Decentralized exchanges (DEXs) have become a cornerstone of the crypto ecosystem by 2026. Top DEX tokens 2026 are attracting attention as more traders seek self-custody and permissionless trading options in the wake of past centralized exchange failures. These DEX projects facilitate billions in trading volume – for example, Uniswap handled over 915 million swaps and more than $1 trillion in volume during 2025 alone. In this neutral overview, we’ll introduce the DEX crypto sector, highlight top DEX tokens (by market prominence and usage), and discuss trends and risks. This list is for educational purposes only, not financial advice.

What Is the DEX Crypto Sector?

A decentralized exchange (DEX) is a peer-to-peer marketplace where cryptocurrency traders swap tokens directly, without a central intermediary. Unlike traditional centralized exchanges (CEXs) where users deposit funds and trades are matched on an internal order book, DEXs allow users to retain control of their assets in personal wallets while trading via smart contracts. This means you trade straight from your crypto wallet, and transactions are settled on-chain in a transparent manner.

DEX platforms come in various forms. Many use automated market maker (AMM) protocols (like Uniswap and PancakeSwap) where liquidity pools of tokens enable instant swaps at algorithmically determined prices. Others use order book designs or hybrids (for example, dYdX uses off-chain order books for derivatives). Common use cases in the DEX sector include:

Token Swaps: Swapping one crypto for another trustlessly (e.g. trading ETH for DAI on Uniswap).

Liquidity Provision: Users supply token pairs to AMM pools to earn a share of trading fees, but face risks like impermanent loss.

Yield Farming: Earning rewards (often paid in DEX tokens) for providing liquidity or staking on DEX platforms.

Cross-Chain Trading: Newer DEX protocols (e.g. THORChain) enable swaps across different blockchains without wrapped tokens.

Perpetuals and Derivatives: Decentralized perpetual swap exchanges (like dYdX and GMX) allow leveraged trading of crypto assets, mimicking some capabilities of centralized derivatives platforms.

How We Selected These Top DEX Tokens

With hundreds of projects in the DEX crypto sector, our list focuses on ten tokens that represent major decentralized exchange platforms or protocols as of 2026. Selection is based on a combination of market capitalization, user adoption, and importance to the niche – for example, total value locked (TVL), trading volumes, and role in DeFi. We also considered developer activity and ongoing innovations; the projects here have shown longevity or technical leadership. Additionally, ecosystem traction played a role – many of these DEXs have integrations or partnerships that indicate influence.

Now, let’s dive into the top 10 DEX tokens in 2026, their platforms, and what makes each noteworthy.

Top 10 DEX Tokens in 2026

1. Uniswap (UNI)

Uniswap is an Ethereum-based DEX protocol that popularized the automated market maker model. Launched in 2018, Uniswap enabled users to swap ERC-20 tokens directly from their wallets using liquidity pools instead of order books. It has since become a flagship DeFi project – by 2025 Uniswap recorded over 915 million swaps in a year and surpassed $1 trillion in annual trading volume, solidifying its position as the largest decentralized exchange by far. The platform’s native token UNI was airdropped to early users and governs the protocol’s development.

Uniswap is essentially the poster child for DEXs. It provides core trading infrastructure for the Ethereum ecosystem and beyond – numerous other DeFi services tap into Uniswap’s liquidity. The project’s innovation (AMMs with constant-product formula) solved the problem of illiquidity for long-tail tokens and inspired countless forked DEXs on other chains. Uniswap’s continued evolution also leads the sector: it introduced concentrated liquidity in Uniswap v3 for greater efficiency, and its upcoming v4 (teased in 2023) focuses on extensibility with customizable “hooks” for pool behavior.

