Litecoin (LTC) is a fast, secure, and decentralized cryptocurrency often called “digital silver” to Bitcoin’s gold. This in-depth guide explores Litecoin’s use cases, tokenomics, recent upgrades like MimbleWimble, and how it compares to Bitcoin. Learn about its supply, tech foundation, and long-term investment potential in 2025.

Litecoin (LTC) Quick Facts:

-

Ticker Symbol: LTC

-

Chain: Litecoin (independent layer-1 blockchain)

-

Contract Address: N/A (native blockchain coin)

-

Circulating Supply: ~75,949,000 LTC (June 2025)

-

Max Supply: 84,000,000 LTC

-

Primary Use Case: Peer-to-peer digital currency for fast, low-cost payments

-

Current Market Cap: ~$6.9 billion (June 2025)

-

Availability on Phemex: Yes (trade LTC on Phemex’s spot market)

What Is Litecoin (LTC)?

Litecoin (LTC) is a decentralized cryptocurrency created in 2011 by Charlie Lee as a faster alternative to Bitcoin. Known as “digital silver,” it operates on its own blockchain and was one of the first forks of Bitcoin, improving transaction speed and efficiency. While Bitcoin’s block times are around 10 minutes, Litecoin’s blocks are created every 2.5 minutes, allowing quicker confirmations and lower fees, making LTC ideal for everyday transactions.

Litecoin addresses Bitcoin’s issues of network congestion and high fees, using the Scrypt mining algorithm to increase transaction volume. It serves as digital cash for daily use, complementing Bitcoin’s role as a store of value. Additionally, Litecoin has been a testing ground for innovations like Segregated Witness (SegWit) and privacy features, which may later be adopted by Bitcoin.

Today, Litecoin remains a significant cryptocurrency, integrated with major payment processors like PayPal and MoneyGram. It’s widely accepted by merchants for transactions, making it a reliable medium of exchange in the crypto ecosystem. Overall, Litecoin offers a proven, efficient way to transfer value and continues to evolve within the cryptocurrency space.

How Many LTC Are There?

Litecoin’s tokenomics mirror Bitcoin’s, featuring a capped supply of 84 million LTC. As of mid-2025, around 76 million LTC are in circulation, meaning 90% of its total supply has been mined. Litecoin’s deflationary design prohibits new minting after the cap is reached, while the mining process generates new coins through Proof-of-Work block rewards.

Litecoin experiences "halving" events approximately every four years, reducing the block reward and creating a predictable inflation rate. After the latest halving on August 2, 2023, the block reward decreased from 12.5 LTC to 6.25 LTC, resulting in about 3,600 new LTC mined daily until the next halving in 2027. The last Litecoin is expected to be mined around 2140.

Unlike some newer cryptocurrencies, Litecoin does not utilize a coin-burning mechanism; its supply only decreases if holders lose access to their wallets. This controlled supply model appeals to investors, as it prevents arbitrary inflation. Currently, with about 75–76 million LTC in circulation and a hard cap of 84 million, the supply dynamics could significantly impact LTC's valuation as it continues to serve as a finite commodity and a digital currency.

What Does LTC Do?

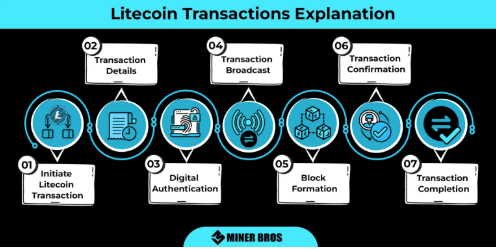

Litecoin’s primary function is to serve as a peer-to-peer digital currency for fast and affordable transactions. In practice, this means LTC is used to transfer value directly between individuals or businesses without needing an intermediary like a bank. Here are some major Litecoin use cases and utilities:

-

Everyday Payments: With low fees and quick confirmation times, Litecoin is ideal for daily transactions and micro-payments. Many merchants, including Newegg and travel sites, accept LTC, making it a practical choice for purchasing goods and services.

-

Online Transfers & Remittances: Litecoin allows for swift cross-border money transfers, often enabling users to exchange LTC to local currency within an hour. Its integration with services like MoneyGram and PayPal enhances its accessibility.

