Decentralized Finance, or DeFi, has transformed how people interact with their money in the crypto world. Among its many applications, DeFi lending stands out as a way to earn passive income or access loans without traditional banks. Imagine a system where you can lend your cryptocurrency to others and earn interest or borrow funds by putting up your crypto as collateral—all powered by code, not middlemen. This guide breaks down DeFi lending in simple terms, covering its core concepts, benefits, risks, and how platforms like Phemex can help you get started by acquiring the assets you need.

What is DeFi Lending?

DeFi lending is like peer-to-peer banking, but without the bank. Instead of depositing your money in a traditional savings account or taking a loan from a financial institution, DeFi lending uses blockchain technology and smart contracts—self-executing code that runs on networks like Ethereum—to connect lenders and borrowers directly.

Here’s how it works: If you have cryptocurrency, such as Ethereum (ETH) or stablecoins like USDC, you can lend it through a DeFi platform. Borrowers, who need liquidity but don’t want to sell their crypto, can borrow these assets by locking up their own cryptocurrency as collateral. The platform’s smart contracts manage everything: they set interest rates, enforce loan terms, and handle repayments automatically. As a lender, you earn interest on your deposited crypto, often at rates higher than traditional savings accounts. As a borrower, you pay interest to access funds while keeping your crypto holdings intact.

Think of it like renting out your car on a peer-to-peer app. You let someone use your car (your crypto), they pay you a fee (interest), and the app (smart contract) ensures they return it in good condition—or you get compensated. The beauty of DeFi lending is its openness: anyone with a crypto wallet and an internet connection can participate, no bank account or credit score required.

Key Terminology Explained

To navigate DeFi lending, it’s helpful to understand a few key terms. These concepts are the building blocks of how lending works in this space.

Collateral

Collateral is the cryptocurrency you lock up when borrowing to ensure you repay the loan. In DeFi, loans are typically over-collateralized, meaning you must deposit more value in crypto than the amount you borrow. For example, to borrow $1,000 worth of USDC, you might need to lock up $1,500 worth of ETH. This protects lenders by ensuring there’s enough value to cover the loan if the borrower defaults.

Over-Collateralization

Over-collateralization is the practice of requiring borrowers to deposit more collateral than the loan’s value. It’s a safety net for lenders and the platform, accounting for crypto’s price volatility. If ETH’s price drops suddenly, the extra collateral ensures the lender can still recover their funds. Most DeFi platforms require collateral ratios of 150% or higher, meaning your collateral must be worth at least 1.5 times the loan amount.

Interest Rate (APY)

The Annual Percentage Yield (APY) represents the interest you earn as a lender or pay as a borrower over a year, factoring in compounding. In DeFi, APYs can vary widely based on supply and demand. For example, lending stablecoins like USDC might yield 5-10% APY, while volatile assets like ETH might offer higher rates due to greater risk. Unlike traditional banks with fixed rates, DeFi rates are dynamic and can change daily based on market conditions.

Liquidation

Liquidation happens when a borrower’s collateral value falls below a certain threshold, usually due to a drop in the crypto’s price. If the collateral no longer covers the loan (e.g., the collateral ratio falls below 150%), the platform automatically sells the collateral to repay the lender. This protects lenders but means borrowers could lose their collateral if the market turns against them. Liquidation is a key risk in DeFi lending, as crypto prices can be unpredictable.

The Main Benefits of DeFi Lending

DeFi lending has gained popularity because it offers unique advantages over traditional finance. Here are the main benefits that make it appealing:

Accessibility

Traditional banking often excludes people without access to a bank account, good credit, or the right documentation. DeFi lending is open to anyone with a crypto wallet and internet access. There’s no need for identity checks, credit scores, or lengthy approvals. Whether you’re in New York or Nairobi, you can lend or borrow crypto instantly, making DeFi a global financial system.

Transparency

DeFi platforms run on public blockchains like Ethereum, where all transactions are visible and verifiable. You can see exactly how much crypto is being lent, borrowed, or locked in a protocol. Smart contracts, which are open-source, govern the rules, so there’s no hidden fine print. This transparency builds trust, as you don’t have to rely on a bank’s promises—you can verify everything yourself.

Higher Yields (Potentially)

DeFi lending often offers higher returns than traditional savings accounts. While a bank might pay 0.5% annually on a savings account, DeFi platforms can offer 5-20% APY on stablecoins or even higher for volatile assets. These yields come from borrowers paying interest, and because DeFi cuts out intermediaries, more of that interest goes directly to lenders. However, higher yields come with higher risks, which we’ll cover later.

