Summary Box

-

Ticker Symbol: PIEVERSE

-

Current Price (Nov 25, 2025): $0.5442

-

Contract Address: 0x0e63b9c287e32a05e6b9ab8ee8df88a2760225a9 (BEP-20 on BSC)

-

Market Cap: ~$94.3 million

-

Circulating/Max Supply: 175,000,000 / 1,000,000,000 PIEVERSE (17.5% in circulation)

-

All-Time High / Low: $0.5485 / $0.1145 (Nov 20 & Nov 14, 2025)

-

All-Time ROI: +4,200% (≈43x from $0.01 IEO price as of Nov 2025)

-

Availability on Phemex: Yes (Listed for Spot and Futures trading)

What Is Pieverse?

Pieverse is a Web3 payment compliance infrastructure designed to make crypto transactions as legally valid as traditional payments. What is Pieverse? In simple terms, it’s a blockchain-based system that turns ordinary on-chain transfers into legally recognized financial records like invoices, receipts, and checks. By bridging the gap between pseudonymous blockchain activity and real-world regulatory standards, Pieverse enables businesses, freelancers, and even AI agents to transact in crypto with built-in compliance.

Founded as an “agent-native” payment stack, Pieverse caters to the emerging era of AI-driven and automated payments. The platform uses a unique TimeFi framework: every transaction’s timestamp and metadata are anchored on-chain, creating an immutable proof-of-payment. This means when you pay with crypto via Pieverse, you automatically get an audit-ready record of the transaction. The core innovation is Pieverse’s x402b protocol, an extension of the HTTP 402 “Payment Required” standard, enabling gasless transactions and automated compliance checks. A relayer system handles gas fees behind the scenes, so users (or AI agents) can initiate payments via API without worrying about blockchain fees, improving ease of use.

In practice, Pieverse allows for on-chain invoices and receipts that are verifiable and jurisdiction-compliant. For example, a freelancer could send a client a payment request through Pieverse; when the client pays in crypto, Pieverse generates a tamper-proof invoice and receipt meeting tax and accounting requirements. DAOs can issue payments with checks that are transparent and auditable. And for machine-to-machine or AI payments, Pieverse provides the rails for autonomous micropayments with compliance built in.

Importantly, PIEVERSE is the utility token powering this ecosystem. Holding PIEVERSE can give fee discounts on the platform, a say in governance, and access to premium features. With a fixed supply of 1 billion tokens, Pieverse is structured to encourage long-term participation and network growth. Overall, Pieverse aims to become the default compliance layer for Web3 payments, blending blockchain’s transparency with the trust and legality required by businesses and regulators.

Current Price & Market Data (as of November 24, 2025)

As of Nov 24, 2025, Pieverse (PIEVERSE) trades around $0.42 USD after a volatile debut month, up over 10% in the past 24 hours with a trading volume of about $103 million. Its market capitalization is approximately $73.6 million, placing it in the 330–350 range among cryptocurrencies.

In the last week, PIEVERSE has seen significant price swings, including a 41% surge in mid-November, followed by a 6% dip due to profit-taking. It remains 23% below its all-time high of ~$0.548 reached on Nov 20, but is up over 260% from its all-time low of ~$0.114 on Nov 14.

With a circulating supply of 175 million PIEVERSE (17.5% of the 1 billion max supply), market movements can be amplified as more tokens unlock. The fully diluted valuation is around $420 million, indicating strong growth potential. PIEVERSE, primarily a BEP-20 token on BNB Chain with interoperability to Ethereum, has high liquidity due to its presence on multiple exchanges.

The 24-hour trading range is $0.329 to $0.442, showcasing intraday volatility typical for a newly listed token. Traders should exercise caution with this volatility and consider stop-loss strategies when trading.

PIEVERSE Price Chart on Phemex (source)

Price History & Performance Overview

Chronological Price History: Pieverse’s token launch took place in late October 2025, with an IEO/IDO at $0.01. After an initial price spike in early November, PIEVERSE hit an all-time low of ~$0.114 on November 14, 2025, representing an 11x gain from the launch price. Following this dip, PIEVERSE surged dramatically, reaching an all-time high of ~$0.5485 on November 20, 2025, driven by major exchange listings and partnership news, achieving a +105.5% weekly gain.

Volatility Profile: PIEVERSE exhibited extremely high volatility, with a trading range from $0.11 to $0.55 and daily price moves of 10-20%. The coin experienced rapid cycles, including an initial bull run, a sharp bear dip, and a strong bull resurgence, typical for new altcoins.

Notable Events Influencing Price:

-

Late Oct 2025: IEO at $0.01 generated buzz due to limited token supply.

