Summary Box (Fast Facts)

-

Ticker/Token: Spark (SPK) – ERC-20 on Ethereum

-

Current Price (July 2025): ~$0.14 USD

-

Market Capitalization: ~$154 million

-

Circulating Supply: ~1.06 billion SPK (of 10 billion max)

-

ROI: +361% from ATL (in 15 days)

-

Chain/Contract: 0xc20059e0317DE91738d13af027DfC4a50781b066

-

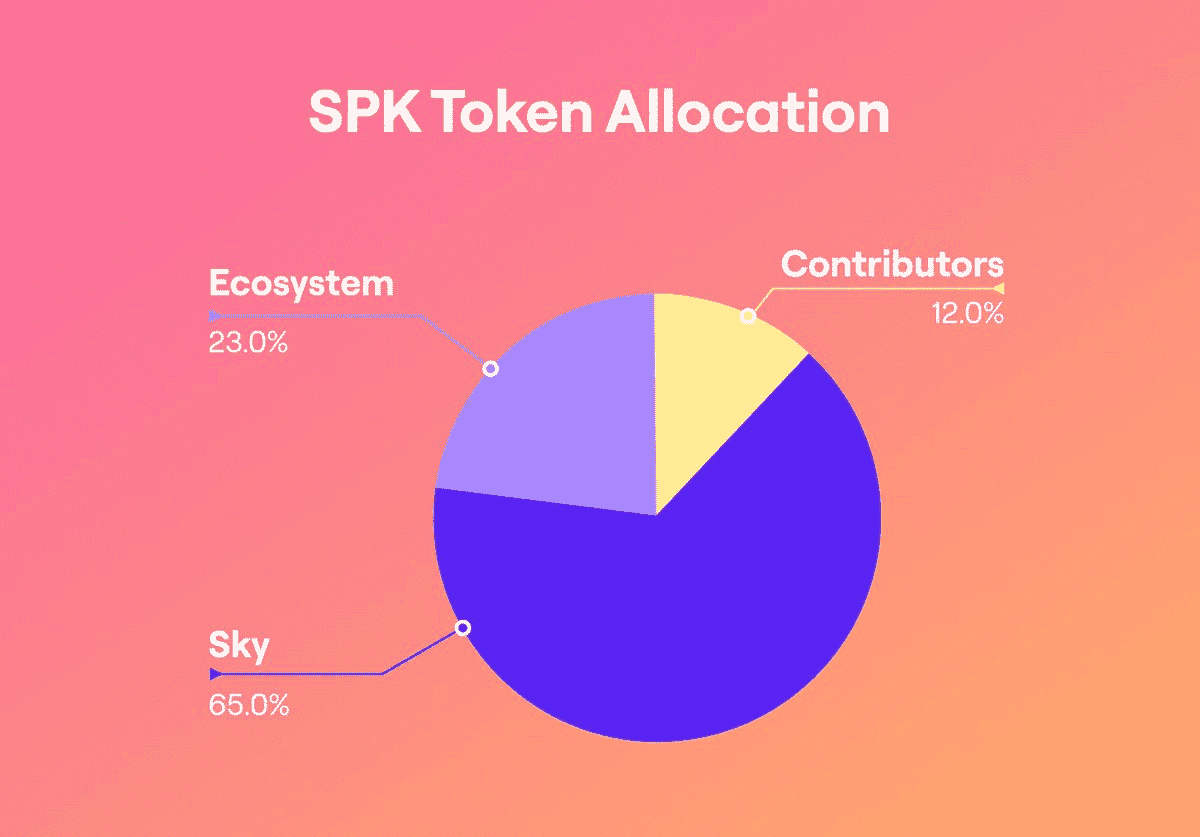

Tokenomics: 65% community rewards, 23% ecosystem, 12% team (released over ~10 years)

-

Use Cases: Governance, staking (yield rewards), and ecosystem utility

-

Available on Phemex: Yes – SPK/USDT spot (listed June 2025)

What Is Spark?

