Bitcoin is notorious for its volatility – the frequent and sometimes dramatic price fluctuations that have both excited investors and spooked skeptics. In financial terms, volatility refers to the degree of variation in an asset’s price over time. High volatility means the price swings widely (rising or falling sharply), while low volatility means it’s relatively stable. Bitcoin (BTC), since its inception, has exhibited far greater volatility than most traditional assets like stocks or gold. This volatility is a double-edged sword: it creates opportunities for traders to make outsized gains in short periods, but it also means Bitcoin can experience steep drops that pose risks to investors. Understanding Bitcoin’s volatility – why it happens, how to measure it, and how to manage it – is crucial for anyone venturing into the crypto market.

What Is Volatility?

Volatile and non-volatile assets (Source: masterthecrypto.com)

Bitcoin is known for its unrestrained volatility, and this is one reason why new investors are often afraid to dabble in cryptocurrencies. Volatility plays an important role in any market: the higher the volatility, the higher the risk and returns.

If there is very little volatility, investors will neither lose nor gain a lot of money. In the stock market, extreme volatility is rare. In crypto, however, it is very common. These high-volatility events present a good opportunity for investors to sell assets at a price higher than where they bought in.

In Bitcoin, people have lost millions of dollars overnight because of high volatility, but many have also become billionaires because of it. Bitcoin volatility is a double-edged sword that can either win you a substantial amount of money or increase your risk of losing everything. Investing in an asset as volatile as Bitcoin should be done with caution and thorough research.

How Is Market Volatility Measured?

The stock market’s volatility is measured by the Cboe Volatility Index (VIX). A value of anywhere between 12 and 20 is considered low. If an asset’s volatility surpasses 30, it is considered extremely volatile.

Volatility in stocks is more stable than in crypto. For example, the VIX was highly stable between 2004 and 2007, and even when the 2008 financial crisis drove the VIX up to 89.53 in October 2008, it quickly came back down to 22.27 just one year later. After the financial crisis, the VIX saw a long period of stability. However, in 2020 this volatility returned due to the coronavirus pandemic’s implications on the economy.

Is There a Volatility Index for Bitcoin?

