Summary

-

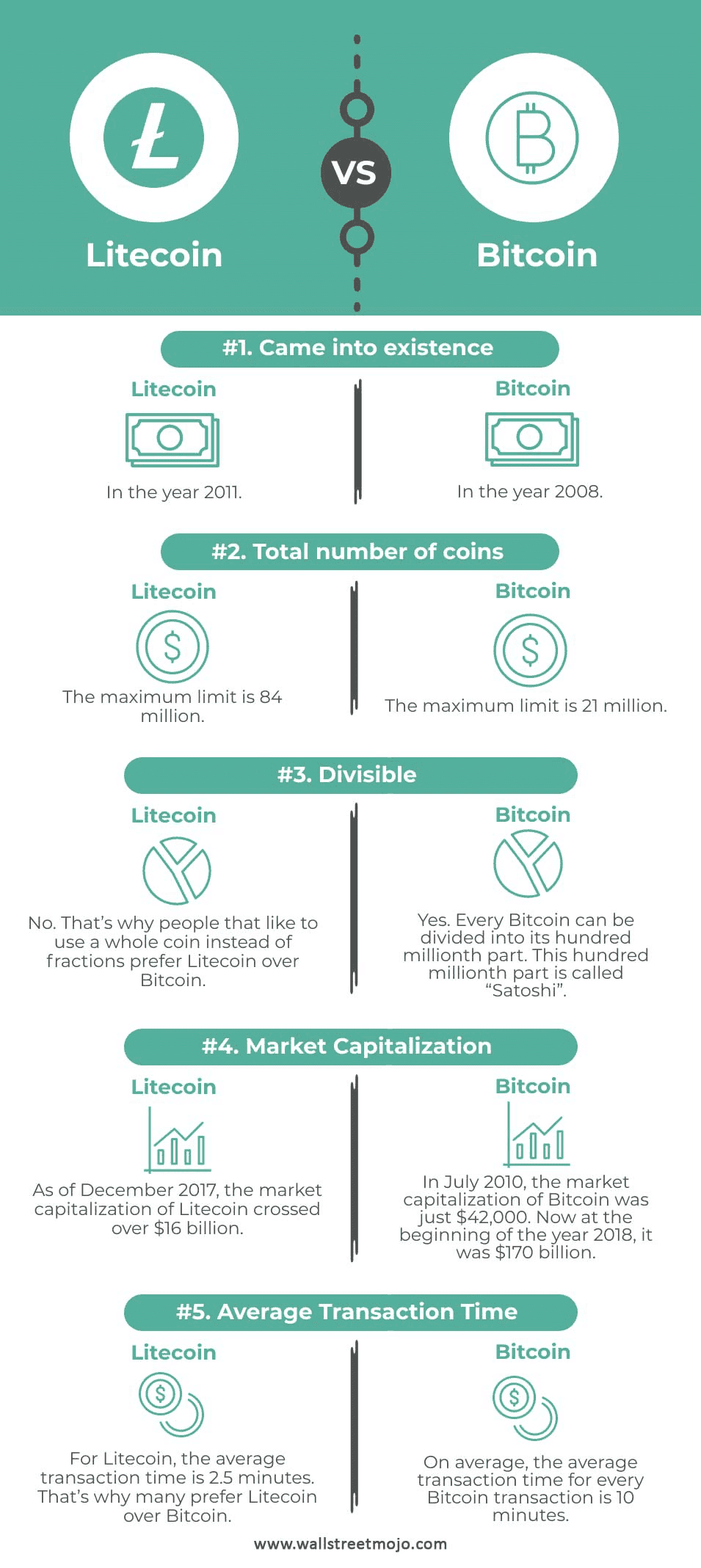

Origin & Purpose: Bitcoin (BTC), launched in 2009 as the first decentralized cryptocurrency, is known as “digital gold.” Litecoin (LTC), created in 2011 as a Bitcoin fork, is referred to as “digital silver” and is designed for faster everyday transactions.

-

Speed & Fees: Litecoin processes blocks 4 times faster than Bitcoin (2.5 minutes vs. 10 minutes), which leads to quicker transaction confirmations. Litecoin typically has lower fees, often just a few cents, compared to Bitcoin, where fees can soar during high traffic. For instance, in December 2023, Bitcoin's average fee peaked at ~$31, while Litecoin's was about $0.0016.

