Summary Box (Fast Facts)

-

Ticker Symbol: ONDO

-

Current Price (Aug 11, 2025): ~$1.05 USD

-

Chain: Ethereum (ERC-20)

-

Contract Address: 0xfaba6f8e4a5e8ab82f62fe7c39859fa577269be3

-

Market Cap: ~$3.3 billion USD

-

Circulating / Max Supply: ~3.15 billion / 10.00 billion ONDO

-

All-Time High / Low: $2.14 (Dec 2024) / $0.0835 (Jan 2024)

-

All-Time ROI: ~19x (≈ +1,800% from $0.055 ICO price)

What Is Ondo Finance?

Price History & Performance Overview

Ondo Finance launched its ONDO token via public sales in 2022 at an initial price of $0.03–$0.055 (CoinList ICO). Early investors saw a staggering all-time ROI near 70x at the token’s peak. However, ONDO only began widespread trading after token unlocks in January 2024, when the circulating supply hit markets. Upon its debut on major U.S. trading platforms in late January 2024, ONDO’s price initially hovered around ~$0.10, even briefly dipping to an all-time low of ~$0.083 as early holders likely took profit. This marked the bottom of ONDO’s first bear trough.

2024 Bull Cycle: As the real-world asset narrative gained traction, ONDO entered a powerful uptrend through 2024. By mid-2024, it had already surged into the ~$0.8–$1.0 range (roughly +1000% from launch). The rally accelerated in late 2024 amid hype around tokenized Treasuries and high-profile partnerships. In December 2024, ONDO reached its all-time high of $2.14, equating to an eye-popping ~40x increase from the ICO price and a ~25x gain year-to-date for early January buyers. During this bull run, year-over-year ROI was exceptional – over +1,000% from Jan 2024 to Jan 2025, making ONDO one of the fastest-growing crypto assets of 2024.

2025 Correction and Recovery: Following its peak, ONDO entered a correction phase in early 2025. The token’s price retraced from $2+ down to the $0.70–$0.90 range by Q2 2025, reflecting profit-taking and a cooldown of RWA euphoria. By April 2025, ONDO traded around ~$0.85, meaning it gave back roughly 60% from the highs – a typical drawdown for a volatile altcoin. Part of this downturn can be attributed to anticipated token unlocks (large tranches of supply scheduled to vest starting 2025–2026) and a general mid-cycle lull. Nevertheless, ONDO’s long-term holders still saw ~30% gains year-over-year by mid-2025, as the price in mid-2024 was around $0.75.

Entering mid/late 2025, bullish momentum returned. In July 2025, ONDO climbed from the high-$0.70s back to ~$0.95–$1.00 – roughly a +27% monthly gain. This resurgence coincided with positive news: a major global exchange listing in April 2025 (after winning a community vote) and ONDO being featured in a U.S. government report on tokenization as a sector leader. By early August 2025, ONDO was flirting with the critical $1 level again, buoyed by a listing on a popular stock trading app that broadened its exposure to millions of retail users. Volatility remains high – intraday swings of 5–10% are not uncommon around big announcements – but ONDO’s overall trajectory has been upward and data-driven: rapid adoption in bull phases, with healthy corrections that establish higher lows in between. As of August 2025, ONDO boasts an all-time ROI of ~1900% from its ICO and has solidified its place as a top RWA token, despite some rollercoaster cycles along the way.

Whale Activity & Smart Money Flows

Recent on-chain data indicates significant whale activity in Ondo Finance. Over the past few months, top crypto wallets have been actively accumulating ONDO, signaling smart money confidence in the token’s future. For instance, blockchain sleuths observed one large holder withdrawing 6.53 million ONDO (≈$5.9M) from an exchange into a private wallet in late July, suggesting an intent to hold off-market. In fact, during the last week of July 2025, the number of whale wallets (addresses holding a sizable percentage of ONDO’s supply) jumped notably. According to Nansen analytics, holdings by crypto whales increased ~20% within a 24-hour span in late July – a strong sign of big-money accumulation. These large investors were moving tokens from exchanges to cold storage, implying they are positioning for a long-term upside rather than looking to sell immediately.

