Der Handel mit Kontrakten ist eine Form des Kryptowährungs-Derivatehandels, bei der Sie eine Vereinbarung (einen Kontrakt) eingehen, um auf den Preis eines Krypto-Assets zu spekulieren, ohne den zugrundeliegenden Basiswert tatsächlich zu besitzen. Einfach ausgedrückt einigen sich ein Trader und eine Börse (wie zum Beispiel Phemex) darauf, die Differenz im Preis eines Assets zwischen dem Öffnen und Schließen des Kontrakts abzurechnen. Dadurch können Trader von Kursbewegungen bei Bitcoin, Ethereum und anderen Kryptowährungen profitieren, indem sie „long“ (auf steigende Kurse setzen) oder „short“ (auf fallende Kurse setzen) gehen – und das ganz ohne physischen Besitz der Coins. Bis 2025 hat sich der Kontrakthandel (auch bekannt als Krypto-Futures-Handel) enorm verbreitet, bietet hohe Hebelwirkungen und neue Produkte wie unbefristete Kontrakte (Perpetuals), birgt jedoch wesentliche Risiken, die besonders neue Trader verstehen sollten.

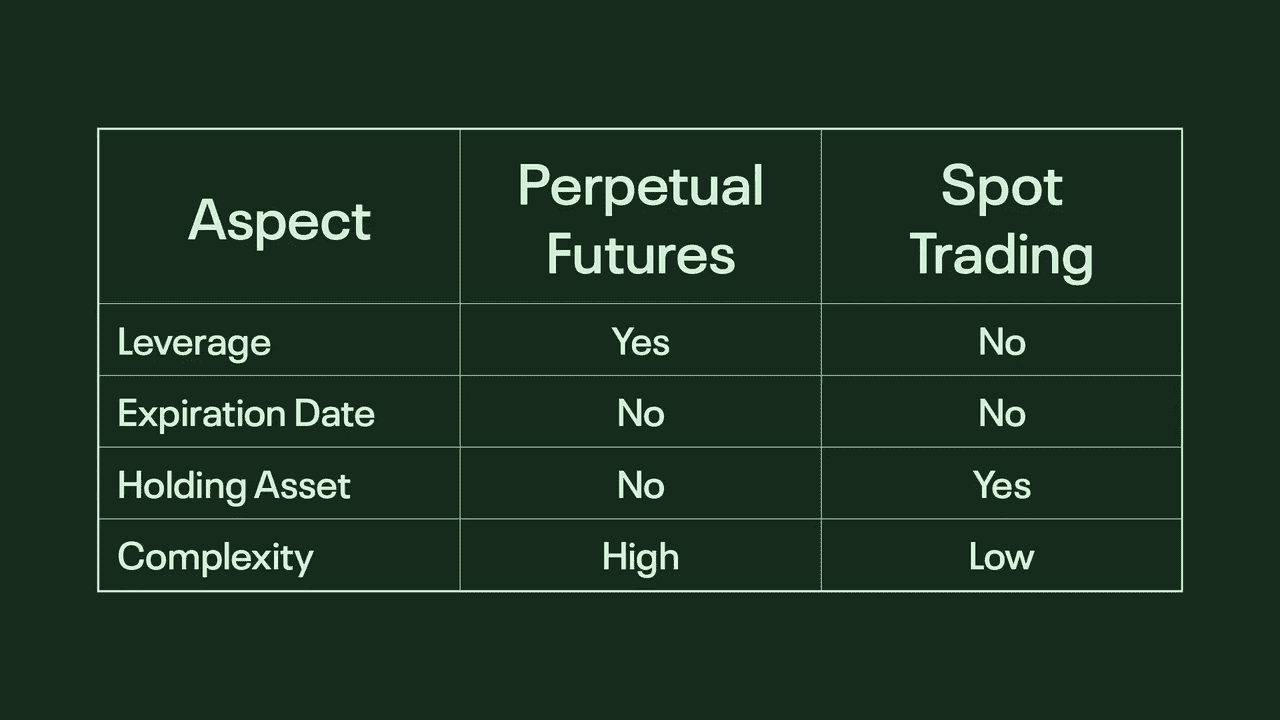

Kontrakthandel unterscheidet sich vom klassischen Spot-Handel. Beim Spot-Handel kaufen Sie die tatsächliche Kryptowährung und halten sie in Ihrem Wallet. Beim Kontrakthandel handeln Sie Kontrakte, die an den Kurs des Coins gebunden sind – Sie besitzen nicht die Coins selbst, sondern ein Derivat, dessen Wert sich vom Basiswert ableitet. Der entscheidende Unterschied ist: Kontrakt-Trader können Hebelwirkung (Leverage) nutzen, um ihre Marktexponierung zu vervielfachen und sowohl von steigenden als auch fallenden Märkten profitieren.

