Contract trading is a form of cryptocurrency derivatives trading where you enter into an agreement (a contract) to speculate on a crypto asset’s price without actually owning the underlying asset. In simple terms, a trader and an exchange (such as Phemex) agree to settle the difference in an asset’s price from the time the contract is opened to when it’s closed. This allows traders to profit from price movements of Bitcoin, Ethereum, and other cryptocurrencies by going “long” (betting on price increase) or “short” (betting on price decrease) – all without ever touching the actual coins. By 2025, contract trading (also known as crypto futures trading) has become immensely popular, offering high leverage and new products like perpetual contracts, but it also comes with significant risks that new traders must understand.

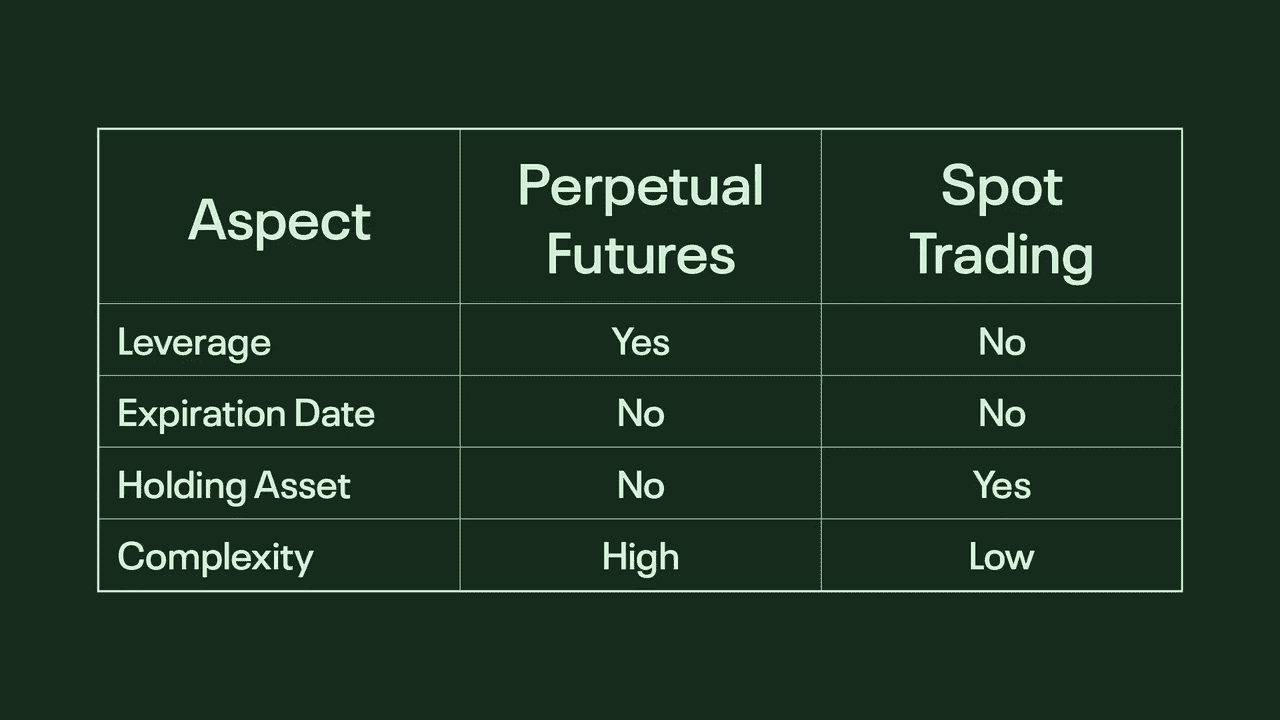

Contract trading differs from regular spot trading. In spot trading, you buy and own the actual cryptocurrency. In contract trading, you trade contracts tied to the crypto’s price – you do not own the coin, but rather a derivative that derives its value from the coin’s price. This key difference means contract traders can use leverage to multiply their exposure, and they can profit from both rising and falling markets.

What Is a Contract in Trading?

A contract in trading is the legal contract in which two parties agree to certain terms:

-

Exchanges: Agree to pay a higher sum of money proportionate to the trader’s initial investment should their trade end up profitable.

-

Traders: Agree to put up collateral and risk losing crypto assets should the trade go in the other direction.

Traders must choose margin for trading contract options. The margin is the amount of leverage a trader uses to increase their profit potential in proportion to the initial amount of money they’re investing. Traders can choose 2x, 3x, 5x, 10x, 50x, and up to 100x.

