Remember 2021? It was the year a single man could tweet a dog meme and add billions to a cryptocurrency's market cap in minutes. The "Musk Effect" was a force of nature—unpredictable, powerful, and wildly profitable for those on the right side of the trade. For a time, Elon Musk wasn't just participating in the crypto market; he was the market.

Those days are over.

But that doesn't mean his influence has vanished. It has evolved. It has become smarter, quieter, and potentially far more impactful.

This is the definitive guide to understanding that shift. We're moving beyond the historical tweet-pumps to provide a data-driven analysis of how Musk's role has transformed from a market mover to a fundamental infrastructure builder. This is the story of the "Musk Effect 2.0" and what it reveals about his true crypto endgame for X (formerly Twitter), Tesla, and the future of digital finance.

Key Takeaways:

-

The original "Musk Effect" (2020-2022) was driven by social media hype and caused extreme short-term volatility in assets like Dogecoin and Bitcoin.

-

This effect has significantly diminished due to market maturity, the introduction of Bitcoin ETFs, and investor fatigue.

-

The "Musk Effect 2.0" is a new, long-term strategy focused on integrating cryptocurrency into the core infrastructure of his companies, especially X.

-

X's pursuit of payment licenses across the US is the strongest evidence of this plan, pointing towards a future where crypto is used for payments on the platform.

-

Investors should now focus on Musk's business filings and product roadmaps rather than his tweets to understand his future impact.

The Peak of the Hype — A Visual History of the "Musk Effect 1.0"

To understand where we're going, we must first remember the chaos of the past. Musk’s influence in the 2020-2022 cycle was legendary, primarily focused on two assets: Bitcoin and Dogecoin.

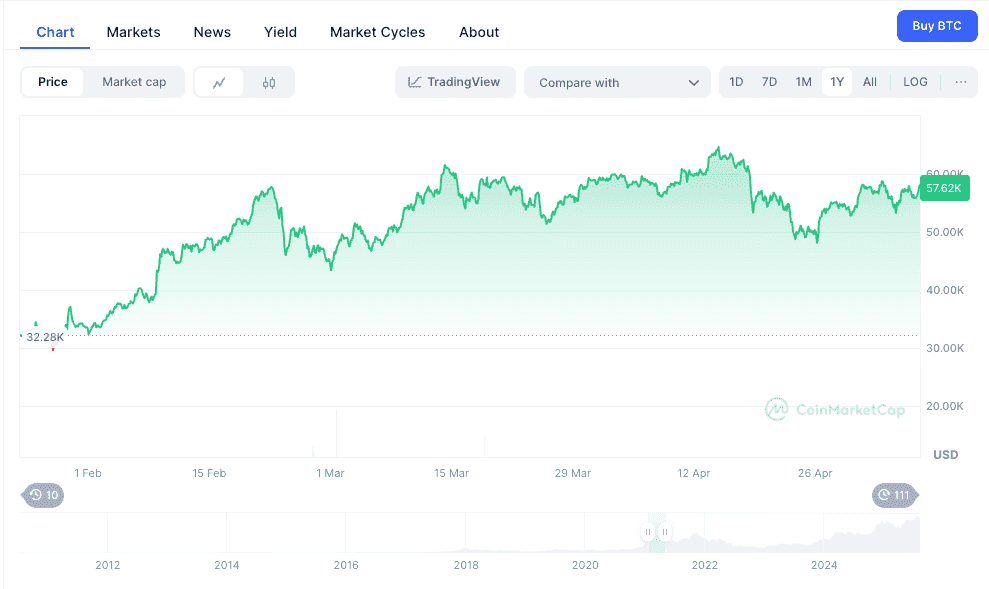

Bitcoin's Rollercoaster Ride

In early 2021, Musk strapped a rocket to Bitcoin. First, Tesla announced its monumental $1.5 billion BTC purchase, then it began accepting Bitcoin for vehicle payments. The market erupted in euphoria. But just as quickly, he pulled the plug, citing environmental concerns and sending the market into a tailspin.

The chart below tells the story better than words ever could, showing a direct and dramatic correlation between his announcements and Bitcoin's price.