As of August 2025, on-chain smart money tracking for ONDO reveals that at least 3 known whale addresses each hold over 1% of the circulating supply (i.e., ~30+ million ONDO per whale). This concentration isn’t extreme, but it’s enough that whale moves can sway the market. So far, the trend appears to be accumulation: whales are adding on dips and outflows from exchanges have outpaced inflows, reducing sell pressure on open markets. For example, in July there were multiple seven-figure ONDO transactions flowing to private wallets, and on one day (July 27) over 22 transactions exceeding $1M in value were recorded. Such stealthy accumulation often precedes price rallies, and indeed ONDO’s late-July price pop coincided with these whale purchases.

Whale behavior also reflects smart contract interactions: some ONDO whales are staking or providing liquidity in Ondo’s ecosystem products. Ondo’s own protocol has over $1.3B in total value locked (TVL), and large token holders have been observed depositing ONDO into governance or yield contracts, indicating long-term commitment. Monitoring tools show no big whale dumps in recent months – no sudden exchange deposit spikes that would hint at impending sell-offs. The absence of major whale selling, combined with continued withdrawals to cold wallets, paints a bullish picture: the “smart money” seems to be holding or adding ONDO. This positive whale trend underpins ONDO’s price stability around $0.90–$1.00 and suggests that informed investors view dips as buying opportunities. Of course, whale sentiment can change, but for now, the smart money flows in ONDO Finance are favoring accumulation over distribution, aligning with the broader optimism around real-world asset tokens.