The risk-to-reward ratio in margin trading is proportional. If there’s a higher leverage multiplier, the profit potential increases substantially. The risk of liquidation increases with higher leverage as well because the trader is playing with borrowed capital.

Bitcoin Contract Trading: An Example

A trader wants to trade 1 Bitcoin on Phemex (at a price of $40,000 USDT), but they only have $400 USDT in their account. A 100x leverage trade would allow them to borrow money at a ratio of 100:1 and effectively trade with a whole Bitcoin worth $40,000.

The $39,600 price difference is considered borrowed capital. With leverage of this kind, the exchange can liquidate a trader if their position moves by a fraction of 1%. With smaller margin positions such as 3x, Bitcoin could shift more than 10% against the trader’s position and they still wouldn’t be liquidated.

If the position is open, the remainder of the funds deposited in the trader’s account act as collateral for the trade. A trader can’t lose more than what they have in their account as collateral.

Traders can open and close trades using limit and market orders — similar to spot trading. The only difference is the number of contracts purchased and the leverage used.

Perpetual Contracts and Funding Fees Explained

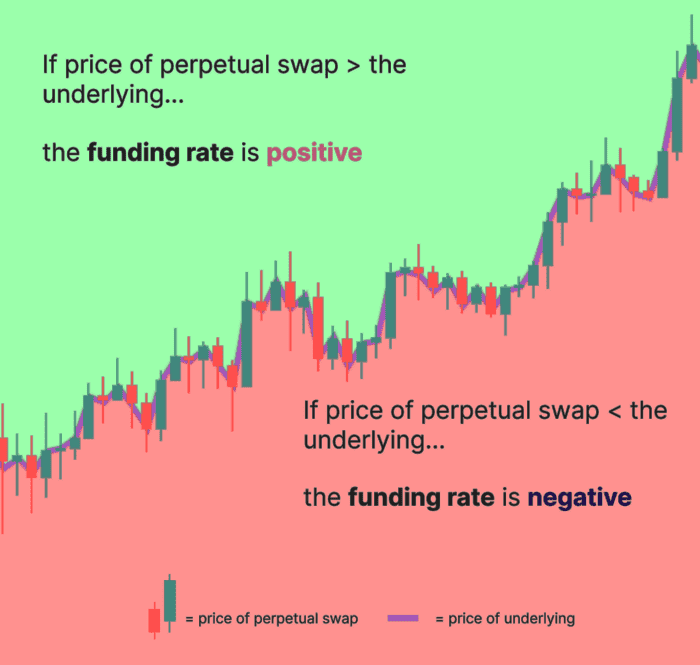

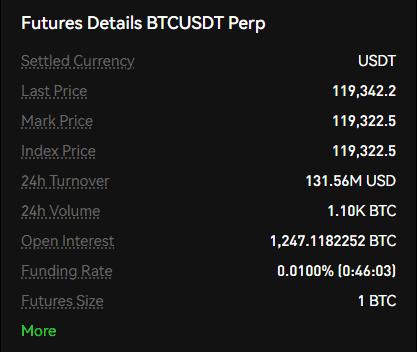

Perpetual contracts are a popular crypto derivative in 2025, differing from traditional futures by having no expiration date, allowing indefinite holding. Exchanges use funding rates to align perpetual prices with the underlying asset’s market price.

A perpetual contract acts like a futures contract without an expiry. For example, a BTC perpetual on Phemex tracks Bitcoin continuously, providing flexibility for traders who don't need to roll over contracts or worry about expiration.

Funding rates are necessary to prevent perpetual contracts from drifting from the spot price indefinitely. These rates are periodic payments exchanged between long and short traders. If the perpetual price exceeds the spot price, longs pay shorts a small percentage. This nudges prices toward the spot. Conversely, if the perpetual is below the spot, shorts pay longs, pushing the price up.

For instance, if the BTC perpetual on Phemex trades at $30,100 and the spot price is $30,000, a +0.03% funding rate means a long position of $100,000 incurs a $30 fee, while shorts receive that amount. These payments accumulate, especially important for long-term positions.

Traders should monitor funding fees, as high rates can impact profitability. In trending markets, funding can become costly for longs or beneficial for shorts. Funding rates are available on trading platforms and can serve as sentiment indicators.

In summary, perpetual contracts offer trading flexibility but come with the important consideration of funding fees. Traders, especially those involved in swing or position trading, should always check these rates before committing to a trade.