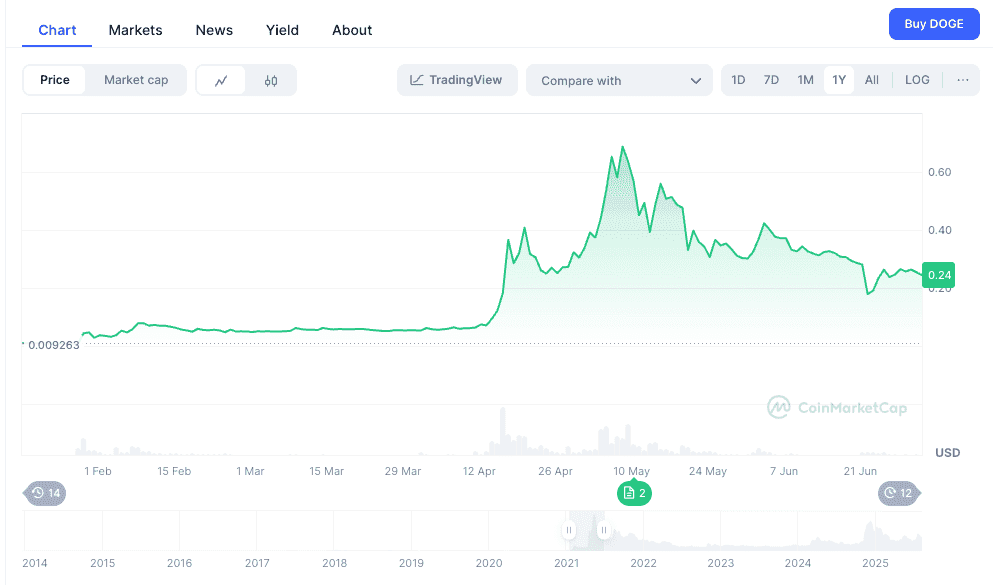

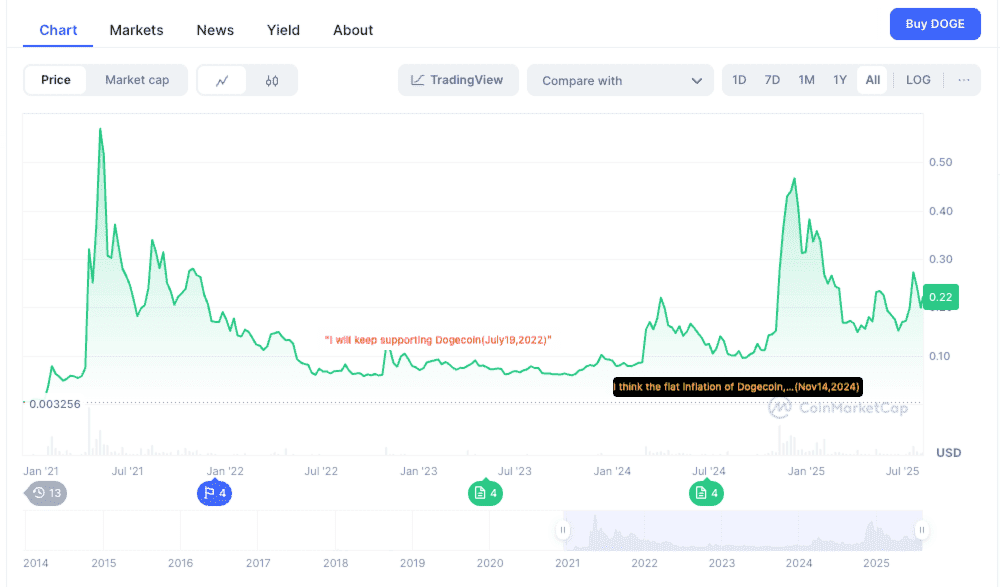

The Rise of the "Dogefather"

Musk's relationship with Dogecoin was even more direct. Through a relentless stream of memes and endorsements, he transformed a joke coin into a global phenomenon. He dubbed himself "The Dogefather," announced a literal mission to the moon funded by DOGE, and culminated his efforts with a highly anticipated appearance on Saturday Night Live. The hype was unprecedented, as was the subsequent "sell the news" event.

The Great Waning — Why the Old Magic Faded

If you've followed crypto recently, you've noticed that a new Musk tweet about DOGE no longer sends the price soaring by 30%. The market seems to have built up an immunity. A data-driven look shows this isn't just a feeling; it's a fact.

So, what happened? Three key factors are at play:

-

Market Maturity: The crypto market of today is not the market of 2021. With the launch of spot Bitcoin ETFs and the entry of trillions of dollars in institutional capital, the market is deeper and more resilient. Institutional players don't panic-sell or FOMO-buy based on a single tweet.

-

Predictability & Fatigue: The novelty has worn off. The market has learned Musk's patterns, and his erratic behavior is now largely "priced in." The element of surprise, which fueled much of the early volatility, is gone.

-

The Shadow of Regulation: In a post-FTX world, regulators like the SEC are scrutinizing market manipulation more than ever. While Musk operates on the edge, the implicit threat of regulatory action has likely tempered his most flagrant market-moving comments.

The Endgame — Uncovering Musk's Infrastructural Strategy (Musk Effect 2.0)

His influence hasn't disappeared; it has pivoted from short-term hype to long-term infrastructure. His new strategy is far more ambitious: to embed cryptocurrency into the very fabric of his global empire.

