Summary Box (Quick Facts)

-

Ticker Symbol: ALLO

-

Chain: Cosmos (with tokens available on Ethereum, BNB Chain, and Base)

-

Contract Address (Ethereum): 0x8408d45b61f5823298f19a09b53b7339c0280489

-

Circulating Supply: ~200.5 million ALLO

-

Total Supply: 1 billion ALLO

-

Primary Use Case: Self-improving decentralized Artificial Intelligence network.

-

Current Market Cap: ~$108 million

-

Availability on Phemex: Yes (Spot)

What Is Allora?

Allora (ALLO) is a decentralized, self-improving artificial intelligence network designed to break down the silos that confine powerful AI within large corporations. Explained simply, Allora creates a collaborative environment where different machine learning models can work together, learn from one another, and generate more accurate and context-aware predictions than any single model could achieve alone.

The network operates through user-created "topics," which define specific prediction categories. Within these topics, AI model operators (known as "workers") submit their predictions, or "inferences." The network's consensus mechanism then combines these inputs, assesses them for quality, and distributes rewards accordingly. This carefully designed incentive system allows Allora to continually learn and improve, bridging the information gap between data owners, AI specialists, and the end-users who need actionable insights. Explore Phemex Academy to learn more about emerging AI cryptocurrencies.

How Many ALLO Are There?

