Why Crypto Market Sentiment Matters

In the crypto world, sentiment is a powerful driver of price action. Unlike stocks, where valuation metrics (like earnings) play a big role, cryptocurrencies often swing on investor emotions, speculation, and narrative. Market sentiment refers to the collective mood and attitude of investors toward the market or a specific asset. It can range from extreme optimism (greed) to extreme pessimism (fear).

In 2025, understanding sentiment is more important than ever. Crypto markets are global and trade 24/7, with a large retail investor presence. This means news, social media buzz, and crowd psychology can rapidly influence prices. For example, a single Elon Musk tweet in past years could send a coin soaring or plummeting within hours. Similarly, rumors of regulatory crackdowns might spark fear and widespread selling. By gauging sentiment, traders can anticipate these kinds of moves or at least better understand the context of price swings.

Sentiment often precedes technicals. You might see sentiment indicators flashing warning signs of greed before a top is in (when technical charts still look bullish), or showing extreme fear when a bottom is near (even as price charts look ugly). Savvy crypto investors use sentiment analysis alongside technical and fundamental analysis to get a fuller picture. Ignoring sentiment is likened to ignoring the wind when sailing – you might have the best ship (technical strategy), but you could still be blown off course by a gust of FUD or FOMO.

Top Crypto Sentiment Indicators in 2025

-

Crypto Fear & Greed Index

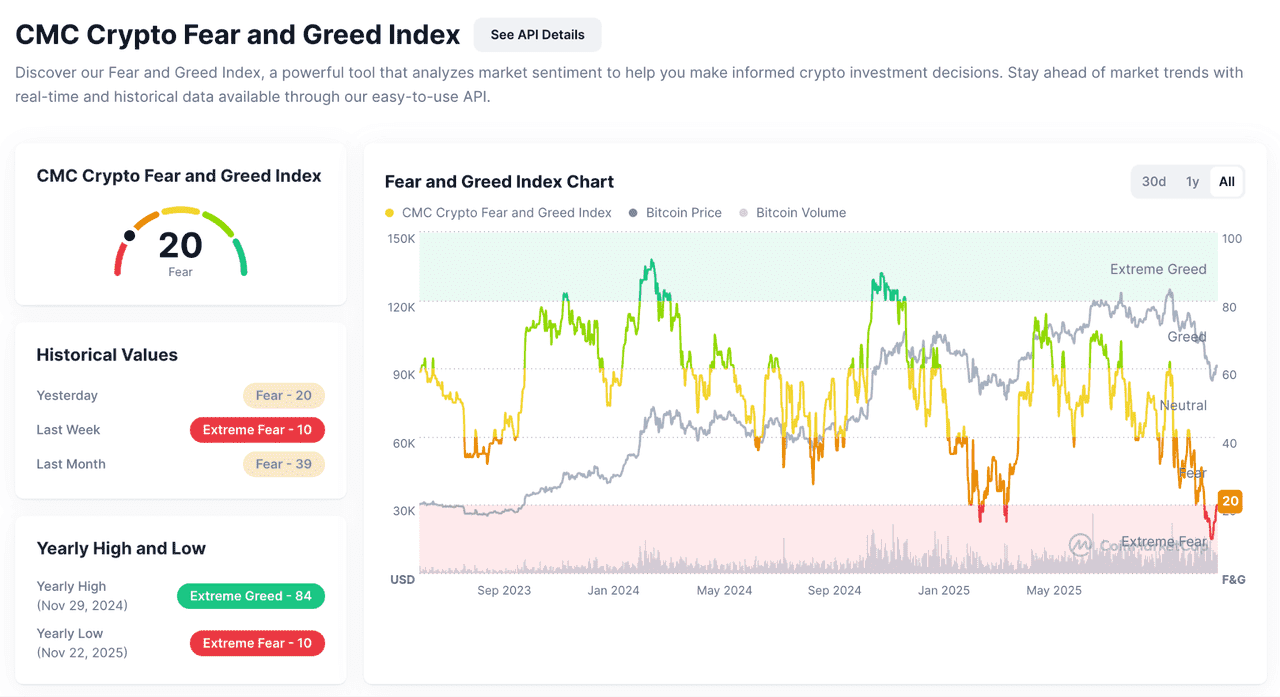

One of the most popular measures of overall market sentiment is the Crypto Fear & Greed Index. This index, inspired by a similar concept in stock markets, compiles a variety of data into a single daily score from 0 to 100 – where 0 means extreme fear and 100 means extreme greed. A neutral value would be around 50.

What it measures: The index is multifactorial. According to (a well-known provider of this index), it typically includes:

-

Volatility: Unusually high volatility or sharp price drops can signal fear.

