Key Takeaways

The following points summarize the core aspects of MicroStrategy’s (Strategy Inc.) Bitcoin treasury strategy and its financial position as of early February 2026:

Total Holdings: As of February 8, 2026, the company holds 714,644 BTC.

Cost Basis: These assets were acquired for an aggregate purchase price of $54.35 billion, representing an average purchase price of $76,056 per Bitcoin.

Funding Mechanisms: The company frequently funds its Bitcoin acquisitions through capital markets, primarily using proceeds from at-the-market (ATM) equity issuance and debt financings.

Accounting Transformation: Following the adoption of ASU 2023-08 on January 1, 2025, the company now measures its Bitcoin holdings at fair value. This shift recognizes price changes in net income, resulting in significant earnings volatility during sharp market moves.

Proprietary Metrics: Strategy Inc. tracks its performance using specialized KPIs such as Bitcoin Per Share (BPS) and BTC Yield, which measure the percentage change in the ratio of Bitcoin holdings to assumed diluted shares outstanding.

Investment Proxy Risks: While often viewed as a Bitcoin proxy, the company cautions that its stock does not represent direct ownership of the underlying Bitcoin. The stock price can deviate significantly from Bitcoin’s market value due to factors like capital structure, dilution, and the preferential rights of preferred stockholders.

MicroStrategy Bitcoin holdings at a glance

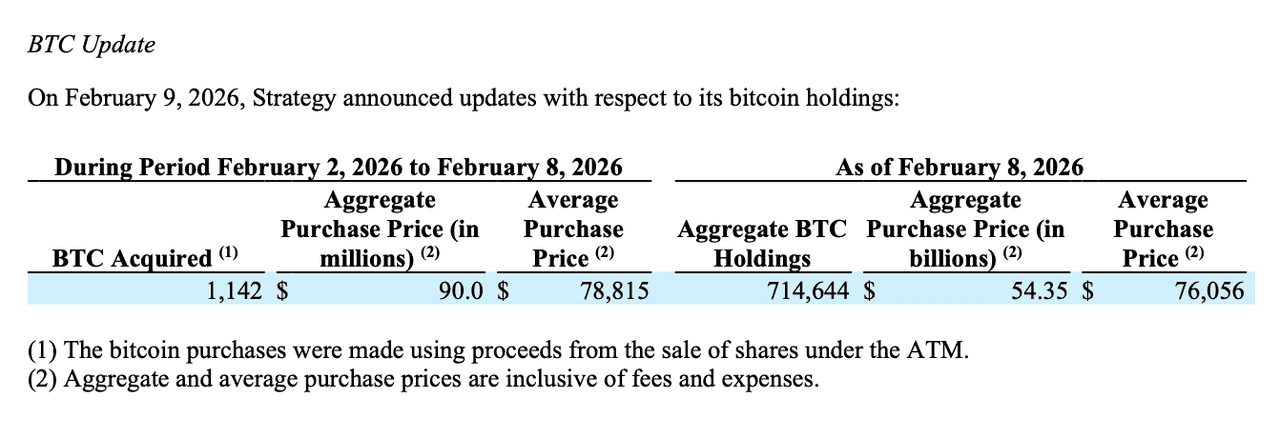

In a Form 8‑K filed February 9, 2026, Strategy Inc. reported: 714,644 BTC held, acquired for an aggregate purchase price of $54.35 billion at an average purchase price of $76,056 per Bitcoin (prices inclusive of fees and expenses). The same 8‑K states the company acquired 1,142 BTC for $90.0 million at an average price of $78,815 (inclusive of fees/expenses).

The filing also discloses net proceeds of $89.5 million from selling 616,715 shares of its Class A common stock under its at‑the‑market (ATM) program, and that Bitcoin purchases in the period were made using proceeds from ATM share sales. At the time of the latest price check (February 10, 2026), Bitcoin is about $69,401.

Using the company’s reported holdings (714,644 BTC), that implies a rough market value near $49.6B, versus the reported aggregate purchase price of $54.35B—an unrealized difference of roughly -$4.8B.