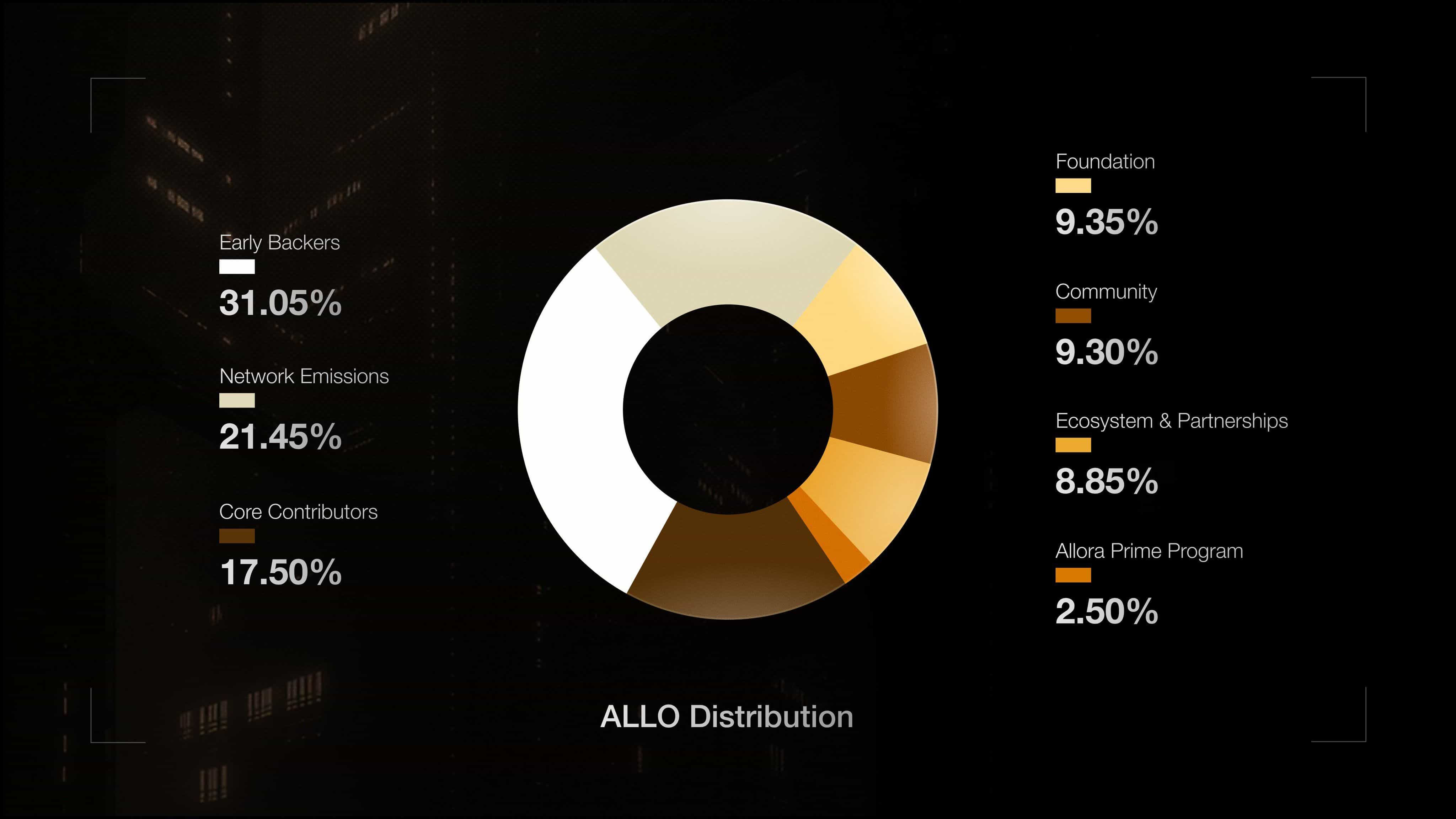

The tokenomics of Allora are structured around a total supply of 1 billion ALLO tokens, designed to support long-term growth and network participation. The distribution is allocated across key areas of the ecosystem.

Token Distribution

The allocation of the 1 billion ALLO tokens is as follows:

-

Early Backers: 31.05%

-

Network Emissions: 21.45%

-

Core Contributors: 17.50%

-

Community: 9.30%

-

Foundation: 9.35%

-

Ecosystem & Partnerships: 8.85%

-

Allora Prime Staking Rewards: 2.50%

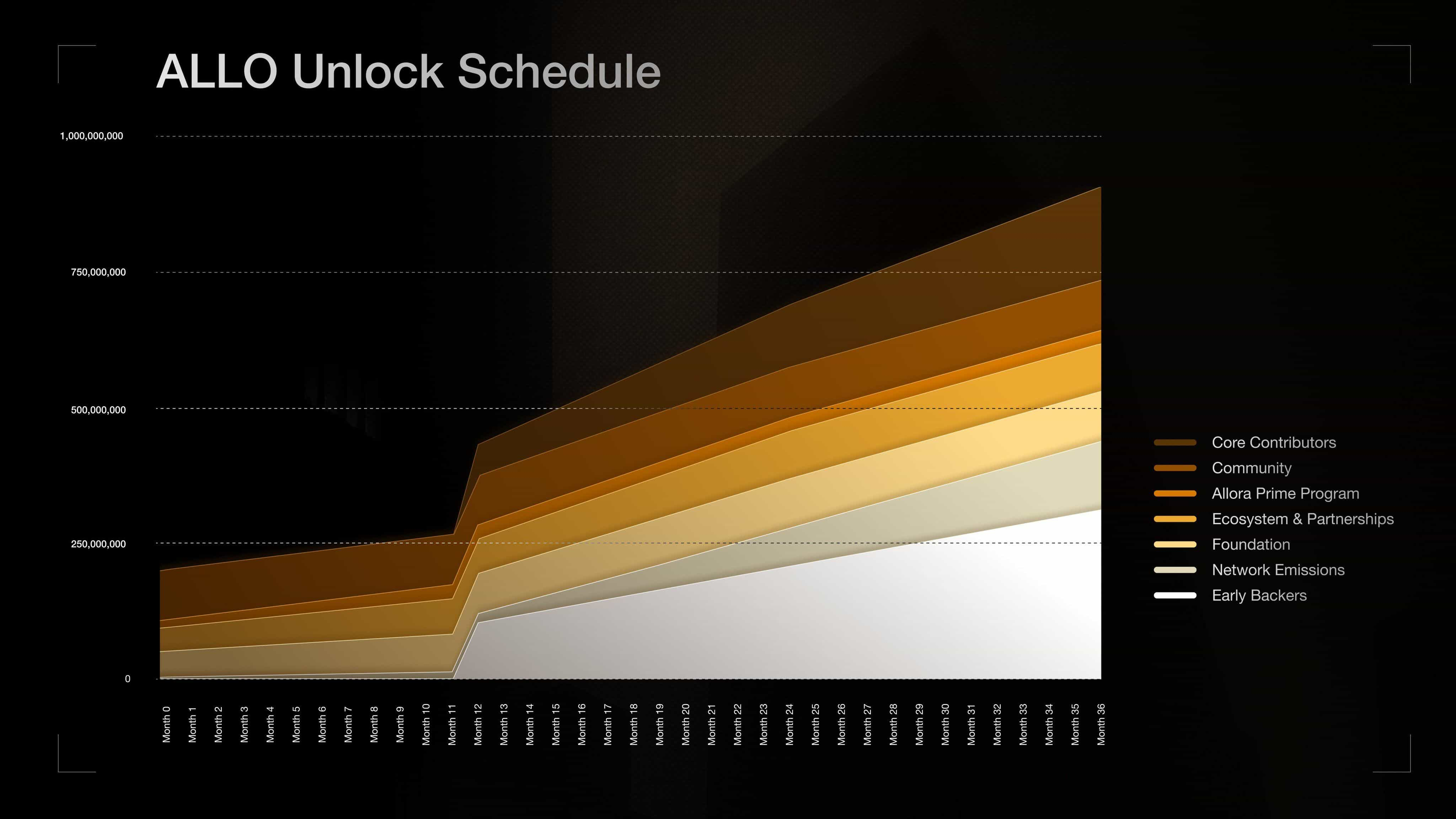

Vesting and Unlock Schedule

To ensure market stability and long-term alignment, the token allocations are subject to specific vesting schedules:

-

Early Backers & Core Contributors: These tokens are locked for 12 months. After this period, 33% of the tokens unlock, with the remainder released linearly over the following 24 months.

-

Foundation: Approximately half of the foundation's allocation (4.925% of the total supply) was unlocked at launch to support liquidity and network security. The rest unlocks linearly over the two years following the Token Generation Event (TGE).

-

Ecosystem & Partnerships: Half of this allocation was unlocked on day one, with the remaining half unlocking linearly over the next two years.

-

Community: A majority of the community allocation was unlocked at the public mainnet launch.

The Network Emissions portion follows a "Bitcoin-like" schedule, where the rate of new token creation for rewards decreases over time, ensuring a sustainable and predictable model for incentivizing participants.

What Does ALLO Do?

The ALLO token is the native utility token that powers the entire Allora ecosystem. The primary ALLO use case is facilitating a decentralized intelligence market through several key functions:

-

Purchasing Inferences: Consumers use ALLO to pay for AI-generated predictions. The network uses a "Pay-What-You-Want" (PWYW) model, allowing users to decide the fee they wish to pay. This fosters flexible price discovery, but topics that receive zero fees will not generate rewards for their contributors, ensuring a healthy market dynamic.

-

Staking and Security: Network participants known as "reputers" and validators stake ALLO to provide economic security and vouch for the accuracy of data. Token holders can also delegate their stake to a reputer to earn rewards passively, further securing the network.

-

Network Participation: ALLO is used to pay registration fees for workers and reputers who wish to contribute to a topic and earn rewards.

-

Reward Distribution: The network uses ALLO to reward participants for their contributions. Workers and reputers receive rewards based on the quality and accuracy of their predictions and assessments, paid out at the end of discrete time periods called "epochs."

Allora vs. Kite

Both Allora and Kite operate at the intersection of AI and blockchain, but they target different aspects of the agentic economy. Here’s how they compare.

| Feature | Allora | Kite |

| Primary Focus | A decentralized marketplace for collective AI intelligence and predictions. | A foundational payment and identity layer for autonomous AI agents. |

| Core Technology | Built on the Cosmos SDK as an app-specific blockchain. Uses "Inference Synthesis" to combine multiple AI models' outputs for superior accuracy. | A purpose-built Layer 1 blockchain. Uses Proof of Artificial Intelligence (PoAI) to align the ecosystem. |

| Main Use Case | Providing sophisticated, context-aware predictions for dApps, DeFi, and other on-chain systems. | Enabling AI agents to have verifiable identities, transact with stablecoins, and operate with programmable governance. |

| Approach | A collaborative, self-improving network where AI models compete and learn from each other to improve collective intelligence. | An infrastructure-focused network providing the essential tools (identity, payments) for an "agentic economy" to function. |

The Technology Behind Allora

Allora's technical foundation is built to support a self-improving, decentralized AI network.

-

Consensus Mechanism: As a Cosmos-based blockchain, Allora utilizes a Proof-of-Stake consensus mechanism, where network validators stake tokens to secure the network and validate transactions.

-

Unique Technologies: The standout technology is its system of Context Awareness. The network not only evaluates the accuracy of predictions ("inferences") but also incentivizes participants to submit "forecasts" on how their peers will perform. This creates a feedback loop that helps the network understand which AI models perform best under specific conditions (e.g., bull vs. bear markets). This enables Allora to deliver better results than any single participant could alone.

-

Topics and Rule Sets: Anyone can create a "topic" to categorize a specific type of prediction. The creator also defines the "rule set," which includes the logic for evaluating how accurate an inference is and the source of ground truth to compare it against.

-

Infrastructure and Notable Partnerships: Allora is backed by prominent venture capital firms, including Polychain Capital, Framework Ventures, and CoinFund, which validates its vision and provides a strong foundation for growth.

