- Ticker Symbol: MYX

-

Current Price (Sept 9, 2025): ~$13.10

-

Blockchain (Chain): BNB Chain (cross-chain support: Arbitrum, Linea)

-

Market Cap: ~$2.59billion (rank ~#47)

-

Circulating Supply: ~197.1 million MYX (19.7% of 1 billion max)

-

All-Time High: $14.37 (Sept 9, 2025)

-

All-Time Low: $0.0467 (June 19, 2025)

-

ROI Since Launch: ~820× (+81,900%) from $0.009 IDO price

-

Listed on Phemex: Yes – MYX/USDT perpetual futures

What is MYX Finance?

MYX Finance is a decentralized exchange (DEX) for perpetual futures trading that aims to combine the benefits of centralized futures markets with DeFi’s transparency and self-custody. In simple terms, MYX lets users trade crypto perpetual contracts (derivatives with no expiry) on-chain, without an intermediary. Its standout innovation is a “Matching Pool Mechanism” (MPM) – a shared liquidity pool that matches long and short positions, enabling near zero slippage even for large trades. By aggregating liquidity in one pool (instead of fragmented order books), MYX solves the problem of thin liquidity and high price impact that many DEXs face. This means traders can enter and exit big positions without drastically moving the price.

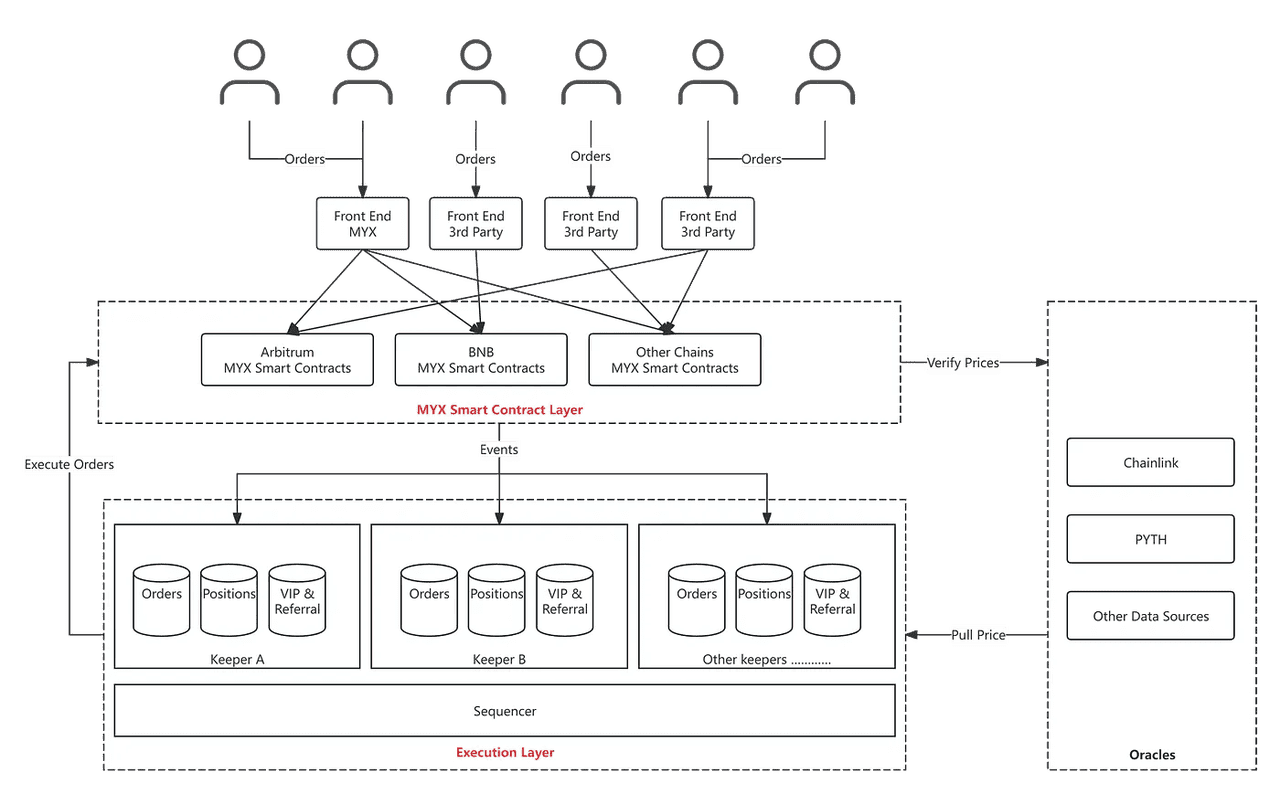

MYX Finance is multi-chain by design. The platform implements chain abstraction to support assets across 20+ blockchains without manual bridges. For example, a user on Arbitrum could trade a Solana-based asset via MYX, with the protocol handling cross-chain execution behind the scenes. This flexibility broadens access to many markets from one interface. Under the hood, MYX uses oracle price feeds (e.g. Chainlink oracles on BNB Chain, Arbitrum, and Linea) to power its pricing, ensuring accurate and tamper-resistant market data.