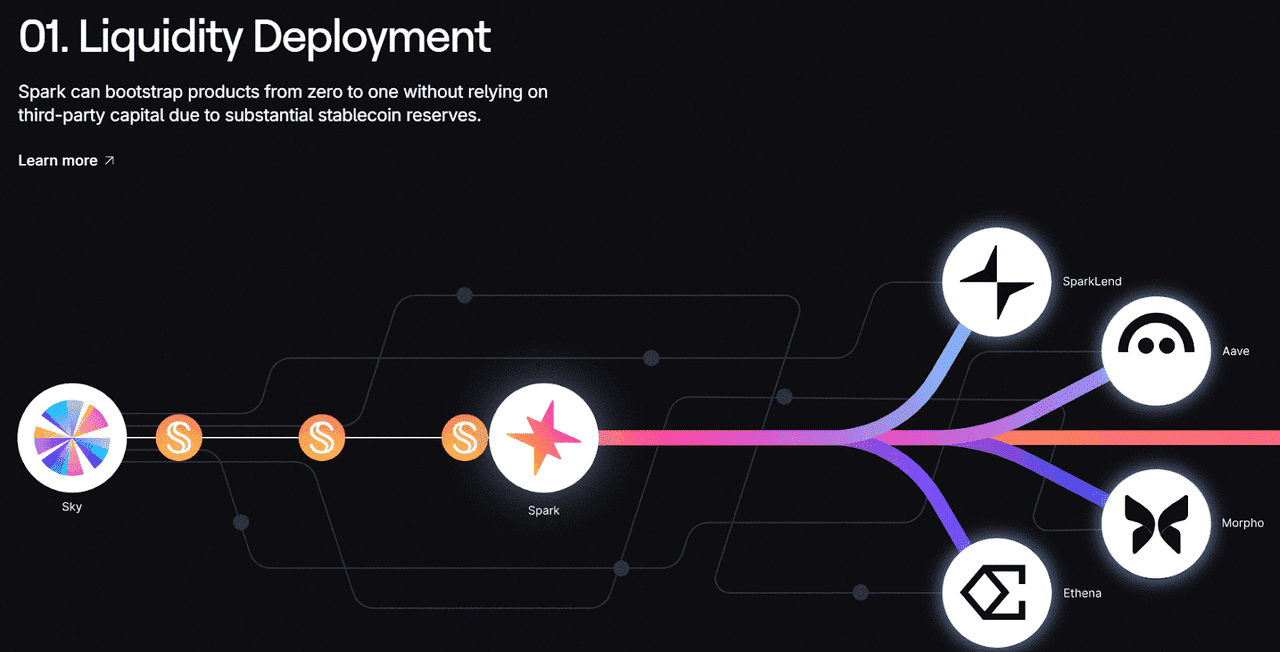

Spark is a decentralized finance (DeFi) platform that serves as an on-chain capital allocator, investing over $3.8B into various yield opportunities to enhance stablecoin returns. It addresses challenges like fragmented liquidity and volatile yields through automated balancing based on market conditions while maintaining a conservative risk profile. Spark simplifies yield generation with products like yield-bearing stablecoins, making earning crypto as easy as saving.

The native token, SPK, functions as a governance and rewards token, allowing holders to vote on protocol decisions and stake for yield. Instead of competing with other DeFi protocols, Spark enhances them, using mechanisms like its SparkLend market, which forks Aave V3 and utilizes MakerDAO’s DAI liquidity. Originating from MakerDAO’s ecosystem, Spark has a robust foundation due to its pedigree and strong liquidity.

