Executive Summary: Navigating Market Volatility in 2026

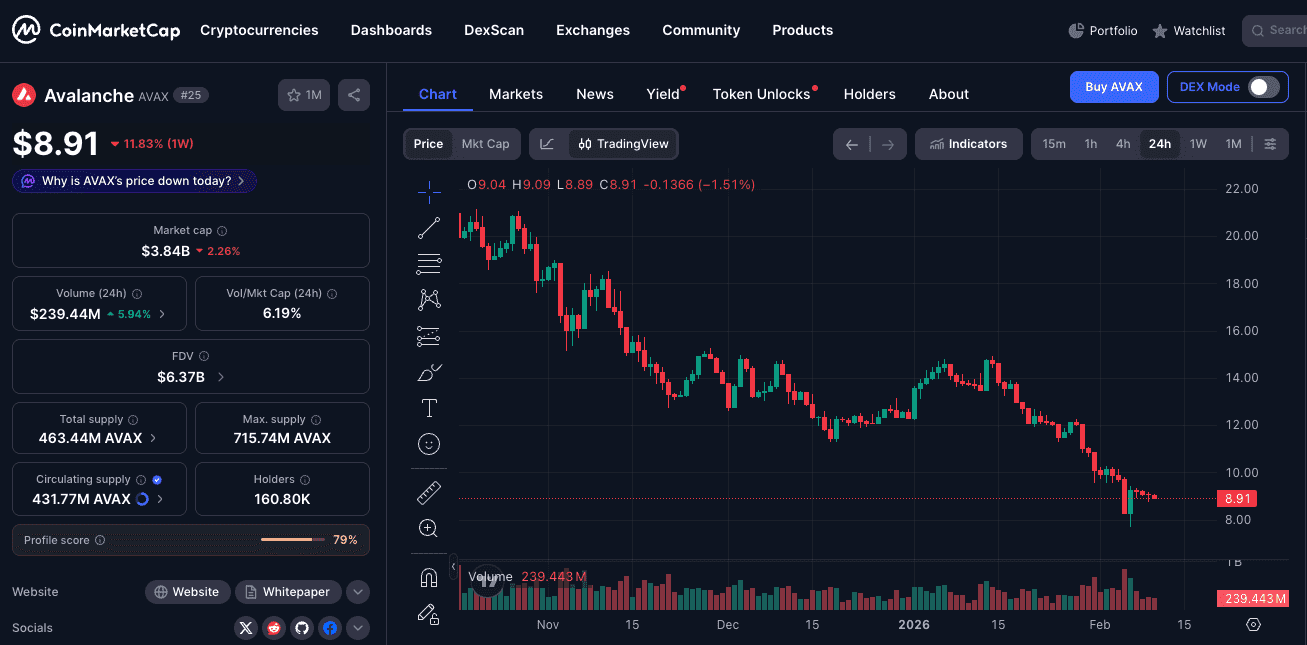

As of February 10, 2026, the digital asset market is experiencing a significant phase of price discovery and volatility. This period, internally referred to by many market participants as the "February Flush," has seen several high-cap assets retest multi-month valuation floors. Avalanche (AVAX) is currently trading at $8.90, following a measured 11.83% decline over the trailing seven-day period.

This trend is not isolated to the Avalanche ecosystem. The broader Layer-1 sector, including Ethereum (ETH) and Solana (SOL), is currently in a retracement phase, with SOL recording a more pronounced correction of -17.57%. Current readings from the Fear & Greed Index suggest a state of "Extreme Fear"—a metric that historically correlates with high-volume price action and potential shifts in market structure. For participants on Phemex, the analytical focus has shifted toward identifying liquidity clusters and assessing the sustainability of the current support levels.

Source:CoinMarketCap

1. AVAX Price Today: Technical Deep Dive at $8.90

The price action observed for AVAX on February 10 provides a detailed case study in "Support Integrity Verification." After the asset deviated from the 8.90 horizontal support zone.

