When it comes to trading – especially crypto trading – psychology and mindset are as critical as strategy. In fact, many traders say the mindset for trading success is the single biggest factor separating profitable traders from the rest. Crypto markets, with their extreme volatility and 24/7 frenzy, can trigger intense emotions: fear during sharp drops, greed during euphoric rallies, FOMO, panic, regret, overconfidence, and more. Learning to manage these emotions and avoid cognitive traps is key to thriving as a trader. This comprehensive 2026 guide to crypto trading psychology will cover why psychology matters, how fear and greed affect decision-making, common cognitive biases in trading, and practical mindset frameworks to cultivate discipline and emotional resilience.

Whether you’re a beginner or an experienced trader, understanding trading psychology will help you make rational decisions rather than emotional ones. Let’s dive in.

Why Trading Psychology Is So Important

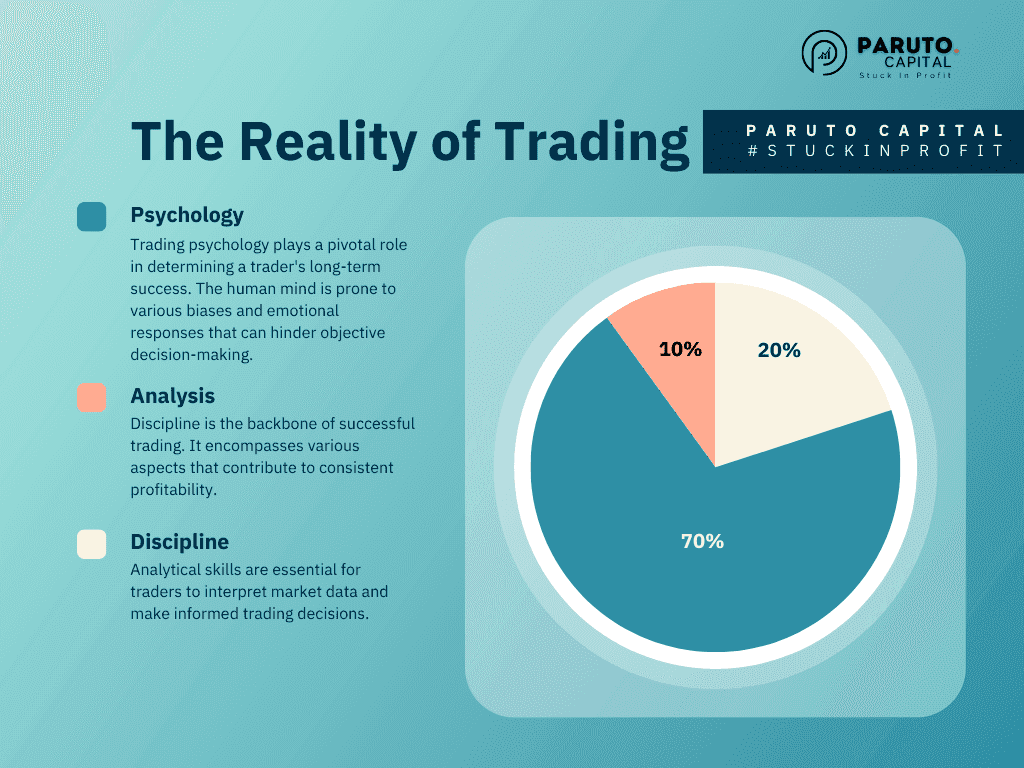

“Trading psychology” encompasses the mental and emotional state that influences a trader’s decisions, significantly impacting performance. Emotions like fear and greed, as well as cognitive biases, often lead to costly mistakes. Studies show that around 94% of traders fail to profit, with psychological factors playing a major role. Dr. Van Tharp highlights that trading success is composed of strategy (10%), money management (30%), and psychology (60%), emphasizing the importance of mental discipline.

In volatile crypto markets, the necessity to counteract crowd behavior is heightened. Key aspects of trading psychology include:

-

Emotional Decision-Making: Stress can cause impulsive actions such as selling in a panic or holding onto a winning trade for too long. Successful trading hinges on making decisions based on logic and strategy, not emotions.

-

Consistency and Discipline: An effective strategy requires consistent application. Emotional fluctuations can lead to erratic trading behavior, underscoring the need for discipline to follow rules and avoid revenge trading after losses.

-

High-Stress Environment: Crypto operates nonstop, with fluctuating prices and information overload leading to heightened stress. Effective stress management techniques are essential to prevent burnout and poor decision-making.