How MicroStrategy built its Bitcoin treasury strategy

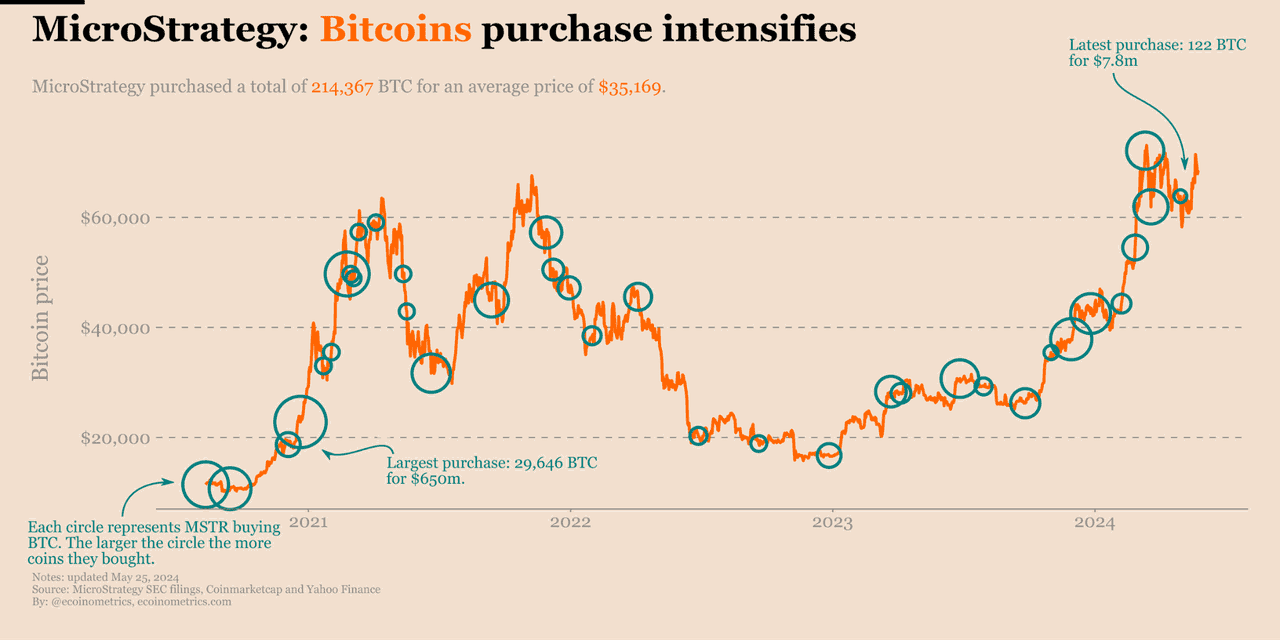

MicroStrategy’s Bitcoin strategy began in 2020 with a high-profile allocation of corporate cash into Bitcoin. An SEC‑filed 8‑K notes that on August 11, 2020, MicroStrategy announced the purchase of 21,454 BTC for $250.0 million.

By late 2020, the company had already scaled meaningfully: a company press release states that as of December 21, 2020, it held about 70,470 BTC, acquired for about $1.125 billion, at an average price of about $15,964 per BTC.

Since then, the company’s Bitcoin holdings have grown from tens of thousands of BTC to hundreds of thousands, and—by early February 2026—over seven hundred thousand BTC. In its fourth quarter 2025 results materials, the company reported 713,502 BTC held as of February 1, 2026, acquired at a total cost of $54.26B (average $76,052 per BTC), and stated that 41,002 BTC had been acquired in January 2026 alone.

A few days later, the February 9, 2026 8‑K update increased the disclosed total to 714,644 BTC as of February 8, 2026, reflecting the additional weekly purchase.

Strategy BTC Holdings Update on most recent SEC filing (source)

How MicroStrategy funds Bitcoin purchases

A defining aspect of the MicroStrategy Bitcoin holdings story is financing—the company repeatedly raises capital and deploys that capital (in whole or in part) into Bitcoin.

From the most recent weekly update, Strategy Inc. explicitly tied its Bitcoin purchases to ATM equity issuance proceeds.

