It is now late 2025, and the global economy continues to face uncertainty. After years of high inflation, geopolitical tensions, and shifting monetary policies, many investors are looking for safe places to preserve their wealth. During times of market volatility or economic downturns, money often flows into assets known as stores of value – investments that are expected to hold or increase their value over time, even when other assets are tumbling. Bitcoin is frequently dubbed “digital gold”, symbolizing its role as a potential store of value in the modern era.

What is store of value?

A store of value is any asset, commodity, or currency that can be saved and retrieved in the future without losing its value. In other words, a good store of value maintains its purchasing power over long periods. Classic examples include gold and high-quality government bonds, which historically have been seen as safe-haven assets. By contrast, perishable goods (like milk or food) are poor stores of value because they degrade and lose worth over time.

To qualify as a store of value, an asset typically has the following characteristics:

Stability of Value

Market decoupling

Preservation of Purchasing Power

Durability and Longevity

Stores of value must be durable. The asset should not degrade or expire. Precious metals are elemental and do not corrode easily; gold jewelry or coins can sit in a vault for ages without losing their integrity, which is why gold is often passed down through generations. Real estate can also serve as a store of value partly due to its durability (land and well-maintained buildings last a long time, though they require upkeep). A country’s currency can serve as a store of value only if the issuing nation maintains economic stability and controls inflation. If money rapidly loses buying power (as seen in hyperinflation scenarios), it fails as a store of value.

History of Money (source)

Traditional Stores of Value: Gold and Money

Gold as a Store of Value

For centuries, gold has been considered the ultimate store of value. Gold’s price tends to be relatively stable and its long-term trend has been a gradual increase. It has intrinsic qualities that support this status:

-

Scarcity: Gold is rare and cannot be manufactured, so its supply grows slowly (primarily through mining).

-

Durability: Gold doesn’t rust or decay; gold artifacts thousands of years old still retain value.

-

Universal demand: Culturally and industrially, gold is desired (for jewelry, electronics, etc.), ensuring there’s almost always buyers.

Historically, gold has held its value even through wars and economic crises. Even in recent years, as global inflation spiked to multi-decade highs, gold reached record nominal prices around 2023. When stock markets went through turmoil – for example, during early 2022’s sell-off – gold’s price dipped only mildly compared to equities, then rebounded. This relative resilience is why investors often increase gold allocations in uncertain times.

However, gold is not entirely risk-free. Its price can stagnate for long periods (for instance, gold prices were flat to down through much of the 1980s and 1990s after peaking in 1980 when adjusted for inflation). Still, gold’s appeal as a store of value remains strong in 2025, and it’s commonly called a “safe-haven” asset.

Is Fiat Money a Store of Value?

What about plain money – national currencies like the U.S. dollar or euro? Technically, money is supposed to be a store of value, one of the core functions of currency. In a stable economy with low inflation, holding cash can preserve value in the short term. But over long periods, fiat currencies usually lose value due to inflation. Most governments target a small amount of inflation (around 2% annually in many countries), which means cash will gradually buy less each year.

In the early 2020s, inflation surged globally – for example, U.S. inflation hit ~8% in 2022, the highest since the 1980s. This eroded the purchasing power of money at a rapid pace. $100 in savings at the start of 2022 had the buying power of only about $92 a year later, assuming 8% inflation. While major currencies like the dollar or euro are far more stable than, say, Venezuelan bolivars or Argentine pesos (which have seen hyperinflation), even “stable” currencies typically depreciate over decades.

Because of this, many do not view holding large sums of cash as a good long-term store of value. That said, in the short term or during deflationary periods, cash can hold value or even gain (if prices of goods fall). And holding some cash is essential for liquidity and transactions. But for long-term wealth preservation, investors often turn to assets like gold, real estate, or increasingly, Bitcoin, instead of holding all wealth in cash.

Is Bitcoin a Store of Value?

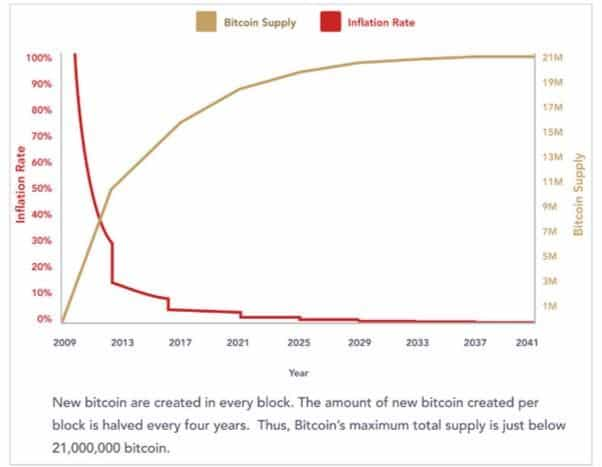

Scarcity

The primary reason Bitcoin is considered a store of value is its limited amount of 21 million, as well as an ever-decreasing fresh supply of Bitcoin as the mining rewards are designed to decrease over time during events known as “halvenings”. This finite supply and decreasing release of new Bitcoin gives it strong deflationary pressures similar to gold.

