Summary (Fast Facts)

-

Ticker Symbol: IP

-

Current Price (Sep 22, 2025): ~$13.62 USD

-

Chain: Story – a Layer-1 blockchain (AI & IP-focused)

-

Market Cap: ~$4.26 billion (Rank #30 by size)

-

Circulating / Max Supply: ~312.7 million IP / No fixed max (1.01B initial supply)

-

All-Time High / Low: $14.92 (Sep 21, 2025) / $1.00 (Feb 13, 2025)

-

All-Time ROI: +1,260% since launch (from $1 to ~$13.6)

-

Availability on Phemex: Yes – Listed for spot trading and futures contracts (IP/USDT)

What Is Story (IP)?

Story is a Layer-1 blockchain platform designed for managing intellectual property (IP) in the internet era. In simple terms, Story provides a decentralized framework where creators can register, license, and monetize their IP assets (such as writings, art, music, or data) with transparent on-chain records. The project falls under smart contract platform and AI & big data categories, as it aims to make valuable creative data available to AI and applications in a rights-cleared way. By leveraging blockchain, Story addresses the problem of unclear ownership and difficult licensing of content online. For example, a writer or artist can record their work on Story’s chain to prove ownership, then set terms for others to remix or use it, all enforced by smart contracts. This ensures creators get credit and royalties automatically, solving a major pain point in digital content rights.

Notably, Story is purpose-built for IP and AI integration. The team emphasizes that AI’s next leap depends on unlocking the $80 trillion IP asset class, which includes everything from media franchises to datasets. Story tokenizes these intellectual properties and makes them programmable, enabling new use cases like machine-readable licenses and automated royalty payments. In other words, it creates an ecosystem where intellectual property can be treated as on-chain assets that are easily traded or integrated into applications. The native token $IP powers this ecosystem – it’s used for paying transaction fees (gas), registering content, purchasing licenses, staking for network security, and participating in governance decisions. By using $IP, creators and users can interact with the Story network’s tools, such as the Story Explorer for discovering content, an IP Portal for managing assets, and modules for permissionless licensing and dispute resolution.

Story (IP) Price Chart (source)

Price History & Performance Overview

Since its February 2025 launch, Story's price journey has been quite dramatic. The token, initially priced at $1.00, quickly surged to around $5–6 as early enthusiasm grew, largely due to major exchange listings and backing from a16z Crypto, which raised over $54 million in 2023. However, by mid-2025, a 30% pullback occurred, and the price settled in the low-$3 range amid market uncertainty and profit-taking.

A pivotal moment came in late August 2025 when the Story Foundation announced an $82 million token buyback, signaling strong confidence from the team. This led to a bullish reversal entering Q3 2025. From late August to September, the token soared past $10, reaching an all-time high of $14.92 on September 21, buoyed by rising on-chain activity, interest in AI tokens, and substantial trading volumes.

Several key events influenced these price movements:

-

Mainnet Launch & Adoption (Feb–Mar 2025): Successfully launched, processing millions of registrations, boosting early price strength.

-

Exchange Listings (Q1–Q2 2025): Major platform listings increased liquidity and sparked price rallies.

-

Whale Accumulation Signals (June 2025): Significant whale buying predicted price increases, with a 40% rally following their accumulation.

-

Partnerships & News (Mid 2025): Collaborations, like the $360M IP reserve with Heritage Distilling, validated the token's use, driving positive sentiment.

-

Token Buyback (Aug–Nov 2025): The buyback announcement further fueled the rally, setting the stage for substantial price gains.

Looking at year-over-year performance, since Story is a 2025-born asset, we can’t compare to 2024 prices, but the trajectory in its launch year has been exceptionally positive. Volatility has been high as expected for a new token – rapid multi-x run-ups and sizable pullbacks of 30-50% have occurred. Yet overall, early backers remain deep in profit. As of late 2025, Story’s price trend is in a strong uptrend (higher highs and higher lows), reflecting both project milestones and a degree of speculation. Going forward, maintaining that performance will depend on how well Story can convert hype into real adoption and navigate upcoming supply events, which we’ll explore next.

