Scalability is one of Bitcoin‘s most significant and longest-standing problems concerning its growth and adoption as a fully-fledged alternative to traditional payment protocols.

As it stands, the Bitcoin network can only process up to 7 transactions per second, which is way below the required throughput for a network aspiring to become a truly global, mainstream value transfer system. For reference, Visa and MasterCard have the capacity to settle more than 5000 transactions per second.

To solve this issue and increase Bitcoin’s throughput capacity, Bitcoin’s passionate development community has proposed several scaling solutions that mainly fall within two broad categories: first layer or protocol-layer solutions and second layer or off-chain solutions.

What is the distinction between a first layer and a second layer scaling solution?

A first layer (a.k.a. an on-chain) scaling solution is a method that involves a fundamental change to the codebase of the actual cryptocurrency protocol. First layer or protocol-layer scaling solutions usually entail an increase in the blocks’ size, as in the case of the Bitcoin Cash hard fork. Another alternative is reducing the block time or the average time it takes the entire network to find a new block and add it to the blockchain.

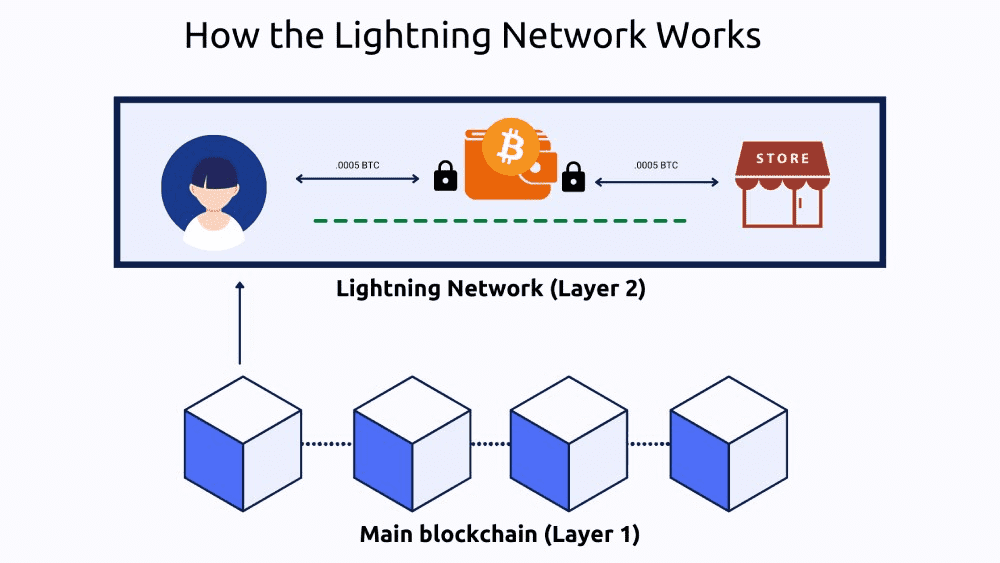

Second layer (or off-chain) solutions, on the other hand, are built on top of the main blockchain and interact with the blockchain without requiring changes to the actual codebase of the underlying protocol. These usually involve offloading certain transactions to secondary off-chain channels in order to reduce network congestion and speed up transaction processing times.

One of the most well known second layer scalability solutions for Bitcoin is the Lightning Network, first implemented on January 10th, 2018.

Why Does Bitcoin Need Lightning Network? The Scalability Challenge

Bitcoin prioritizes security and decentralization, leading to limited throughput with blocks of about 1–2 MB every 10 minutes. This results in congestion during peak usage, with average transaction fees soaring, especially during events like the 2021 NFT craze. Bitcoin can only handle around 7 transactions per second (TPS), which is insufficient for mass adoption.

On-chain scaling, such as increasing block size or reducing block time, risks centralization and technical issues, thus the Bitcoin community has opted for alternative solutions like SegWit and the Lightning Network. Proposed in 2015 by Joseph Poon and Thaddeus Dryja, the Lightning Network is a Layer-2 solution that allows for off-chain transactions, reducing the burden on the main blockchain.

By utilizing payment channels, Lightning enables frequent transactions to be settled off-chain, addressing scalability and transaction speed issues. This makes micropayments feasible, as it allows for very small transactions with negligible fees, fostering new use cases like content tipping and machine-to-machine payments.