Team & Origins

Allora was developed by Allora Labs, previously known as Upshot. The team has a strong background in developing predictive oracles and related technologies. Their work on Allora stems from years of research into creating a decentralized "intelligence layer" that can be integrated with any on-chain protocol. The project has raised significant capital across multiple funding rounds since 2021, underscoring its long-term vision and development timeline.

Key News & Events

-

Mainnet Launch (November 2025): The Allora network officially went live, marking the launch of its decentralized intelligence network and the ALLO token.

-

Exchange Listings (November 2025): Shortly after its launch, ALLO was listed on Phemex and other platforms, making it accessible to a global audience.

-

Initial Price Volatility: Following its launch and airdrop, the ALLO token experienced a significant price correction of over 60%, a common occurrence for newly launched, VC-backed projects as early investors and airdrop recipients take profits.

Is ALLO a Good Investment?

Determining whether Allora (ALLO) is a good investment requires a balanced look at its potential and risks. (Disclaimer: This is not financial advice. Crypto trading involves risks; only invest what you can afford to lose.)

-

Past Performance: As a newly launched token, ALLO’s price history is short. It saw a sharp decline immediately after launch, which is typical for projects with significant early investor and airdrop allocations. Investors should anticipate high volatility in the early stages.

-

Community Growth: The project has garnered significant attention due to its innovative approach to decentralized AI and strong VC backing. Its success will depend on its ability to foster a robust community of developers, model creators ("workers"), and consumers.

-

Tech and Market Positioning: Allora’s technology is at the forefront of the decentralized AI (DeAI) narrative. Its context-aware, self-improving model is a unique solution to a complex problem. The ALLO investment potential is tied to its ability to become the foundational intelligence layer for Web3, a sector with massive growth potential.

-

Risks:

-

Volatility: Like all new altcoins, ALLO is subject to extreme price volatility.

-

Competition: The AI and crypto space is highly competitive, with other projects vying for market share.

-

Execution Risk: The team must successfully execute its ambitious roadmap and attract a critical mass of network participants.

-

In conclusion, Allora presents a compelling, high-risk, high-reward opportunity. Its long-term value will be driven by the network's adoption and the utility of its decentralized intelligence.

Community Perspectives (via Reddit)

Given the recent launch of Allora, community discussions on platforms like Reddit are just beginning to form. Early conversations focus on:

-

Post-Airdrop Price Action: Many users are discussing the price drop after the launch, with experienced traders noting this is a common pattern for hyped projects.

-

The Technology: More technically inclined users are diving into the whitepaper, discussing the potential of the Inference Synthesis model and its applications in DeFi and beyond.

-

Long-Term Potential: Debates are emerging about whether ALLO can recover from its initial dip and fulfill its promise as a leader in the decentralized AI space.

As the project matures, these community forums will become a valuable source for gauging sentiment and tracking grassroots adoption.

How to Buy ALLO on Phemex

For traders looking to gain exposure to this innovative project, here’s how to buy ALLO on a secure and trusted platform:

-

Sign Up for Phemex: Create an account on Phemex if you don’t have one already.

-

Fund Your Account: Deposit cryptocurrency or purchase it directly with fiat currency.

-

Navigate to the Spot Market: Find the ALLO/USDT trading pair on the Phemex Spot Market.

-

Place Your Order: Choose your order type (Market, Limit, etc.) and enter the amount of ALLO you wish to purchase.

-

Confirm the Trade: Review and confirm your transaction.

To learn more about trading this and other cryptocurrencies, explore our dedicated guides on the Phemex Academy. Trade ALLO now on Phemex!

FAQs

1. What problem does Allora solve?

Allora solves the problem of "siloed machine intelligence," where powerful AI is controlled by a few large companies. It creates a decentralized network where AI models can collaborate, leading to more accurate and accessible intelligence for everyone.

2. Is the ALLO token necessary for the network?

Yes, the ALLO token is essential. It is used to pay for AI-generated inferences, reward network participants for their contributions, secure the network through staking, and facilitate governance.

3. Why did the ALLO price drop after launch?

The price drop was likely caused by a combination of factors, including early investors taking profits and airdrop recipients selling their tokens. This is a common pattern for new token launches with significant pre-launch allocations.

Summary: Why It Matters

Allora represents a forward-thinking approach to artificial intelligence, shifting the paradigm from closed, centralized systems to an open and collaborative network. By enabling machine learning models to work together and continuously improve, it unlocks the potential for smarter, more adaptive, and more accessible AI for decentralized applications. Its success could position it as a critical infrastructure layer for the future of Web3, where verifiable and context-aware intelligence is paramount. As the digital world increasingly relies on AI, a decentralized, transparent, and self-improving network like Allora is not just innovative—it's essential.