Summary: KTA Key Metrics

-

Ticker / Token: Keeta (KTA)

-

Blockchain Network: Base (Ethereum Layer-2) – transitioning to Keeta’s own Layer-1 mainnet

-

Current Price: ~$0.58 USD (Oct 23, 2025)

-

Market Capitalization: ~$249 million (rank ~#276–317 by market cap)

-

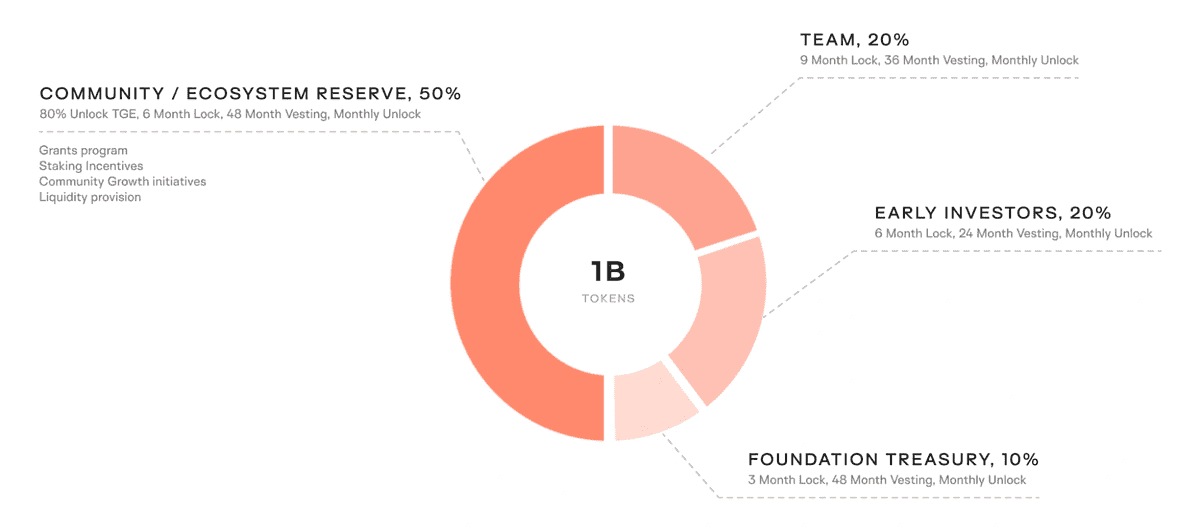

Circulating Supply: ~431 million KTA (out of 1.0 billion max)

-

All-Time High: $1.68 (June 9, 2025) – now ~65% below ATH

-

All-Time Low: $0.006820 (March 8, 2025) – now over +8,500% above ATL

-

ROI Since ICO: ~+3,900% (≈39× from ~$0.0127 seed price)

-

Listed on Phemex: Price tracking available / How to buy Keeta

What Is Keeta?

What is Keeta? Keeta is a next-generation Layer-1 blockchain platform focused on unifying payment networks and real-world asset (RWA) tokenization. It aims to solve cross-border payment friction by enabling secure, instant cross-chain transactions with built-in compliance features. Keeta touts a proprietary high-speed ledger capable of up to 10–11 million transactions per second (TPS) with ~400ms finality, far exceeding traditional blockchains. This extreme throughput, combined with ultra-low fees (~$0.0001 per tx), is designed to make global transfers “as easy as Venmo,” according to Keeta’s founder. The network includes native tokenization tools for any asset and built-in KYC/AML compliance, allowing institutions to integrate via APIs without sacrificing regulatory requirements.

Keeta’s ecosystem value lies in bridging traditional finance (TradFi) with decentralized finance. It targets use cases like real-world asset trading, interbank transfers, and stablecoin issuance on-chain. Notably, former Google CEO Eric Schmidt is an investor and advisor, having personally backed Keeta with $17 million and praising it as “orders of magnitude more scalable and efficient than existing solutions”. This high-profile support has bolstered Keeta’s credibility in a crowded L1 sector. Overall, Keeta can be categorized as an infrastructure Layer-1 (L1) blockchain with a strong focus on payments, compliance, and RWA integration, distinguishing it from general-purpose chains.