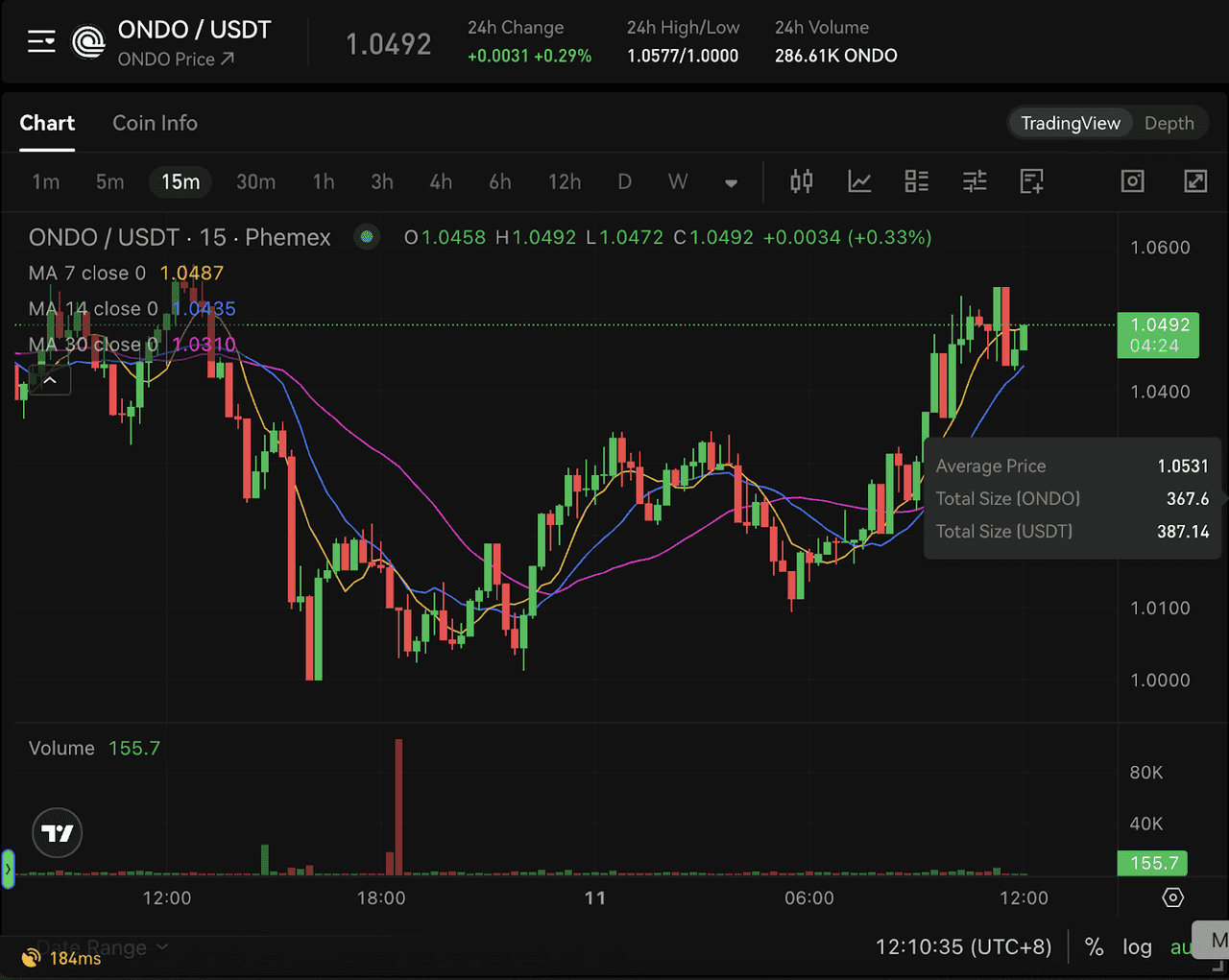

On-Chain & Technical Analysis

From a technical analysis standpoint, Ondo’s price chart shows key levels for traders. ONDO has been ranging between approximately $0.73 (support) and $1.19 (resistance) over the past several months. The $0.73–$0.75 zone has proven to be strong support, with bulls defending it and establishing higher lows since May. Conversely, $1.20 is a critical resistance level, with multiple failed attempts to break above $1.1–$1.2 in 2025.

Chart patterns indicate potential bullish momentum, as a falling wedge or accumulation channel formed from May to July, resolved upward by late July when ONDO attempted to climb toward $1.00. Increased trading volume on up-days supports this trend. The daily RSI is in the 55–65 range, signaling moderate bullish momentum, while moving averages show ONDO trading above its 50-day MA, with a potential golden cross on the horizon.

Fibonacci retracement levels suggest resistance around $1.00 and a target of $1.40 if $1.20 is breached. Traders are eyeing take-profit levels at $1.13, $1.25, and $1.40, with stops near $0.79. Analysts believe a bullish structure is forming, emphasizing the need to hold $0.85–$0.90 to confirm the uptrend. A breakout above $1.20 could target the $1.50–$2.00 zone, while failure to maintain above $0.75 may indicate a bearish turn. Overall, the current analysis leans bullish short-term, with critical markers at $0.75 support and $1.20 resistance.

Fundamental Drivers of Growth

Several fundamental factors could drive ONDO’s growth in the coming years:

-

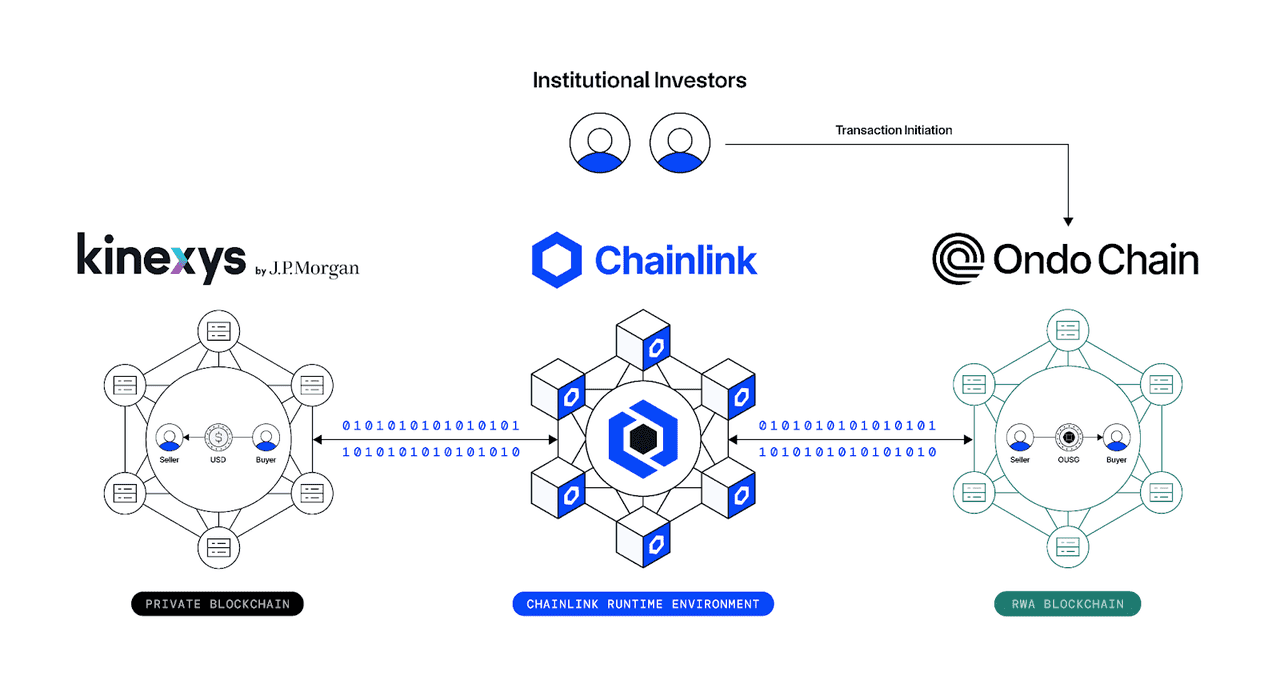

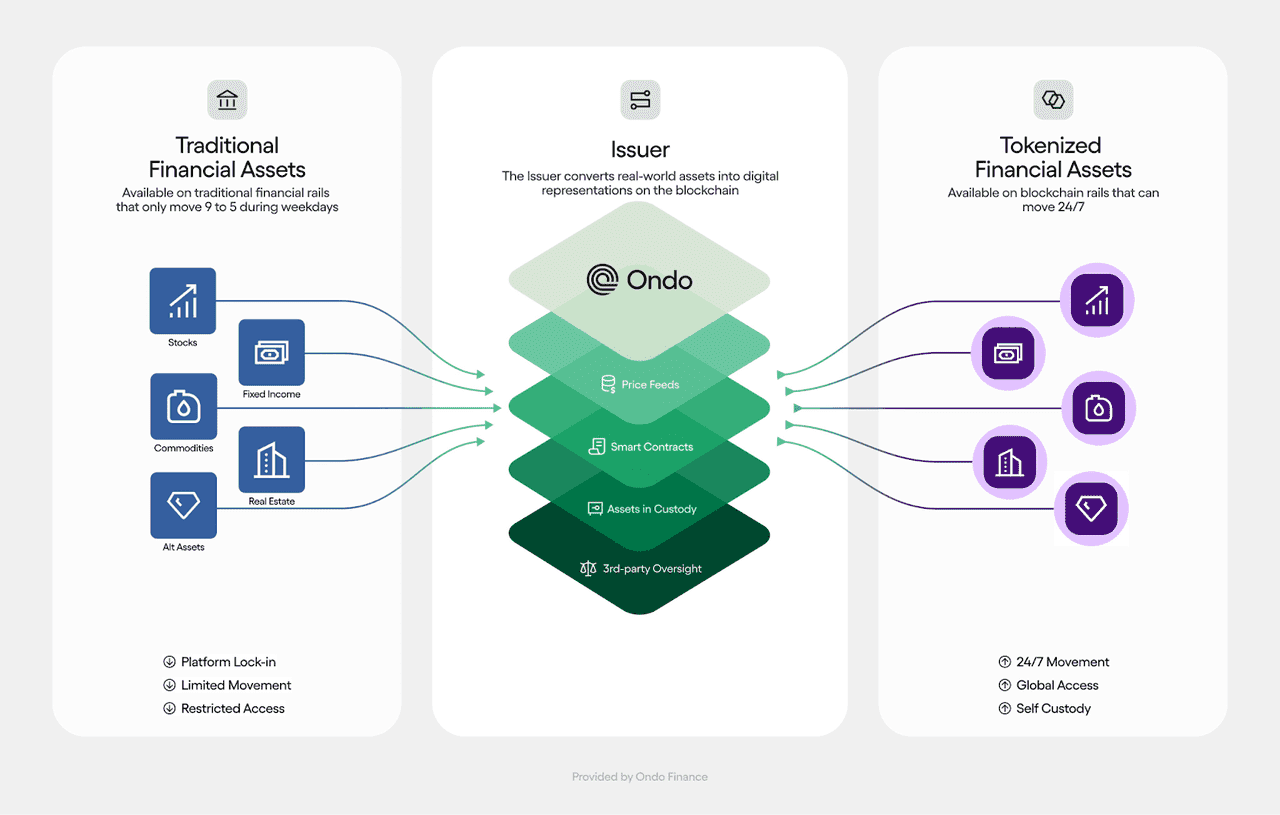

Innovative Tech & Differentiation: Ondo Finance focuses on tokenizing yield-bearing assets with instant settlement, bridging TradFi and DeFi. Its ability to link on-chain stablecoins to off-chain investments, like short-term bond funds, offers a unique value proposition. Ongoing innovation in smart contract security, blockchain support, and user experience will help maintain a competitive edge.

-

Network Adoption & Market Share: With over $1.3 billion TVL and more than $2 billion in tokenized Treasury transactions processed in 2024, Ondo is a leading RWA protocol. Expanding its user base among retail and institutional players could capture a significant share of the burgeoning tokenization market, especially with partnerships like those with BlackRock enhancing credibility.

-

Integrations and Use Cases: Ondo is integrating with broader DeFi and Web3 ecosystems, allowing its tokenized funds to interact with other platforms. Expanding into NFTs and real estate tokenization could diversify its offerings, while partnerships with Layer-2 networks and identity providers could attract new users.

-

Partnerships & Ecosystem Growth: Key partnerships with firms like BlackRock and fintech companies have laid a strong foundation. Future collaborations with traditional banks and crypto exchanges, along with ecosystem grants for developers, could significantly enhance platform usage and growth.

-

Token Utility – Staking & Governance: The ONDO token currently enables governance participation and could incorporate staking incentives in the future. This would reduce circulating supply while rewarding long-term holders, making governance more engaging.

In summary, ONDO’s growth is driven by technological leadership, network expansion, strategic partnerships, and a strong tokenomics structure, all of which support its bullish future outlook.

Key Risks to Consider

No investment is without risk, and investing in Ondo Finance carries its share of considerations. Key risks include:

-

Competitive Threats: The RWA and tokenization space is highly competitive, with players like Centrifuge, Polygon, and TradFi consortia entering the market. If competitors provide better yields or gain regulatory approval faster, Ondo's growth may be hindered.

-

Token Dilution & Unlocks: Ondo's tokenomics involve significant supply unlocks through 2028, with about 6.5 billion tokens (65% of total supply) gradually entering the market. This dilution risk could pressure prices, especially if early investors sell unlocked tokens. Investors should note the fully diluted market cap is much higher than the current circulating cap.

-

Regulatory Impact: Operating at the intersection of crypto and regulated securities, Ondo may face compliance challenges if regulators classify its offerings as securities. While the team appears to be working within regulatory frameworks, any adverse regulation could impact usage and partnerships.

