Solana is a high-performance, open-source blockchain platform designed to address the scalability limits of older chains. Launched in March 2020, Solana aims to provide fast and ultra-low-cost transactions – so cheap (around $0.00025 per transaction) and so quick (blocks ~0.4 seconds) that analysts have dubbed it a potential “Visa of crypto”. It’s a Layer-1 network built to support smart contracts and decentralized applications (dApps) at massive scale.

Summary (Quick Facts)

-

Ticker Symbol: SOL

-

Chain: Solana mainnet (Layer-1 blockchain)

-

Contract Address: Native coin (no Ethereum contract)

-

Circulating Supply: ~520 million SOL (May 2025)

-

Max Supply: No fixed cap (decreasing inflation ~1.5% long-term)

-

Primary Use Case: High-speed Layer-1 for scalable dApps (DeFi, NFTs, gaming)

-

Current Market Cap: ~$90 billion (May 2025)

-

Availability on Phemex: Yes (SOL is listed for spot and futures trading on Phemex)

What Is Solana?

At its core, Solana tackles the blockchain trilemma (scalability, security, decentralization) by leveraging both software and hardware innovations. In contrast to Ethereum’s occasional congestion and high fees, Solana’s architecture prioritizes throughput, allowing it to process tens of thousands of transactions per second on-chain. Unlike many competitors that use sharding or layer-2 networks, Solana keeps a single global state while scaling throughput with Moore’s Law improvements in hardware. A novel component called Proof-of-History (PoH) functions as a cryptographic timestamp that orders events before consensus, effectively serving as a decentralized clock for the network. This, combined with a Proof-of-Stake (PoS) consensus mechanism, allows Solana to finalize transactions extremely quickly while maintaining security. The end result is a blockchain that can handle high traffic without choking – a critical feature for DeFi platforms, NFT marketplaces, Web3 games, and other applications that require speed and low fees.