Whale Activity & Smart Money Flows

Recent data shows that large holders, or "smart money," have been accumulating $IP instead of selling. Notably, in June 2025, two whale addresses together acquired 16 million IP tokens (worth ~$47.5 million) during a price consolidation around $3–4, signaling confidence from investors. On-chain analytics indicated that this accumulation often precedes price surges.

In mid-September, there was a significant outflow of $IP from exchanges to private wallets, totaling around $2.65 million in a single day. Such moves typically indicate that holders plan to retain their tokens, reducing sell pressure and contributing to a 13% price increase. Additionally, a whale withdrew 433,176 IP from Bybit, suggesting long-term holdings.

Ownership data reveals concentrated holdings among early backers and the core team, with major tokens locked until 2029. Recent metrics showed no evidence of major whale dumping; instead, the trend has been one of accumulation. Services like Nansen and Arkham have noted increasing whale interest.

Moreover, whales are engaging with smart contracts, staking IP for rewards and providing liquidity on DEXs. Interest from institutional players, like Grayscale's Story Trust and an $82M buyback initiative by the project itself, further support the bullish sentiment.

In summary, whale activity indicates a strong accumulation trend for $IP, with minimal signs of distribution. As of now, on-chain analytics reflect confidence among big players, creating a positive outlook for Story.

On-Chain & Technical Analysis

From a technical analysis standpoint, Story’s price action in late 2025 shows a strong uptrend with key support and resistance levels to monitor. After breaking its previous high, IP faces resistance near the psychological $15 level, just above the recent peak of $14.92. If it can move past $15, it may gain momentum into uncharted territory. Immediate support lies around $12.25, which was a key breakout point, while the next notable support is at $10.15. Falling below $10 could weaken the technical structure significantly.

Recent indicators suggest IP is in overbought territory, as reflected by the RSI likely peaking above 70, indicating short-term overheating. However, a slight cooling in RSI as the price consolidates around $13-14 is seen as healthy. The MACD remains bullish, maintaining its positive momentum, though a slowdown may indicate waning strength.

IP is currently above key short-term moving averages, particularly the 20-day moving average around $11. Dips toward the 20 DMA could present buying opportunities as long as it stays above longer MAs. Volume metrics support the bullish trend, with a significant increase in the On-Balance Volume (OBV) during the recent rally, indicating strong buying interest.

On-chain metrics show over 1.7 million total transactions with minimal gas fees, indicative of growing network activity. If on-chain activity continues to rise, it may further justify the price strength.

In summary, key levels to watch are resistance at ~$15 and support at ~$12.25 and ~$10.15. While bullish momentum is present, traders should monitor for potential dips and ensure $IP holds above significant support levels. A break below $10 with high volume could trigger a deeper correction, but currently, bulls seem to be in control.