Was ist ein Kontrakt im Trading?

Ein Kontrakt im Trading ist eine rechtliche Vereinbarung, in der sich zwei Parteien auf bestimmte Konditionen einigen:

-

Börse: Verpflichtet sich, dem Trader einen höheren Betrag proportional zum ursprünglichen Investment auszuzahlen, falls der Trade profitabel ist.

-

Trader: Verpflichtet sich, Sicherheiten zu hinterlegen und riskiert bei Verlust das eingesetzte Krypto-Vermögen.

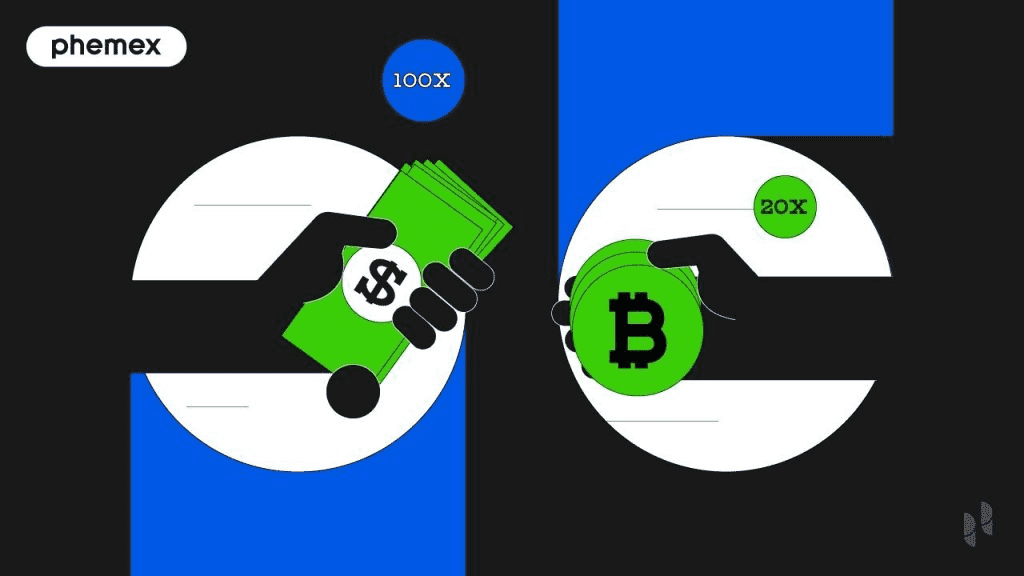

Trader müssen die Margin (Sicherheitsleistung) für den Kontrakthandel wählen. Die Margin bestimmt, welchen Hebel ein Trader einsetzen kann, um das Gewinnpotenzial im Verhältnis zur eingesetzten Kapitalsumme zu erhöhen. Zur Auswahl stehen z.B. 2x, 3x, 5x, 10x, 50x und bis zu 100x Hebel.

Das Chance-Risiko-Verhältnis im Margin-Trading ist proportional: Ein höherer Hebel steigert zwar das Gewinnpotenzial deutlich, doch steigt zugleich auch das Liquidationsrisiko, da mit geliehenem Kapital gehandelt wird.

Bitcoin-Kontrakthandel: Ein Beispiel

Ein Trader möchte auf Phemex mit 1 Bitcoin handeln (zum Preis von 40.000 USDT), verfügt jedoch nur über 400 USDT auf seinem Konto. Mit einem 100x Hebel kann er eine Summe im Verhältnis 100:1 „leihen“ und effektiv Bitcoin im Wert von 40.000 USDT handeln.

Die Preisdifferenz von 39.600 USDT gilt als geliehenes Kapital. Bei solch hohem Hebel kann die Börse die Position bereits bei einer Kursbewegung von unter 1 % liquidieren. Bei niedrigeren Hebeln wie 3x müsste sich Bitcoin mehr als 10 % gegen den Trader bewegen, ehe eine Liquidation erfolgt.

