Beyond spot trading—buying and selling Bitcoin (BTC) directly—there are two primary ways to trade BTC: longing (buying in anticipation of price increases) and shorting (selling in anticipation of price declines). This guide explains how to execute these strategies on Phemex using perpetual contracts. We’ll cover step-by-step instructions, benefits, risks, and risk management techniques to help you trade Bitcoin effectively.

What Are Long and Short Positions in Bitcoin Trading?

-

Long Position: Buying Bitcoin expecting its price to rise. You purchase BTC at a lower price and aim to sell at a higher price, profiting from the difference. For example, buying 1 BTC at $100,000 and selling at $110,000 yields a $10,000 profit.

-

Short Position: Selling borrowed Bitcoin expecting its price to fall. You sell BTC at a higher price, repurchase it at a lower price, return the borrowed amount, and keep the difference as profit. For example, selling 1 BTC at $100,000, then repurchasing at $90,000, results in a $10,000 profit after repayment.

Both strategies can be executed on Phemex using perpetual contracts, derivative products that allow trading with leverage without owning the underlying asset. Unlike traditional futures, perpetual contracts have no expiration date, offering flexibility to hold positions as long as your funds allow.

How to Long Bitcoin on Phemex

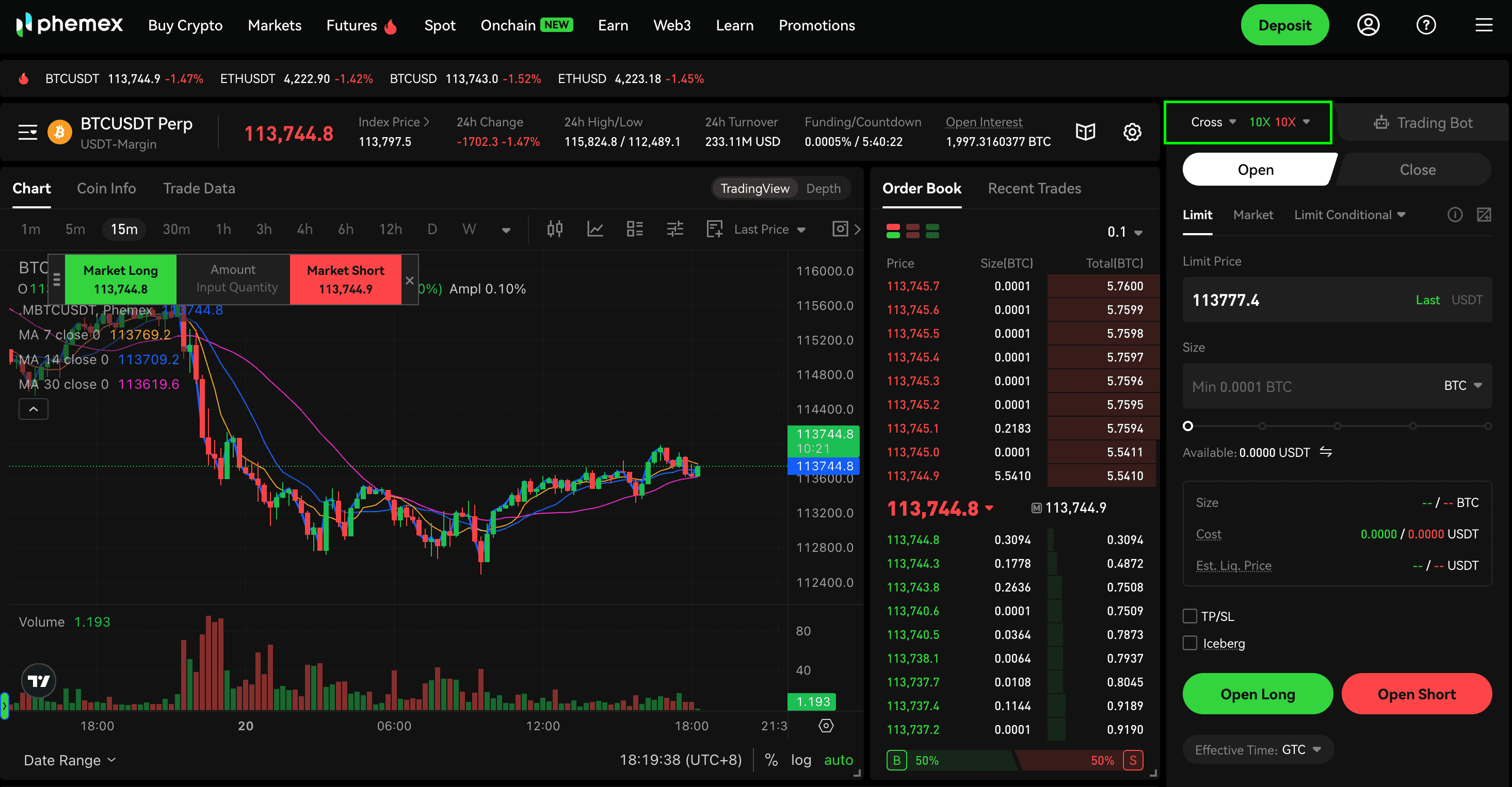

To profit from a potential price increase, open a Long position on a Bitcoin Perpetual Contract. Follow these steps:

-

Log in to your Phemex account.