-

Supply & Economics: Bitcoin has a maximum supply of 21 million coins, while Litecoin's is 84 million. Both undergo halving events approximately every four years to reduce issuance. Litecoin's latest halving in August 2023 reduced its block reward to 6.25 LTC. Bitcoin is scarcer, yet Litecoin's larger supply can make it more practical for small transactions.

-

Technology & Mining: Both Bitcoin and Litecoin use Proof-of-Work, with Bitcoin utilizing SHA-256 and Litecoin using Scrypt. Although Scrypt was intended to be ASIC-resistant, ASICs exist for both. Merged mining with Dogecoin enhances Litecoin's security without additional energy costs.

-

Use Cases & Adoption: Bitcoin is primarily viewed as a store of value, while Litecoin is recognized for fast, low-cost payments, making it popular among merchants. In 2023, Litecoin ranked as the top cryptocurrency on BitPay, showcasing its strong adoption for transactions.

-

Network Security & Decentralization: Bitcoin's hash rate provides robust security, while Litecoin’s hash rate is lower but has remained secure since its launch. Bitcoin has more nodes, enhancing decentralization, but Litecoin’s smaller blockchain size makes running a full node more accessible. Both are fully decentralized in development with active open-source communities.

This concise summary captures the key comparisons between Bitcoin and Litecoin while addressing their current status up to 2025.

Background: Bitcoin vs Litecoin in Brief

Bitcoin (BTC) was introduced via Satoshi Nakamoto’s whitepaper in 2008 and launched in January 2009. It created the concept of a blockchain-based scarce digital asset. Bitcoin’s mission is to be a peer-to-peer electronic cash system, but due to its limited throughput and design choices prioritizing security, it is increasingly regarded as a store of value (hence “digital gold”). Over the years, Bitcoin’s network grew to billions of dollars secured, and it sparked the entire cryptocurrency industry.

Litecoin (LTC) was released in October 2011 by Charlie Lee, an ex-Google engineer, as one of the earliest Bitcoin derivatives (altcoins). Lee’s goal was to improve on Bitcoin’s shortcomings by tweaking parameters: reducing block time, increasing total supply, and using a different mining algorithm. He famously said Litecoin was intended to be the silver to Bitcoin’s gold. From its early days, Litecoin aimed to complement Bitcoin, not replace it – for instance, by handling small transactions more efficiently. Over a decade later, Litecoin is still among the top cryptocurrencies by market capitalization (often in the top 10–20 range), demonstrating longevity and consistent usage.

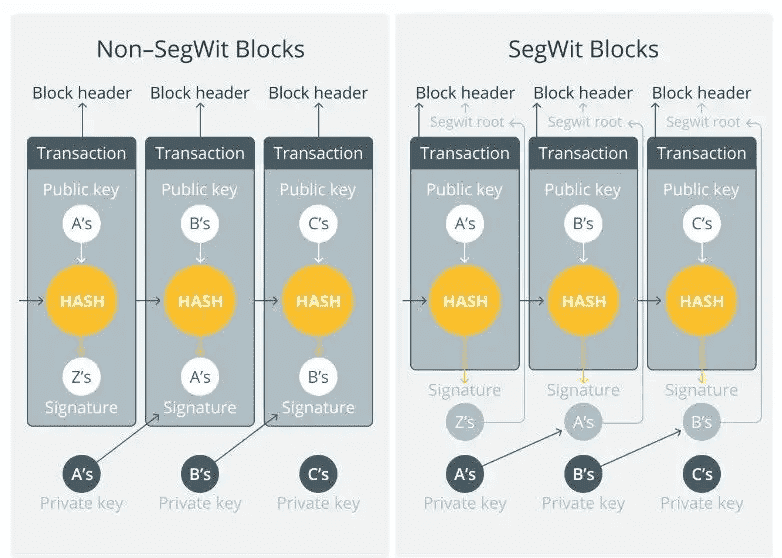

Despite their differences, Bitcoin and Litecoin share the same fundamental architecture: both are decentralized, permissionless cryptocurrencies that you can send directly to anyone in the world without intermediaries. Litecoin’s codebase is actually based on Bitcoin’s, with modifications. Improvements in Bitcoin’s software often get ported to Litecoin and vice versa. For example, Segregated Witness (SegWit) – a major Bitcoin protocol upgrade in 2017 that helped enable Lightning Network – was activated on Litecoin first in May 2017 as a proving ground, then on Bitcoin. This highlights the complementary nature: Litecoin can act as a testnet for Bitcoin upgrades (due to its smaller size and community willing to adopt changes faster).

