The king of meme coins is undoubtedly Dogecoin (DOGE), a crypto coin that was born from a Shiba Inu Internet meme and remains in the top cryptocurrencies of all time. DOGE is currently valued at $0.13, with a circulating supply of 132.67 billion DOGE for a market cap of $17 million.

What Is Dogecoin?

Dogecoin (DOGE) is “an open-source, peer-to-peer digital currency, favored by Shiba Inus worldwide.” Having spent several years trading at a reasonably static level and dropping further down the cryptocurrency ranking tables as newer and more popular initiatives emerged, on January 29, 2021, DOGE recently entered the top ten for the first time since 2015. Thanks to the antics of the WallStreetBets group of Redditors orchestrating a series of epic price pumps across various assets, it subsequently hit the global headlines.

So what is the story behind DOGE? How did it become the asset of choice for a group of anti-establishment retail traders in January 2021, and what are the chances of it maintaining the pump in the longer term?

Dogecoin Origins

Dogecoin (DOGE) was launched in December 2013 as a joke by Billy Markus and Jackson Palmer. The pair had the idea of creating a cryptocurrency that had a broader appeal than existing digital assets. They decided to base the currency on the Shiba Inu meme that had been the subject of a viral craze in 2013. The meme typically has a picture of a Japanese Shiba Inu dog surrounded by Comic Sans text saying things like “much wow.”

Dogecoin is a recognized form of currency, even for purchasing Tesla merchandise. (Source: hitc.com)

Markus and Palmer decided to adopt the popular meme for their cryptocurrency. They forked Dogecoin from Luckycoin, which is now obsolete, but was itself forked from Litecoin. Therefore, although it’s a proof of work blockchain, Dogecoin doesn’t use the same SHA-256 mining algorithm as Bitcoin and its many forks, meaning it can’t be mined with Bitcoin ASIC mining equipment. Dogecoin, and Litecoin, use the Scrypt algorithm, so miners use dedicated Scrypt mining hardware.

One month after its launch, the coin was already showing exponential growth in value, from $0.0004155 on the 18th of January 2014 to $0.002168 on the 21st of the same month. This represented a growth of over 500% in only three days. Today, Dogecoin remains one of the most popular coins, funding Olympic sports teams and charitable causes, among other things.

Dogecoin vs Bitcoin

Apart from the mining algorithm, there are other differences between Bitcoin and Dogecoin. Notably, a few months after launching, Dogecoin developers decided to do away with a monetary policy that would put a cap on the total maximum supply of 100 million DOGE. Eventually, DOGE mining became merged with Litecoin mining, as the inflationary supply was disincentivizing miners from participating in the Dogecoin network.

Why Is Dogecoin Successful?

The Dogecoin cryptocurrency’s huge and rapid growth classifies it as a “unicorn” in the crypto space. This growth is largely attributable to its strong community spirit, with its fans urging the likes of Elon Musk to take Dogecoin to the moon. The coin has been endorsed by the likes of Mark Cuban and Gene Simmons, and Elon Musk made Tesla merch buyable with Doge in January 2022. Following this announcement, among others by him, the price of Dogecoin shot up.

Endorsements from major players, including Elon Musk, have led to massive increases in Dogecoin’s value. (Source: thesun.co.uk)

There has even been a Dogecoin Super Bowl commercial, which declared that “fate loves irony” — referring to the fact that this meme coin was originally created as a joke.

Meme coins are now becoming increasingly common, as investors scramble to find the next Dogecoin. Some crypto experts believe that the generally stronger communities behind meme coins give them an advantage over other cryptos. Additionally, their ability to create viral memes that are shared across the Internet heighten their visibility, and thus their presence in the minds of investors.

Dogecoin’s Initial Success

As unlikely as it may seem, Dogecoin enjoyed significant early success after its launch and in the period leading up to the 2017 bull run. The Dogecoin genesis block was mined in early December 2013, and within a few weeks, it had jumped by 300%. Within a year of launch, it had achieved a market capitalization of $20 million and was highly popular with a large and active community around it.

In 2014, the Dogecoin community also supported several charitable initiatives through the Dogecoin Foundation. In January, it raised over $30,000 worth of DOGE, which was donated to the Jamaican bobsled team so they could attend the 2014 Winter Olympics in Sochi, Russia.

In the same year, a Twitter user also donated $11,000 worth of DOGE to the Doge4Water initiative, which aimed to help provide clean drinking water for people in rural Kenya. The initiative was hoping to reach a goal of $30,000 by the time of World Water Day in March, and the generous donation from one individual helped achieve this target a week beforehand.

Around the same time, Dogecoin users crowdfunded $50,000 to sponsor NASCAR driver Josh Wise, resulting in him driving a high-performance racing car around the track with the Doge meme’s image emblazoned on the hood.

All of these developments helped Dogecoin gain a reputation of being the internet’s tipping cryptocurrency.