-

Market Volatility & Macro Factors: Ondo's yields depend on traditional assets. Falling global interest rates or broader market downturns might diminish its appeal compared to riskier crypto assets. Additionally, ONDO's value could be affected by major movements in the crypto market.

-

Project Execution & Community Engagement: Ongoing development and positive community sentiment are essential. Stagnation or negative shifts in community perception can erode investor confidence.

In summary, while Ondo has strong growth potential, risks from competition, dilution, regulation, market conditions, and execution must be carefully evaluated. Investing in ONDO requires conviction and an appetite for volatility. Always conduct your own research before investing.

Analyst Sentiment & Community Insights

Analyst sentiment around Ondo Finance and ONDO is positive as of mid-2025, reflecting strong performance and leadership in the RWA sector. Crypto analysts often highlight Ondo as a top play, noting a “blockbuster July” and expecting “explosive” price action for August. The recent growth in partnerships and tokenized assets sets the stage for a potential rally, with ONDO already seeing a 5% intraday move recently.

Market commentators view ONDO as a benchmark for the tokenization sector, with its price up 1000% since launch, helping to push the RWA market to new heights. It has been frequently mentioned alongside established altcoins like Chainlink and Cardano, indicating strong interest.

Community sentiment is also upbeat, with active discussions on Reddit and Twitter that applaud Ondo’s real-world use case. While many are enthusiastic about its future, some express caution regarding upcoming unlocks and long-term value.

Public interest has surged along with ONDO’s price rallies, reflected in spikes on Google Trends and high watchlist counts on CoinGecko and CoinMarketCap, where it holds a favorable 4.0/5 rating. Institutional sentiment is growing too, with significant recognition, including mentions in a U.S. White House economic report.

Overall, the sentiment for Ondo Finance is cautiously bullish, with a strong following and optimism about its future, although recognizing that sentiment can shift rapidly in crypto.

Is Ondo Finance a Good Investment?

Is Ondo Finance a good investment? The answer depends on your investment horizon, risk tolerance, and belief in the project’s mission. Ondo Finance offers a compelling long-term use case: it’s bringing real-world financial assets on-chain, which could be a foundational pillar of crypto’s next growth phase. The long-term thesis is strong – real yields from tokenized bonds address a clear demand in DeFi for stable, legitimate yield sources. Ondo’s early traction (billions in transactions, top partnerships) suggests it has staying power and could continue to lead the RWA niche.

From a token strength perspective, ONDO has demonstrated tremendous growth (massive ROI since launch) and now commands a multi-billion market cap, indicating market confidence. The team behind Ondo is experienced (ex-Goldman Sachs, etc.), and they’ve delivered on key milestones like product launches and exchange listings. ONDO also benefits from real usage – unlike many speculative tokens, its value is tied to a platform with revenue (though how that accrues to tokenholders is mainly via ecosystem growth and governance, as there’s no direct dividend).

However, prospective investors must weigh the macro risks and token-specific risks we discussed. In the short to medium term, ONDO’s price could be volatile, influenced by crypto market swings, interest rate changes, and those large token unlocks. There’s also regulatory uncertainty that could impact all RWA projects. These factors mean that ONDO, despite its strong fundamentals, is not a risk-free investment.

For long-term investors who are bullish on the tokenization trend, ONDO could be a good investment as part of a diversified portfolio, essentially a bet that Ondo Finance will capture a meaningful share of the future of on-chain finance. If that vision comes true, ONDO’s value in 5–10 years could be significantly higher than today. On the flip side, short-term traders might also find opportunities given ONDO’s high liquidity and responsiveness to news/technicals, but they should be nimble and use risk management due to the token’s volatility.

Crucially, this is not financial advice. Whether ONDO is “good” for you depends on doing your own research and possibly consulting a financial advisor. As always in crypto, never invest more than you can afford to lose. With that caveat, many analysts and community members do view Ondo Finance as a promising, innovative project that could reward patient investors in the long run, making it a speculative yet potentially rewarding investment heading into 2025–2030.