Crypto Derivatives Market Size

The crypto derivatives data we can extract from data aggregators shows that the daily crypto derivatives volume among all crypto exchanges is over $100 billion. Out of the total crypto derivatives market size, Phemex processes 2-3%, with a daily volume surpassing $2-3 billion.

The Bitcoin derivatives market comprises over 50% of the crypto derivatives market. In 2021, crypto derivatives beat spot markets by trade volume for the first time in history. Crypto derivatives are still new and maturing. They offer similar tools as traditional derivative markets.

The market for non-crypto derivatives worldwide is said to be worth over $1 quadrillion. This combines derivatives for assets such as stocks, forex, precious metals, and more.

Futures vs Spot Trading

Spot trading works by purchasing assets and taking ownership of them on a permanent basis. Derivative trading works by purchasing contracts related to the asset and the spot price dictates the profitability of these contracts.

Assets such as Bitcoin are not owned by the trader in derivative trading. Even in stock markets, derivative traders don’t actually own the shares. Phemex users can trade derivatives for most coins listed on our spot market. As a top crypto derivatives exchange, we aim to expand our contract offerings to all spot pairs listed on our exchange.

Traders retain full control over their trades when they trade derivatives. For instance, they can long/short, adjust leverage, set take-profit/stop-loss options, and close their positions with limit or market orders.

Derivative and Contract Trading Strategies

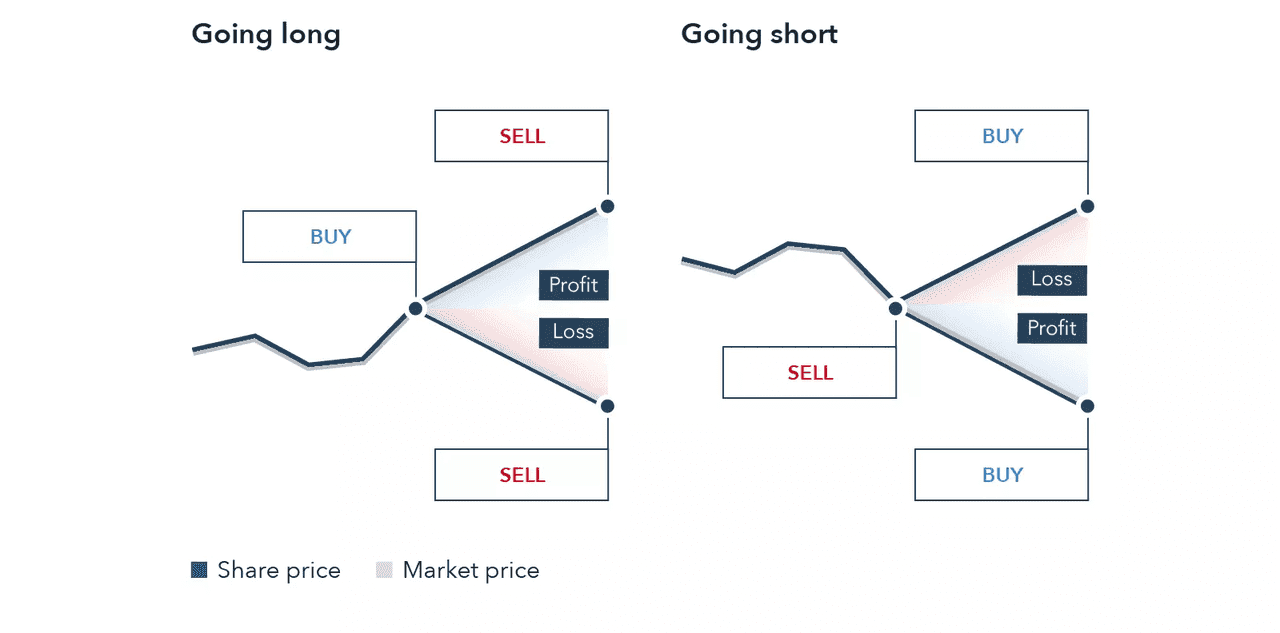

Cryptocurrency derivatives trading can be easy. Longing and shorting are the most-used derivative trading strategies, combined with leverage.

-

Long (Buy): Contract positions that bet the price of Bitcoin or an altcoin will increase.

-

Short (Sell): Contract positions that bet the price of Bitcoin or an altcoin will decrease.

If a trader opens a long (Buy) position on Bitcoin, the spot price has to go up in order for them to make a profit from the moment their trade is open. This means that if the price goes down, they risk losing a percentage of their assets.