A. Volume Analysis and Market Absorption

Data from live market aggregators indicates that AVAX’s 24-hour trading volume has experienced a 5.94% uptick, currently hovering at approximately $239.44M. In technical analysis, an increase in volume during a price stabilization phase often suggests "absorption." This phenomenon occurs when sell-side pressure is met with equivalent buy-side limit orders, often seen in the form of long lower wicks on the 4-hour and daily candlestick charts. This typically indicates that market participants are identifying the 9.00 range as a zone of interest.

Source:CoinMarketCap

B. The Relative Strength Index (RSI) Mechanics

On the daily timeframe, the RSI (Relative Strength Index) has descended into the 28-32 range. In the historical context of Avalanche’s market cycles, an RSI reading below 30 is classified as "Oversold." While this indicator does not guarantee an immediate price reversal, it historically suggests that the downward momentum may be reaching a point of exhaustion, often preceding a technical relief rally as the market seeks a new equilibrium.

C. Market Capitalization & Tokenomics Evaluation

With a circulating Market Cap of 6.37B, AVAX is currently trading at a valuation structure that reflects the current macro-economic climate of 2026. The circulating supply, currently at 431.77M AVAX (approximately 60% of the maximum supply), suggests that while programmatic unlocks continue, the market is actively attempting to price in these inflationary components at the sub-$10.00 valuation level. Tokenomics play a crucial role in this process.

2. Competitive Analysis: The L1 Landscape Comparison

To contextualize the current valuation of AVAX, it is essential to perform a relative strength analysis against its primary peers, Ethereum and Solana. The data from Feb 10, 2026, reveals a significant divergence in how these protocols are weathering the current market correction.

Comparison Table: Feb 10, 2026 Market Status

| Metric | Avalanche (AVAX) | Ethereum (ETH) | Solana (SOL) |

| Current Price | $8.90 | $2,047.67 | $85.73 |

| Weekly Change (1W) | -11.83% | -11.86% | -17.57% |

| Market Cap | $3.84 Billion | $247.13 Billion | $48.65 Billion |

| Volume (24h) | $239.44 Million | $25.61 Billion | $3.91 Billion |

| Circulating Supply | 431.77M AVAX | 120.69M ETH | 567.52M SOL |

| 24h Change | -2.26% | -0.91% | -0.67% |

Key Analytical Takeaways:

Volatility Benchmarking: Solana has exhibited the highest relative volatility this week, dropping over 17.5%. This suggests that speculative positions within the SOL ecosystem may be undergoing a more rapid deleveraging process compared to the more stabilized retreat seen in AVAX.

The Ethereum Anchor: Ethereum is currently maintaining a precarious position above the $2,000 mark. Market analysts often view $2,000 ETH as a pivot point for the entire Altcoin sector; should ETH fall below this level, secondary support for AVAX at $7.50 may become a point of focus.

Relative Valuation Metrics: AVAX’s market capitalization is currently less than 10% of Solana’s. For traders utilizing a "relative value" strategy, this divergence may be interpreted as a potential opportunity for rebalancing if the broader market enters a recovery phase.

3. Social Sentiment Analysis: Reddit vs. X (The Behavioral Component)

In the 2026 crypto landscape, market price is the quantitative output, but social sentiment often serves as the qualitative leading indicator. By monitoring platforms like Reddit and X, we can assess the current temperament of both retail and institutional cohorts.

Reddit (r/Avax & r/CryptoCurrency): Institutional Focus

The discourse on Reddit is currently characterized by a focus on long-term network utility rather than short-term price action.

Development Narratives: A significant portion of the community is discussing the "Avalanche 9000" upgrade and its implications for scalability. The prevailing sentiment suggests that while the current price action is challenging, the underlying developer activity remains consistent with a growth trajectory.

Accumulation Strategies: There has been a quantifiable increase in threads discussing 'Dollar Cost Averaging' (DCA) at the 10 prices were followed by periods of network expansion.

