In 2026, the top Layer 1 blockchain tokens continue to form the foundation of the crypto ecosystem, powering everything from decentralized finance to NFTs and gaming. Layer 1 (L1) networks like Bitcoin, Ethereum, and Solana are the base blockchains upon which entire crypto economies are built, making the Layer 1 crypto sector crucial for Web3 infrastructure. This article provides a neutral, educational overview of ten major Layer 1 projects by market activity and ecosystem traction in 2026.

What Is the Layer 1 Crypto Sector?

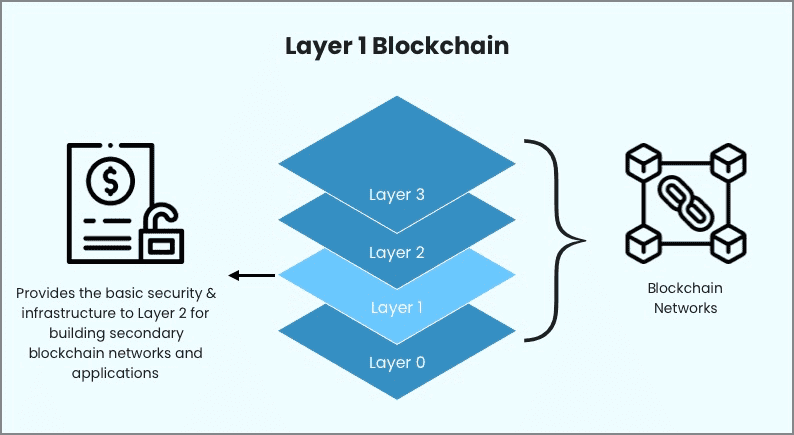

Layer 1 blockchains are independent base networks that validate and record transactions without needing any other chain. They handle their own consensus and security at the protocol level, meaning they don’t rely on another blockchain (unlike Layer 2 solutions which build on top of L1s). Each Layer 1 has its native cryptocurrency (for example, BTC on Bitcoin or ETH on Ethereum) used to pay transaction fees, incentivize validators/miners, and participate in on-chain governance or staking.

Common use cases for Layer 1 networks include simple value transfer (Bitcoin for peer-to-peer digital cash), and more complex operations like executing smart contracts (Ethereum, Solana, etc.) to run decentralized applications. Many DeFi protocols, NFT marketplaces, games, and Web3 services operate directly on Layer 1 chains, making these networks the “highways” of the decentralized world. Because L1s directly manage security, scalability, and decentralization, improvements at this base layer can have broad effects – for instance, upgrades to consensus mechanisms or block size can increase transaction throughput and lower fees across the entire ecosystem.

Layer 1 Blockchains (source)

Top 10 Layer 1 Blockchain Tokens in 2026

Each of the following sections provides a neutral profile of a major Layer 1 blockchain token, including its mission, technical features, token utility, strengths, and risks.

-

Bitcoin (BTC)

Bitcoin is the original cryptocurrency and Layer 1 blockchain, created in 2009 as a decentralized digital currency. Its primary goal is to serve as peer-to-peer electronic cash and a store of value independent of any government. Bitcoin’s network relies on Proof of Work (PoW) mining, where a distributed network of miners validate transactions and secure the ledger. With a fixed supply of 21 million BTC, Bitcoin is often likened to “digital gold” due to its scarcity and durability as an asset.

Bitcoin introduced the concept of a trustless, permissionless base layer for transferring value. While it does not natively support complex smart contracts, Bitcoin’s robust security and unmatched decentralization make it a foundational Layer 1 network.

Bitcoin runs on a simple but powerful technology stack. Transactions are batched into blocks approximately every 10 minutes, and miners compete to add new blocks via PoW, which requires significant computational work (hashing). This makes the network extremely secure – Bitcoin has by far the highest cumulative hash power of any network, deterring attacks. However, Bitcoin’s design trades speed for security: it handles only about 5–7 transactions per second on-chain, and transaction fees can spike during peak demand. Developers have introduced improvements like SegWit and the Taproot upgrade to enhance capacity and privacy, and Layer 2 networks like Lightning handle small payments off-chain to improve scalability.

