TerraUSD (UST) is an algorithmic stablecoin pegged to the US Dollar running on the Terra (LUNA), Ethereum (ETH), and other blockchains. The UST stablecoin was built to deliver DeFi (decentralized finance) trading on the Terra ecosystem. UST is a decentralized, scalable, and yield-burning stablecoin with a $16 billion market cap and 16 billion UST coins in circulation.

UST is one of the largest stablecoins in the crypto industry. The UST stablecoin is deeply connected to the LUNA token, which is the main token of the Terra ecosystem. The LUNA price is propped up by the UST stablecoin because users need to purchase and burn LUNA tokens in order to mint UST.

According to DeFi Llama, Terra is the second largest DeFi chain after Ethereum with nearly $30 billion in TVL (total value locked). The UST token is largely responsible for the success of the ecosystem as it’s used for decentralized trading on Terra exchanges and powers their DApps (decentralized applications).

Terraform Labs, a South-Korean based company, is behind the UST stablecoin, which is responsible for keeping the peg stable to 1 USD. The company burns LUNA tokens to mint UST and offers staking solutions using DApps such as Anchor Protocol. The company announced a plan to purchase billions of dollars worth of Bitcoin (BTC) to back the value of the UST stablecoin.

Summary:

- Terra is a native blockchain with a native token called LUNA. It’s developed by a South-Korean company called Terraform Labs. The LUNA token currently has a $37 billion market cap.

- UST is the stablecoin of the Terra ecosystem. UST currently valued at $16 billion with 16 billion UST in circulation. The combined Terra ecosystem has a valuation of over $50 billion.

- The LUNA and UST coins are interconnected because LUNA is required to create more UST. The value of LUNA goes up as they have to be purchased and burned to mint new UST.

- UST is currently the 16thlargest crypto by market cap and is used on decentralized exchanges and centralized exchanges for trading.

- Developers use the UST token to assign value to their tokens on the Terra ecosystem – the second largest DeFi ecosystem after Ethereum by TVL.

- The stablecoin is pegged to the USD algorithmically and LUNA reserves are sold and burned if it deviates from its peg.

- Terraform Labs announced it plans to become the largest Bitcoin holder in the world and has purchased over $1 billion in Bitcoin in 2022 to back the UST stablecoin.

- Terra Station can be used to mint new UST by depositing LUNA and burning it. Anchor Protocol is the largest staking DAppfor UST with $11 billion deposited and offers up to 20% annual yield.

Trade UST on Phemex now:

How Did UST Make LUNA Successful?

The UST stablecoin is mostly responsible for the success of the Terra ecosystem, currently valued at $50+ billion dollars. The reason is the unique minting mechanism that allows users to obtain UST.

On Ethereum, companies such as Tether (USDT) mint their own stablecoins and they are not tied to Ethereum. On Terra, the founders made it mandatory to purchase and burn LUNA tokens in order to mint UST. This creates a snowball effect of users who start buying LUNA and burning it to create UST.

The Terra ecosystem launched in 2018 but it saw explosive growth in 2021. During 2021, UST had a market cap of only $2 billion. The market cap has since increased 8x to over $16 billion in 2022. The minting process made Terra the second-largest DeFi ecosystem, only trailing behind Ethereum. Terra has surpassed competitors such as Avalanche (AVAX) and Solana (SOL).

