Discover Spark (SPK), a next-generation DeFi protocol optimizing yield across stablecoins and real-world assets. This in-depth guide explores SPK’s tokenomics, use cases, governance power, and how to buy SPK on Phemex. Learn how Spark is reshaping liquidity infrastructure, what sets SPK apart from competitors, and whether it’s a smart investment in 2025.

Summary Box (Quick Facts)

-

Ticker Symbol: SPK

-

Chain: Ethereum (ERC-20)

-

Contract Address: 0xc20059e0317DE91738d13af027DfC4a50781b066

-

Circulating Supply: ~1.7 billion SPK (17% of max)

-

Max Supply: 10 billion SPK

-

Primary Use Case: Governance, staking and rewards token for the Spark DeFi ecosystem

-

Current Market Cap: ~$80 million (June 2025)

-

Availability on Phemex: Yes (listed June 2025)

What Is Spark (SPK)?

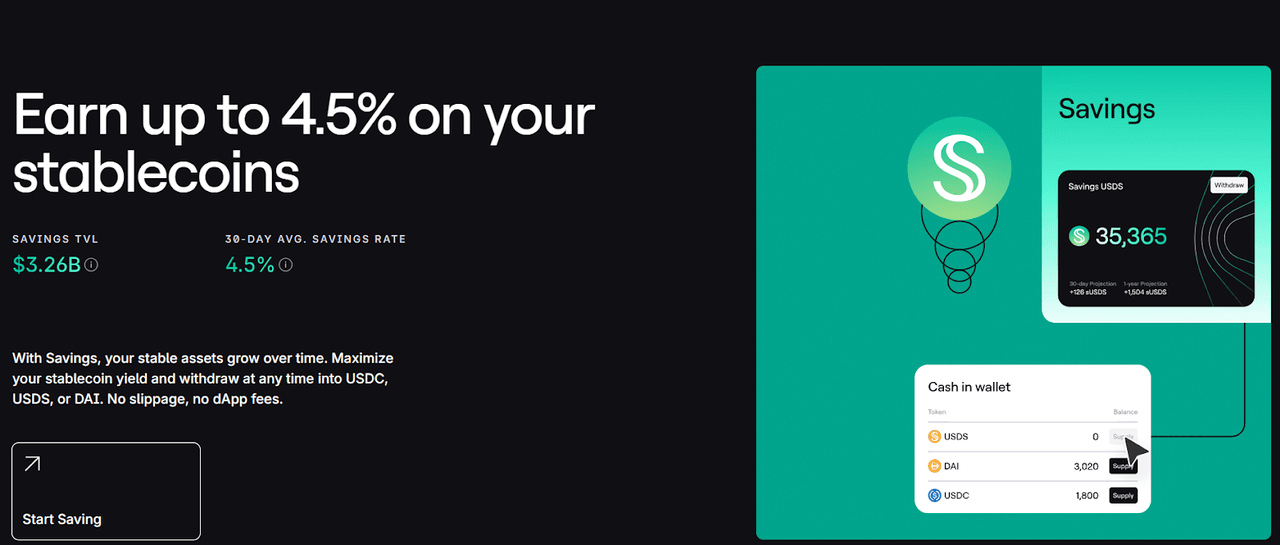

Spark is a decentralized finance (DeFi) platform that acts as an on-chain "capital allocator," designed to maximize yield on stablecoins across the crypto ecosystem. By deploying over $3.8 billion across various DeFi protocols, exchanges, and real-world assets, Spark addresses key challenges in the DeFi space, such as fragmented liquidity and unstable yields. This results in a streamlined yield machine for users to earn passive income on stablecoins with competitive rates.

The native token, SPK, is crucial to the ecosystem, serving as both a governance and staking token. Holding SPK gives users a voice in decision-making and aligns their interests with the platform's growth and security. Instead of competing with other DeFi platforms, Spark enhances them by providing deep liquidity and stable yields.

Spark aims to simplify complex yield strategies into user-friendly products, making crypto earning as easy as a savings account. With SPK now live, both casual investors and DeFi enthusiasts can engage with this promising project, driving a new wave in crypto finance.

How Many SPK Are There?