-

Market Momentum/Volume: High buying volume and positive momentum can indicate greed (people chasing gains).

-

Social Media: Sentiment analysis of social platforms (like how positive or negative tweets are, or how frequently Bitcoin/crypto is mentioned).

-

Surveys: Previously, surveys of investor sentiment were included (though as of 2025 some providers have paused surveys).

-

Bitcoin Dominance: If Bitcoin’s dominance (its share of total crypto market cap) is rising, it can indicate fear (investors retreating to the “safety” of BTC), whereas falling BTC dominance can indicate greed (investors speculative in altcoins).

-

Google Trends: Trends in search queries can reflect interest or concern around crypto. For instance, a spike in searches for “Bitcoin crash” indicates fear.

These factors are weighted and combined into the Fear & Greed score updated daily.

Crypto Fear and Greed Index (source)

How to use it: Investors often use extreme readings as contrarian signals:

-

Extreme Fear (typically 0-25): “Investors are too worried.” This often happens after prolonged price drops. It can signal a potential bottom or buying opportunity if fundamentals are unchanged. For example, in mid-November 2025, the Fear & Greed Index stuck in “Extreme Fear” (around 10-15) for weeks as Bitcoin dropped under $100K, reflecting widespread bearishness. Such stretches of fear have historically preceded market bottoms. Indeed, analysts note that when sentiment is that depressed, much of the selling may have already occurred.

-

Extreme Greed (typically 75-100): “Investors are getting too greedy.” This often occurs during euphoric rallies and can precede a correction. For instance, if the index reaches the 90s as altcoins go parabolic, it might be a time to be cautious, take some profits, or at least tighten risk management. A famous example was in late 2024 when speculation on a potential Bitcoin ETF approval drove the index to “Extreme Greed” territory; shortly after, Bitcoin saw a sharp pullback as excitement overshot reality.

However, it’s crucial not to use Fear & Greed Index in isolation. Sometimes markets can stay greedy for a long time (during strong bull runs) or fearful for extended periods (in deep bear markets). Instead, use it as one input: if other indicators or your analysis suggest a top, an Extreme Greed reading adds confirmation to be cautious.

In 2025, some improved versions of sentiment indexes incorporate even more data (like options market sentiment, funding rates, etc.) to provide a nuanced view. Nonetheless, the classic Fear & Greed Index remains a go-to quick snapshot of the market mood.

-

Funding Rates and Open Interest

For those trading crypto derivatives (perpetual futures), funding rates are a direct window into trader sentiment and positioning. A funding rate is the periodic fee paid between long and short traders in a perpetual futures contract to keep the contract’s price close to the underlying asset’s price. When the funding rate is positive, longs pay shorts; when negative, shorts pay longs.

What it indicates:

-

High positive funding rate: This means longs are so dominant (and willing to pay to hold their positions) that the contract price is above the spot price. It indicates bullish sentiment (everyone betting on upside). If funding becomes extremely high, it signals an overcrowded long trade – potentially a warning that the uptrend is overextended and a pullback or crash (long squeeze) could occur.

-

High negative funding rate: This occurs when shorts are very crowded, indicating bearish sentiment. If funding is very negative, it suggests many are betting on downside – which paradoxically can set the stage for a short squeeze (a sudden jump upward as shorts get liquidated) if the market moves up unexpectedly.

In 2025, with crypto derivatives volume huge on platforms like Phemex, funding rates have become a key intraday sentiment gauge. Traders watch funding across major assets:

-

If Bitcoin’s funding rate flips deeply positive during a rapid price rise, it might be a sign that bullish leverage is high – a cautious trader might tighten stops or even take a contrarian short-term position expecting a snap-back.

-

If Ethereum’s price has been dropping and funding is deeply negative (shorts piling in), a contrarian might look for a “short squeeze” rally possibility, or at least avoid opening new shorts.

Open Interest (OI): Related to funding, OI measures the total number of outstanding derivative contracts. Rising open interest along with extreme funding can signal lots of new money betting one way. For example, surging OI plus very positive funding = many new longs entering aggressively. A subsequent price dip could trigger a cascade of long liquidations (since so many are leveraged), accelerating a correction. Thus, funding+OI analysis is key for anticipating sudden squeezes or flushes.

A famous case was in early 2024: as Bitcoin approached a local peak around $70k, funding rates were highly positive and open interest hit records. When the price stalled, a cascade of long liquidations followed, sending BTC down sharply – a classic sentiment overheat scenario.

For daily trading, many platforms display funding rates. As a rule of thumb:

-

Neutral funding (around 0) means balanced sentiment.

