Summary:

- Compound is a DeFi lending and borrowing protocol; according to its official website, its total value locked (TVL) is about $3.5 billion as of 19 June 2022.

- It lets users deposit and lend out funds in exchange for earning yield or interest at a rate determined algorithmically according to supply and demand; other users can then borrow funds by putting up crypto collateral.

- It uses smart contracts to store and manage these transactions, meaning lenders enjoy the benefit of earning interest without having to trust a third party such as a bank, with their funds.

Launched in 2017, Compound Finance is a project that seeks to build a decentralized (DeFi) money market with efficient and frictionless operations.

At the time of writing, Compound Finance crypto, COMP, trades at $27.84 per token with a circulating supply of over 7.1 million for a market cap of about almost $200 million.

What Is Compound?

In finance, compounding refers to money’s ability to grow exponentially over time. The reinvestment of profits earned from an initial sum results in compounded returns with each cycle. In the world of cryptocurrencies and DeFi, Compound crypto (COMP) is a project that offers users the opportunity to grow their crypto investments exponentially without a middleman.

Compound Finance offers a decentralized open-source platform that brings the lending and borrowing capabilities of traditional finance to crypto. Built as an autonomous money market on the Ethereum network, Compound Finance uses blockchain technology to cut costs and improve efficiency. The platform’s algorithm is designed to enable both individuals and institutions to earn interest on their digital assets as lenders, when they provide liquidity to the DeFi markets. Meanwhile, users seeking a loan can borrow directly from these liquidity pools without negotiating with counterparties or authorities.

How Compound Finance Works

Just like a bank, Compound Finance allows users to deposit their digital assets to earn interest, just as they would in a typical bank savings account. The core objective is to offer retail and institutional users an avenue to leverage their digital assets’ time value.

Compound employs smart contracts to store and manage the capital deposited to the platform, with its algorithm autonomously determining interest rates for loans.

Because it is an open-source platform, anyone can connect to the protocol with a crypto wallet and immediately start earning interest on their crypto assets or start borrowing. Similarly, smart contracts enable borrowers to access loans in the form of other digital assets supported by the platform by collateralizing their crypto assets, doing away with the need for lengthy background checks.

How the Lending and Borrowing Process Works on Compound Finance

To earn interest on crypto assets, a user has to use a Web 3.0 crypto wallet such as Metamask. The user then links the wallet to the Compound platform and supplies liquidity to one of the available liquidity pools by locking his funds in the platform for a given period of time. Lenders can supply a variety of cryptocurrencies such as ETH, DAI, BAT, USDT, ZRX, and REP, to mention a few.

Once liquidity is supplied, the platform’s Mint Function is executed to generate a token that represents a portion of the lender’s contribution to the liquidity pool. This is the cToken (more details on the cToken below). cTokens are sent to the lender’s account in exchange for the supplied liquidity. These determine how much interest one will receive.

On the other hand, borrowers can access loans from these pools by paying pre-determined interest rates. These payments are then shared among liquidity providers based on the ratio of their contributions. The algorithm can detect real-time changes in every coin’s supply and demand and set each crypto asset’s interest rates accordingly.

Borrowers on Compound have to provide collateral in the form of another crypto asset to receive a loan. A collateral factor is then assigned to the borrower based on their supplied assets. For example, suppose a borrower supplied 100 BAT coins as collateral, and the collateral factor for BAT is 50%. In that case, the borrower will only be able to borrow another crypto asset with an equivalent value of 50 BAT. Every crypto asset on Compound comes with its crypto collateral factor. Borrowing more than your account’s collateral factor leads to the liquidation of your account.

The Compound Finance liquidation process is another of the project’s important features. When a borrowing account is liquidated for exceeding its collateral factor or failing to pay back a loan, a liquidation incentive is put in place for other users to repay a portion of the outstanding borrowed amount in exchange for a portion of the collateral. Upon payment of an outstanding loan, the borrower’s collateral is released and can be freely redeemed or transferred to other wallets.

Compound Finance Crypto: cToken

cTokens are redeemable tokens native to the Compound Finance ecosystem that represent a portion of a liquidity pool. For example, if an individual deposits ETH into the protocol, the algorithm will convert ETH to cETH. Likewise, depositing Litecoin (LTC) will lead to a conversion of LTC to cLTC.

It is the cETH or cLTC that earns interest proportional to the amount of liquidity it represents in its pool. Because cTokens are ERC-20 tokens generated in the Compound protocol, the user’s actual digital assets (in this case, ETH) never leave the lender’s wallet. However, within the time that liquidity is provided to the platform, the user will not be able to transfer the ETH to another wallet unless they exit Compound’s market.

