The worlds of traditional finance (TradFi) and decentralized finance (DeFi) are no longer parallel universes; they are rapidly converging. At the forefront of this exciting intersection are tokenized stocks—a groundbreaking innovation that promises to redefine how we think about ownership, accessibility, and the very nature of financial markets. For investors accustomed to the rhythms of either Wall Street or the crypto markets, this new asset class can seem both intriguing and complex.

Are they real stocks? Are they cryptocurrencies? How do they actually work, and are they safe?

This in-depth guide will demystify tokenized stocks, providing a clear, comprehensive overview for any investor looking to understand this powerful new financial tool. We'll explore what they are, the intricate mechanism that gives them value, how they stack up against traditional stocks and CFDs, and the crucial balance of their pros and cons.

A Simple Definition: Digital Wrappers for Real-World Shares

At its core, a tokenized stock is a digital token that represents ownership of one share of a publicly traded company. Think of it as a digital certificate of ownership that lives on a blockchain.

Let's use an analogy. Imagine you own a rare, valuable painting. To make it easier to trade and secure, you place it in a high-security vault and receive a digital, cryptographically-secure certificate that proves you own it. You can now trade this certificate with anyone in the world, instantly. The certificate's value is directly tied to the painting in the vault. If the painting's value goes up, so does the certificate's.

A tokenized stock works in precisely the same way:

-

The "Painting": A real share of a company, like Apple (AAPL) or Tesla (TSLA).

-

The "Vault": A regulated and audited financial institution or custodian.

-

The "Digital Certificate": The token itself, which is issued on a blockchain (e.g., Ethereum, Solana, or a permissioned chain).

Each token is designed to mirror the economic value of its underlying share. If one share of AAPL is trading at $170, one tokenized AAPL (let's call it tAAPL) should also be worth $170. If Apple issues a dividend, the holder of the tokenized stock is entitled to receive that dividend, typically paid out as a stablecoin or other digital asset equivalent to the dividend's value.

Crucially, you don't directly own the traditional stock certificate in your brokerage account. Instead, you own a digital asset that is fully backed by the real-world share, giving you legitimate economic exposure to the stock's performance.

The Mechanism: The Architecture Behind the Token

The magic of tokenized stocks lies in the robust, trust-based mechanism that connects the on-chain token to the off-chain asset. This process is not alchemy; it's a carefully orchestrated financial and technological procedure. The bedrock of this entire system is the 1:1 asset backing principle: for every token in circulation, there must be one genuine share held in custody.

However, the way this principle is implemented can vary. Two dominant models have emerged, each with its own structure, advantages, and challenges.

Model 1: The Separated Issuer-Platform Model

This is the most common and open model, defined by a clear separation of duties between the issuer and the trading platform. This structure is designed to distribute risk and regulatory responsibility effectively. Phemex, for example, provides access to tokenized stocks that operate on this model.

Here is the operational path:

-

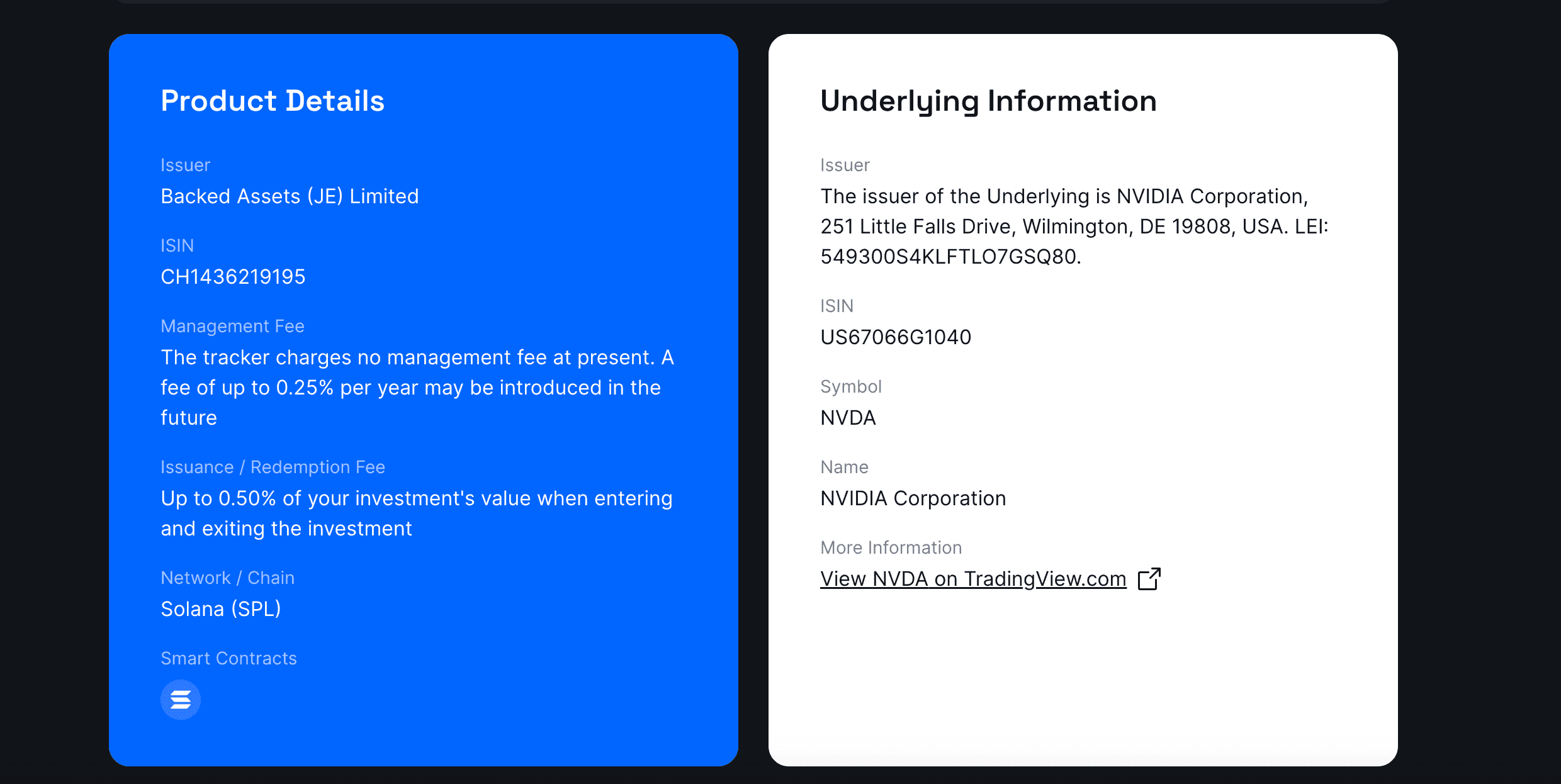

Regulated Issuer Acquires the Asset: The process begins with a specialized, regulated financial institution. A prominent example of such an issuer is Backed Finance, which holds a Swiss or EU regulatory license. This issuer uses a prime brokerage channel, like Interactive Brokers (IBKR), to purchase real shares (e.g., NVDA) on the US stock market.

-

Segregated Custody: The purchased shares are not held by the issuer or the exchange. Instead, they are deposited with a highly-regulated, independent custodian such as Clearstream or a segregated account at the prime broker. This ensures the assets are bankruptcy-remote and protected from issues at the issuer or exchange level.

-

1:1 Minting on a Public Blockchain: Once the shares are confirmed to be in custody, the issuer mints a corresponding number of tokens (e.g., NVDAx from a provider like xStocks) on a public blockchain like Solana or Ethereum (as an ERC-20 token). The 1:1 ratio is strictly maintained and publicly auditable.