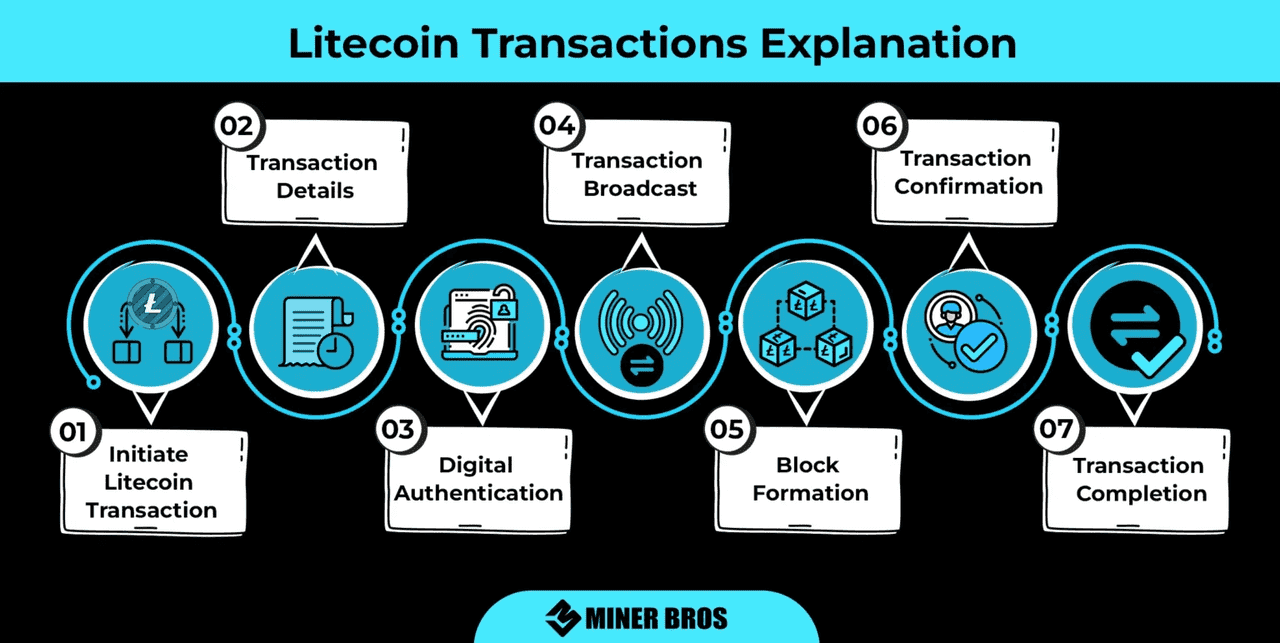

Litecoin Transaction Flow (source)

Transaction Speed and Fees

One of the key practical differences between Bitcoin and Litecoin is transaction processing speed and cost:

-

Block Generation Time: Bitcoin targets a block every 10 minutes, while Litecoin aims for 2.5 minutes. This means Litecoin confirms transactions about four times faster. For instance, sending Bitcoin may require about 30–60 minutes for multiple confirmations, whereas Litecoin can provide confirmation in roughly 15 minutes for six confirmations, making it more suitable for point-of-sale payments.

-

Throughput: Litecoin can handle around 28 transactions per second, compared to Bitcoin's 7. This higher throughput reduces congestion and allows more transactions to be processed quickly.

-

Transaction Fees: Bitcoin fees can soar during busy periods due to limited block space, often exceeding $30. Conversely, Litecoin typically has fees of just a few cents, even during high usage, making it appealing for small transactions.