-

Capital Preservation vs. Impulses: Focus on protecting your capital rather than chasing profits. This mindset helps mitigate risky behaviors driven by greed, aligning with the belief that trading is a long-term endeavor.

-

Adapting to Market Conditions: Markets are dynamic, requiring traders to adjust their strategies. A resilient mindset involves humility and flexibility, crucial for acknowledging mistakes and adapting to new market realities.

In conclusion, mastering trading psychology is key to leveraging your skills effectively. The greatest challenge in trading is often self-discipline. Next, let’s explore managing the primary emotions of fear and greed.

Importance of Psychology in Trading (source)

Controlling Emotions: Fear and Greed in Crypto Trading

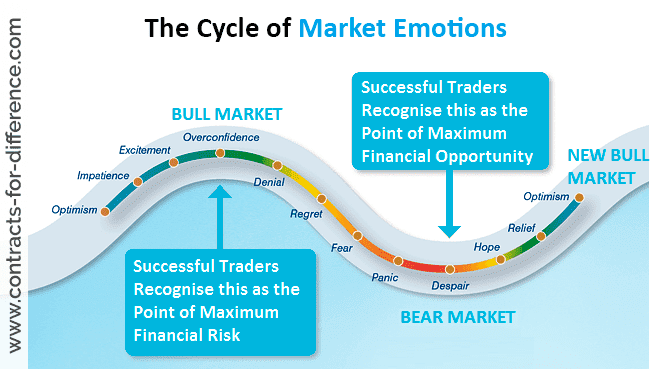

Two emotions dominate trading decisions: fear and greed. They correspond to the two basic market states: down and up. Understanding these emotions and how to control them is central to trading psychology.

Fear: Managing the Pain of Loss

Fear in trading is the anxiety of losing money or making poor decisions, especially in the volatile crypto market. Common manifestations include:

-

Panic Selling: Traders dump holdings rapidly during market drops, often locking in losses near bottom points, which goes against the strategy of buying low.

-

Paralysis (Fear of Pulling the Trigger): Fear can prevent traders from executing planned trades. They may hesitate to enter or exit positions, potentially missing profitable opportunities.

-

Avoiding the Market: After losses, traders might avoid the market altogether, missing valid setups due to excessive fear.

How to avoid and control fear in trading? Here are strategies:

-

Use Risk Management to Quantify Risk: Quantify your risk on each trade (e.g., "I'm risking 2% of my capital"). Knowing your maximum loss can reduce fear and provide a clear exit plan.

-

Trade with Money You Can Afford to Lose: Only use capital that won’t financially devastate you if lost. This reduces emotional pressure.

-

Have a Trading Plan and Trust It: Develop a solid plan with entry/exit criteria and risk management. Adhering to your plan helps shift focus from fear to long-term strategy.

-

Acknowledge Fear, Don’t Suppress It: Recognize your fear rather than suppress it. Use mindfulness techniques to assess if your actions stem from fear or market signals.

-

Gradual Exposure: Start trading with small amounts to build confidence. Gradually increase your position size as you become more comfortable with risk.

Example - If you buy Bitcoin at $40,000 and it drops to $35,000, fear may push you to sell. However, if your analysis indicates strong support at $34,000 and that’s your planned stop, stick to your strategy to avoid panic selling. This disciplined approach separates those who regularly sell at the worst times due to fear from those who can ride out the recovery.

Greed: Mastering the Urge for More

Greed in trading is the euphoric hunger for gains, leading to overtrading, excessive risk-taking, and failing to take profits. Key ways greed manifests in crypto trading include:

-

Overleveraging / Oversizing: After a few wins, traders may overestimate their capabilities and increase leverage, which amplifies risk and can lead to substantial losses.

-

Not Taking Profit (Holding Out for Moon): Greed may cause traders to hold out for higher gains, ignoring profit targets. This can lead to losses when prices drop.

-

Chasing Hype (FOMO): The fear of missing out can drive traders to enter positions late, often resulting in buying at market tops due to emotion rather than analysis.

-

Revenge Trading / Not Accepting Losses: After a loss, greed may prompt traders to take impulsive trades to recover losses, often aggravating their situation.

How to overcome and control greed:

-

Set Clear Profit Targets and Take Partial Profits: Predefine realistic profit targets and stick to them to reduce impulsive decisions.

-

Remind Yourself: The Market Gives and Takes: Reflect on past market cycles to stay grounded. Ask yourself if holding is rational or driven by greed.