Solange die Position offen ist, dienen die hinterlegten Mittel im Konto als Sicherheit (Collateral) für den Trade. Ein Trader kann maximal das verlieren, was er als Sicherheit eingesetzt hat.

Trader können Trades mit Limit- und Market-Orders öffnen und schließen – ähnlich wie beim Spot-Handel. Der Unterschied liegt lediglich in der Kontraktanzahl und dem gewählten Hebel.

Perpetual Contracts und Finanzierungssätze erklärt

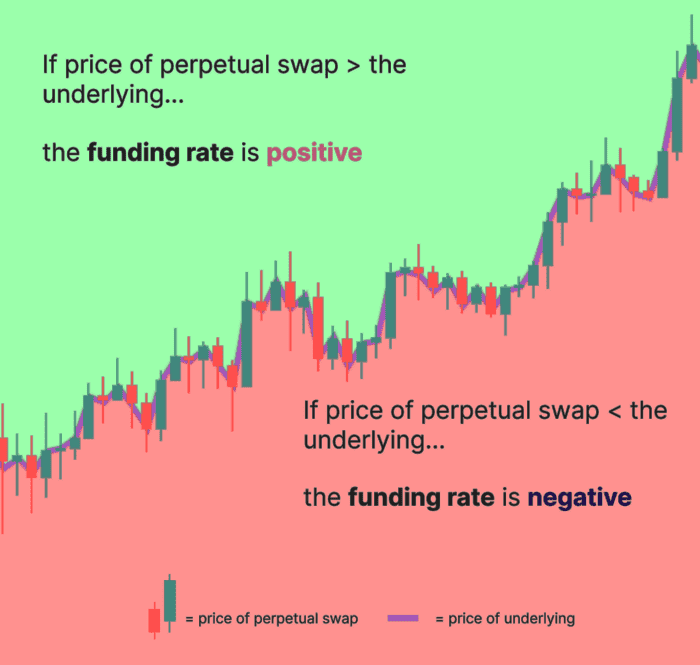

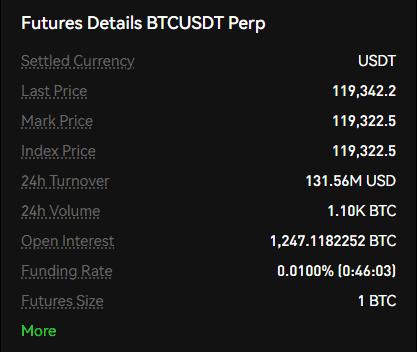

Unbefristete Kontrakte (Perpetual Contracts) zählen 2025 zu den beliebtesten Krypto-Derivaten. Im Gegensatz zu traditionellen Futures haben sie kein Ablaufdatum und können beliebig lange gehalten werden. Börsen nutzen Funding Rates, um Perpetual-Preise am Spotmarkt auszurichten.