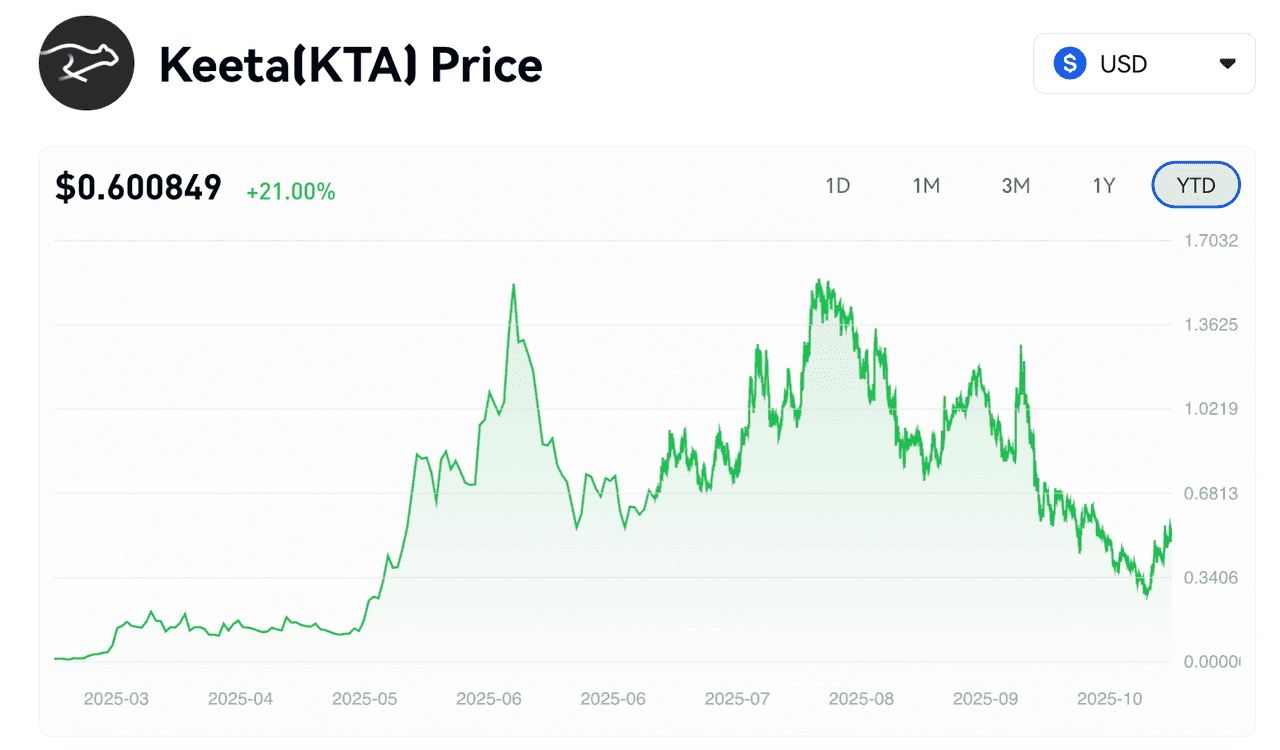

Keeta Price (source)

Price History & Performance Overview

Keeta’s price history in 2025 has been dramatic. The project launched its token KTA in March via the Base network, as its mainnet wasn’t live. Initially, KTA traded around $0.0127 and even dipped to ~$0.0068 shortly after launch. However, by Q2 2025, as buzz around its technology grew, KTA surged over 700%, climbing from about $0.10 to roughly $0.80, increasing its valuation from ~$100M to ~$800M. Drivers of this rally included claims of unprecedented TPS, its positioning as a "compliant Solana-killer," and Eric Schmidt's involvement.

KTA peaked at $1.68 by June 9 but faced a significant correction over the summer, dropping to about $0.27 by mid-October—a decline of roughly 80%. Factors contributing to this pullback included profit-taking and the realization that the mainnet was not yet live. One whale sold 1.51 million KTA at ~$1.00, netting $1.52M in profit.

In October, KTA rebounded after Coinbase added it to its roadmap, leading to a price jump from about $0.26 to $0.57 on the trading announcement. By late October, it stabilized in the mid-$0.50s, maintaining a ~100% increase for the month. Year-to-date, KTA was up ~40× from its ICO price and +10,000% from launch, though the journey has been volatile, with 29% monthly volatility recently. Major developments are likely to continue influencing these price swings as Keeta matures.