-

Ethereum (ETH)

Ethereum is the pioneering smart contract Layer 1 platform, launched in 2015, with a mission to be a “world computer” for decentralized applications. It extends blockchain utility beyond simple payments (like Bitcoin) to programmable contracts that run on-chain. Ethereum enables developers to build and deploy dApps for finance, gaming, social media, and more by writing smart contracts (typically in Solidity). Over the years, Ethereum has grown into the largest Layer 1 ecosystem of dApps, ranging from decentralized exchanges and lending platforms to NFT marketplaces. In 2022, Ethereum switched its consensus mechanism from PoW to Proof of Stake, massively improving its energy efficiency and paving the way for future scalability upgrades.

Ethereum is arguably the most influential Layer 1 blockchain for Web3, as it introduced the broad capabilities that many other networks emulate. By 2026, Ethereum remains the center of gravity for DeFi and NFTs – hosting a majority of total value locked in DeFi and high-profile NFT projects. Many Layer 2 networks (like Optimism and Arbitrum rollups) rely on Ethereum as their base layer, further cementing its role. Its position is often described as the base settlement layer for a multi-chain ecosystem, where Ethereum provides security and decentralization, and various Layer 2 or sidechains handle high-throughput transactions.

-

Solana (SOL)

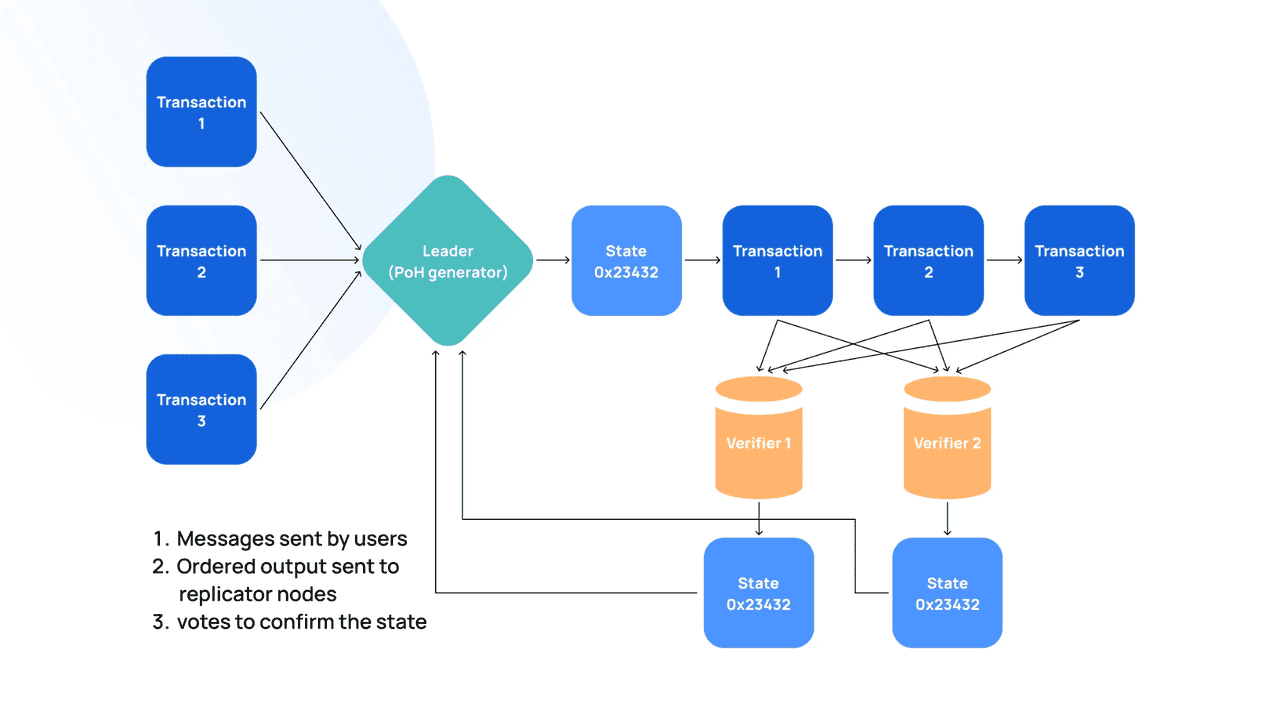

Solana is a high-performance Layer 1 blockchain launched in 2020, designed to support scalable and user-friendly decentralized applications. Its founding vision was to maximize throughput and minimize costs by innovating on consensus and network architecture. Solana introduced a mechanism called Proof of History (PoH) – a cryptographic clock that orders events – combined with a Delegated Proof of Stake consensus. This allows Solana to process transactions in parallel and achieve confirmation times of a few hundred milliseconds. The network’s mission is often summarized as achieving web-scale performance on blockchain, making it suitable for applications like order-book exchanges, high-frequency trading, and rich interactive games that demand speed.

