Summary Box (Fast Facts)

-

Ticker Symbol: LIGHT

-

Current Price (Nov 17, 2025): $1.82

-

Contract Address: 0x477c2c0459004e3354ba427fa285d7c053203c0e

-

Market Cap: $78.2 million

-

Circulating/Max Supply: 43,056,972 / 420,000,000 LIGHT

-

ATH / ATL Price: $2.72 (Oct 21, 2025) / $0.5265 (Sep 27, 2025)

-

All-Time ROI: +50% (since initial launch in Sep 2025)

-

Availability on Phemex: Yes (Spot & Futures trading available)

What Is Bitlight?

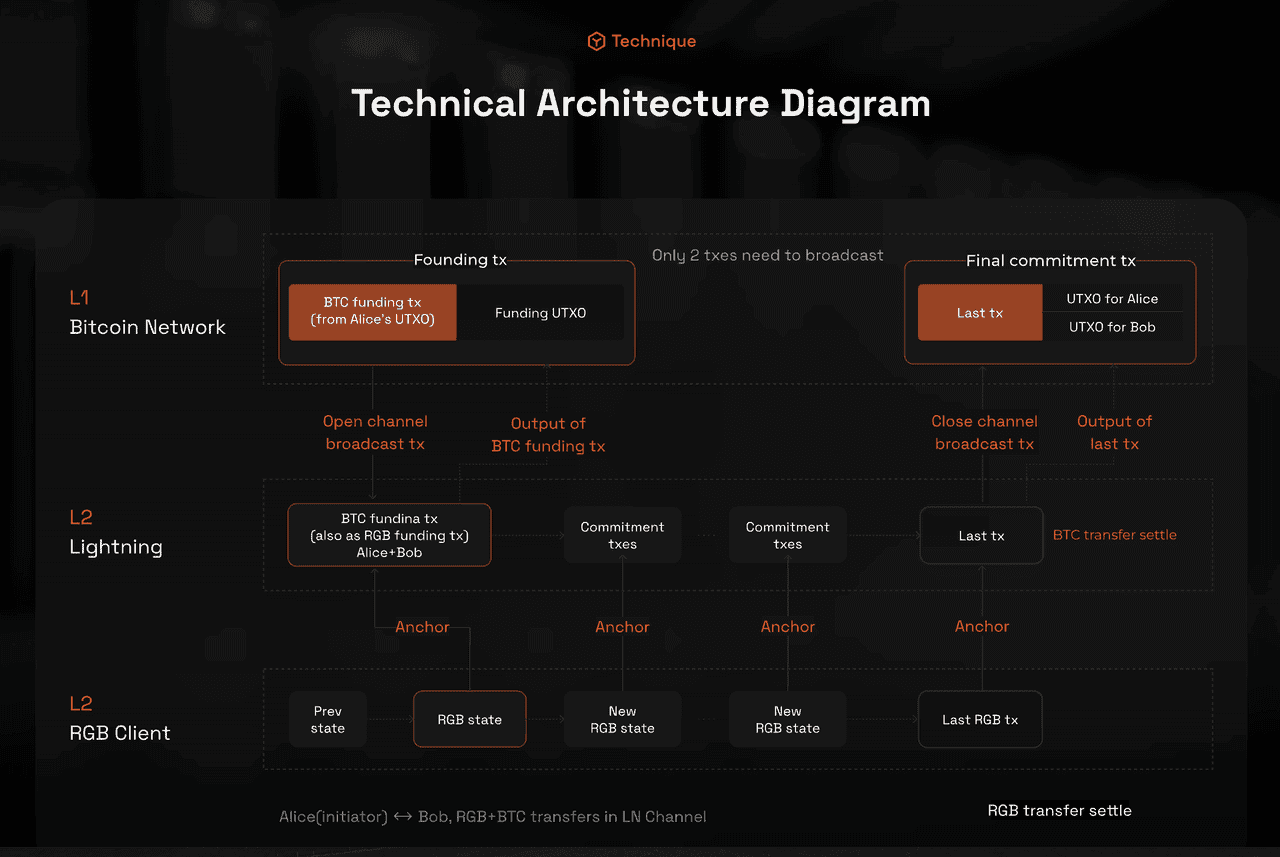

Bitlight is a Bitcoin Layer-2 infrastructure project designed to bring smart contracts and high-speed transactions to the Bitcoin network. As a major contributor to the RGB protocol (a smart contract framework on Bitcoin), Bitlight enables native Bitcoin smart contracts and stablecoin payments via the Lightning Network. In simpler terms, Bitlight aims to transform Bitcoin from a simple store of value into a versatile platform for decentralized finance (DeFi) and tokenized assets, while preserving Bitcoin’s security and decentralization.