-

Early Nov 2025: New exchange listings boosted volume and price.

-

Mid Nov 2025: Futures contracts drew significant interest, resulting in a 56% surge on Nov 21.

-

Partnership Announcements: Collaborations in AI and DeFi enhanced use cases and market interest.

-

Market Conditions: Broader crypto sentiment affected PIEVERSE/USDT, which showed resilience amidst market weakness.

Whale Activity & Smart Money Flows

Pieverse is still in the early stages of whale activity, with 90% of its token supply initially concentrated in a single address on Ethereum and 10% on BNB Chain, indicating that team and foundation wallets hold most of the 1 billion tokens. Currently, only 175 million PIEVERSE (17.5%) are circulating, meaning roughly 82.5% remain in non-circulating wallets. The top 10 addresses control over 70-80% of the supply, highlighting significant ownership concentration.

Recent whale activity shows a mix of accumulation and distribution. During the rally to $0.54, some early investors took profits, while others appeared to buy on the dip to around $0.30–$0.35. Despite substantial exchange volume (over $100M daily), there haven’t been large sell-offs, indicating confidence among early backers.

Investors should watch token unlock dates closely, as large transfers to exchanges could signal selling pressure. Conversely, if whales withdraw to cold storage, it might indicate long-term confidence. Additionally, some whales are utilizing Pieverse's cross-chain capabilities through the LayerZero bridge for potential arbitrage.

In summary, while Pieverse’s whale landscape is currently dominated by strategic holders and active traders, there's no indication of an imminent large sell-off. Observing whale movements will be crucial for anticipating future price changes.

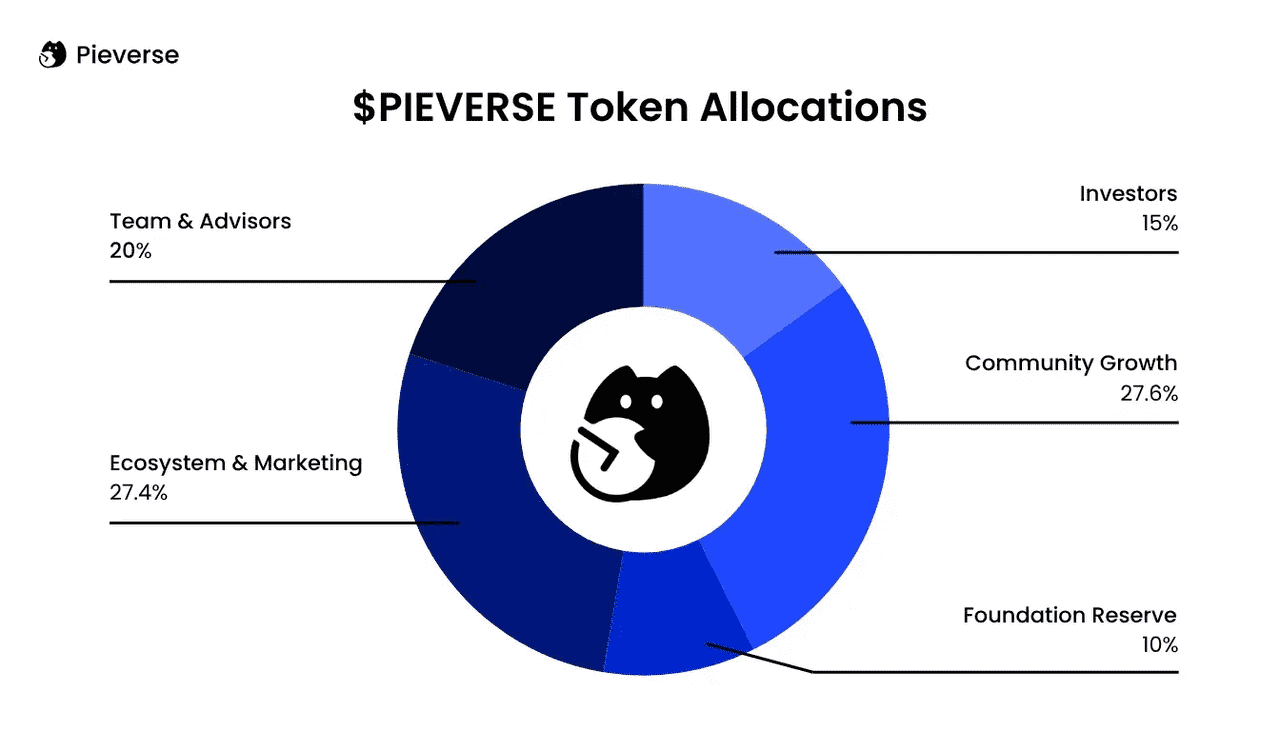

PIEVERSE Token Allocation (source)

On-Chain & Technical Analysis

From a technical analysis perspective, Pieverse is in a developing phase with notable trading levels emerging in its first month:

-

Support & Resistance Levels: The primary support is the all-time low around $0.114, but current support is found in the mid-$0.30s, particularly around $0.32–$0.35, which aligns with the 30-day moving average (~$0.317). On the upside, resistance is at $0.50 (just below the ATH of $0.548). Failing to break above the ATH could result in a bearish double-top pattern.