-

Confirmation Security: While Bitcoin’s slower blocks mean larger average values per block, some analysts suggest that two Litecoin confirmations (~5 minutes) offer comparable security to one Bitcoin confirmation (~10 minutes). For most everyday transactions, both networks are secure, but Bitcoin might be preferred for larger transfers.

In summary, Litecoin excels in speed and low fees, positioning itself as a payment coin, while Bitcoin is often viewed as a store of value.

Consensus Algorithm and Mining

Bitcoin and Litecoin both use Proof-of-Work (PoW) mining, but they differ in algorithms and communities. Bitcoin employs SHA-256, which is dominated by specialized ASIC machines, while Litecoin uses Scrypt, a memory-hard algorithm intended to support CPU and GPU miners. This initially kept Litecoin more decentralized, although ASICs for Scrypt were developed around 2014, leading to a mining ecosystem that, while still distinct, also utilizes ASICs.

A notable feature of Litecoin is merged mining with Dogecoin. Since 2014, miners can earn rewards for both cryptocurrencies simultaneously, enhancing Litecoin’s security and hash rate. This collaboration differentiates it from Bitcoin, which stands alone.

As of 2025, Bitcoin's hash rate is immense, making it highly secure against 51% attacks. Litecoin’s hash rate is lower but sufficient for its needs, bolstered by the incentive of dual Dogecoin rewards. Both networks aim for decentralization, though mining pools dominate.

In summary, while Bitcoin and Litecoin both use PoW, they operate like different industries: Bitcoin as a massive gold mining operation and Litecoin as a smaller silver mining endeavor. Litecoin’s choice of Scrypt and its merged mining with Dogecoin helped it flourish without directly competing with Bitcoin.

SegWit vs. Non-SegWit blocks (source)

Supply, Halvings, and Economic Differences

Bitcoin and Litecoin both have finite supplies and halving mechanisms, but their specifics differ significantly:

Maximum Supply: Bitcoin has a maximum of 21 million BTC, while Litecoin has 84 million LTC (4:1 ratio). Although theoretically, if Bitcoin reaches $100,000, Litecoin could be around $25,000 based on scarcity, historically, Litecoin tends to trade at 1:100 or 1:200 of Bitcoin's price. This results in a perception that Bitcoin is more valuable, though Litecoin's larger supply makes it psychologically easier for new users to invest in.

Halving Schedule: Both networks halve their block rewards approximately every four years. Bitcoin's most recent halving was in May 2024 (reward dropped from 6.25 to 3.125 BTC), while Litecoin's occurred in August 2023 (12.5 to 6.25 LTC). Both coins now have inflation rates below 2% annually, with Bitcoin's slightly lower at around 1.5% in 2025.

Economic Use and Market Cap: Bitcoin's market cap is significantly larger than Litecoin's, often around $1 trillion, compared to Litecoin's single-digit billions. Investors mainly view Bitcoin as a store of value, while Litecoin is seen as a more speculative asset.

Value Proposition: Bitcoin is often referred to as digital gold due to its scarcity and institutional adoption, while Litecoin is known as digital silver, emphasizing its utility as a fast, low-cost transaction medium.

Recent Developments: Litecoin introduced the MimbleWimble Extension Blocks for privacy in May 2022, which Bitcoin hasn’t incorporated at the protocol level. Litecoin has also benefited from increased usage due to features like the Lightning Network and cross-chain atomic swaps. By mid-2023, Litecoin saw a surge in transactions thanks to “Ordinals,” reaching record levels.Bitcoin and Litecoin both have finite supplies and halving mechanisms, but the specifics and implications differ.

Use Case and Adoption

Bitcoin’s Use Case: Bitcoin has evolved into a store of value and a hedge against inflation, often referred to as "digital gold." While initially intended for everyday payments, scaling issues and community choices have shifted this role to solutions like the Lightning Network or other cryptocurrencies such as Litecoin. Bitcoin is accepted as payment by various merchants, usually via Lightning or through immediate fiat conversion, and is favored in regions facing currency crises.

Litecoin’s Use Case: Litecoin is designed for payments, offering faster confirmations and lower fees, making it practical for commerce. It has gained traction among payment processors and crypto ATMs, sometimes surpassing Bitcoin in usage volume. Merchants, from retailers to luxury dealers, accept Litecoin, and its adoption is increasing in regions like Africa.