Bitcoin supply and inflation rate (Source: River Financial)

Durability and portability

Volatility

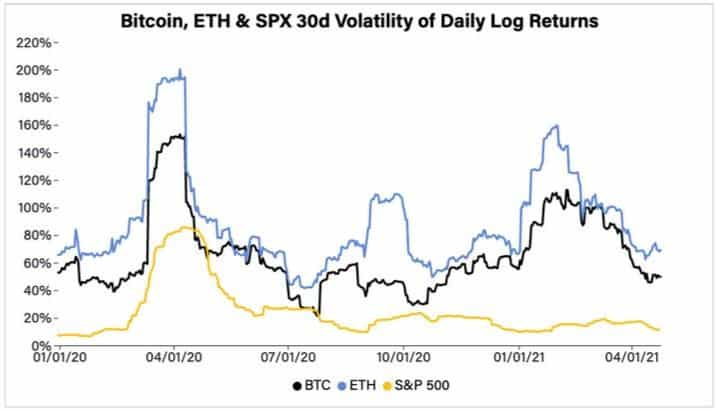

One of the biggest issues with Bitcoin as a store of value is its high volatility and massive price swings. Just this past week Bitcoin dropped 30.5%, which is a large swing for any asset, much less a store of value asset that is supposed to provide investors with stability. Gold by comparison only dropped 2.63% in that same time. As long as Bitcoin continues to face such volatility, it will have a hard time justifying its label as a store of value, as it won’t be able to provide investors with the stability and steady price appreciation they expect from an asset that is meant to serve as a store of value.

Bitcoin volatility relative to other assets (Source: Coindesk)

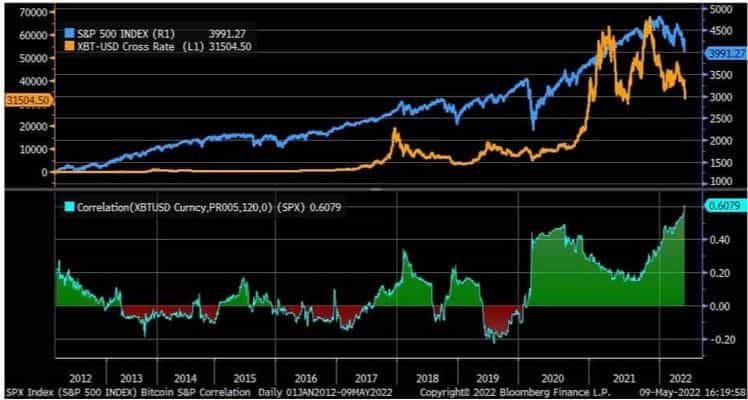

Correlation with markets

As previously mentioned, another important quality of a store of value is its ability to decouple from the financial markets and maintain its price while other assets drop. Bitcoin has not yet seen this decoupling and in fact has a correlation coefficient of 0.6 with the S&P 500, which is quite high considering a coefficient of 1 means a perfect correlation.

Bitcoin has at times been less correlated, with a coefficient of -0.2 in 2019 and a coefficient of 0.1 in 2016; however, as Bitcoin has grown more mainstream and attracted more institutional investors, it has also become more correlated with the rest of the financial markets. Ironically, its success in attracting the big players has also affected its ability to serve as an effective store of value.

Bitcoin correlation with S&P 500 (Source: Finbold)

All in all, Bitcoin does have many characteristics that make it an excellent store of value; however, one needs to look at the price chart to see that Bitcoin may have some way to go before it can rightfully claim the status of a bona fide store of value.