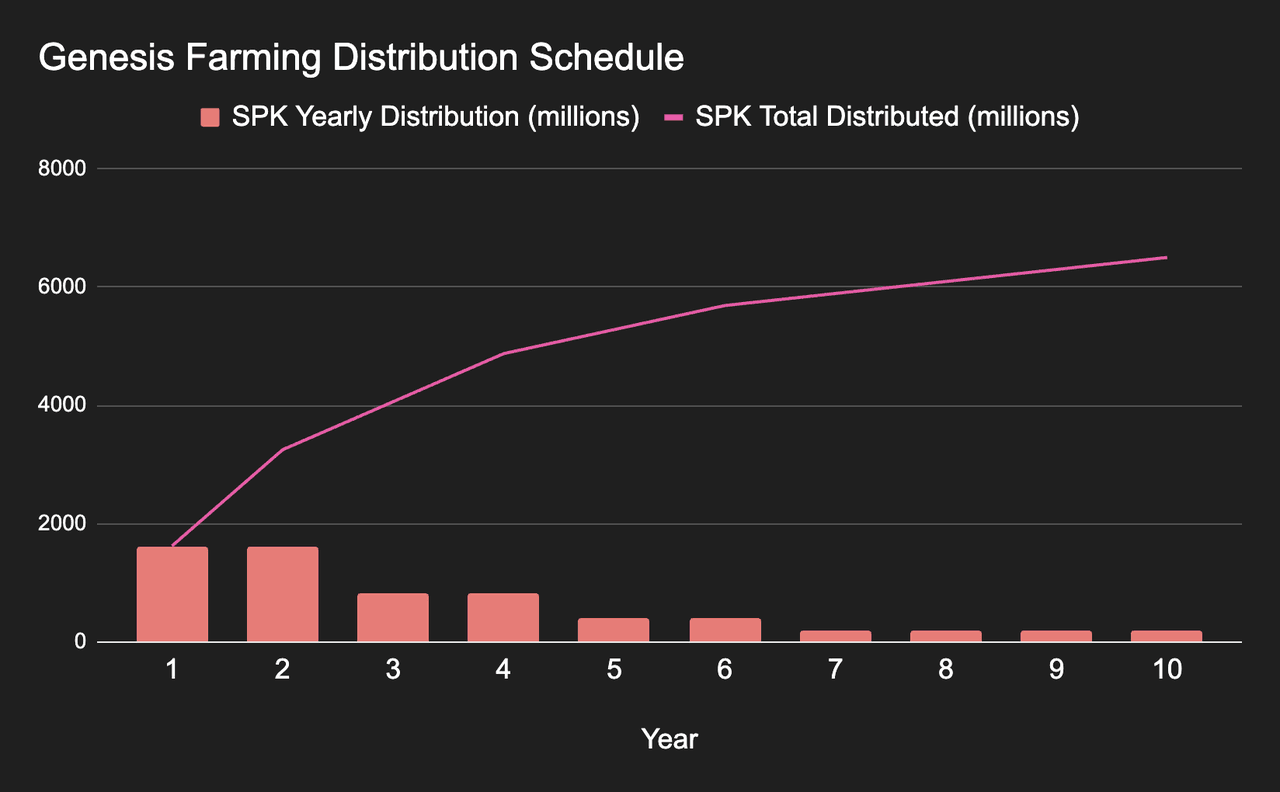

Spark has thoughtfully structured its token supply for sustainability, with a fixed max supply of 10 billion SPK tokens minted at launch. These tokens will be gradually released over a decade to encourage long-term participation, with 65% allocated for community farming rewards, 23% for ecosystem growth, and 12% for team contributors.

As of mid-2025, approximately 1.7 billion SPK are circulating, mainly from an initial airdrop and early incentive programs. A significant airdrop of 300 million SPK occurred on June 17, 2025, to decentralize ownership within the DeFi community. While the token supply will increase steadily through farming rewards, the emission rate will decline over time, keeping inflation low.

Spark’s tokenomics emphasize gradual release and active usage, avoiding extreme deflationary tactics and relying on real utility to drive demand. The supply is managed with transparency and the potential for community adjustments via on-chain proposals. With SPK now available on Phemex, access is straightforward, and supply will continue to support ecosystem growth.

What Does SPK Do?

The value of any cryptocurrency derives from its use case, and SPK is rich with utility within the Spark ecosystem. SPK serves three main purposes for its holders and the network: governance, staking, and rewarding the community.

-

Governance: SPK holders can participate in governance votes to influence key decisions, such as interest rates and new product launches, ensuring the community drives Spark's decentralized future. These votes are conducted via on-chain proposals and can significantly impact how the protocol's $3.5B+ liquidity is managed.

-

Staking & Security: SPK can be staked to support the network's security, with stakers earning rewards through programs like Spark's “Symbiotic” staking and Spark Points system. This mechanism incentivizes users to lock their tokens, benefiting both the platform's stability and their own long-term earning potential.