2. Curve (CRV)

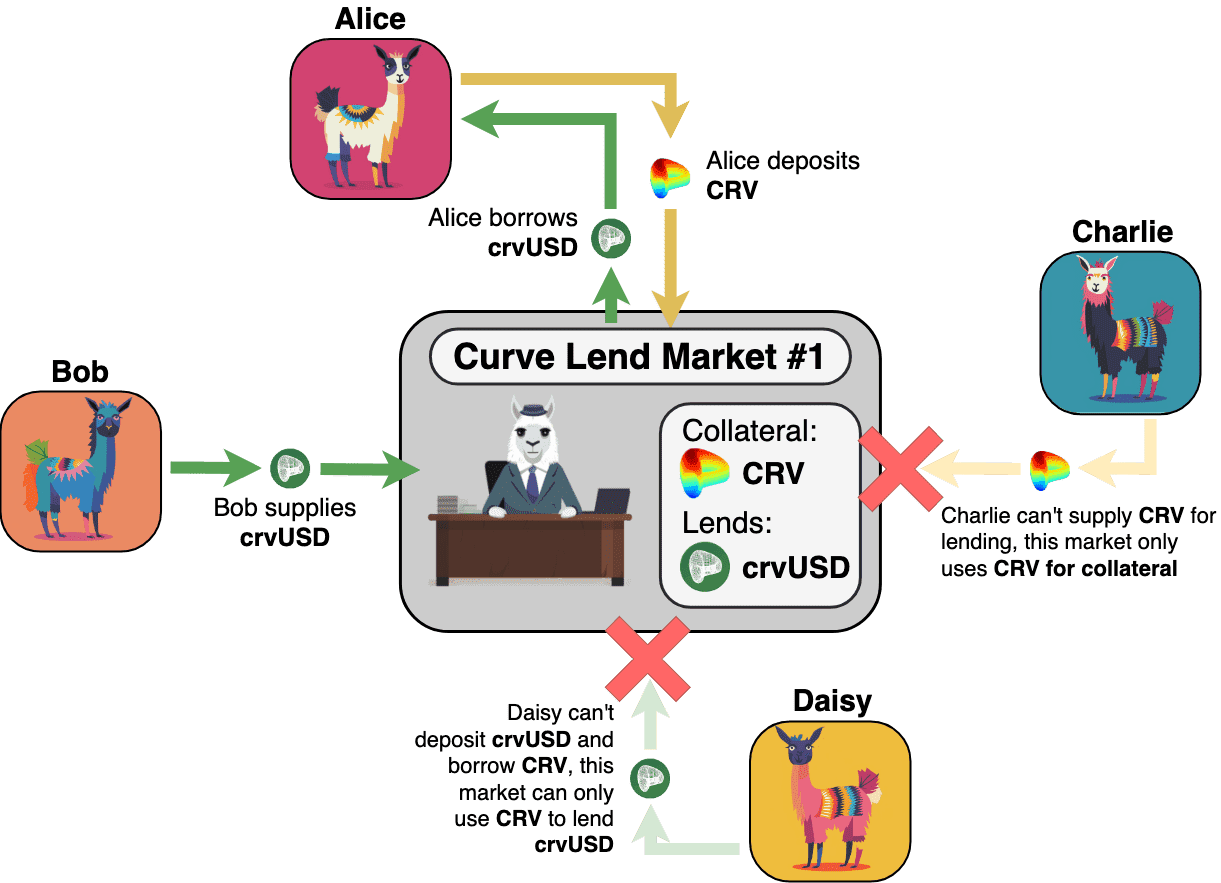

Curve Finance is a decentralized exchange specializing in stablecoin and pegged asset swaps. Launched in 2020 on Ethereum, Curve’s AMM is optimized for minimal slippage when trading assets that should have equal value (like USDC–DAI, or WBTC–renBTC). This niche focus made Curve a backbone of DeFi’s stablecoin and liquidity infrastructure. By 2026, Curve supports swaps across multiple chains (Ethereum and several Layer-1 and Layer-2 networks) and remains one of the largest DEXs by total value locked. Its native token CRV was introduced in 2020 and plays a central role in governance and incentive alignment (often referred to as “Curve’s veTokenomics”).

Curve fills a crucial role by enabling efficient trading of stablecoins and other pegged assets (like liquid staking derivatives) with very low fees and slippage. This makes it ideal for users and protocols that need to move large amounts of stable-value assets without significant price impact. For example, if you want to swap $1 million USDC to DAI, Curve offers a much tighter spread than a typical AMM. As such, many DeFi strategies rely on Curve for yield farming, stablecoin liquidity, and arbitrage opportunities. Curve’s model has been so influential that the competition to control its CRV emissions was dubbed the “Curve Wars” in DeFi circles.