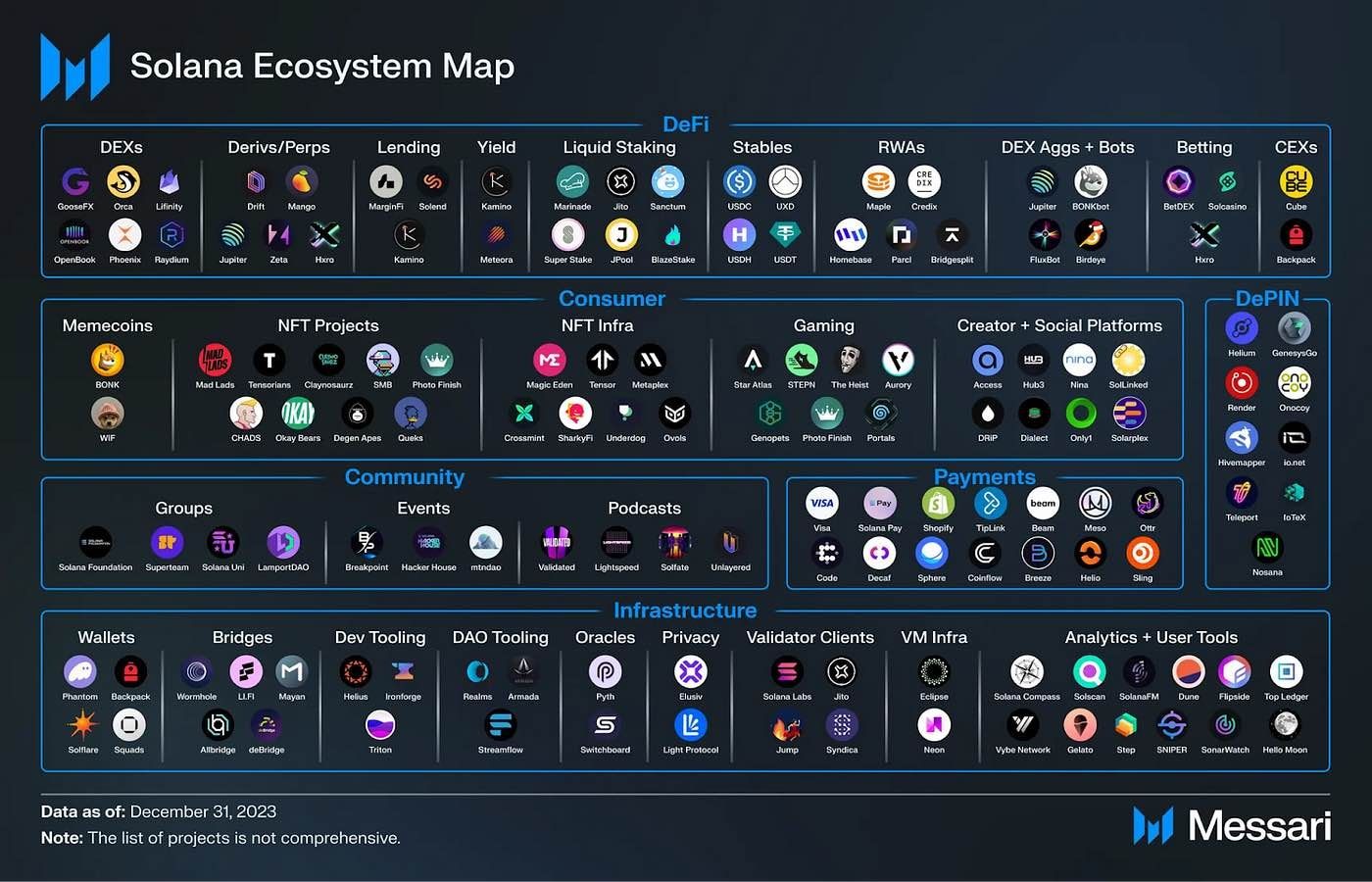

Solana has rapidly grown into one of the largest crypto ecosystems, often ranking among the top projects by market capitalization. It has become a hub for decentralized finance (DeFi) protocols, non-fungible tokens (NFTs), and other Web3 use cases due to its efficiency. In short, Solana is one of the fastest blockchains in operation, and its growth poses a serious challenge to more established networks like Ethereum in certain domains. On the flip side, Solana’s rapid rise hasn’t been without issues. The network’s unique design – which emphasizes performance – led to several high-profile outages under heavy load, sparking debates on decentralization and reliability. Nonetheless, the project has continued to iterate and improve, attracting a vibrant community of developers and users.

How Many SOL Are There?

Solana’s supply dynamics differ from Bitcoin’s hard-capped model. SOL does not have a fixed maximum supply – instead, it follows an inflationary monetary policy designed to reward network participants. At launch, Solana’s genesis block created 500 million SOL tokens. New tokens are continually issued via inflation, though on a reducing schedule, while a portion of fees are burned to offset inflation.

As of May 2025, the circulating supply of SOL is approximately 520 million tokens. Some additional SOL exists but remains locked or vested; the total supply (including locked coins) is around ~590 million. Importantly, Solana’s protocol does not enforce a hard cap on supply. Instead, it uses a disinflationary inflation model: the initial inflation rate was ~8% per year at launch, and this rate decreases by 15% each year until it reaches a long-term inflation rate of 1.5% annually. In practical terms, the current annual inflation is about ~4–5% and declining over time, eventually leveling out at 1.5% to sustain the network’s security rewards.

To counteract inflation and help stabilize the token supply, Solana employs a token-burning mechanism. 50% of each transaction fee on Solana is burned (destroyed), while the other 50% is retained by validators as a reward. This means that higher on-chain activity leads to more SOL being burned, creating a natural balancing force against the minting of new tokens. During periods of heavy usage, fee burns can significantly offset the inflation rate, moving the tokenomics closer to net neutral inflation. However, under normal network conditions in 2025, Solana remains modestly inflationary (i.e. the supply is still growing each year, though at a slowing pace).

