Satoshis (SATs) are the smallest unit of Bitcoin, and they have become increasingly important as the price of Bitcoin has risen over the years. Just as a US Dollar can be divided into 100 cents, each Bitcoin (BTC) is divisible into 100,000,000 satoshis. In other words, 1 SAT = 0.00000001 BTC. This fine divisibility makes Bitcoin practical for small transactions and accounting, despite its large price per coin. For example, if someone owns 0.1 BTC, that is equal to 10,000,000 SATs. At Bitcoin’s price levels in 2025, even a fraction of a coin can represent thousands of dollars in value, which is why SATs have entered everyday crypto vocabulary. This article will explore the origin of the satoshi unit, why it’s needed, how to calculate and convert satoshis, and how SATs are used in practice – from transaction fees to expressing altcoin values. We’ll also bring you up to date with the latest context (as of November 2025) on SATs and Bitcoin’s growth.

Origin of the Satoshi Unit

The term “satoshi” comes from Bitcoin’s mysterious creator, Satoshi Nakamoto, and represents a tribute to the person (or group) who created Bitcoin’s protocol. In Bitcoin’s seminal whitepaper “Bitcoin: A Peer-to-Peer Electronic Cash System” published in October 2008, Satoshi Nakamoto described a decentralized digital currency and implicitly set the stage for Bitcoin’s divisibility. When Bitcoin’s blockchain launched in January 2009, the software defined Bitcoin’s smallest unit as 1 satoshi – one hundred millionth of a BTC.

Why such extreme divisibility? It was partly to ensure that as Bitcoin gained value, it could still be used for tiny transactions (microtransactions) and to measure small amounts. Satoshi Nakamoto built into the code the idea of handling Bitcoin amounts in base units (satoshis) behind the scenes, even if user interfaces show decimals in BTC. In fact, within Bitcoin’s code and blockchain, amounts are almost always counted in satoshis (sometimes called “satoshis base units”), not whole bitcoins. This approach avoids floating-point rounding issues and makes sure the system can account for every fraction of a coin precisely.

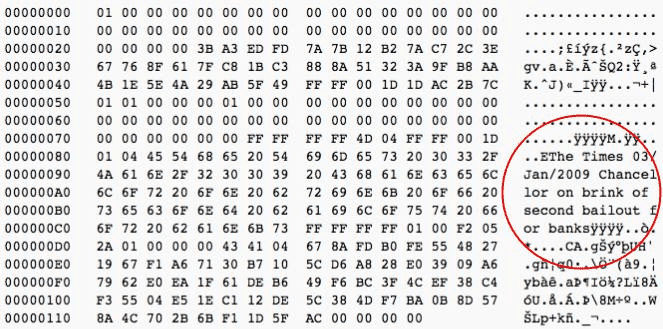

Historically, the genesis (first) block of Bitcoin contains an artifact that ties Bitcoin’s creation to real-world events – Satoshi Nakamoto embedded the text “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks” into Bitcoin’s Genesis Block as a comment. This was a reference to a newspaper headline that day, and it has been interpreted as both a timestamp and a statement on monetary policy (highlighting the contrast between Bitcoin’s fixed supply and central bank bailouts of 2008–2009). That first block’s reward was 50 BTC – which equals 5,000,000,000 SATs – demonstrating how even early on, Satoshi was thinking in terms of satoshis for technical implementation.

Satoshi Nakamoto remained active in Bitcoin’s development through 2010, communicating with early adopters on forums like Bitcointalk. By the time Satoshi disappeared from the community (last known communication was in April 2011), the convention of using “BTC” for one bitcoin and “satoshi” for the smallest unit was established. In honor of the creator, the community later abbreviated satoshi to “SAT” or “SATs” in plural. It’s common to hear crypto enthusiasts talking about “stacking sats,” meaning accumulating Bitcoin even in small increments.

Bitcoin Genesis Block (source)

Why Are Satoshis Needed?

As Bitcoin’s price increased dramatically over the years, dealing only in whole bitcoins became impractical for many uses. Satoshis (SATs) are essential for enabling small transactions and measurements on the Bitcoin network. Here are a few key reasons SATs matter:

-

Accessibility: With Bitcoin prices around $100,000, one satoshi is worth about $0.001. Quoting prices in SATs, like saying a coffee costs 50,000 SATs, is more intuitive than using decimals in BTC.