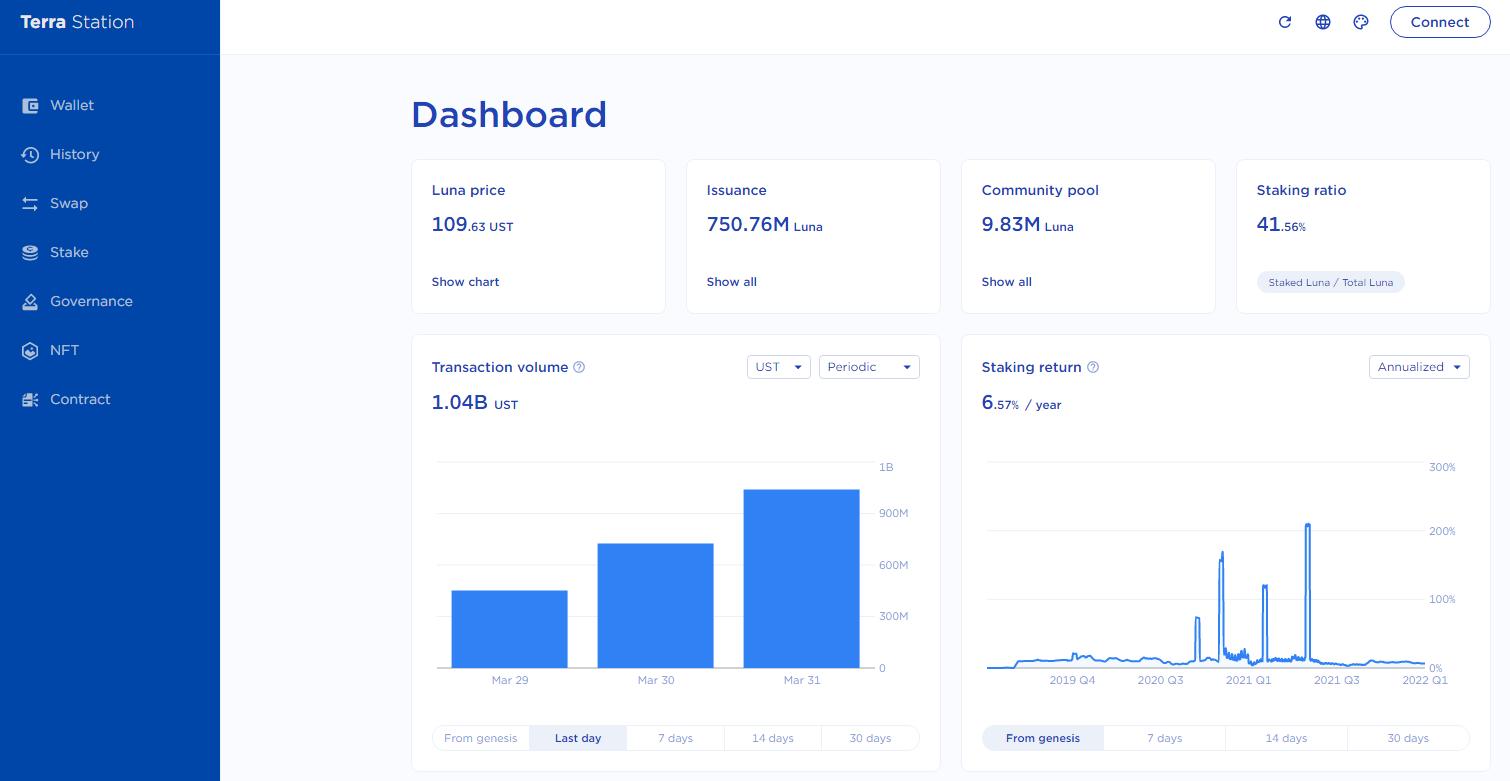

The Terra Station dashboard with Terra’s DeFi applications.

Terra uses a “seigniorage” process that builds up money reserves from the burning of its asset. When users purchase LUNA tokens, they add liquidity to the ecosystem and they’re forced to burn them which decreases the supply and makes the LUNA token more valuable.

The UST value fluctuates slightly above or below the $1 value peg. The peg is driven by supply and demand dynamics, the same as all other stablecoins. The main difference is that UST is not cash-backed the way coins such as USD Coin (USDC) are, but it’s backed by the value of LUNA and the liquidity behind it.

If the UST protocol loses its peg, Terra users immediately tap into their LUNA reserves and sell them to keep the price stable. This is similar to other algorithmic stablecoins such as the Reserve Rights (RSV) stablecoin. The team is also making efforts to increase the backing of their stablecoin by diversifying their assets.

How Does TerraUSD Work?

TerraUSD was launched as an ERC-20 token but it’s currently a multi-chain token that is used for DEX trading, CEX trading, and staking. The UST stablecoin offers multiple advantages:

DeFi Trading

UST can be used to exchange coins on the largest DeFi Networks. It competes with other decentralized stablecoins such as Tether (USDT) and USD Coin (USDC). With a large market cap, it’s also a favorite for traders on centralized exchanges such as Phemex due to widespread availably. A trader could purchase UST on our exchange and send it to a decentralized wallet such as Terra Station or another exchange that supports it.

Multi-Chain

UST is available on the Terra, Ethereum, Cosmos (ATOM), Avalanche (AVAX), Solana (SOL), Fantom (FTM), and Harmony (ONE) blockchain networks. Users can obtain UST on Ethereum exchanges such as Uniswap (UNI) the same way they can obtain UST on Avalanche’s Penguin Finance. Traders on these respective networks can exchange their ERC-20 token equivalents for UST liquidity.

Scalability

The mechanics behind Terra’s minting policy imply that an unlimited supply of UST can be minted by owners who possess LUNA reserves. There are no minimum limits as to how much UST a user can mint as long as they possess the LUNA equivalent. The minting process is transparent and publically-viewable on the blockchain.

Staking

Networks built around the UST stablecoin such as Anchor Protocol provide an APY of up to 20% per year for staking. As the protocol is relatively new, early adopters can benefit from their large interest rates in exchange for depositing liquidity. This is bullish news for LUNA holders because the demand for UST goes up, and the only way to obtain UST is to purchase LUNA.

UST is now available on Phemex:

How Is UST Minted?