Community and Development: Bitcoin's development is cautious due to the value it secures, while Litecoin's development is more experimental, having implemented privacy features like MWEB. The Litecoin community actively promotes its usage and reliability, with Charlie Lee remaining a prominent figure. In contrast, Bitcoin relies on an open-source community for maintenance.

Interoperability: Litecoin is similar to Bitcoin, allowing for easy cross-chain swaps, especially with both supporting SegWit and Lightning. Users can convert between the two cryptocurrencies quickly for transactions.

Public Perception: Bitcoin enjoys widespread recognition, while Litecoin is known as a reliable altcoin, often the first that newcomers encounter. Though it may lack hype, Litecoin is trusted to remain relevant, typically participating in market growth alongside Bitcoin but with unpredictable timing.

In summary, Bitcoin serves as a reserve asset for long-term investment, while Litecoin acts as a currency for daily transactions. Together, they complement each other, with Bitcoin anchoring value and Litecoin facilitating smaller transactions. Many users hold both for their unique advantages.

Security and Decentralization

Both Bitcoin and Litecoin operate without a central authority, but their differences in scale have implications:

-

Hash Rate & Security: Bitcoin has a much larger hash power, making it the most secure PoW network. Litecoin, particularly with Dogecoin’s merged mining, also has strong hash power, deterring 51% attacks. Neither coin has faced successful double-spend attacks, making them robust against such threats.

-

Node Decentralization: Running a full node helps decentralize the network. Bitcoin's blockchain is over 400 GB, while Litecoin’s is about 100 GB in 2025, making Litecoin nodes easier to run. Bitcoin has tens of thousands of nodes globally, while Litecoin has a few thousand, making Bitcoin more decentralized by numbers, though Litecoin remains sufficiently decentralized.

-

Development Centralization: Bitcoin has more decentralized development, with multiple independent teams. Litecoin had a smaller core team historically, with influenced by Charlie Lee, though it has open-source contributors and a community-driven development approach, particularly with upgrades like MWEB.

-

Network Reliability: Both networks boast excellent uptime, with Litecoin reporting 100% uptime. Their decentralization prevents single points of failure, unlike some newer chains that may halt due to central oversight.

-

Community & Censorship Resistance: Bitcoin's larger user base makes it hard to censor transactions, while Litecoin's mining and node community also enhances resistance to censorship. Both coins support peer-to-peer transactions without central control, emphasizing their value in decentralization.

Overall, Bitcoin is more decentralized due to its scale, but Litecoin remains secure and sufficiently decentralized for practical use.

Bitcoin vs Litecoin (source)

Conclusion: Complementary Roles and Long-Term Outlook

In summary, Litecoin and Bitcoin represent two distinct yet complementary cryptocurrencies. Bitcoin, as the first mover, is seen as the premier store of value, boasting robust security and institutional support. Litecoin, on the other hand, adapts Bitcoin's framework for more efficient everyday transactions with faster block times and lower fees.

Key differences such as transaction speed and fee structure make Litecoin preferable for smaller transactions, while Bitcoin's scarcity and security solidify its role as the foundation of the crypto financial system. Despite Litecoin not displacing Bitcoin, it continues to thrive alongside it, often being offered as a quicker alternative in payment systems.

Looking ahead to 2025, Bitcoin is advancing with the Lightning Network and potential mainstream adoption, while Litecoin’s relevance will depend on its utility for payments and ongoing technological updates. Innovations like Litecoin’s MWEB enhance its privacy, but its future may be impacted by the rise of stablecoins and CBDCs.

From an investment perspective, Litecoin is often viewed as undervalued and experiences spikes during altcoin seasons, whereas Bitcoin is recognized by traditional investors as the dominant player. Even if Bitcoin’s scaling reduces Litecoin’s advantages, it could still serve as a valuable alternative.

In essence, Bitcoin and Litecoin can be likened to gold and silver in the digital currency space. Bitcoin serves as a secure store of value, while Litecoin enables quick and cost-effective transactions. Together, they contribute to the broader goal of decentralized currency, catering to varying user needs: security with Bitcoin and efficient payments with Litecoin.