In just a few years, decentralized finance (DeFi) has grown into a $200 billion industry; much of the money goes into DEXs (decentralized exchanges), which produce most of the trade volume.

Trading in DeFi is facilitated using the Automated Market Maker (AMM) model on exchanges such as Uniswap, Curve, PancakeSwap, Balancer, and others. Without any centralized market makers controlling liquidity in a DEX, platforms must incentivize users to provide liquidity instead, in a peer-to-peer fashion.

These incentives come in the form of liquidity provider (LP) tokens, which represent a share in a coin traded on a DEX.

What Are LP Tokens?

A liquidity provider (LP) token is the tool used to incentivize investors to offer this much-needed liquidity for the functioning of decentralized exchanges such as Uniswap (UNI), Curve Finance (CRV) and PancakeSwap (CAKE).

LP tokens represent a share in a coin traded on a DEX; as such, LP token holders receive a share of the transaction fees (usually 0.3% per trade) each time other users make a trade.

Anyone can create LP tokens and/or withdraw them or burn them – liquidity providers on exchanges receive LP tokens once they submit a token pair of equal value i.e. a 50:50 balance between an ERC-20 token and a “liquid” token such as Ethereum (ETH) or Tether (USDT).

LP tokens are ERC-20 coins, but these only represent a share in the DEX where the LP token was created. The exchange has no control over the LP tokens and owners can manage them as they wish.

An example of an LP Token

High-cap cryptos such as Ethereum or stablecoins are usually used to back the value of another token.

For example, a trader who wants to invest $100 in Shiba Inu (SHIB) liquidity can submit $50 in SHIB tokens and $50 in USDT.

He will receive an LP token certifying that he is the owner of that liquid pair, and others can trade by purchasing SHIB tokens or selling them for USDT. He will then receive a portion of the trade fees – usually 0.3% per trade.

Once a user deposits crypto, a new LP token is generated, and it is sent to his decentralized wallet such as MetaMask. He can hold it, transfer it to another wallet, or burn it by sending it to the genesis address. As long as he owns the LP token, he can withdraw liquidity at any time and get his crypto back.

How Do LP Tokens Work?

LP tokens power all trading on decentralized exchanges.

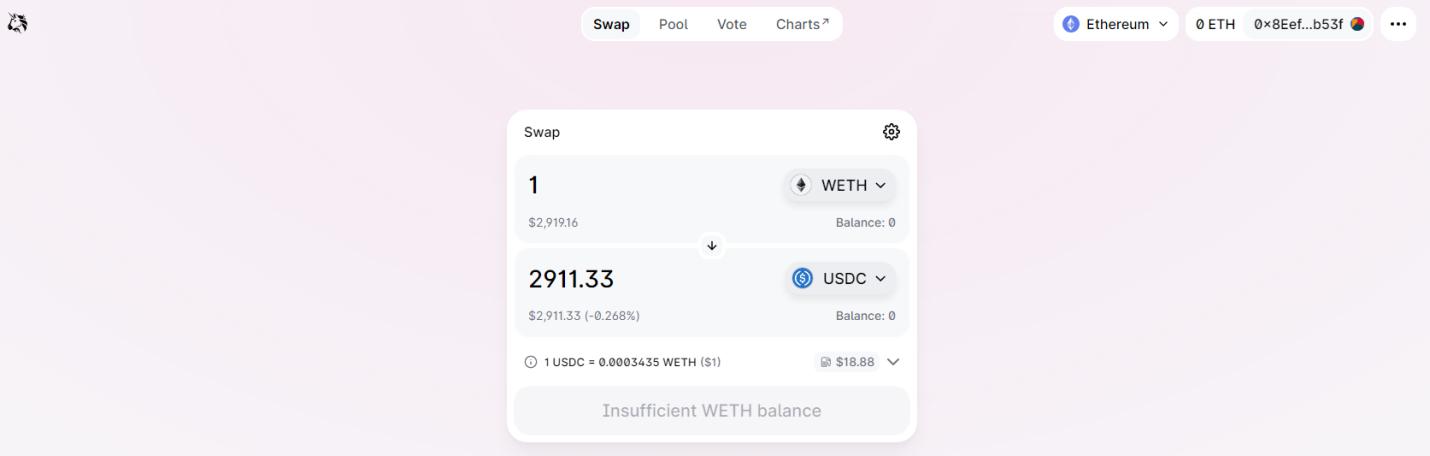

Let’s say we’re swapping ETH for USDC. If we swap 1 ETH at the current value of $2,911 USDC, we will not be drawing from Uniswap’s private assets but rather third party users who submitted liquid pairs for ETH/USDC on the platform and own an LP token:

Visiting the ETH/USDC pair on Uniswap will show us the current TVL (total value locked) in the LP token pool combined and the amount of revenue that was generated in daily trading fees for LP providers:

The current 24-hour volume surpassed $40 million and LP providers earned a combined $124,980 for the day. The LP profit rate is 0.3% per swap proportionate to their share of the pool. This percentage is among the lowest as this is one of the safest pairs to add liquidity for. Riskier ERC-20 tokens can earn providers more than 1% per swap.

