Summary:

- Fully diluted market cap (or fully diluted valuation, FDV) refers to the market cap of a cryptocurrency when all of its coins have been released.

- It is calculated by multiplying the maximum supply of a crypto by its current value per coin.

- A low difference between market cap and fully diluted market cap is ideal; a fully diluted market cap that is much higher than market cap may be a sign that the crypto is overvalued and vulnerable to inflationary pressure in the future.

Before making any investment decision, it is important to understand the current value and success potential of any asset, and this is all the more true in the crypto space where there are no reporting standards. To do this, there are several metrics that investors use, such as market cap and fully diluted market cap.

Although both metrics are similar and commonly used by several crypto investors, they each have different meanings and applications.

What Is Fully Diluted Market Cap?

The fully diluted market cap of a token, which is also known as fully diluted valuation (FDV), is the value of its market cap when all of its tokens have been fully mined or released.

The FDV metric helps investors assess if the current price of the cryptocurrency is sustainable into the future or if it is currently selling above its ideal value.

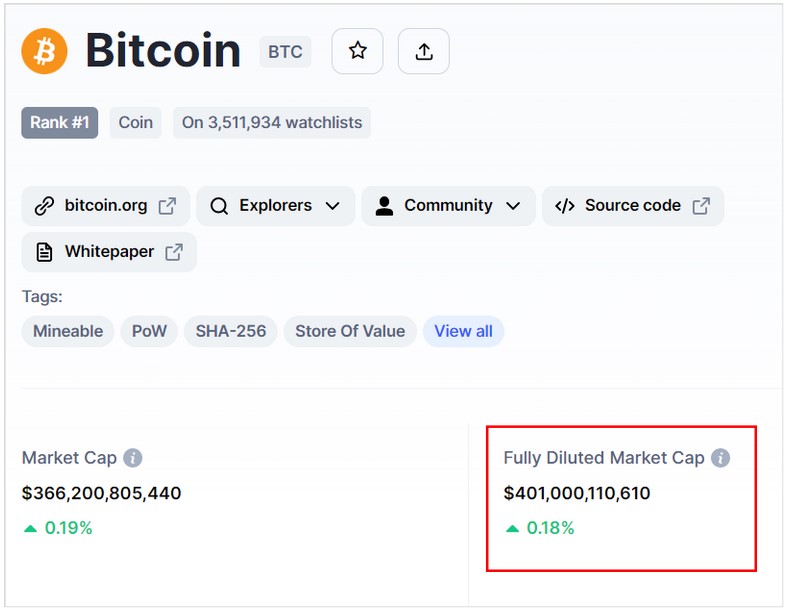

Most crypto data dashboards show FDV (Source: Coinmarketcap)

How to Calculate Fully Diluted Market Cap

To calculate the FDV of a coin, you need to multiply the maximum supply of any given token with the present market price of the token:

Fully diluted market capitalization =

Maximum supply of a coin/token x current token price.

For example, Bitcoin’s maximum supply of coins is 21 million. At its current trading price of $19,099, its fully diluted market cap would be:

21 million x $19,099 = $401,079,000,000

This FDV crypto metric allows investors to understand the future value or market cap of a cryptocurrency if its price were to remain the same into the future until all its coins were sold.

The question you may be asking at this point is: “What is the difference in fully diluted market cap vs market cap?”

Market Cap vs Fully Diluted Market Cap

What Is Market Cap?

Market cap refers to the total value of a cryptocurrency at a specific time period. It is dependent on the current price and circulation of coins at the given time.

Market cap is calculated by multiplying the current price of the coin by the current number of coins in circulation.

Market capitalization=

Circulating coin/token supply x Current coin/token price

Using the example of Bitcoin, its market cap would be:

19,176,843 x $19,099 = $366,258,524,457

As a rule of thumb, the higher the market cap, the more stable the cryptocurrency is perceived to be. The same is true for popularity, as coins that are perceived as stable tend to grow in popularity more often than not.

How is Fully Diluted Market Cap Different from Market Cap?

There are 2 major factors that make FDV different from market cap:

- Accuracy: The market cap gives a fairly accurate idea of the present worth of a coin. The FDV does not give a truly accurate picture of the future worth of the coin; since it can only be projected using current values, it does not take into account the crypto’s future growth and market adoption.

- Inflationary effect: Another drawback of the FDV metric is that it doesn’t factor in the inflationary effects of the coin’s supply on its price. If a coin’s future supply exceeds the market demand for it, its price and value will fall.

This is one of the reasons fully diluted market cap should only be used as a rough estimate of a coin’s future value, and not as a definitive metric.

How to Use Fully Diluted Market Cap in Crypto Trading?

Let’s look at the different possibilities when comparing fully diluted market cap vs market cap and what each of these outcomes mean for investors. Ideally, it is best for the difference between the market cap and the fully diluted market cap to be low.

1) High difference between market cap and fully diluted market cap

If the difference is high, this is a sign that there will be a lot of pressure from inflation as more coins are released, which may indicate that the coin is presently overvalued.

For instance, using an extreme example, if the present market cap of a cryptocurrency is $15 million and its FDV is $200 million, this could be an indication that the coin is currently overvalued.

2) Almost equal difference between market cap and fully diluted market cap

If the difference between the crypto FDV and market cap is barely noticeable, this is often a good sign that the coin is currently fairly valued or undervalued.

For example, if the fully diluted market cap of a cryptocurrency is $10 million and its market cap is also $9.5 million, this would indicate that the coin is currently fairly valued.

Ethereum is currently one of the cryptocurrencies with this kind of FDV (Source: Coinmarketcap)

3) Low difference between market cap and fully diluted market cap

If the difference between the FDV and the market cap is very low, this is an indication that inflation won’t have a huge effect on the value or price, and that the coin is currently undervalued.

A good example of this would be if the crypto FDV was $100 million, and its market cap was $90 million.

This would be an indication that the coin is currently undervalued and that there is potential for growth.

Does Fully Diluted Market Cap Matter?

At this point, if you’re wondering if the fully diluted market cap is a reliable metric, the answer is that it depends.

The fully diluted market cap can give you a good idea of how a cryptocurrency will perform in the future and can be a helpful metric in crypto investment decision-making.

However, it is important to note that the fully diluted market cap is just one metric and should not be used in isolation.

The fully diluted market cap metric can be an especially valuable tool for crypto investors who are looking to invest in a cryptocurrency for the long term. It is always best to analyze fully diluted market cap in combination with other indicators, such as market cap, to get a more accurate picture of a cryptocurrency’s value.

Read More

- What is Crypto Market Cap and How To Calculate It?

- Market Cap to TVL Ratio: Simple But Underrated Crypto Indicator

- Circulating Supply vs Total Supply: Beware Dilution Risk

- Hard Cap vs Soft Cap: A Quick Guide to Evaluating ICOs

- Crypto Derivatives Are Surging, But What’s Missing from the Market?

- May 2021 Crypto Market Analysis

- How To Do Crypto Research: The Best Ways to Get Started

- Crypto Trading vs. Investing: Key Differences Explained