-

Transaction Fees: Fees are typically calculated in satoshis at the protocol level. For example, a fee might be 10 SATs per vByte, which becomes clearer for users when expressed as a whole number in SATs rather than a fraction of BTC. During peak times, fees can surge significantly.

-

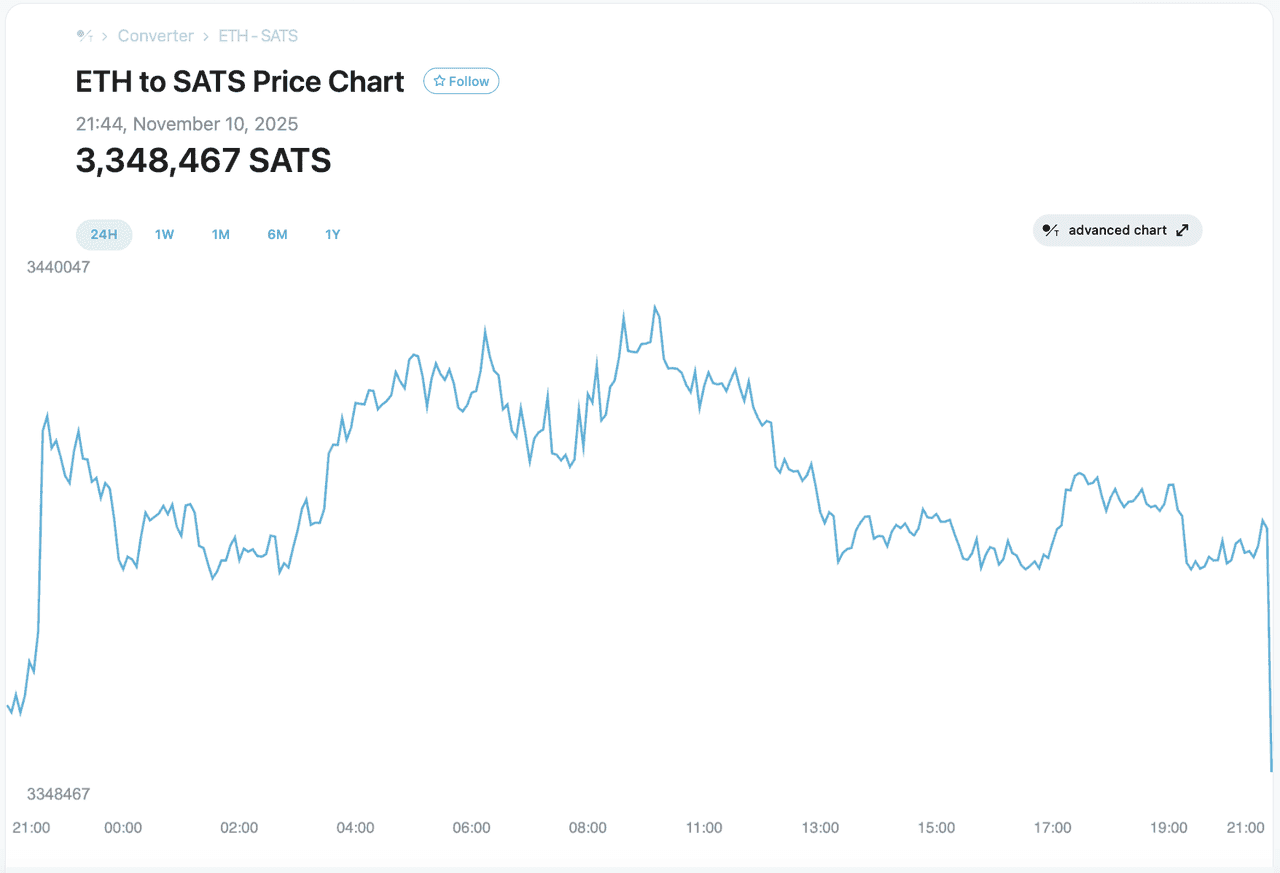

Comparing Value Across Cryptos: Traders often express altcoin values in SATs, facilitating easier comparisons. For example, saying “Dogecoin is 250 SATs” is more straightforward than quoting BTC. While it might seem abstract, this practice underlines Bitcoin as the standard of value: people say “sats” almost as a base currency of crypto, analogous to how one might quote values in cents or pence for smaller denominations of a base currency.