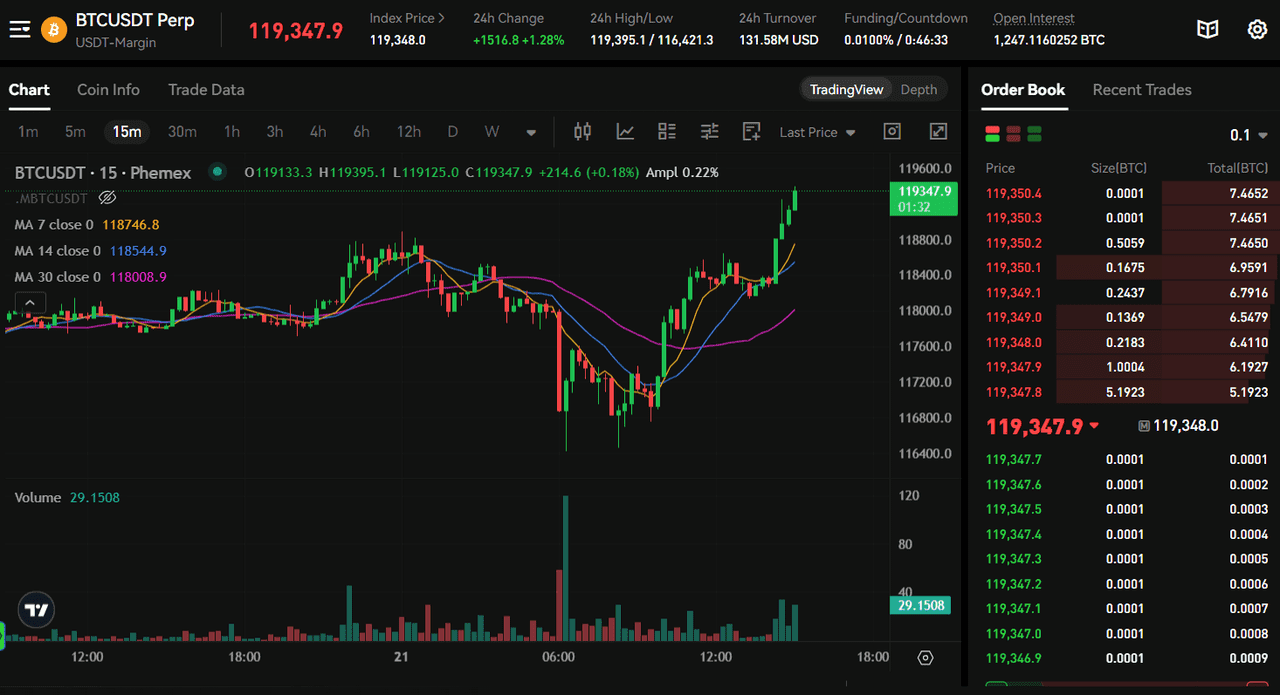

If a trader is using 100x leverage, the best strategy is to use the minute (1M, 5M, 15M) charts that show minor price fluctuations that affect the price. If they are using 3x leverage, they could rely on hourly (1H, 4H), daily (1D), or weekly (1W) charts to predict future price movements.

Contract trades are much shorter than spot trades because there’s more leverage involved. Traders take profit earlier to hedge against the risk of their position moving against them and close trades faster should the position move against them.

Benefits of Contract Trading in Crypto (Step-by-step Guide)

Crypto contract trading offers several key advantages over regular spot trading:

Leverage for Higher Gains: Leverage allows traders to control larger positions with less capital, significantly increasing potential profits. For instance, 10× leverage turns a 1% price move into a 10% return.

Profit in Both Markets: Traders can go long or short with ease, enabling profit opportunities even in bear markets. Many traders capitalized on shorting during the 2022–2023 downturn.

No Need to Hold Actual Crypto: Trading derivatives means you don’t deal with owning the coins, reducing risks such as hacking. However, be mindful of counterparty risks at the exchanges.

Capital Efficiency: Lower capital requirements and margin trading let you free up funds while still gaining market exposure. Some exchanges even allow stablecoins as collateral across different markets.

Hedging Tools: Investors can hedge risks in their portfolios, such as shorting ETH contracts if they anticipate a price drop, thus protecting their holdings.

24/7 Liquidity & Execution: Crypto contract markets provide continuous access and high liquidity, allowing for quick execution with minimal slippage and competitive fees.