In summary, Lightning complements Bitcoin by facilitating high-frequency, small-value transactions, while the base layer focuses on secure, larger transfers, making everyday use more practical.

How Lightning Network Works (source)

What is The Lightning Network?

The Lightning Network is a second layer off-chain payment protocol that operates on top of the BTC blockchain. It was developed by Joseph Poon and Thaddeus Dryja and published in the Lightning whitepaper back in 2015.

The idea behind the Lightning Network is to solve Bitcoin’s scalability issues by routing transactions away from the main chain. Instead, it uses user-generated bi-directional payment channels that allow the network participants to make almost instantaneous peer-to-peer cryptocurrency transactions.

The Lightning Network is separate from the Bitcoin network operating on top of it. By “on top of it,” we mean that users making payments using the Lightning Network can transact with other peers in the network without broadcasting or recording every single transaction on the main blockchain.

An important thing to remember here is that the Lightning Network does not have its own currency or its own blockchain. Instead, it’s merely a network for exchanging Bitcoin transactions cheaply, privately, and almost instantaneously. For reference, a typical transaction on the Bitcoin network takes at least 10 minutes to settle and can cost up to several dollars in transaction fees. In contrast, Bitcoin transactions routed through Lightning take milliseconds to settle and cost less than one satoshi or a fraction of a penny.

How Does The Lightning Network Work?

As we already mentioned, the Lightning Network enables Bitcoin users to create bidirectional, peer-to-peer, off-chain channels and conduct as many transactions as they’d like without broadcasting every one of those on the Bitcoin blockchain.

In order to set up a payment channel on the Lightning Network, two transacting parties need to create a joint multi-signature wallet, which is a special type of cryptocurrency wallet that requires more than one private key or signature to authorize a transaction. In certain respects, the multi-signature wallet is like a joint bank account where all signatories need to sign off on the transaction before it’s confirmed.

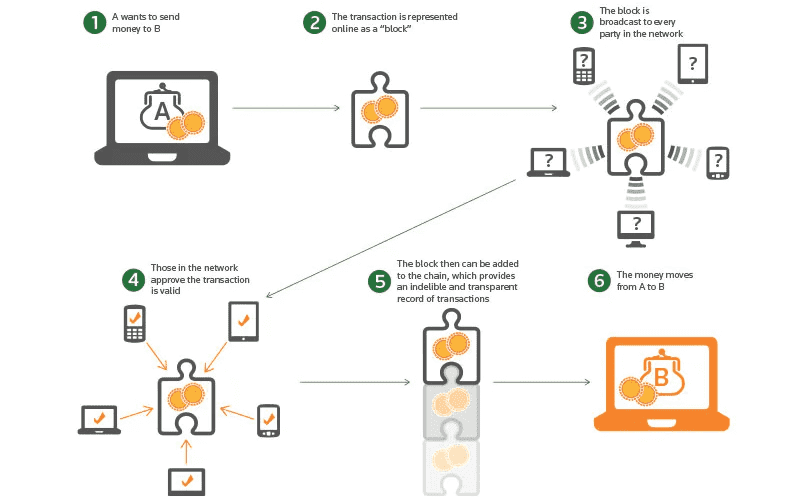

The payment channel or the multi-sig wallet is created with a so-called anchor or opening transaction. This is a regular on-chain transaction recorded on the Bitcoin blockchain. With the opening transaction, the parties deposit a certain amount of bitcoin in the multi-sig wallet. Later on, they can use these funds to make as many feeless and instantaneous transactions on the network.

The amounts deposited by both parties does not have to be equal. For example, if Alice and Bob want to open a Lightning payment channel, Alice could deposit one BTC to the multi-sig wallet, while Bob could deposit two. The Lightning Network then uses Bitcoin’s native smart contract protocol to keep track of what belongs to who, such that either party can only access up to as much as they deposited to the multi-sig wallet.

From this point forward, all transactions between the two parties within the payment channel are conducted off-chain. In fact, if we get down to it, the Lightning Network doesn’t actually send bitcoins back and forth between the parties but instead merely updates each party’s respective balances within the multi-sig wallet.

Since all transactions essentially occur off-chain or within the multi-sig wallet, there’s no need for mining to confirm the transactions, which saves significant time and costs.

