Decentralized finance (DeFi) has opened up many opportunities to accumulate wealth. For example, through yield farming, staking, and liquidity mining. However, the complexity of moving assets across various money lego programs to make a passive income makes it a confusing and complex process for most investors. Moreover, cryptocurrency’s infamous volatility means that investors must constantly monitor the market to make informed decisions on whether to be risk averse or take a chance. The Anchor protocol is designed to address these issues and provide a simple and risk-free way to earn a lucrative passive income.

What Is the Anchor Protocol?

The Anchor protocol is a savings protocol launched by Seoul-based company Terraform Labs in March 2021. It creates stable high-earning savings by accepting deposits of TerraUSD (UST) from investors and rewarding them with high-yield and low-volatility interest rates. Through this, it expects to increase demand for UST, which aims to surpass DAI in circulation. By offering high interest rates and minimizing exposure to crypto volatility through its use of stablecoins, Anchor attracts investors who are looking for a passive income with low exposure. In doing so, Anchor protocol is growing the DeFi network and putting it in direct competition with traditional financial institutions.

The Anchor protocol is redefining savings to be a decentralized process that works for the investor as opposed to major banks. Investors will benefit from a high 20% annual percentage yield (APY) as opposed to the APYs of below 1% offered by most bank savings accounts. However, differently to many crypto investments, they will worry less about losing their invested assets due to price volatility. Additionally, investors can make instant withdrawals, meaning that if they feel concerned about the way things are going, they can get out quickly.

How does the Anchor protocol achieve all this?

How does Anchor Work?

In its simplest form, Anchor works in the following way: Investors purchase UST, deposit it into the Anchor protocol, and receive instant, stable, and high-yield savings. However, two questions remain:

- How is the Anchor protocol able to offer a stable income and keep investments away from cryptocurrency’s value volatility?

- How can the Anchor protocol pay out such a high APY compared to traditional financial institutions?

Comparison of current deposit and borrow amounts on the Anchor App (March 2022). (Source: app.anchorprotocol.com)

The Anchor protocol achieves the above in the following ways:

Avoiding crypto volatility

To avoid the constant price fluctuation and volatility of cryptocurrencies, the Anchor protocol employs Terra stablecoins that are pegged to the value of the US Dollar. The Terra ecosystem stablecoin chosen as the investment currency (currently UST) works to keep the investment and interest in line with the stable fiat currency, USD.

High APYs

To provide such high APYs to their investors, the Anchor protocol lends out the UST investments to borrowers. These borrowers must deposit bonded assets (bAssets) as collateral for that UST loan. bAssets are fungible and transferable tokens that represent ownership of staked Proof-of-Stake (PoS) assets. As stakes in a PoS protocol, they continuously generate cash from their staking Thus, these bAssets can generate the high yields that Anchor then pays out to investors. The Anchor protocol currently accepts bonded Ether (bETH) and bonded Luna (bLuna), the respective bAssets from Terra and Ethereum’s PoS protocols, as collateral for UST loans.

An example of how it works is as follows: bLuna generates an 11% annual interest from its staking rewards. To borrow $1000 of UST on the Anchor protocol, an investor must deposit twice the amount of bLuna, i.e., $2000. This means that while the borrower has their UST loan, their collateralizedbLuna is generating 22% APY for the Anchor protocol. Thus, 20% APY can be given to investors and 2% kept back as a “yield reserve” to make up for any drop in APY due to low borrowing demand.

How To Earn a Passive Income with Anchor

In order to earn any income through the Anchor protocol, individuals must first become part of the Terra ecosystem by adding the Terra Station chrome extension.