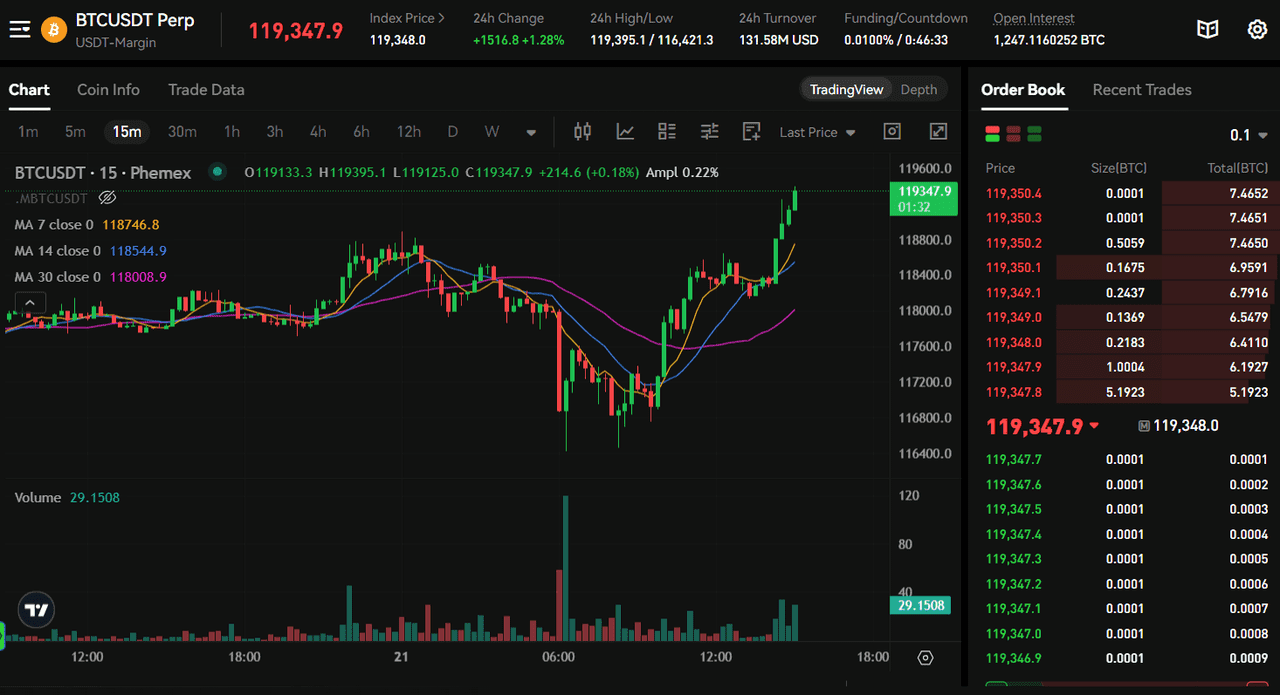

Ein Perpetual Contract funktioniert wie ein Futures-Kontrakt – nur ohne Verfall. Beispielsweise verfolgt ein BTC Perpetual auf Phemex den Bitcoin-Preis kontinuierlich; Trader müssen keine Kontrakte rollen oder auf das Ablaufdatum achten.

Funding Rates verhindern, dass Perpetual-Kontrakte sich dauerhaft vom Spot-Preis abkoppeln. Diese Sätze sind periodische Zahlungen zwischen Long- und Short-Tradern. Notiert der Perpetual oberhalb des Spot-Preises, zahlen Longs eine Prämie an Shorts. Dadurch wird der Preis in Richtung Spot bewegt. Liegt der Perpetual unterhalb des Spots, zahlen Shorts an Longs – der Preis wird nach oben gedrückt.

Wenn z.B. der BTC Perpetual auf Phemex bei 30.100 USDT handelt und der Spotpreis bei 30.000 USDT liegt, führt ein Funding Rate von +0,03% bei einer Long-Position über 100.000 USDT zu Kosten von 30 USDT – Shorts erhalten diesen Betrag. Besonders bei längerfristigen Positionen können sich solche Gebühren summieren.

Trader sollten Funding Fees stets im Blick behalten, da hohe Sätze die Rentabilität beeinträchtigen können. In trendstarken Märkten können Funding-Gebühren für Longs teuer bzw. für Shorts vorteilhaft sein. Die aktuellen Sätze finden sich direkt in der Handelsplattform und dienen häufig auch als Sentiment-Indikator.

Zusammengefasst bieten Perpetual Contracts hohe Flexibilität, Trader sollten aber die Finanzierungskosten stets berücksichtigen – vor allem Swing- oder Positions-Trader sollten Funding Rates vor jedem Trade prüfen.

Marktvolumen von Krypto-Derivaten

Daten von Markt-Trackern zeigen, dass das tägliche Volumen aller Krypto-Derivate-Börsen weltweit bei über 100 Milliarden US-Dollar liegt. Phemex macht davon 2–3% aus – also über 2–3 Milliarden US-Dollar täglich.

Der Bitcoin-Derivate-Handel macht über 50% des gesamten Krypto-Derivatevolumens aus. 2021 übertraf das Handelsvolumen von Krypto-Derivaten erstmals die klassischen Spotmärkte. Krypto-Derivate sind noch relativ neu, das Angebot entwickelt sich aber rasch – inzwischen gibt es vergleichbare Instrumente wie an traditionellen Finanzmärkten.

Der weltweite Markt für traditionelle Derivate (außerhalb von Krypto) gilt als über 1 Billiarde US-Dollar schwer – einschließlich Derivaten auf Aktien, Devisen, Rohstoffe und mehr.

Futures vs. Spot-Handel

Spot-Handel bedeutet, dass Sie Assets kaufen und dauerhaft besitzen. Beim Derivatehandel erwerben Sie hingegen Verträge, deren Profitabilität vom Spot-Kurs abhängt.

Assets wie Bitcoin werden im Derivatebereich nicht tatsächlich vom Trader gehalten – ähnlich wie bei Börsen-Derivaten auf Aktien. Auf Phemex können Nutzer für fast alle im Spotmarkt gelisteten Coins und Kontrakte auch Derivate handeln – mit dem Ziel, das Angebot ständig auszubauen.