The "X" Factor: The "Everything App" with a Crypto Core

This is the centerpiece of his endgame. Forget the tweets and focus on the business filings. X Payments LLC, the financial arm of his social media giant, has been quietly securing money-transmitter licenses across the United States in states like Pennsylvania, Arizona, and Utah.

These licenses are not for show. They are the legal foundation required to build a peer-to-peer payment system directly within X. The logical roadmap is clear:

-

Phase 1: Enable traditional fiat currency payments.

-

Phase 2: Integrate cryptocurrencies for tipping, creator payments, and eventually, full e-commerce.

Dogecoin is the obvious first choice for integration. Its low transaction fees, massive community (cultivated by Musk himself), and brand as "the people's crypto" make it a perfect fit for X's vision.

This is the critical difference between Musk Effect 1.0 and 2.0. This isn't about pumping the price. It's about generating mass adoption through real-world utility. Integrating DOGE into X could seamlessly onboard hundreds of millions of users to crypto, an accomplishment most projects can only dream of.

Tesla's Balance Sheet: What the Data Says Now

Beyond hype, Tesla's actions provide concrete data. After its initial $1.5 billion purchase, Tesla sold a significant portion of its holdings. However, according to its most recent quarterly reports, the company continues to hold a substantial amount of Bitcoin on its balance sheet (currently valued at over $1.47 billion as of Q1 2025). This "HODL" strategy, maintained through extreme market volatility, signals a long-term belief in Bitcoin as a reserve asset, a far more powerful statement than any tweet.

Risks and Hurdles to Musk's Crypto Vision

Musk's path is not without challenges.

-

Regulatory Scrutiny: Integrating crypto into a massive social platform will attract intense regulatory oversight from the SEC and other global bodies.

-

Technical Challenges: Building a secure, scalable payment network that can handle millions of transactions per second is a monumental technical task.

-

User Adoption: Convincing hundreds of millions of users to switch from traditional payment methods to crypto, even one as simple as DOGE, will be a major hurdle.

The Definitive Elon Musk & Crypto Timeline (2019-2025)

For reference, here is a complete timeline of the key moments that define his journey.

-

February 2019: First calls Bitcoin's structure "quite brilliant" on a podcast.

-

December 2020: Publicly asks about converting Tesla's massive balance sheet to BTC.

-

February 2021: Tesla's official filing reveals its $1.5 billion Bitcoin purchase.

-

April 2021: Dubs himself "The Dogefather" on Twitter ahead of his SNL appearance.

-

May 2021: Hosts Saturday Night Live, leading to a massive "sell the news" DOGE crash.

-

May 2021: Reverses course, announcing Tesla will suspend Bitcoin payments due to environmental concerns.

-

January 2022: Tesla launches a merchandise section payable exclusively in Dogecoin.

-

October 2022: Officially completes his $44 billion acquisition of Twitter.

-

July 2023: Twitter officially rebrands to "X," signaling the "Everything App" ambition.

-

2024-2025: X Payments LLC successfully secures money-transmitter licenses across numerous US states, laying the groundwork for a native payment system.

Conclusion: From Volatility to Utility — How to Invest in the New Musk Effect

Elon Musk's role in the crypto space has undergone a profound and irreversible change. He has evolved from the market's greatest source of volatility into one of its most important potential infrastructure builders.

The takeaway for savvy investors is clear.

The smart money is no longer glued to Elon Musk's Twitter feed waiting for the next meme. It's watching X's job postings for blockchain engineers, Tesla's quarterly reports for changes in its digital asset strategy, and the public records of state financial regulators.

The Musk Effect 2.0 won't be triggered by a tweet. It will be unveiled in a product update or a regulatory filing. That is where the real, long-term opportunity now lies.

Frequently Asked Questions (FAQ)

Q1: Does Elon Musk still own Bitcoin?

A: Yes. While Musk's personal holdings are private, his company Tesla continues to hold a significant amount of Bitcoin on its balance sheet, valued at over $1.47 billion as of early 2025.

Q2: Will X (Twitter) use Dogecoin?

A: While there has been no official announcement, it is widely speculated that Dogecoin will be the first cryptocurrency integrated into X's payment system. This is due to Musk's public affinity for DOGE, its low transaction fees, and its strong community.

Q3: What is the "Musk Effect"?

A: The "Musk Effect" refers to the ability of Elon Musk's public statements, particularly his tweets, to cause significant and immediate price movements in cryptocurrencies like Bitcoin and Dogecoin. The effect was most prominent in 2021 but has since diminished.

Q4: Why did Tesla stop accepting Bitcoin?

A: In May 2021, Elon Musk announced that Tesla was suspending Bitcoin payments due to concerns over the "rapidly increasing use of fossil fuels for Bitcoin mining and transactions."