When the parties decide they’re through transacting with each other, they, or either party individually, can close the Lightning payment channel by sending and signing a so-called closing transaction. Again, this is a regular on-chain transaction broadcast on the main Bitcoin ledger. The closing transaction allows the parties to broadcast the final sums of their entire off-chain activity in a single Bitcoin transaction, effectively lowering the number of on-chain transactions enabling Bitcoin to scale.

Routing payments

The Lightning Network’s key feature is that it allows routing payments across connected peers within the network. This is actually what makes the Lightning Network a network. Otherwise, this entire off-chain infrastructure wouldn’t be nearly as useful.

What does this mean? It means that every peer in the Lightning Network can transact with every other peer in the network as long as they’re connected through some other peer(s) in the network. For example, if Alice wants to send Jane some Bitcoin, she doesn’t have to open a direct Lightning payment channel with Jane; instead, she can route her transaction through the payment channel previously established between Bob and Jane. To do this, Bob will transfer the bitcoin to Jane, and, in turn, Alice will reimburse Bob the full amount through their own direct payment channel.

In this manner, peers within the Lightning Network can connect and transact at lightning speeds and pay nominal fees. When one peer sends some bitcoin to another peer in the network, the protocol automatically calculates and routes the transaction through the shortest possible path. If somewhere along the path the connection breaks, or some of the peers in the chain have insufficient funds to carry on the transaction, the transaction will simply get canceled without any recourse to either party.

This second layer network, made up of thousands of interconnected payment channels, allows for millions of instant transactions to take place without clogging or causing any trouble for the main Bitcoin network.

Lightning Network Flow (source)

Advantages of The Lightning Network

The Lightning Network enhances Bitcoin's practicality as a currency with several key benefits:

-

Fast Transactions: Lightning allows for near-instant payments, enabling immediate confirmations suitable for everyday purchases like food or taxi fares, eliminating the typical 10-minute wait for block confirmations.

-

Low Fees: Transaction fees on Lightning are extremely low, often just a few satoshis, making it feasible for micropayments and global remittances. For instance, sending $100 in BTC might cost only a few cents—far lower than on-chain fees.

-

Scalability (Throughput): Lightning can handle significantly more transactions than on-chain processes since it isn't limited by block size. Theoretically, it could manage millions of transactions per second, facilitating Bitcoin's growth without congesting the blockchain.

-

Privacy: Unlike on-chain transactions, which are publicly recorded, Lightning payments remain private. Only channel funding and closing appear on the blockchain, and routing through multiple nodes obscures transaction origins and destinations.

-

Interoperability and Global Access: Lightning is an open protocol allowing anyone to use it without permission. Multiple implementations exist, which fosters a diverse ecosystem of wallets and services. It enables instantaneous transactions worldwide, benefiting users in regions with high remittance costs or unstable currencies.

-

Enables New Use Cases: Lightning supports micropayments, allowing for streaming money, tipping on social media, and small e-commerce transactions. This creates a circular economy in places like El Salvador where Bitcoin is used for everyday purchases, making transactions as quick as card payments.

Limitations and Challenges of Lightning Network

While Lightning is a powerful solution, it has several challenges, particularly in the early stages of adoption:

-

Liquidity Management: Large payments require sufficient channel liquidity. For instance, to receive 1 BTC, a user must have that amount allocated in inbound capacity. Balancing channels can be complex, requiring users to open multiple channels or use services for incoming capacity.

-

Online Requirement: Effective use of Lightning often necessitates that either the user or a service is online to send and receive payments. This poses challenges, especially for casual users who may not always have internet access.

-

Channel Capacity & Economic Locks: Funds in a channel are locked for its entire lifetime, meaning they’re unavailable on-chain until the channel closes. Opening channels incurs on-chain fees, which can be high during spikes, deterring new users.

-

Routing Issues: Payments can sometimes fail due to a lack of routing availability, particularly for larger amounts. Although multi-path payments are improving this, failures can result in delays, impacting user experience.

-

Custodial vs Non-Custodial Balance: Many users prefer custodial wallets for convenience, but this introduces trust issues. Non-custodial options provide more security but come with technical challenges.