X (Twitter): Institutional Sentiment and Liquidity

On X, the conversation is more focused on capital flows and institutional positioning.

Liquidity Health: Analysts have pointed out that AVAX’s Volume-to-Market Cap ratio (6.19%) remains healthy, suggesting that the asset maintains high liquidity—a crucial factor for institutional entry and exit.

Capital Rotation Theory: There is an emerging thesis regarding capital rotation out of high-beta assets that have experienced significant crashes (-17% for SOL) into assets perceived as having more stable support structures, such as Avalanche.

4. Ecosystem Fundamentals: Structural Maturity in 2026

The Avalanche ecosystem in 2026 has transitioned from purely speculative use cases to more structured, institutional-grade applications. This structural shift provides a fundamental backdrop to the current $8.90 price level.

Subnets and Real World Assets (RWA)

By 2026, Avalanche has established itself as a leading protocol for Institutional Subnets. Unlike monolithic blockchains, Avalanche’s architecture allows global financial entities to deploy private, compliant blockchains. The demand for AVAX within these subnets—primarily for gas fees and validator collateral—creates a utility-driven demand floor that was less prevalent in previous market cycles.

Gaming and Consumer Integration

The ecosystem has seen the successful deployment of several high-fidelity gaming titles on dedicated Subnets. These applications have led to a stabilization of Daily Active Users (DAU), meaning that network utility is increasingly decoupled from price volatility, as users continue to interact with the chain for non-financial purposes.

5. Potential Market Scenarios on Phemex

The current volatility at the $8.90 level presents several scenarios for traders using Phemex’s professional toolset. Below are common market approaches based on different risk profiles.

Scenario A: Long-term Accumulation (Low Risk)

Market participants focusing on a 2026-2027 recovery horizon often utilize "Laddered Buy Orders." This involves allocating capital at current levels (7.80 support zone to account for potential "wick-downs" or liquidity grabs.

View AVAX/USDT Spot Market on Phemex

Scenario B: Technical Swing Trading (Moderate Risk)

Traders looking for a mean reversion toward the 50-day EMA (currently near 9.10 resistance. Risk management in this scenario typically involves a stop-loss placement just below the recent local low of $8.70 to maintain a favorable risk-to-reward ratio.

Explore AVAX Margin Trading with 5x Leverage

Scenario C: Futures Scalping and Hedging (High Risk)

In environments of extreme volatility, Perpetual Contracts are often used to hedge spot holdings or to capitalize on intra-day price swings between $8.50 and $9.50. Traders frequently monitor "Liquidation Heatmaps" to identify where clusters of leveraged positions may trigger rapid price movements.

Trade AVAXUSDT Futures on Phemex

6. Macro Verdict: The 2026 Market Outlook

The current correction affecting ETH (-11.8%), SOL (-17.5%), and AVAX (-11.8%) is indicative of the broader integration of crypto-assets into global liquidity cycles. As inflation data stabilizes and central bank policies evolve in 2026, the question for market participants is not whether the market will find an equilibrium, but at what level that equilibrium will be established.

Avalanche at $8.90 represents a project with significant technical pedigree trading at a valuation that reflects the current market’s "Extreme Fear." For the disciplined observer, this phase of the market provides the data necessary to make informed, risk-adjusted decisions.

Final Market Data Points (Feb 10, 2026):

AVAX Primary Support: $8.50 - $8.90

AVAX Resistance Levels: $10.20 / $12.50

ETH Correlation Pivot: $2,000

SOL Correlation Pivot: $80.00

Disclaimer: Cryptocurrency trading involves substantial risk and may not be suitable for all investors. The high degree of leverage available in margin and futures trading can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite. The information provided in this analysis is for educational and informational purposes only and does not constitute financial or investment advice. Always perform your own due diligence and use risk management tools such as stop-loss orders on the Phemex platform.