-

Network Fees and Utility: LTC serves as the utility token for transaction fees within its network, typically costing just a few cents. While it doesn’t have staking or governance features, LTC’s value supports network security by rewarding miners.

-

Integration in Apps and Cross-Chain Use: Litecoin has pioneered atomic swaps with Bitcoin, showcasing its ability for cross-chain transfers. It also supports the Lightning Network for faster, off-chain transactions, although its use is not as widespread as Bitcoin’s.

-

Store of Value and Digital Asset Investment: Many view LTC as a store of value or investment, often calling it "silver to Bitcoin’s gold." Its history, lower volatility compared to newer coins, and strong reliability contribute to its perception as a stable asset.

In summary, Litecoin’s use cases revolve around being a fast, cost-effective medium of exchange. Its integration into payment platforms and its role in enabling cross-chain transactions (like atomic swaps) highlight its versatility. Though Litecoin doesn’t offer smart contracts or elaborate DeFi features, its straightforward functionality to reliably send value remains a fundamental and valuable service in the digital economy.

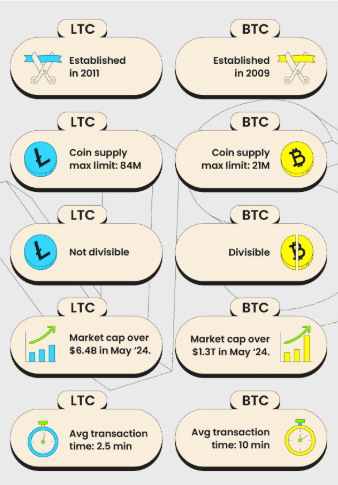

Litecoin vs Bitcoin

Litecoin vs Bitcoin is a classic comparison, as Litecoin was born as a fork of Bitcoin’s code with tweaks to improve on certain aspects. Both are decentralized, Proof-of-Work cryptocurrencies intended as electronic cash, but there are key differences in their technology and use:

-

Speed and Transaction Fees: Litecoin offers significant advantages over Bitcoin in terms of transaction speed and fees. It generates blocks every 2.5 minutes, allowing transactions to be confirmed in about 5–15 minutes, compared to Bitcoin's 30–60 minutes. Additionally, Litecoin's transaction fees are typically much lower, making it more suitable for small payments, especially during high network activity. For instance, while Bitcoin's average fees spiked over $30 in early 2021, Litecoin's remained just a few cents.

-

Technology & Algorithm: Both Bitcoin and Litecoin use Proof-of-Work consensus but different hashing algorithms. Bitcoin uses the SHA-256 algorithm, which is dominated by ASIC miners, while Litecoin uses Scrypt, a memory-intensive algorithm designed to make mining accessible to consumer hardware like GPUs. Although ASICs were developed for Scrypt, the mining resources of Litecoin and Bitcoin remain distinct, meaning they don't compete directly. Notably, Litecoin supports merged-mining with Dogecoin, allowing miners to earn rewards from both cryptocurrencies simultaneously, which strengthens the security of both networks.

-

Supply and Economics: Bitcoin has a maximum supply of 21 million BTC, while Litecoin has 84 million LTC, making Litecoin more plentiful and individually cheaper. However, Bitcoin's scarcity per coin is higher. Both undergo halving events roughly every four years, with Bitcoin halving every 210,000 blocks and Litecoin every 840,000. This creates a similar deflationary policy, but Litecoin's larger supply may lead it to reach full circulation around the same time as Bitcoin (approximately 2140). In terms of market capitalization, Bitcoin consistently dominates, often being over 50 times larger than Litecoin, which typically ranks in the top 10–20 altcoins. This reflects Bitcoin’s greater demand and adoption as the original cryptocurrency.