Whale Activity & Smart Money Flows

Keeta's rapid rise has attracted attention in on-chain whale activity, with analysts noting significant “smart money” movements. One early whale accumulated ~2.12M KTA for $137k and later sold 1.51M KTA during a summer peak for ~$1.52M, netting nearly $1.49M in profit. With 60% of the total supply initially locked and 40% treated as equity, this reduces sell-pressure from insiders, which could be bullish for value retention.

Whale tracking shows both accumulation and distribution. Ahead of the Coinbase listing, large wallets accumulated KTA, indicating confidence in a price surge. Post-listing, no major sell-off was observed, as KTA's price held steady.

Smart money sentiment is also noted, with concentrated holder distribution but mitigated concerns of unlocks if early holders are indeed locked as equity. However, about 60% of airdropped KTA remains unclaimed, posing a risk of dilution if those tokens are sold when claimed. Overall, KTA's whale activity reflects classic patterns, with large players accumulating and taking profits, while new investors may enter on dips. Tools like Arkham allow for easy monitoring of these movements.

Keeta Tokenomics (source)

On-Chain & Technical Analysis

From a technical analysis perspective, KTA's charts show positive momentum after the October rally. The daily RSI dipped to around neutral (~48 as of Oct 23) following a previous spike into overbought territory during the Coinbase pump, indicating that recent price fluctuations from $0.57 to $0.45 and back to $0.58 helped ease overbought conditions. The MACD flipped positive as KTA bounced off a low of $0.26, signaling a new uptrend. However, KTA remains below its 50-day simple moving average of ~$0.71, suggesting the medium-term trend is still catching up.

On-chain metrics are mixed, with the Market's Fear & Greed Index at 27, signaling caution in altcoins. KTA's sentiment remains “Bearish,” reflecting its recent downtrend. The token’s volatility is high at ~29%, indicating traders should expect substantial fluctuations.

Key support is at the recent low of $0.26, which many expect to hold, while resistance levels are around $0.60 and $0.80, with $1.00 being a significant psychological milestone. The all-time high of $1.68 remains a distant resistance.

In summary, KTA shows improving short-term momentum, but it must surpass mid-term moving averages and key resistance levels to confirm a sustained uptrend. Traders should monitor trading volume and on-chain activity post-mainnet launch while managing risk due to high volatility. Setting stop-loss levels around $0.26 can aid in navigating potential downturns.

Long-Term Price Forecast (2027–2030)

Projecting out to 2027–2030, KTA’s price becomes increasingly speculative and dependent on fundamental success. By 2027, Keeta will need to prove itself as a legitimate Layer-1 player to maintain value. If it can capture even a small share of global payment traffic or RWA tokenization, the upside could be substantial. Let’s consider two ends of the spectrum for a Keeta price forecast 2027–2030:

-

Bullish 2030 Scenario: If Keeta gains widespread adoption among banks and fintechs, realizing its promise of 10M+ TPS, demand for KTA could surge. Optimistic forecasts suggest a price around $20 by 2030, implying a multi-billion dollar market cap. Even a more conservative estimate of $5–$10 would make early investors happy, assuming consistent growth in its ecosystem.

-

Bearish 2030 Scenario: Conversely, if Keeta fails to compete with Ethereum, Solana, or newer L1s, or if regulatory hurdles arise, KTA could drop below $0.10, indicating a lack of traction. Critics suggest that if promised throughput compromises decentralization, use could dwindle, leading to sell-offs.

Most likely trajectory: Realistically, KTA may settle between these extremes, potentially ranging from $2–$5 by 2027, with mid to high single-digits by 2030. This outcome assumes healthy growth without total market dominance. Investors should monitor daily active users, total value transacted, and developer activity, as these factors will be more indicative of value than short-term trends. Long-term crypto forecasts are speculative, so a cautious approach is essential.