Compound Finance’s COMP Token

The COMP token is another token on the Compound ecosystem, and it is used as a governance token that gives holders the rights to make proposals and vote on the direction of the platform.

About 42% of the total supply of 10 million COMP tokens is reserved to be earned by platform users. These COMPs are first placed into a Reservoir contract, and 2,312 COMP tokens are allocated per day to markets in a fixed allocation for distribution. The COMP supply on the platform is split 50:50 among liquidity providers and borrowers. These COMPs can be earned through participation in voting and other governance activities on Compound.

Compound Finance has transformed into a decentralized governance structure from its previous centralized model. COMP token holders can influence the listing of new cToken markets, update oracle addresses on the platform, and even update the platform’s interest rate model. The decentralized community of COMP token holders and their delegates are now in charge of governing and managing the Compound ecosystem.

Token holders with 1% COMP can delegate and propose various governance actions. Any address with voting power is allowed to participate in any proposal’s voting process on the platform. For a proposal to be implemented, it has to receive a minimum of 400,000 votes. The proposal is dropped if it fails to achieve this minimum requirement.

Who Is Behind Compound Crypto (COMP)?

Robert Leshner, an alumnus of the University of Pennsylvania, is one of the founders of Compound Finance. Leshner worked as a principal at Cerity Partners, a financial services provider based in New York. He was also involved in the internet industry and was a Product Lead at Postmates, an online food delivery service powered by Uber.

Another co-founder and fellow alumnus of the University of Pennsylvania, Geoffrey Hayes, has a background in software engineering. He worked as an engineering manager at Postmates and became Leshner’s long-time collaborator. They both co-founded Safe Shepherd, an identity protection service provider, and were the heads of the firm before selling it in 2015.

Leshner and Hayes currently hold executive positions at Compound Labs, an open-source software development company that backs the Compound protocol. Leshner currently serves as CEO, and Hayes as CTO. Compound Labs manages the Compound ecosystem, including Compound Finance and Treasury (a platform that helps traditional financial technology and institutions access to DeFi interest rates), and others.

