Ethereum (ETH) has been on a remarkable rally in recent weeks, leaving many crypto investors wondering why Ethereum is pumping so strongly. In early August 2025, ETH’s price surged above $4,600 for the first time in years - a parabolic move up over 215% from its April low near $1,350. This dramatic ETH pump is being driven by a perfect storm of bullish factors: positive on-chain and technical signals, supportive macroeconomic trends (like cooling inflation and ETF approvals), major Ethereum network upgrades and growth in its ecosystem, as well as upbeat investor sentiment and whale accumulation. In this article, we’ll break down each of these drivers and explain why Ethereum is pumping now, what the data shows, and how ETH compares to Bitcoin and other altcoins. We’ll also discuss ETH price targets and an Ethereum price forecast going forward.

On-Chain and Technical Factors Fueling the ETH Pump

Ethereum’s on-chain activity and technical market data provide strong evidence of this rally’s momentum. Several key metrics have hit multi-year highs alongside the price increase:

-

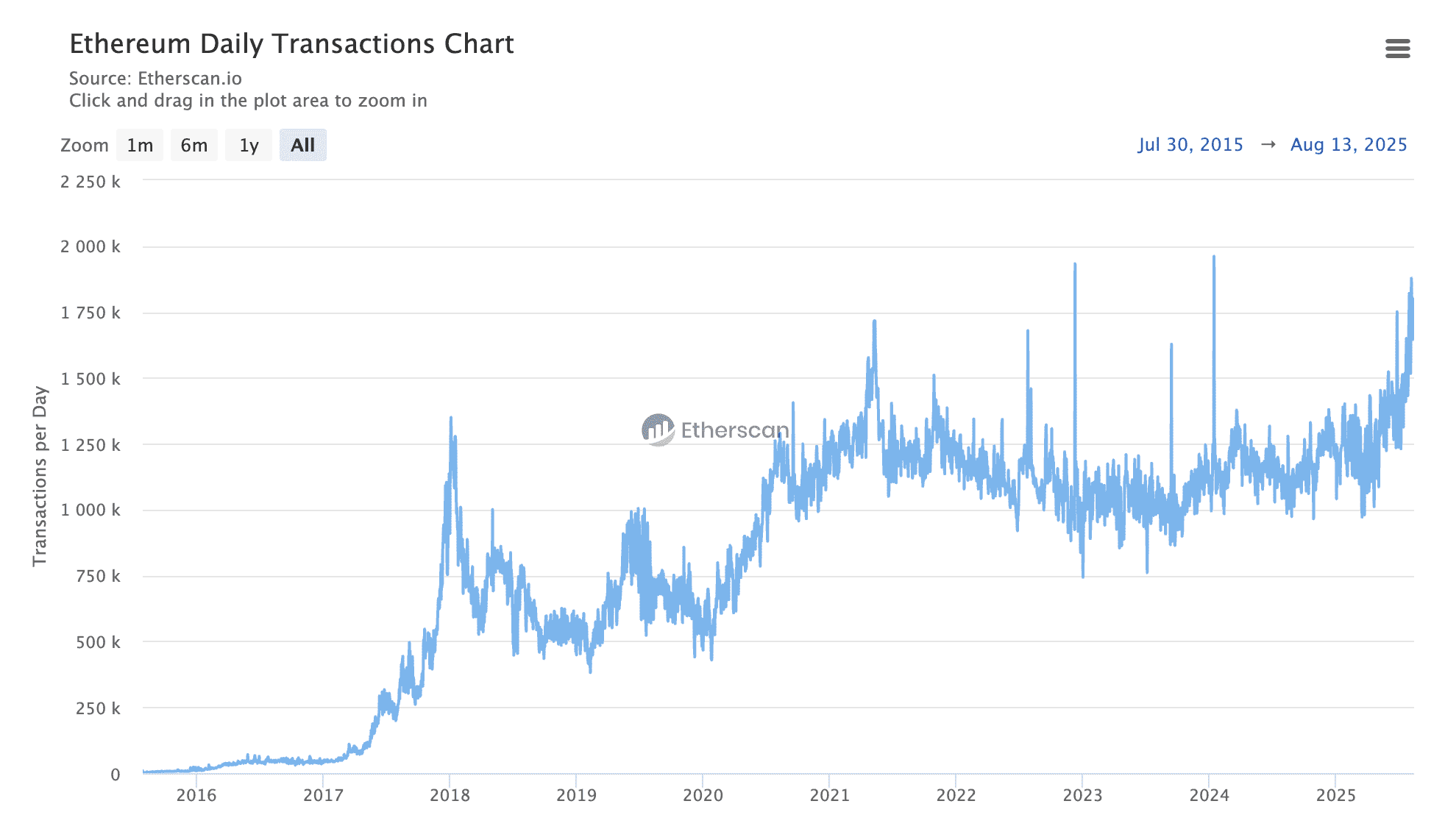

Record Network Usage: In early August 2025, Ethereum processed over 1.74 million transactions in a single day, surpassing previous peaks, with daily active addresses rising to over 680,000, driven by increased DeFi activity and institutional interest.

-

Most Holders In Profit: Approximately 97% of ETH holders are now "in the money," reflecting a strong market rebound from bear-market lows. While some may cash out, this widespread profitability indicates a robust upswing.

-

Soaring Futures Open Interest: Ethereum futures open interest hit a record ~$60 billion in mid-August, up 250% from April, showcasing a surge in bullish bets and increased market confidence.

-

Key Technical Breakouts: Ethereum broke through important resistance levels, sustaining around $4,300–$4,500, indicating a bullish trend. High trading volume and strong technical indicators point toward continued upward momentum.Meanwhile, momentum gauges such as the Relative Strength Index (RSI) briefly pushed above 70, putting ETH in “overbought” territory. An elevated RSI simply reflects how rapid and strong the rally has been. Small pullbacks may occur (and indeed happened around mid-August), but the technical backdrop shows Ethereum firmly in an uptrend with strong momentum.