Flexibility

DeFi lending gives you control. As a lender, you can often withdraw your funds at any time (depending on the platform’s rules). As a borrower, you can use loans for anything—trading, paying bills, or even funding another DeFi strategy—without explaining yourself to a bank. Plus, DeFi operates 24/7, unlike banks that close on weekends or holidays.

The Core Risks of DeFi Lending

While DeFi lending is exciting, it’s not without risks. Understanding these risks is crucial before diving in.

Smart Contract Risk

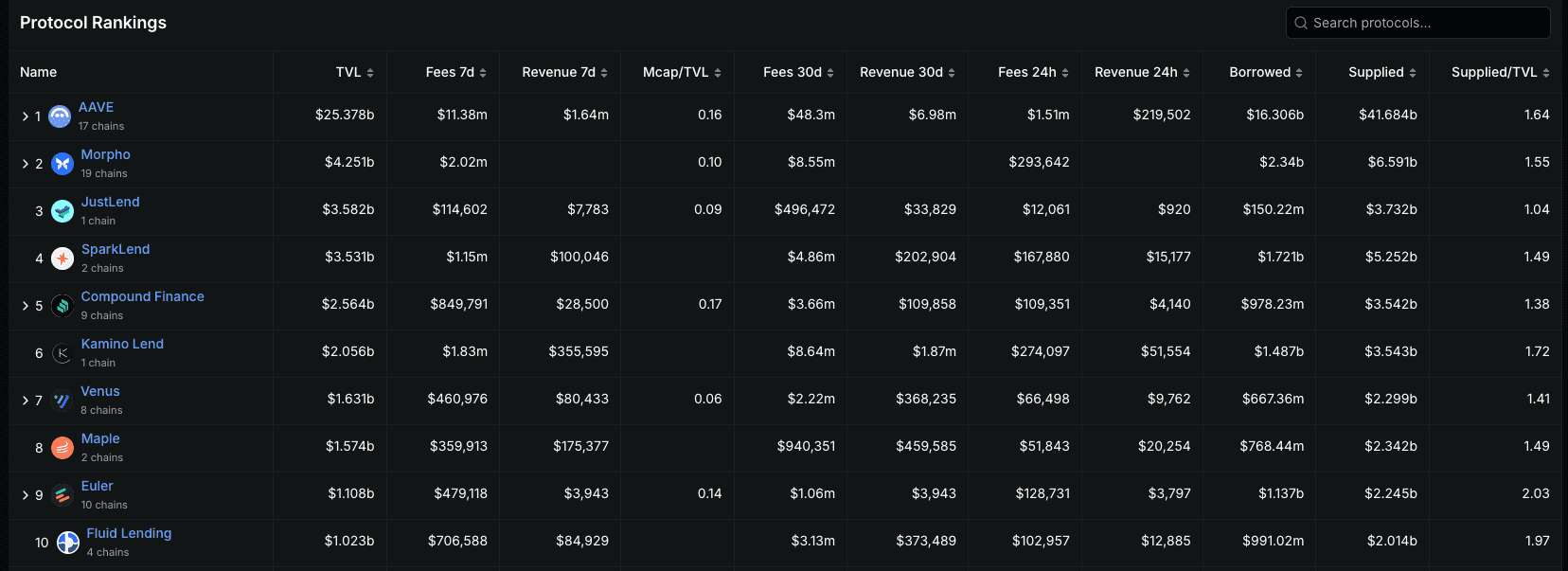

DeFi platforms rely on smart contracts, which are code written by humans. If the code has bugs or vulnerabilities, hackers could exploit it, potentially draining funds from the protocol. While established platforms like Aave or Compound undergo audits to minimize this risk, no smart contract is 100% secure. In 2021 alone, DeFi hacks led to losses of over $1.3 billion, underscoring the importance of choosing reputable platforms.

Liquidation Risk

For borrowers, liquidation is a major concern. Crypto prices are volatile, and a sudden drop in your collateral’s value could trigger liquidation. For example, if you borrow $1,000 against $1,500 of ETH and ETH’s price falls 30%, your collateral might no longer meet the required ratio, leading the platform to sell it. This can result in significant losses, especially in bear markets.