-

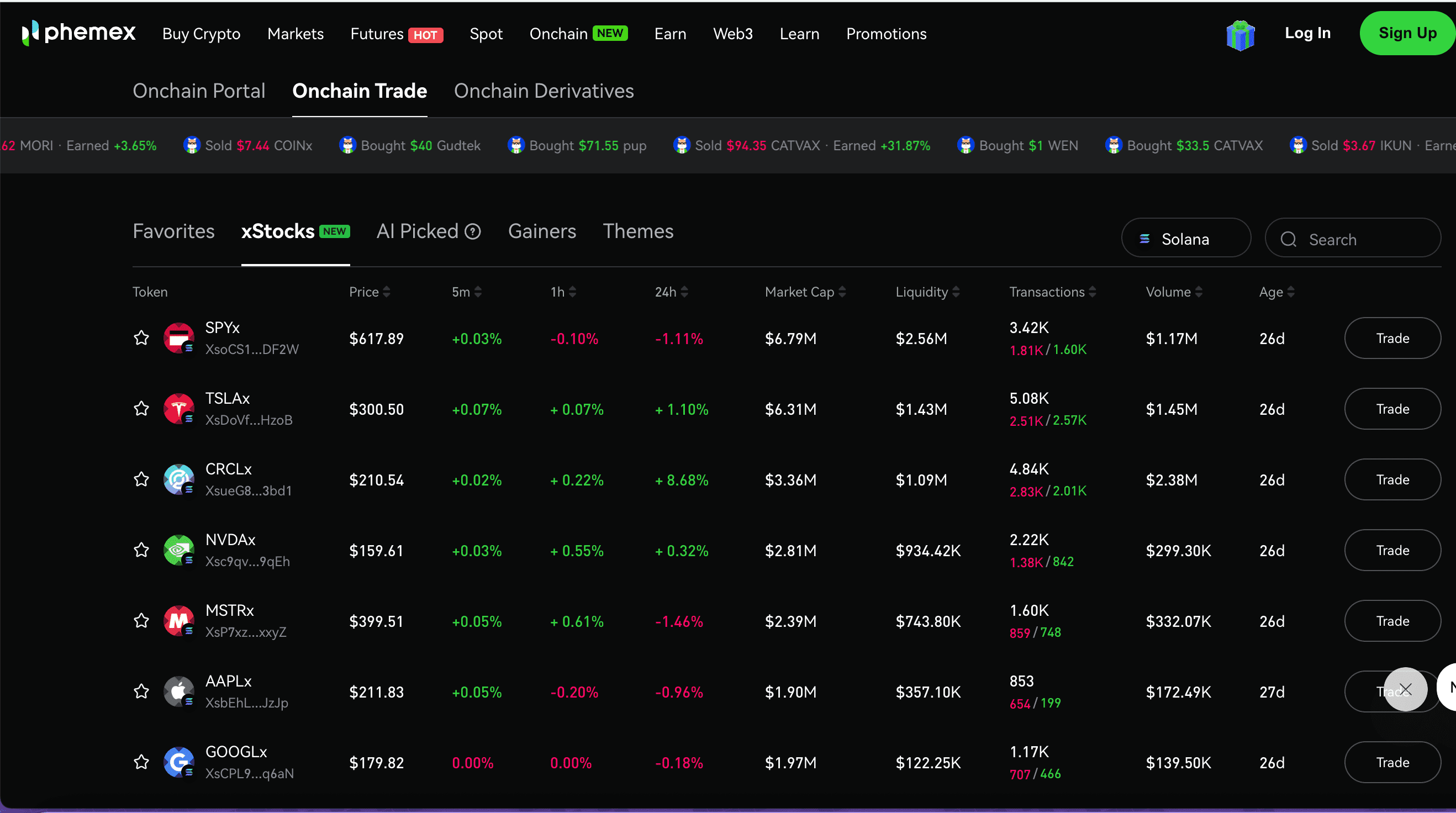

Distribution and Trading: These newly minted tokens are then made available on crypto trading platforms like Phemex. These platforms provide the secondary market, offering liquidity, order book matching, and a user-friendly interface for global investors.

The key feature of this model is that the issuer is the primary entity responsible for compliance. They handle the regulatory licensing, asset custody, and transparency disclosures. The trading platform acts as a front-end "distributor" or access point, reducing its own regulatory burden related to securities issuance. This allows for rapid and compliant expansion into non-US markets.

This model is not entirely new. FTX famously pioneered a similar path around 2020. While the service was popular, it ceased operations following FTX's collapse. It's critical to note that the model's framework was largely sound; its downfall was due to the fraudulent activities within FTX's broader corporate structure, not an inherent flaw in the tokenization process itself. This history underscores the absolute importance of the issuer's and platform's integrity.

Model 2: The Vertically Integrated Broker-Issuer Model (The Robinhood Approach)

A contrasting approach is the "closed-loop" model, best exemplified by Robinhood. Instead of integrating services from a third-party issuer, Robinhood leverages its own licensed infrastructure to control the entire value chain.

-

In-House Acquisition and Custody: Robinhood's European subsidiary, which holds a securities license in Lithuania, legally purchases and custodies US stocks and ETFs.

-

Private Minting and Trading: They then mint corresponding tokens on a blockchain (initially Arbitrum, with plans for a proprietary Robinhood Chain) and make them available for trading exclusively within their own app.

-

Closed-Loop System: Every transaction updates the on-chain state, but the entire ecosystem—from procurement to trading and settlement—is contained within Robinhood's walled garden.

This model is much harder to replicate as it requires the platform to hold its own comprehensive securities licenses. It gives the operator full control, but it is inherently less open and less connected to the broader, composable DeFi ecosystem.