Trader behalten beim Handel mit Derivaten stets die volle Kontrolle: Sie können long/short gehen, den Hebel anpassen, Take-Profit/Stop-Loss setzen und Positionen schließen – wahlweise per Limit- oder Market-Order.

Strategien für Derivate- und Kontrakthandel

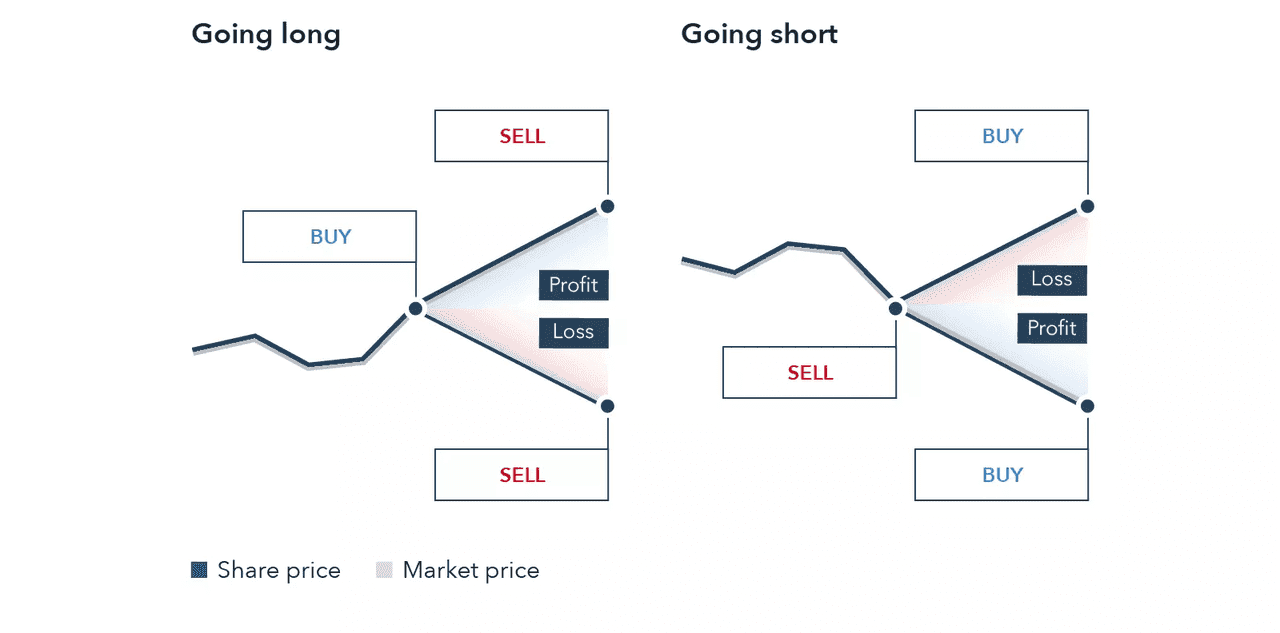

Der Handel mit Kryptowährungs-Derivaten ist mit den richtigen Strategien auch für Einsteiger möglich. „Long“ und „Short“ zählen zu den meistgenutzten Handelsansätzen, häufig in Kombination mit Hebel.

-

Long (Kauf): Kontraktpositionen, die auf steigende Kurse bei Bitcoin oder einem Altcoin setzen.

-

Short (Verkauf): Kontraktpositionen, die auf fallende Kurse bei Bitcoin oder Altcoins spekulieren.

Öffnet ein Trader eine Long-Position auf Bitcoin, muss der Kurs ab Öffnung steigen, um Gewinne zu realisieren. Fällt der Kurs, drohen anteilige Verluste am eingesetzten Vermögen.

Wer mit 100x Hebel handelt, sollte vor allem kurzfristige Charts (1M, 5M, 15M) nutzen, um kleine Kursschwankungen auszunutzen. Mit 3x Hebel eignen sich Stunden-, Tages- oder Wochen-Charts für Trendprognosen.

Kontrakt-Trades sind meist deutlich kurzfristiger als Spot-Trades – wegen des Hebels sichern Trader Gewinne früher ab und hedgen gegen plötzliche Kurswendungen sowie schnelle Verluste.