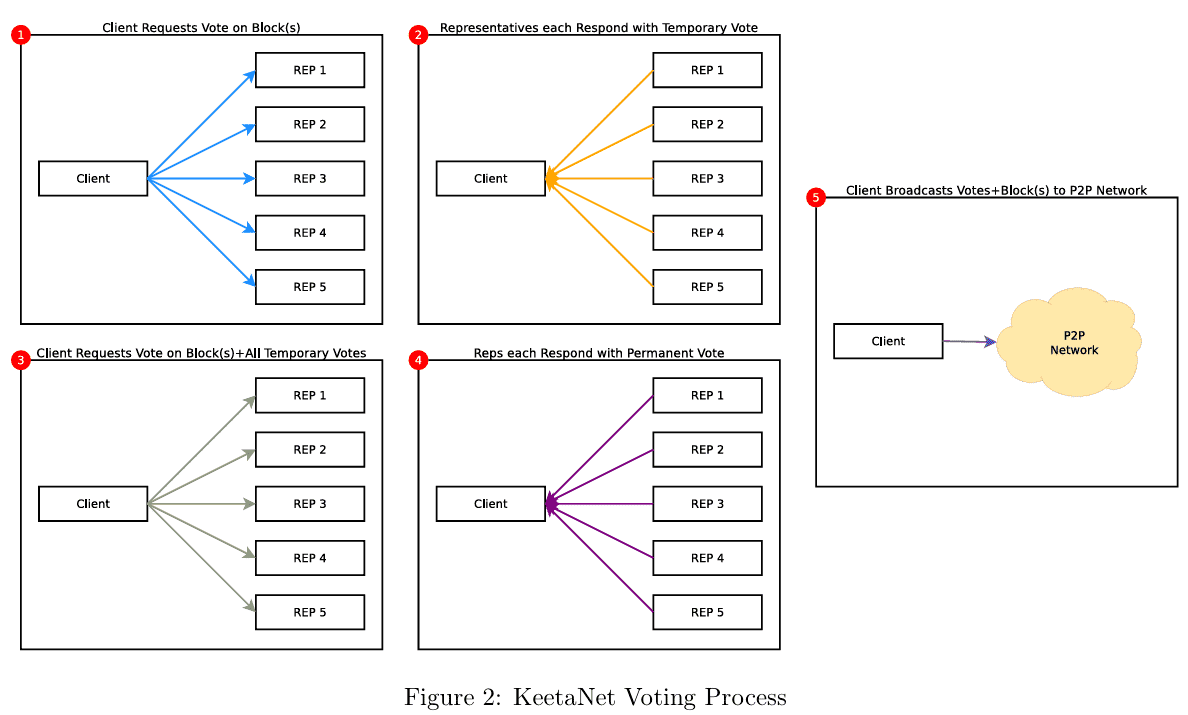

Keeta Voting Process (source)

Fundamental Drivers of Growth

Keeta’s growth, and consequently KTA’s price appreciation, will depend on key fundamental factors beyond market hype:

-

Innovative High-Speed Architecture: Keeta’s DAG/blockchain hybrid claims 10–11 million TPS throughput. If verified, this could position Keeta as one of the fastest networks, attracting high-frequency trading, real-time gaming, and IoT applications.

-

Built-In Compliance & Identity: Keeta integrates compliance tools, featuring KYC identity certificates that enable regulated entities to use the network while meeting legal standards. This design could attract banks and enterprises, particularly as regulatory scrutiny increases.

-

Real-World Asset (RWA) Tokenization Boom: Keeta aims to tokenize assets like currencies and equities, tapping into a growing ~$26B RWA market. With KYC-compliant stablecoins like KUSD and AUSD, Keeta can facilitate seamless asset representation on-chain, benefiting KTA holders through buybacks.

-

Staking, Governance & Utility of KTA: KTA will be essential for transaction fees, staking, and governance on the network. If Keeta employs a Proof-of-Stake model, increased network activity could drive demand for KTA, also enhancing its use in DeFi applications.

-

Major Integrations & Partnerships: Keeta has formed partnerships, such as with SOLO for credit scoring and Google Cloud for infrastructure. Upcoming milestones like a high-frequency DEX launch and a KUSD debit card can spur user growth, with the potential for significant strategic partnerships.

-

Developer Traction: The success of Keeta will depend on attracting developers. A public GitHub release and a grant program are part of their strategy. If numerous dApps emerge by 2026, it could signal long-term growth; lack of development would be concerning.

In summary, Keeta’s fundamental strengths revolve around speed, compliance, and finance-centric functionality. If the project can execute on these and grow an ecosystem, these drivers will underpin sustained value in KTA beyond speculative trading.