-

Security Concerns: The security of Lightning heavily relies on Bitcoin’s underlying infrastructure, making it essential to remain aware of potential vulnerabilities.

Overall, while Lightning offers significant advantages, these challenges need to be addressed for broader adoption.

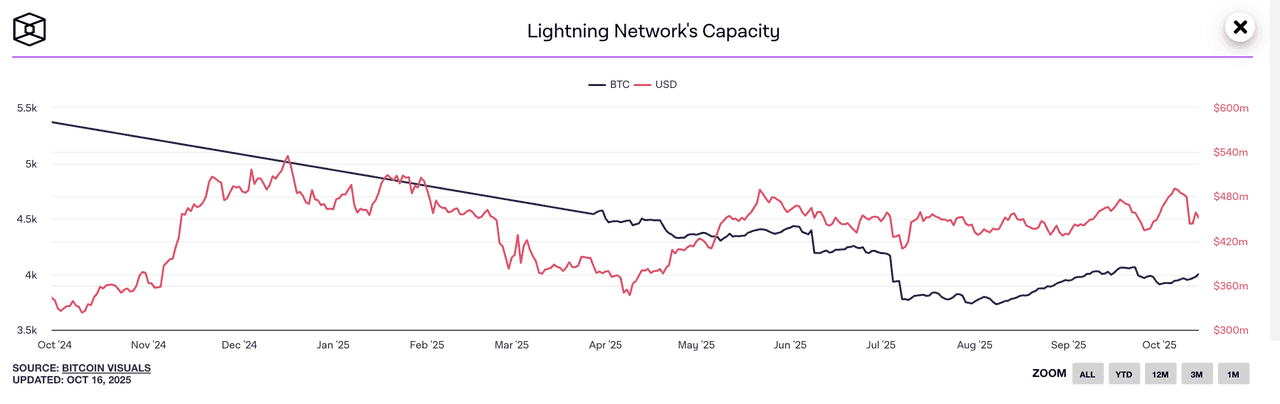

Lightning Network Capacity (source)

Lightning Network in 2025: Current State and Developments

By October 2025, the Lightning Network has grown significantly, evolving from a niche experiment to a vital component of Bitcoin’s infrastructure. Here are the key developments:

Network Growth: Since 2021, the Lightning Network's capacity has increased, reaching over 5,000 BTC in late 2023, though it declined to around 4,200 BTC by mid-2025. Despite a 20% drop, analysts suggest this may be due to structural optimizations, as routed payments soared by over 1200% from August 2021 to August 2023, indicating more efficient use of existing capacity.

Node and Channel Count: The number of nodes grew from ~16,000 in 2021 to over 20,000 by 2023, but public channel counts have shown a slow decline since 2022. This consolidation indicates efficiency, with fewer but larger, better-managed channels.

-

Taproot and PTLCs: The transition to PTLCs post-Taproot upgrade enhances flexibility and obscures routing information.

-

Dual Funding and Channel Splicing: Dual funding allows both parties to contribute to channels immediately, and channel splicing helps manage liquidity without closing channels.

-

Watchtowers and Security: Improved security features with built-in watchtower services protect users against cheating risks.

-

AMP and Multi-Path Routing: Modern wallets are utilizing multi-path techniques to increase payment success rates, and trampoline routing is being tested to assist smaller nodes.

Adoption Metrics: Payment volume on the Lightning Network has been rapidly increasing, with remarkable adoption stories emerging globally, especially in Africa.

To sum up, as of 2025 the Lightning Network is considerably more robust, widely integrated, and user-friendly than it was just a few years prior. It’s handling real economic activity: from expats remitting money, to consumers buying meals, to traders moving funds between exchanges, to content creators getting tipped online. Challenges remain (like ensuring decentralization and liquidity distribution as it scales), but ongoing improvements aim to address these. The narrative around Lightning has shifted – it’s no longer “if Lightning works” but rather “Lightning is working, how far can we scale it and what new things can we do with it.”

In the big picture, Lightning is fulfilling the promise of making Bitcoin usable as a fast global payments network, complementing Bitcoin’s role as sound money. The coming years will likely see Lightning continue to grow, especially as more wallets abstract technical details and perhaps with the rise of stablecoin usage on it bringing in new users who just want cheap, instant USD transfers – all secured by Bitcoin underneath.