Bitcoin futures trading has become an integral part of the crypto market, offering several advantages over traditional spot trading. One of the biggest benefits is flexibility – traders can short, long, or hedge Bitcoin price movements without actually owning any BTC.

Bitcoin futures trading has become an integral part of the crypto market, offering several advantages over traditional spot trading. One of the biggest benefits is flexibility – traders can short, long, or hedge Bitcoin price movements without actually owning any BTC.

In this updated guide, we’ll explain these three key strategies in simple terms, discuss how they work with Bitcoin futures, and why they’re popular in 2025. Whether you’re betting on Bitcoin’s price going down (shorting), up (longing), or protecting yourself against risk (hedging), understanding these concepts will help you navigate the crypto futures market with more confidence.

Phemex processes over 5 billion USD in 24‑hour futures trading volume and around 4 billion USD in open interest across more than 580 trading pairs (over 450 listed coins), offering BTC futures with up to 100x leverage, a Multi‑asset Mode for unified collateral, and deep liquidity for efficient execution.

What Are Bitcoin Futures and Why Use Them?

Bitcoin futures are contracts that let traders agree on buying or selling Bitcoin at a future date for a set price. Unlike spot trading (where you buy and sell actual Bitcoins on the spot), futures trading doesn’t require holding the physical asset. This brings a few advantages for traders:

-

No need to own BTC upfront: You can enter a Bitcoin futures contract without already having Bitcoin. This lowers the barrier to entry – for instance, you could short Bitcoin via futures even if you don’t hold any.

-

Leverage: Futures exchanges often allow trading with leverage (borrowing funds to increase position size). This means you can control a larger position with a smaller amount of money, potentially amplifying profits (but also losses – leverage is a double-edged sword).

-

Trade both directions easily: With futures, it’s as straightforward to bet on the price going down as it is up. On spot markets, betting on a decline (“shorting”) is more complex, often involving borrowing assets. Futures make short selling seamless – any futures contract can be sold to open a short position instantly.

-

Hedging opportunities: Futures were originally designed for hedging in traditional markets, and crypto is no different. Traders and Bitcoin miners can use futures to lock in prices and manage risk, as we’ll explore below.

In summary, Bitcoin futures provide flexibility and tools for both speculative trading and risk management. Now let’s dive into the specific strategies of shorting, longing, and hedging with Bitcoin futures.

How to choose a Bitcoin Futures Exchange?

Look for these key features in any reputable Bitcoin futures platform:

- High liquidity: 24h volume >$1B and open interest >$500M ensures tight spreads and fast execution

- Multiple contract types: USDT-margined, coin-margined, and perpetuals for strategy flexibility

- Reasonable leverage: 20-100x available, but start with 5-10x maximum

- Risk management tools: Stop-loss, take-profit, and position calculators

- Practice mode: Demo trading to test strategies without risk

- Transparent fees: Maker/taker fees under 0.06%/0.08% with clear funding rates

Phemex specifics: Offers 5B+ USD daily volume, 580+ pairs, Multi‑asset Mode for unified collateral, and up to 100x leverage across USDT/USDC/coin-margined BTC contracts.

Shorting Bitcoin Futures (Betting on Price Drop)