Key Risks to Consider

Investing in Keeta (KTA) comes with several risks that potential investors should consider:

-

Token Supply Dilution: Currently, 430M KTA tokens are circulating, but around 60% of airdropped tokens (~258M KTA) remain unclaimed. If these tokens are claimed and sold, it could increase supply and pressure prices. Moreover, when team or investor lockups expire, they could also lead to selling pressure. Investors should keep an eye on token release schedules to avoid dilution risks.

-

Regulatory and Centralization Risks: Keeta aims to be compliant, but this may lead to a more centralized architecture, which could raise concerns within the crypto community. If regulatory stances tighten, Keeta could face challenges, particularly if it is labeled as a security. The built-in KYC could deter privacy-focused users, complicating its value proposition.

-

Adoption/Utility Risk: The successful adoption of Keeta is uncertain. If it fails to attract users and developers post-launch, it may struggle against competitors like Ethereum and Solana. If it doesn’t offer unique utility, it risks becoming irrelevant, leading to sell-offs.

-

Competition and Market Share: Keeta faces intense competition from both crypto networks and traditional payment systems. If incumbents improve faster than blockchain adoption grows, Keeta may lose its niche. New Layer-1s could also offer similar or better technology.

-

Execution and Technology Risk: High claims, like 10M TPS, necessitate rigorous testing. Any major technical flaws or delays in delivering features could undermine investor confidence. As Keeta is still in early stages, flawless execution is crucial.

-

Market Volatility & Macro Factors: KTA is subject to crypto market volatility. It experienced significant declines during market downturns, and broader macroeconomic factors can also impact its performance.

Investors should remain vigilant about these risks when considering an investment in Keeta.