There is a 1 cent fee to mint UST on Terra’s decentralized trading platform called Terra Station. Terra’s blockchain is not compatible with Ethereum wallets such as MetaMask, but users need to install the TerraStation wallet and deposit LUNA. Once they have LUNA in their TerraStation wallet, they can mint UST directly on the platform using market swaps.

Terra Station’s decentralized exchange where UST is minted.

For example, if we want to mint $10 worth of UST, we have to deposit the equivalent in LUNA. At the moment, LUNA is trading at $108 which means we need 0.092 LUNA to swap for $10 in UST. The system charges a $0.01 fee and the LUNA deposited is automatically burnt, while the new UST tokens are minted and deposited in the trader’s wallet. The opposite works for traders who want to swap LUNA for UST on TerraStation.

There are arbitrage bots that ensure the value of UST is pegged to one dollar. If UST deviates from the peg, arbitrate bots quickly deposit LUNA and mint UST in exchange. They do the reverse if the value of UST goes above a dollar. The process is transparent and can be seen on Terra Finder, a block explorer that lists all transactions on the Terra network.

Who Is Behind UST?

Terra was invented by South-Korean co-founders Do Kwon and Daniel Shin. Do Kwon is currently the CEO and the face of Terraform Labs. He was previously a software engineer at Microsoft. As a self-made billionaire, he was featured in Forbes’s 30 under 30 and is currently residing in Singapore.

The co-founders had the vision for Terra since 2018 and raised $32 million by large crypto exchanges and Silicon Valley VC capital firms to launch the project. The LUNA coin was released in 2019 and the UST stablecoin was released in 2020.

Do Kwon is ambitious about the future of the Terra ecosystem and recently stated “We plan to be the biggest decentralized money in crypto, period.” He was responsible for expanding Terra’s assets such as UST to other blockchains. He is currently spearheading an endeavor to purchase billions of dollars worth of Bitcoin to back the value of UST across multiple chains. Under his lead, Terra became the DeFi ecosystem with the largest TVL after Ethereum.

How To Get TerraUSD Interest?

TerraUSD staking can yield up to 20% yearly interest on Anchor Protocol, a decentralized staking platform built by Terraform Labs. The user only has to deposit UST in a TerraStation wallet and proceed to stake them on the platform. The interest is fixed for a yearly stake. For example, if they deposit $100,000 UST they can get $20,000 in yearly interest. Users can also stake LUNA tokens for a smaller 5-10% annual yield.

Anchor Protocol’s decentralized lending and borrowing services.

Anchor Protocol can afford to pay these interest rates because their UST is used for decentralized stablecoin lending. The yield may not remain this high in the future as the growth rate is exponential. The total number of deposits grew from $2 billion in 2021 to $12 billion in 2022. This represents an increase of 6x in less than a year. The total collateral available for lending on the platform is $7 billion.

Trade UST on Phemex:

What Is The Future Of UST?

UST is currently one of the most successful stablecoins in the crypto industry. It aims to become the largest stablecoin and money in DeFi. The future challenges for Terraform Labs will be to preserve the backing of UST by purchasing assets not related to the Terra ecosystem.

Their main plan, according to CEO Do Kwon is to purchase Bitcoin to back the value of UST. They have purchased more than $1 billion worth of Bitcoin in Q1 2022 and Do Kwon stated that Terra plans to “become the biggest Bitcoin holder after Satoshi.” This will entail purchasing tens of billions more in Bitcoin as the Terra ecosystem grows and UST is spread across dozens of different blockchains.

A certain percentage of the UST currently minted goes towards Bitcoin purchases. Once the company accumulates sufficient Bitcoin reserves, they can use the backing to preserve the peg of the UST token and keep the interest yield high on Anchor Protocol.

Conclusion

TerraUSD is part of the larger stablecoin network built on the Terra blockchain. Terra also offers other stablecoins such as TerraEUR, TerraCAD, and TerraAUD. These stablecoins are a part of Terra’s mission to change money and decentralized finance.

The UST minting process is fully decentralized and automated using smart contracts. Users have to deposit LUNA to mint and there are no centralized entities approving the transactions. The UST tokens can also be sold for LUNA or any other token in the Terra ecosystem.

UST is currently among the top 5 largest stablecoins and aims to take the first place by growing the Terra ecosystem. It offers among the largest yields for staking in the crypto industry through Anchor Protocol – one of the applications that made the Terra ecosystem successful.

Read More

- What is Terra ($LUNA): Create stable, scalable DeFi Products

- All You Need to Know About Stablecoins: Cryptocurrency’s Gold Standard

- What is Tether USDT: The Ultimate Guide to Buy/Sell USDT

- What is Anchor Protocol: The Savings Account of The Future?

- USDC vs USDT: Which Is The Better Stablecoin to Use?

- What Is TrueUSD (TUSD)? A Regulated USD-Backed Stablecoin

- What Is DeFi Llama: A DeFi Analytics Dashboard for Professional DeFi Traders

- What is USDD Stablecoin? Is It Really Stable?