Summary

-

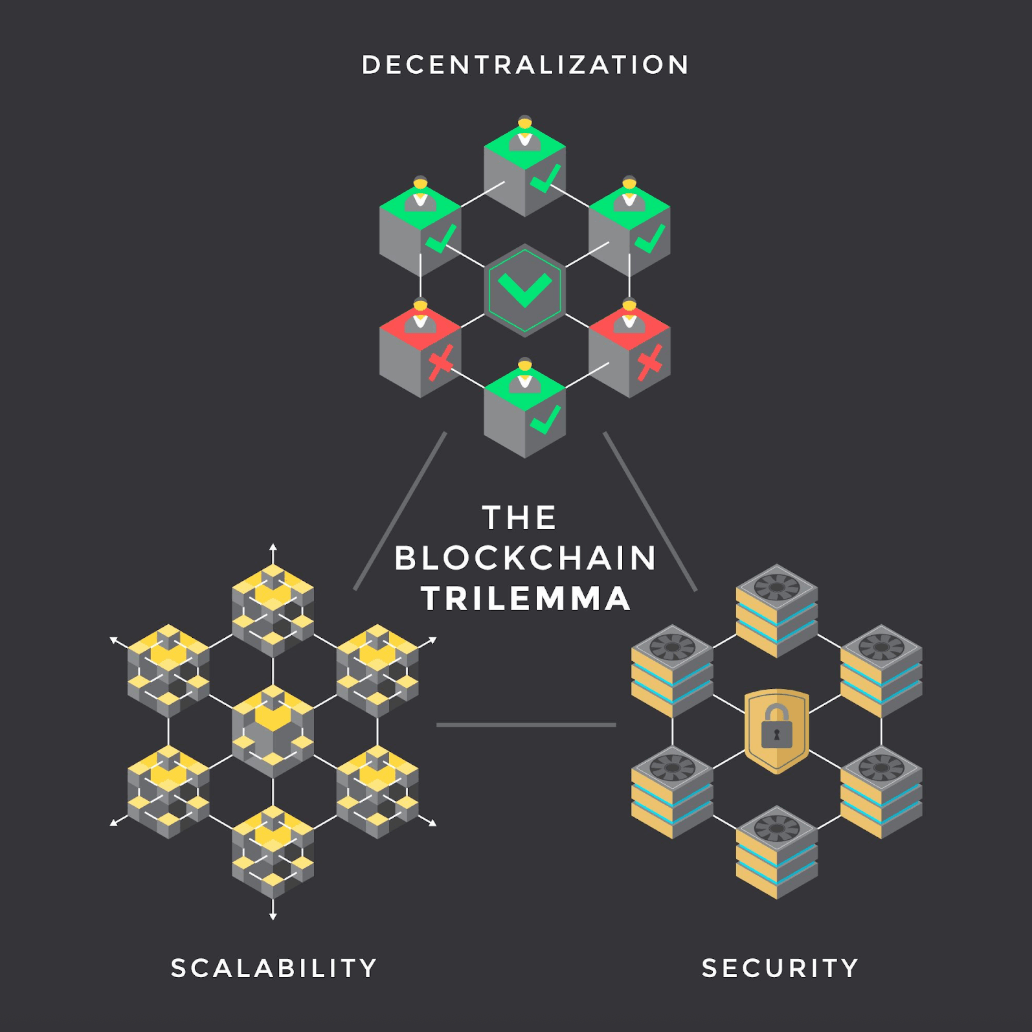

The Blockchain Trilemma refers to the challenge of achieving decentralization, security, and scalability simultaneously on a blockchain network. Typically, improving one aspect comes at the cost of the others, leading to fundamental blockchain scalability issues in today’s networks.

-

Is there a solution? The industry is tackling the trilemma through innovative designs. Layer 1 blockchains are upgrading their architectures (Ethereum’s move to 2.0, sharding, Solana’s high-speed design, etc.), and Layer 2 solutions (Lightning Network, rollups, sidechains) offload work to boost throughput. New paradigms like modular blockchains (e.g. Celestia) and advanced cryptography (zk-rollups) are emerging to balance security vs decentralization vs scalability.