Market Risk

Lenders also face risks tied to market conditions. Interest rates in DeFi are dynamic, so the APY you see today might drop tomorrow if demand for borrowing decreases. Additionally, if you lend a volatile asset like ETH, its value could decline, reducing the real value of your returns even if the APY remains high.

Regulatory Uncertainty

DeFi operates in a regulatory gray area. Governments worldwide are still figuring out how to regulate decentralized platforms, and future laws could impact how DeFi works or whether certain platforms can operate in your country. While this doesn’t directly affect your funds, it could limit your access to certain protocols.

Getting Started with DeFi Lending

If you’re intrigued by DeFi lending, here’s a basic roadmap to get started:

-

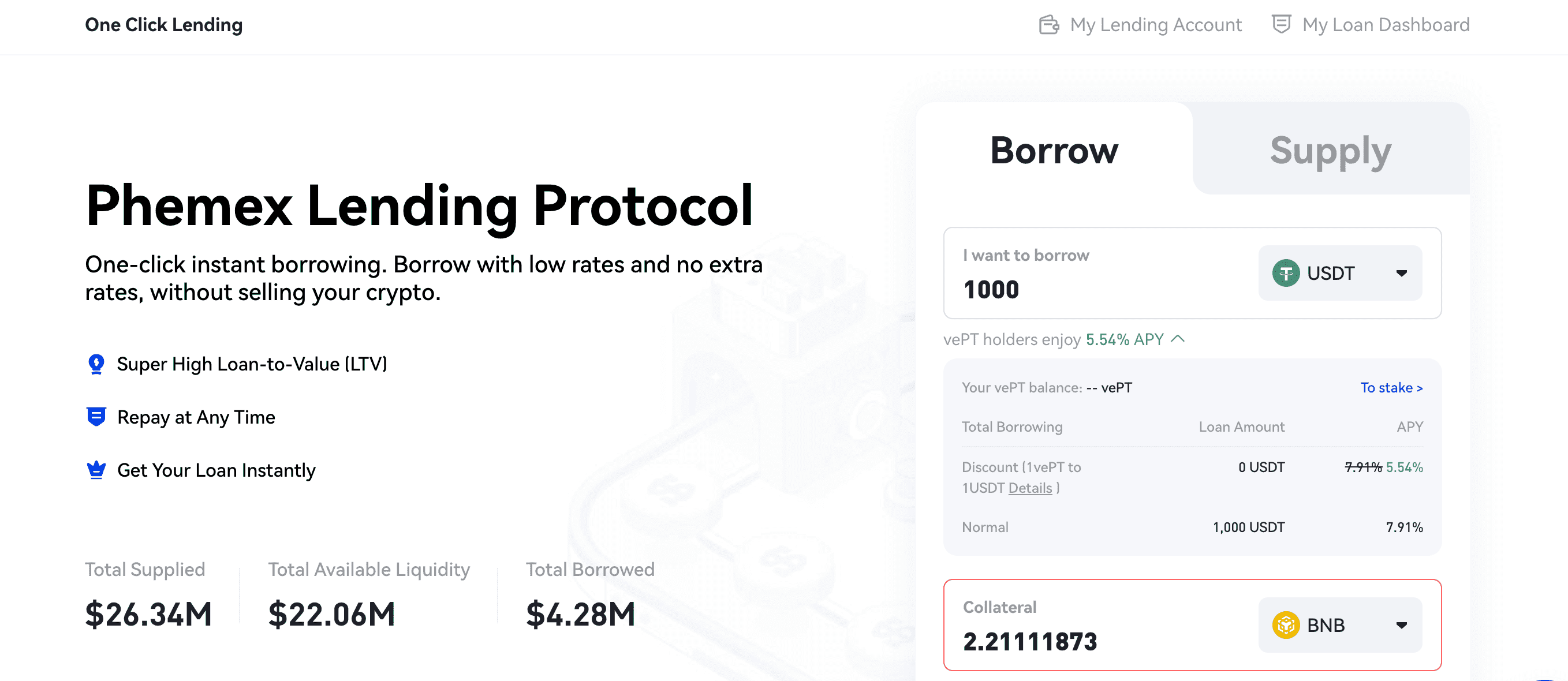

Acquire Crypto Assets: You’ll need cryptocurrency to participate, such as ETH, USDC, or DAI. Platforms like Phemex make it easy to buy these assets securely using fiat or other cryptocurrencies. Phemex offers a user-friendly interface, robust security, and low fees, making it a reliable choice for getting the tokens you need to enter DeFi.