Solana Network (source)

Solana quickly made a name as one of the fastest Layer 1s, earning it a spot among top Layer 1 projects as a “Visa of crypto” contender. By 2026, Solana is known as a leader in high-throughput use cases, with a thriving ecosystem of NFT marketplaces (such as Magic Eden), DeFi protocols (like Serum and Raydium), and Web3 social apps. It carved out a niche as a chain that puts user experience (fast and cheap transactions) first, which attracted many consumer-facing dApps and NFT projects. Solana’s approach stands in contrast to Ethereum’s more modular roadmap as Solana aims to scale at Layer 1 without sharding.

-

Cardano (ADA)

Cardano is a Layer 1 blockchain platform known for its research-driven approach to development. Launched in 2017 by Input Output Global (led by Ethereum co-founder Charles Hoskinson), Cardano set out to be a third-generation blockchain, improving on issues of scalability, interoperability, and sustainability seen in earlier projects. Its development is guided by academic peer review and formal methods – every major component of Cardano’s design (from its consensus algorithm to smart contract language) has been backed by scientific research. Cardano’s overarching mission is to provide a secure and scalable platform for running smart contracts and decentralized applications, with a particular focus on applications in identity, governance, and financial inclusion, especially in emerging markets.

In the Layer 1 landscape, Cardano is often recognized as a prominent platform that values security and rigor over speed of delivery. By 2026, it has a strong community and is among the top blockchains by market cap (ADA is widely held), but its ecosystem growth (in terms of dApps and DeFi) has been more gradual compared to some peers. Cardano introduced smart contract capability in 2021 (Alonzo upgrade), and since then its DeFi and NFT ecosystem, while smaller than Ethereum or Solana’s, has begun to flourish with decentralized exchanges, lending protocols, and NFT collections.

-

Polkadot (DOT)

Polkadot is a Layer 1 blockchain network with a unique multi-chain design aimed at achieving interoperability between different blockchains. Launched in 2020 by Parity Technologies (co-founded by Gavin Wood, Ethereum’s former CTO), Polkadot’s vision is a “blockchain of blockchains.” Instead of one monolithic chain handling all tasks, Polkadot provides a Relay Chain (the central chain) that coordinates an ecosystem of many parallel chains called parachains. Each parachain can be customized for specific use cases (one might be optimized for DeFi, another for gaming, etc.) and they all plug into the Relay Chain for security and cross-communication. The overarching goal is to solve scalability (many chains operating in parallel) and allow specialized execution while still enjoying shared security and interoperability.

Polkadot occupies the interoperability niche in the Layer 1 sector. By 2026, it is a leading project enabling diverse blockchain projects to work under one umbrella of security. Polkadot has a strong presence in the developer community, in part due to its substrate framework (which teams use to build their parachains). Many consider Polkadot a pioneer in the multi-chain vision, influencing other interoperability efforts. In practice, Polkadot’s ecosystem now boasts parachains covering areas like DeFi (Acala, parallel finance), privacy (Manta), smart contract hubs (Moonbeam for Ethereum compatibility), and more.

-

Avalanche (AVAX)

