For years, the crypto industry has been on a quest for its "killer app"—the innovation that would bridge the gap between the esoteric world of decentralized finance and the tangible value of the global economy. After cycles of hype and speculation, the answer is finally emerging, and it's not a fleeting meme. It's the most significant narrative since the dawn of DeFi: Real-World Assets (RWA).

This isn't just a future promise; it is a $66.4 billion reality. That's the current market capitalization of the RWA sector today, a figure that is growing with the force and inevitability of a tectonic shift. We are witnessing the construction of a trillion-dollar bridge between the vast, established value of traditional assets and the unprecedented efficiency, transparency, and accessibility of the blockchain.

This guide is designed to be your definitive resource for this new era. We will go beyond the surface-level definitions to provide a comprehensive A-to-Z framework for understanding the RWA ecosystem. We will dissect the $66.4 billion market, analyzing the top coins that compose it. Most importantly, we will provide a step-by-step guide on how you can invest in this revolution directly on Phemex, showcasing how our innovative products like xStocks are putting you at the forefront of this financial paradigm shift.

What Are Real-World Assets (RWA) in Crypto?

In the simplest terms, a Real-World Asset (RWA) in crypto is a digital token that represents a legally recognized ownership claim on a tangible, off-chain asset.

Think of it like this: the deed to a house is a piece of paper that legally represents your ownership. An RWA takes this concept into the 21st century. It transforms the deed—or a stock certificate, or a bond—into a secure, programmable token on a blockchain. This token can then be traded, fractionalized, and used as collateral with the speed and global reach of Bitcoin or Ethereum.

The process of bringing a real-world asset on-chain, known as tokenization, typically involves three key stages:

-

Off-Chain Formalization: The asset's value and legal ownership are established and verified in the real world. This involves legal structuring, often through a Special Purpose Vehicle (SPV), to ensure the asset is securely held and that the token has a valid legal claim.

-

Information Bridging: Data about the asset's value and performance must be reliably transmitted to the blockchain. This is where oracles—secure data feeds provided by essential infrastructure like Chainlink—come into play, acting as the trusted link between the off-chain and on-chain worlds.

-

On-Chain Representation: A smart contract is deployed to create and issue the tokens that represent the asset. These smart contracts govern how the tokens are managed, traded, and how any associated yield (like dividends or rental income) is distributed to token holders.

Why RWA is Crypto's Trillion-Dollar Bridge to the Real World

The excitement that has propelled the RWA market to a $66.4 billion valuation isn't just about new technology; it's about solving fundamental problems and unlocking unprecedented value.

-

For Investors: Unlocking New Yield and Diversification: For the first time, crypto-native investors can access stable, high-quality yields from sources uncorrelated to crypto market volatility. Tokenized U.S. Treasury bills, for example, bring the global "risk-free" rate directly into DeFi, providing a safe haven and a sustainable source of yield.

-

For Asset Owners: Gaining Liquidity on Illiquid Assets: The global real estate market is worth hundreds of trillions of dollars, yet it is notoriously illiquid. Tokenization allows a commercial property owner to sell fractional shares of their building to a global pool of investors, unlocking capital without having to sell the entire asset.

-

For DeFi: Creating a Sustainable, Real-Yield Foundation: The "yield farming" boom of 2020 was largely driven by inflationary token rewards. RWA provides DeFi protocols with a source of real, sustainable yield derived from off-chain economic activity, like business loans or mortgage payments. This creates a more mature and resilient foundation for the future of decentralized finance.