-

Funding that is consistently high or rising for days suggests an imbalanced sentiment that often precedes a reversal (the market eventually punishes the crowded side).

Keep an eye on funding especially during extreme sentiment periods. It often complements the Fear & Greed Index: during “Extreme Greed” periods in spot markets, you often see high positive funding in futures as everyone is leveraged long, and vice versa for “Extreme Fear”.

-

Social Media and Sentiment Tracking Tools

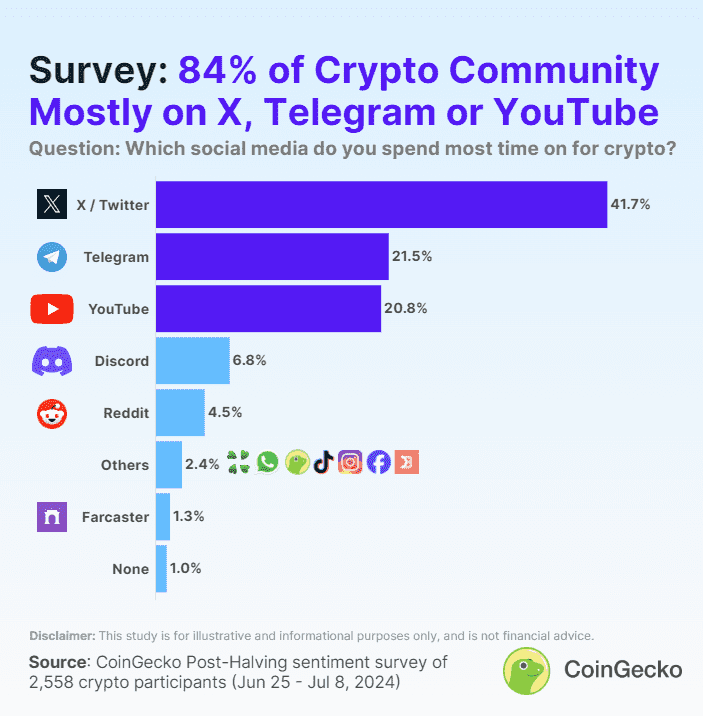

Crypto lives on social media. Social metrics have become crucial sentiment indicators:

-

Mentions and Trends: The frequency a coin or topic is mentioned on Twitter/X, Reddit, etc. For example, a sudden surge in mentions of a small altcoin can coincide with its price pumping (lots of hype). Tools like LunarCrush, Santiment, or trading platforms’ sentiment trackers measure social volume and even the positivity/negativity of posts.

-

Sentiment analysis of posts: Advanced tools use natural language processing (NLP) to gauge whether social media posts about Bitcoin or other cryptos are predominantly positive, negative, or neutral. If the crowd on Twitter is overwhelmingly bullish and euphoric, that’s a sign of extreme greed sentiment. If the majority of posts are doom and gloom, sentiment is very bearish.

Social Media Activity in Crypto (source)

In 2025, traders often monitor crypto Twitter trends, subreddit threads, and Telegram group chatter for an edge:

-

If you see influencers and timelines filled with “moon” optimism, new retail investors bragging about gains, and memes about lambos, it suggests exuberance – often a contrarian red flag.

-

If you see capitulation-like posts (“I’m quitting crypto,” “crypto is dead”) and silence on formerly buzzing crypto forums, it can suggest despair – often seen near bottoms.

One example: During the meme coin frenzy in 2025, spikes in Twitter mentions of coins like “Pepe” or “Doge 2.0” preceded massive price pumps. Traders who used social listening tools to catch these trends early could ride the wave (with caution), whereas those who joined late often got burned when the hype peaked. The rapid rise and fall of these trends underscored that social sentiment can be extremely volatile – a coin that’s all over TikTok today might be forgotten next week.

Caution: Social media sentiment can be manipulated. Whales or coordinated groups may spread bullish or bearish narratives to influence markets for their benefit. Always take raw social sentiment with a grain of salt. It's valuable to note extremes (if even the Uber drivers are talking about buying crypto, perhaps we’re near a top; if even crypto die-hards are throwing in the towel, perhaps near a bottom), but always verify with other data.

-

On-Chain Metrics (Behavioral Indicators)

While not sentiment in the traditional sense of emotions, on-chain analytics often reveal investor behavior patterns that reflect sentiment:

-

Wallet Activity: For instance, an increase in active addresses or transactions might indicate growing interest or usage (potentially bullish sentiment about a network). Conversely, stagnant on-chain activity might coincide with a market lull or bearish sentiment.

