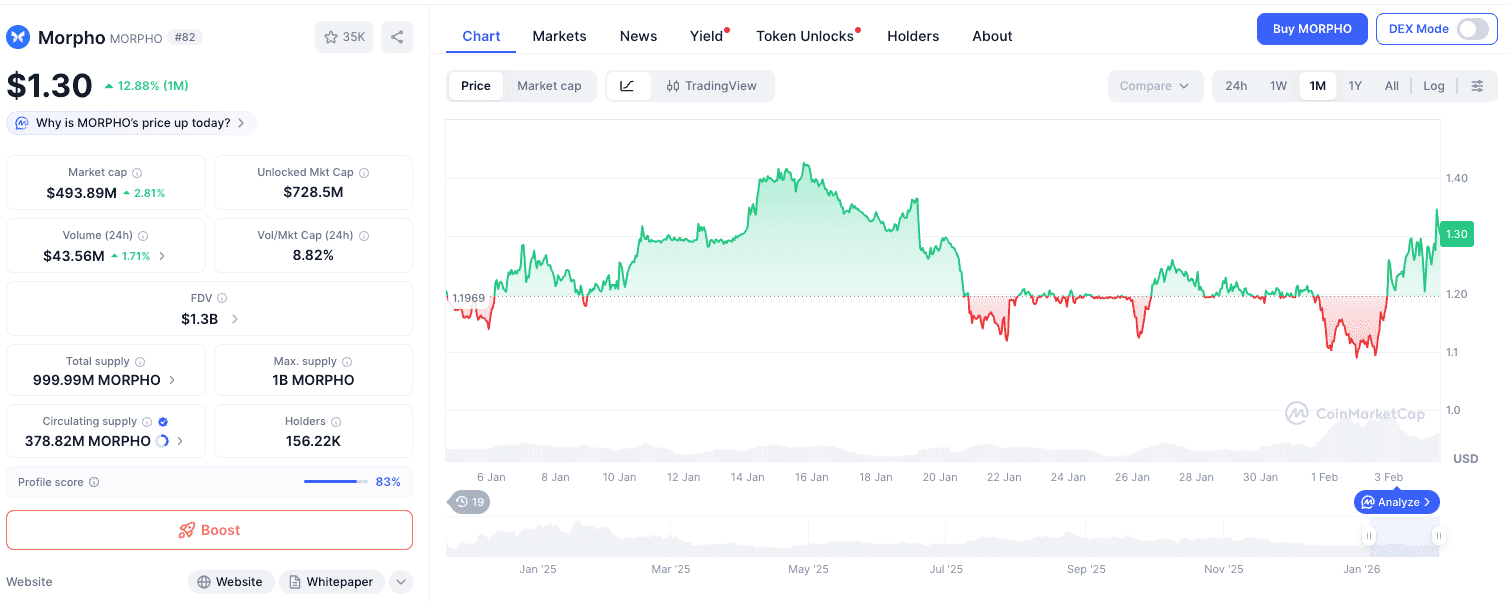

Entering 2026, the decentralized finance (DeFi) landscape has transitioned from basic liquidity provisioning toward advanced capital efficiency and modularity. Market data from early 2026 indicates a notable increase in the utilization and market activity of Morpho (MORPHO), a protocol designed to re-engineer the fundamental mechanics of decentralized lending and borrowing. With the MORPHO token recently observing a price level near $1.30 and a circulating market capitalization approaching $500 million, the protocol is being analyzed not merely as an "optimization layer," but as a foundational primitive in the modular DeFi stack.

This guide provides an objective technical breakdown of the Morpho protocol, its peer-to-peer matching engine, and its positioning within the institutional and retail lending sectors as of 2026.

