maintain Their Peg?

Fiat-backed hold reserves, crypto-backed use over-collateralization, algorithmic adjust supply.

Are Stablecoins Legal?

Yes, with US GENIUS and STABLE Acts clarifying regulations in 2025.

How Can I Earn Passive Income with Stablecoins?

Deposit in Phemex Savings or DeFi protocols like Aave.

How Are Stablecoins Used for Remittances in 2025?

Stablecoins like USDC enable instant, low-fee cross-border payments, saving 5–10% vs. bank transfers, per Chainalysis.

Is a Stablecoin a Good Investment?

Stablecoins are designed for stability and yields, not price growth. USDC offers greater transparency and regulatory compliance; USDT provides higher liquidity and broader acceptance.

Conclusion

Stablecoins, with a $265 billion market, are revolutionizing finance in 2025, powering DeFi, payments, and tokenized assets. With US regulations like the GENIUS Act ensuring safety, they’re more reliable than ever. Trade and earn with stablecoins on Phemex, your trusted platform for low fees and high liquidity. Start today!

Disclaimer: The information presented in this article is for educational and informational purposes only. It does not constitute investment advice, financial advice, trading advice, or any other form of advice, and you should not treat any of the article's content as such. Phemex does not recommend that any specific cryptocurrency should be bought, sold, or held by you. The cryptocurrency market is subject to high market risk and volatility. Past performance is not indicative of future results. All investment strategies and investments involve risk of loss. You should conduct your own due diligence and consult a qualified financial advisor before making any investment decisions. Phemex is not responsible for any investment decisions you make based on the information provided in this article.