Trade CRV Now

3. PancakeSwap (CAKE)

PancakeSwap is the dominant DEX on the BNB Smart Chain (BSC), known for its food-themed branding and gamified features. It launched in late 2020 and quickly gained popularity as a cheaper, faster alternative to Ethereum-based DEXs during times of high Ethereum fees. PancakeSwap uses an AMM model similar to Uniswap but has expanded into a broader DeFi ecosystem with yield farming, lotteries, NFT profiles, and more – all powered by its token CAKE. By 2026, PancakeSwap has grown beyond BSC and offers multi-chain support (including Ethereum and other networks), making it a multi-chain DEX platform.

PancakeSwap plays the role of the leading DEX in the BSC ecosystem, which is one of the largest blockchain environments by user count. It brought DeFi functionality to millions of users who preferred or migrated to BSC for its low transaction costs and high throughput. In doing so, PancakeSwap significantly increased the accessibility of DEX trading for retail users. The project’s success also demonstrated how a DEX can differentiate via community engagement – PancakeSwap introduced gamification (lottery, prediction markets, cute syrup-themed graphics) to attract users.

4. dYdX (DYDX)

dYdX is a decentralized exchange focused on advanced trading features like perpetual futures, margin trading, and spot markets for crypto assets. It emerged in 2019 on Ethereum as a pioneer in decentralized margin trading and has since become one of the top platforms for decentralized derivatives. In a significant shift, dYdX launched its own blockchain (an app-specific chain in the Cosmos ecosystem) in late 2023, aiming to improve performance and fully decentralize the order book and matching engine. The DYDX token was released in 2021 to bootstrap liquidity and governance, and by 2026 it serves as the governance token for the dYdX protocol on its independent chain.

dYdX occupies the decentralized derivatives niche – which is crucial because it offers traders an alternative to centralized exchanges for futures and leverage. While early DEXs like Uniswap handled spot swaps, dYdX brought more sophisticated trading (up to 20x or higher leverage on perpetual contracts) into the DeFi realm. This attracts a different segment of users, including more professional traders, and significantly increases on-chain trading volumes (perps can generate high turnover).

5. THORChain (RUNE)

THORChain is a decentralized exchange protocol that specializes in cross-chain swaps – it allows users to trade assets across different blockchains without using wrapped tokens or centralized bridges. Essentially, THORChain functions as a cross-chain AMM, with a network of nodes and liquidity pools that connect major chains like Bitcoin, Ethereum, Binance Chain, etc. Launched in mainnet form around 2021 (after earlier testnets and an incentivized beta called Chaosnet), THORChain has carved out a unique niche enabling native BTC-to-ETH swaps and many more combinations that typically aren’t possible directly on other DEXs. Its native token RUNE is integral to the network’s design, serving as the settlement asset and providing security. By 2026, THORChain continues to expand its supported chains and has introduced a slicker interface to broaden accessibility.

THORChain’s role is the bridge of DEXs – it brings interoperability to decentralized trading. In the broader crypto landscape, different blockchains are usually siloed (Bitcoin on its own chain, Ethereum on another, etc.), and swapping between them normally requires a centralized exchange or using synthetic/wrapped tokens. THORChain offers a decentralized liquidity network to swap truly native assets (e.g., real BTC for real ETH) in a non-custodial way.

6. 1inch (1INCH)