-

Exchange Flows: When large amounts of Bitcoin or Ether flow onto exchanges, it can mean investors are looking to sell (fear), whereas heavy outflows (people moving coins to cold storage) can indicate accumulation (greed or long-term optimism).

-

Whale Holdings: If whale wallets (holding large amounts) are accumulating, that often shows smart money confidence (bullish sentiment). If they’re distributing or sending to exchanges, it might signal caution.

-

HODLer Metrics: Data like the proportion of long-term holders vs. new holders can gauge sentiment. In late-stage bull markets, you often see newer traders (short-term holders) increasing – a sign of FOMO. In bear bottoms, long-term holder proportion is high – the patient money remains, the weak hands have left.

For example, during the mid-2025 peak, on-chain data showed an uptick in coins aged less than 1 month (lots of new buyers/traders entering) and a slight decline in long-term holdings. This kind of shift often aligns with euphoric sentiment where newer market participants are piling in (usually near a top). Indeed, short-term traders’ share jumping is often a hallmark of late bull runs.

On-chain metrics require interpretation and context, but they add a sentiment dimension grounded in actual behavior rather than surveys or opinions. They are especially useful for Bitcoin and Ethereum where data is rich. Platforms like Glassnode, CryptoQuant, and Santiment provide such metrics.

-

News and Media Sentiment

The tone of news coverage can also be considered a sentiment indicator. In crypto, major news events quickly translate to sentiment shifts:

-

Regulatory news: Positive developments (like a country adopting favorable crypto laws or a Bitcoin ETF approval) can swing sentiment bullish; negative news (exchange hacks, bans in big markets) can spur fear.

-

Mainstream media coverage: How the non-crypto media talks about crypto. In mania phases, you might see Bitcoin on the cover of mainstream finance magazines with extremely optimistic headlines – a sign that sentiment is extremely bullish (often a top indicator). Conversely, headlines like “Is This the End of Crypto?” in mainstream outlets often appear near bottoms when sentiment is poor.

-

Crypto media and influencer sentiment: What prominent analysts and crypto news sites are saying can feedback into sentiment. If most are extremely optimistic and downplaying any risks, it might be peak sentiment; if most are pessimistic or talking only about downturns, could be bottoming.

In 2024, for instance, as rumors swirled about the first U.S. Spot Bitcoin ETF approval, crypto news sites and mainstream finance news turned decidedly upbeat. Bitcoin’s price rallied in anticipation, showing that sentiment led price – people bought the rumor (greed). After the official news hit (or if it gets delayed), often a “sell the news” effect happens when sentiment had become too one-sided.

Some traders employ a “news sentiment” strategy: track headlines and sentiment of news articles or use AI to score media coverage as positive/negative. When everyone is on one side of the boat (all headlines positive or all negative), the contrarian in a volatile market like crypto looks to the other side.