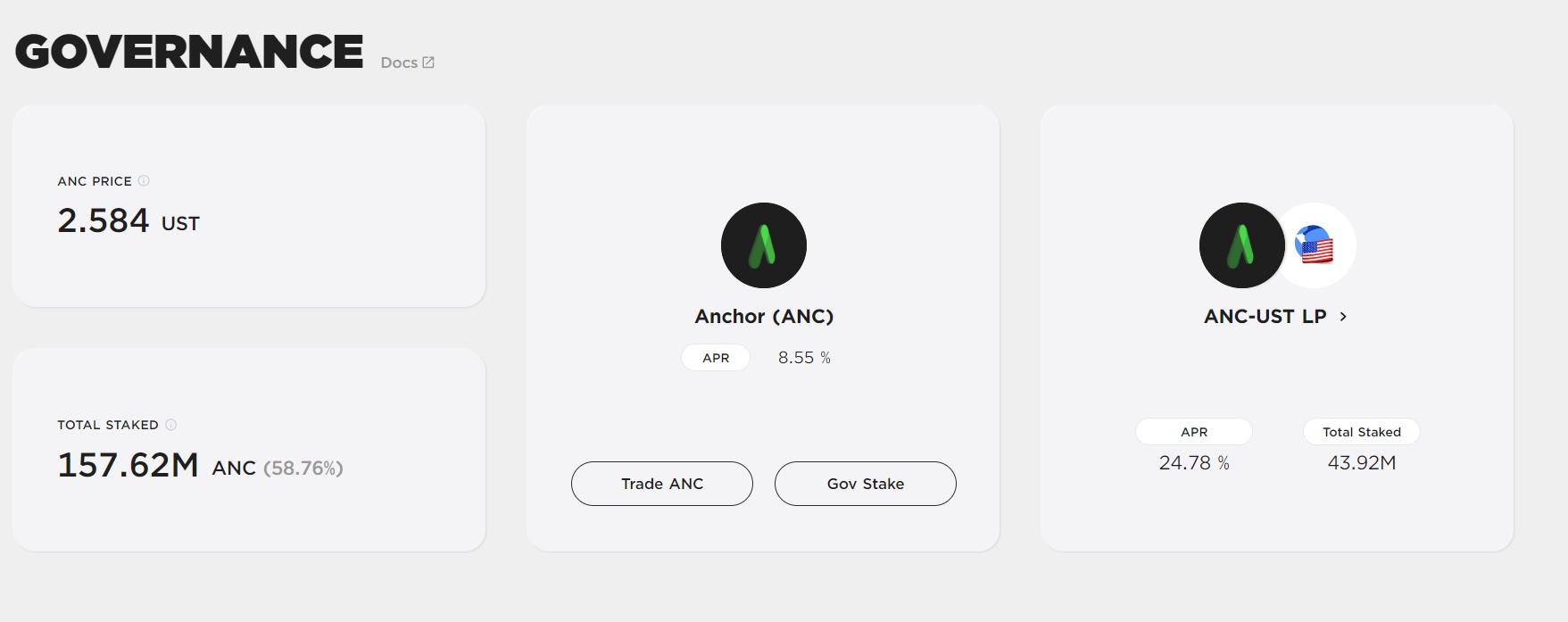

Interested investors can get involved in the governance of Anchor while earning interest. (Source: anchorprotocol.com)

Then, an individual will either create a Terra wallet or connect to a Ledger hardware wallet, after which they can follow four basic pathways to earn yield:

- Deposit UST to earn 20% APY:This is the simplest way to earn a passive income on the Anchor protocol and means that the investor will only deal in stablecoins. For this, an investor will simply go to the “Earn” tab on the Anchor platform, deposit UST, and earn a near-fixed 20% interest on their investment. It is worth noting that Anchor will charge a transaction fee, which is higher for smaller amounts and becomes less significant as the amount increases.

- Post bonded Luna (bLuna) or bETH as collateral and borrow UST to then earn ANC: This option involves going to Anchor’s “Borrow” tabwhere an investor will borrow UST by using bLuna or bETH as collateral. The investor can then do whatever they want with their borrowed UST, including depositing it as above to earn 20% APY. To borrow UST, the borrower will pay an annual percentage rate (APR), meaning that they are paying to borrow. However, they will also be earning Anchor coins (ANC) for having borrowed the UST, and this rate is often higher than the paid APR rate. Thus, the Anchor protocol will essentially pay you to borrow UST. To obtain bLuna or bETH, an investor can swap assets, including UST, for Luna or Ether (ETH) on TerraSwap and then mint them as bAssets. It is worth noting that bAssets are not stablecoins and are subject to crypto’s volatility, so in order not to have your collateral liquidated, you should never borrow the full amount of UST possible.

- Provide ANC/UST liquidity and then stake the liquidity pool(LP) assets to earn ANC: This option can be found on the “Govern” tab. Here, the investor will provide assets to the ANC-UST LP. More liquidity in the pool will mean that ANC and UST transactions are delivered at better rates and their values will be more stable. The reward for providing this liquidity comes in the form of a percentage of all the transaction fees. Next, the investor should stake those liquidity provider tokens (LP tokens) to simultaneously gain staking rewards. To provide liquidity to the ANC-UST LP, an investor must provide an even amount of both assets and pay a transaction fee.

- Stake Anchor token (ANC) to become involved with governance and earn ANC:This option involves heading to the “Govern” tab, where the investor will stake ANC to participate in governance and earn rewards. This is a very simple option, but also generates the lowest APY rate, which fluctuates with the value of the Anchor crypto. This option means that the investor can hold on to a stake in the Anchor protocol, get involved with governance, and earn ANC staking rewards.

ANC Token and Price Analysis

The ANC coin is the native token of the Anchor protocol. It is used to create management polls for stakers to vote on, for many of the Anchor protocol’s internal fees, and for investments in the protocol.