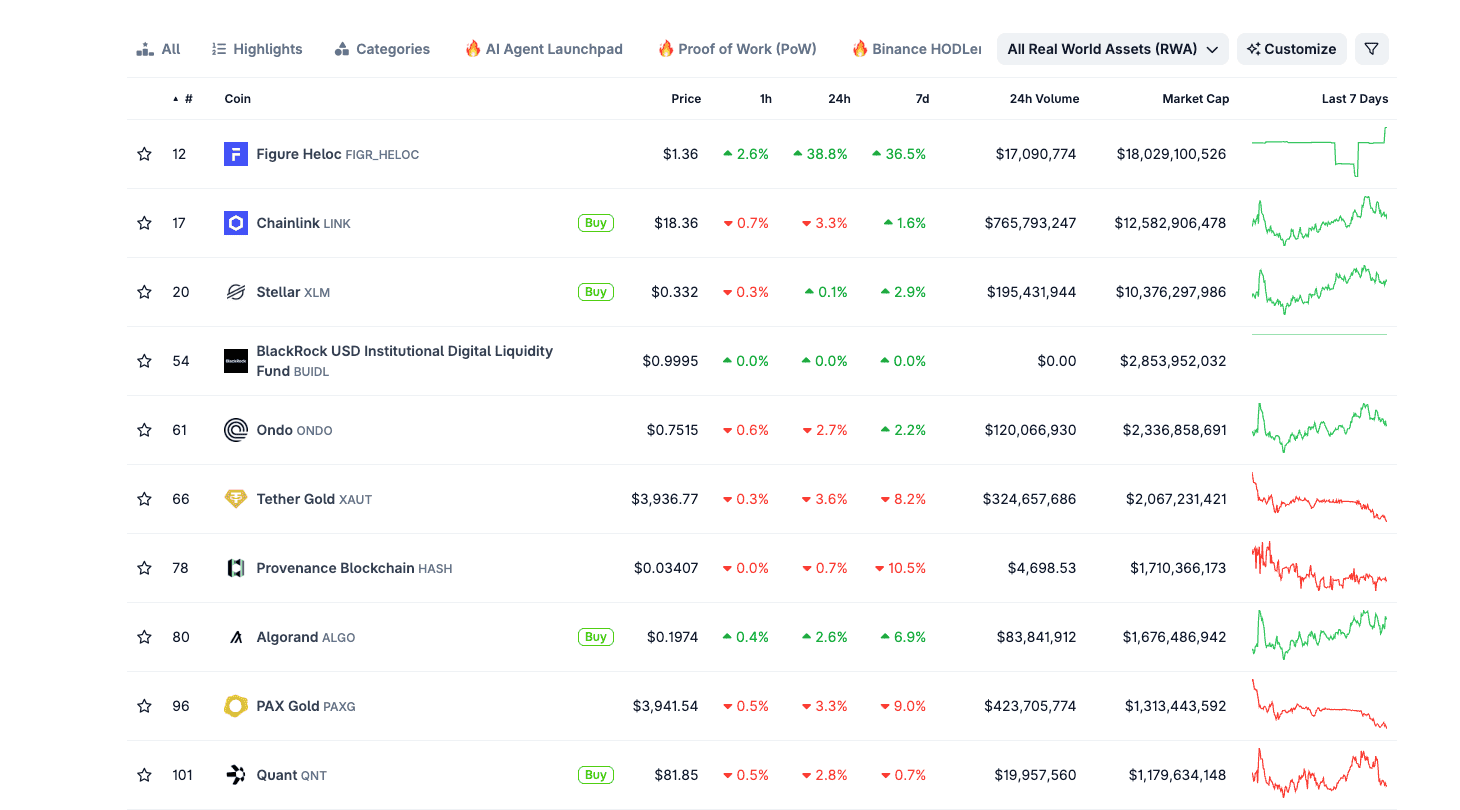

Dissecting the $66.4 Billion RWA Market: A Look at the Top Coins

To truly understand the RWA landscape, one must look at how the market itself is composed. The list of top RWA coins reveals a sophisticated, multi-layered ecosystem. It's not just one type of asset; it's a stack of interconnected technologies. We can break it down into three primary categories:

Top Real World Assets (RWA) Coins by Market Cap, Source: CoinGecko

Category 1: Asset-Backed Tokens (The Assets Themselves)

These are the most direct form of RWA. The value of these tokens is directly collateralized by a real-world commodity or financial instrument. They are the digital representations of the value they hold.

-

BlackRock USD Institutional Digital Liquidity Fund (BUIDL): With a market cap of $2.85 billion, BUIDL represents the pinnacle of institutional adoption. Managed by the world's largest asset manager, this token is a share in a fund that invests in U.S. Treasury bills. Its existence is one of the most powerful endorsements of the RWA thesis.

-

Tether Gold (XAUT) & PAX Gold (PAXG): With a combined market cap of over $3.4 billion, these tokens are a prime example of commodity tokenization. Each token is a digital claim on one troy ounce of physical gold held in a secure vault. They provide the stability of gold with the transportability of crypto.

Category 2: RWA-Specific Protocols (The Tokenization Engines)

These are the "picks and shovels" of the RWA gold rush. They are specialized protocols and blockchains building the tools and platforms to make tokenization possible at scale.

-

Ondo Finance (ONDO): As the top-trending RWA coin with a $2.33 billion market cap, Ondo has masterfully carved out its niche in tokenizing U.S. government debt and other institutional-grade financial products, making them accessible to the DeFi world.

-

Figure Heloc (HELOC): A powerful new entrant that has seen explosive growth. Figure is a technology company that uses its own blockchain, Provenance, to originate and service real-world financial assets like mortgages and home equity lines of credit (HELOCs). Its token represents a stake in this vertically integrated ecosystem.

-

Provenance Blockchain (HASH): With a market cap of $1.71 billion, Provenance is a purpose-built, public blockchain designed specifically for the financial services industry. It was created from the ground up to handle the compliance and regulatory needs of tokenized assets, making it a key player for institutional adoption.