-

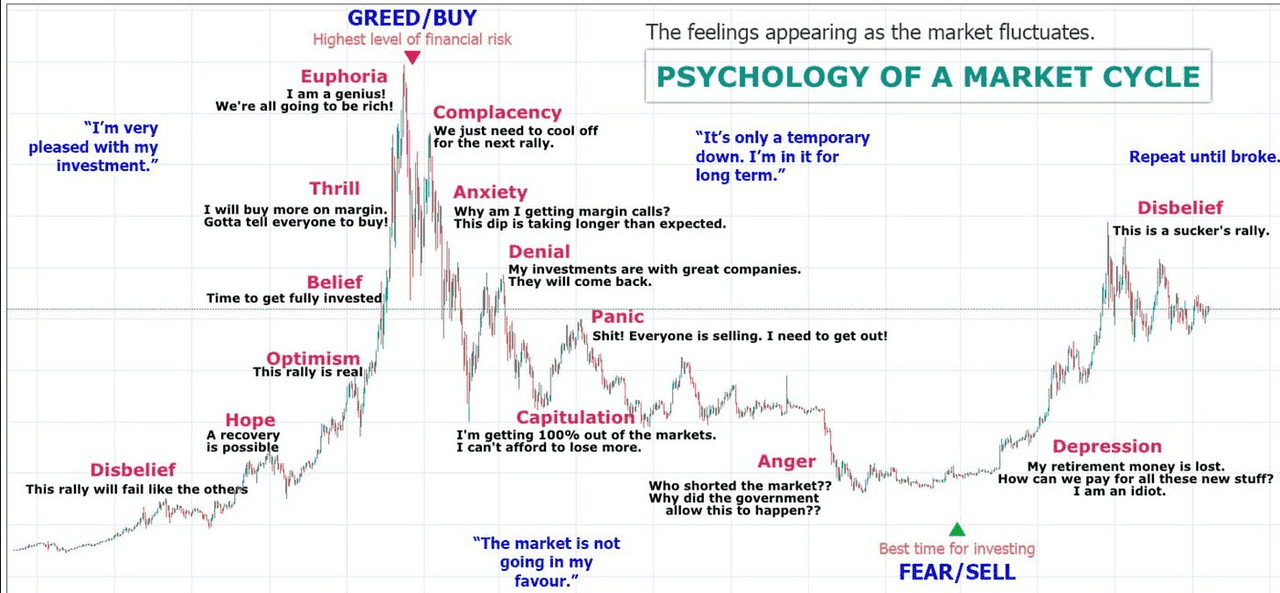

Combining Sentiment Indicators

No single sentiment indicator gives the full story. Smart traders in 2025 combine multiple signals to cross-verify:

-

If social media hype, extreme greed index readings, and high positive funding rates are all occurring together, the evidence is strong that the market may be over-exuberant and due for a correction. That’s a cue to tighten stops or even take a short-term short position.

-

If fear index is extreme, sentiment on forums is very bearish, and yet you see whales quietly accumulating on-chain, that alignment might suggest a bottom is forming. Perhaps it’s time to cautiously buy when others are fearful, assuming other factors (like fundamental outlook) are stable.

In practice, you might create a dashboard: e.g., Fear & Greed Index at a glance, funding rates data, social trending keywords, and some on-chain metrics. If the majority of those show either extreme fear or extreme greed, you have a narrative for market sentiment that can inform your trades.

Market Cycle Psychology (source)

Using Sentiment to Inform Your Crypto Strategy

Here are some practical tips for leveraging sentiment indicators:

-

Contrarian vs Momentum: Some traders use sentiment contrarily (e.g., sell when others are greedy, buy when others are fearful). This aligns with Warren Buffett’s famous advice. It often works at extremes. However, during the middle of a strong trend, following sentiment (momentum trading) can work too – e.g., moderately greedy sentiment in an early bull market is not a reason to sell; you might ride the wave until greed becomes extreme.

-

Timing Matters: Sentiment extremes can last. Just because an indicator flashes Extreme Greed doesn’t mean price will immediately drop the next day – it could stay extreme for weeks as the asset keeps rising. Use sentiment to alert you, but look for confirming price action before acting decisively. For example, you might note extreme greed, and then wait until you see a technical breakdown (like a trendline break) to actually exit a position.

-

Risk Management: When sentiment indicators point to a potential reversal (top or bottom), consider adjusting your risk. This could mean scaling out of positions, tightening stop-losses, or avoiding new trades in the direction of the crowd until things cool down.

-

Asset-Specific Sentiment: Overall market sentiment (Bitcoin-centric, as many indices are) could be greedy, but perhaps a certain altcoin has its own sentiment dynamics. For instance, an altcoin might be hyped (greedy sentiment locally) even if the broader market is neutral. So also gauge sentiment on the asset you’re trading. There are now fear/greed type indices for some major altcoins and tools to check sentiment for individual coins (like by tracking their social media mentions and community mood).

-

Stay Updated: Sentiment can flip fast in crypto. A sudden news event can turn euphoria into fear overnight (or vice versa). Thus, sentiment indicators are to be checked regularly – many are updated daily or even real-time (social feeds). Make it a habit to scan them just as you would price charts.

Conclusion

Crypto sentiment indicators like the Fear & Greed Index, funding rates, and social media metrics have become essential tools in the trader’s arsenal by 2025. They provide insight into the psychological state of the market that pure price charts might not reveal on their own. A trader who was watching sentiment in late 2024, for example, might have sensed the over-optimism as Bitcoin neared its peak (extreme greed readings, everyone talking about it, funding rates high) and exercised caution. Similarly, in the doldrums of bear phases, sentiment gauges often show “extreme fear” just when opportunity is greatest for those with a contrarian view.

For beginner and intermediate market participants, it’s important to integrate sentiment analysis in a balanced way:

-

Use it to contextualize price movements (e.g., a price breakout on high greed might be less sustainable than one on neutral sentiment).

-

Use it to avoid emotional decisions (if you know everyone else is fearful, you may be more rational about not panic selling, or if everyone’s greedy, you might resist FOMO).

-

Use it alongside technical analysis and fundamental developments. Sentiment is like the mood of the market – powerful but changeable.

By keeping a pulse on the market’s emotions through these indicators, you can make more informed, level-headed decisions. Crypto is as much about people and psychology as it is about technology and charts. In 2025’s fast-paced crypto landscape, mastering sentiment analysis – knowing when fear or greed is peaking – will give you a valuable edge in trading and investing.