Vorteile des Kontrakthandels im Krypto-Bereich (Step-by-Step Guide)

Der Handel mit Krypto-Kontrakten bringt zahlreiche Vorteile gegenüber dem klassischen Spot-Handel:

Hebel für größere Gewinne: Mit Leverage (Hebel) können Trader mit weniger Kapital größere Positionen bewegen – das vervielfacht eventuelle Profite. Zum Beispiel bedeutet ein 10x Hebel: Aus einer 1%-Kursbewegung wird ein 10%-Gewinn.

Profite in beiden Marktrichtungen: Trader können mit wenigen Klicks long oder short gehen und so auch in Bärenmärkten Gewinne erzielen. Viele nutzten das Shorten beim Krypto-Abwärtstrend 2022–2023.

Kein Halten echter Kryptowährungen: Mit Derivaten umgehen Trader den Besitz der Coins – das mindert Risiken wie Hacks. Dennoch sollte das Kontrahentenrisiko der Börsen berücksichtigt werden.

Kapital-Effizienz: Geringere Anforderungen an Eigenkapital/Margin schonen das Kapital, das dadurch an anderen Märkten einsetzbar bleibt. Viele Börsen akzeptieren mittlerweile Stablecoins als Margin über verschiedene Märkte hinweg.

Absicherungsmöglichkeit (Hedging): Strategische Anleger können Risiken im Portfolio hedgen, etwa indem sie ETH-Kontrakte shorten und so einen Kursrückgang absichern.

Rund-um-die-Uhr-Liquidität & Ausführung: Krypto-Kontraktmärkte sind 24/7 geöffnet, bieten hohe Liquidität und damit schnelle Order-Ausführung mit niedrigen Spreads und Gebühren.

Vielfältige Strategien: Kontrakthandel erlaubt zahlreiche Ansätze – vom Daytrading über Swing Trading bis hin zu Arbitrage. Profit ist so auch abseits des klassischen Haltens möglich.

Perpetual-Kontrakte: Diese Kontrakte haben kein Ablaufdatum; Trader können ihre Positionen so lange halten, wie sie Funding und Liquidation steuern.

Zugang zu vielen Märkten: Viele Börsen bieten Kontrakte auf eine große Auswahl an Assets – inklusive weniger bekannter Tokens. Handel ist ohne direkten Besitz möglich.

Kurzum: Kontrakthandel ist deutlich flexibler und eröffnet strategische Chancen, die Spot-Handel nicht bietet – vor allem für aktive Trader. Die erhöhte Komplexität und das höhere Risiko müssen allerdings umsichtig gemanagt werden.

Risiken beim Kontrakthandel und wie man sie beherrscht

Der Kontrakthandel ist attraktiv, birgt aber erhebliche Risiken – vor allem durch die Volatilität an Krypto-Märkten. Die wichtigsten Gefahren und Tipps:

-

Hohes Hebelrisiko: Leverage kann Kapital im Nu aufbrauchen. Bereits 1 % Gegenbewegung bei 100x Hebel führt zum Totalverlust der Margin. Anfänger sollten mit geringem Hebel (maximal 5x) und klarem Loss-Limit arbeiten.

-

Marktvolatilität & Preisspitzen: Unerwartete Nachrichten verursachen oft schnelle Kursausschläge – das kann Stop-Losses bzw. Liquidationen auslösen. Vermeiden Sie hohe Hebel bei wichtigen Nachrichten und behalten Sie die Wirtschaftsdaten im Blick.

-

Liquidations-Kaskaden: Liquidationen können weitere Verkäufe auslösen und den Kurs rapide drücken. Halten Sie eine solide Margin, um Volatilität standzuhalten.

-

Funding Fee Kosten: Hohe Finanzierungssätze können Gewinne aufzehren. Funding Rates regelmäßig prüfen und ggf. verlustreiche Positionen rechtzeitig auflösen.

-

Komplexität & Plattformkenntnisse: Jede Börse hat eigene Regeln & Mechanismen. Starten Sie mit kleinen Trades, um die Plattform risikofrei kennenzulernen.

-

Emotionales Risiko: Starke Emotionen führen zu Fehlentscheidungen. Bleiben Sie beim Trading-Plan und vermeiden Sie Impulshandlungen.

-

Technische Risiken: Sorgen Sie für eine stabile Internetverbindung und beachten Sie mögliche Wartungen oder Downtimes der Börse – gerade beim Daytrading kritisch.