-

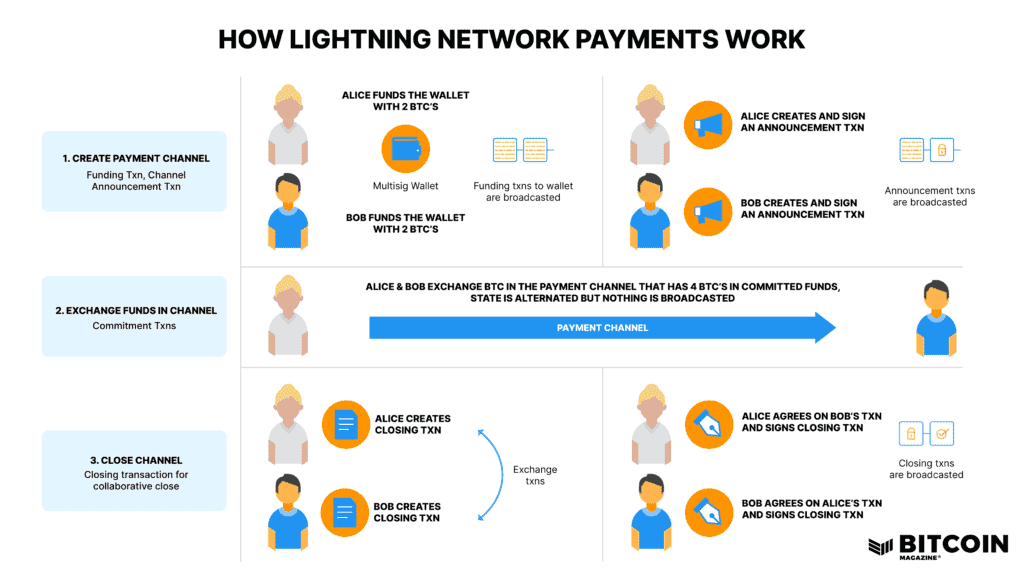

Micropayments & Layer 2: With Bitcoin’s Layer 2 solutions like the Lightning Network, transactions involving tiny amounts of BTC (even a few satoshis) have become feasible and fast. Lightning channels can route payments as low as 1 satoshi (and even smaller units called millisats within the channel state). For applications like tipping, gaming rewards, or IoT payments, being able to send say 500 sats (fractions of a penny) is valuable. Satoshis make these micro-transactions possible.

In summary, satoshis are needed to keep Bitcoin usable and relatable as it scales. If Bitcoin one day trades at $1 million, quoting prices or fees in BTC would involve cumbersome 0.0000X numbers – but in SATs, that $1 million BTC would make 1 satoshi equal to $0.01 (1 cent), a very convenient equivalence. Some even discuss the idea of a future where “1 sat = 1 cent” if Bitcoin’s value appreciates enough. While that’s speculative, it underscores that SATs are the bridge between Bitcoin’s macro value and the micro transactions of daily life.

Ethereum Price denominated in SATs (source)

Bitcoin Denominations and Symbols

While “bitcoin” (BTC) and “satoshi” (SAT) are the most important units, the community has explored other denominations too. In 2015, Bitcoin was assigned an ISO currency code (XBT or BTC), and proposals were made for units like millibitcoin (mBTC) and microbitcoin (μBTC):

-

1 mBTC (millibit) = 0.001 BTC (one thousandth) = 100,000 SATs.

-

1 μBTC (microbitcoin or sometimes called bit) = 0.000001 BTC (one millionth) = 100 SATs.

In theory, mBTC or μBTC could be used similarly to how we use dollars and cents (e.g., “I sent 5 mBTC for the payment”). However, in practice, these units have not gained wide adoption compared to satoshis. As Bitcoin’s price grew, the community gravitated more towards SATs. Why? Possibly because SATs, being an integer unit, resonate more (“1000 SATs” feels simpler than “0.00001000 BTC” or “10 μBTC”). It’s also a unique branding – “stack sats” became a meme encouraging saving Bitcoin bit by bit.

Another consideration is the symbol for satoshis. Bitcoin has a well-known symbol (₿). For satoshis, there is no official unicode symbol yet. Most websites and apps simply use “SAT” or “sats.” There have been community suggestions (like a satoshi sign, perhaps a reversed B or an S with some design), but none have stuck universally. Given Bitcoin’s global nature, it may take consensus or an official standard proposal to establish a satoshi symbol. Until then, “SAT” in text is the de facto representation.