-

Ecosystem Utility & Rewards: SPK is integral to Spark's ecosystem. While fees may not be paid in SPK, the revenue generated indirectly benefits SPK holders through governance decisions, liquidity mining, and community initiatives. SPK is designed to operate across various DeFi platforms, potentially being accepted as collateral or used for yield farming in the future.

Importantly, SPK is designed to be integrated across multiple networks and DeFi platforms. Spark itself operates on Ethereum mainnet and several Layer-2 networks (like Base, Optimism, Arbitrum, etc.), so SPK as an Ethereum-based token can move fluidly to those ecosystems via bridges. As Spark’s influence grows, there’s potential for SPK to be accepted as collateral in other DeFi protocols, or used in yield farming on partner platforms. In essence, SPK’s utility is to empower a whole suite of DeFi activities: it’s the governance key, the staking fuel, and the reward token all at once.

SPK vs Bitcoin

It’s always illuminating to compare a new token with the king of crypto. SPK vs Bitcoin may sound like comparing apples to oranges – and in many ways it is – but it highlights Spark’s niche and innovations. Here’s how Spark’s token stands up against Bitcoin on key fronts:

-

Technology: Bitcoin operates on a proof-of-work blockchain tailored for secure value transfers, while SPK is an ERC-20 token utilizing Ethereum's proof-of-stake and smart contracts. This allows SPK to benefit from Ethereum's features, making it more complex and versatile than Bitcoin's straightforward system.

-

Speed & Fees: Spark transactions settle within seconds to a minute, compared to Bitcoin's roughly 10-minute block times. SPK transactions, especially on Layer-2s, are often quicker, though users face Ethereum gas fees. Bitcoin has lower transaction frequency and can experience high fees, prioritizing security over speed.

-

Use Case: Bitcoin primarily serves as a digital currency and store of value. In contrast, SPK governs a lending protocol and facilitates DeFi activities, focusing on community engagement rather than everyday transactions.

-

Decentralization & Security: Bitcoin is well-known for its decentralization and security, backed by thousands of global nodes. SPK benefits from Ethereum's security but depends on community governance for decision-making. While Bitcoin changes require consensus among miners, Spark's governance is more community-driven. Overall, Bitcoin is a secure digital asset, while SPK serves as a governance token within a DeFi network.

The Technology Behind SPK

Spark’s technology combines established DeFi components with innovative features. As a token within the Spark Protocol rather than a standalone blockchain, SPK relies on Ethereum’s Proof-of-Stake consensus for validating transactions, benefiting from its security and decentralization.