How to Create LP Tokens?

To create LP tokens, a user first has to own crypto in a decentralized wallet. Get a decentralized wallet such as MetaMask and send Ethereum or other tokens to your address. Once they’re in your wallet, you can add liquidity and start earning revenue for every swap on the platform. We’ll head to the Uniswap Pools page to browse the most popular pools on the network:

The top crypto pairs on Uniswap ranked by total value locked.

Let’s say we wanted to add liquidity for the WBTC/ETH pair. We would first head to the token pair on Uniswap and click “Add Liquidity”:

Easily add liquidity for every crypto pair on a DEX.

Uniswap will re-direct us to a page where can submit wBTC and ETH tokens of equal value to generate an LP token:

The two sides of the pair must have equal value in dollars.

We can’t just submit one side of the pair; we have to submit both sides. For example, 1 ETH at the moment has the same value as 0.073 WBTC. The exchange automatically adjusts them. To learn how to calculate LP token value, combine both sides of the pair – in this case the value of the LP token is $5,822 or the equivalent of 2 ETH. Once we submit the pair, we’re entitled to 0.3% fees for every swap proportionate to our stake in the pool.

If the exchange provides an APR (Annual Percentage Yield) for staking LP tokens, this process is called “yield farming.” For example, traders can receive a certain % APR for submitting LP token pairs on exchanges like Curve Finance and staking them on the platform for other users. These tokens can be claimed by the user manually once their stake is complete.

How to Launch Your Own Coin and Generate an LP token?

If a person wants to create a new ERC-20 token, they have to add liquidity in Ethereum or another coin that would back the value of their token. Once the coins are created, they have zero value until an LP token is created that connects them to a liquid token with established value.

It can be tricky to add a new coin on Uniswap because the exchange won’t recognize ERC-20s that just launched and founders have to use their contract addresses to locate them on the blockchain. Head to Etherscan (Ethereum’s block explorer) and locate the contract address of your coin. For example, if we head to the Shiba Inu token we can find the contract here:

ERC-20 tokens are assigned a contract address to identify them.

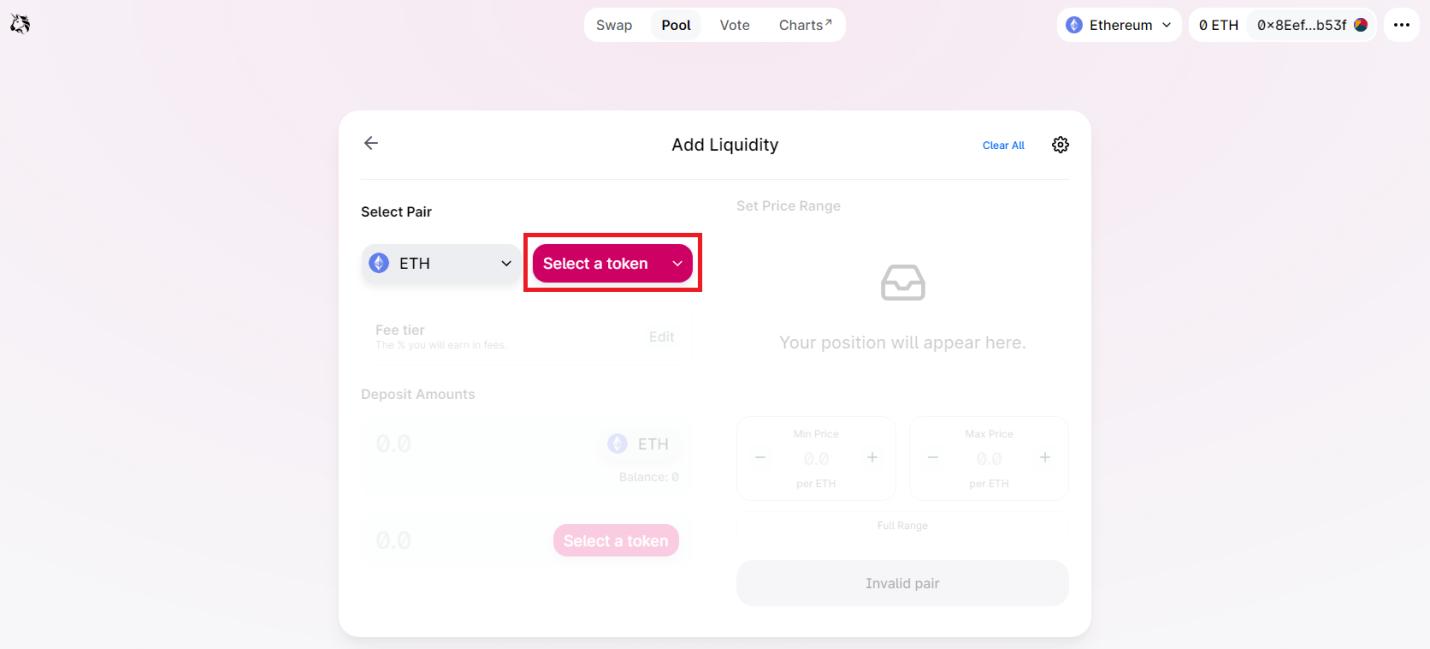

Left-click to copy the contract address and head to Uniswap “Pools” and click “New Position”:

Create a new position for a token not listed on Uniswap.