-

Transfer USDT to your USDT-M contract account or BTC to your COIN-M contract account as margin.

-

Select BTC as your trading pair and adjust leverage by clicking the leverage number.

-

Pick an order type, enter your order details, and click [Open Long/Long] to submit.

-

If the price rises, you can profit from the price difference.

Example: You open a 5x leveraged long position on 1 BTC at $100,000. If BTC rises to $105,000, your profit is ($105,000 - $100,000) × 5 = $25,000, minus trading fees.

How to Short Bitcoin on Phemex

To profit from a potential price drop, open a Short position on a Bitcoin Perpetual Contract. Follow these steps:

-

Log in to your Phemex account.

-

Transfer USDT to your USDT-M contract account or BTC to your COIN-M contract account as margin.

-

Select BTC as your trading pair and adjust leverage by clicking the leverage number.

-

Pick an order type, enter your order details, and click [Open Short/Short] to submit.

-

If the price falls, you can profit from the price difference.

Example: You open a 5x leveraged short position on 1 BTC at $100,000. If BTC falls to $95,000, your profit is ($100,000 - $95,000) × 5 = $25,000, minus trading fees.

Benefits of Long and Short Bitcoin Trading

-

Profit in Any Market Direction: Longing capitalizes on price increases, while shorting enables profits during price declines, allowing trading in both bull and bear markets.

-

Leverage for Amplified Returns: Phemex offers up to 100x leverage, enabling larger positions with less capital. For example, with $1,000 and 10x leverage, you can trade a $10,000 position.

-

High Liquidity: Phemex ensures minimal slippage and efficient order execution with deep liquidity, even for large trades.

-

No Ownership Required: Perpetual contracts allow speculation on BTC price movements without holding the actual asset, simplifying trading.

Risks of Long and Short Bitcoin Trading

Trading Bitcoin with leverage involves certain risks, but these can be managed effectively with the right strategies. Explore our next section below to discover practical tools and techniques to protect your capital and trade confidently.

-

Unlimited Loss Potential (Shorting): Unlike long positions, where losses are capped at your initial investment (e.g., $10,000 if BTC goes to $0), shorting has theoretically unlimited losses if BTC’s price rises significantly. For instance, shorting 1 BTC at $100,000 and seeing it rise to $150,000 results in a $50,000 loss per BTC, magnified by leverage.

-

Liquidation Risk: Leverage amplifies both profits and losses. If the market moves against your position and your margin falls below the maintenance margin, your position may be liquidated, resulting in a total loss of your margin.

-

Volatility Risk: Bitcoin’s price can fluctuate rapidly.

-

Short Squeeze Risk (Shorting): A rapid price increase can force short sellers to buy back at higher prices, driving prices higher.

-

Funding Rate Costs: Perpetual contracts involve periodic funding rates. Holding a position against the market trend (e.g., shorting in a bull market) can increase costs, eroding profits.

Risk Management Strategies

Effective risk management is critical for successful Bitcoin trading. Here are essential techniques to protect your capital:

-

Use Stop-Loss Orders: Set a stop-loss order to automatically close your position at a predetermined price, limiting losses. For example, in a short position at $100,000, set a stop-loss at $102,000 to cap losses at $2,000 per BTC. Learn more: How to Set a Take Profit or Stop Loss Order.

-

Hedge with Options: Purchase a call option to hedge a short position or a put option to hedge a long position. This limits losses if the market moves against you, though options carry time decay risks. Learn more: Call vs. Put Options Explained.

-

Enable Hedge Mode: Phemex’s Hedge Mode allows simultaneous long and short positions for the same trading pair, offsetting losses from one with gains from the other. Learn more: How to Use Hedge Mode.

-

Use Lower Leverage: High leverage (e.g., 100x) increases liquidation risk. Start with lower leverage (e.g., 1x–10x) to manage volatility.

-

Monitor Technical Indicators: Use tools like Relative Strength Index (RSI), Moving Averages, Bollinger Bands, or Average Directional Index (ADX) to identify entry and exit points. For example, an RSI above 70 may signal an overbought market, favoring a short position.

-

Dollar-Cost Averaging (DCA): For long positions, buy small amounts of BTC regularly to reduce volatility’s impact, averaging your entry price over time.

When to Long or Short Bitcoin

-

Long Bitcoin When:

-

Technical indicators (e.g., RSI below 30, indicating oversold conditions) suggest a bullish trend.

-

Positive news, such as regulatory approvals or institutional adoption drives demand.

-

Bitcoin approaches key support levels with signs of base-building (higher RSI, lower volume).

-

-

Short Bitcoin When:

-

Technical indicators (e.g., RSI above 70, indicating overbought conditions) predict a bearish trend.

-

Negative events, such as hacks or regulatory crackdowns, could depress prices.

-

Bitcoin breaks below key support levels with high volume and low RSI, signaling bearish momentum.

-

Always conduct your own research and avoid trading based on unverified information.

Conclusion

Trading Bitcoin on Phemex using perpetual contracts offers opportunities to profit from both rising and falling prices. Longing and shorting are powerful strategies, but they carry risks like unlimited losses when shorting and liquidation due to leverage. Always use risk management tools like stop-loss orders and Hedge Mode and stay informed about market trends to trade Bitcoin with confidence. Trade responsibly, only invest what you can afford to lose, and explore Phemex Academy for further education.