Introduction

Imagine a blockchain network that is open to everyone, impossible to hack, and blazingly fast. It sounds ideal – but today’s reality is that blockchain developers face a tough compromise in achieving all three goals at once. This conundrum is known as the Blockchain Trilemma. In simple terms, a blockchain needs to be decentralized (no central authority, run by many nodes), secure (protects against attacks and errors), and scalable (able to handle thousands of transactions per second for worldwide use). The catch: improving one of these properties often weakens one of the others.

This challenge matters because for cryptocurrencies and blockchain applications to achieve mainstream adoption, they must compete with traditional systems that already offer high speed and security. For instance, Visa and Mastercard routinely handle 5,000–10,000 transactions per second with ease. Compare that to Bitcoin’s ~7 TPS or Ethereum’s ~15 TPS on their base layers, and you can see the gap. If blockchains can’t scale without sacrificing decentralization or security, they risk being too slow or too centralized for global use. In this Phemex Academy article, we’ll break down what the blockchain trilemma is, why it’s such a big deal, and how the latest Layer 1 and Layer 2 innovations are striving to solve the blockchain trilemma in 2025.

What Is the Blockchain Trilemma?

The blockchain trilemma is a concept coined by Ethereum’s co-founder Vitalik Buterin to describe the trade-offs in blockchain design. It posits that a blockchain network has three core desired properties – decentralization, security, and scalability – but can only fully optimize two at the expense of the third. In other words, you can’t have everything: if you want extremely high throughput (scalability), you might have to centralize or reduce security; if you insist on iron-clad security and decentralization, you will likely process transactions more slowly.

To an outsider, many blockchains appear to tick all three boxes. In reality, under the hood most networks lean into two out of three qualities. Let’s break down each pillar of this trilemma and see why it’s so hard to have it all:

The Blockchain Trilemma (Source)

The Three Pillars: Decentralization, Security, Scalability

1. Decentralization: Decentralization means no single entity or small group controls the network – control is distributed across many independent participants (nodes). This is the heart of why blockchains are considered trustless and censorship-resistant. In a decentralized network, anyone can join and help validate transactions, and the rules are enforced by code and majority consensus rather than by a central server or authority. Bitcoin, for example, is highly decentralized: tens of thousands of nodes worldwide keep the network running, making it nearly impossible for any authority to censor or alter transactions. Decentralization matters because it gives blockchain its open, permissionless nature – no bank or company can unilaterally freeze your funds or rewrite the ledger.

2. Security: Security is the ability of a blockchain to protect against attacks, bugs, and fraudulent behavior. A secure blockchain ensures that transactions are valid and final – no double-spending of coins, no unauthorized alterations, and resilience against hackers taking over the network. Security comes from a combination of cryptography (the math that secures digital signatures and hashing) and the consensus mechanism that the network uses to agree on the state of the ledger. For example, Bitcoin’s Proof-of-Work (PoW) makes it astronomically expensive to rewrite history – an attacker would need more computing power than 51% of the miners worldwide, which is practically unfeasible. This is why Bitcoin is often praised for its strong security. Similarly, after Ethereum’s transition to Proof-of-Stake (PoS) in 2022, Ethereum is secured by over half a million validators staking real ether – attacking it would require obtaining and risking an enormous amount of capital, providing a strong economic disincentive.

3. Scalability: Scalability is the capacity of a blockchain to handle a growing amount of work – typically measured in transactions per second and overall throughput. A scalable blockchain can process large volumes of transactions quickly and at low cost, even during peak usage. This is essential if we want blockchain to compete with mainstream payment networks or support applications with millions of users. For context, as mentioned, Visa’s network can theoretically handle up to ~20,000 TPS and usually averages a few thousand TPS comfortably. Early blockchains are far behind that level of throughput. Bitcoin’s ~5–7 TPS and Ethereum’s ~10–15 TPS mean if you try to use them for, say, all the world’s daily payments or a viral app, you’ll hit a wall. When Ethereum got extremely popular during surges like the CryptoKitties game craze in 2017 or the DeFi and NFT boom in 2020, the network became congested – transactions slowed down and fees skyrocketed due to limited capacity. Clearly, scalability is a major hurdle for wider adoption.

Why Can’t Blockchains Have It All? (Security vs. Decentralization vs. Scalability)

At its core, the blockchain trilemma is about trade-offs. There’s a reason no public blockchain has flawlessly optimized decentralization, security, and scalability at the same time – improving one often impacts the others.