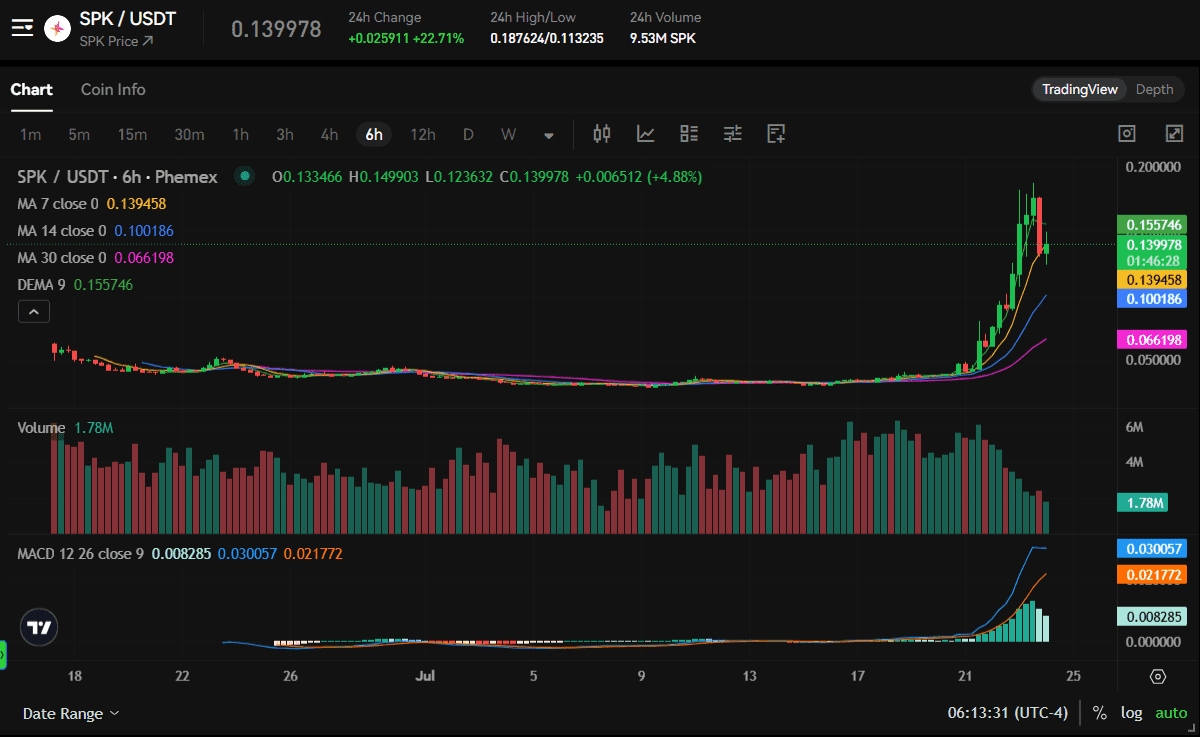

SPK Price History & Performance Overview

As of late July 2025, SPK trades around $0.13, reflecting a 4x increase since early July, with a market cap near $144 million and a circulating supply of about 10.6% of the total. The 24-hour trading volume has exceeded $2.6 billion, indicating strong investor interest. Spark’s Total Value Locked (TVL) is approximately $8.9 billion, suggesting SPK could be undervalued given its low market cap relative to its TVL.

SPK launched in mid-June 2025 via a major airdrop. After an initial dip to $0.0293, the price surged over 90% on July 23, reaching an all-time high of $0.1845, driven by increasing TVL and strong demand for stablecoin yields. Circulating supply tightened as many airdropped tokens were staked, helping fuel the rapid ascent. In summary, SPK’s price and market dynamics indicate a promising trajectory for this emerging DeFi protocol.

Whale Activity & Smart Money Flows

SPK's rise is significantly influenced by the on-chain behavior of large holders, or "whales." In the month following its launch, these investors accumulated approximately 3.9 million SPK, increasing their holdings from about 6.5 million to over 10.4 million, a 60% jump. Meanwhile, "smart money" addresses, typically institutional or experienced DeFi investors, saw a 250% month-over-month increase in their SPK balance, though their total holdings remain relatively small at around 56,000 SPK. This accumulation indicates strong confidence among informed investors, often attracting retail traders chasing momentum.

Notably, SPK's exchange balances dropped approximately 37%, from 597 million to 368 million, indicating that many tokens are being moved into self-custody or staking, which can create upward price pressure due to reduced liquidity. As of mid-July, around 129 million SPK were staked, reflecting significant community engagement and limiting token circulation.

However, there are mixed signals. During the price peak, exchange inflows turned positive, indicating some holders began moving SPK back to exchanges for profit-taking, which can precede a price pullback. While whale accumulation and reduced circulating supply appear bullish overall, caution is warranted due to potential short-term corrections from profit-taking activities.SPK's rise is significantly influenced by the on-chain behavior of large holders, or "whales." In the month following its launch, these investors accumulated approximately 3.9 million SPK, increasing their holdings from about 6.5 million to over 10.4 million, a 60% jump. Meanwhile, "smart money" addresses, typically institutional or experienced DeFi investors, saw a 250% month-over-month increase in their SPK balance, though their total holdings remain relatively small at around 56,000 SPK. This accumulation indicates strong confidence among informed investors, often attracting retail traders chasing momentum.