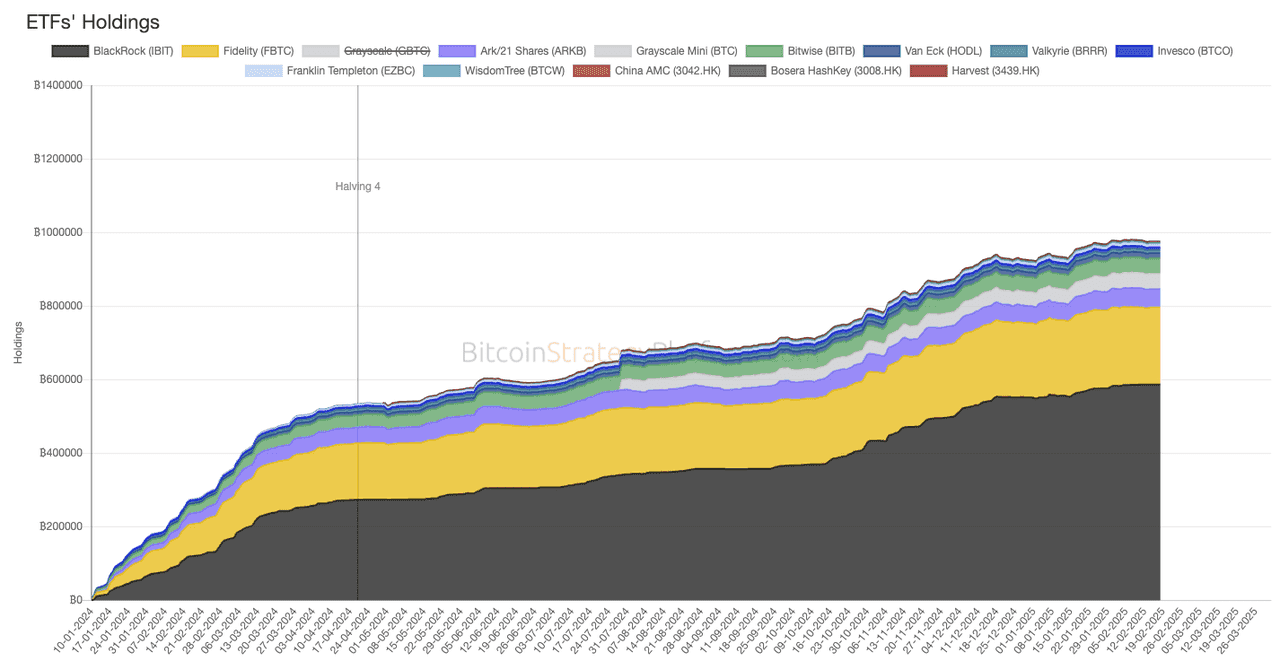

Adoption and Institutional Support

One aspect that has changed between Bitcoin’s early years and 2025 is the level of institutional adoption. Big financial players – from hedge funds to nation-states – are now involved in Bitcoin. Surveys in 2025 showed that 59% of institutional investors were planning to allocate at least 5% of their portfolios to crypto, primarily Bitcoin. Major banks that once shunned Bitcoin have started offering custody or exposure. Several countries and states have even begun holding Bitcoin reserves: for example, by 2025, nations like El Salvador (which adopted Bitcoin as legal tender in 2021) continued to accumulate BTC, and regions like Texas and some U.S. pension funds started investing in Bitcoin as a long-term reserve asset. The launch of regulated Bitcoin exchange-traded funds (ETFs) also opened the doors for pensions and endowments to invest, bringing tens of billions of dollars into Bitcoin in 2024–2025. This wave of adoption is gradually increasing Bitcoin’s liquidity and could be contributing to reduced volatility over time (a broader holder base with long-term outlooks tends to stabilize price swings).

Increasing acceptance by institutions also lends credence to the idea that Bitcoin is seen as a value asset rather than purely speculative. When companies like Tesla or MicroStrategy hold Bitcoin on their balance sheets as a treasury reserve, they are essentially treating it as a store of value akin to cash or gold. In MicroStrategy’s case, CEO Michael Saylor explicitly positions Bitcoin as superior to cash for preserving shareholder value. This trend of corporate and government adoption, if it continues, reinforces Bitcoin’s legitimacy and could make its market behavior more stable (though it’s not guaranteed).

Bitcoin ETF holdings diagram (source)

The Bottom Line: Is Bitcoin a Good Store of Value?

Bitcoin clearly possesses some key attributes of a store of value: scarcity, durability, divisibility, and growing acceptance. Over its 15+ year history, Bitcoin’s long-term trend has been strongly upward – early adopters have seen enormous appreciation, far outpacing inflation. From just a few cents in 2010, Bitcoin climbed to around $69,000 at its peak in 2021, and despite multiple deep corrections, as of late 2025 it is valued in the tens of thousands of dollars per coin. Long-term holders argue this track record shows Bitcoin does retain and increase value over time, particularly as adoption grows.

However, Bitcoin is still evolving and not yet as reliable a store of value as gold. Its volatility remains a major downside; an asset that can lose 50% of value in a year (as in 2022) can undermine confidence for investors seeking stability. Additionally, regulatory risks hover – governments could in theory heavily restrict crypto, which might impact its value. There are also technological risks (though Bitcoin’s network has proven robust so far).

So, is Bitcoin a good store of value? The safest assessment in 2025 is that Bitcoin is an emerging store of value. It shows many characteristics of one and is increasingly used as such by a subset of investors. Yet, it hasn’t fully matured to the point of displacing gold or fiat as the go-to stable asset. If Bitcoin’s market continues to deepen and its wild price swings moderate further in coming years, it could very well earn the title of “digital gold” in truth. For now, it remains a unique asset that can potentially preserve and grow wealth – but with a higher risk and volatility profile than traditional stores of value. Investors considering Bitcoin as a store of value should weigh those risks and perhaps view it as a complement to, rather than a replacement for, more established safe-haven assets.