Introduction

Tom Lee, the veteran Wall Street strategist from Fundstrat Global Advisors, is making headlines with a bold forecast: Ethereum could surge to $16,000 by the end of 2025, mirroring Bitcoin’s explosive 2017 rally. In this Phemex blog, explore Lee’s vision of Ethereum’s “Bitcoin 2017 moment,” driven by stablecoins and tokenization. As chairman of BitMine Immersion Technologies, Lee is backing this with a $250 million ETH treasury strategy, holding a record 833,137 ETH—$3 billion—making BitMine the world’s largest corporate ETH holder. With rivals and volatility in play, can ETH deliver? Unpack the trends, data, and risks shaping Ethereum’s path.

Who Is Tom Lee and His Ethereum Influence in 2025

Tom Lee, co-founder of Fundstrat Global Advisors, is a Wall Street expert known for accurate market predictions. He correctly forecast Bitcoin’s 2017 rise and S&P 500 trends, earning investor trust. His recent Ethereum focus has put him at the center of crypto attention. “Ethereum’s scarcity is a game-changer,” Lee told DL News in July 2025, highlighting corporate buying as a driver per DL News. His August 7, 2025, CNBC interview solidified his $16,000 ETH prediction, tied to the 2017 ETH/BTC ratio of 0.14. Leading BitMine’s ETH strategy, Lee’s bridging Wall Street and crypto in 2025.

Ethereum’s ‘Bitcoin 2017 Moment’: $16,000 Price Prediction

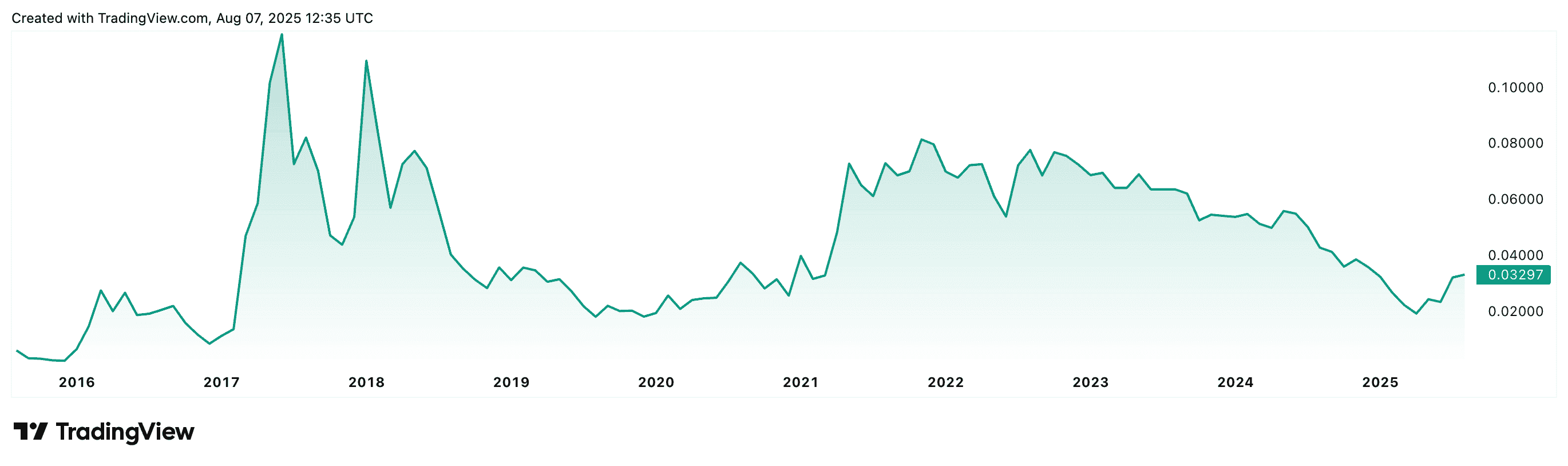

Lee sees Ethereum echoing Bitcoin’s 2017 20x surge, per CNBC, August 7, 2025. With ETH at $3,824, he predicts a rise to $7,000–$16,000 by year-end. The $16,000 target assumes Ethereum hits its 2017 ETH/BTC ratio of 0.14, requiring Bitcoin to reach $114,000. Long-term, he eyes $20,000–$60,000 as institutions join in.