On-Chain & Technical Analysis

On-Chain Metrics: Spark's on-chain fundamentals are impressive, with a total value locked (TVL) of approximately $8–10 billion, making it one of the top DeFi platforms. As of July 2025, it was the 6th-largest DeFi protocol after a 38% TVL increase over 30 days. The TVL is primarily in Spark's lending markets ($4.8B) and stablecoin savings products ($2.45B), with around $4B in the Spark Liquidity Layer. In the past year, Spark generated $66 million in fees and $5.6 million in revenue, attracting nearly 200,000 users by July. Spark offers competitive yields, such as ~12.65% APY on the USDS stablecoin, appealing to yield farmers and bolstering demand for its rewards token, SPK. The protocol's integration of real-world assets further enhances yields and credibility.

Technical Analysis: SPK's price action has evolved, initially dropping post-launch but forming a base around $0.03–$0.05 before a bullish breakout in mid-July. This breakout above $0.05 indicated a trend reversal, and SPK eventually reached a key resistance at $0.124. Following a decisive breakout past this level, SPK surged to ~$0.18. However, momentum indicators suggested overbought conditions, leading to a healthy correction to ~$0.13. Immediate support levels are at $0.110 and $0.101, with a deeper support around $0.087. If SPK surpasses its recent high, it may experience less resistance until the psychological $0.20 level, although consolidation may occur due to its rapid ascent. The technical outlook remains cautiously optimistic.

Fundamental Drivers of Growth

Spark and its SPK token have several fundamental factors that could drive growth in the coming years:

-

Soaring TVL and Usage: Spark’s TVL exceeds $8 billion, indicating strong market demand and profitability, with substantial annual revenue. A large user base (200k+) suggests network effects that can enhance SPK's valuation.

-

Attractive Yield Incentives: Offering double-digit APY on stablecoins attracts crypto capital. Spark taps into various yield sources, maintaining above-market yields, which boosts demand for SPK as it's tied to platform usage.

-

Strong Backing & Team Expertise: Founded from MakerDAO with a skilled team from Phoenix Labs, Spark benefits from deep liquidity and credibility, leveraging Maker’s DAI reserves to enhance growth and community engagement.

-

Innovation in DeFi Mechanics: Unique features like governance-defined interest rates and the Spark Liquidity Layer provide a competitive edge, while its multi-chain presence aids user acquisition.

-

Real-World Asset (RWA) Integration: Spark’s venture into RWAs, such as investing in BlackRock’s money market fund, brings stable yields into the crypto space and could attract institutional capital.

-

Community and Governance Engagement: With 65% of SPK allocated to rewards, initiatives like airdrops and quests foster user participation and strengthen community resilience.

-

Undervaluation Relative to Peers: Analysts suggest SPK is undervalued compared to similar DeFi tokens, which could attract investors seeking price corrections.

In summary, Spark’s growth drivers are a combination of impressive internal metrics (TVL, yields, users, revenue) and strategic positioning (MakerDAO lineage, multi-chain, RWA integration). If the team continues executing and the DeFi sector remains vibrant, these factors could propel SPK significantly higher over time. Fundamentally, Spark is trying to become a backbone of on-chain liquidity and yield generation.

Key Risks to Consider

No investment is without risk, and Spark’s rapid rise comes with several key risks that potential investors should keep in mind:

-

Token Supply Inflation: SPK’s supply schedule poses risks, with only 10-17% of 10 billion tokens circulating. Allocating 65% to community rewards over ten years means substantial new SPK will enter the market, potentially exerting downward pressure on prices if demand doesn’t keep pace. Early airdrop recipients received large amounts (e.g., 300M SPK), creating dilution risk; the fully diluted valuation could be 10x the current cap, affecting per-token value.

-

Post-Airdrop Sell-Offs: While the airdrop distribution enhances decentralization, many holders may sell for profit after the programs conclude by late 2025. This could cause significant price drops if supply surpasses organic demand, especially after initial incentives fade.

-

Extreme Volatility: SPK has experienced significant price swings, which can benefit traders but challenge long-term investors. Rapid price changes can trigger liquidations or push prices down sharply, risking a crash especially if a downturn in crypto markets occurs.

-

Regulatory and Censorship Risks: Spark operates in a heavily regulated environment, particularly concerning DeFi and stablecoins, which may restrict U.S. user access and raise privacy concerns. Increased regulatory compliance could diminish its decentralized appeal and impact SPK’s value.