-

Use Case and Adoption: Bitcoin is regarded as “digital gold,” serving as a store of value and hedge against inflation, while Litecoin is often called “digital silver,” focusing on daily transactions. Bitcoin has wider acceptance across platforms and institutions, but Litecoin is popular among merchants for its efficiency in payments. Both cryptocurrencies are accepted by many of the same merchants, with Litecoin included in platforms like PayPal alongside Bitcoin and others. In terms of development, Bitcoin prioritizes security and decentralization, moving cautiously. Conversely, Litecoin, with a smaller development team, has implemented updates more quickly, such as activating SegWit earlier and adopting the MimbleWimble Extension Block for privacy enhancement, potentially testing features that Bitcoin might consider in the future.

-

Decentralization and Security: Bitcoin is the most secure blockchain due to its higher hash rate and greater computational power compared to Litecoin, making it more resistant to 51% attacks. However, Litecoin has maintained security since its inception, with no notable successful attacks. While both networks are decentralized, Bitcoin has more nodes and a larger user base. Litecoin has a smaller but dedicated community and was once more home-miner friendly due to its Scrypt mining algorithm. Running a full node for either network is possible, but Litecoin's smaller blockchain makes it more accessible in terms of storage and bandwidth.

In summary, Litecoin vs Bitcoin centers on a balance between speed and adoption. Litecoin provides faster, cheaper transactions for everyday payments, while Bitcoin is the most secure and widely accepted for large-value storage and transfers. Litecoin is designed to complement Bitcoin, acting as an efficient payment coin alongside Bitcoin’s dominance. Both can coexist, similar to gold and silver, each with its own strengths.

The Technology Behind LTC

Under the hood, Litecoin shares much of its DNA with Bitcoin but with a few important technical distinctions and innovations. Here’s a breakdown of the technology powering Litecoin:

-

Consensus Mechanism – Proof of Work (PoW): Litecoin operates on a Proof-of-Work consensus algorithm, where miners use computational power to solve cryptographic puzzles, validating transactions and adding blocks to the blockchain. It employs the Scrypt hashing algorithm, chosen for its memory-hard properties, making mining more accessible than Bitcoin's method. This approach has led to slightly more decentralized mining, as it still allows for GPU rigs alongside ASIC miners. The network adjusts difficulty to maintain block times around 2.5 minutes.

-

Blockchain and Transactions: Litecoin’s blockchain functions like Bitcoin’s, with transactions clustered in blocks connected by cryptographic hashes. Each Litecoin block can hold up to 4 MB of data, similar to Bitcoin post-SegWit, allowing for roughly 56 transactions per second. In 2023, Litecoin processed over 67 million transactions, demonstrating its ability to handle significant usage due to faster block times.

-

MimbleWimble Extension Blocks (Privacy Technology): Activated in May 2022, the MimbleWimble Extension Block (MWEB) upgrade introduces enhanced privacy features by obfuscating transaction details. Users can choose confidential transactions, adding a privacy mode that Bitcoin lacks natively. This dual-functionality maintains compliance while offering privacy options.

-

Lightning Network and Layer-2: Litecoin is fully compatible with the Lightning Network, enabling instant, off-chain transactions. This early adoption allows for near-instant, zero-fee transfers and cross-chain swaps between Litecoin and Bitcoin, enhancing transaction efficiency.

-

Infrastructure and Partnerships: The Litecoin network is supported by its active community and open-source development, partly funded by the Litecoin Foundation. Partnerships with companies like Crypto.com and TenX have expanded Litecoin's utility, including LTC-funded debit cards.

-

Security and Record: Litecoin has demonstrated strong security and stability throughout its lifespan, with no major breaches or critical bugs. It boasts a 100% uptime record for over a decade, as noted by its community. While its codebase is largely based on Bitcoin’s—allowing for rigorous testing—Litecoin has sometimes lagged in adopting the latest security enhancements due to a smaller development team. However, it features core elements like Multi-Sig support, HD wallets, and hardware wallet integrations, ensuring ease of use and security. Additionally, Litecoin's use of Scrypt and decentralized mining has proven resilient over time.

Litecoin builds on Bitcoin’s design with features like Scrypt mining and MimbleWimble privacy, resulting in a fast and reliable blockchain. While it lacks smart contracts like Ethereum, its focus on payments drives its development. Litecoin is an essential part of the crypto infrastructure, often working alongside Bitcoin through merge mining and cross-chain initiatives, showing how a longstanding blockchain can innovate to remain relevant.