Seien Sie stets wachsam, setzen Sie nie mehr ein, als Sie verlieren können, nutzen Sie Risikomanagement-Tools und seien Sie auf Worst-Case-Szenarien vorbereitet.

So traden Sie Krypto-Kontrakte auf Phemex

Für Einsteiger hier eine benutzerfreundliche Schritt-für-Schritt-Anleitung, wie Sie bei Phemex Krypto-Kontrakte handeln – einer der führenden Krypto-Derivatebörsen. Phemex bietet 2025 eine starke Plattform für den Handel mit Perpetual Futures auf zahlreiche Kryptowährungen mit bis zu 100x Hebel.

-

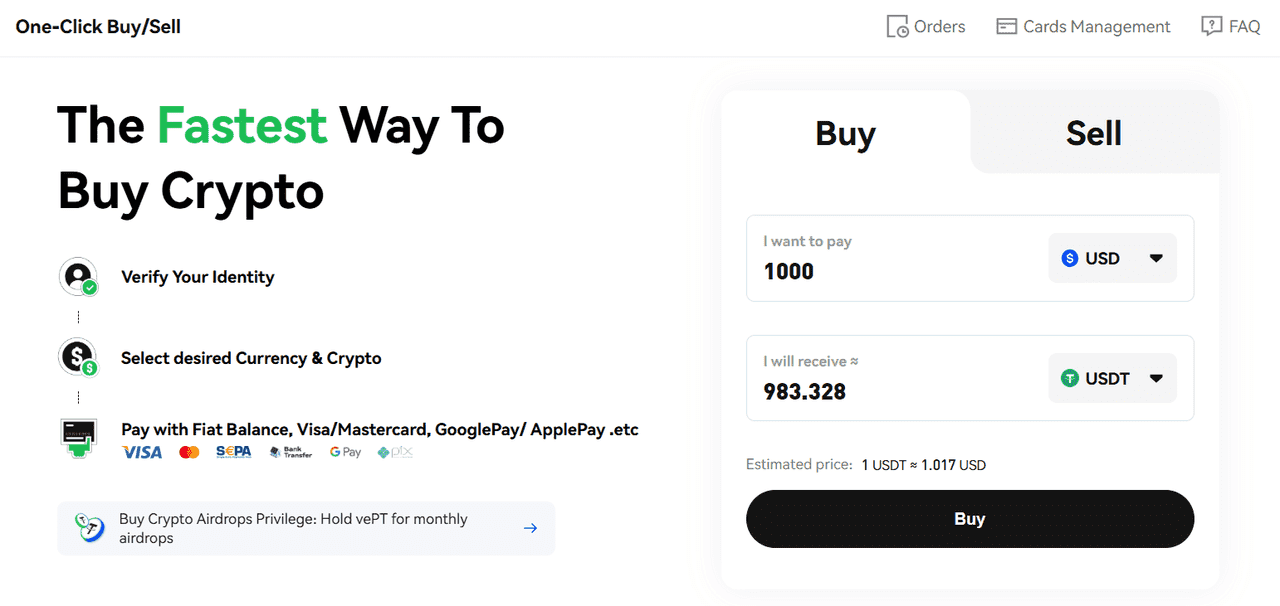

Phemex-Konto erstellen und aufladen: Falls noch nicht geschehen, registrieren Sie sich bei Phemex und aktivieren Sie die Zwei-Faktor-Authentifizierung für mehr Sicherheit. Nach der Registrierung müssen Sie Guthaben aufladen – etwa USDT, BTC, ETH von einer anderen Börse/wallet, oder via „Krypto kaufen“ direkt auf Phemex per Kreditkarte oder Banküberweisung.

-

Guthaben in das Kontraktkonto transferieren: Phemex trennt Spot-Konto (regulärer Handel) und Kontraktkonto (Futures). Nach der Einzahlung gehen Sie zu Ihren Vermögenswerten und verschieben den gewünschten Betrag ins Kontraktkonto.

-

Kontraktmarkt auswählen: Gehen Sie in den Bereich „Märkte“ oder „Futures-Handel“. Hier finden Sie alle verfügbaren Perpetuals (ggf. auch klassische Futures) – etwa BTC/USDT Perpetual, ETH/USDT Perpetual und viele Altcoins. Phemex erweitert das Angebot laufend.