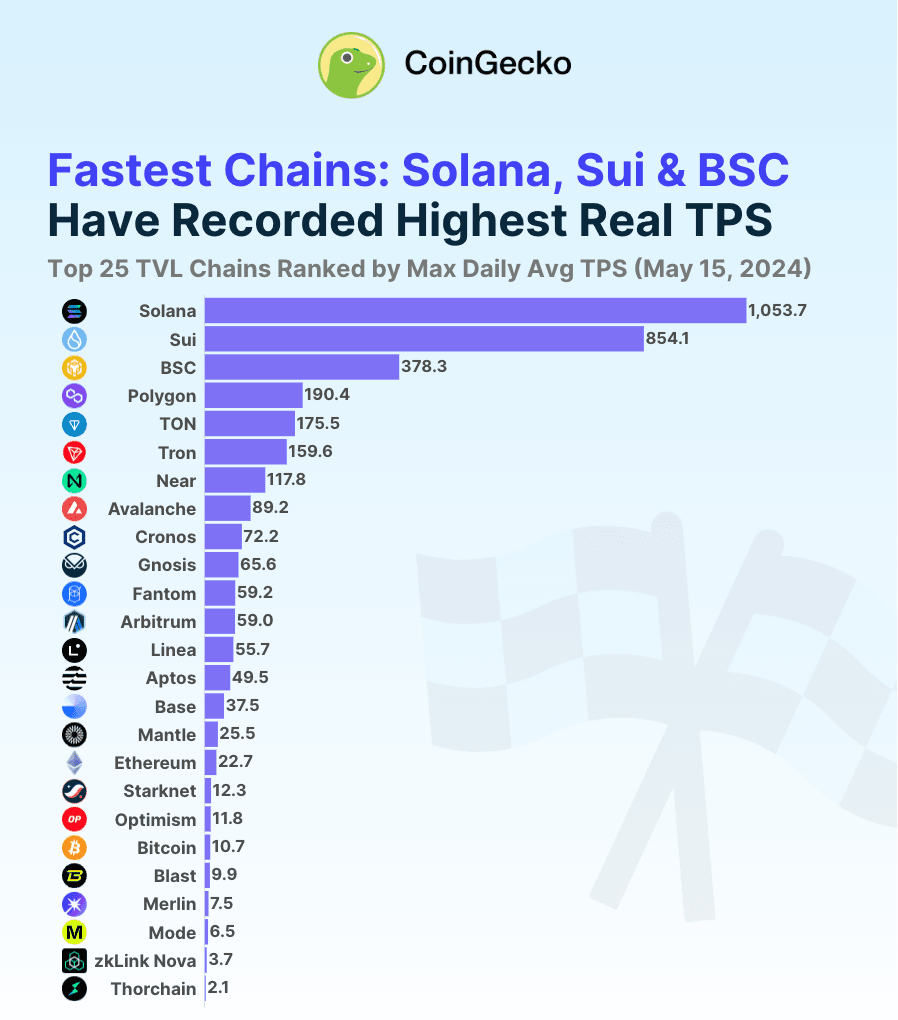

Source: CoinGecko

What Does SOL Do?

SOL is the utility token of the Solana ecosystem, and it has multiple important functions within the network:

-

Transaction Fees: Just like ETH on Ethereum, SOL is used to pay for transaction fees (gas) on the Solana network. Every time you perform an action – whether it’s transferring a token, minting an NFT, or executing a smart contract – a small fee denominated in SOL is required.

-

Staking and Network Security: SOL can be staked (locked up with a validator) to help secure the network and participate in consensus. Solana uses a Delegated Proof-of-Stake model, meaning SOL holders can either run validator nodes themselves or delegate their tokens to professional validators. In return, stakers earn rewards in SOL from the network’s inflation issuance. Staking is crucial for Solana’s security because the more SOL is staked, the more costly it would be for a malicious actor to attack the network.

-

Governance and Ecosystem Participation: While Solana’s on-chain governance is not as formalized as some networks, holding SOL still grants influence in the ecosystem. For instance, SOL stakeholders can voice opinions or vote on certain community proposals when those arise. More directly, many Solana-based DeFi projects use SOL as a governance or utility token within their protocols.

-

DeFi Usage: Solana’s speed and low fees have fostered a thriving DeFi environment. SOL plays a role similar to ETH in Ethereum’s DeFi – it’s often a base trading pair and widely used asset across Solana’s decentralized exchanges and lending protocols. For instance, you might provide SOL as collateral on Solana lending platforms like Solend to borrow stablecoins, or use SOL to swap for other tokens on DEXs like Orca and Raydium.