COMP Price History

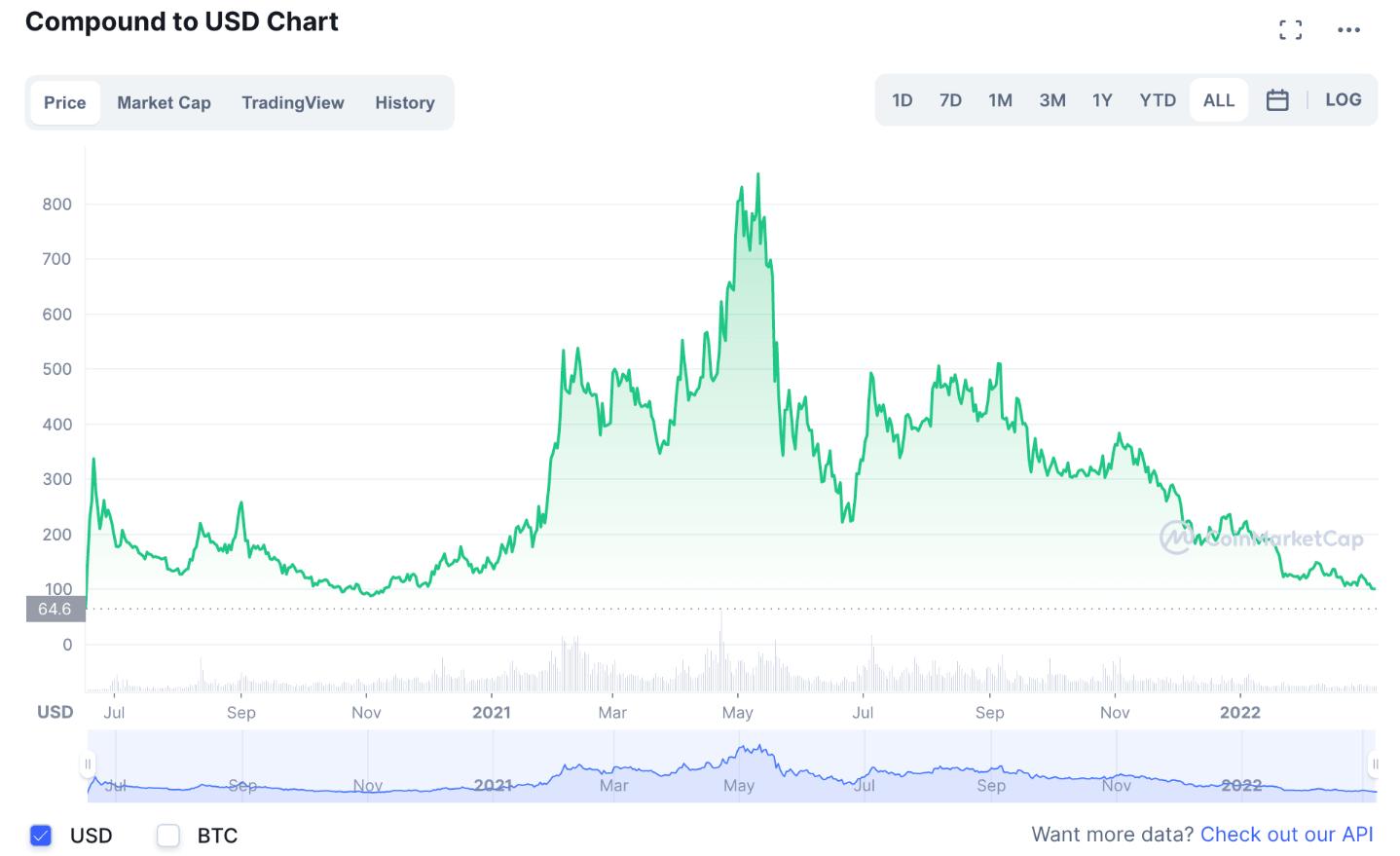

The COMP token’s initial coin offering (ICO) was reported to have taken place on 15 June 2020. Based on CoinMarketCap’s earliest available data from 2020, COMP’s price skyrocketed from $64.64 on 17 June to $337.05 on 21 June, soon after its listing. It was a remarkable 421% increase in just a matter of days. However, COMP plunged to $87.64 on 3 November.

COMP price chart from 2020 to 2022 (Source: CoinMarketCap)

In 2021, the entire crypto market was in a bullish uptrend as a result of the Bitcoin boom. COMP’s price regained momentum and hit a high point of $534.09 on 5 February. This rise could also be attributed to Compound’s launch of Gateway, a Substrate blockchain that functions as a cross-chain interest rate market.

While its price plummeted to $346.53 on 24 March, the rally soon resumed, and COMP reached an all-time high of $911.20 on 12 May, coinciding with the launch of the Compound Treasury.

After crashing by more than 60% to $342.96 on 23 May before falling further to $221.85 on 21 June. In November, Bitwise, the world’s largest crypto index fund manager, invested in COMP through the newly established Compound fund, and COMP traded at $383.49 on 3 November before dropping again to $180.98 on 13 December.

From the beginning of 2022, as the crypto market trended downwards, COMP similarly dropped to a 90-day low of $112.19 on 24 January, and at time of writing is trading at $27.84. COMP currently ranks #109 on CoinMarketCap in terms of market cap.

The Future of COMP: How Safe Is Compound Finance?

In October 2021, a faulty upgrade to the protocol caused some $160 million to be at risk. Users started to receive millions of dollars in free COMP tokens, in what was considered as one of the biggest-ever losses involving smart contracts.

After Compound founder Leshner asked users to voluntarily return the tokens via a tweet, about $38.7 million was recouped. Compound assured the public that no supplied or borrowed funds were at risk, but this incident may have contributed to the loss of its market leadership.

While it was one of the earliest lending protocols in crypto, Compound Finance has since been overtaken by competitors such as MakerDAO, Aave and Curve Finance in a fiercely competitive market. With a TVL of some $3.5 billion however, it remains a formidable and resilient player with active development activity in an industry that is still extremely nascent.

How does COMP play against Competitors?

How to Buy Compound Crypto (COMP)?

Phemex offers both spot and contract trading for investors to choose from. However, for beginning crypto buyers, spot trading is recommended. To buy COMP on Phemex, follow the instructions below.

1 The first step to buying cryptocurrency on Phemex is to go to the Phemex homepage, register for an account, and select Markets.

2 On the Markets tab enter COMP into the search bar on the top right, immediately after, the COMP/USDT trading pair will appear below – select Trade to move on to the next step.

2 On the Markets tab enter COMP into the search bar on the top right, immediately after, the COMP/USDT trading pair will appear below – select Trade to move on to the next step.

3 You will then be redirected to the Phemex trading platform for the COMP/USDT pair. To do a simple spot trade we recommend doing a market order where you can buy COMP at the market price. To do so, select Market, enter the amount of USDT you want to buy of COMP, and click Buy COMP.

Read More

- Aave (AAVE) vs Compound (COMP): Which Is The Better Staking Platform?

- What Is cETH: The Currency of Compound’s Ethereum Lending Pool

- What Is DeFi: How To Be Your Own Bank With $100

- What is Cream Finance (CREAM): Lending Protocol

- What Does the DeFi Hype Mean for ETH?

- https://phemex.com/academy/defi

- What is Crypto Lending?

- What is Coin98 (C98): All-In-One DeFi Trading Platform