-

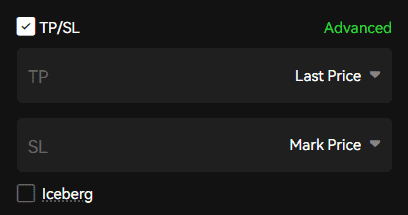

Das Trading-Interface verstehen: Im Interface finden Sie Candlestick-Charts, das Orderbuch und das Orderpanel. Wichtige Elemente: Leverage-Slider, Ordertyp, Positionsgröße, sowie Optionen für Take Profit und Stop Loss.

-

Position eröffnen: Prüfen Sie alle Angaben (insbesondere, ob Sie „Kaufen/Long“ oder „Verkaufen/Short“ wählen wollten). Bei Market Orders wird die Position sofort zum Marktpreis geöffnet, bei Limit Orders bei Erreichen Ihres gewählten Kurses. Anschließend erscheinen in der Positionsübersicht meist folgende Details:

-

Positionsgröße: z. B. 0,5 BTC (notional) long, oder 10.000 Kontrakte etc.

-

Eröffnungskurs: Durchschnittskurs Ihrer Positionseröffnung.

-

Mark-Preis: Referenzkurs für den P&L und Liquidationsberechnung.

-

Unrealisierter Gewinn/Verlust: Ihr momentaner Profit/Verlust (verändert sich live mit dem Kurs).

-

Liquidationspreis: Wenn der Kurs diese Schwelle erreicht, erfolgt die Liquidation – behalten Sie diesen Abstand stets im Blick!

-

Margineinsatz: Wie viel Guthaben als Collateral blockiert ist.

-

-

Trade überwachen und managen: Sie können im laufenden Trade jederzeit Stop-Loss oder Take-Profit setzen/anpassen. Achten Sie auf Marktnews & Volatilität und behalten Sie speziell bei länger laufenden Positionen die Funding Rates im Auge, damit es keine Überraschungen bei Gebühren gibt.

-

Position schließen: Sie können Ihre Kontrakt-Position jederzeit schließen – entweder per Market-Order sofort oder Limit-Order bei Erreichen eines Wunschkurses. Herzlichen Glückwunsch – Sie haben einen Kontrakt gehandelt!

Wer diese Schritte befolgt, kann als Anfänger den Kontrakthandel hands-on in risikoarmer Umgebung testen. Starten Sie stets klein – traden Sie erst mit geringem Kapital, bis Sie das System sicher verstehen. Erst mit wachsender Erfahrung und Wissen sollte die Positionsgröße steigen. Die Plattform von Phemex ist 2025 anwenderfreundlich, doch das Risikomanagement obliegt immer Ihnen als Trader.

Fazit

Kontrakthandel ist ein wichtiger Teilbereich des Krypto-Derivatehandels und bietet Tradern die Möglichkeit, ihre Gewinnmargen mithilfe von Leverage signifikant zu steigern. Um Kontrakthandel zu verstehen, ist Vorwissen zu Spot-Trading und zu Krypto-Charts essenziell. Krypto-Derivatehandel eignet sich vor allem für fortgeschrittene Nutzer. Da sie ein höheres Risiko bergen, sollten Derivate nur von Tradern mit vertiefter Markt- und Toolkenntnis genutzt werden, die sich der Volatilität bewusst sind. Für Anfänger mag der Einstieg zunächst komplex wirken – doch mit Lernbereitschaft und vorsichtigem Üben wird der Derivatehandel schnell zum wertvollen Bestandteil des eigenen Toolkits. Immer daran denken: Bildung und Risikomanagement sind die besten Verbündeten. Nutzen Sie etwa Stop-Loss-Orders, wählen Sie einen sinnvollen Hebel und riskieren Sie niemals mehr, als Sie zu verlieren bereit sind. Auch 2025 bieten Krypto-Märkte enorme Chancen – für all jene, die diszipliniert, informiert und verantwortungsvoll handeln.

Mehr erfahren

- Was ist Kontrakthandel im Krypto und wie funktioniert es?

- Wie handelt man Krypto: Der ultimative Investitions-Guide

- Was sind Krypto-Derivate und wie funktionieren sie?

- Was sind Krypto-Derivate: Die wichtigsten Bitcoin-Derivate erklärt

- Was sind Krypto-Optionen und wie funktionieren sie?

- Krypto-Trading vs. Investieren: Die wichtigsten Unterschiede

- Was sind Krypto-Futures und wie funktionieren sie?

- Was ist CFD-Trading? Ist es für Anfänger geeignet?