From a user perspective, MYX functions like a high-performance futures exchange: it offers up to 50× leverage on perpetual contracts while maintaining full collateralization to manage risk. Traders can long or short virtually any token as long as there’s an existing AMM market for it. This opens the door to perpetual trading on a wide range of altcoins that typically lack derivatives markets. All trades are non-custodial (you hold your keys), and a two-layer account system separates custody from execution, even enabling gas-free transactions via meta-transactions in some cases (meaning users aren’t slowed down by constant on-chain fees). In essence, MYX Finance’s value proposition is to deliver CEX-like speed and efficiency (zero slippage, high leverage, deep liquidity) in a DeFi setting, giving traders a new venue to deploy advanced strategies without trusting a centralized platform.

On the token side, MYX is the platform’s utility and governance token. It has a fixed supply of 1 billion tokens. Holders can stake MYX to earn a share of platform fees and receive discounted trading fees, aligning incentives for token holders with the exchange’s growth. Staked MYX also grants governance rights over protocol parameters. In summary, MYX tokens accrue value by powering the ecosystem: they reward users for providing liquidity or using the exchange, and give the community a say in key decisions. This token model, combined with MYX Finance’s innovative tech, positions it as a rising competitor to both centralized futures exchanges and other DeFi perp platforms.

MYX Finance Workflow Process (source)

Current Price & Market Data (September 2025)