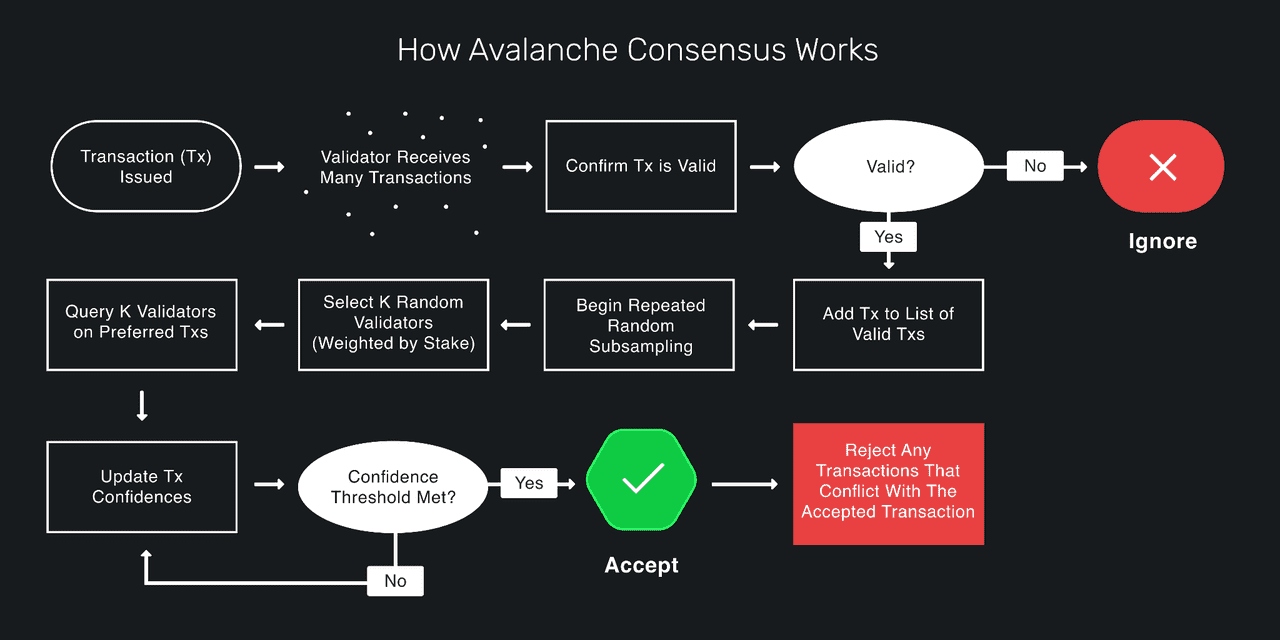

Avalanche is a Layer 1 blockchain platform that launched in 2020, known for its emphasis on speed, flexibility, and “subnet” architecture. Created by Ava Labs, Avalanche aims to be a platform for launching not just dApps, but entire customized blockchains that can interoperate. Its key innovation is the Avalanche consensus protocol, which uses a randomized, repeated subsampling mechanism to achieve fast finality (often under 2 seconds) and high throughput. The mission of Avalanche is to digitize and trade any asset with sub-second finality, and to allow enterprises or communities to easily create their own tailor-made blockchain networks (subnets) that can tie into the broader Avalanche ecosystem.

Avalanche Consensus (source)

Avalanche has established itself as a versatile Layer 1 choice for both DeFi and enterprise applications. By 2026, it’s recognized as one of the leading Ethereum-compatible networks (the C-Chain of Avalanche runs an instance of the EVM, making it easy for Solidity developers to deploy), and it has a solid DeFi community with projects like Trader Joe, BENQI, and others.

-

Tron (TRX)

Tron is a Layer 1 blockchain platform that launched in 2018 with the aim of decentralizing content and entertainment on the web. Founded by Justin Sun, Tron’s early narrative was about enabling content creators to have ownership over their creations without centralized platforms (it even acquired the file-sharing service BitTorrent to integrate with its ecosystem). Over time, Tron evolved into a general-purpose blockchain platform known for its high throughput and low transaction costs, making it particularly popular for everyday payments and simple smart contracts. Tron uses a Delegated Proof of Stake (DPoS) consensus mechanism, where a limited number of “Super Representatives” produce blocks. Its mission today can be seen as providing a fast, cost-effective blockchain infrastructure for digital value exchange and entertainment applications, appealing especially to retail users in regions where low fees are crucial.

By 2026, Tron has solidified a somewhat unique role: it is one of the most widely used networks for stablecoin transactions and value transfers, even if it’s often under the radar in developer discussions. Thanks to near-zero fees and quick confirmation, Tron became the chain of choice for transferring Tether (USDT) – a huge portion of USDT’s supply and daily volume is on Tron, facilitating remittances and exchange transfers cheaply. This has kept Tron consistently in the top blockchains by transaction count.

-

NEAR Protocol (NEAR)

NEAR Protocol is a Layer 1 blockchain launched in 2020 that focuses on usability and scalability through sharding. Created by NEAR Inc. and the NEAR Collective, NEAR aims to be a developer-friendly platform for decentralized applications, emphasizing an easy onboarding experience for both developers and users. One of NEAR’s distinguishing goals is to make blockchain as approachable as web development, with features like human-readable account names (instead of long hex addresses) and intuitive tools. NEAR’s architecture uses a scaling technique called Nightshade sharding, where the network is split into multiple shards that process transactions in parallel, but all contribute to a single chain’s security. The ultimate mission of NEAR is to enable open web applications with the performance to rival traditional apps, while being accessible and affordable to use.