The Evolution of DeFi Lending: Morpho’s Role in 2026

To analyze the current market position of Morpho, it is essential to understand the structural evolution of lending protocols. Historically, the sector was characterized by "Peer-to-Pool" models. While these models provided necessary immediate liquidity, they inherently included a "spread"—the mathematical gap between what a borrower pays and what a lender receives. This spread functions as a liquidity reserve but often results in sub-optimal interest rate efficiency for both parties.

By 2026, the market has shifted toward high-frequency requirements and institutional-grade precision. Sophisticated participants, including decentralized autonomous organizations (DAOs) and liquidity providers, increasingly prioritize protocols that minimize these efficiency gaps. Morpho was developed to address this specific demand, evolving from an optimization layer built on top of existing protocols into a standalone, modular lending infrastructure.

Technical Architecture: Understanding Morpho Blue

The increased market attention toward Morpho in the first quarter of 2026 is largely attributed to its transition toward a decentralized, modular architecture. This shift represents a departure from "monolithic" lending protocols where a single governance body dictates all risk management parameters.

1. Morpho Blue: The Modular Primitive

Morpho Blue serves as a "trustless primitive" within the ecosystem. Unlike legacy platforms where the protocol’s DAO must vote on every listed asset or LTV (Loan-to-Value) ratio, Morpho Blue is permissionless.

This architecture allows qualified participants—ranging from fintech developers to risk management firms—to initialize lending markets with any asset pair and customized risk parameters. Users can select specific oracles, LTV ratios, and liquidation triggers. In the 2026 regulatory environment, this modularity is significant as it decentralizes risk management, allowing different "vaults" to operate under varying risk-compliance standards without affecting the entire protocol.

2. The P2P Matching Engine

Morpho’s core value proposition remains its ability to facilitate Peer-to-Peer (P2P) matching within a traditional pool-based environment.

Matching Logic: When a lender and borrower are matched directly (P2P), they bypass the liquidity pool’s spread. The lender receives a rate closer to the borrower’s cost, and the borrower pays a rate closer to the lender’s yield.

The Fallback Mechanism: A critical safety and liquidity feature of Morpho is its fallback capability. If a direct P2P match is unavailable or if a participant exits the match, the protocol seamlessly re-routes the liquidity to underlying pools (such as its own Morpho Blue vaults or integrated third-party protocols). This ensures that liquidity remains available even when P2P matching is not achievable.

In the 2026 market, where interest rate margins are increasingly compressed, this efficiency mechanism is a primary factor for high-net-worth liquidity providers who seek to optimize yield performance without incurring the full "liquidity tax" of traditional models.

Comparative Analysis: Morpho vs. Traditional Peer-to-Pool Models

For users evaluating the technical differences between Morpho and established protocols like Aave, the distinction lies in the approach to risk and efficiency.

| Feature | Legacy Peer-to-Pool (e.g., Aave V2/V3) | Morpho (P2P + Modular Blue) |

| Matching Logic | All funds are socialized in a shared pool. | P2P matching with automated pool fallback. |

| Capital Efficiency | Limited by a fixed "Spread." | Optimized by minimizing the spread via direct matching. |

| Market Creation | Governance-dependent (requires DAO voting). | Permissionless (allows for market-specific creation). |

| Risk Management | Global (one set of parameters for all users). | Localized (risk is isolated to specific vaults/markets). |

| Oracle Integration | Centralized governance selection. | Agnostic (users/vault managers choose the oracle). |

From a technical perspective, Morpho represents a move toward non-custodial and localized risk management, allowing participants to choose the specific risk profile that aligns with their internal compliance mandates.

MetaMorpho: Institutional Risk Orchestration

While Morpho Blue provides the base infrastructure, MetaMorpho serves as the risk management layer. MetaMorpho allows for the creation of "Meta-Lending" vaults.

In the 2026 DeFi ecosystem, risk management has become a specialized service. Professional entities, such as risk curators or financial analysts, can manage MetaMorpho vaults by selecting specific Morpho Blue markets that meet certain safety criteria. This allows users to participate in a "passive" lending experience while benefiting from "active" risk oversight by professional curators. This separation of the base lending layer (Morpho Blue) from the risk management layer (MetaMorpho) is a key architectural advantage in maintaining protocol stability.