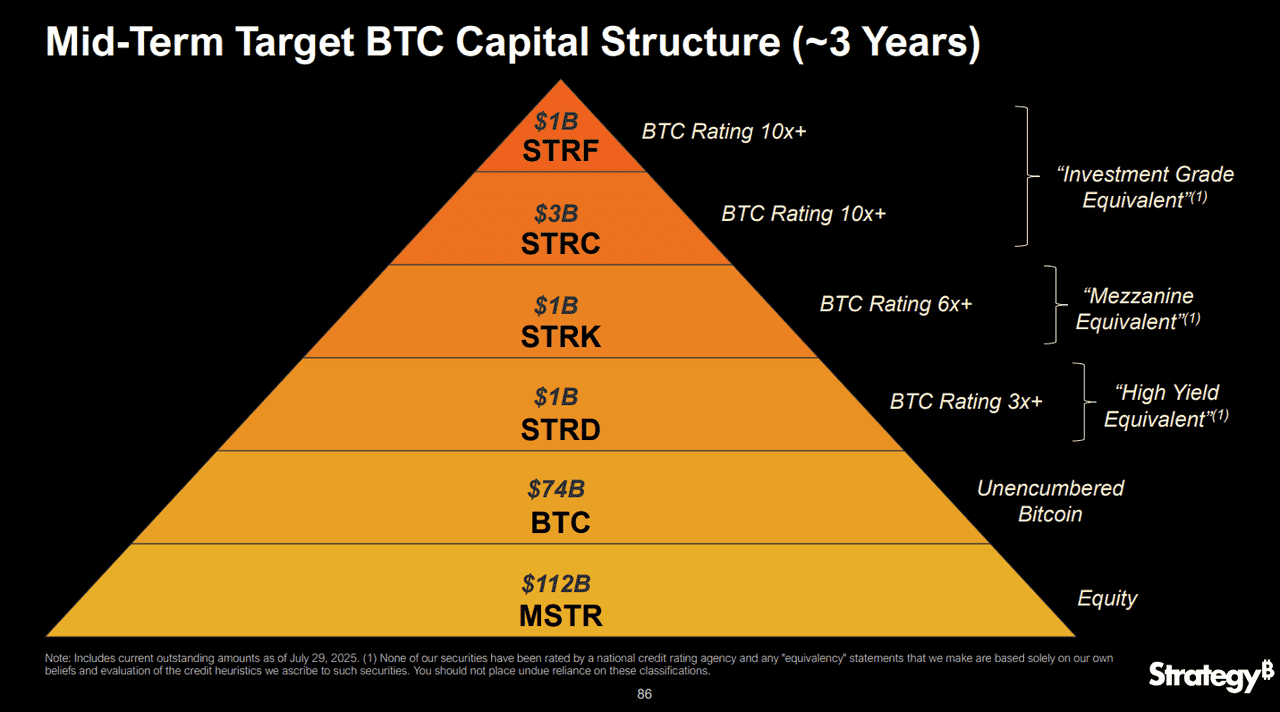

At a higher level, the company’s fourth quarter 2025 results materials highlight how central capital markets have become to its strategy. The company stated it raised $25.3 billion in 2025, describing itself as the “largest US equity issuer” that year (and referencing multiple preferred stock IPOs).

Those same materials describe the company as both:

a Bitcoin treasury company pursuing “financial innovation strategies” tied to its Bitcoin holdings, and

an “AI‑powered enterprise analytics software” business (i.e., the operating software segment still exists alongside the Bitcoin strategy).

The company has also emphasized that it uses a mix of equity, debt financings, and cash flows from operations to accumulate Bitcoin.

A practical takeaway for readers: when evaluating MicroStrategy BTC holdings over time, it’s not just “Bitcoin price up/down.” It’s also important to track share count changes (dilution), debt and preferred obligations, and the cadence of ATM issuance—because these can change the risk/return profile of holding the stock as a Bitcoin proxy.

How MicroStrategy reports Bitcoin on financial statements

Understanding MicroStrategy Bitcoin holdings also requires understanding a major accounting shift that reshaped how Bitcoin appears in GAAP financials.

The accounting rule change: ASU 2023-08 and fair value

In December 2023, issued ASU 2023‑08, which (in general) requires in-scope crypto assets to be measured at fair value, with changes in fair value recognized in net income each reporting period, along with new disclosures.

The effective date in the standard is for fiscal years beginning after December 15, 2024.

MicroStrategy’s adoption and what it changed in reporting

Strategy Inc. has disclosed it adopted ASU 2023‑08 on January 1, 2025, and that adoption requires Bitcoin holdings to be re-measured at fair value, with fair value changes recognized in net income.