Category 3: Foundational Infrastructure (The Rails)

This category includes established blockchains and essential services that, while not exclusively RWA-focused, are considered critical infrastructure for the RWA ecosystem to function and scale.

-

Chainlink (LINK): With a massive $12.5 billion market cap, Chainlink is the indispensable oracle network of crypto. For RWAs, it is absolutely essential. Chainlink's services are required to reliably bring off-chain data—like interest rates, asset prices, or credit scores—onto the blockchain to be used in smart contracts.

-

Stellar (XLM): One of the original pioneers of asset tokenization, Stellar's network, with a market cap of $10.3 billion, was designed from day one for the efficient issuance and exchange of digital assets representing real-world value, from currencies to securities.

-

Algorand (ALGO): Known for its institutional-grade performance, security, and scalability, Algorand's blockchain is a natural fit for the high-stakes world of RWA. Its architecture is well-suited to handle the complex transactions and compliance requirements of regulated financial assets.

How to Invest in RWAs on Phemex: A Step-by-Step Guide

The RWA market is vast and complex, but at Phemex, we believe in providing a curated and powerful investment experience. Our platform is uniquely designed to give you access to the two key pillars of the RWA revolution.

Pillar 1: Investing in RWA Infrastructure (The Protocol Tokens)

This is the strategy of investing in the "picks and shovels" we just discussed. By buying tokens like ONDO, you are investing in the growth of the entire RWA ecosystem. As more assets are tokenized on these platforms, the demand for their native tokens for governance, security, and transaction fees is expected to grow.

How to Invest in RWA Tokens on Phemex:

-

Log in to your Phemex account and navigate to the "Spot" trading section.

-

Search for the RWA token you're interested in, for example, "ONDO/USDT".

-

Analyze the chart and place your order just as you would for any other cryptocurrency.

Pillar 2: Investing Directly in Tokenized Assets (Phemex xStocks)

This is where the revolution becomes real for every investor. Phemex is proud to feature xStocks, an innovative on-chain trading product available on our platform. This integration gives you direct access to invest in tokenized representations of the world's most sought-after stocks and ETFs.

As you can see from the Phemex Onchain Trade interface, you now have access to a full suite of top-tier global assets, including:

-

TSLAx (Tesla)

-

AAPLx (Apple)

-

GOOGLx (Google)

-

NVDAx (Nvidia)

-

SPYx (S&P 500 ETF)

-

QQQx (Nasdaq 100 ETF)

-

GLDx (Gold ETF)

-

MSTRx (MicroStrategy)

This is more than just trading; it's a fundamental upgrade to the investing experience:

-

24/7 Market Access: The traditional stock market sleeps. xStocks trade 24/7/365, allowing you to react to news and manage your portfolio whenever you want, without being constrained by Wall Street's opening bell.

-

Fractional Ownership: Want to invest in Tesla but don't want to buy a full share? xStocks allow you to buy fractions of a share, making even the most expensive stocks accessible to everyone.

-

Global Accessibility: For many investors around the world, accessing the US stock market is a complex and expensive process. xStocks, powered by the efficiency of blockchains like Solana, break down these barriers, offering permissionless access to global markets.

The Role of Phemex in the RWA Era: More Than Just an Exchange

We are not passive observers of the RWA revolution; we are active builders and facilitators. Our strategy is to be your premier gateway to this new financial frontier through a three-pronged approach:

-

A Curated Marketplace: The RWA space is complex. We don't list every RWA token. Our team conducts rigorous due diligence to bring you access to the highest-quality, most promising infrastructure projects in the space, ensuring you are investing in the future leaders of the RWA ecosystem.

-

Innovative Product Access: We go beyond just listing standard tokens. By integrating leading products like xStocks, we provide you with a direct gateway to gain exposure to tokenized real-world assets. Our commitment is to bring the most innovative and valuable RWA opportunities directly to your fingertips.

-

An Authoritative Education Hub: The world of RWA is complex. Through our Academy and Blog, we are committed to providing you with the highest quality analysis and educational content—like this very guide—to help you navigate this new landscape with confidence. We believe an educated investor is a successful investor.

Conclusion: Your Portfolio for the Future

The migration of the world's assets onto the blockchain is not a matter of "if," but "when." The $66.4 billion market is just the first drop in an ocean of trillions. This shift is already underway, and it represents one of the single greatest investment opportunities of our generation.

Real-World Assets are the powerful engine that will drive the next wave of crypto adoption, bringing stability, real yield, and unparalleled diversification to the digital asset space. From the foundational protocols building the rails of this new economy to direct on-chain access to the world's most valuable companies, the opportunities are vast and exciting.

The era of purely speculative digital assets is evolving into a new age where blockchain technology enhances and democratizes access to real, tangible value. The future of finance is being built today, and it is a future where your portfolio can seamlessly blend the best of the old world with the innovation of the new.