The interface will ask you to select one of the existing popular tokens or input an Ethereum contract address that would allow you to generate an LP token for that crypto. Press on “Select a token” and paste in the contract address you copied from Etherscan:

Locate the token by inputting the contract address.

The interface automatically locates the Shiba Inu token using the contract address we pasted from Etherscan. If this is a new token, the interface will display the token name assigned in the original contract:

The SHIB token was discovered using the contract address.

In this case, we can’t create a new token because the SHIB token is already liquid, but we can head to the SHIB/ETH page and add liquidity. New positions are only reserved for tokens that lack liquid presence on Uniswap and the first depositor owns 100% of the LP tokens.

The same LP token creation process applies for other exchanges, but LP tokens can go under different names. For example, on the Balancer exchange LP tokens are called “Balancer Pool Tokens” or “BPTs”.

How to Burn LP Tokens?

Burning LP tokens involves sending them to the burn address which is the Ethereum genesis address. This is the first address that existed on the Ethereum blockchain which no one has the private keys to, which means all tokens sent to the address are lost permanently.

The following is the burn address for Ethereum and other EVM-compatible chains such as Avalanche (AVAX), Fantom (FTM), and others:

0x000000000000000000000000000000000000dEaD

The Ethereum burn address on Etherscan states that it is commonly used by projects to burn coins:

Use the burn address to break LP token and secure a project.

If a user sends any token to this address, they won’t be able to recover it. The burn address is the most valuable address on the blockchain because tens of billions of tokens are burned by sending them there. The most common reason to burn is to decrease the supply of a crypto and increase its value. Founders often burn LP tokens to prove they’re not going to pull the liquidity as they lose control over the LPs.

Note: As blockchain is an irreversible ledger, there is no way to actually burn or remove the coins from existence permanently. The term “burning” is a metaphor for sending tokens to the null address, but we’re technically only transferring ownership to that address. If someone regained the private keys to the genesis address, they would be in control of all assets in that address.

Burning LP tokens increases trust in a project because there is no way a person could pull liquidity from an LP they don’t own. The term “rug-pulling” is used to describe scams in which the founder of a crypto withdraws the tokens, crashing the price to zero as a result of no liquidity.

Burning is a higher safety mechanism than “locking” tokens because locked tokens can be unlocked but burned tokens can’t be retrieved.

Risks of Investing in LP Tokens

Participating as a liquidity provider and investing in LP tokens is not without risk, however. As a crypto asset changes in value, investors run the risk of losing out on potentially higher gains if the crypto increases in value, or losses if the crypto drops in value. This is called impermanent loss, because technically any losses or gains are only realized when the LP token is withdrawn.

Another risk is that of security–investors can lose all their LP tokens and the original crypto they invested into a liquidity pool if there is a hack.

Conclusion

LP tokens are integral to the decentralized finance ecosystem because they serve as a certificate of ownership of liquidity. In traditional markets, cash is the most liquid asset and is synonymous with the term “liquidity”. In crypto trading, it is difficult to convert ERC-20 coins to cash which is why “liquidity” refers to high-cap coins such as Ethereum, Tether, or other coins. These coins are used to add value to new and existing tokens.

Each LP token represents ownership in two cryptocurrencies of equal value. Users who possess LP tokens are fully in control of these tokens and can withdraw their liquidity for both sides of the pair at any time. They can also transfer the LP tokens to another wallet or burn them by sending them to the genesis address.

PhemexPulse

Beyond the traditional gains from investing in LP Tokens, PhemexPulse offers an additional avenue for earnings through its social trading program, inviting users to further capitalize on their trading skills. PhemexPulse embodies the future of social trading, fostering a community-centric environment for cryptocurrency enthusiasts.

PhemexPulse, launching in January 2024, is poised to redefine social trading within Phemex's Web 3.0 ecosystem. This innovative social trading platform provides a unified space for crypto traders to engage, share knowledge, and monetize their expertise.

This initiative underscores Phemex's commitment to pioneering in the realm of social trading. By connecting users in a collaborative and rewarding ecosystem, PhemexPulse is set to transform the social trading landscape, making it more accessible, interactive, and beneficial for traders worldwide.

For any inquiries contact us at support@phemex.com

Follow our official Twitter | Join our community on Telegram

Trade crypto on the go: Download for iOS | Download for Android

Phemex | Break Through, Break Free

Read More

- What is a Liquidity Bootstrapping Pool (LBP): Protecting Investors from Whales and Bots

- What is a Liquidity Pool: Achieving Efficient Asset Trading

- What is Social Trading in Crypto & How does it Work?

- What is a Liquidity Provider & How does it Work?

- What Are Decentralized Applications (dapps)?

- How To Trade Crypto: The Ultimate Investing Guide

- What Is DeFi: How To Be Your Own Bank With $100

- What is Copy Trading: Replicate any Trading Portfolio