By leveraging Taproot-enabled RGB contracts on Bitcoin’s base layer and Lightning Network channels for speed, Bitlight can facilitate near-instant, low-cost transactions without congesting the Bitcoin blockchain. The Bitlight Labs team is focused on building core protocol code, developer tooling, and user applications to deliver scalable, non-custodial asset transfers on Bitcoin’s network. In essence, Bitlight’s LIGHT token powers a Bitcoin “smart chain” ecosystem – a category that merges Bitcoin’s security (Layer 1) with Layer-2 efficiency for payments and contracts. This solves the problem of Bitcoin’s limited functionality by enabling things like token issuance (e.g. stablecoins) and smart contracts directly on Bitcoin, unlocking new ecosystem value while using the Lightning Network to maintain speed and low fees. What is Bitlight? It’s Bitcoin’s answer to Ethereum’s programmability – a project turning Bitcoin into a multi-functional platform without sacrificing its core strengths.

Current Price & Market Data

Bitlight (LIGHT) is currently priced at around $1.82, with a market cap of approximately $78 million. The token has surged over 50% in the past 24 hours, with daily trading volume exceeding $80 million, indicating strong liquidity and interest. Over the past week, LIGHT is up about 12.6% and 46% in the last 30 days, showing a solid recovery from October lows. It ranks around #340 by market cap.

Recently, LIGHT has been volatile, trading between $1.17 and $2.35 in the last 24 hours. The current price is about 33% below its all-time high of $2.72 and 247% above its all-time low of $0.53. With a circulating supply of 43.06 million tokens (10.3% of the max supply), the limited float contributes to its price volatility.

Despite the overall cautious sentiment in the crypto market, with Bitcoin trading around $90k in November 2025, LIGHT's rally suggests specific positive catalysts. Traders should be aware of the wide price swings and monitor liquidity, as the high trading volume can change rapidly. Overall, LIGHT remains below its peak but has significantly increased from its launch price, highlighting its volatility.

LIGHT/USDT Chart on Phemex (source)

Price History & Performance Overview

Bitlight, launched in September 2025 with its LIGHT token at around $1.20, experienced a tumultuous price history. Following its debut across numerous exchanges and a community airdrop, the token briefly dropped to an all-time low of ~$0.53 due to selling pressure from airdrop recipients. However, it quickly recovered in early October, fueled by excitement over Bitlight’s technology.

The pivotal moment came on October 21, 2025, when Bitlight Labs released a whitepaper detailing its Layer-1/Layer-2 integration for Bitcoin, propelling LIGHT to an all-time high of about $2.72—equating to a roughly 400% gain from its earlier lows. However, the price couldn't hold, falling back to around $0.80–$1.00 amid broader market fluctuations and profit-taking by investors.

By mid-November, LIGHT saw renewed interest and climbed back above $1.50, even reaching the $1.80s. The year-to-date ROI stands at about +50%, demonstrating significant volatility with daily moves of 10-20% and occasional intraday swings exceeding 50%. Key events that influenced the price include the Phase I airdrop, various exchange listings, and the whitepaper launch.

In summary, Bitlight's price history reflects early dips followed by a surge on positive developments and subsequent corrections. With its youth, the token has shown its potential for volatility, and investors should be ready for significant price movements ahead. Strong support is noted around $0.50, with $2.70 as the next resistance to watch.

Whale Activity & Smart Money Flows

Tracking whale behavior in LIGHT is challenging due to its newness and the majority of the supply being locked up. Notably, around 90% of the 420M supply (approximately 378 million tokens) is held by the project team, foundation, or allocated for future release. Over 50% is set for ecosystem incentives and airdrops, meaning a significant portion is controlled by entities like the Bitlight treasury, which may lead to potential supply overhang if these tokens are moved.

The top wallets likely include team members and early investors from a $9.6M Pre-A funding round led by Amber Group, with some investors holding several million tokens. While the initial airdrop decentralized the holder base to some extent, many tokens moved to exchanges, influencing price fluctuations.

Notable crypto VCs have backed Bitlight, indicating long-term support rather than quick profits, with no signs of them offloading their tokens yet. Key metrics to watch include the concentration of large holders and exchange reserves, as movements by whales could significantly impact market sentiment.

In summary, LIGHT’s dynamics are shaped by its locked supply and early backers, with the risk of future whale activity once more tokens enter the market.

On-Chain & Technical Analysis

From a technical analysis standpoint, Bitlight (LIGHT) has shown distinct trading patterns over its short ~2-month history.