2015-2020 – Elon Musk and Dogecoin

In 2015, Jackson Palmer abandoned the Dogecoin project after expressing his discontent with how get-rich-quick schemers and malicious hackers had taken over the community.

However, Dogecoin didn’t die out. In the lead-up to the 2017 bull run, the DOGE price started to climb along with the rest of the cryptocurrency markets. In early January 2018, DOGE hit an all-time high of $0.017 with a market cap just shy of $2 billion.

But like the rest of the cryptocurrency markets, the price didn’t sustain. Dogecoin dropped off, and by the end of December 2020, it was trading at $0.004 with a market cap of $154 million, occupying #42 in the Coinmarketcap rankings. This came about even despite the Dogecoin community’s attempts to reignite the token’s previous popularity, briefly engaging Elon Musk in a Twitter ruse to pretend he was the new CEO of Dogecoin.

2021 – Dogecoin Enters WallStreetBets

DOGE probably would have remained at its current trading levels, with its position dropping further down the rankings and new investment focused on up-and-coming projects. After all, that’s what had occurred during most of the last five years.

However, in the third week of January 2021, all bets were off when traders involved in the WallStreetBets subreddit turned the markets upside down. The story began in late 2019 when a lone trader and Redditor had noticed that Wall Street hedge funds were betting on bricks-and-mortar game retailer GameStop to go bust.

Despite the company having a relatively healthy balance sheet, institutional traders had pushed GameStop’s stock price down to $2-4 per share, with short interest many times higher than floating stock levels.

A year or so later, other Redditors had started to notice the situation and that the original trader had held onto long positions with the conviction that GameStop was a viable concern. As more Reddit traders jumped on the bandwagon, GameStop’s share price skyrocketed, forcing a short squeeze for the Wall Street hedge funds.

The situation came to a head on January 28, when Robinhood and other retail trading venues shut down GameStop trading. The move was almost universally condemned across social media, and surprisingly, by both Democrat and Republican politicians in the US.

How Dogecoin Works

Aside from its unique online presence, the Dogecoin meme coin features the same basic structures any other cryptocurrency:

- Decentralization: Dogecoin is traded peer-to-peer on various platforms, with each transaction validated by the proof-of-work (PoW) consensus mechanism. Instead of relying on a central regulator for validation, each transaction is validated by miners all over the world.

- Blockchain technology: By being built on its own blockchain, Dogecoin can maintain security, traceability, and anonymity. A blockchain requires over 50% of its blocks (which are distributed all over the world via miners) to come to an agreement before one transaction can be validated. This makes it extremely difficult for hackers to fake transactions. Additionally, once a transaction has been verified, it’s publicly saved on the blockchain forever. Every person who sends or receives DOGE has public proof of the transaction.

Dogecoin differentiates itself technically in that it’s built on Litecoin (LTC) technology. Dogecoin initially ran solo, halving its rewards to miners every two months. However, this meant that miners — the backbone of the network’s security — were less incentivized to mine for Dogecoin. Fewer miners meant less network protection, and decreased security would mean the end for the meme coin. In 2014, Dogecoin embarked on merged mining with Litecoin, in a process known as a hard fork. This meant that Dogecoin and Litecoin miners would mine for both coins simultaneously, thereby adding an increased security layer and keeping DOGE alive.

The 2014 Dogecoin hard fork merged Dogecoin mining with Litecoin mining, effectively saving the coin from extinction. (Source: litecoin-foundation.org)

What Is Dogeday 4/20?

After solidifying its security and ensuring miner incentivization, Dogecoin could once again focus on increasing its value. In a further effort to boost Dogecoin’s visibility, the community dubbed April 20 (usually known as “weed day”) “Dogeday 4/20.”

#DogeDay became the second-highest trending hashtag on Twitter on April 20, 2021, pushing major players, including Milky Way and Snickers, to tweet their support. This showed the world the strength of Dogecoin’s community, which hugely impacted the meme coin’s popularity.

Dogecoin community members hoped Dogeday would spike the coin’s value to $0.69 — and some others hoped the coin would reach $1.00 through this method. The closest it has come was in July 2021, when it rose to only $0.0052 away from $0.69.

Dogecoin’s clever use of memes has helped it grow a loyal following. (Source: reddit.com)

How Many Dogecoins Are There, and What Difference Does It Make?

Dogecoin is inflationary, meaning there is no end to the number of coins that can be mined, i.e., created. You might think that this would cause Dogecoin’s value to decline, but Dogecoin’s value depends on various factors, not only supply and demand. In addition to including how many Dogecoins exist, these factors include how many investors trust in the asset and buy it, how many public figures endorse the coin, and so on. Dogecoin has had great exposure, with the likes of Elon Musk causing it to jump 20% in December 2020 when he tweeted “One word: Doge,” another 25% with his “Wow” tweet in February 2021, and then another 27% in December 2021 with another tweet: “Tesla will make some merch buyable with Doge.” This kind of exposure is so powerful that it has created a fear of missing out (FOMO) in investors — one that has been able to offset the deflationary effect of having unlimited coins.