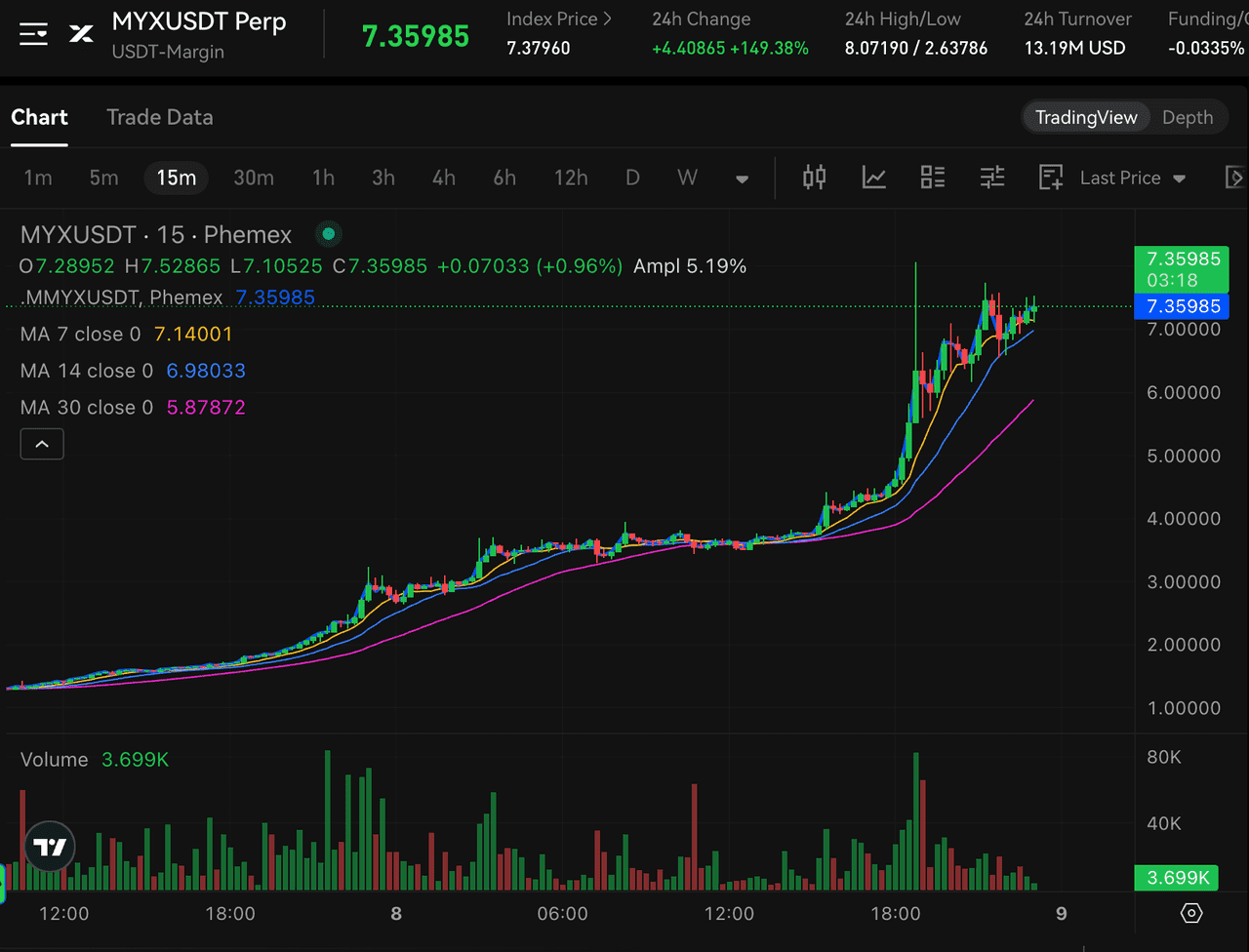

As of September 8, 2025, MYX is trading around $7.40 per token, just below its all-time high of ~$7.52 reached earlier that day. The price surged over +216% in the past 24 hours and an impressive +443% in the last week, reflecting a significant spike in trading interest. Over the past month, MYX's growth is approximately +500%, rising from about $1.20. With a current market capitalization of around $1.46 billion, MYX ranks #66 in global crypto rankings.

Trading volume is substantially high, with $449 million reported in the last 24 hours, making MYX the #1 daily gainer on CoinGecko. The market liquidity appears robust, especially on Bitget, where the MYX/USDT pair alone handled over $227 million. Despite this, its market cap is ~46× larger than its $31.9 million total value locked (TVL), indicating potential speculation.

Currently, MYX is trading just 1–2% below its record high, up approximately +15,750% from its all-time low of $0.0467 set on June 19, 2025. However, this rapid rise brings high volatility, with intraday price swings over 200%. Circulating supply is relatively low, with only about 197.1 million MYX available, which can amplify market fluctuations. The fully diluted valuation (FDV) is around $7.4 billion, showing potential growth if all tokens were in circulation. Overall, MYX is characterized by huge price gains, high trading volumes, and strong momentum.