Support & Resistance Levels: Several price zones have established themselves:

-

$2.50–$2.70 – Major resistance region, with selling pressure near this all-time high. A break above $2.70 with volume could signal a bullish trend.

-

$1.20 – $1.30 – Key support zone, having served as both resistance and support historically. As long as LIGHT stays above this range, bulls maintain control.

-

$0.80 – $1.00 – Represents support from the late October consolidation. Falling below $1.00 could indicate further declines.

-

$0.50 – $0.60 – The all-time low and potential last support level, unlikely to be revisited unless major negative events occur.

Moving Averages: The recent rebound seems to have pushed LIGHT back above its 21-day SMA (around $1.30) and possibly above its 50-day SMA (around $1.5), suggesting an uptrend and dynamic support.

Momentum Indicators: The recent surge pushed momentum high:

-

Relative Strength Index (RSI): Likely moved from oversold to overbought, indicating possible consolidation ahead.

-

MACD: Recently flipped to a bullish crossover, confirming upward momentum. Traders should watch for potential bearish crossovers.

Volume & On-chain Signals: Recent rallies saw a massive volume increase (24h volume ~ $118M), confirming trader interest. Whale activity indicates new buying rather than sell-offs, which supports the recent price action.

Fibonacci Levels: Using retracements from the high of $2.72 to the low of $0.53, the 38.2% retracement is around $1.88, and current price near $1.83 indicates a ~40% pullback from the ATH. Holding above the 38.2% level (~$1.80) suggests strength. If the price drops, the next Fibonacci levels are 50% (~$1.62) and 61.8% (~$1.36). During the recent decline, LIGHT fell below 61.8% to ~$0.80 but has since recovered. Key resistance levels include $1.88 (38.2%), ~$2 (near the 30% retracement), and $2.72 (0% retrace).

Technical Outlook: Currently, LIGHT shows short-term bullish momentum with higher highs and lows in November, but remains in a volatile range. Continuation above $1.20 could lead to an uptrend, though RSI signals a potential pullback. Key levels are $1.20 support and $2.30-$2.70 resistance. A break past ATH could signal further upward movement, while losing $1.00 could turn the bias bearish. Combining on-chain insights with chart signals is essential for accurate predictions, as the project is still young and evolving.

Bitlight Technical Architecture (source)

Fundamental Drivers of Growth

What could drive Bitlight (LIGHT) to significantly increase in value? Let’s examine the key fundamentals and catalysts for its long-term growth:

-

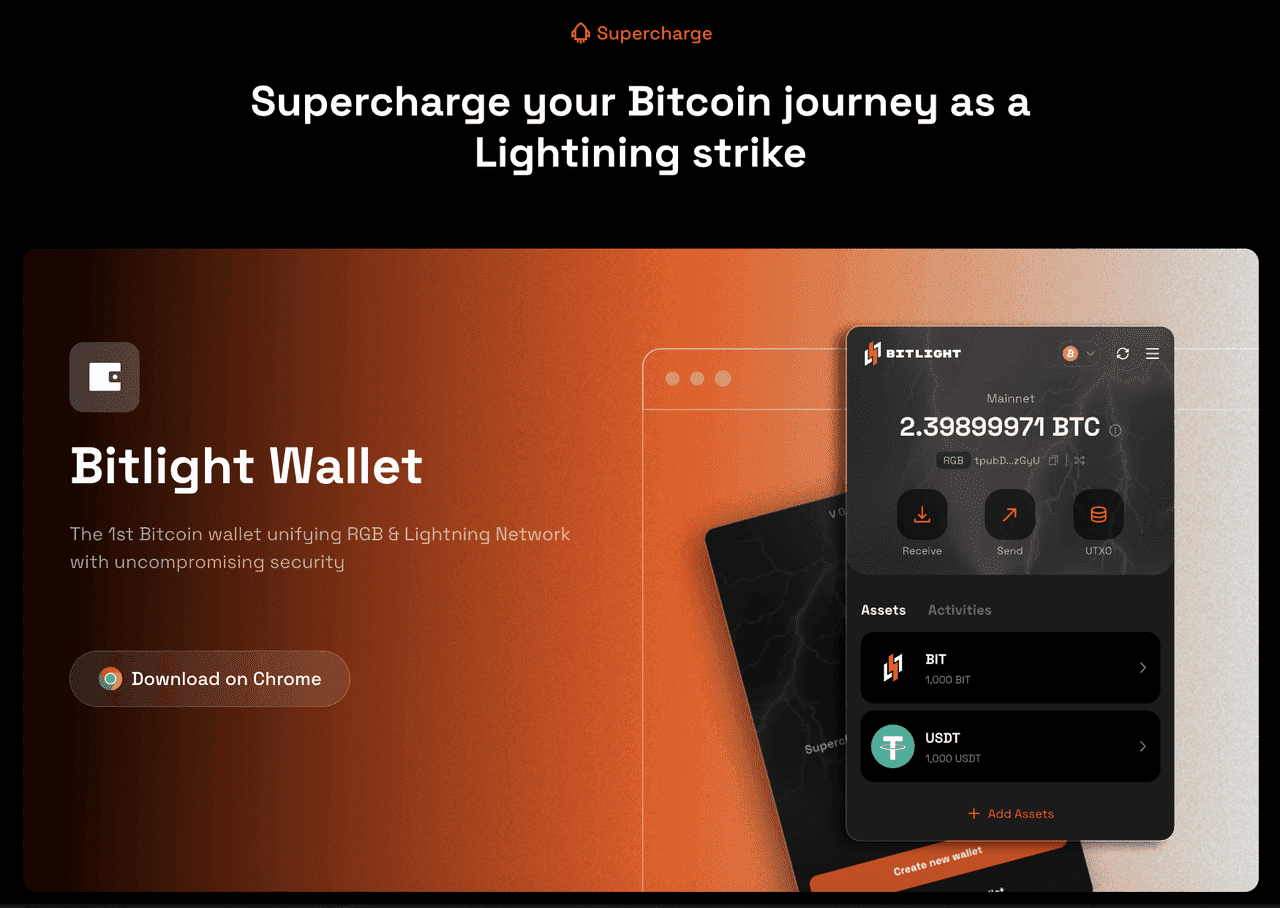

Technological Differentiation: Bitlight combines Bitcoin's security with smart contract capabilities using the RGB protocol and the Lightning Network, offering unique Bitcoin-native DeFi and tokenization solutions. Its innovative architecture aims to enhance efficiency and scalability for smart contracts, potentially accelerating the adoption of Bitcoin-native stablecoins and DeFi tools. Increased tech success could lead to a higher demand for LIGHT, as it is used for fees and governance.

-

Network Adoption & Ecosystem Growth: The value of Bitlight will largely depend on its network effect. Growth would stem from developers building applications like decentralized exchanges or lending platforms on Bitlight. A thriving ecosystem would drive demand for the LIGHT token due to more transactions and staking needs. Initiatives like hackathons and partnerships could further boost developer engagement and integration with wallets and exchanges would enhance usability.

-

Real-World Use Cases (Payments & Beyond): Bitlight aims to enable fast, low-cost payments, particularly stablecoin transactions via Lightning. Capturing real-world payment flows could validate its utility, especially through partnerships with fintech companies. By facilitating everyday transactions and potentially powering microtransactions or NFT issuance, Bitlight positions itself as a crucial Layer-2 solution within the evolving Bitcoin economy, driving significant growth.

-

Partnerships and Alliances: Partnerships can greatly enhance project growth for Bitlight Labs. Collaborating with entities like the Lightning Network or stablecoin issuers such as Tether or Circle could provide valuable synergies and showcase its smart contract capabilities. Involvement from VCs and exchanges can also lead to future collaborations, enhancing liquidity and feature offerings. Additionally, bridging with Ethereum and joining interoperability alliances could further drive its growth and validate its credibility.

-

Tokenomics & Staking/Governance: The utility of the LIGHT token is crucial, serving both governance and as a fee token for services. Engagement from token holders in governance could attract long-term investors. Introducing staking or node incentives would lock up tokens, reduce circulation, and increase demand, particularly if fees are paid in LIGHT. A strong tokenomic model can initiate a growth loop, leading to increased value and resource availability for further incentives.

In summary, Bitlight’s growth hinges on technology, adoption, and integration. Its innovative approach—merging Bitcoin security with Lightning speed—positions it uniquely. If successful by 2025-2030 as a backbone for the Bitcoin economy, LIGHT could see substantial gains. Tracking metrics like active addresses and Lightning channel volume will be key indicators of Bitlight's progress in achieving sustainable growth.

Key Risks to Consider

Investing in Bitlight (LIGHT) carries several risks that potential investors should consider:

-

Competitive Threats: Bitlight operates in a rapidly evolving space, competing with solutions like Stacks, Rootstock, and Ethereum's Layer-2 networks. If Bitlight doesn’t provide a superior solution for Bitcoin DeFi, it may lose traction among developers and users to alternative platforms.