-

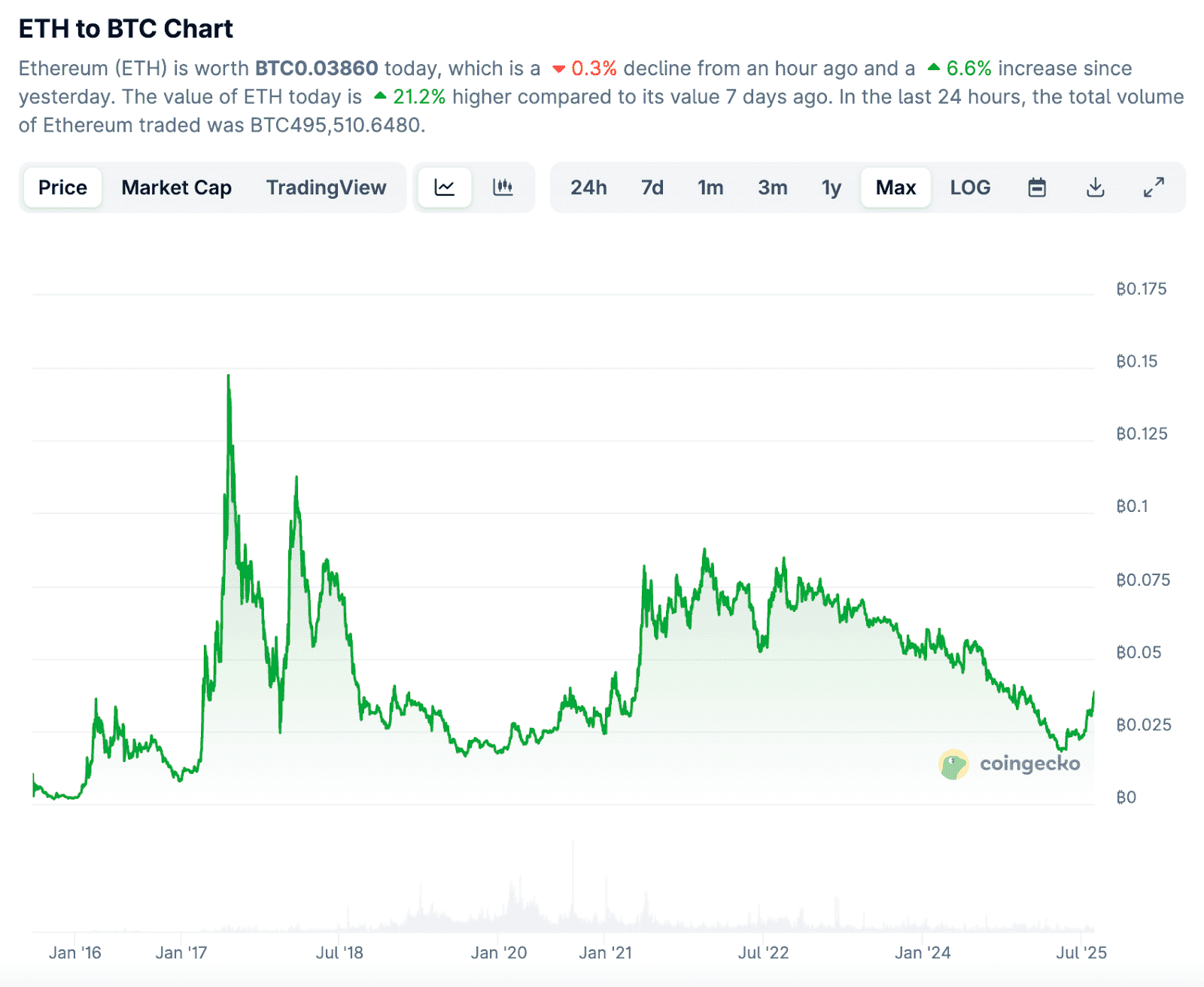

ETH/BTC Outperformance: The ETH/BTC ratio doubled from its lows, reflecting Ethereum’s outperformance over Bitcoin and compelling reasons for investors to shift capital into ETH.

In summary, on-chain metrics and market trends support the notion that Ethereum’s rally is driven by real activity and investor confidence. Next, we’ll explore the macroeconomic factors at play.

Ethereum Daily Transactions

Macro Tailwinds: Inflation Cooling, ETFs, and Policy Boosts for Ethereum

In 2025, the macro environment has become crypto-friendly, significantly boosting Ethereum's price. Declining U.S. inflation, now at 2.7% year-over-year, has led to expectations of Federal Reserve interest rate cuts, supporting risk assets like cryptocurrencies. This optimistic outlook has sparked a crypto rally, with traders pricing in an 82% chance of a rate cut in September, benefiting speculative assets like Ethereum.

Additionally, 2025 has seen a surge in institutional inflows through Ethereum exchange-traded funds (ETFs), which garnered nearly $2 billion in Q3 alone. With total assets under management for Ethereum ETFs reaching approximately $19.2 billion, traditional finance’s interest is evident, further validating Ethereum's investment case.

There's also anticipation of more crypto ETF approvals, which could include major altcoins like Solana and XRP. The initial launches of Bitcoin and Ethereum ETFs already triggered significant inflows, reinforcing the positive sentiment around crypto.

Regulatory developments are also supportive, with the U.S. government exploring the inclusion of cryptocurrencies in retirement accounts and the passage of the “GENIUS Act” for stablecoin clarity, positively impacting Ethereum. These trends collectively reduce uncertainty and increase institutional confidence in the crypto market.

Ethereum Ecosystem Growth: Upgrades, Staking Boom, and Layer-2s

Ethereum has seen significant fundamental developments over the past year, strengthening its price. Key upgrades post-Merge, particularly the March 2024 “Dencun” upgrade, improved scalability by introducing “blob” data transactions, which dramatically reduced Layer-2 rollup costs and gas fees. This has enhanced Ethereum's efficiency and set the stage for future growth, with recent developments like the completed “Pectra” update on May 7, 2025.