Whale Activity & Smart Money Flows

MYX’s rise has been significantly influenced by whales and experienced traders, as on-chain data indicates that a few large players have orchestrated much of its price volatility. For instance, during the early August rally, six coordinated wallets executed 2,240 micro-buy orders on PancakeSwap, amassing approximately 6.72 million MYX (~$3.9M) and then consolidated these in a separate address. This strategy led to a ~260% price surge before the Aug 6 unlock, surprising many retail investors and priming the market for a short squeeze; Binance futures data noted negative funding rates, indicating many traders were short on MYX.

In early September, the token experienced a massive short squeeze, with over $39.7 million in MYX shorts liquidated within 24 hours. The cascading effect from these liquidations contributed to a sharp price spike, benefiting whales and early insiders who managed to cash out during the frenzy. Data also pointed to unusual patterns of MYX flowing through intermediary addresses before reaching exchanges, raising concerns about potential wash trading aimed at inflating trading volumes.

Notably, even seasoned traders can struggle with timing; for example, a top Binance futures trader, “Gou Da E,” held onto a long position during a price stagnation and eventually locked in a $30,000 profit, but missed further gains as the price soared past $7.

In summary, whale activity and smart-money behavior heavily influence MYX’s market dynamics. Retail traders often find themselves reacting to the moves of larger players, and signs of artificial volume indicate that the market can be misleading. Thus, attentive investors can benefit from tracking whale accumulation and exchange flows to anticipate potential price movements.

MYX/USDT Perpetual Futures Market on Phemex (source)

On-Chain & Technical Analysis

From a technical analysis standpoint, MYX’s recent price chart resembles a parabola, which could lead to sharp corrections. Key support is around $3.00, the breakout point from an earlier spike. Holding above this level is crucial for maintaining bullish momentum; otherwise, MYX could revert to the $1.5–$2.0 range. Resistance is at the all-time high of $7.50, with potential psychological barriers at $10 and approximately $11-$12 based on Fibonacci levels.

Technical indicators are showing extremes. The RSI reached ~98, indicating overbought conditions and often preceding a pullback. Although the MACD showed bullish trends, it suggested slowing momentum as price hit new highs. Moving averages also indicate that MYX is far above its medium-term means, with the 50-day EMA potentially offering support in the mid-$2 range if a dip occurs.

Volume analysis reveals a significant increase during breakout, with 1.47M tokens traded in a 4-hour candle. Declining volume during a pullback would be healthier than high volume on a decline, which could point to distribution.

On-chain metrics show over 200,000 unique addresses interacting with MYX, indicating strong community engagement. MYX's DEX had a total trading volume of $4.7B in its first year. Monitoring exchange inflows and outflows can provide insights into market behavior.

Lastly, open interest in futures surged during MYX’s rise. High open interest could fuel further price action but also raises the risk of liquidations if positions reverse.

Bottom line: The technicals and on-chain metrics show a market that went vertical and is likely to correct or consolidate. Key supports to watch are ~$5 (minor psychological level), $3 (major breakout level support), and below that the $1.5-$2 zone (previous range). Key resistance is the $7.5 ATH region, then $10 if it ever pushes higher. Indicators like RSI and funding rates have hit extremes that are usually unsustainable in the short term. MYX has proven it can defy gravity when a short squeeze is on – but gravity eventually applies to all assets, and steep parabolic moves often retrace a significant portion (50% or more) before finding equilibrium.

Fundamental Drivers

Several fundamental factors will drive MYX Finance’s value in the coming years, beyond just market speculation. Understanding these drivers can help assess whether MYX has an enduring edge or just short-term hype:

-

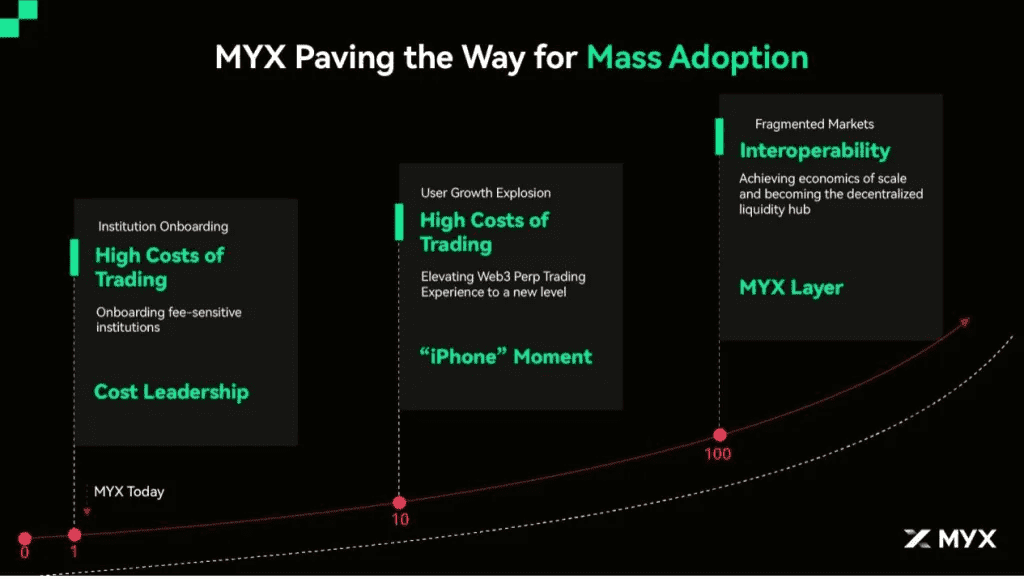

Innovative Technology & Trading Experience: MYX’s Matching Pool Mechanism (MPM) allows zero slippage trades through a unified liquidity pool, enabling large perpetual swaps without order book concerns. This could provide a strong edge over AMM-based exchanges. MYX supports trading across various tokens, attracting traders interested in leverage (up to 50x, with potential for 125x). If MYX enhances its trading engine for speed, low fees, and reliability, it could achieve a reputation for superior trading experiences, crucial for user retention.

-

Rapid Ecosystem Growth & Adoption: MYX has shown significant early growth, boasting over 200,000 addresses and $4.7B in volume within a year. Ongoing growth in active users, trading volume, and total value locked (TVL) is essential. MYX operates across multiple blockchains, allowing access to diverse trading communities.

-

Token Utility & Staking Rewards: MYX tokenomics incentivize holding through trading fee shares for stakers, making it appealing to revenue-focused investors. MYX holders receive fee discounts and may see increased demand from potential utilities, such as using MYX as collateral or for governance rights influenced by community decisions.