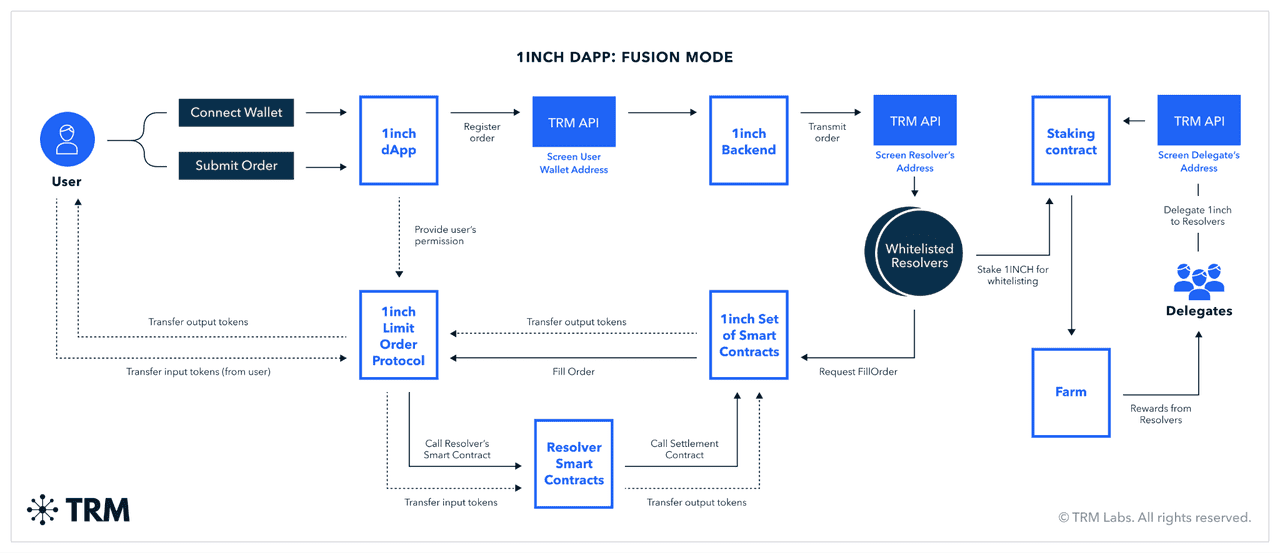

1inch is a DEX aggregator platform that sources liquidity from multiple decentralized exchanges to offer users the best prices for token swaps. Instead of being a single exchange, 1inch operates as a routing protocol: when a user wants to trade one token for another, 1inch’s algorithm (called Pathfinder) scans across dozens of DEXs and liquidity pools to find the most favorable swapping route, potentially splitting the trade across several venues to minimize slippage. Launched in 2019 during an ETHGlobal hackathon, 1inch has grown into one of the most widely used aggregators, expanding to support multiple chains. The 1INCH token was introduced in late 2020 and functions as a governance and utility token within the 1inch Network, which also encompasses features like a liquidity protocol and limit order protocol.

1inch’s role is to make the DEX ecosystem more efficient and user-friendly. With the proliferation of many DEXs (Uniswap, SushiSwap, Curve, Balancer, etc.), token prices can vary across platforms and liquidity can be fragmented. An aggregator like 1inch brings all that together, so a trader doesn’t have to manually check each DEX for the best rate. This not only ensures better deals for users (better execution prices by reducing slippage and optimizing path), but it also effectively increases overall DEX liquidity utilization by connecting pools.

7. SushiSwap (SUSHI)

SushiSwap is a community-driven DEX and DeFi platform that started as a famous fork of Uniswap but quickly developed its own identity and expanded multi-chain. Launched in late 2020 via a controversial “vampire attack” (incentivizing users to migrate liquidity from Uniswap), SushiSwap’s creators issued the SUSHI token as a reward to liquidity providers and a governance token. Despite early drama – including the pseudonymous founder “Chef Nomi” briefly running off with treasury funds then returning them – SushiSwap survived and grew into a full-fledged ecosystem. By 2026, SushiSwap operates on dozens of blockchains and rollups, offering not just AMM swaps but also features like lending, yield farming, launchpad, and an upcoming concentrated liquidity upgrade. SUSHI token holders govern the protocol and benefit from a portion of fee revenue (Sushi was one of the first DEXs to introduce fee sharing with token stakers).

SushiSwap’s journey has been one of decentralization and breadth. It proved that a community-led project could fork and compete with an established player, which galvanized the narrative of DeFi’s open composability. SushiSwap’s key role has been providing an alternative DEX platform with a strong emphasis on community. For traders and liquidity providers, SushiSwap often offered attractive rewards (especially early on via high SUSHI emissions) and a similar experience to Uniswap.

8. GMX (GMX)

GMX is a decentralized exchange platform specializing in perpetual futures and spot trading with a unique liquidity pool mechanism. Launched in late 2021, GMX gained prominence on Arbitrum (an Ethereum Layer-2) and later on Avalanche, by offering users up to 50x leverage on crypto perpetual contracts in a decentralized, user-friendly way.

It differentiates from order book-based perps (like dYdX) by using an automated market maker model where a single multi-asset liquidity pool (called GLP) acts as the counterparty to traders. The GMX token is the platform’s utility and governance token, notable for granting holders a share of the platform’s revenue (paid out in ETH/AVAX). By 2026, GMX has become one of the leading decentralized derivatives protocols, expanding to additional chains such as a version on Solana (GMX-Solana) and potentially others, all while maintaining a strong “real yield” narrative for token holders.