-

Smart Contract and Platform Risk: Vulnerabilities in smart contracts are a concern. Spark’s integration with various protocols exposes it to potential hacks, which could erode user confidence and Total Value Locked (TVL). Ensuring robust security is crucial, given past exploits in the DeFi space.

-

Competition and Market Saturation: Spark faces stiff competition from numerous DeFi platforms. Maintaining attractive yields and a superior user experience is essential. If competitors replicate Spark's model or traditional finance becomes more appealing, demand for SPK could stagnate.

-

Macro and Crypto Market Risk: Overall market conditions will impact SPK’s performance, especially during crypto bear markets, influencing investor sentiment and trading activity.

-

Governance and Execution Risk: As Spark transitions to community governance with SPK, the direction of the project will depend on proposals and votes. There’s a risk that governance could become contentious or slow to react. If large stakeholders (whales or even MakerDAO itself) control governance, smaller holders might feel disenfranchised.

In summary, while Spark has huge potential, investors must weigh these risks. As always in crypto: Do Your Own Research (DYOR) and be prepared for scenarios both good and bad.

Analyst Sentiment and Community Insights

Analyst Sentiment: Analysts and crypto researchers hold a broadly positive view on Spark (SPK), noting its strong fundamentals. With SPK becoming the 6th largest DeFi platform, many believe its ~$119M market cap appears undervalued compared to its billions in total value locked (TVL) and projected $200M annual revenue. Comparisons to other projects suggest significant upside for SPK. However, technical analysts caution against potential short-term corrections, citing buyer exhaustion and profit-taking risks, particularly after its recent price surge. Articles highlight the need for SPK to maintain above support levels to avoid pullbacks. Some overly bullish predictions suggest SPK could reach $1, adding excitement to the narrative.

Community Insights: The crypto community is buzzing about Spark, likening it to "MakerDAO’s new DeFi powerhouse" due to its reputable team. Positive user experiences with Spark's products and attractive airdrop and staking programs have contributed to its viral popularity, evidenced by high social media sentiment. However, concerns exist around Spark's VPN ban, sparking debates on decentralization and censorship resistance. Despite mixed feedback, many view Spark as a standout DeFi launch of 2025, with increased interest in its potential reflected in community discussions.

In summary, analyst and community sentiment leans bullish on Spark, recognizing its strong fundamentals and growth, but with a shared acknowledgment of short-term uncertainty and some ideological concerns. This measured excitement about what Spark has achieved is tempered by the knowledge that crypto markets can swing dramatically, and will likely to persist in the near term.

Is Spark a Good Investment?

Investing in Spark (SPK) depends on your risk tolerance and belief in the future of decentralized finance. The project has strong fundamentals, including significant user adoption and a solid development team. If you believe in DeFi's expansion, accumulating SPK now, while its market cap is still low, could lead to substantial returns. Some analysts suggest SPK may be undervalued compared to established projects like Maker and Aave, and smart money is buying in.

However, SPK carries risks due to its volatility and the potential for significant short-term losses if initial hype wanes. Increased token supply could also dilute value unless demand increases. New investors should be cautious, especially since early holders might take profits, impacting price momentum.

From a risk-reward perspective, SPK is moderately high risk but offers high reward potential if Spark succeeds. For long-term crypto enthusiasts who believe in DeFi, SPK could be a worthwhile part of a diversified portfolio, but proper position sizing is essential.

Investors should stay engaged in governance and project developments, which can provide insights into token value changes. If you’re willing to accept the risks and volatility, SPK may fit your investment strategy. However, those seeking quick profits should look elsewhere. Always remember to conduct your own research, as opinions on SPK's future vary widely. Spark has the potential to reward long-term investors significantly, but be prepared for price fluctuations and consider the associated risks.

Phemex is a top-tier platform for trading Spark (SPK), offering deep liquidity, competitive fees, and robust trading tools in a secure environment. As one of the first exchanges to list SPK in June 2025, Phemex has since maintained a highly active market, ensuring efficient execution even during volatility. Traders benefit from low or zero fees, advanced order types, real-time TradingView charts, and a smooth user experience across web and mobile. With 24/7 support and a reputation for reliability, Phemex stands out as a user-friendly, trustworthy venue to trade or invest in Spark.