Market Data and 2026 Outlook

As of the current 2026 market snapshot, MORPHO is trading at approximately $1.30, with a circulating supply of 378 million tokens. Technical analysis of the chart indicates the asset has established support levels following its January activity, moving past previous resistance at the $1.20 mark.

The "Real Yield" Narrative of 2026

The 2026 market narrative is focused on "Real Yield"—sustainable returns generated through protocol utility rather than inflationary token emissions.

TVL Dynamics: Morpho has observed a steady migration of Total Value Locked (TVL) from older, less efficient protocols as users prioritize the higher net yields offered by P2P matching.

Protocol Governance: The MORPHO token serves as the governance mechanism, allowing holders to participate in the strategic direction of the Morpho Blue ecosystem.

Sentiment Analysis: Market sentiment for Morpho, as reflected in community data and institutional research reports, remains focused on its role as a liquidity-efficient alternative to traditional "monolithic" lending.

Note: Market valuations and price actions are subject to high volatility. Past performance is not indicative of future results.

Managing DeFi Assets on Phemex

For traders and participants looking to engage with the evolving DeFi sector, Phemex provides a robust infrastructure for both spot and derivative markets.

1. Spot Market Access

Users who intend to hold MORPHO for governance participation or long-term portfolio diversification can access the MORPHO/USDT spot pair. Spot trading involves the direct purchase of the underlying asset without the use of leverage.

Trade MORPHO/USDT Spot on Phemex

2. Futures

For experienced traders seeking to manage price volatility or hedge existing lending positions, Phemex offers futures. These instruments allow for the use of leverage to enhance capital efficiency, though they carry a significantly higher risk of capital loss. Phemex’s advanced charting tools provide the necessary data to monitor MORPHO’s price trends in real-time.

Trade MORPHO/USDT Futures on Phemex

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves significant risk, including the potential loss of principal. Users should conduct their own research and consult with a professional advisor before making any financial decisions.

Conclusion: The Role of Morpho in Modern DeFi

Morpho represents a significant technical iteration in the plumbing of decentralized finance. By addressing the inherent inefficiencies of the "spread" and introducing a modular, permissionless market structure, Morpho Blue and MetaMorpho have established a new standard for lending in 2026.

The protocol has successfully transitioned from an optimization tool into an independent ecosystem. Its modularity ensures it remains adaptable to new asset classes and emerging risk models without requiring comprehensive protocol overhauls. For participants ranging from liquidity providers to market analysts, Morpho sits at the intersection of capital efficiency and decentralized risk management.

FAQ: Morpho Crypto Protocol

Q: What factors influence Morpho's current market activity?

A: Morpho’s activity in 2026 is driven by the adoption of its Morpho Blue infrastructure, which offers enhanced capital efficiency and modularity compared to traditional peer-to-pool models.

Q: What is the relationship between Morpho and other lending protocols?

A: Morpho originated as an optimization layer for protocols like Aave. While it maintains a "fallback" compatibility with major liquidity pools, Morpho Blue is an independent lending primitive that operates autonomously.

Q: How is yield generated on the Morpho protocol?

A: Yield is generated through interest paid by borrowers. Through P2P matching, lenders can potentially earn higher rates than in traditional pools by reducing the intermediary spread.

Q: What are the risks associated with Morpho Blue?

A: While the Morpho Blue core is designed for immutability and simplicity, the "permissionless" nature of the markets means users must independently evaluate the risk profile of individual vaults and oracles.

Q: What is the difference between Morpho Blue and MetaMorpho?

A: Morpho Blue is the fundamental execution layer for lending and borrowing. MetaMorpho is a curation layer that allows risk managers to create diversified vaults, simplifying the experience for depositors who prefer professional risk oversight.