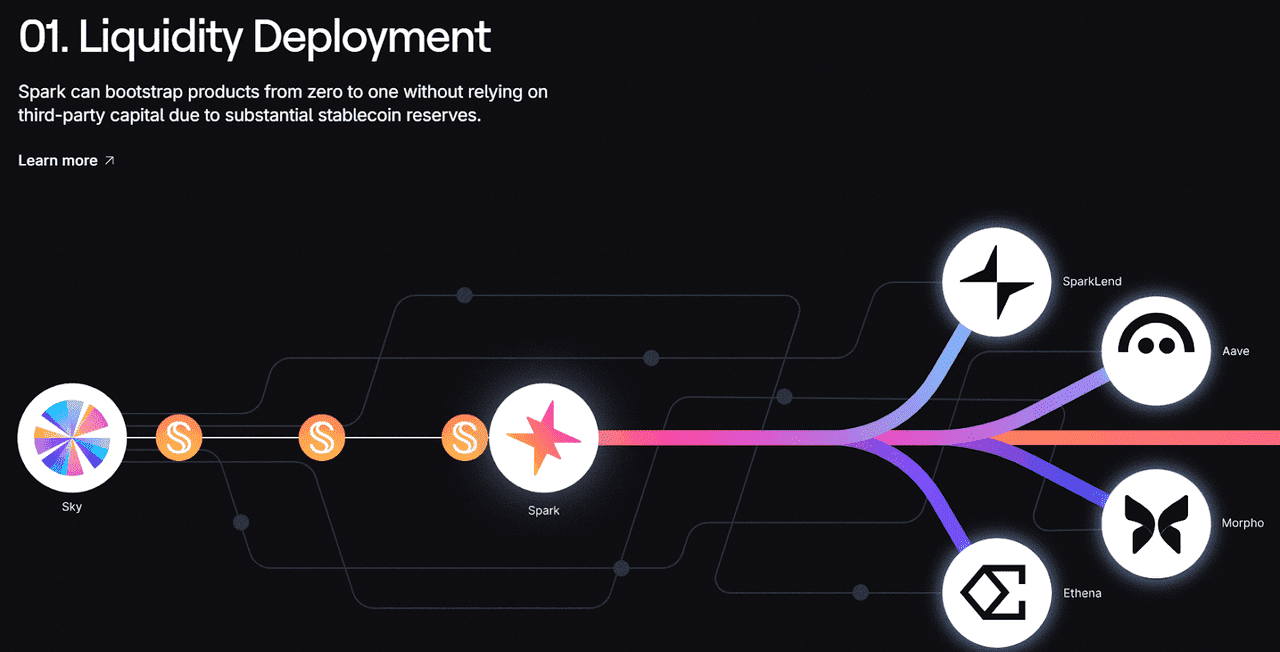

At its core, Spark manages liquidity through the Spark Liquidity Layer (SLL), which autonomously deploys capital across various platforms to maximize returns. This system uses smart contracts and oracles to monitor rates and efficiently allocate funds, ensuring steady yields for users even amidst market fluctuations.

Additionally, Spark integrates with MakerDAO’s system, utilizing a fork of Aave v3 for products like Spark Lend, which features fixed interest rates. This design enables liquidity support, preventing the need for rate spikes when demand is high.

Spark’s multi-chain infrastructure spans Ethereum and Layer 2 networks (like Base, Optimism, and Arbitrum), facilitating cost-effective transactions. Its partnerships, particularly in traditional finance, include investments in tokenized real-world assets (RWAs), like BlackRock’s money market fund, showcasing a fusion of DeFi and TradFi.

In summary, while Spark leverages technologies from giants like Ethereum and MakerDAO, it also ventures into new territory with automated yield allocation and RWA integration, delivering a seamless user experience powered by intricate smart contract orchestration.

Team & Origins

Spark is a DeFi project that originated from the vision of several key figures at MakerDAO, known for the DAI stablecoin. In 2023, MakerDAO initiated the “Endgame Plan,” creating subDAOs, with Spark designed as the lending arm to optimize its $6+ billion stablecoin reserve. Developed by Phoenix Labs, founded by former MakerDAO engineers, Spark aims to enhance DAI’s utility.

In May 2023, Spark Lend was launched, allowing users to lend and borrow assets like ETH and DAI. This was followed by Spark Savings, introducing yield-bearing stablecoins. The protocol expanded to multiple chains, reflecting careful growth.

A significant event was the SPK token launch in June 2025, marking Spark’s shift to decentralization and community governance. The launch featured a broad airdrop, fostering inclusivity. MakerDAO itself, now rebranded as Sky, is Spark’s primary backer, providing liquidity through its ecosystem rather than traditional venture capital.

Today, Phoenix Labs and an open-source community support Spark, which is actively managed by SPK holders. Spark’s evolution from MakerDAO into an independent platform embodies the spirit of innovation and decentralization in the DeFi space.

Key News & Events

Spark and its SPK token may be relatively new, but they’ve already generated plenty of headlines. Here are some major news and events that mark Spark’s evolution:

-

Q2 2023 – Launch of Spark Protocol: Spark Lend goes live as MakerDAO’s first subDAO product, introducing a lending platform and integrating with Maker’s DAI Savings Rate, attracting attention in the DeFi community.

-

Late 2023 to 2024 – Expansion of Spark Products: Spark launches Spark Savings on Ethereum and Layer-2 networks, offering higher yields and partnering with BlackRock for a $1B investment in Real-World Assets (RWAs). The Total Value Locked (TVL) grows to over $8B.

-

June 17, 2025 – SPK Airdrop and Token Launch: SPK is minted and 300 million tokens are airdropped to users. The token debuts with an ~$40 million market cap, creating buzz and significant trading in its first 24 hours.

-

June 2025 – Exchange Listings (Phemex and more): SPK is listed on several major exchanges, including Phemex, contributing to over $100M in trading volume. This rapid support underscores strong interest in SPK.

-

Mid 2025 – SPK Price Volatility: In the days after launch, SPK’s price hit an all-time high of around $0.12 before retracing to about $0.05-$0.06. This ~60% swing, while dramatic, is not unusual for a freshly launched token. It reflected initial excitement (and perhaps speculative frenzy) during the airdrop hype, followed by natural profit-taking and price discovery.

-

Ongoing – Development and Governance: Post-launch, Spark’s community has begun to exercise its governance muscle. Early proposals in late 2025 include adjustments to interest rates on Spark Lend (using SPK votes to tweak borrowing costs for certain assets) and allocations of Spark’s treasury funds. The Spark DAO (governed by SPK holders) is now active. Additionally, Phoenix Labs continues to ship updates – from security audits to new chain deployments.