-

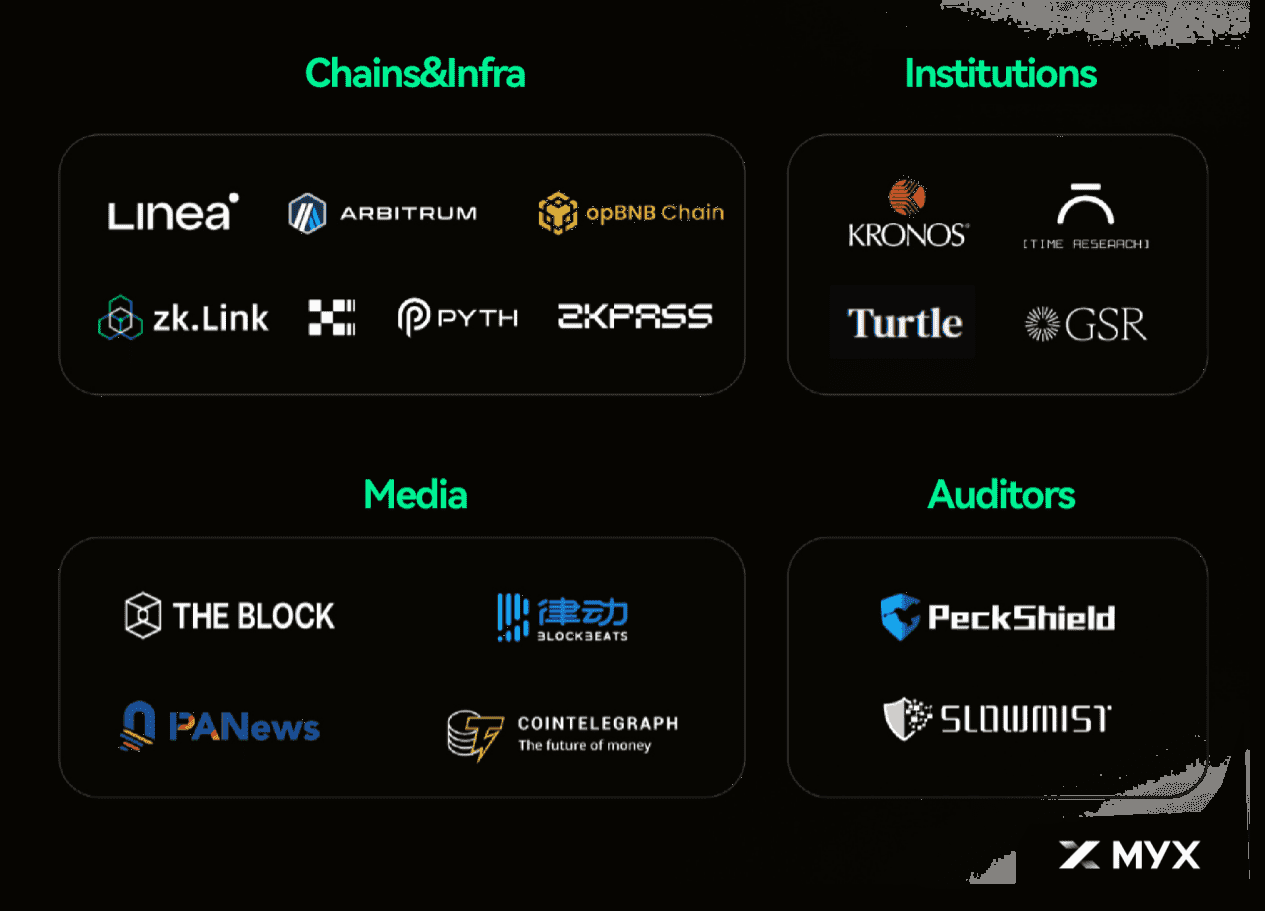

Backing and Partnerships: Backed by notable crypto venture firms and a successful funding round raising $5M, MYX gains credibility and potential partnerships. Integration with Chainlink oracles ensures reliable pricing for derivatives. Collaborations with other DeFi protocols and potential ties to Binance could further enhance its standing in the market.

In essence, MYX’s long-term success will hinge on whether it can deliver a superior decentralized trading product and continue to grow its user base in a sustainable way. Its unique tech (MPM zero slippage pool), multi-chain approach, and token incentive model are all strong fundamental pillars. If these are executed well, they give MYX a technological and network advantage that can drive value beyond short-term hype. On the other hand, these drivers have to overcome the challenges and risks listed in the next section.

MYX Vision and Goal Roadmap (source)

Key Risks

Despite its impressive rise, MYX Finance faces significant risks that potential investors should weigh:

-

Regulatory Risk: Operating as a decentralized perpetuals exchange, MYX exists in a regulatory gray area that could attract scrutiny from authorities globally. Restrictions or bans in certain jurisdictions could limit access and impact token value if DeFi derivatives trading is curtailed.

-

Token Dilution & Unlocks: With only ~19.7% of tokens currently circulating, upcoming unlocks could lead to token inflation. Significant sell pressure may arise from early investors taking profits, which could depress prices if demand doesn’t keep pace with supply.

-

Market Manipulation & Trust: Allegations of market manipulation, such as coordinated whale activity and wash trading, pose risks of inflated prices and a damaged reputation. Lack of trust may deter new investors if perceived as a manipulative asset.

