Launched in 2018, the Liquid Network is a sidechain solution designed to provide faster, more secure, and confidential Bitcoin transactions between individual and institutions such as exchanges, brokers, and market makers. At the time of writing, the network’s native token Liquid Bitcoin (L-BTC) is pegged to 3378 BTC (around $183 million).

What Is the Liquid Network?

The Liquid Network is a Layer 2 sidechain settlement network built on the Elements platform to improve the efficiency of crypto trading. Unlike in Bitcoin, blocks on the Liquid Network sidechain are not mined with a proof of work algorithm. Instead, each block is signed by specialized hardware units (known as “functionaries”) selected through a round-robin system. These functionaries serve to sign transactions, generate new blocks, and secure the BTC pegged in to the network.

With the widespread adoption of Bitcoin (BTC) since its launch by Satoshi Nakamoto in 2009, scalability has remained a key concern. One of the areas in which Bitcoin still lags significantly behind is transaction speeds. While traditional payment solutions such as Visa and Mastercard are capable of performing up to 5000 transactions per second (TPS), Bitcoin can only process up to seven.

Slower transaction speeds pose significant problems to both individual and institutional investors. As Bitcoin transactions can take up to 60 minutes or more to settle, there are significant inefficiencies and risks when it comes to arbitrage. Traders can often be unsure of their margins until validation is completed on the blockchain. The public nature of the Bitcoin network also puts large over-the-counter (OTC) trades under the risk of front-running as third parties have ample time to act on information through readily-available public trackers.

The result is that despite the network’s promise, it has proven difficult to adapt Bitcoin for enterprise-scale applications. While new projects have aimed to create scalable solutions by building entirely new blockchains, they have a fundamentally different vision and come with additional risks such as increased centralization and lower liquidity. Two key types of solutions have been proposed to enhance transaction speeds without moving to a completely new network:

- Layer 1 (on-chain) solutions such as the Bitcoin Cash (BCH) hard fork involve a fundamental change to the code underlying Bitcoin. For example, they could modify key parameters such as the size of each block on the chain (the block size) or the time it takes to add a block to the chain (the block time). Though Layer 1 solutions can improve transaction times, they have proven controversial to maximalists who believe that they have fundamentally altered Satoshi Nakamoto’s original vision of immutability and censorship resistance.

- Layer 2 (off-chain) solutions such as sidechains are an overlaying network that sits on top of an underlying blockchain. Layer 2 solutions help improve scalability by handling user transactions on a separate “side” network, which are then bundled and only submitted to the Layer 1 network when necessary (such as during withdrawal). The major issue with Layer 2 solutions is that they limit the composability of other projects. To ensure security, BTC that has been locked in to a Layer 2 network cannot interact with the wider Bitcoin network until withdrawn.

As a Layer 2 solution, Liquid Network aims to facilitate the adoption of Bitcoin.

What Does the Liquid Network Do?

The Liquid Network offers a variety of features on top of traditional Bitcoin functionality:

Improved transfer speeds

Bitcoin transfers on the Liquid Network are fully validated within an average of two minutes, significantly faster than the Bitcoin average of 10 minutes. Exchanges can also provide faster deposit and withdrawal services to their users by holding a portion of the asset in the Liquid Network, transferring custodial risk from a single point of attack to the entire Liquid Network. With the Liquid Network, traders can move their funds rapidly between exchanges and accounts without being hamstrung by long and uncertain confirmation times.

Synthetic assets

New assets such as utility tokens, security tokens, stablecoins (DAI, USDT), and digital collectibles (NFTs) can be issued on the Liquid Network. Similar to ERC-20 tokens, these assets can be traded freely across the network, taking advantage of its privacy, speed, and security so long as there is adequate liquidity. The Liquid Network has a native synthetic asset, Liquid Bitcoin (L-BTC), which is used to represent the amount of BTC pegged in and operates on a different security model to the BTC mainchain.

Confidential transactions

Unlike Bitcoin, Liquid Network sidechain hides asset types and transaction figures from any third-party monitoring services while retaining the ability to validate transaction amounts, wallet balances, and the total supply of the asset. The Liquid Network is designed to ensure the confidentiality and prevent the front-running of large trade orders while retaining data such as the sending address, receiving address, and transaction fees for transparency. Only the parties involved in a transaction (or those with the appropriate key) can see the asset type or amount sent.

Atomic swaps

Through the open-source Liquid Swap Tool, users can perform a trust-minimized peer-to-peer swap of any two assets tokenized on the Liquid platform (such as from L-BTC to Liquid USDT (L-USDT). Each swap involves two parties: the prosper that initiates the swap proposal, and the respondent who receives and acts on the swap proposal. By minimizing counterparty risk, Liquid atomic swaps help users trade with more partners.

Peg-in and Peg-out Transactions

Traders can make use of the Liquid Network by moving their BTC from the Bitcoin mainchain to the Liquid sidechain, after which L-BTC is issued to their wallet through the peg-in and peg-out processes. The issued L-BTC can then be used to take advantage of the speed and confidentiality features of the network. Aside from its use in trading, L-BTC is used to pay for transaction (gas) fees for all asset transfers on the Liquid sidechain.