This accounting shift can create very large income statement swings when Bitcoin prices move sharply. In its fourth quarter 2025 results, the company reported an operating loss that included an unrealized loss on digital assets of $17.4 billion, explicitly noting it had applied fair value accounting for multiple quarters by that point, and contrasting that with the prior “cost-less-impairment” model used before 2025.

The company’s own KPI notes also warn readers that, because of fair value accounting, it may record unrealized gains or losses based on Bitcoin price changes during a period. Such impacts that are not necessarily captured by the company’s non-GAAP style Bitcoin-per-share KPIs.

Michael Saylor: The Face of Corporate Bitcoin Adoption

It’s hard to talk about MicroStrategy’s Bitcoin journey without mentioning Michael Saylor. As the company’s Executive Chairman and former CEO, Saylor has become one of the most recognizable voices in the Bitcoin world. He didn’t just lead the first major wave of corporate Bitcoin buying, he made it central to the company’s identity.

Since 2020, Saylor has championed Bitcoin as the “ultimate store of value,” often comparing it to digital gold. His personal belief in Bitcoin has gone hand-in-hand with MicroStrategy’s strategy, making headlines almost every time the company adds to its Bitcoin stash.

Through interviews, social media posts, and public statements, Saylor has helped shape the narrative around Bitcoin as a long-term asset for businesses. For many investors and crypto enthusiasts, “Saylor and Bitcoin” have become almost synonymous.

Even when markets get volatile, Saylor’s steady tone and firm stance often reassure Bitcoin believers. And while MicroStrategy’s approach may not work for every company, there’s no denying that Saylor has played a huge role in making corporate Bitcoin adoption a global conversation.

History of MicroStrategy Bitcoin Purchases (source)

What MicroStrategy Bitcoin holdings mean for investors and the market

MicroStrategy (Strategy Inc.) has become a major “Bitcoin treasury stock,” so its disclosures matter not just to shareholders but to broader market narratives around corporate adoption.

MicroStrategy as a Bitcoin proxy

Media and analysts often describe Strategy/MicroStrategy stock as providing “leveraged exposure” or proxy exposure to Bitcoin, because the company holds a very large Bitcoin position and repeatedly adds to it using capital raises. At the same time, the company itself cautions that its stock price can deviate significantly from the market value of its Bitcoin holdings because many other factors influence the trading price such as capital structure, dilution expectations, debt and preferred claims, market sentiment, etc.

Key risks to understand

A neutral, education-first way to interpret the MicroStrategy Bitcoin holdings story is to separate Bitcoin price risk from structural risk.

Bitcoin price risk: If Bitcoin declines below the company’s average purchase price, the market value of its holdings can fall below aggregate cost (as shown in early February 2026 disclosures and market coverage).

Structure risk (capital stack): Strategy’s KPI disclosures emphasize that its assets (including Bitcoin) are subject to existing and future liabilities, and to the preferential rights of preferred stockholders; it also notes scenarios in which it might need to sell shares or Bitcoin to meet obligations, which could affect the “Bitcoin-per-share” picture.

Concentration risk: In SEC filings, the company has explicitly stated that the concentration of its Bitcoin holdings enhances risks inherent in its strategy, and that the absence of diversification increases those risks (language typical of risk factor disclosures).

Why it remains influential

Whether one views the strategy as innovative or risky, the basic reason MicroStrategy/Strategy remains influential is scale. It continues to position itself as the “world’s first and largest Bitcoin treasury company,” and it provides frequent disclosures that make it unusually trackable compared to many corporate crypto adopters.

For real-time market context, Strategy’s stock was about $138.44 at the latest quote on February 10, 2026, underscoring how closely the market watches updates around Bitcoin holdings, accounting impacts, and capital raises.

How MicroStrategy Bitcoin Holdings Impact the Broader Crypto Market

Because MicroStrategy (Strategy Inc.) holds Bitcoin at a scale rarely seen outside exchanges, ETFs, and large custodians, its disclosures can influence crypto markets in a few practical ways including through narrative, liquidity expectations, and headline-driven sentiment.