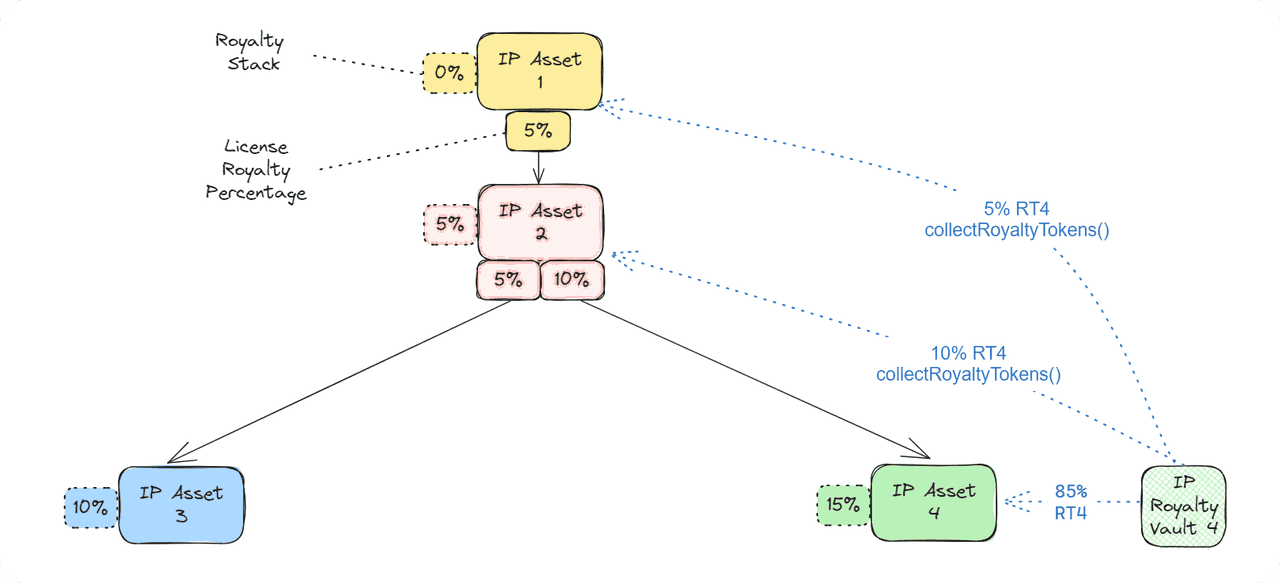

IP Asset Diagram (source)

Fundamental Drivers of Growth

Story’s impressive growth potential is underpinned by several fundamental drivers that could fuel demand for the IP token over the coming years:

-

Network Adoption & Ecosystem Growth: The number of creators and companies using the Story network is a key indicator of growth. As of mid-2024, over 200 teams are building on the Story Protocol, with notable projects like Space Runners’ “Ablo” and AI storytelling platform “Sekai.” Partnerships with institutions like Oxford and Stanford indicate strong ecosystem growth. As more creators register their works and apps integrate Story’s licensing, the utility of the $IP token for fees, staking, and governance will increase, reinforcing a cycle of growth.

-

Tech Differentiation & Innovation: Story offers unique technical features tailored for IP. It is EVM-compatible, supports advanced token standards, and has introduced a “Proof-of-Creativity” protocol for automated licensing and royalty splits. Its infrastructure handles microtransactions efficiently, essential for licensing data. These innovations position Story for scalable, automated IP licensing, driving further growth.

-

Integrations & Partnerships: Strategic alliances are crucial for growth. Collaborations with entities like Orderly Network in DeFi and Heritage Distilling in corporate finance enhance the token's integration into various sectors. Partnerships with major agencies hint at potential uses in entertainment IP management. New integrations across various industries will add utility and expand the user base.

-

Staking and Governance Utility: The $IP token plays a vital role in network security and governance. It is used for staking, which can reduce supply and encourage long-term holding. As the network evolves, $IP will empower holders to influence Story's future through governance voting, promoting further decentralization and participation.

-

Backers and Capital Access: Story’s growth is further underpinned by its strong backers, which include top-tier venture capital and influencers in tech. Having Andreessen Horowitz (a16z Crypto), Polychain Capital, Samsung Next, and even celebs like Paris Hilton’s media firm onboard gives Story access to capital, talent, and partnerships that many projects lack. It raised $140M in total funding as of 2024, meaning it has a war chest to fund development, hackathons, marketing, etc.

In summary, the fundamental drivers for Story’s growth include: a rapidly expanding user base and content network, differentiated technology tailor-made for a huge market (IP and AI), strategic integrations/partnerships pulling in real-world usage, and token economics that promote holding (staking, governance) as well as significant investor backing.

Key Risks to Consider

No investment is without risk, and Story is no exception. Prospective investors should weigh several key risks of investing in Story:

-

Competitive Threats: Story operates in competitive areas like blockchain, IP management, and AI. Risks include mainstream tech companies creating their own IP management systems or other crypto projects attracting users away from Story. Platforms like Ethereum may implement IP licensing protocols that reduce the need for Story. To stay competitive, Story must focus on innovation and partnerships.