The transition to proof-of-stake has also boosted staking activity, with over 36 million ETH staked by August 2025, representing about 29% of the circulating supply. The successful Shanghai upgrade allowed staked ETH withdrawals, resulting in net inflows of approximately 14.77 million ETH. This reduction in liquid supply, coupled with rising staking yields, has contributed positively to ETH's market dynamics, drawing in institutional investors.

Liquid staking derivatives (LSDs) have further fueled the DeFi ecosystem, with Lido Finance accounting for nearly 25% of all staked ETH. This has increased capital efficiency, allowing staked assets to be utilized in various DeFi applications, resulting in significant growth in Ethereum’s total value locked, now exceeding $200 billion.

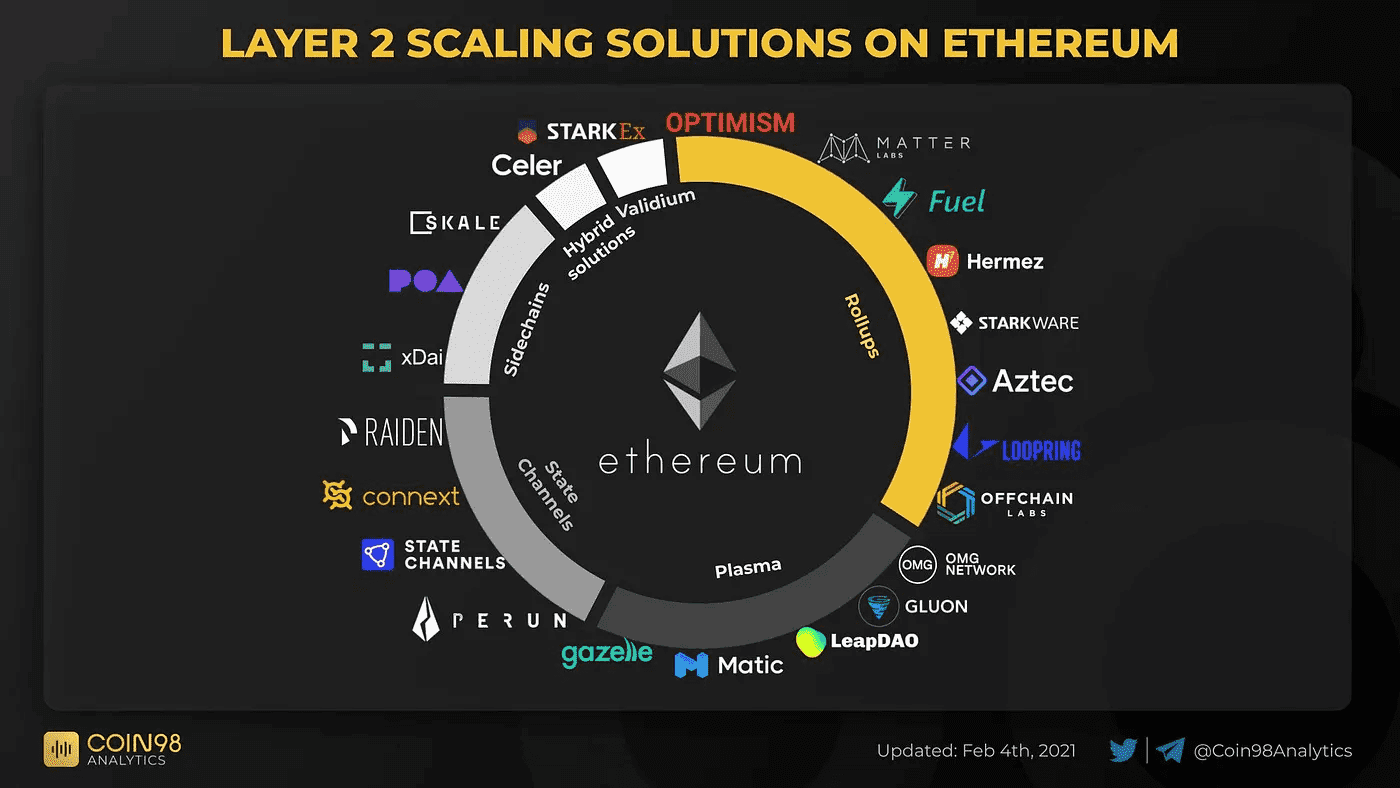

Finally, Ethereum’s Layer-2 scaling solutions have matured, reducing costs and increasing transaction capacity while maintaining dynamic on-chain conditions. These developments reinforce Ethereum’s fundamental value and support the ongoing bullish sentiment surrounding ETH.