GMX’s role is as a leading decentralized leveraged trading platform, and it has significantly advanced the concept of “DeFi perps.” It provided an answer for retail users who wanted to trade with leverage without using centralized exchanges – fulfilling a similar need as dYdX but with a simpler pool-based approach. GMX proved that an AMM-style model could handle leveraged trading; its oracle pricing (using Chainlink) and large liquidity pool meant traders could execute big positions with relatively low slippage.

9. Osmosis (OSMO)

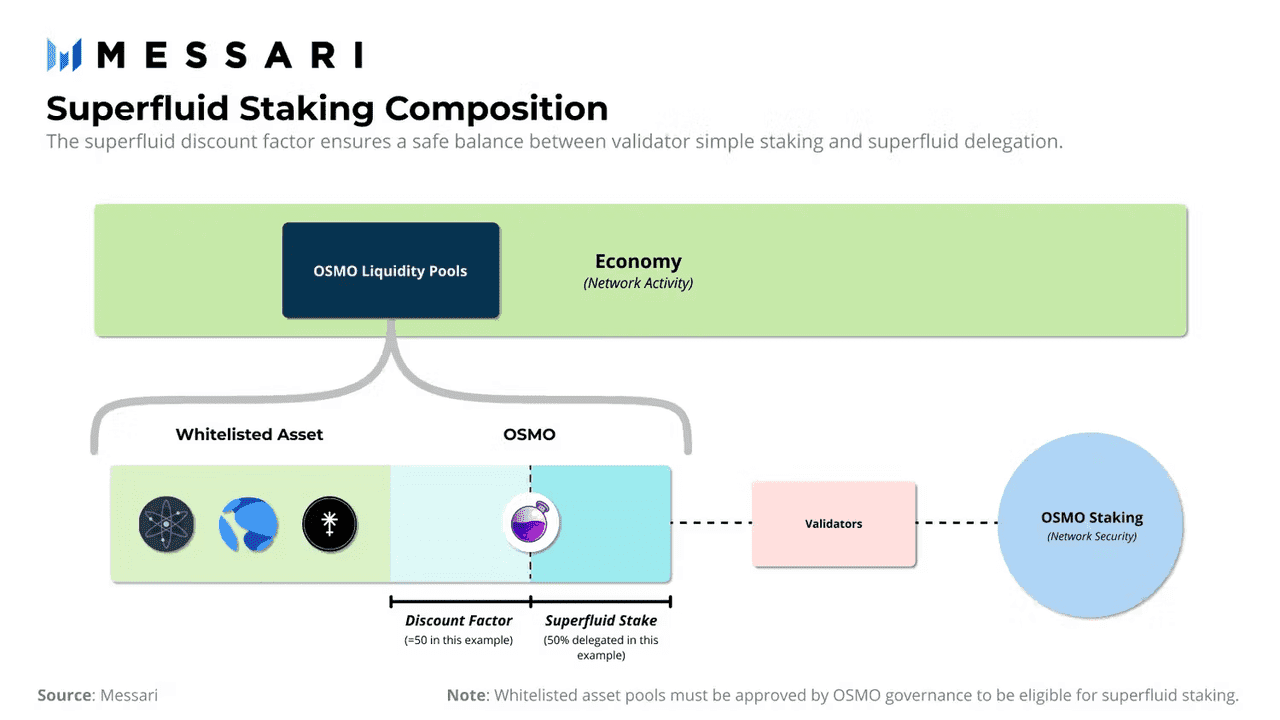

Osmosis is a decentralized exchange built on the Cosmos ecosystem, specifically as an application-specific blockchain (app-chain) using the Cosmos SDK. Launched in 2021, Osmosis quickly became the primary DEX for the Inter-Blockchain Communication (IBC) enabled networks (Cosmos “zones”), allowing seamless swapping of assets from various Cosmos chains (like ATOM, JUNO, AKT, etc.) in a unified interface. It operates an AMM with a focus on sovereignty (being its own chain) and customization of liquidity pools. The OSMO token is Osmosis’ native token, used for governance, staking (securing the chain), and as a liquidity mining reward. By 2026, Osmosis processes transactions across nearly 50 interconnected blockchains through IBC, making it a hub of liquidity in the Cosmos ecosystem.

Osmosis serves as the de facto DEX of Cosmos. In the Cosmos vision of many sovereign chains, Osmosis provides a neutral ground where assets from different chains can be traded trustlessly. It has been pivotal in bootstrapping liquidity for new Cosmos projects; when a new zone launches its token, listing it on Osmosis is the typical route to price discovery and liquidity. So Osmosis plays a role analogous to Uniswap/PancakeSwap in their ecosystems, but spanning multiple blockchains rather than one.