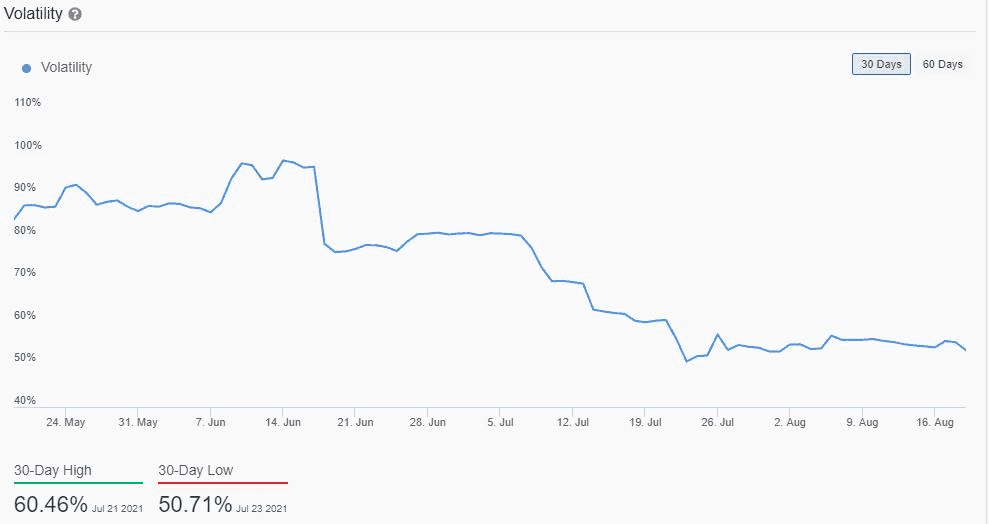

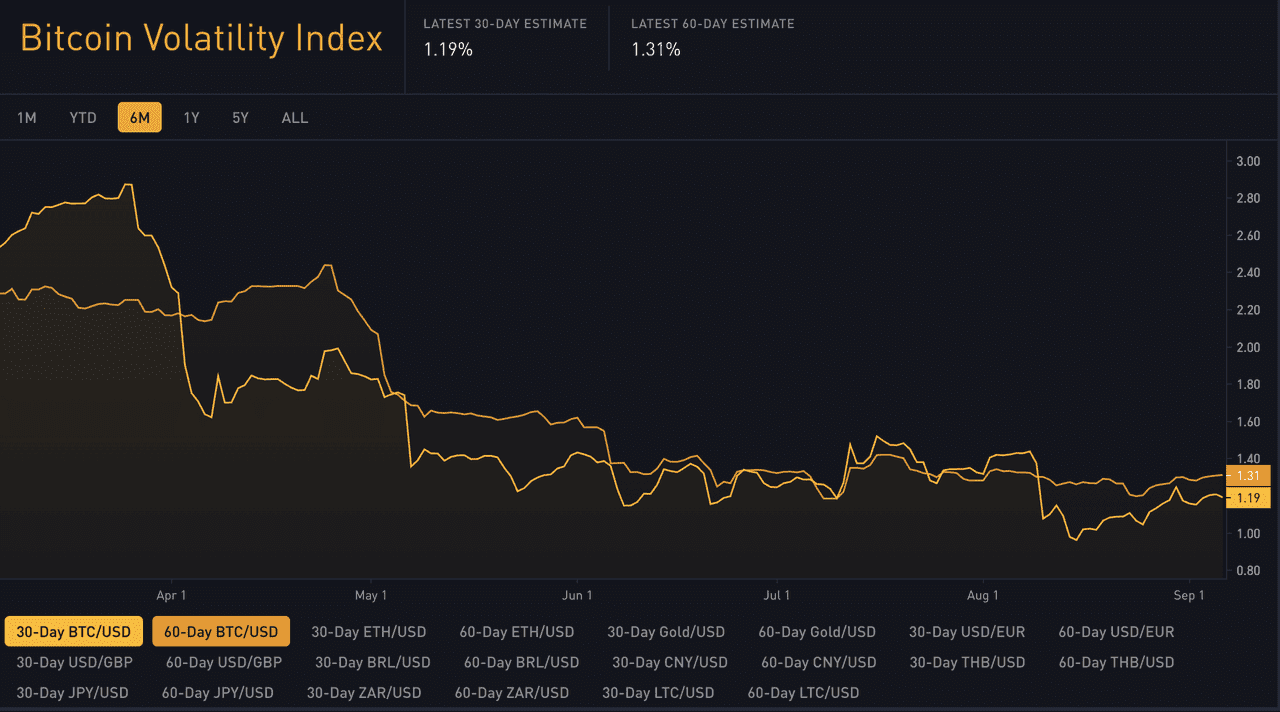

Bitcoin’s volatility is measured by the Bitcoin Volatility Index. The index measures Bitcoin’s historical volatility by calculating the “standard deviation of daily returns for the preceding 30 and 60-day windows.”

In June 2021, when Bitcoin’s price fell below $30,000, its 30-day and 60-day volatility index values reached their highest points since April 2020. There are no official thresholds for determining what counts as “extreme,” but one only needs to look at Bitcoin’s chart for the past 10 years to know that it has not enjoyed as much stability as stocks.

30-days Volatility Index (source: Phemex)

Measuring Bitcoin Volatility

To quantify Bitcoin's volatility, analysts use several metrics:

Historical (Realized) Volatility measures past price fluctuations, typically expressed as an annualized percentage. For instance, if Bitcoin’s 30-day realized volatility is 60%, it means one might expect a price change of up or down 60% over a year. Bitcoin's historical volatility often ranges from 50% to over 100%, significantly higher than assets like gold (10-15%) or major stock indices (15-25%).

Implied Volatility is derived from options prices and reflects market expectations for future volatility. For example, in August 2025, implied volatility was around 26% but jumped to 37% during market fluctuations. Rising implied volatility can indicate an anticipated price breakout.

Volatility Indices like DVOL and BitVol track implied volatility, making it easier to monitor. For example, a BitVol value of 80 signifies 80% annualized implied volatility.

When calculating volatility, one takes daily log returns of BTC, computes their standard deviation over a set period, and annualizes the result. For instance, a 3% daily standard deviation over 30 days results in approximately 57% annualized volatility.