Clear Comparison: Tokenized Stocks vs. Traditional Stocks vs. CFDs

| Feature | Tokenized Stocks | Traditional Stocks | Contracts for Difference (CFDs) |

| Ownership | Representative ownership. You own a digital token fully backed by a real share held in custody. | Direct ownership. You are the legal owner of the share, with voting rights and a certificate in your name. | No ownership. It's a contract between you and a broker to exchange the difference in a stock's price from open to close. |

| Trading Hours | 24/7/365. The market never closes, operating like the crypto market. | Limited to traditional market hours (e.g., 9:30 AM - 4:00 PM ET, Mon-Fri), excluding holidays. | Typically 24/5, following the global forex market schedule, but closed on weekends. |

| Accessibility | Global and borderless (primarily non-US). Anyone with internet can access them on a crypto platform. | Often restricted by geography, nationality, and requires opening an account with a specific, regulated broker. | Availability is highly dependent on regional regulations. Banned for retail investors in some countries (e.g., USA). |

| Settlement Speed | Near-instant. Trades are settled on the blockchain in seconds or minutes. | T+1. It takes one business day for the trade to officially settle and for ownership to transfer. | Instant settlement of profit/loss within the broker's platform, but no underlying asset is exchanged. |

| Fractionalization | Natively supported. You can easily buy a tiny fraction of a high-priced stock (e.g., 0.01 tAMZN). | Broker-dependent. Many modern brokers offer it, but it's a feature of the broker, not the stock itself. | Natively supported. You can open a CFD position for any size, effectively trading fractions. |

| DeFi Composability | High (for open models on public chains). Can be used as collateral, in liquidity pools, etc. | None. Assets are locked in traditional financial systems. | None. It is a bilateral contract, not a transferable asset. |

Pros and Cons: A Balanced View for the Modern Investor

The Advantages (Pros)

-

Unprecedented Accessibility & Global Liquidity: This is arguably the most significant benefit. An investor in Southeast Asia can buy a token representing a US-listed stock with the same ease as an investor in Europe. This breaks down geographical and financial barriers, creating a single, global liquidity pool for non-US investors.

-

24/7/365 Market Access: The world doesn't stop when Wall Street closes. Tokenized stocks trade around the clock, allowing investors to react to breaking news or global events in real-time.

-

Democratization through Fractional Ownership: Stocks like Berkshire Hathaway Class A (BRK.A) or Amazon (AMZN) can be prohibitively expensive for many. Tokenization makes it trivial to buy $10 or $50 worth of any stock, allowing for greater diversification.

-

Enhanced Efficiency and Programmability: By leveraging public blockchains, trades settle nearly instantly. Furthermore, these tokens are "composable"—they can be seamlessly integrated into the wider DeFi ecosystem, unlocking new yield strategies unavailable in TradFi.

The Potential Risks (Cons)

-

Regulatory Uncertainty & Geographic Limitations: This is a major headwind. The U.S. Securities and Exchange Commission (SEC) has not yet approved such products for retail sale in the United States. Consequently, this model is primarily targeted at non-US investors.

-

Counterparty and Issuer Trust: Even with independent custodians, you are placing significant trust in the issuer. The FTX saga is a stark reminder that the integrity of the operating entities is paramount. This is why it's critical to choose established platforms like Phemex, which provide access to assets from vetted, regulated providers like Xstocks.

-

Liquidity Fragmentation: Because the Separated Issuer model is relatively easy to replicate, multiple platforms could end up offering distinct tokenized versions of the same stock. This could fragment liquidity, leading to thinner order books compared to the unified traditional market.

-

Smart Contract Vulnerabilities: The tokens are governed by smart contracts on a blockchain. While generally secure, any code can have bugs or vulnerabilities that could be exploited by malicious actors.

Conclusion: The Future of Investing is Here

Tokenized stocks are more than just a novelty; they represent a fundamental evolution in financial market infrastructure. By wrapping traditional, proven assets in modern, efficient technology, they offer a glimpse into a future where investing is truly global, accessible 24/7, and seamlessly integrated with the digital economy.

While the landscape is still developing and risks certainly exist—particularly around regulation and the need for trustworthy issuers—the potential to democratize wealth creation on a global scale is immense. For the informed investor, they offer an exciting new avenue for portfolio diversification and a chance to be at the cutting edge of financial innovation.

Ready to move from theory to practice?

See how tokenized stocks work in practice on Phemex.