Taken together, these ecosystem factors – successful upgrades like Dencun, the massive wave of staking (reducing float), thriving DeFi and liquid staking, plus L2 scaling – provide a strong fundamental backdrop for Ethereum’s pump. The network is more efficient, more widely used, and more deflationary than ever, painting a bullish picture for long-term value. It’s not just hype; Ethereum’s core metrics and capabilities have materially improved, which investors are rewarding with a higher price.

Ethereum Layer 2 solutions

Investor Sentiment and Whale Activity: “Smart Money” Driving the Rally

Ethereum's recent price surge is largely driven by shifting market sentiment and activity from large investors, or "whales." In 2025, many significant players have been accumulating ETH, with notable examples like Tom Lee’s BitMine fund, which holds 833,000 ETH and plans to raise an additional $24 billion for more purchases. This alone is a massive vote of confidence compared to existing Ethereum ETFs. In total, over 1.035 million ETH (worth over $4.1 billion) has been acquired by large whale addresses since mid-July, and the number of addresses holding over 10,000 ETH has reached a yearly high, signaling long-term bullish positioning.

Ethereum investment funds have seen substantial inflows, with over $570 million in one week, highlighting strong retail and institutional demand. This influx creates a positive feedback loop, further boosting prices. Market sentiment has turned bullish, with indicators like the Fear & Greed Index reflecting heightened enthusiasm, and analysts suggesting higher implied volatility for ETH compared to Bitcoin.

Interestingly, retail traders have been more cautious, which often occurs in the early stages of significant rallies. This skepticism may eventually lead to increased buying as FOMO sets in. While there have been instances of sell-offs by whales, the overall trend points to accumulation.

The presence of these deep-pocketed buyers supports a confident market environment, indicating that current dips are seen as buying opportunities.

In summary, investor sentiment around Ethereum is highly optimistic, with whales and institutions backing the asset robustly.

Ethereum vs. Bitcoin and Other Altcoins: How Does ETH Stack Up?

Ethereum’s recent surge is notable when compared to Bitcoin and select altcoins like Solana. In 2025, Ethereum has outperformed Bitcoin, which has remained stable around $120,000. While Bitcoin's gains have been modest, Ethereum jumped nearly 30%, indicating stronger relative momentum. This disparity reflects the different narratives: Bitcoin's stability as "digital gold" contrasts with Ethereum’s tech platform and DeFi growth benefits. Some capital has shifted from Bitcoin to Ethereum, contributing to its momentum.

In addition to Bitcoin, many altcoins have also risen, with Solana seeing a 13% increase amid improved DeFi activity. However, Ethereum's dominance is significant, with a market cap of around $520 billion, well ahead of other altcoins. While many altcoins move in Ethereum’s slipstream, its rally has sparked broader momentum in the whole market without diminishing other networks' growth.

Different catalysts drive their strengths: Bitcoin benefits from expectations around a spot ETF and macroeconomic factors, while Ethereum thrives on ETF inflows, protocol upgrades, and staking yields. This diverse set of drivers suggests Ethereum may continue gaining on Bitcoin. Some argue, however, that any ETH outperformance could be short-lived. Lastly, competition from "Ethereum killers" like Solana and Avalanche exists, but Ethereum’s unique positioning and ongoing developments keep it at the forefront of the crypto landscape.

Overall, Ethereum’s rally has outpaced Bitcoin in recent weeks and spurred broader altcoin gains. It sits in a sweet spot: large enough to be considered a “safe” blue-chip crypto by institutions, yet with enough technological upside and yield to excite growth-oriented investors. ETH’s pump has arguably led the market, flipping the script from early 2024 when Bitcoin was the sole leader. If this trend persists, we could see Ethereum continue to close the gap in market cap with Bitcoin, especially as more use cases and upgrades come to fruition. For now, Ethereum and Bitcoin are both benefiting from the return of a crypto bull cycle, but Ethereum holders have had a bit more to celebrate lately.