-

Decentralization vs. Scalability: The more decentralized (open and distributed) a network is, generally the slower and less efficient it becomes. If anyone can run a node, many nodes will be slower or geographically far apart, making consensus take longer. For example, on a highly decentralized network, every transaction might need to be verified by thousands of nodes, introducing latency. In contrast, a more centralized system (fewer, trusted nodes) can be blazing fast because there are fewer “cooks in the kitchen.”

-

Scalability vs. Security: Making a blockchain faster often involves reducing redundancy or validation rigor. For instance, if you try to confirm blocks quicker or process more transactions in a short time, you might give up some security guarantees. A concrete example is setting very low fees and fast block times – it could invite spam or not allow enough time for global consensus, potentially increasing the risk of forks or double-spend attacks.

-

Security vs. Decentralization: One might assume these two always go hand-in-hand (since decentralization helps security by removing single points of failure), but there can be tension here as well. Extremely robust security measures or complex consensus algorithms can inadvertently centralize power. For example, a blockchain might rely on very expensive hardware or massive financial stake to secure the network. This ensures attackers need deep pockets, which is good for security, but it also means only a handful of wealthy or resource-rich entities can participate in block production – which hurts decentralization.

Trade-offs within the Blockchain Trilemma (Source)

In essence, the blockchain trilemma implies there is no free lunch. Each design decision in a blockchain protocol tilts the balance among the three pillars. Different projects prioritize different attributes based on their goals:

-

Bitcoin prioritizes security and decentralization (making it a superbly secure, uncensorable store of value) at the cost of raw performance.

-

Some newer chains prioritize scalability (high TPS and quick finality) but often do so by being more centralized or by reducing the rigorousness of decentralization. For instance, Solana can process thousands of TPS, but it achieves this partly by requiring powerful nodes and using a synchronized time mechanism (Proof of History) that, while innovative, means not everyone can easily run a node.

-

Other chains like Ripple (XRP Ledger) or Binance Smart Chain explicitly sacrifice decentralization – they have a limited set of validators – to maximize speed and throughput for payments or DeFi transactions. These look more like traditional systems with a blockchain veneer, trading off the trustless ideal for scalability.

Approaches to Tackling the Trilemma (Layer 1 and Layer 2 Solutions)

Blockchain innovators have not admitted defeat to the trilemma – instead, they’ve come up with creative strategies to improve scalability without fatally compromising security or decentralization. Broadly, these strategies fall into two categories:

-

Improving the base layer (Layer 1) – upgrading the blockchain’s core protocol and infrastructure to make it more scalable.

-

Offloading work to secondary layers (Layer 2) – keeping the base layer lean and secure, while handling extra transactions on top of it.

There’s also a new category of modular architectures that blur the line between L1 and L2 by splitting a blockchain’s responsibilities into separate layers by design. Let’s dive into the major approaches with examples from recent years:

Layer 1 Innovations: Making Blockchains Themselves More Scalable

? Ethereum 2.0 (The Merge and Sharding): Ethereum is a flagship example of an L1 evolving to solve the trilemma. In 2022, Ethereum performed “The Merge,” transitioning its consensus from Proof-of-Work to Proof-of-Stake. This dramatically reduced energy usage and set the stage for future scalability upgrades. The next big step on Ethereum’s roadmap is sharding – splitting the blockchain into 64+ smaller chains (shards) that share the load. Each shard will process a portion of transactions in parallel, and a central Beacon Chain will coordinate them. In theory, this could boost Ethereum’s throughput to tens of thousands of TPS when fully implemented.

? New Consensus Mechanisms: Several modern blockchains use alternative consensus algorithms designed for speed and decentralization. For example, Avalanche introduced a unique consensus where nodes repeatedly sample each other in a gossip fashion to quickly reach agreement – this allows thousands of nodes to confirm transactions with finality in under a second, and Avalanche achieves potentially 4,500+ TPS on its main chain. Another approach is Algorand’s Pure Proof-of-Stake, which uses a technique called verifiable random functions to randomly select a small committee of validators for each block from the wider token-holder pool. Because the committee is randomly chosen and changes every block, the network can remain decentralized (anyone with the minimum stake has a chance to be selected) yet the block confirmation is fast and efficient (only a small group has to agree at any moment). Solana’s Proof of History + PoS is another innovation: Solana uses a cryptographic clock to order transactions before consensus, speeding up validation. It reaches 50k TPS in theory (typically a few thousand TPS in practice) and 400ms block times, using a network of over 1,000 validators.