-

NFTs: Solana emerged as one of the top chains for NFTs and SOL is the currency powering that economy. When users mint or trade NFTs on Solana marketplaces (such as Magic Eden or Metaplex), they pay in SOL. Notable NFT collections (like Degenerate Ape Academy and others) have been launched on Solana, driving demand for SOL to purchase these collectibles. By early 2024, Solana had surpassed $5 billion in all-time NFT sales volume – a testament to its popularity in the NFT realm.

-

Payments: Outside of crypto-native dApps, SOL is finding use in payment scenarios. Solana Pay, a payment protocol, enables merchants to accept crypto (like USDC or SOL) with near-instant settlement. SOL can serve as a medium of exchange for remittances or peer-to-peer payments where speed is essential. High-profile integrations – such as Visa’s pilot of USDC stablecoin settlements on Solana – highlight the network’s capability in traditional payment flows.

In summary, SOL’s use cases span securing the blockchain (through staking), powering network transactions, and enabling the rich tapestry of apps on Solana – from decentralized finance to digital collectibles and beyond.

Solana vs Bitcoin (Differences and Comparison)

Solana vs Bitcoin is often a study in contrasts: one prioritizes speed and scalability, while the other prioritizes simplicity and security. Both are valuable in their own domains, but they have fundamental differences in technology and use case.

Bitcoin (BTC) was created primarily as a decentralized digital currency and store of value. Its design is relatively simple – a robust network for peer-to-peer payments and a hedge against inflation, with a fixed supply of 21 million BTC. Solana (SOL), on the other hand, is a smart contract platform more akin to Ethereum, aimed at hosting complex applications (DeFi, NFTs, etc.) and handling high throughput. In other words, Bitcoin is often called “digital gold,” whereas Solana is more like a high-speed computing network or “crypto cloud platform.”

-

Technology: Bitcoin uses Proof-of-Work (PoW) consensus, where thousands of miners around the world expend energy to secure the network and validate blocks. This makes Bitcoin extremely secure and decentralized, but also relatively slow and energy-intensive. Solana uses a combination of Proof-of-Stake (PoS) and Proof-of-History (PoH). PoH is not a consensus mechanism on its own but a cryptographic clock that orders events, which then feeds into the PoS consensus.

-

Speed and Fees: Because of the above, Solana is extremely fast and cheap compared to Bitcoin. An average Bitcoin transaction takes around 10 minutes to confirm (and during peak times, delays can be longer), with fees that can range from a couple of dollars to tens of dollars depending on congestion. Solana transactions confirm in seconds or fractions of a second, and the fee is typically $0.0001–$0.001 (less than a penny). This makes Solana far more practical for high-volume or small-value transactions.

-

Decentralization: Bitcoin is considered the gold standard for decentralization in terms of network participation – tens of thousands of nodes run the Bitcoin software globally, and no single entity controls the network. Its security is hardened by over a decade of continuous operation with virtually 100% uptime. Solana, while still decentralized, is more concentrated in its validator set. Running a Solana validator has high hardware requirements (powerful servers with fast internet), which limits the number of participants.

In summary, Solana vs Bitcoin is akin to comparing a high-speed train to a secure vault. Solana is faster, more scalable, and more versatile – it can run entire decentralized exchanges and NFT platforms on-chain, things Bitcoin is not designed to do. Bitcoin is slower but more battle-tested and purely focused on being money.