-

Employ Risk Management Even in Profit: Use trailing stop-losses to secure profits and set a fixed risk-per-trade rule to avoid overcommitting after wins.

-

Check Greed with Logic: Analyze your motives and ensure decisions are based on sound reasoning rather than greed.

-

Learn from Stories and Data: Read trading psychology books to understand the perils of greed and use a trading journal to document your experiences.

In the crypto context of 2026, greed is as prevalent as ever. We see it in phenomena like meme coin manias, where people throw risk management out the window hoping for 100x overnight. We see it in bull markets where newcomers leverage trade altcoins heavily because they’ve only seen prices go up. One must steel themselves against these temptations. Recognize that opportunities are endless in the market, but capital is finite – protect your capital by avoiding reckless greed-driven bets.

An insightful metric related to greed/fear is the Crypto Fear & Greed Index, which tracks market sentiment (e.g., via volatility, volume, social media, etc.). For instance, in late 2025, the index at times showed “Extreme Greed” when Bitcoin reached new highs, reflecting rampant bullish sentiment. Savvy traders use such signals as a caution – when the crowd is extremely greedy, it might be time to be cautious or take profits, and vice versa. This is a way to externally monitor collective greed/fear and ensure you’re not swept along blindly.

To sum up, controlling greed involves staying humble, sticking to your plan, and sometimes doing the uncomfortable thing (like taking profit while everyone else is shouting “HODL for more!”). It’s about realizing trading is a long game: you want to be there for the next opportunity rather than blow up on one aggressive gamble.

Market Cycle Emotions (source)

Common Cognitive Biases in Crypto Trading (and How to Avoid Them)

Beyond raw emotions, our brains have built-in cognitive biases – systematic thinking errors – that can adversely affect trading. Here are several common cognitive biases in trading, especially relevant to crypto, and tips to avoid them:

-

Confirmation Bias: This is the tendency to focus on information that confirms your beliefs while ignoring contradictory evidence. In trading, you might only seek out bullish news if you believe a coin will rise. How to avoid: Actively seek opposing viewpoints and question your assumptions. Set objective invalidation points to guide your decisions.

-

Anchoring Bias: This bias occurs when you rely too much on initial information (the "anchor") when making decisions. For example, fixating on a purchase price can skew your judgment. How to avoid: Regularly reassess based on current data and market conditions, setting stop-losses and targets based on market structure.

-

Availability Heuristic: This leads you to overestimate likely outcomes based on recent, memorable events. Recent bullish news might make bullish outcomes seem more probable. How to avoid: Base decisions on objective data and historical performance rather than vivid memories.

-

Loss Aversion & Sunk Cost Fallacy: Loss aversion makes losses feel worse than gains feel good, often causing traders to hold losing positions too long. How to avoid: Use pre-planned stop-losses and view losses as learning opportunities. Adopt a probabilistic mindset to detach from individual trades.

-

Hindsight Bias: After an event, it seems obvious in hindsight, which can create overconfidence. How to avoid: Keep a trading journal to document your thoughts prior to events, reminding you of the uncertainty involved in trading.

-

Recency Bias: This bias involves giving more weight to recent events over long-term trends. If recent prices have been rising, you might expect that to continue. How to avoid: Analyze larger time frames and recognize signs of changing market conditions, using broader indicators to guide your perspective.

-

Overconfidence Bias: After some success, traders might overestimate their abilities or knowledge. This leads to taking trades outside of one’s expertise, neglecting risk management, or trading too frequently. How to avoid: Continue to stick to disciplined trading strategy and rules regardless of success.

By recognizing these biases, you can put in place mental checks and balances. In 2026, with AI-driven news feeds and social media influencing traders, being aware of biases is more important than ever.

Developing a Winning Trading Mindset (Frameworks and Tips)

Now that we’ve covered emotions and biases, let’s focus on how to actively cultivate a strong trading mindset. This includes daily practices, mental frameworks, and habits that build emotional discipline and resilience over time.

Create and Follow a Trading Routine

Having a structured trading routine is key to managing emotions. Relying on a process instead of mood helps maintain discipline.

-

Pre-Market / Morning Routine: Check major news and updates, review open positions relative to your plan, mark key chart levels for monitored assets, and consider a quick mindfulness exercise.

-

During Trading: Set specific times to evaluate the market, like reviewing charts at the top of each hour, rather than constantly monitoring prices. If day trading, take breaks after several hours or impactful trades to clear your mind.