Team & Origins

Litecoin was founded by Charlie Lee in October 2011 as one of the first altcoins created after Bitcoin. Lee, a computer scientist and former Google engineer, aimed to create a complementary cryptocurrency for faster transactions, using modified Bitcoin code. The Litecoin network launched on October 13, 2011, following a fair launch with no significant pre-mine.

Lee continued to promote Litecoin while working at Coinbase, where he served as Director of Engineering. In 2017, he sold or donated all his LTC holdings to avoid conflicts of interest, leading to community controversy despite his ongoing involvement as Litecoin's chief evangelist.

Today, the Litecoin Foundation, a non-profit established in 2017, manages the development and community efforts, with Lee as Managing Director. The Foundation relies on donations and partnerships to support growth, including funding key upgrades and organizing community events.

Litecoin gained prominence quickly, becoming one of the largest cryptocurrencies by market cap by 2014. Notable milestones include the activation of Segregated Witness in 2017 and the implementation of the Lightning Network. Now, Litecoin is supported by a mix of its Foundation team, independent developers, and a global community, with Charlie Lee remaining a central figure.

Key News & Events

Litecoin has a rich history spanning over a decade. Here are some major news and events that have shaped Litecoin (LTC) over the years:

-

October 2011 – Launch of Litecoin: Litecoin launches after Charlie Lee announces it on Bitcointalk. It quickly becomes known as the first successful Bitcoin fork, offering faster transaction speeds.

-

December 2013 – Dogecoin Forks from Litecoin: Dogecoin forks from Litecoin, enhancing miner collaboration through merged mining, linking the two communities.

-

May 2017 – Segregated Witness Activated: Litecoin activates Segregated Witness, improving scalability and paving the way for the Lightning Network. LTC reaches nearly $350 by December 2017.

-

December 2017 – Founder Sells His LTC Holdings: Charlie Lee sells his LTC holdings to maintain transparency, leading to a price decline after the market peak.

-

August 2019 – Second Halving: The second halving reduces mining rewards to 12.5 LTC. Litecoin secures a top 5 market position.

-

October 2020 – PayPal Adds Litecoin: PayPal supports Litecoin, boosting its mainstream visibility.

-

2021 – Network Adoption and NFTs: Litecoin experiences growth, hitting an all-time high of around $413.83 in May. Development of the MimbleWimble upgrade continues.

-

May 2022 – MimbleWimble (MWEB) Upgrade Activates: The MimbleWimble upgrade activates, introducing optional privacy features but triggering delistings on major South Korean exchanges due to regulatory concerns.

-

February 2023 – Litecoin NFTs via Ordinals: Litecoin adopts NFT capabilities via the Ordinals project, generating renewed interest and activity.

-

July/August 2023 – Third Halving Event: Litecoin undergoes its third halving, reducing rewards to 6.25 LTC, stabilizing the price around $110.

-

Late 2023 – Record Usage: Litecoin sees record usage, demonstrating ongoing relevance in the crypto space.

Each of these events has contributed to Litecoin’s story: from its birth and early adoption, through technical upgrades and market cycles, to its modern-day status as an established cryptocurrency. The common theme is that Litecoin consistently aims to be a stable, universally accessible digital currency, and its development and community moments all feed into that narrative.

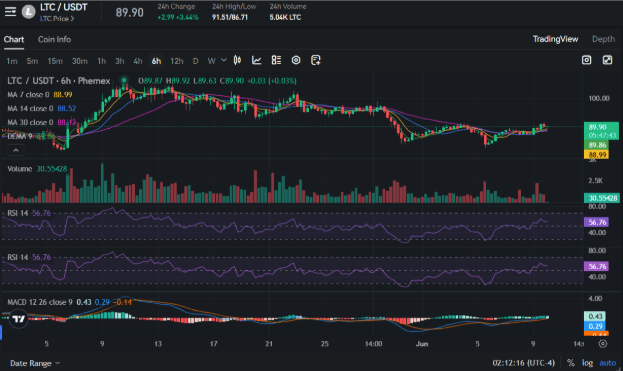

Is LTC a Good Investment?