-

Competition: The decentralized derivatives market is becoming increasingly competitive, with rivals like GMX and dYdX offering compelling alternatives. MYX must innovate continuously to retain user interest and avoid losing market share.

-

Project Execution & Development Risk: As a young project, MYX must effectively execute its roadmap amidst technical challenges. Failures, such as smart contract vulnerabilities or poor community engagement, could undermine user trust and project viability.

-

Macro and Sector Risk: Being a high-beta crypto asset, MYX is vulnerable to overall market conditions. A prolonged bear market could significantly hinder demand for speculative assets like MYX.

-

Token Economics & Governance Issues: Another risk is that the incentive structure might not be sustainable. MYX has been rewarding liquidity providers and stakers presumably via token emissions (40% of supply is for ecosystem incentives). If those emissions over time lead to sell pressure without proportional platform growth, it can become a spiral.

In summary, while MYX has huge potential, it is not short on risks. Prospective investors should be prepared for high volatility and the possibility that things could go awry.

Analyst Sentiment & Community Insights

Sentiment around MYX Finance is mixed, blending hype from rapid gains with caution from seasoned observers. On social media, particularly Twitter, many retail traders celebrate its price surge, calling MYX the next big thing in DeFi and highlighting its unique features. Analysts, however, express skepticism, noting unusual volume patterns and warning against potential wash trading. Discussions on Reddit compare MYX to past DeFi tokens that experienced boom-and-bust cycles, with advice to take profits.

Sentiment polls show about 60% of responses on CoinGecko are bullish, while 40% lean bearish or uncertain. MYX is categorized among speculative tokens driven by retail enthusiasm, indicating it might face a reversal. Influential traders share mixed views, advising caution while still recognizing MYX’s momentum.

In community channels like Telegram and Discord, users mostly share positive experiences, bolstering confidence. Currently, there are no major complaints, but any negative feedback could impact sentiment quickly. Overall, while community enthusiasm is strong due to recent gains, analysts warn about the possibility of a manipulated pump. Those considering MYX should heed both the bullish community insights and the cautious analysts' warnings, as shifting sentiment can occur rapidly.

MYX Finance Ecosystem Partners (source)

Is MYX Finance a Good Investment?

Determining whether MYX Finance is a good investment depends on your risk tolerance, time horizon, and belief in its fundamentals. MYX is a promising DeFi platform specializing in perpetual futures, attracting significant community interest and potential high returns. Analysts suggest it could reach $0.5–$1+ in the coming years, although this prospect comes with considerable risks.

The investment landscape is volatile, and prices can fluctuate dramatically based on market sentiment. It's critical for potential investors to be cautious, as MYX could quickly decline in value. Those looking at MYX should consider phased investing or trading with a strategy, like waiting for price dips or using stop-loss orders to manage risk.

While investing in MYX offers significant upside, it’s highly speculative, and investors should only commit funds they can afford to lose. For risk-tolerant individuals convinced by MYX's vision, it may be a suitable opportunity, but it's essential to conduct thorough research and monitor market developments actively.

Disclaimer: Cryptocurrency investments carry significant risk. The discussion above is for informational purposes and reflects conditions as of Sept 8, 2025. It is not investment advice. Always conduct thorough research and consider your own financial situation before investing.

Conclusion

For traders interested in MYX, Phemex offers a compelling venue to trade this volatile token. Phemex was among the first major platforms to list MYX/USDT contracts, and trading MYX on Phemex gives you a powerful, flexible, and secure environment to harness MYX’s volatility. You can utilize leverage to maximize potential returns, short the token if you think it will dip, and employ advanced order types to manage the wild price swings – all on a platform that’s built for professional-grade trading. Phemex’s early support for MYX demonstrates their commitment to listing promising assets, and it means as a trader you didn’t have to wait – you could trade the MYX rally from day one on a reliable exchange. Given MYX’s story is still unfolding, having access to it on Phemex positions you well to react to new developments, whether you’re trading short-term momentum or hedging a longer-term holding.