ETH to BTC Chart

ETH Price Targets and Future Outlook

With Ethereum nearing its all-time high of around $4,800 from late 2021, analysts and investors are optimistic about its future price trajectory. Many traders set short-term targets around $5,000, which would signal a significant technical breakout, particularly after Ethereum's recent push above $4,300. A bullish chart pattern suggests potential upside to about $5,200.

Looking ahead, more ambitious forecasts for late 2025 and 2026 suggest Ethereum could reach $7,000 to $8,500 if Bitcoin continues to rise significantly, with some analysts drawing parallels to historical cycles. Should ETH hit around $8,000, its market cap would approach $1 trillion, reinforcing its potential as a mainstream asset.

While the outlook is generally positive, investors should be cautious of volatility. Rapid price increases often lead to profit-taking, and indicators like a high RSI suggest potential pullbacks. Analysts expect that after any corrections, Ethereum could continue its upward trend if key drivers such as network growth and institutional adoption remain strong. Overall, the sentiment is that new highs for Ethereum are likely a matter of “when, not if.”

Conclusion: A Confluence of Catalysts Behind Ethereum’s Pump

Ethereum’s recent pump in price is the result of a confluence of positive factors coming together at the right time. Unlike some past crypto rallies that were driven mainly by hype, this ETH surge has robust underpinnings:

-

On-chain fundamentals are strong – usage is at record levels and the supply-demand dynamics (with so much ETH staked or held by long-term believers) favor price appreciation.

-

Technical market factors show momentum – with high open interest, bullish chart breakouts, and strengthening trend indicators confirming that buyers are in control.

-

Macro and institutional tailwinds have opened the floodgates – lower inflation and the prospect of easier monetary policy have revived risk appetite, while the advent of Ethereum ETFs and pro-crypto regulations have unleashed a wave of capital into the market. Ethereum sits at the epicenter of this influx, second only to Bitcoin, and is reaping the benefits of newfound legitimacy among big investors.

-

Ethereum’s own ecosystem is firing on all cylinders – the successful Dencun upgrade and upcoming technical improvements address scalability, the explosive growth in staking has tightened supply and aligned incentives for holders, and Ethereum remains the dominant platform for DeFi, NFTs, and more despite competition. The network’s evolution has given investors tangible reasons to be optimistic about long-term value, not just short-term speculation.

-

Market sentiment and whales are aligned in bullishness – large players are accumulating, not dumping, and the crypto community at large is rediscovering confidence in ETH. Positive sentiment can be a powerful accelerant in crypto, and currently it’s tilted in Ethereum’s favor, with many seeing it as the asset with both blue-chip credibility and high-upside potential in this cycle.

Of course, no rally goes up in a straight line. Traders should be mindful of potential corrections (even sharp ones) along the way. Issues like overly high leverage, regulatory surprises, or macro setbacks (e.g. a resurgence of inflation) could temporarily stall the uptrend. Ethereum also faces the perennial challenge of competition and the need to continually innovate – which it has been meeting, but must continue to do so to justify its valuation. Short-term volatility aside, Ethereum’s trajectory in 2025 so far highlights its resilience and ability to come back from downturns “like a phoenix,” jumping from ~$1,350 in April to over $4,400 by August.

In essence, Ethereum’s recent pump showcases the cryptocurrency’s maturing fundamentals combined with cyclical market forces. If these trends persist, Ethereum’s current pump might be just the beginning of a broader ascent in the coming months. As always in crypto, only time will tell, but for now ETH holders have plenty of reasons to feel upbeat. Why is Ethereum pumping? Simply put, because a perfect storm of factors is making 2025 a bullish era for the world’s second-largest cryptocurrency. The crypto markets are never certain, but Ethereum’s strong showing suggests it could be entering a new golden phase, and that is a fundamentally solid foundation for any price rally.