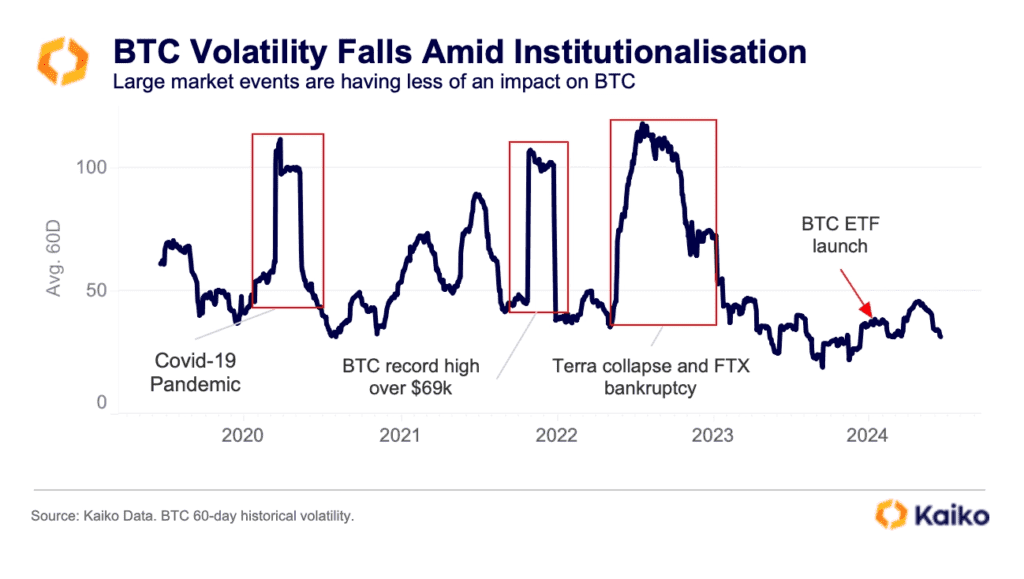

Bitcoin's volatility is cyclical, with periods of high volatility often clustering together. For example, late 2020-2021 saw explosive volatility, while early 2022 was marked by downside turbulence. Understanding these patterns helps traders strategize accordingly.

Historically, Bitcoin's 60-day volatility averages around 5-6% daily (about 80-95% annualized), with fluctuations varying widely during different market phases. These metrics give a clearer picture of market turbulence at any time.

Why Is Bitcoin So Volatile?

From October 2017 to January 2018, Bitcoin’s volatility reached 8%, twice that of the volatility it reached in early 2020. In April 2021, Bitcoin was trading at $65,000. But in July, after China announced a crackdown on mining farms and Elon Musk deemed Bitcoin’s environmental impact harmful, its price plunged below $30,000.

To better understand why Bitcoin’s price fluctuates and what drives its volatility, let’s look at the following factors:

-

Limited regulation: Unlike other markets, crypto markets have no central authority that can interfere when volatility becomes too high. Without targeted anti-market manipulation laws, it’s also easier for manipulators to run schemes that contribute to high volatility.There are some anti-fraud laws in place that can prevent market manipulation, but it is difficult to track people who run and participate in pump and dump schemes through messaging groups.

-

News events: Simply put, bad news makes Bitcoin’s price fall, and good news makes the price rise. For example, when Elon Musk tweeted that Tesla was no longer going to accept Bitcoin as payment, Bitcoin’s price fell by 10%. When Tesla announced that it would resume Bitcoin transactionsonce BTC is mined with cleaner energy, the price went back up by 9.60%.Many Bitcoin investors base their decisions on crypto-related news. When they hear something good about Bitcoin and see that the price is going up, they experience FOMO and decide to invest.

-

Public perception and speculation: Many people say that Bitcoin has no intrinsic value, instead, it derives its value from people’s trust. Therefore, public perception is important. As a decentralized currency, Bitcoin’s value is driven by speculation. Unlike the stock market, where you buy shares of a company based on its performance, most people invest in Bitcoin because they hope its price will go up in the future, without understanding the technology behind it. This leads to a lot of guessing and speculation. Stocks generate dividends, and people who invest in them know that they will get their investment back, but with Bitcoin, there are no dividends and there is no guarantee that investors will get a return on their investment. When people lose faith in Bitcoin, its price can plummet.Bitcoin investment is all about making good guesses. If you predict the price will go up and you buy before it actually does, you will make a profit. You will also make a profit if you short sell Bitcoin and the price goes down. These speculation-based bets make Bitcoin extremely volatile.

Bitcoin 30-day and 60-day Volatility (source)

What Major Events Have Contributed to Bitcoin’s Volatility?

As mentioned above, news events can have a significant impact on Bitcoin’s price. Events such as hacking of crypto exchanges and the proposal of new laws regarding Bitcoin regulation can both move its price up or down very quickly.

In 2013, for example, China banned Bitcoin transactions, which caused its price to crash from around $1,200 to $840. In 2016, when former Bitcoin Core developer Mike Hearn declared Bitcoin dead and left the community, Bitcoin’s price fell from around $400 to $360. After a few months, it overcame this drop and reached an all-time high of $1,220.

More recently, after U.S. President Joe Biden announced that his administration would double taxes on capital gains for people making more than $1 million, Bitcoin’s price fell 5% to $48,886. This was the first time since March that it had fallen below $50,000.

Perhaps this will change when Bitcoin becomes more widely accepted around the world, but for now, aggressive news-driven price changes are very common.

Bitcoin's Volatility Compared to Other Assets

To understand Bitcoin's volatility, it's useful to compare it with other asset classes:

Stocks (Equities): The S&P 500 has an annualized volatility of around 15%, while Bitcoin's typical volatility ranges from 60-100%. A daily move of 2% in stocks is significant, while Bitcoin often moves 5-10% in a day. During bear markets, stocks may drop 20-30% over months, whereas Bitcoin can experience similar losses in weeks or less.