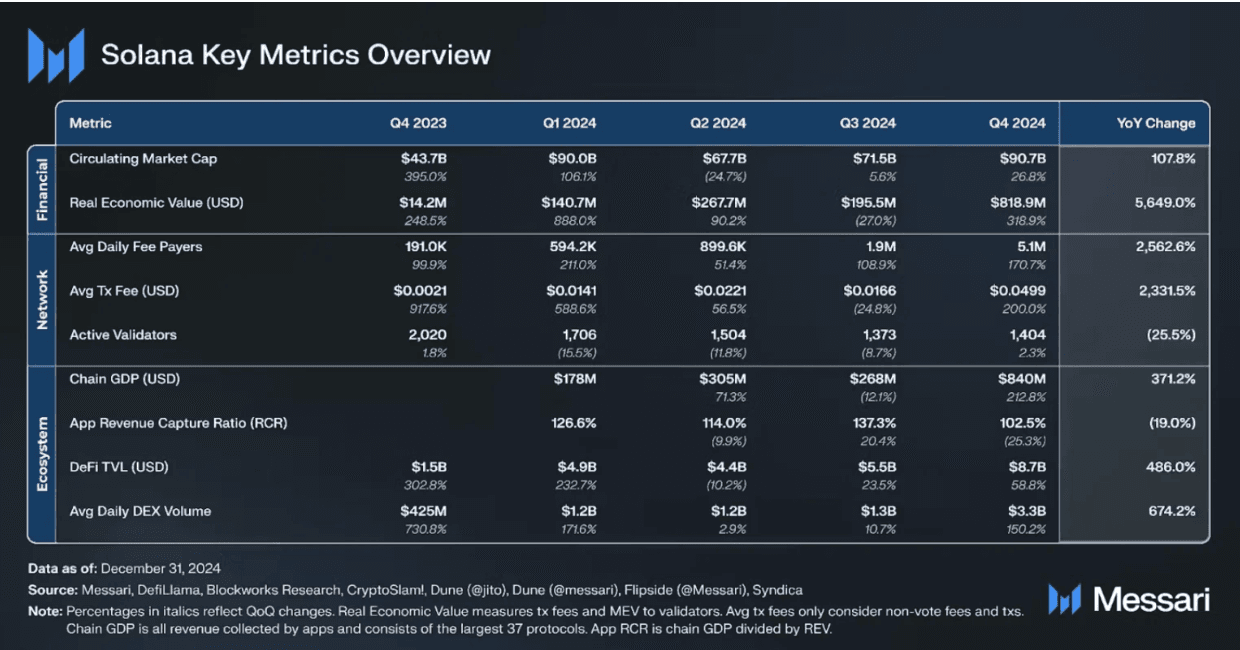

Source: Messari

The Technology Behind SOL

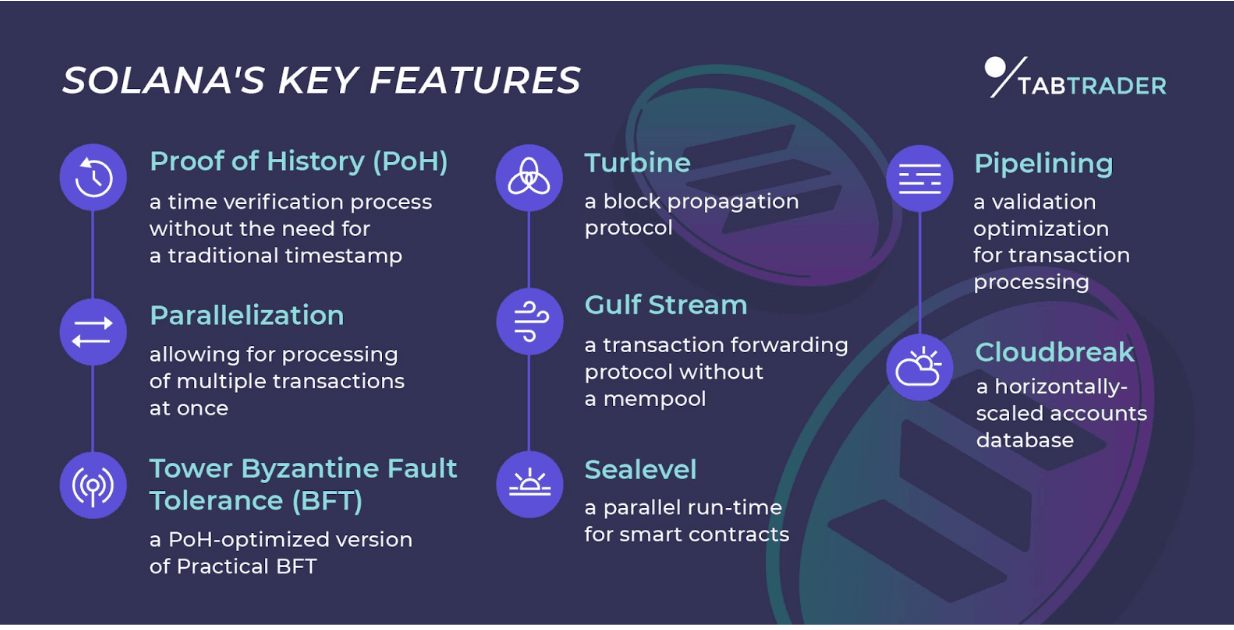

Solana’s technology stack sets it apart from many other blockchains. It was engineered from the ground up for speed and throughput, introducing several novel innovations:

-

Proof of History (PoH): The marquee innovation of Solana is Proof-of-History, a concept devised by founder Anatoly Yakovenko. PoH is essentially a cryptographic timestamping mechanism. It produces a verifiable sequence of hashes that proves time has elapsed between events, like a decentralized clock for the network. In practice, PoH allows validators to trust the order of incoming transactions without having to communicate intensely to agree on time – they already have this global clock running.

-

Tower BFT (Consensus): On top of PoH, Solana runs a customized Proof-of-Stake consensus called Tower BFT (Byzantine Fault Tolerance). Tower BFT is like a Solana-specific version of Practical BFT that leverages the PoH clock. Validators (those who stake SOL) vote on blocks, and because they share a PoH reference, they can lock in votes on a certain sequence of hashes. Tower BFT enables the network to quickly reach consensus with minimal communication, since the history is already agreed upon via PoH.

-

Parallel Processing (Sealevel): A major technical edge for Solana is its ability to process many smart contract operations in parallel. Solana’s runtime (the Solana Virtual Machine, running eBPF bytecode) is designed for parallel transaction processing, an approach called Sealevel. Unlike Ethereum’s single-threaded EVM (where transactions execute one by one), Solana transactions specify ahead of time which states (accounts) they will read or write. The runtime can thus execute non-overlapping transactions simultaneously across multiple CPU cores. This means, for instance, if one transaction is interacting with Wallet A and another with Wallet B, and they don’t touch the same data, they can be processed at the same time.

-

Ultra-Fast Network and Hardware Utilization: Solana’s architecture is built to take full advantage of modern hardware improvements. It uses techniques like pipelining (processing transaction stages in parallel like an assembly line), Turbine (a block propagation protocol that breaks data into small chunks to send efficiently to nodes), and Gulf Stream (mempool-less transaction forwarding, which pushes transactions to the expected leader in advance to reduce confirmation time). Essentially, Solana scales vertically with hardware – as commodity hardware gets faster, Solana’s capacity can increase (an approach inspired by database scaling and Moore’s Law). This is in contrast to other chains like Ethereum that try to scale horizontally (through sharding or layer-2 networks).

Source: TabTrader

Team & Origins

Solana’s story begins with its founder, Anatoly Yakovenko, a seasoned engineer with a background in telecommunications. In late 2017, Yakovenko published a whitepaper for a new concept called Proof of History. This laid the foundation for Solana.

Solana’s mainnet launch took place in March 2020 (as a beta), after two years of rigorous development and testing (including Tour de Sol, a public testnet competition). The launch was relatively quiet – at the time, Ethereum and other platforms dominated mindshare – but Solana’s promise of high throughput quickly gained attention.

Early on, Solana garnered significant interest from venture capital. In 2019, Solana Labs raised about $20 million in a Series A round led by Multicoin Capital, with investors including Foundation Capital and others. This was crucial seed funding that helped build out the team and technology. The big boost came in June 2021, when Solana Labs completed a $314 million private token sale (notably, $314.15M – the number pi) led by Andreessen Horowitz (a16z) and Polychain Capital. With these funds, Solana set up a foundation and grant program to turbocharge its ecosystem growth.

Solana’s growth in 2021–2022 was also driven by communities like the Solana Foundation (a non-profit supporting development and adoption) and Solana Labs (the core company contributing to the protocol).

Anatoly Yakovenko remains a key figurehead as Solana Labs CEO, often representing Solana in interviews and conferences. Raj Gokal serves as COO, focusing on strategy and community growth. The Solana Labs team grew to include talent from companies like Google, Apple, Intel, and Dropbox – fitting for a project that merges software and hardware expertise. The blend of traditional tech engineers and crypto natives gave Solana a unique culture: very focused on performance and user experience, sometimes at odds with the more cypherpunk/academic culture of other blockchain orgs.