Dogecoin Price Analysis

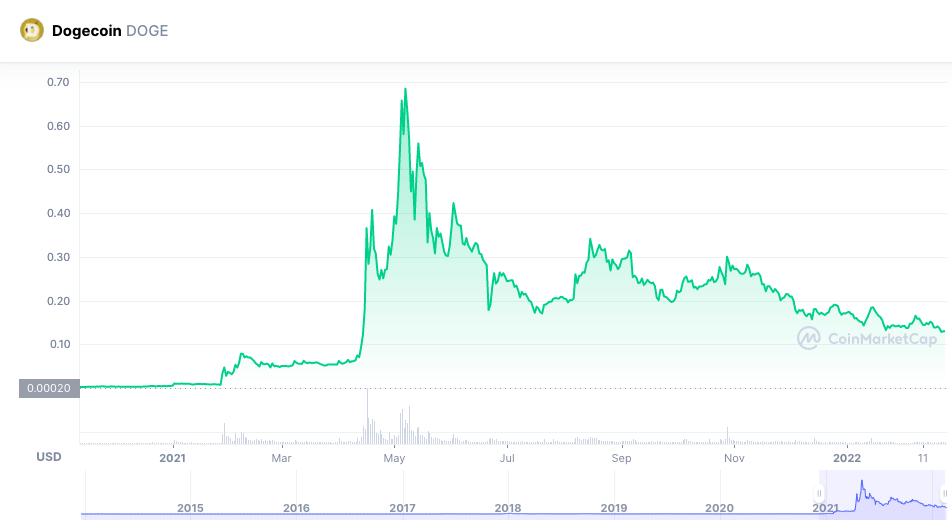

Dogecoin saw significant interest as soon as it launched, amassing a huge following and a large number of investors. However, as an inflationary coin, it first struggled to see real growth in terms of value-per-coin. This all began to change once the meme coin’s community came together to push major players, from Musk to Snickers, to show support for the coin and thus overcome this downward pull on its value. Soon, DOGE saw its value gather momentum, and following a final and great push for Dogeday 4/20, the coin reached over $0.68 in July 2021.

Dogecoin’s massive growth in its first months of trading, followed by its downward struggle — as shown by Dogecoin price graph from December 2013 to December 2016. (Source: coinmarketcap.com)

Dogecoin’s price saw huge growth once again after its community came together to influence whale investors, such as Musk — as shown by Dogecoin price graph from Nov 2020 to Feb 2022 (Source: coinmarketcap.com)

Unfortunately, following the highs came the lows, and Dogecoin found itself following it the path of the crypto market’s bearish turn — steadily rising and dropping back to $0.13 (at the time of writing).

DOGE’s downturn came as a consequence of the renewed push to ban mining from the likes of Russia. However, this potentially problematic development has since become one that could encourage larger acceptance of crypto. Russia is now looking to regulate crypto in order to accept it as legitimate currency, while India looks to do the same with proposed taxation. The crypto community has voiced various responses — from beliefs that taxation and regulation are the only path to digital currency acceptance, to beliefs that governmental interference defeats crypto’s entire purpose.

Dogecoin’s strong community has shown that it has the power to rally and force its coin into the spotlight. However, with these conflicting stances on the future of cryptocurrency, it’s unclear whether the community will stay united.

Is Investing in Dogecoin a Good Idea?

Dogecoin has kept a strong footing, despite the many challenges it has faced. From its previous pre-Litecoin difficulties to its fluctuations in value, its community has consistently come together to take action. The strong and unified reactions from this meme coin’s community have truly shown the coin’s potential. Additionally, its resilience is evidenced by the fact that it has remained popular since 2013, surviving the 2018 and 2021 crypto crashes and so far riding out the 2022 bear market.

Dogecoin is a cryptocurrency with a lot of potential, and judging by its continued rank at #10, it could well be set to stay. If Dogecoin can keep its community engaged and unified, then it could well ride out the bear market to soar when the next 4/20 comes around.

Conclusion

Dogecoin is a coin with purpose and community that has overcome many obstacles to consistently remain in the top cryptocurrencies. With a powerful support base, clever usage of memes to drive engagement, and innovative technology to ensure security and prosperity, Dogecoin looks well positioned to stay. However, as with any volatile asset, things can change quickly. If you’re thinking of buying or trading DOGE, it’s important to do due diligence and use technical analysis tools to make an informed decision.

Read More

- Dogecoin vs. Shiba Inu: Which Is Better?

- Phemex Analysis in a Minute: How to Capitalize on DOGE's Hot Streak

- What is Baby Doge: How Much Bite Does This Latest Meme Coin Have?

- What is Shiba Inu: Dogecoin Killer or Imitator?

- January BTC Market Analysis

- Why are Meme Coins so Popular in this Crypto Cycle?

- How to DYOR (Do Your Own Research): A Comprehensive Guide

- What is Cryptocurrency & How It Differs From Digital Cash