-

Post-Market / Evening: Review your trades by journaling; note decisions, emotions, and outcomes. This helps identify behavioral patterns and allows you to adjust your routine accordingly.

A consistent routine automates positive behaviors, such as setting stop-loss orders immediately after entering a trade, reducing the influence of fear or greed.

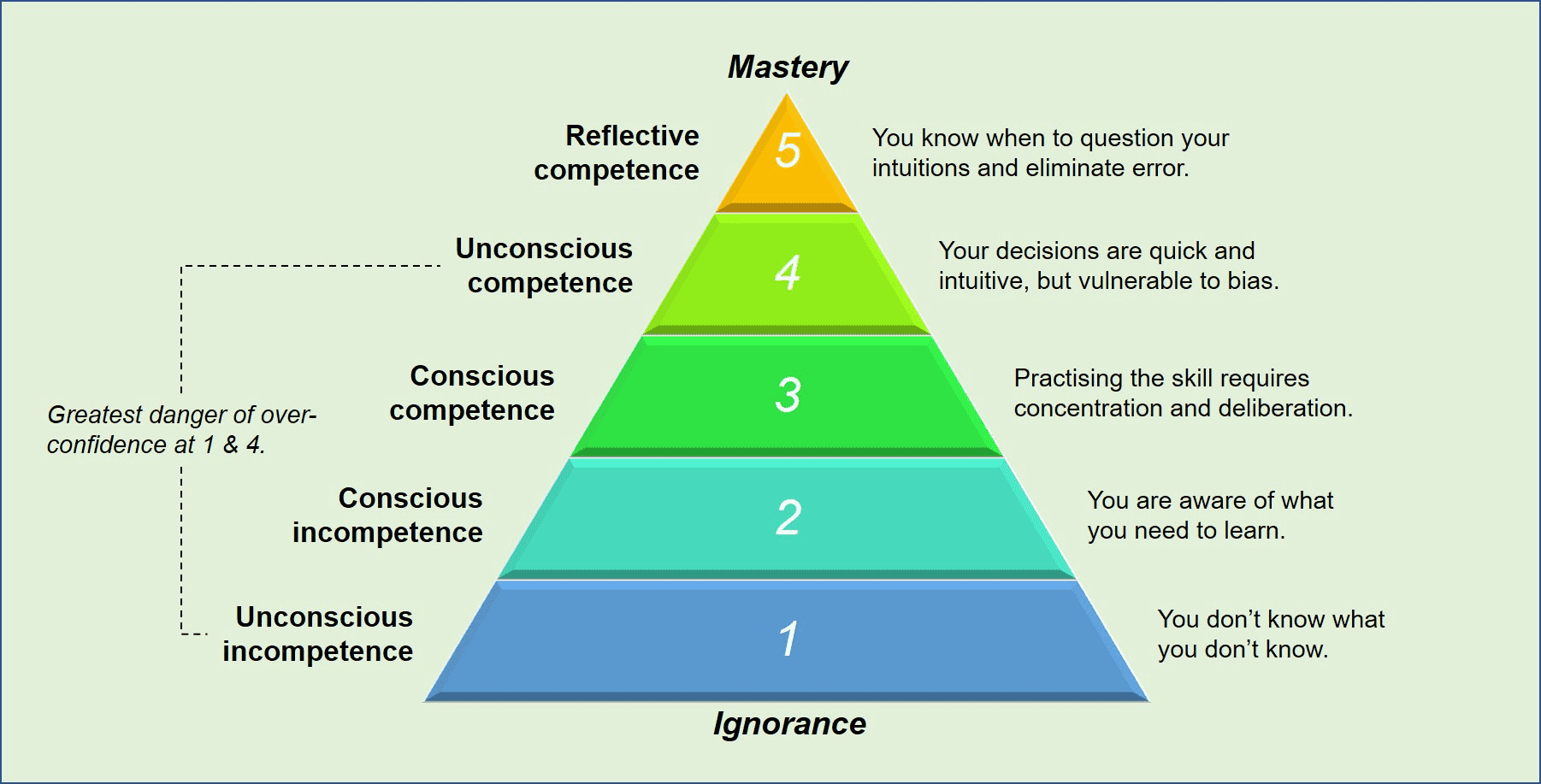

The Five Stages of Trading Competence

There’s a concept often referred to in trading communities as the five stages of trading psychology (similar to stages of competence or realization):

-

Unconscious Incompetence: Beginners unknowingly make errors, often leading to losses.