Disclaimer: Not financial advice. Investing in cryptocurrency carries risk, and you should always do your own research and consider your risk tolerance before investing.

When evaluating Litecoin’s investment potential, there are several factors to weigh:

-

Track Record and Longevity: Litecoin is one of the oldest cryptocurrencies, with over 12 years of history. Therefore it has demonstrated resilience in the volatile crypto market, experiencing significant price fluctuations—most notably an 8,000% increase in 2017 and another surge in 2020–2021. Its all-time high was around $413 in May 2021, but as of mid-2025, LTC trades much lower, suggesting potential undervaluation for investors betting on its future recovery. Past performance indicates Litecoin often rises during bullish periods, generally alongside Bitcoin, though it lagged behind in sectors like DeFi in 2021.

-

Utility and Adoption: Litecoin's widespread acceptance by merchants and payment apps underscores its real-world utility. In 2023, record-high transactions reflected growing organic demand. As "digital silver" to Bitcoin's "digital gold," LTC offers a cheaper alternative for those seeking value storage. Its limited supply and institutional products, like the Grayscale Litecoin Trust, enhance its legitimacy.

-

Community and Development: Litecoin has a loyal but smaller community compared to Bitcoin and Ethereum, fostering ongoing interest. However, development has slowed since the implementation of MWEB in 2022, raising concerns about innovation. While this stability reassures some investors, it could hinder competitiveness against faster-evolving projects.

-

Market Position and Competition: Litecoin faces strong competition from various payment-focused cryptocurrencies, such as XRP and Stellar, as well as stablecoins like USDT and USDC. Despite its early launch and decentralized nature, Litecoin struggles to compete with Bitcoin's superior store-of-value appeal and network effect, limiting its growth potential. Its best-case scenario might be to maintain a fraction of Bitcoin's market cap. Investors may see Litecoin as a more affordable, albeit volatile, option if they believe in Bitcoin's long-term success. However, emerging technologies like central bank digital currencies could threaten Litecoin's relevance.

-

Liquidity and Trading: Litecoin is highly liquid, frequently ranking among the top cryptocurrencies for trading volume. This liquidity makes it easy for investors to buy or sell LTC, especially on platforms like Phemex The high liquidity minimizes slippage, making it a solid choice for both retail and institutional traders.

-

Risks – Volatility & Regulatory: Litecoin is subject to volatility, with price drops over 80% during bear markets. While regulatory risks are relatively low due to its profile as a fair-launch, proof-of-work coin, the optional MimbleWimble privacy feature may lead to potential restrictions in certain jurisdictions. Interest in Litecoin could decline as newer projects emerge, and its conservative approach may label it as "old tech," limiting its speculative appeal despite providing stability.

In conclusion, is Litecoin a good investment? Litecoin combines stability with modest growth potential. With a solid market presence, real utility as a payment coin, and a capped supply, it appeals to investors seeking an alternative to Bitcoin and Ethereum. While it’s considered a lower-risk altcoin, expect less dramatic returns compared to newer altcoins due to its large market cap. Its future performance will depend on market trends and its ability to remain relevant through adoption and tech improvements.

Ultimately, whether LTC is a good investment depends on your goals. If you value a fast, decentralized payment option, Litecoin is a strong choice. However, if you're looking for high yields or explosive innovation, it may seem less exciting. Always consider the risks and consult financial advice tailored to your situation.

How to Trade LTC on Phemex: For those interested in trading or investing in Litecoin, Phemex provides a user-friendly and secure platform. Here is a guide on how to buy Litecoin (LTC) on Phemex, or alternatively you can trade for LTC via their spot market. Phemex also offers advanced trading tools, and for experienced traders, Litecoin perpetual futures contracts allow trading LTC with leverage. Because Phemex is focused on customer experience, it’s a great place to start if you’re new to crypto trading. As always, practice risk management when trading. Whether you plan to hold LTC long-term as an investment or trade short-term price movements, Phemex’s platform can accommodate your strategy, providing real-time price charts, liquidity, and strong security for your assets.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry inherent risks due to market volatility, regulatory uncertainty, and technological factors. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions. Phemex does not endorse or guarantee the performance of any token or project.