Diverse Strategies: Contract trading supports various strategies like day trading, swing trading, and arbitrage, giving traders multiple ways to profit beyond just holding assets.

Perpetual Contracts: These contracts have no expiration, allowing traders to maintain positions indefinitely as long as they manage funding and avoid liquidation.

Access to Various Markets: Many exchanges offer contracts for a wide range of assets, making it easier to trade even less common tokens without direct ownership.

In summary, contract trading offers flexibility and strategic opportunities that traditional spot trading lacks, making it especially appealing for active traders. However, it also comes with increased complexity and risks that should be managed carefully.

Risks of Contract Trading and How to Manage Them

While contract trading can be appealing, it's essential to understand the associated risks due to the volatility of crypto markets. Here are key risks and management tips:

-

High Leverage Risk: Leverage can quickly diminish your capital. A 1% adverse move with 100× leverage results in total margin loss. Beginners should use low leverage (5× or below) and always calculate potential losses.

-

Market Volatility & Price Spikes: Sudden news can lead to rapid price swings that trigger stop-losses or liquidations. Avoid high leverage during major events and monitor economic calendars.

-

Liquidation Cascades: Liquidations can trigger further sell-offs, leading to rapid price drops. Maintain a healthy margin level to withstand volatility.

-

Funding Fee Costs: High funding rates can erode profits over time. Monitor funding rates and consider exiting high-cost positions.

-

Complexity and Platform Knowledge: Each exchange has distinct rules. Familiarize yourself with the platform’s operations through small trades.

-

Emotional Risk: Strong emotions can lead to poor decision-making. Stick to a trading plan and avoid impulsive actions.

-

Technical Risks: Ensure a stable internet connection and be aware of potential exchange downtimes, particularly for day trading.

Be vigilant and never trade more than you can afford to lose, use risk management tools, and be prepared for worst-case scenarios.

How to Trade Crypto Contracts on Phemex

If you’re new to contract trading, here’s a beginner-friendly walkthrough of how you would start trading crypto contracts on Phemex – one of the leading crypto derivatives exchanges. By 2025, Phemex offers a robust platform for trading perpetual futures on various cryptocurrencies with up to 100× leverage.

-

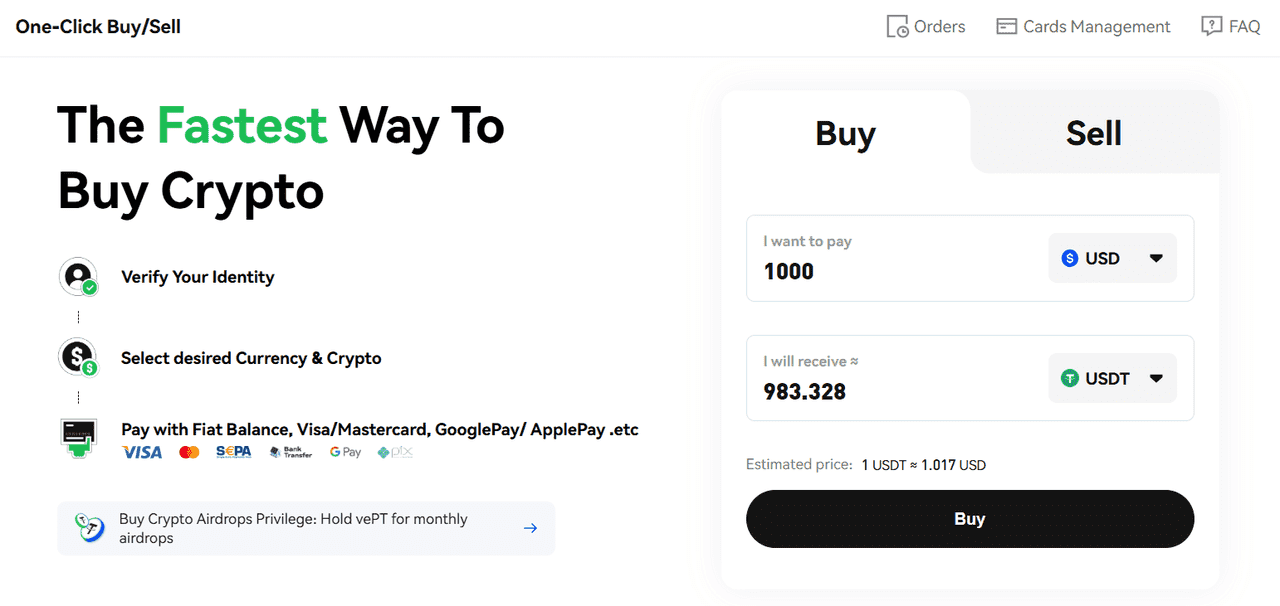

Create and Fund Your Phemex Account: If you haven’t already, sign up for an account on Phemex. Enable two-factor authentication for security. Once your account is set up, you’ll need to deposit funds. You can deposit crypto (e.g., USDT, BTC, ETH) from another wallet/exchange into your Phemex wallet. If you don’t own any crypto yet, Phemex has a “Buy Crypto” service where you can purchase crypto via credit card or bank transfer.