? Sharding in Practice (NEAR, Polkadot): Ethereum isn’t the only one sharding. NEAR Protocol launched with sharding from the start, splitting its blockchain into multiple “chunks” processed in parallel, and it dynamically adjusts the number of shards based on load. Polkadot takes a slightly different route with its “parachains” – parallel blockchains that plug into a central Relay Chain. Each parachain can be considered a shard specialized for certain tasks, and the Relay Chain’s validators secure them all. Cosmos also enables many independent chains that interconnect, though each zone has its own validators. These projects show that dividing work is a viable way to scale L1s, albeit with added complexity.

Layer 1 vs. Layer 2 solutions (Source)

Layer 2 Solutions: Scaling on Top of Secure Base Layers

While some developers work on making Layer 1 stronger, others choose a different philosophy: keep the base blockchain (L1) as decentralized and secure as possible, and move the heavy lifting of transactions off-chain to a Layer 2. Layer 2 solutions essentially create a secondary framework where most transactions occur, and only minimal summary information or commitments are recorded on the main chain. This relieves congestion and dramatically increases effective throughput, all while inheriting the security of the underlying Layer 1 for final settlement.

Common Layer 2 approaches include:

-

State Channels: This concept allows participants to transact privately off-chain and only submit the final results to L1. A famous example is Bitcoin’s Lightning Network. Two parties lock a certain amount of BTC in a multi-signature address (opening a channel), then they can send countless payments between each other by just exchanging signed messages (which re-distribute the funds) instantly. These payments are not broadcast to the entire blockchain – only the participants see them. When they’re done, they post one final transaction to the Bitcoin blockchain (closing the channel) that reflects the net result.

-

Sidechains: A sidechain is an independent blockchain that runs in parallel to the main chain (L1) but is pegged to it in some way (usually via a bridge). Sidechains can have their own validators and rules optimized for speed. Users can move assets from the main chain to the sidechain, use the sidechain for faster/cheaper transactions, then move assets back. One example is Polygon (formerly Matic Network), which started as a sidechain for Ethereum. Polygon’s POS sidechain processes transactions much faster and cheaper than Ethereum’s mainnet by using its own set of validators (which is somewhat less decentralized than Ethereum’s). It checkpoints periodically to Ethereum (submitting hashes of its state) to boost security, but it doesn’t rely on Ethereum’s consensus for every transaction.

-

Rollups (Optimistic and ZK): Rollups are the shining stars of Ethereum’s scaling strategy in 2023–2025. A rollup executes transactions off-chain, but regularly posts a compressed summary of those transactions back to the Ethereum main chain. By doing so, the heavy work is done off-chain, and Ethereum only needs to verify a proof or brief data representing many transactions. There are two main types of rollups:

-

Optimistic Rollups: These assume transactions in a batch are valid and publish them to Ethereum with a minimal footprint. They “optimistically” don’t do any heavy computation on L1 unless challenged. If someone spots a fraudulent transaction in the batch, they can submit a fraud proof within a challenge window to prove something was wrong, and the invalid batch is reverted. Because of this mechanism, optimistic rollups like Arbitrum and Optimism can achieve huge throughput gains (hundreds to thousands of TPS per rollup) and only occasionally use L1 for dispute resolution. The downside is a slight delay in finality – users might wait ~1 week to be absolutely sure their funds withdrawn from the rollup aren’t challenged.

-

ZK Rollups (Zero-Knowledge Rollups): These are more advanced – they generate a validity proof (using zero-knowledge cryptography) that mathematically proves the off-chain transactions were correct. This proof is posted to Ethereum, and Ethereum’s nodes can verify this succinct proof without re-running all the transactions. If the proof checks out, the batched transactions are all confirmed final (no need for a challenge period, since the correctness is guaranteed by math). ZK rollups can thus offer near-instant finality and very high security, essentially equivalent to L1, because invalid batches simply cannot produce a valid proof. Examples of ZK rollups include StarkNet, zkSync, and Loopring.