10. Balancer (BAL)

Balancer is an Ethereum-based automated market maker protocol known for its customizable multi-asset pools and dynamic fee options. Launched in 2020, Balancer extended the concept of AMMs beyond Uniswap’s model by allowing pools with up to 8 different tokens in any ratio, essentially acting as a self-balancing index fund where users earn fees for providing liquidity. The protocol’s flexibility made it popular for creating specialized pools (like token index funds, or stable asset pools) and it became a DeFi staple. Balancer’s governance token BAL was introduced in mid-2020, primarily to decentralize control and reward liquidity providers. By 2026, Balancer operates on Ethereum and multiple Layer-2s (Polygon, Arbitrum, Optimism) and powers other DeFi services (many projects build on Balancer’s pools for their yield or index products). It’s recognized as one of the best DEX tokens by market cap in the DeFi infrastructure segment.

Balancer’s role is as a flexible AMM platform and liquidity infrastructure. It is often described as a “Generalized AMM” because one can configure pools with different weights (e.g., 60/40, 80/20 ratios instead of 50/50) and multiple assets. This makes it more than just a DEX – protocols use Balancer to create index-like funds (like PieDAO or Index Coop did), or to manage treasuries (holding multiple tokens in one pool that automatically rebalances).

Trends Shaping the DEX Token Landscape in 2026

Several macro trends are influencing DEX projects and their tokens in 2026, reflecting both technological progress and the evolving regulatory climate:

Cross-Chain and Multichain Integration: The crypto landscape is evolving towards multichain DEXs, with protocols like THORChain and Osmosis, as well as established platforms like Uniswap and SushiSwap operating across multiple blockchains. By 2026, seamless cross-chain trading is expected, allowing users to swap assets easily, with bridge aggregators simplifying the process. DEX tokens may benefit from expanded utility in multi-chain liquidity networks that facilitate “omnichain” trading experiences.

Layer-2 Scaling and Performance Improvements: Layer-2 solutions (e.g., Arbitrum, Optimism) are enhancing DEX experiences by migrating transactions from expensive Layer-1 Ethereum, resulting in lower fees and faster settlements. This increased efficiency is driving DEX volumes up and encouraging token adaptations, like Uniswap's Layer-2 deployments. The DEX sector aims to provide a user experience akin to CEXs while maintaining decentralization.

Regulation and Compliance Features: As regulatory frameworks evolve, many DEXs are starting to explore KYC requirements and geo-blocking, especially for larger trades. While core contracts remain permissionless, regulatory compliance could influence token values. DEX tokens that manage to maintain utility without crossing into security territory may perform better, leading to more formal governance processes to address regulatory pressures.

Aggregator and Improved UX: By 2026, DEX aggregators like 1inch and Matcha are expected to dominate the trading landscape, offering unified access to liquidity and better pricing through smart routing. This trend favors large DEXs but may challenge smaller ones. Enhanced user experience features, such as simplified workflows and gasless trading, could encourage a broader user base to utilize DEXs without realizing it, indirectly boosting the popularity of DEX tokens.

Conclusion

The decentralized exchange sector in 2026 showcases a rich diversity of projects, each pushing the envelope in different ways. We have covered ten prominent DEX tokens – from Uniswap’s dominance in AMM trading, to dYdX and GMX opening the door for decentralized derivatives, to cross-chain innovators like THORChain and Osmosis, and others like SushiSwap, PancakeSwap, 1inch, Curve, Balancer contributing unique flavors to the ecosystem. This diversity means as a whole, the DEX sector is more resilient and versatile than it was a few years ago. There are DEXs focusing on stablecoins, on multi-chain swaps, on high-speed trades, on community governance, and so on. For users, this is a big win: competition drives better features, and one can choose a platform that fits their needs and risk appetite.

Crypto assets, including DEX tokens, are highly volatile and risky. Prices can whipsaw by large percentages in a single day. There is also operational risk in using DeFi platforms (technical glitches, hacks). Always do your own research (DYOR) beyond what’s been covered here. If needed, consult with financial professionals, especially if you’re risking a significant portion of your capital. And never invest money you can’t afford to potentially lose.