-

Trend and Moving Averages: Short-term moving averages are more relevant given the limited history. The 7-day SMA and 14-day SMA track recent price changes. Recent highs above $0.54 led to an overbought condition, with the price now stabilizing closer to the 7-day SMA in the low $0.40s.

-

Momentum Indicators (RSI, MACD): The RSI hit overbought levels during the rally but has cooled to a more neutral range of 50-60 post-correction, allowing potential for upward movement if demand returns. The MACD showed bullish momentum but likely crossed into bearish territory during the dip.

-

Fibonacci and Price Zones: Fibonacci retracement levels indicate that the 50% level (~$0.33) aligns with recent lows, suggesting a healthy pullback. A drop to the 61.8% level (~$0.27) would be normal in volatile markets. Future resistances on an upward break could target ~$0.65 and ~$0.75.

-

Volume & On-Chain Metrics: Volume spikes on up-days, with on-chain metrics reflecting significant transaction activity, especially during price peaks. Whale activity can also signal price impacts.

In summary, PIEVERSE is experiencing high volatility and is in a price discovery phase, with key support around the low $0.30s and resistance at $0.50-$0.55. Caution is needed as momentum indicators reset, and Bitcoin’s performance will heavily influence the altcoin's ability to sustain breakouts. Bulls can drive prices up on positive news, but maintaining gains will require ongoing interest.

Fundamental Drivers of Growth

Several key factors could drive Pieverse’s growth and enhance its token value heading into 2025–2030:

-

Unique Tech Differentiation: Pieverse’s gasless payment protocol (x402b) and timestamping infrastructure position it as a unique compliance layer in the crypto space. This differentiation meets the increasing demand for reliable and compliant crypto payment solutions, giving Pieverse an essential first-mover advantage.

-

Network Adoption & Ecosystem Growth: As more users and businesses join Pieverse, its value increases. The onboarding of Web3 businesses, DAOs, freelancers, and AI applications, alongside early partnerships (e.g., with RaveDAO and DeAgentAI), will expand its ecosystem. Each integration enhances network effects, making participation more appealing.

-

Integrations in DeFi and Web3 Services: Pieverse is designed for seamless integration with DeFi platforms, NFT marketplaces, and real-world asset projects. Collaborations—like those with DeFi lending platforms for compliant receipts—can significantly drive demand for its services and token.

-

Partnerships and Recognition: Pieverse has been actively forming partnerships and garnering recognition. Partnerships with projects like Allora, Xeleb Protocol (Timestamping Alliance), and involvement in compliance-focused alliances can drive adoption. Also, if Pieverse can partner with traditional entities – say, an accounting software provider or an enterprise blockchain initiative – that could bridge more users into its ecosystem.

-

Tokenomics & Staking/Governance: Pieverse’s tokenomics are structured to encourage long-term growth, with significant allocations for community incentives and team involvement. Plans for staking and governance could further attract token holders for passive income and active participation, enhancing usage and demand.

-

Macro Trends Favoring Compliance: Increasing regulatory scrutiny on crypto transactions may drive businesses toward compliant solutions like Pieverse. As the need for audit-ready records grows, Pieverse is well-positioned to fulfill this demand, aligning itself with trends in crypto and traditional finance.

In summary, Pieverse is strategically positioned for growth through unique technology, network expansion, and alignment with regulatory trends.

PIEVERSE Token Unlock Schedule (source)

Key Risks to Consider

Like any crypto investment, Pieverse carries risks that should be openly examined before making a decision. Key risks include:

1. Competitive Threats: As an early mover in crypto compliance, Pieverse may face competition from established companies and new startups that offer alternative solutions. If a competitor secures better regulatory certifications or more significant enterprise deals, Pieverse could lose market share. Maintaining innovation and ecosystem growth is crucial to fend off rivals.

2. Token Dilution and Vesting Supply: Currently, only 17.5% of tokens are circulating, with over 800 million PIEVERSE set to be released gradually. Early investors may sell when their tokens unlock, creating potential price cliffs unless managed carefully. It's essential for investors to track the vesting timeline to avoid surprises.