Gold: Gold is seen as a stable store of value, with volatility around 10-15%. A 5% daily swing in gold is rare, while Bitcoin can swing 5% in hours. This higher volatility contributes to Bitcoin's historically higher returns, but makes some investors skeptical of its status as "digital gold."

Fiat Currencies (Forex): Major fiat currencies have low volatility, generally 5-10% annually. Bitcoin, lacking central bank backing, is more volatile, often changing more in a month than what major currencies do in years.

Other Cryptocurrencies: Many altcoins are even more volatile than Bitcoin, with smaller coins often seeing daily swings of 20%+. Bitcoin tends to be less volatile than many altcoins.

Correlation During Market Stress: Bitcoin's correlation with other risk assets increases during market stress, as seen in March 2020. In calmer periods, its correlation can vary, sometimes moving independently from equities. Over time, Bitcoin has shown mixed behavior as a “risk-on” or “risk-off” asset.

Overall, Bitcoin's volatility has historically been accompanied by high returns. As its market cap grows, some anticipate that volatility may decrease, although it has remained significant.

How Can I Profit from Bitcoin’s Volatility?

High volatility may seem daunting if you are new to crypto, but most people agree that it is not a bad thing. You can profit massively from Bitcoin volatility if you have a solid strategy.

Short and Long Bitcoin

Most people prefer a less-risky long-term approach (buying and holding until Bitcoin’s price has gone up significantly), but many also use short-term approaches to make quick profits. In short-term trading, predicting price movements is challenging. When a price declines dramatically, it can lead to FOMO, causing people to sell their coins and lose money as a result. If you are able to accurately predict Bitcoin’s price, then you can make a lot more money with short-term investments than a buy and hold strategy.

In any case, you’ll want to diversify your investments. If you invest only in Bitcoin, your entire portfolio is vulnerable to any price crashes Bitcoin may experience.

Bitcoin Volatility Downward Trend (source)

Trading and Hedging Strategies for Bitcoin's Volatility

For traders, Bitcoin's volatility represents both risk and opportunity. Here are key approaches:

Swing Trading: Traders capitalize on intermediate-term price movements, using technical analysis to identify momentum shifts. They often aim to buy during ~10-15% pullbacks and sell at highs, employing indicators like Bollinger Bands to gauge price corrections. Discipline with stop-loss orders is crucial to manage potential losses.

Day Trading and Scalping: Day traders focus on intraday price movements, often using leverage for amplified gains. The 24/7 nature of Bitcoin trading allows opportunities during active market hours. However, trading with leverage is risky, as a wrong move can lead to significant losses.

Market-Neutral and Arbitrage Strategies: Sophisticated traders might use options or statistical arbitrage to profit from volatility without directional bias. Strategies include long straddles on events expected to generate significant price movements or selling options when implied volatility seems overstated.

Hedging with Futures/Options: Long-term holders can hedge against downturns by shorting futures or buying put options, protecting their investments from price drops while acknowledging the costs involved.

Risk Management Practices: Effective risk management is vital in volatile markets. Traders often limit risk to 1-2% of their capital per trade, use stop-loss and take-profit orders, and avoid excessive leverage to withstand adverse price moves.

Psychological Discipline: Managing emotions is crucial; experienced traders prepare with a plan to avoid panic selling or impulse buying during volatility.

Who Should Be Wary of Bitcoin’s Volatility?

Bitcoin’s high volatility is not for everyone. If you have a high-risk tolerance, it makes sense to invest in Bitcoin and consider its high volatility an advantage. But older investors with less risk tolerance may find it more suitable to invest in less-volatile assets like bonds.

In addition, many businesses find it too risky to accept Bitcoin as payment, because they have to convert BTC into their local currencies. Bitcoin’s price can change significantly between the time it’s accepted by a business and the time it’s converted into local currency. By the time it’s converted, it might be worth much more or much less in the local currency than when it was accepted. Many businesses can’t accept this unpredictability.

Conclusion

Compared to stocks and other securities, Bitcoin is still new, and it is a digital asset. As it becomes more widely accepted with time, its volatility may decrease. Low volatility would take away many quick-profit opportunities from traders, but would also make Bitcoin more attractive to institutional investors as a safer investment similar to stocks. Volatility is inherent to Bitcoin's journey, often requiring early investors to endure substantial downturns alongside impressive gains. For traders, this volatility presents opportunities to profit, while long-term holders must recognize that price swings are a natural part of an emerging asset in price discovery.

Key takeaways include managing risk - consider reducing your position size or using hedges if you’re uncomfortable with potential losses. Stay informed about news events that can influence market movements and use protective tools, like stop losses and diversified portfolios. Bitcoin's volatility has generally been trending downward over the long term, moving from extreme fluctuations to more moderate ones. As Bitcoin matures, its volatility may decrease, but significant fluctuations are still expected.