In the landscape of Layer 1s, NEAR is seen as a next-generation scalable platform that competes with other high-performance chains like Solana, Avalanche, and Ethereum’s Layer 2s. By 2026, NEAR has developed a respectable ecosystem of DeFi protocols (e.g., Ref Finance, Burrow), NFT marketplaces (e.g., Paras), and web3 social/gaming apps. It has also pioneered usability features such as seamlessly allowing users to interact with dApps using email or phone verification through wallets, which lowers entry barriers. NEAR also introduced the concept of “progressive security” – starting with a few shards and planning to add more as demand grows, which it has been doing.

-

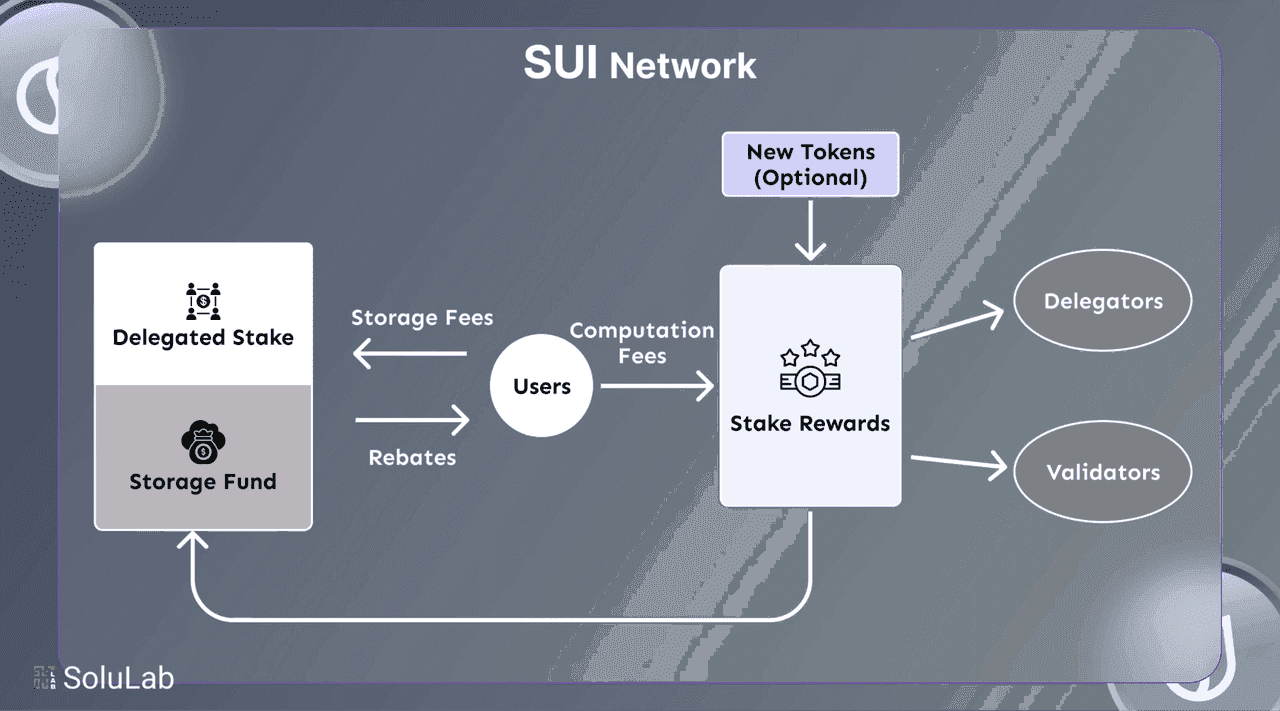

Sui (SUI)

Sui is a relatively new Layer 1 blockchain (mainnet launched in 2023) that focuses on high-speed transactions and a novel approach to data processing, particularly suited for asset-intensive applications like gaming. Developed by Mysten Labs, which includes former engineers from Facebook’s Diem project, Sui’s design introduces an object-centric model of blockchain data. Instead of accounts holding balances, Sui treats every piece of data (coins, NFTs, etc.) as an object that can be independently owned and mutated. This model, combined with Sui’s consensus mechanisms, allows many transactions that don’t conflict to be processed in parallel. Sui’s mission is to deliver instant finality and massive scalability for web3 applications, making user experiences seamless for things like in-game item trades, real-time payments, and other use cases requiring throughput beyond what traditional blockchains offer.