Key News & Events in Solana’s History

Solana’s journey since launch has been marked by noteworthy milestones, both positive and challenging. Here are some of the key news and events that have defined Solana and the SOL token:

-

March 2020 – Mainnet Beta Launch: Solana’s mainnet went live in beta in March 2020, marking the official birth of the Solana network. Initially, Solana flew under the radar, but this launch introduced its high-performance blockchain to the world.

-

November 2021 – All-Time Price High: During the late 2021 crypto bull run, SOL’s price skyrocketed, reaching an all-time high around $260 in November 2021. Solana at this point was one of the best-performing assets of 2021, climbing from just a few dollars at the start of the year to the top 5 by market cap. This surge coincided with booming activity on Solana’s network (NFT mania, DeFi growth) and widespread investor enthusiasm for “Ethereum killers.”

-

June 2022 – Multiple Outages: In 2022, Solana experienced several shorter outages (ranging from a few hours to most of a day). Notably in May and June 2022, bot activity and bugs caused two significant halts. In one instance, a bug related to durable transaction nonce caused a block production halt in June 2022 that lasted about 4 hours before a fix was coordinated. In total, Solana had five outages in 2022, undermining confidence and earning Solana a reputation for instability. The team acknowledged these issues, with co-founder Yakovenko referring to outages as Solana’s “curse” resulting from its ultra-low fees attracting malicious spam.

-

November 2022 – FTX Collapse Impact: The collapse of the FTX exchange and Alameda Research in Nov 2022 had a pronounced effect on Solana. FTX’s founder Sam Bankman-Fried was a major backer of Solana (his companies held a lot of SOL and had invested in Solana projects). When FTX imploded, SOL’s price plunged over 50% in a matter of days, and more than 94% down from its peak by end of 2022. Projects like Serum, which were closely tied to FTX, were either discontinued or rebooted by the community.

-

April 2023 – Solana Mobile Saga Launch: Solana Labs launched the Saga smartphone in April 2023, an Android-based device tailored for crypto users. Saga came with the Solana Mobile Stack (SMS), a suite of tools including a mobile wallet adapter and seed vault for secure key custody. While a niche product, the Saga phone made headlines as a bold move into hardware by a blockchain project.

-

Late 2023 – Ecosystem Resurgence: By Q4 2023, Solana’s ecosystem was showing signs of strong recovery and growth. An uptick in NFT activity saw Solana NFT monthly volumes reach their highest levels since 2022 (with over $365M in NFT sales in one month of Dec 2023). A new wave of DeFi apps and even meme coins (like BONK) drove user engagement. Impressively, Solana’s developer community kept expanding – an Electric Capital report in early 2024 found Solana attracted more new developers than any other blockchain in 2023–2024.

-

Late 2024 – SOL Price Recovery: By the end of 2024, SOL not only recovered from its post-FTX slump but even hit a new all-time high of around $263 again. This was a remarkable comeback, demonstrating renewed market confidence. Factors contributing to this surge included the improving macro crypto environment and Solana-specific catalysts like the Visa/PayPal news and the community’s vigorous activity in areas like SocialFi and gaming.

Source: RR2 Capital

Is SOL a Good Investment? (Not Financial Advice)

Before we dive in, remember that assessing any cryptocurrency’s investment potential is speculative, and this isn’t financial advice. SOL, like all crypto, is a volatile asset, and you should do thorough research and consider your risk tolerance before investing.

With that said, let’s consider Solana’s investment case. SOL has some strong points in its favor:

-

Track Record and Performance: Solana has demonstrated the ability to deliver high performance at scale, and SOL has been among the best-performing crypto assets during bullish periods. Early investors saw astonishing returns – SOL famously went from around $1 in early 2021 to about $260 by November 2021. Even after crashing in 2022, Solana recovered and in 2024 reached new highs, showing resilience.

-

Ecosystem Growth and Community: One of Solana’s biggest positives is its thriving ecosystem. The network has attracted a large number of developers and projects. In fact, in 2024 Solana reportedly onboarded more new developers than Ethereum (7,625 new devs on Solana vs 6,456 on Ethereum, according to an industry report). A growing developer base usually correlates with more innovation and usage on the chain, which can drive value to SOL.