Ethereum powers 60% of the $250 billion stablecoin market, handling 95% of BitPay’s volume and $6.4 billion in Tether fees. It leads tokenization, hosting 60% of real-world assets for firms like JPMorgan and Visa. Circle’s IPO and the GENIUS Act add momentum.

ETH/BTC Ratio Chart (Source)

BitMine’s Record Ethereum Treasury Strategy: 833,137 ETH

Lee’s turning BitMine Immersion Technologies (AMEX: BMNR) into an Ethereum powerhouse. In 27 days, BitMine amassed 833,137 ETH—$3 billion—making it the world’s largest corporate ETH treasury, surpassing SharpLink Gaming’s 438,200 ETH per PR Newswire. BitMine aims for 5% of ETH’s supply, roughly 6 million ETH or $22 billion. Backed by Peter Thiel’s Founders Fund and Galaxy Digital, its stock jumped 400–900% since June 2025 according to Bloomberg.

Lee calls BitMine the “MicroStrategy of Ethereum,” with “ETH per share” as a key metric. Ethereum’s uptime and compliance outshine banks like JPMorgan, which flag 7% of transactions as suspiciou.

Stablecoins: Ethereum’s Killer App for 2025

Lee calls stablecoins Ethereum’s “killer app,” and the numbers back him up. Ethereum handles 60% of the $250 billion stablecoin market, processing 95% of BitPay’s volume and $6.4 billion in Tether fees. This dominance drives billions in daily transactions, making Ethereum the backbone of digital payments.

Former Treasury Secretary Scott Bessent predicts a $2 trillion stablecoin market by 2030, with Ethereum leading the charge per The Block. Major players like JPMorgan, Robinhood, and Visa are building on Ethereum, drawn by its reliability and smart contract capabilities. Circle’s IPO and the GENIUS Act, supporting stablecoin regulation, signal a boom in institutional adoption. Lee argues stablecoins could spark Ethereum’s “Bitcoin 2017 moment,” as they bridge traditional finance and crypto, boosting network fees and ETH’s value. But risks like regulatory delays or competing blockchains could slow this momentum.

Why Ethereum’s Driving Institutional Adoption in 2025

Ethereum’s fundamentals are strong:

-

Staking yields ~3% annually, attracting long-term holders.

-

Ethereum ETFs drew $2.18 billion in one week, showing institutional demand.

-

Stablecoins fuel billions daily, with a $2 trillion market in view.

Its role in DeFi and NFTs strengthens its Wall Street appeal. Scott Bessent sees stablecoins transforming finance, with Ethereum at the core.

Ethereum Price Risks to Watch in 2025

Ethereum faces challenges. It’s down 23% from its 2021 high and dropped 5% in August 2025. Rivals like Solana, Cardano, and Tron offer faster, cheaper networks. Stablecoin regulations could face delays or restrictions.

BitMine’s rapid ETH buying and 400–900% stock surge raise concerns if prices stall. Lee sees dips as buying opportunities but warns volatility is real.

Bitcoin vs. Ethereum: A 2025 Outlook

Lee supports both crypto giants. Bitcoin’s “digital gold,” aiming for $1 million long-term, while Ethereum’s smart contracts drive the digital economy per Bankless podcast. Stablecoins link traditional finance and crypto, with Ethereum as the hub. ETH’s utility gives it a near-term edge.

Ethereum Price Outlook: What’s Next for 2025?

Lee’s $16,000 call depends on:

-

ETF inflows staying strong.

-

Stablecoins like USDT and USDC scaling up.

-

BitMine hitting its 5% ETH supply goal.

Phemex’s platform offers tools to navigate ETH’s volatility. Trade ETH on Phemex’s spot or futures markets to capitalize on swings, but monitor market signals and institutional moves.

Conclusion

Tom Lee’s $16,000 Ethereum prediction grabs attention. BitMine’s record 833,137 ETH treasury and stablecoin dominance fuel the “Bitcoin 2017 moment.” But rivals, volatility, and regulatory risks remain. Trade ETH on Phemex’s spot or futures markets and stay informed on ETH’s path to $16,000—or beyond.

Disclaimer: The content provided in this article is for informational purposes only and does not constitute financial, investment, legal, or trading advice. Cryptocurrency markets are highly volatile and involve significant risk. Readers should conduct their own research and consult with a qualified financial advisor before making any investment or trading decisions. Phemex and the author are not responsible for any losses or damages resulting from the use of the information presented herein.