At the moment your crypto wallet is probably full of different tokens representing various Web3 projects. But imagine a future in which you can own a slice of Manhattan real estate, a piece of a rare vintage car collection, or even shares in a solar farm—all in your blockchain wallet. That’s the value proposition of the Real World Assets (RWA) narrative in decentralized finance. And the leading project in this revolutionary field is Ondo Finance, a platform that aims to turn illiquid, tangible assets into tradable tokens on the blockchain. Ondo Finance is a decentralized platform focused on tokenizing real-world assets—physical or financial holdings like real estate, equities, or bonds—and integrating them into blockchain ecosystems. By converting these assets into digital tokens, Ondo unlocks liquidity, transparency, and accessibility traditionally reserved for institutional investors.

Overview of Ondo Finance

Ondo Finance’s strategy revolves around transforming stable, yield-generating assets from conventional finance - such as bonds or real estate - into blockchain-based tokens. By doing so, it marries the trust and stability of traditional markets with the streamlined, borderless nature of decentralized technology.

As a trailblazer in crypto and DeFi, Ondo aims to level the playing field by making institutional-caliber financial tools available to everyday users. The project operates on the principle that blockchain isn’t just a disruptor—it’s a tool to refine and expand access to financial systems. To achieve this, Ondo blends time-tested practices from traditional finance. It harmonizes robust investor safeguards, transparent reporting, regulatory adherence, and client-centric design alongside blockchain’s inherent advantages such as instant settlement and global reach.

Ondo’s operations are divided into two core divisions:

-

Asset Management: This team designs and manages tokenized versions of traditional financial instruments, ensuring they retain familiar benefits like predictable returns while still incorporating blockchain’s efficiency.

-

Technology Development: This branch builds decentralized protocols that power Ondo’s ecosystem, ensuring scalability and seamless integration with broader DeFi platforms.

Together, these elements create a bridge between old and new financial worlds, offering products that appeal to both cautious traditional investors and crypto-native users seeking stability.

Ondo’s Product Suite and Value Proposition

Ondo Finance offers various investment options directly through its platform, each of which is clearly outlined with explanations of the assets backing them, projected returns, potential risks, and eligibility requirements. A defining feature of Ondo’s strategy is its protocol design. Once launched, these protocols function autonomously, with governance and user interfaces managed by independent organizations rather than Ondo itself.

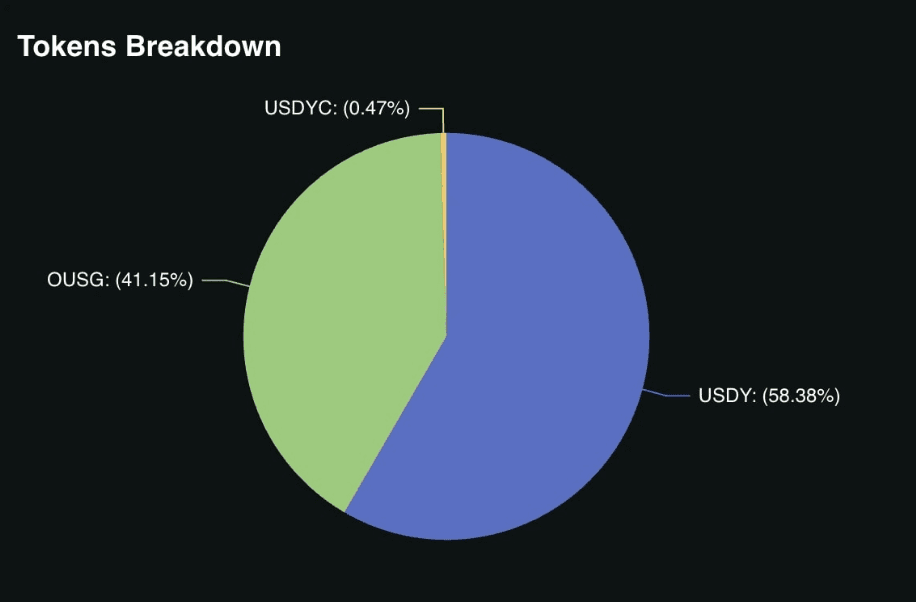

One standout example is USDY (US Dollar Yield Token). USDY acts as a blockchain-based instrument backed by short-term U.S. Treasury bonds and liquid bank deposits. It’s tailored for global investors seeking the convenience of stablecoins paired with consistent yields tied to the U.S. dollar. This approach simplifies access to traditionally complex financial instruments while maintaining the stability of conventional assets and the flexibility of decentralized technology.

Another product created by Ondo is Flux Finance, which marks a major leap forward in decentralized lending systems. Built on the foundation of Compound V2, Flux enhances its predecessor by accommodating two types of tokens: permissionless assets like USDC and permissioned assets like OUSG, which represents Ondo’s tokenized short-term U.S. Treasury fund. This dual approach allows users to freely lend stablecoins like USDC, while borrowing against assets such as OUSG demands meeting predefined regulatory and security criteria.

Flux mirrors Compound’s model by using a peer-to-pool (p2pool) structure. This means lenders deposit assets into a shared pool, and borrowers secure loans by providing collateral that exceeds the borrowed amount. This overcollateralized setup ensures system stability, combining decentralized flexibility with safeguards to meet compliance standards. By blending open access with controlled permissions, Flux bridges innovation and security in line with Ondo’s overarching mission.

|

Feature |

Ondo Finance |

Centrifuge |

MakerDAO |

|

Asset Types |

Treasuries, Real Estate |

Invoices, Royalties |

Commercial Loans |

|

Liquidity |

High (via DEX listings) |

Moderate |

Variable |

|

Regulatory Compliance |

Fully Licensed |

Partial |

Evolving |

|

APY Range |

4-8% |

6-12% |

3-5% |

The Ondo Roadmap for RWA Expansion

-

Phase 1 – Accelerate Tokenized Cash Adoption

Ondo’s initial phase prioritizes scaling the use of its tokenized cash equivalents - USDY, OUSG, and OMMF—by boosting adoption, forging blockchain alliances, and refining cross-chain interoperability tools. This includes streamlining transfers between networks and simplifying conversions, ensuring seamless access for users across ecosystems. -

Phase 2 – Tokenize Public Securities

Next, Ondo will tackle the tokenization of publicly traded assets like stocks and ETFs. It plans to address barriers such as fragmented liquidity and underdeveloped infrastructure. The goal is to create robust frameworks that enhance market efficiency while maintaining compliance with global financial standards. -

Phase 3 – Pioneer Broader RWA Integration

While specifics remain confidential, Ondo’s final phase will explore tokenizing a wider array of real-world assets (RWAs) to blend centralized oversight with decentralized protocols. This phase aims to reimagine legacy financial services, from trade finance to insurance, by embedding blockchain’s transparency and accessibility into their core.

Conclusion

In crypto’s unpredictable landscape where trust and security are non-negotiable, Ondo prioritizes collaboration with established institutions. Ondo has partnered with traditional finance heavyweights like BlackRock for asset management and giants such as BNY Mellon, Citi, JP Morgan, and State Street for custodial and operational roles. This alignment with regulated entities ensures institutional-grade safeguards. By anchoring its ecosystem in proven partnerships, Ondo balances DeFi’s disruptive potential with the reliability demanded by global investors.