To avoid confusion, it’s crucial to specify units when discussing Bitcoin values. Saying “I have 50,000” could mean 50,000 BTC (wealth beyond imagination), or 50,000 SATs (which is only 0.0005 BTC). So, always clarify BTC vs SAT. As a rule of thumb, use SATs for tiny amounts or when focusing on technical details (like fees, altcoin prices, etc.), and BTC for larger amounts or general discussions about price.

Satoshis conversion to Bitcion (source)

How to Calculate and Convert Satoshis

Calculating satoshis is straightforward since it’s just base-10 math. Here are some quick conversions and methods:

-

From BTC to SATs: Multiply the amount of BTC by 100,000,000. For example, 0.005 BTC * 100,000,000 = 500,000 SATs. If someone holds 0.028 BTC, that’s 2,800,000 sats.

-

From SATs to BTC: Divide the number of sats by 100,000,000. For instance, 250,000 sats / 100,000,000 = 0.0025 BTC.

-

In USD (or other fiat) terms: You can convert via Bitcoin’s price. Suppose BTC = $100,000 (for easy math). Then 1 sat = $100,000 / 100,000,000 = $0.001. Conversely, $1 = 1,000 sats at that price. If BTC is $50,000, then 1 sat = $0.0005 (half a tenth of a cent), so $1 = 2,000 sats. Many price tracker sites have a “satoshi to USD” calculator. For example, Bitcoin Magazine’s satoshi calculator shows real-time conversion: at a BTC price of $34,000, 1 sat ≈ $0.00034.

|

Bitcoin (BTC)

|

Satoshis (SAT)

|

USD Equivalent (at $60k/BTC)

|

|

1 BTC

|

100,000,000 SATs

|

$60,000 USD

|

|

0.1 BTC

|

10,000,000 SATs

|

$6,000 USD

|

|

0.01 BTC

|

1,000,000 SATs

|

$600 USD

|

|

0.001 BTC

|

100,000 SATs

|

$60 USD

|

|

0.0001 BTC

|

10,000 SATs

|

$6 USD

|

|

0.00001 BTC

|

1,000 SATs

|

$0.60 USD

|

|

0.000001 BTC

|

100 SATs

|

$0.06 USD

|

|

0.0000001 BTC

|

10 SATs

|

$0.006 USD

|

|

0.00000001 BTC

|

1 SAT

|

$0.0006 USD

|

(The above assumes $60,000 per BTC. At higher prices, the USD equivalent per SAT increases linearly. For instance, at $120,000/BTC, each SAT would be $0.0012.)

To be in Bitcoin’s top 1% of holders, you need only about 0.28 BTC (28,000,000 SATs). This is based on Bitcoin's limited supply and the global population. While the distribution of BTC is uneven, the idea motivates many to “stack sats,” as accumulating SATs could be worthwhile. In 2021, 0.28 BTC was valued at $12,000, and by 2025, it could reach around $28,000. Newcomers are encouraged to set SAT accumulation goals, such as aiming for 1,000,000 SATs.

Today, many wallet apps allow balance displays in SATs, and some exchanges quote prices in SATs by default. Tools like preev.com facilitate SAT <-> BTC <-> fiat conversions. With increasing Bitcoin adoption, consumer pricing in SATs may become common, especially in countries with weaker currencies.

Using Satoshis in Real Life (Transactions and Beyond)

On-Chain Transactions: When you send Bitcoin on-chain, the amounts are ultimately handled in satoshis. For example, if you send 0.005 BTC to someone, the blockchain transaction might say it’s transferring 500,000 SATs to the recipient’s address. Miners charge fees in SATs per byte of data. As mentioned earlier, these fees fluctuate. In periods of high congestion (like the NFT-like Ordinals boom in 2023 or major bull runs), users experienced fees of tens or even hundreds of satoshis per vByte. In April–May 2023, the surge of ordinal inscriptions caused the average fee to spike – not quite to 2021’s record, but still significant (for instance, average fees of $30+ at one point, which is ~50,000+ SATs). This highlighted both the need for scaling solutions and the reality that thinking in satoshis is practical – people would say “the fee is 100 sats/byte right now” to describe network conditions. By denominating fees in SATs, users can easily compare options: e.g., one wallet might let you set a fee of 20 sats/vByte for slower confirmation, vs 100 sats/vByte for fast.