-

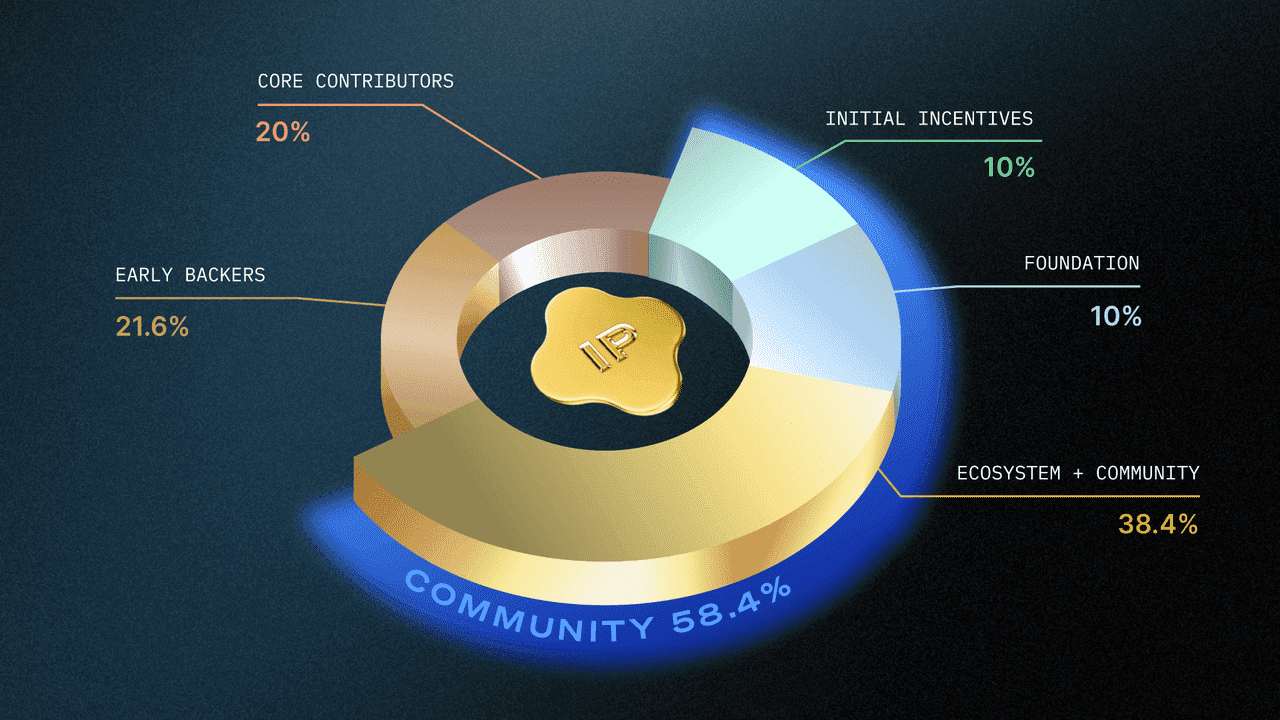

Token Dilution & Unlocks: Approximately 25-30% of Story’s 1 billion tokens are circulating, with the rest locked for various stakeholders until 2029. Upcoming token unlocks before then could increase selling pressure, especially if holders choose to sell during initial vesting stages. Past trends indicate price drops around significant unlock events, and perceptions of future dilution could impact market sentiment and price appreciation.

-

Regulatory and Legal Risks: Story faces dual regulatory challenges—crypto regulations could classify $IP as a security, affecting liquidity, while its IP model might encounter legal issues regarding ownership and enforceability. Varying IP laws across countries complicate the enforcement of its model. Additionally, potential lawsuits related to tokenized IP could pose significant risks, necessitating close monitoring of regulatory changes.