Every indication is that Spark’s story is just beginning. The successful launch of SPK and its rapid integration into trading platforms like Phemex are strong signals of confidence. Observers are now watching how the Spark community steers the project through its next chapters – be it adapting to regulatory changes, outpacing competitors, or innovating with new DeFi products. Rest assured, news about SPK will continue to flow as Spark strives to remain at the cutting edge of decentralized finance.

Is SPK a Good Investment?

Now for the million-dollar question (quite literally, for some): Is Spark’s SPK token a good investment? The answer, of course, isn’t black-and-white. SPK offers an enticing mix of strong fundamentals and high potential, but it also carries the risks and wildcards inherent to any new crypto.

The Bullish Case:

Spark’s SPK token is backed by strong fundamentals. The protocol already manages over $8 billion in assets and generates consistent revenue from lending and yield strategies—this isn’t a speculative project, it’s a functioning, profitable DeFi platform. Holding SPK effectively makes you a stakeholder in that ecosystem. The project’s origins in MakerDAO, one of DeFi’s most trusted names, lend it credibility and technical depth that many new tokens lack. Community engagement is strong, with thousands of users claiming the airdrop and actively participating in governance and discussions - an encouraging sign for sustained growth.

SPK is also uniquely positioned at the intersection of major crypto trends: DeFi lending, stablecoins, real-world asset integration, and multi-chain liquidity. It addresses critical inefficiencies, like fragmented yields and underutilized capital, and offers solutions that could scale across the ecosystem. As DeFi continues evolving, Spark’s infrastructure could become foundational - and SPK’s value would likely grow with it.

Another bullish factor: SPK isn’t just a passive governance token. It has real, immediate utility—staking for Spark Points, voting on key decisions, and earning rewards—all of which incentivize holding rather than selling. This built-in utility, combined with support from MakerDAO’s reserves, creates a layer of resilience against market volatility. At a ~$0.05 price and ~$80M market cap, SPK could be significantly undervalued, especially when compared to similar DeFi tokens that have reached valuations in the hundreds of millions. If Spark continues delivering and market conditions remain favorable, SPK’s upside potential is considerable.

The Bearish Case:

No investment comes without risk, and SPK is no exception. With only a brief price history, its long-term behavior is hard to gauge. Early volatility—dropping from $0.12 to $0.05—shows the token is still finding its footing. A large portion (83%) of the total supply remains locked and will be released gradually, which could put downward pressure on price if demand doesn’t grow fast enough. Inflation is planned but real, and SPK’s fully diluted valuation is significantly higher than its current market cap.

There are also regulatory uncertainties. Spark’s involvement with stablecoins and yield products puts it in a category often scrutinized by regulators. While MakerDAO has navigated this landscape carefully, Spark’s independent expansion could expose it to new legal challenges, especially in jurisdictions with strict financial rules. Additionally, broader market downturns could affect SPK even if Spark itself continues to grow—bear markets don’t spare fundamentals.

Spark also faces stiff competition. It aims to act as an infrastructure layer, but it still competes with major players like Aave, Lido, and Compound for users and liquidity. If those platforms offer better returns or innovate faster, Spark may struggle to retain its edge despite its deep ties to MakerDAO.

Finally, there’s execution risk. Spark’s roadmap is ambitious—multi-chain expansion, decentralized governance, and continued product rollout—but any technical failure or exploit could damage user trust. SPK’s investment appeal also depends on governance-driven value accrual. If token holders don’t approve mechanisms like buybacks or revenue sharing, SPK’s value may not reflect Spark’s success. Investors should watch how the community steers these decisions going forward.

Conclusion:

SPK is a bold play in the DeFi arena – one with considerable promise and known pitfalls. It offers exposure to a cutting-edge protocol that is actually delivering utility in the crypto world. Owning SPK means having a stake in what could become foundational infrastructure for on-chain finance. The upside could be significant if Spark cements itself as a go-to liquidity hub, and if the community continues to drive smart governance that benefits token holders. However, one must weigh the uncertainties: high short-term volatility, a long road of token emissions, and all the typical unpredictability of crypto markets.

Disclaimer

This article is for educational purposes only and does not constitute financial advice. All investment strategies involve risk, including loss of capital. Please conduct your own research (DYOR) and consult with a licensed financial advisor if needed. Phemex does not guarantee returns or endorse third-party platforms mentioned.