Lightning Network and Microtransactions: Satoshis shine on the Lightning Network, where you can send very small payments instantly with almost no fee. For example, an online content creator might charge 500 SATs to view an article. That’s a trivially small amount (maybe a few cents) but via Lightning it can be done efficiently – something not feasible if you had to do an on-chain BTC transaction due to base layer fees. Lightning channel balances are often displayed in satoshis. If you’re running a Lightning node or using a wallet like Phoenix or Wallet of Satoshi, you might notice your balance given in SATs by default. The trend in the Lightning community is to frame things in satoshis since it makes values like 50 or 100 sound like tangible whole numbers instead of decimal dust. By 2025, Lightning’s growth had a mix of developments: capacity rose through 2022 and 2023, then saw a slight decline by mid-2025 in public metrics – but behind the scenes, user adoption of Lightning for small payments (in sats) continues via platforms like Nostr (for tipping) and El Salvador’s Chivo app, etc. As Bitcoin’s base layer becomes more of a settlement network, it’s plausible that everyday Bitcoin spending will be done in SATs on Layer 2.

Lightning Network payments (source)

Pricing Goods and Services: A few niche cases have emerged where goods are priced in SATs, especially in communities that strongly adopt Bitcoin. For instance, some online stores or Bitcoin conferences might price merchandise in satoshis. In El Salvador, which adopted Bitcoin as legal tender in 2021, small items like a coffee might be quoted as, say, ₿0.0001 (which is 10,000 sats) rather than switching to fiat in conversation. That said, globally most people still mentally convert to their local currency. But if Bitcoin’s price keeps climbing, we may cross a psychological threshold where talking in whole sats feels more convenient. There’s even been discussion of naming conventions if 1 sat becomes too large – i.e., if Bitcoin gets so valuable that 1 sat is a few cents, would we need a smaller unit? (Currently, that’s not an issue; and the Bitcoin protocol doesn’t allow smaller than 1 sat unit on-chain. But off-chain, Lightning can technically consider millisatoshis for division within channels.)

Stacking Sats (Investing Habit): Many Bitcoiners use the phrase “Stacking Sats” to describe regularly accumulating Bitcoin in small quantities. This has become a movement of sorts, encouraging people to save in Bitcoin over time. For example, services that do automatic recurring buys might say “You stacked 150,000 sats today.” By expressing the purchase in sats, it highlights the growth of one’s Bitcoin stash in a way that feels substantial and motivating, even if it’s a fraction of a BTC. Especially for those new to Bitcoin who might be discouraged that they can’t buy an entire coin, reframing the goal to accumulating, say, a million satoshis (0.01 BTC) is a more achievable interim milestone.

Another context is taking profits and measuring portfolio in sats. Crypto traders sometimes set a goal to maximize the amount of BTC (sats) they hold, rather than measuring gains in USD. They might trade altcoins and then convert profits into BTC, effectively increasing their satoshi stack. Many professional traders prefer taking profit in Bitcoin to accumulate more SATs instead of cash, since BTC’s supply is limited while fiat can be printed indefinitely. This strategy is about long-term value – they trade actively but the end game is to grow their Bitcoin holdings (denominated in satoshis) because they believe in Bitcoin’s store of value potential over inflated fiat currencies. As a symbolic gesture, saying “I earned 100k sats from that trade” is a way of focusing on Bitcoin as the unit of account for wealth.

Conclusion

Satoshis (SATs) are the smallest units of Bitcoin, named after its creator, Satoshi Nakamoto. With 1 Bitcoin consisting of 100 million SATs, even small holdings of BTC represent thousands or millions of SATs. As Bitcoin’s price and adoption rise, the importance of SATs grows, facilitating transaction fees, small purchases, and comparisons between altcoins.

By 2025, very few people will own a full Bitcoin, but holding even 0.28 BTC (28 million SATs) may place you in the top 1% of holders. This underscores the value of “stacking sats” over time through methods like dollar-cost averaging or earning BTC.

Innovations like the Lightning Network are making it easier to spend SATs on everyday items, and the term has entered popular crypto conversations. Understanding SATs enhances one’s grasp of Bitcoin’s design for inclusivity and divisibility. As Bitcoin adoption grows, SATs may become as commonly referenced as cents are to dollars. So, when interacting with Bitcoin, consider thinking in SATs—it can provide a fresh perspective on value. Remember the mantra: “Stay humble and stack sats!”