Modular Blockchain Designs: A New Frontier (Separation of Powers)

Beyond the straightforward L1 vs L2 distinction, there’s a rising concept of modular blockchains. Traditional blockchains are monolithic – each node does everything (execution of transactions, reaching consensus, ensuring data availability, etc.). Modular blockchains split these tasks into different layers or modules that specialize in one function. By doing so, each layer can scale and optimize independently, working together to form a complete system. This approach directly targets the trilemma by not forcing one single network to do all three tasks at once.

For example, Initia (INIT) aims to combine Layer 1 security with customizable Layer 2s. The modular trend is just beginning, but it points toward a future where decentralization and security are handled by a lean base layer, and scalability is achieved by many execution layers working at once.

Modular Blockchain Spectrum (Source)

Has the Blockchain Trilemma Been Solved?

Despite the remarkable progress in recent years, it’s safe to say no blockchain platform has completely solved the trilemma as of 2025 – at least, not in the sense of achieving maximal decentralization, security, and scalability all at once. Every approach involves some trade-off, even if minimal. However, the landscape has shifted dramatically towards workable compromises:

-

Bitcoin remains decentralized and secure, and through Layer 2 (Lightning) it has improved scalability for payments. But on-chain, Bitcoin deliberately does not prioritize high TPS, so the trilemma is managed by pushing most activity off-chain. This means Bitcoin the base layer hasn’t “solved” it so much as sidestepped scalability to secondary layers, which is a valid approach but requires users to trust those channels for everyday transactions.

-

Ethereum post-merge is far more scalable than it was a few years ago, thanks to the flourishing of rollups. The combination of Ethereum + rollups is arguably one of the first instances of largely overcoming the trilemma for general-purpose applications: Ethereum provides decentralization and security, while rollups provide scalability. Users on rollups like Arbitrum or zkSync today enjoy fast, cheap transactions with security derived from Ethereum. Once Ethereum adds data sharding (expected in the next couple of years), the capacity for rollups will multiply, truly allowing the network to serve mass adoption. So, while Ethereum hasn’t at base layer solved the trilemma, its multi-layer design might achieve the end-goal (scalable and secure & decentralized) in aggregate.

-

Alternate L1s (Solana, Avalanche, Algorand, etc.) each chose a different point in the decentralization–security–scalability spectrum. None of them can claim all three in full. Solana, for instance, leans toward scalability and fairly good security but is less decentralized. Avalanche aims for a middle ground: higher decentralization than Solana (more validators) but also high speed with sub-second finality. It hasn’t reached the decentralization level of Ethereum or Bitcoin, but it’s significantly more scalable. These trade-offs were conscious design choices. The “Layer 1 wars” of 2021–2022 showed that different users and developers were willing to accept different balances (some cared more about low fees and speed, others about trustlessness). Today, there is an understanding that no single chain will suit every need, and that’s okay. We might use Bitcoin for ultimate security, Ethereum for decentralized apps with scaling via L2, Solana for high-performance needs, etc., each optimizing a different corner of the triangle.

-

Modular and Multi-Chain Ecosystems: We’re also seeing that instead of one chain to rule them all, a network of interconnected chains might collectively solve the trilemma. The Cosmos ecosystem with many app-chains, Polkadot’s parachains, and Ethereum with its rollups all point to a multi-chain future. In such a future, the question is less “did one chain solve it?” and more “does the network of chains provide decentralization, security, and scalability collectively?” The rise of bridging protocols and interoperability means users might not even need to know which chain they’re on – they’ll just use the application, and behind the scenes the load is distributed across many specialized chains or layers. This is one vision for overcoming the trilemma: not by concentrating all qualities into one blockchain, but by architecting the crypto ecosystem in layers and segments that, as a whole, achieve the desired properties.

Conclusion

The blockchain trilemma – balancing decentralization, security, and scalability – has been crypto’s biggest technical challenge for over a decade. It is the reason we don’t yet see a blockchain replacing Visa or the New York Stock Exchange outright: every improvement comes with a trade-off. However, the industry’s response to this challenge has been one of relentless innovation. From on-chain solutions like proof-of-stake and sharding, to off-chain solutions like rollups and state channels, to completely new architectures like modular blockchains and DAGs, the gap is steadily closing. In 2025, the trilemma isn’t fully solved, but it’s also not stopping progress. For crypto users and builders, understanding the blockchain trilemma is crucial because after all, it’s the endgame that projects around the world are collaboratively striving to achieve.