-

Competitive Positioning: Solana often draws comparisons to Ethereum and other layer-1s. It has carved out a niche as arguably the most performant Layer-1 that’s fully operational (while newer chains like Aptos or Sui also tout high TPS, Solana is ahead in adoption). Solana’s low fees and fast UX give it an edge in user onboarding – for example, an NFT mint on Solana is seamless compared to the sometimes frustrating experience on Ethereum L1. This has made Solana the go-to chain for many NFT projects and a top choice for new Web3 games.

-

Adoption and Real-World Integration: A key factor for any crypto’s value is actual adoption. Solana has been making tangible inroads: Visa and Mastercard have tapped Solana for pilot programs, Stripe and PayPal integrated Solana for payments, telecom projects like Helium use Solana for real-world services, and even regulators have taken note (if only to debate its status).

However, there are also risks and challenges to weigh:

-

Technical Risks: As we discussed, Solana’s history of network outages is a blemish. Any future prolonged outage or serious security incident could erode confidence and drive developers/users to other chains. Solana is often criticized for being relatively more centralized (in terms of who controls infrastructure and the need for coordination in crises) – if decentralization is compromised too much, it might face community backlash or even a hard fork by dissenting validators.

-

Regulatory and Market Risks: The SEC’s actions show that U.S. regulation is a looming factor. If SOL were ever explicitly deemed a security in the U.S., it could face exchange delistings and reduced access for a huge market of investors. On the other hand, if regulatory clarity emerges (for example, legislative distinctions that categorize SOL as a non-security utility token), that cloud could lift.

-

Economic and Token Risks: Solana’s tokenomics, while sound in design, mean SOL holders face ongoing inflation. Currently around 4-5% of new SOL is created annually and distributed to stakers. If network usage doesn’t keep up, this could exert sell pressure. It’s worth noting that a significant amount of SOL is staked (over 70% of supply often), which shows holders are locking it up for yield – a good sign of commitment, but also means unstaking events or unlocks can introduce volatility.

In conclusion, SOL can be a high-reward, high-risk investment. It has a top-tier technology stack, significant adoption, and momentum that suggest it could appreciate in value as the crypto space grows. Indeed, some analysts and funds have expressed very bullish targets for Solana. At the same time, one must be cognizant of the downsides: volatile price swings, technical hiccups, and regulatory uncertainties. As always, diversification and careful position sizing are prudent.

How to Trade SOL on Phemex: If you’ve decided to acquire or trade Solana’s SOL token, Phemex offers a user-friendly platform to do so. Phemex is a global cryptocurrency exchange where SOL is listed for trading. Here’s a quick guide:

-

Sign Up and Fund Your Account: First, register an account on Phemex (if you haven’t already) and complete any required verification. You can fund your account by depositing cryptocurrency or even by purchasing crypto with a credit card directly on Phemex. The platform supports buying SOL with a card, so you could buy USDT or USDC and then trade for SOL, or sometimes buy SOL straight with fiat via their partners.

-

Navigate to SOL Trading: On the Phemex trading interface, look for the SOL/USDT trading pair. Phemex offers SOL on its spot market – meaning you can trade actual tokens – and it may also offer futures contracts for SOL for advanced traders.

-

Place an Order: Decide how much SOL you want to buy (or sell). You can use a market order to buy instantly at the current market price, or set a limit order at a specific price if you have a target entry.

-

Secure Your SOL: Once your order executes, the SOL will appear in your Phemex account balance. Phemex allows you to hold SOL on the exchange or you can withdraw it to your personal Solana wallet for long-term storage. Phemex also has an Earn program where you might stake or lend out SOL to earn interest directly on the platform.

-

Utilize Trading Tools: Phemex provides various tools like charting, stop-loss orders, and take-profit orders which you can use to manage your trade. For instance, if you bought SOL and want to cap your downside, you can set a stop-loss order to automatically sell if price drops below a certain threshold.

In summary, trading SOL on Phemex is straightforward: register, fund, navigate to SOL market, and trade. Always double-check you’re trading the correct pair and consider using security features like two-factor authentication on your Phemex account. Happy trading, and may your Solana journey be as fast and smooth as the Solana network itself!