-

Execution and Development Risks: As a young project, Story's success hinges on ongoing development and user growth. A slowdown in development or a decline in community engagement could signal risks. User adoption is crucial; if growth stagnates, the token's market value might suffer. Transitioning from traditional systems to blockchain can be challenging, meaning user acquisition is critical for Story’s future.

-

Security and Smart Contract Risks: Lastly, as a Layer-1 blockchain and protocol, Story faces technical risks such as smart contract bugs, exploits, or network attacks. If a hacker were to find a vulnerability in the Story Protocol (for example, in how IP assets are tokenized or how royalties are distributed) it could lead to loss of funds or a network halt.

In weighing these risks, one should approach Story with a balanced perspective. Risk management steps like the buyback show the team attempting to mitigate token-related risks. Nonetheless, any investment in IP should be made with the understanding that you are taking on not just normal crypto volatility, but also the uncertainties of a nascent business model (tokenized IP) and the regulatory/competitive gauntlet that comes with it.

IP Tokenomics (source)

Analyst Sentiment & Community Insights

Analyst sentiment on Story (IP) has been largely positive, though there's some skepticism as well. Many crypto experts consider it a promising new L1 project due to its unique niche and notable backing, like Chris Dixon from a16z, who praised its vision of compensating creators through blockchain. a16z’s significant investments ($54M seed and $80M Series B) highlight their bullish outlook.

Community sentiment varies but leans optimistic, especially following recent interest spikes. Updates on Twitter/X have generated excitement among token holders, while some Reddit users expressed surprise at its rapid rise, noting it achieved a 100x increase post-listing. However, criticisms have emerged concerning the departure of founder Jason Zhao, indicating that the community is carefully scrutinizing team dynamics.

Expert opinions mirror this duality; some analysts view Story as a potential “blue chip,” while others warn of its speculative nature, cautioning against overhype. Community metrics are strong too, with over 29,000 users watching Story on CoinMarketCap, reflecting high interest. Geographically, Story is gaining traction in regions like Korea and Nigeria, boosted by local involvement.

Additionally, search interest and online discussions have increased alongside its price movements, a typical trend in the crypto space. User reviews on platforms like CoinMarketCap show a favorable rating for Story, indicating interest in its concept and performance.

Finally, market sentiment aggregators (like LunarCrush which track social mentions) show Story entering top ranks during its rally. LunarCrush data around late September ranked Story’s social engagement highly, with thousands of mentions and strong “bullish sentiment” scores. In summary, analyst and community sentiment on Story is cautiously optimistic.

Is Story a Good Investment?

Determining if Story (IP) is a good investment depends on your outlook and risk tolerance. Story presents both compelling strengths and risks. It targets a vast market with a unique use case focused on blockchain for IP rights, backed by reputable investors and promising technology partnerships. If successful, it could significantly increase demand for $IP tokens.

The token's value is tied to its multifaceted utility, including gas, staking, and governance. The dedicated team's efforts and alignment with the growing AI trend overall make it a more attractive investment. However, investing in Story carries macro risks like crypto volatility and regulatory issues, as well as project-specific challenges.

Investors should assess their belief in Story’s potential against these risks. If confident in the trend of tokenized IP, accumulating $IP tokens could lead to significant returns by 2025–2030. Conversely, caution is warranted due to potential hurdles like legal challenges.

Position sizing is essential; Story might fit better as a smaller part of a diversified crypto portfolio. Monitoring metrics such as registered IP assets and daily transactions is crucial to gauge the project's traction.

Story (IP) has potential for those who believe in its vision and can handle volatility. As always, do your own research, consider your financial goals, and invest an amount you can afford to lose. The investment potential remains promising but speculative as we move toward 2030.

Phemex is a top-tier centralized crypto exchange that offers a premium trading experience for assets like Story. If you’re looking to trade $IP, Phemex provides a holistic environment for Story traders: top-notch security, powerful trading tools, deep liquidity, and innovative features like bots and social trading.