Peg-in transactions are initiated with a Liquid node when the user sends BTC from the Bitcoin mainchain to a peg-in address on the Liquid Network. After 102 separate confirmations to ensure the network isn’t affected by chain reorganization on the Bitcoin network, the BTC becomes “locked” and the Liquid Network mints a 1:1 representation of the BTC in the form of L-BTC.

To ensure the two-way 1:1 pegging of L-BTC and BTC, a peg-in is the only manner in which new L-BTC can be minted on the Liquid Network. Exchanges may opt to peg-in larger amounts of L-BTC ahead of time to ensure faster L-BTC and BTC exchange times for their users.

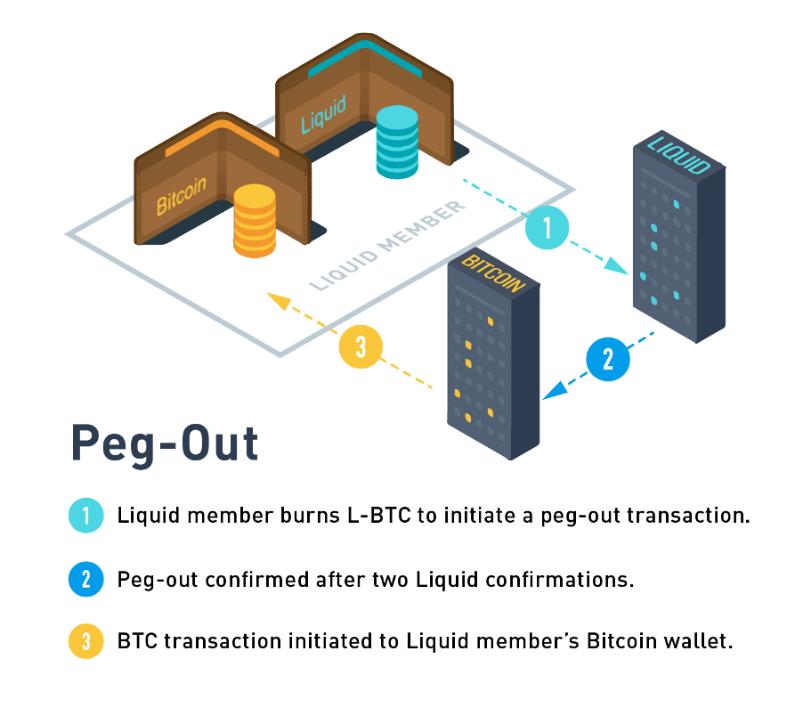

Peg-out transactions are the inverse of peg-in transactions, and are initiated when any amount of L-BTC held by a Liquid Federation member on the sidechain is sent to an empty address (burned) to release the corresponding amount of “locked” BTC. After two separate confirmations on the Liquid Network sidechain, the locked BTC is sent from the Liquid Network’s wallet on the Bitcoin Mainchain to a whitelisted Federation member address to process the peg-out. These transactions are performed in batches on a regular interval of 20-60 minutes.

Who Is Behind the Liquid Network?

The Liquid Network was created by Blockstream, a blockchain infrastructure company based in Victoria, Canada and founded in 2014. The company is led by CEO Adam Back, the inventor of the Hascash system used in the Bitcoin mining process and one of the first two people contacted by Satoshi Nakamoto for the Bitcoin project. Since its founding, Blockstream has raised over $210 million from major institutional investors.

The project is currently being operated and run by the Liquid Federation, a group of cryptocurrency businesses that includes exchanges, infrastructure companies, and developers. The federation is made up of 15 functionaries, which operate specialized hardware to confirm transactions and secure network funds; normal members that vote on elections and network updates; and nodes that ensure normal functionary behavior. As only federation members are authorized to provide L-BTC to BTC peg-out services, the Liquid Network relies on the trustworthiness of its functionaries and constitutes a more centralized enterprise project.

Liquid Network vs Lightning Network

While the Lightning Network targets microtransactions to make Bitcoin more accessible to retail users, the Liquid Network is focused on large transactions and high volumes from enterprise users such as financial institutions and exchanges. The growth of L-BTC in circulation maintained a steady albeit slow growth from the project’s launch to Dec 2019, after which volume boomed from Jan 2020 – Apr 2020. As the purpose of the Liquid Network is to improve the efficiency of large-scale Bitcoin transactions, its success will be measured in how well it can encourage enterprise users to adopt Bitcoin.

Conclusion

The Liquid Network provides key infrastructure to keep Bitcoin competitive with tokens such as Ethereum (ETH) and Solana (SOL) by providing greater interoperability, enhanced transaction scalability, and programmable functionality. As a Layer 2 technology, sidechains such as the Liquid Network provide a middle-ground solution that improves upon core Bitcoin functionality without overtly tampering with the project’s original vision.

Read More

- Bitcoin Lightning Network: What Is It?

- What is a Sidechain: The Most Versatile Layer 2 Solution?

- What Are the Blockchain Layers? Layer 3 vs. Layer 2 vs. Layer 1 Crypto

- What Are Ethereum Layer 2 Solutions: Decentralized Scalability

- What is Liquidity in Cryptocurrency& How does it Work?

- What is a Liquidity Pool: Achieving Efficient Asset Trading

- What is a Liquidity Bootstrapping Pool (LBP): Protecting Investors from Whales and Bots

- What is Ethereum Layer 2 & How does it Work?