3. Regulatory Impact and Uncertainty: Despite its compliance focus, Pieverse faces risks from evolving regulations. Difficult regulations could hinder operations or generate competition from government standards. The project must navigate the complex legal landscape as it develops.

4. Execution & Adoption Risks: As a young project, Pieverse must execute its roadmap effectively. Delays in launching features or poor tech performance can dampen enthusiasm and hurt reputation. Adoption may also grow slower than expected, impacting the token's value proposition.

5. Weakening Development or Community Activity: Continuous development and community engagement are vital. A decline in developer activity or community interest could signal trouble. Sustaining community momentum will be essential for long-term success.

6. Macro and Market Risks: Broader market trends can affect Pieverse, making it essential to stay informed of the overall crypto market's performance.

Understanding these risks can help investors make informed decisions regarding Pieverse.

Analyst Sentiment & Community Insights

Analyst Sentiment: Crypto analysts and market observers have a cautiously bullish outlook on Pieverse, fueled by strategic exchange listings and its unique compliance narrative. CoinMarketCap notes a positive consensus, but warns of broader macro crypto fears. While analysts highlight the potential for institutional crypto payments, they caution that the recent price surge is driven by hype, and emphasize the need for actual adoption. Price targets for 2025-2026 vary, with some suggesting a fair value above current prices if milestones are met.

Community Sentiment: Among holders, sentiment is generally positive, buoyed by recent gains, but tempered by realism. Social media conversations reflect excitement about Pieverse's potential, with influencers touting its compliance capabilities as a game-changer. However, some community members remind others to be cautious based on past market behaviors, leading to a mixed view with a CoinMarketCap community rating around 3.5 out of 5. Discussions also center around token utility and whale activities.

Social Media Trends: Pieverse has gained traction during significant events like its initial launch, resulting in a mix of positive excitement and negative reactions from those who bought at a peak. Reddit discussions on its long-term viability reveal growing awareness and typical FOMO concerns.

Influencers and Analysts: Crypto influencers have started commenting on Pieverse's recent price surge, with one noting its partnership with an AI token led to significant speculation. This highlights mixed perceptions between excitement and caution.

Google Trends and Interest: Search interest for “Pieverse” peaked in mid-November 2025, driven by its price rally and exchange listings, particularly in Southeast Asia and the U.S. Interest has since cooled but remains above pre-launch levels, indicating a newly established baseline awareness.

Overall Sentiment Outlook: The overall sentiment is one of guarded optimism. Both analysts and the community recognize Pieverse's potential to address real needs in the crypto space, although the future will depend on its ability to sustain momentum and achieve adoption.

Pieverse Vision for Timestamping (source)

Is Pieverse a Good Investment?

Determining if Pieverse is a good investment involves balancing its potential against significant risks. On the bullish side, Pieverse addresses a real need in the crypto market with its gasless, timestamped payment framework for compliance and record-keeping. Its strong performance and early partnerships demonstrate market interest and execution capability. If it becomes a leading compliance layer for Web3, the token value could rise dramatically. For risk-tolerant investors, Pieverse offers a chance at significant returns in a speculative growth segment.

However, caution is essential, as the project is still new and faces execution and competition risks. The expected new supply of tokens could limit price appreciation without a corresponding demand increase. Conservative investors might find Pieverse too speculative at this stage, given its lack of a lengthy track record.

If interested, consider a small position that allows for volatility, keeping an eye on the project’s milestones and community development. In summary, while Pieverse has promising potential for the 2025–2030 horizon, it remains a speculative investment, requiring careful consideration and ongoing research.

Why Trade Pieverse on Phemex?

Phemex is a top-tier centralized exchange that has quickly built a reputation for security, speed, and user-focused innovation. For traders considering Pieverse, Phemex offers an excellent venue to trade this token, combining deep liquidity with advanced trading features. Founded by former Morgan Stanley executives, Phemex has grown into one of the leading crypto trading platforms globally. It’s known for its rock-solid security (cold wallet storage, multi-signature protection) and a fast matching engine that can handle high throughput – meaning even during volatile moves (which PIEVERSE often has), Phemex executes trades smoothly without downtime. The exchange is very much trader-focused: it consistently rolls out new features and improvements such as automated trading bots and passive income opportunities via Phemex Earn.

In essence, trading PIEVERSE on Phemex not only gives you access to a reliable and feature-rich exchange, but it also lets you utilize a whole suite of trading and investment tools. Whether you want to simply buy and hold PIEVERSE, actively trade its wild price swings, or automate your strategy, Phemex has you covered. Plus, with Phemex’s reputation for transparency and user-centric service (no withdrawal fees on certain promotions, responsive customer support, etc.), you can trade with peace of mind.