-

Conscious Incompetence: Failures prompt the realization of a need for education and practice.

-

Conscious Competence: Strategies and skills develop but require focused effort to apply, with active emotional management.

-

Unconscious Competence: Good trading habits become second nature; traders handle losses calmly and trust their processes.

-

Conscious Mastery (some add this stage): Even skilled traders continuously refine their abilities and strategies, staying adaptive to market changes.

Understanding these stages helps identify areas for growth. For instance, if you're in "Conscious Incompetence," prioritize learning. If you're nearing "Unconscious Competence," remain humble, as the markets can be unpredictable.

Hierarchy of Competence (source)

Build Emotional Discipline Like a Muscle

Treat managing emotions as training. Techniques include:

-

Meditation and Mindfulness: Practice mindfulness for 10 minutes daily to increase awareness of emotional triggers. This helps you notice feelings like anxiety during trades and allows for thoughtful responses instead of impulsive reactions. Apps can aid with meditation or breathing exercises after stressful events.

-

Physical Health: Your physical well-being impacts trading psychology. Prioritize sleep, a healthy diet, and regular exercise to manage stress and emotional stability. Set trading boundaries, like “no trading between 2am-6am,” to maintain health.

-

Set Process-Oriented Goals, Not Just Outcome Goals: Focus on goals you can control, like “I will execute my plan daily,” rather than just outcome goals, such as achieving a 50% return. This builds good habits and reduces emotional stress.

-

Use Technology Wisely: Leverage tools like automated alerts or stop-loss orders to enforce discipline and prevent emotional trading decisions.

-

Community and Accountability: Share your goals with a trading buddy to enhance accountability. Choose supportive partners focused on discipline, avoiding those that promote bad habits.

Embrace a Continuous Learning Mindset

The market is always changing, with new technologies and regulations emerging. By 2026, AI tools may play a significant role in trading. To avoid being left behind, adopt a continuous learning mindset. This involves intellectual humility—acknowledging you don’t know everything and staying curious. Regular learning counteracts overconfidence, helps refine strategies, and reduces the need to be right. Practical steps include reading various trading books, studying market history, taking education courses, reviewing past trades to learn from mistakes, and possibly finding a mentor. Revisiting material like Mark Douglas’s “Trading in the Zone” can strengthen your psychology.

Plan for Breaks and Balance

Burnout can impair judgment, especially in the 24/7 crypto market. Schedule regular breaks, such as avoiding charts one day a week or taking time off after significant trades to reset emotionally. Balance trading with hobbies and family, as a well-rounded life fosters better trading decisions. Sometimes, doing nothing is best; if conditions are unfavorable or you’re off-kilter, it's wise to wait for clear opportunities.

Leverage the Fear/Greed of Others

Mature trading psychology involves managing both your emotions and observing market sentiment for opportunities. By 2026, sentiment indicators like the Crypto Fear & Greed Index can help gauge market psychology. Use them contrarianly: buy when others are fearful and take profits when there's extreme greed. As Warren Buffett said, “Be fearful when others are greedy, and greedy when others are fearful.” A strong mindset is needed to go against the crowd, requiring confidence in your analysis and control over your emotions.

Putting It All Together

Achieving the ideal trader’s mindset is a journey that requires continuous self-improvement, even for top traders. You will still experience emotions like fear and greed, but the goal is to manage them rather than eliminate them. Building habits that favor rational actions over impulsive reactions is key.

Imagine this scenario: It’s 2026, and after a regulatory news alert, the crypto market drops 15% in an hour. Your heart races, but instead of panicking, you follow your trading plan and exit your position with minimal damage. Acknowledge the loss, but remember it’s just one trade. You resist the urge to revenge trade and take a moment to clear your head.

You analyze the market calmly, noting prices at long-term support with high fear sentiment. This prepares you for a potential re-entry if a reversal pattern emerges. You re-enter a small position based on your strategy, keeping emotions in check. If it fails, you have a stop; if it succeeds, you scale in more.

As the market stabilizes and rises, you book partial profits according to your plan and trail stops. Ultimately, you recoup your loss while demonstrating emotional control and adherence to your strategy. This reflects the essence of successful trading: mastering both yourself and the market.

In summary, crypto trading psychology is about self-awareness and self-regulation. New challenges will arise, but with a strong mindset—controlling emotions and building good habits—you'll navigate the market confidently. Remember, success in trading comes not from avoiding emotions but from managing them. Investing in your mindset is investing in your greatest asset—yourself.