Sui Network (source)

By 2026, Sui has emerged as one of the notable “next-gen” Layer 1s, often grouped with Aptos (another chain born from Diem’s remnants) as leaders of a new wave of scalable blockchain tech. Sui distinguishes itself in the Layer 1 sector through its emphasis on developer ergonomics for managing digital assets and its ability to handle very high TPS in testing environments.

-

BNB Chain (BNB)

BNB Chain refers to the Layer 1 blockchain originally initiated by Binance (one of the world’s largest crypto exchanges). BNB Chain actually consists of two chains: the BNB Smart Chain (BSC) which is EVM-compatible and runs smart contracts, and the older Binance Beacon Chain for simple asset transfers. Launched in 2020, BSC was created to offer a faster, low-fee alternative for Ethereum-compatible dApps, bootstrapped by Binance’s vast user base. BNB is the native token of both chains – it was initially issued by Binance as an exchange token, but now also fuels the BNB Chain’s blockchain operations. The mission of BNB Chain is to provide an accessible, high-throughput platform for DeFi, gaming, and other dApps, leveraging Binance’s ecosystem.

Trends Shaping the Layer 1 Token Landscape in 2026

Interoperability and Multichain Ecosystems: By 2026, the shift towards a multichain world is evident, with various Layer 1 networks interacting seamlessly. Users expect to transfer assets across chains, driven by projects like Polkadot and Cosmos that enable connections through shared security or trust-minimized bridges. Traditional Layer 1s are also adapting to enhance interoperability, leading to the rise of omnichain DeFi and cross-chain NFTs. This evolution means that a "best Layer 1" is determined by its ability to integrate into the multichain ecosystem, although it also introduces risks, such as bridge hacks, prompting investment in safer interoperability technologies.

Institutional Interest and Real-World Asset Integration: Layer 1 blockchains are gaining traction in traditional finance, particularly with the tokenization of real-world assets (RWAs) like bonds and real estate. Public chains, such as Ethereum and Avalanche, are being utilized for enterprise purposes, pushing the development of compliance features and permissioned sidechains. Interest in stablecoins and CBDCs is increasing, with some Layer 1s positioning themselves for regulatory compatibility, thereby attracting institutional investment and enhancing market stability.

Energy Efficiency and Consensus Innovation: The 2022 Ethereum Merge spurred a trend toward energy-efficient consensus algorithms across new Layer 1 projects. By 2026, most are utilizing Proof of Stake or variations to minimize environmental impact, appealing to eco-conscious investors. Consensus research is also advancing with faster and more secure variations, allowing blockchains to operate on less resource-intensive hardware. Overall, the focus on sustainability is reshaping the Layer 1 landscape.

Regulatory Impact on Base Layers: The evolving regulatory landscape is significantly shaping Layer 1 tokens. Over the past few years, regulators have increased scrutiny on crypto projects, questioning whether certain Layer 1 tokens are securities. Issues of sanctions and censorship have prompted efforts for censorship-resistant infrastructure, shaping future validator designs. Overall, regulation is a double-edged sword for Layer 1 tokens: it introduces uncertainties while pushing the industry towards maturity and compliance. By 2026, a fragmented global regulatory landscape persists, with tokens freely tradeable in some areas and restricted in others, making regulatory resilience a crucial consideration for investors and users.

Conclusion

The Layer 1 blockchain sector in 2026 is diverse, with each project showcasing unique philosophies, technologies, and communities. Bitcoin is known for simplicity and security, Ethereum shines with its smart contracts, and newer chains prioritize speed and modularity. This variety offers users and developers options but also fosters intense competition as these networks evolve and innovate.

It's crucial to acknowledge the risks involved in the crypto landscape. The projects recognized in 2026 are prominent but not guaranteed for future success, and engagement with them requires thorough research. As the pace of change is rapid, staying updated is paramount.

This article is solely for informational purposes and should not be considered investment advice. Crypto markets are volatile, and Layer 1 tokens can fluctuate significantly in price. Always invest what you can afford to lose and do your own research. By understanding the current landscape and the inherent risks, you can better navigate the evolving world of blockchain technologies. Stay safe and informed on your crypto journey!