As a new DApp, the Anchor protocol is still seeing a lot of movement in its valuation. The complete price chart below shows that it was successful and gained rapid popularity upon launch, rising from $3.29 to $7.43 in only two days. It then dropped and stabilized between $5–$6 through April and May, before dropping to lows of $2.63 in June and even $1.71 in July. This rapid bearish turn was most likely caused by the 2021 crypto crash, which saw bearish behavior across the crypto sector and led to the liquidation of many assets and coins. With China outlawing crypto mining, and Tesla’s Elon Musk publicly declaring that Bitcoin (BTC) was in fact quite centralized, many had their confidence shaken and moved to sell their crypto assets at lighting speed. Anchor protocol, being a very new DeFi protocol and thus lacking data to prove its feasibility, would have certainly felt the effects of the crash.

ANC price chart Mar 2021 – Oct 2021. (Source: coinmarketcap.com)

Today, crypto is slowly making a comeback. ANC is now valued at $2.55 and recently saw a increase in trading volume over just 24 hours. In addition, it has a market cap of $341 million and a total value locked (TVL) of $3.5 billion, putting its Market Cap to TVL Ratio at 0.09646, which means plenty of space for further growth.

ANC price chart April 2021 – March 2022. (Source: coinmarketcap.com)

However, despite seeing both bullish and bearish behavior over the last few months, ANC is yet to demonstrate a steady bullish trend again. However, its increase in popularity demonstrated by its increase in trading volume points to a potential rebirth.

Conclusion

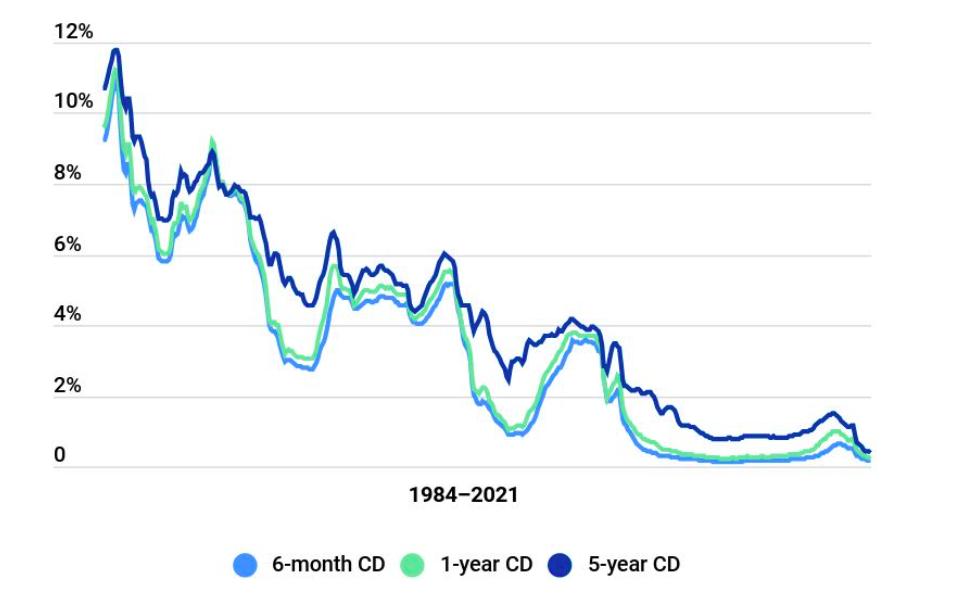

Anchor protocol is an exciting new way to look at savings. It offers investors the chance to put money aside and earn real yield, instead of locking money in a traditional bank savings account and only earning minimal interest. This will be particularly attractive to those who have seen the massive slip in APY rates over the last 40 years. In the US, interest rates have fallen from nearly 12% to near 0% since the 1980s. In the UK, base interest rates have sunk to a 300-year low, dropping from 0.25% to 0.01% over 2020 to counter the impact of COVID-19, and not showing a recovery in 2021.

If it can gather the necessary momentum and attract enough UST borrowers, Anchor finance looks set to become a very lucrative way to save. It represents an exciting prospect to be able to take more control of one’s own finances without relying on banking institutions, which thanks to recent economic crashes, are now viewed with increased suspicion.

Read More

- What is a Cryptocurrency Savings Account & How does it Work?

- What Is DeFi: How To Be Your Own Bank With $100

- TerraUSD (UST): The Stablecoin That Made LUNA Successful

- https://phemex.com/academy/defi

- All You Need to Know About Stablecoins: Cryptocurrency’s Gold Standard

- What is Terra ($LUNA): Create stable, scalable DeFi Products

- What is Yield Farming & How does it Work?

- Phemex Analysis in A Minute: Pro Guide to Enter ENA - The DeFi Giant!