-

Transfer Funds to Contract Trading Account: Phemex typically separates your Spot account (for regular trading) and Contract account (for futures). After depositing, go to your Assets page. Move the amount you want to use for contract trading from your spot wallet to your contract wallet.

-

Choose a Contract Market: Navigate to the “Markets” or “Futures Trading” section on Phemex. You’ll see a list of available perpetual contracts (and possibly fixed-date futures). Common pairs are things like BTC/USDT perpetual, ETH/USDT perpetual, and many altcoins. Phemex continually adds popular crypto futures.

-

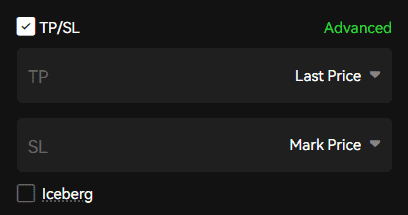

Understand the Trading Interface: Once you open a contract trading interface, you’ll see candlestick charts, the order book, and an order entry panel. Key elements include the leverage slider, order type, quantity, and take-profit and stop-loss options.

-

Open the Position: Double-check everything (especially that you intended to click “Buy/Long” vs “Sell/Short”). If all looks good, confirm the order. If it’s a market order, your position opens immediately at the current market price. If a limit order, it will open once the market reaches your specified price. After opening, you’ll see your Open Position details, typically in a panel below the chart:

-

Position size: e.g., 0.5 BTC (notional) long, or 10,000 contracts, etc.

-

Entry price: The average price where your position was opened.

-

Mark price: The current reference price used for P/L and liquidation (often an index price).

-

Unrealized P&L: Your current profit or loss if you closed now (this fluctuates with price).

-

Liquidation price: A very important number – if the market hits this price, you’ll be liquidated. Monitor how far it is from entry.

-

Margin used: How much of your balance is locked in this trade as collateral.

-

-

Monitor and Manage the Trade: Once the trade is live, you can add a stop-loss or take-profit (if you didn’t at entry, or adjust them). Keep an eye on market news and volatility. Also watch the funding rate if you plan to hold a long time, so you aren’t surprised by fees.

-

Closing the Position: You can close your contract trade at any time. If you’re in profit or you’ve had enough, you can either execute a market close or set a limit order to close at a specific price. Congratulations – you’ve completed a contract trade!

By following these steps, beginners can get a hands-on feel of contract trading in a relatively safe manner. Always start small – maybe trade with a tiny amount of capital at first to learn the ropes. As your confidence and knowledge grow, you can scale up your trading size. Phemex’s platform in 2025 is user-friendly, but the responsibility of managing risk is on you as the trader.

Conclusion

Contract trading is a part of crypto derivatives trading that allows traders to increase their profit margins by using leverage. To understand how contract trading works, users must be familiar with spot trading and crypto charts. Cryptocurrency derivative trading is recommended for intermediate and advanced users. As they carry higher risk, they should only be traded by people with a better understanding of the trading tools and the volatility of the crypto markets. For beginners, the world of crypto derivatives can seem complex at first, but with study and cautious practice, it becomes an invaluable part of one’s trading toolkit. Always remember: education and risk management are your best friends. Use tools like stop-loss orders, keep your leverage reasonable, and never trade more than you can afford to lose. The crypto markets in 2025 still offer tremendous opportunities, but they can be unforgiving to those who jump in carelessly.

Read More

- What is Contract Trading in Crypto & How does it Work?

- How To Trade Crypto: The Ultimate Investing Guide

- What are Crypto Derivatives & How do they Work?

- What are Crypto Derivatives: Most Popular Bitcoin Derivatives Explained

- What are Crypto Options & How do They Work?

- Crypto Trading vs. Investing: Key Differences Explained

- What are Crypto Futures & How do They Work?

- What Is CFD Trading? Is It Good For Beginners?