-

Set Up a Crypto Wallet: You’ll need a non-custodial wallet like MetaMask or Trust Wallet to interact with DeFi platforms. These wallets let you control your private keys and connect to protocols like Aave, Compound, or MakerDAO.

-

Choose a DeFi Platform: Research reputable lending platforms. Aave and Compound are popular for lending and borrowing, while MakerDAO is known for its DAI stablecoin loans. Check each platform’s APY, collateral requirements, and security track record.

-

Deposit or Borrow: As a lender, deposit your crypto into a platform’s lending pool to start earning interest. As a borrower, lock up collateral and borrow against it. Always double-check the collateral ratio and liquidation risks.

-

Monitor Your Position: DeFi markets move fast. Keep an eye on your collateral’s value (if borrowing) or your APY (if lending). Tools like DeFi Pulse or Zapper can help you track your portfolio.

-

Stay Safe: Only use audited platforms, avoid investing more than you can afford to lose, and diversify your assets to reduce risk.

Phemex Connection

To participate in DeFi lending, you first need to acquire the right cryptocurrencies, such as ETH for collateral or stablecoins like USDC for lending. Phemex is a trusted platform where you can easily purchase these assets. With its intuitive interface, advanced security features, and competitive fees, Phemex simplifies the process of getting the tokens you need to jump into DeFi. Whether you’re buying ETH to use as collateral or USDC to lend for steady returns, Phemex provides a seamless on-ramp to the decentralized world.

Once you have your assets, you can transfer them to a DeFi-compatible wallet and start exploring lending platforms. Phemex’s focus on security ensures your funds are safe during the acquisition process, giving you peace of mind as you venture into DeFi.

Tips for Success in DeFi Lending

To make the most of DeFi lending, keep these tips in mind:

- Start Small: DeFi can be complex, and the risks are real. Begin with a small amount to learn how platforms work before committing more funds.

- Diversify: Don’t put all your crypto into one platform or asset. Spread your lending or borrowing across multiple protocols to reduce risk.

- Understand Fees: DeFi transactions on Ethereum can incur gas fees, which vary based on network congestion. Budget for these costs, especially when depositing or withdrawing funds.

- Stay Informed: Follow DeFi news on platforms to stay updated on protocol upgrades, hacks, or market trends. Knowledge is your best defense.

- Use Stablecoins for Stability: If you’re risk-averse, consider lending stablecoins like USDC or DAI, which are pegged to the dollar and less volatile than ETH or BTC.

The Future of DeFi Lending

DeFi lending is still in its early stages, but it’s evolving rapidly. New protocols are emerging with lower collateral requirements, cross-chain compatibility, and innovative yield strategies. Layer-2 solutions like Optimism and Arbitrum are reducing Ethereum’s gas fees, making DeFi more accessible. Meanwhile, institutional interest is growing, with traditional finance players exploring ways to integrate DeFi into their offerings.

However, challenges remain. Scalability, regulatory clarity, and user education are critical for DeFi’s mainstream adoption. As the space matures, we can expect more user-friendly interfaces, better security practices, and tools to simplify the DeFi experience for newcomers.

Conclusion

DeFi lending offers a compelling way to earn passive income or access liquidity using your cryptocurrency. By acting as a decentralized bank, it empowers you to lend or borrow without intermediaries, offering accessibility, transparency, and potentially higher yields. However, the risks—smart contract vulnerabilities, liquidation, and market volatility—require careful consideration.

If you’re ready to explore DeFi lending, start by acquiring assets like ETH or USDC on a platform like Phemex, set up a wallet, and choose a reputable protocol. With the right knowledge and caution, DeFi lending can be a powerful tool to grow your crypto portfolio or unlock new financial opportunities. Dive in, but always tread carefully in this dynamic and evolving space.

Disclaimer: The information presented in this article is for educational and informational purposes only. It does not constitute investment advice, financial advice, trading advice, or any other form of advice, and you should not treat any of the article's content as such. Phemex does not recommend that any specific cryptocurrency should be bought, sold, or held by you. The cryptocurrency market is subject to high market risk and volatility. Past performance is not indicative of future results. All investment strategies and investments involve risk of loss. You should conduct your own due diligence and consult a qualified financial advisor before making any investment decisions. Phemex is not responsible for any investment decisions you make based on the information provided in this article.