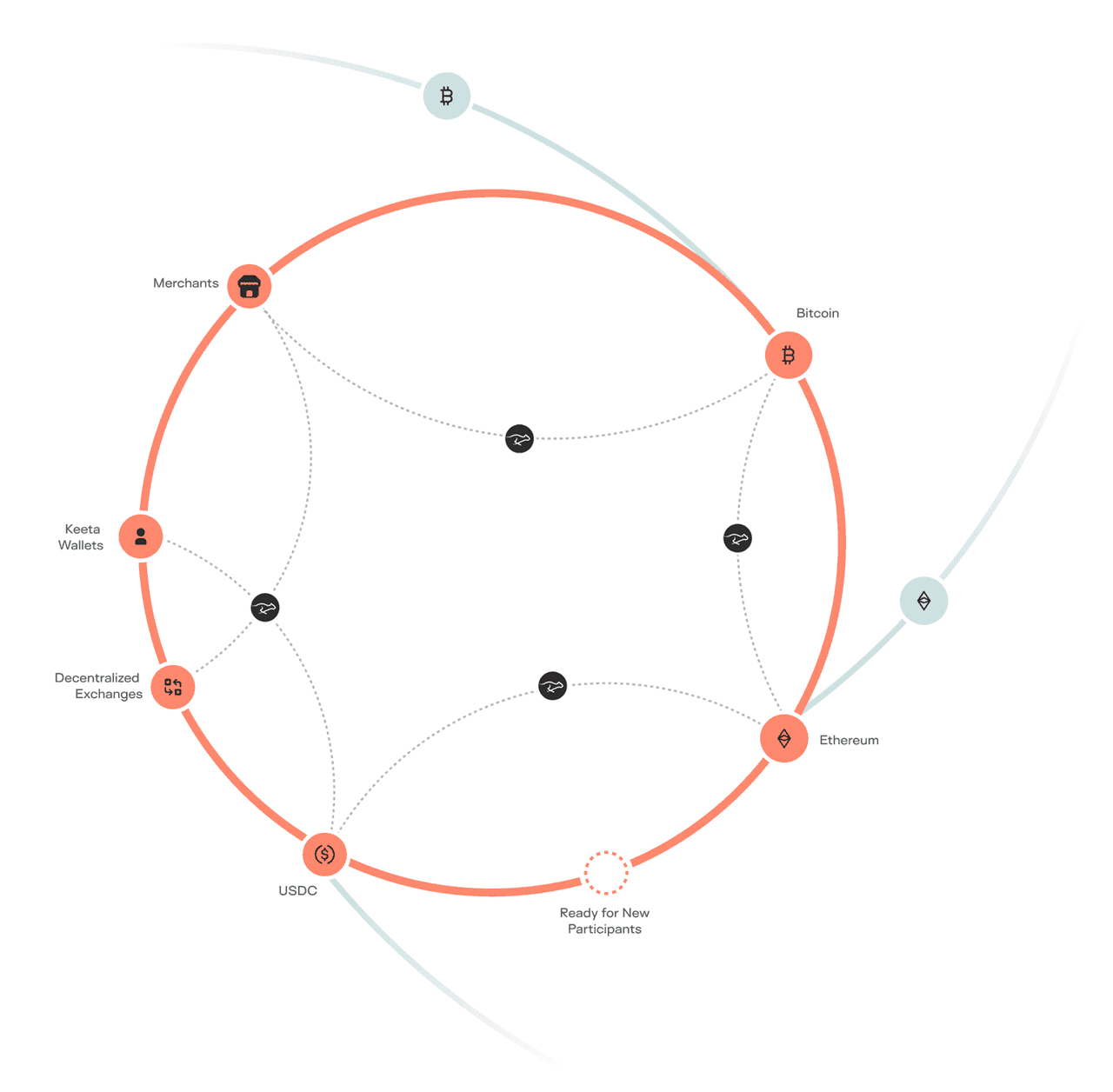

Keeta Network ecosystem (source)

Analyst Sentiment & Community Insights

Analyst sentiment on Keeta is divided, highlighting its high-risk, high-reward nature. Some crypto analysts are optimistic about its technology and recent exchange activity, with The Daily Hodl recognizing Keeta as a promising “little-known altcoin” following Coinbase news. Bitscreener suggests that despite volatility, KTA could rise to ~$2.53 by 2026, indicating that many believe Keeta is currently undervalued. The project has garnered attention from reputable sources like Cointelegraph and CoinDesk, with its unique approach and partnerships with traditional finance entities, including being featured in a Google Cloud blog post.

However, skeptics raise concerns about potential centralization, arguing that Keeta's structure undermines its blockchain promise. Some label it a possible “ghost chain,” worrying about low liquidity post-migration to its network. Social media buzz shows Keeta trending on X (Twitter) during major announcements, particularly after the Coinbase listing, while Google Trends indicates rising searches during peak moments.

Community sentiment on platforms like CoinGecko and CoinMarketCap is predominantly positive, though this can change with price fluctuations. In conclusion, while there’s optimism about Keeta’s future, there's a cautionary note urging verification of claims. As one Reddit user pointed out, “Dig deeper into Keeta, but verify everything, as false promises are common in our industry.” This reflects the current sentiment: cautiously intrigued.

Is Keeta a Good Investment?

So, is Keeta a good investment? The answer will depend on your risk tolerance and belief in the project’s long-term vision. On the one hand, Keeta offers a compelling narrative: a fast, scalable Layer-1 tailored for real-world finance, backed by credible figures and making headlines with exchange listings. It has delivered eye-catching returns in 2025 for those who got in early, and it continues to show potential catalysts (technology rollouts, partnerships, etc.) that could drive future growth. If Keeta succeeds in capturing even a slice of the multi-trillion dollar cross-border payments market or RWA sector, KTA’s upside could be enormous in the coming years.

On the other hand, prospective investors must acknowledge that Keeta is still highly speculative and not yet battle-tested. The project is less than one year into mainnet, competing in an arena where many startups have fallen short. KTA’s price is extremely volatile, and there are legitimate risks (as discussed) regarding supply dilution and adoption. Not financial advice: but a prudent approach might be to treat KTA as a high-risk, high-reward allocation – one that could pay off handsomely if Keeta becomes a top blockchain by 2030, but also one that could underperform or crash if things go awry.

A balanced view: Keeta has strong fundamentals on paper (speed, compliance, backing) and early market traction, which makes it promising. Yet, investors should only invest what they can afford to lose, because it’s also unproven. Diversification is key – KTA might be a good investment as a small part of a broader crypto portfolio, rather than a lone bet.

In summary, Keeta is a bold bet on the future of crypto-finance integration. It could be a breakout success or another case of “great idea, tough execution.” Time will tell. The team’s progress in 2025–2026 will be crucial to watch. Always do your own due diligence and consider consulting financial advice if needed.