A high-visibility “corporate adoption” signal

When a public company repeatedly discloses large, programmatic Bitcoin accumulation, it reinforces the “Bitcoin as a corporate treasury asset” narrative, especially since Strategy describes itself as a Bitcoin treasury company and publishes frequent purchase/holdings updates. That narrative can spill over into broader crypto sentiment (risk-on/risk-off), even for assets beyond BTC, because Bitcoin often sets the tone for overall market positioning.

A real supply-and-demand factor

At 714,644 BTC disclosed as of February 8, 2026, Strategy’s position is large enough that market participants pay attention to whether it’s adding, pausing, or potentially forced to sell (even if the company repeatedly frames its approach as long-term). Even when the weekly buys are modest (e.g., 1,142 BTC in one week), the expectation of continued buying—especially if funded through capital markets—can affect short-term sentiment and trading behavior.

Capital markets linkage: BTC ↔ equities feedback loop

Strategy often funds Bitcoin purchases through equity issuance, which creates a reflexive “bridge” between equity market conditions and Bitcoin demand: if equity issuance is flowing smoothly, markets may assume Strategy can keep accumulating; if equity conditions tighten, that assumption can weaken. Separately, many investors treat Strategy’s stock as a Bitcoin proxy, so sharp moves in the stock, especially around disclosures, can reinforce broader crypto risk sentiment.

Earnings/filings can become “macro headlines” for crypto

With fair value accounting (ASU 2023-08 adoption), Strategy’s income statement can swing dramatically with Bitcoin price moves and consequently generate big headlines such as reported large unrealized losses in certain periods. That tends to amplify attention around drawdowns or rallies and can contribute to short-term volatility in BTC and correlated assets.

Downturn dynamics: risk framing spreads beyond BTC

During steep declines, coverage often focuses on whether Strategy’s average cost is above/below market and what that means for its balance sheet, which can shape the broader “crypto winter” narrative. That narrative can pressure risk appetite across altcoins too - even if the fundamentals of those networks are unrelated.

Importantly, Strategy’s own disclosures emphasize that its capital structure, obligations, and other factors can cause its stock price to deviate from the market value of its Bitcoin holdings. That’s another reason why headlines about Microstrategy and Michael Saylor can influence sentiment even when they don’t directly change spot BTC supply.

Strategy Bitcoin Capital Structure (source)

FAQ on MicroStrategy Bitcoin holdings

How many Bitcoins does MicroStrategy have? As of the most recent company disclosure available through February 10, 2026, Strategy Inc. reported 714,644 BTC held as of February 8, 2026.

What is MicroStrategy’s average Bitcoin purchase price? The February 9, 2026 8‑K reports an average purchase price of $76,056 per BTC for its aggregate holdings (inclusive of fees and expenses).

What was MicroStrategy’s latest Bitcoin purchase? For the period February 2–8, 2026, the company disclosed purchasing 1,142 BTC for $90.0 million at an average price of $78,815.

How did the crypto accounting rules change affect MicroStrategy? ASU 2023‑08 shifted in-scope crypto accounting toward fair value measurement with fair value changes flowing through net income, which can increase earnings volatility during large Bitcoin price moves. Strategy disclosed adopting ASU 2023‑08 on January 1, 2025 and reported substantial unrealized gains/losses in periods after adoption.

Does owning MicroStrategy stock mean you own its Bitcoin? No. Strategy explicitly states that owning its common stock does not represent an ownership interest in the Bitcoin held by the company, and it cautions that its securities can trade at prices that deviate significantly from the market value of its Bitcoin holdings.

Conclusion

MicroStrategy’s Bitcoin holdings are influential for a simple reason: scale plus frequency of disclosure. As of February 8, 2026, Strategy reported 714,644 BTC held, acquired for an aggregate purchase price of $54.35 billion at an average price of $76,056 per BTC—figures that many market participants watch like a macro indicator.

For readers, the most grounded way to interpret MicroStrategy’s impact is to separate Bitcoin price exposure from strategy and structure effects: how purchases are financed, how accounting treatment affects reported earnings, and how market psychology reacts to weekly updates. Together, those factors help explain why a single corporate balance sheet can influence broader crypto narratives, especially during major rallies or drawdowns. If you’re interested in buying, selling, and trading Bitcoin especially following a new Microstrategy headline, you can do so on Phemex, the leading user-first crypto exchange.