-

Token Dilution & Supply Unlocks: Currently, only 10% of LIGHT tokens are circulating, with 90% yet to be released. This creates potential downward pressure on prices as new tokens enter the market. If a significant amount is unlocked simultaneously, it could lead to oversupply and sharp price drops.

-

Regulatory Impact: The regulatory landscape is volatile. If the LIGHT token is classified as a security or if Bitlight’s functionalities face regulatory scrutiny, it could limit its adoption and use. Actions from regulators related to stablecoins and Bitcoin could also indirectly affect Bitlight.

-

Execution and Development Risk: As an early-stage project, Bitlight faces challenges in meeting its developmental roadmap. Delays, technical hurdles, or security issues could undermine community trust. Sustained funding and effective team execution are critical for its success.

-

Community and Market Sentiment: The strength of Bitlight’s community is vital. If it fails to engage users and developers, interest in the project may decline, impacting its overall viability.

Investors should stay informed about these risks while considering their investment in Bitlight.

Bitlight Wallet (source)

Analyst Sentiment & Community Insights

The sentiment around Bitlight (LIGHT) has shifted to cautiously bullish, particularly after its recent activity in October and November 2025. Analysts from CoinMarketCap noted the project's high utility potential but highlighted supply risks due to large token unlocks. Their outlook suggests that Bitlight’s success hinges on technological delivery and market conditions.

The $9.6M funding led by major crypto VCs has been a strong vote of confidence, as institutional backing signifies a real demand for Bitlight’s Layer-2 vision, differentiating it from speculative tokens.

On social media, sentiment has been largely positive, with 37.7% of tweets bullish. The community is excited about recent exchange listings and technological advancements. Polls on platforms like CoinMarketCap show a recent shift to bullish sentiment, although some community members urge caution due to upcoming supply challenges.

Expert commentary acknowledges Bitlight's potential but stresses the volatility of LIGHT’s price. The consensus is one of tentative optimism—many believe it’s a promising project, but they await proof of its capabilities with future developments. Google Trends show increasing interest, signaling a growing awareness of Bitlight among the public. Overall, analysts and the community express hope, tempered by a desire for tangible progress.

Is Bitlight a Good Investment?

With the information presented, the key question is whether Bitlight (LIGHT) is a good investment. The answer varies based on your investment horizon, risk tolerance, and belief in the project’s vision.

Long-Term Use Case: Bitlight aims to enhance Bitcoin by introducing smart contracts and scalable asset transfers. If you see a future for Bitcoin beyond a mere store of value, then Bitlight’s proposition could be compelling. Its success could position LIGHT as a valuable component of a Bitcoin layer-2 economy, making it a potentially good long-term investment.

Token Strength & Ecosystem Traction: Bitlight has demonstrated solid technology and early traction. However, the true value of LIGHT relies on actual usage and growth in network activity. If it fails to launch within a year, its appeal could weaken. Nonetheless, strong community support and venture capital backing provide a competitive advantage.

Macro and Timing Considerations: The broader market context will affect LIGHT's attractiveness. In a bearish market, even promising projects can struggle, making timing critical for investments. A cautious approach may involve starting with a smaller investment and adding more as the project progresses.

Risk-Reward Profile: Bitlight offers high potential rewards, but also significant risks, including technical and competitive challenges. Those who believe in the technology and can withstand market volatility might view it as a speculative opportunity. Conversely, risk-averse investors might find it unsuitable.

In summary, Bitlight is a high-risk, high-reward opportunity with promising features but significant hurdles. Its potential remains intriguing as we approach 2025–2030. Stay informed, manage risks, and invest only what you can afford to lose.

Not Financial Advice! Your investment decision should stem from personal research. Consult Bitlight’s whitepaper, official updates, and community feedback for insights. Diversification is essential; avoid concentrating your investments in one project.

Why Trade Bitlight (LIGHT) on Phemex?

Whether you’re bullish or bearish on Bitlight’s outlook, if you decide to trade LIGHT, you’ll need a reliable platform to do so. Phemex is a top-tier centralized exchange that offers a secure, fast, and user-friendly environment for trading cryptocurrencies – including Bitlight. Phemex is known for its robust security measures, including cold wallet storage of assets and advanced risk management. In the volatile crypto markets, every second counts. Phemex provides a high-performance trading engine that executes orders with extremely low latency. Phemex has also introduced Trading Bots that let you automate strategies. While trading is one aspect, Phemex also offers ways to earn on your crypto. Phemex Earn provides flexible and fixed savings products where you can deposit certain coins to earn interest.

In short, trading LIGHT on Phemex offers a combination of security, advanced tools, and flexibility that is hard to beat. You have the confidence of a reputable exchange and the convenience of multiple trading products in one place.