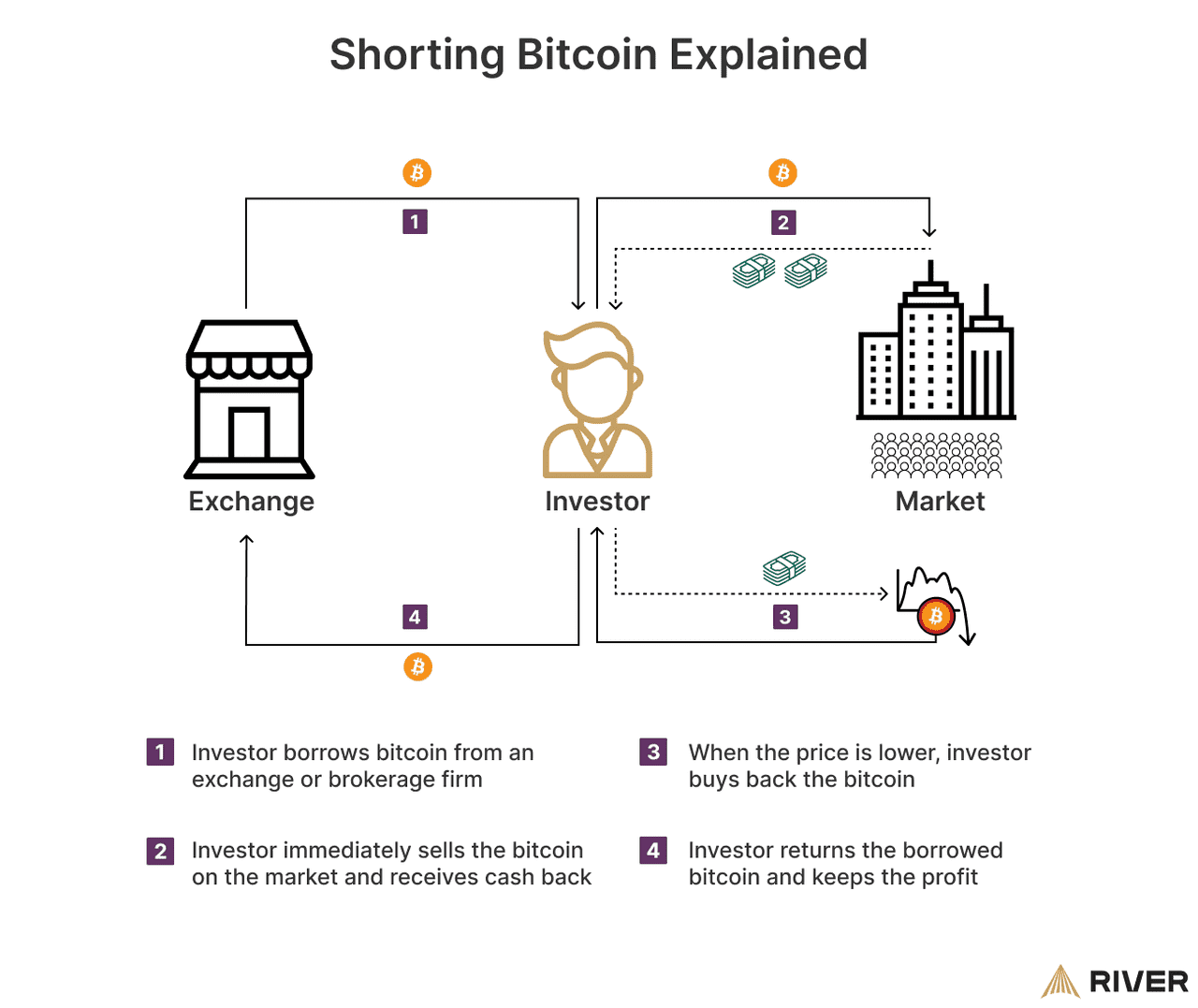

Shorting (or taking a short position) means you are betting that Bitcoin’s price will fall in the future. In a Bitcoin futures context, shorting involves entering a contract to sell Bitcoin at today’s price, with the hope of buying it back cheaper later when the contract expires or is closed. Essentially, you profit from a price decline.

How shorting works: When you short a Bitcoin futures contract, you don’t actually own or deliver Bitcoin at the start. Instead, you commit to a contract that gains value if BTC’s price goes down. If the price indeed drops by the contract’s settlement time (or when you close the position), you can buy Bitcoin at the lower price and fulfill the contract you sold at the higher price, pocketing the difference as profit. For example:

Shorting Example: $30K to $25K Drop

Imagine Bitcoin is $30,000 today. You enter a futures contract to sell 1 BTC at $30,000 (opening a short position).

A week later, Bitcoin's market price has fallen to $25,000. You decide to close your futures position. To do this, you'd buy 1 BTC at $25,000 in the futures market (closing out the short contract you initiated at $30,000).

You sold at $30k and bought back at $25k, so you earned $5,000 in profit (minus any fees) because the price dropped as you predicted.

If instead Bitcoin's price rose to $35,000, your short position would result in a loss (you'd have to buy back at a higher price than you sold). In practice, if the price rises too much, your position could get liquidated (closed by the exchange to prevent further losses beyond your collateral). This is why shorting is risky – potential losses are theoretically unlimited if price keeps rising.

Shorting Bitcoin Explainer (source)

Why short Bitcoin futures?

Traders short Bitcoin futures for a few reasons:

- Speculation: If you strongly believe Bitcoin's price will go down (due to market trends, news, etc.), shorting allows you to profit from that decline.

- Hedging downside: Even if you hold Bitcoin, you might short futures to hedge (protect) against near-term drops. For example, say you own 1 BTC in your wallet. You're worried the price might crash in the coming month, but you don't want to sell your long-term holdings. You could short 1 BTC worth of futures. If the price does drop, the profit from your short futures can offset the loss on your held Bitcoin, keeping your net value stable.

- Easier than shorting on spot: Shorting on spot exchanges usually requires borrowing Bitcoin (since you need to sell Bitcoin you don't own). This can be complicated and often limited. In contrast, futures exchanges make shorting as simple as clicking "sell" on a contract. You can open a short position instantly, using USDT or another margin asset as collateral, without the need to find someone to lend you BTC. This ease of use and the ability to short at any time gives futures an edge for those wanting to bet against the market.

Keep in mind: Shorting with leverage amplifies risk. If you use leverage (say 5x or 10x) on a short, even a small upward move in Bitcoin's price can trigger large losses quickly. Always manage your risk with stop-loss orders and only risk what you can afford to lose. Shorting is a valuable tool but requires a strong understanding of market volatility.

Longing Bitcoin Futures (Betting on Price Rise)

Longing (taking a long position) is the opposite of shorting – you bet that Bitcoin’s price will rise in the future. With a Bitcoin futures contract, longing means entering a contract to buy Bitcoin at today’s price, expecting to sell it later at a higher price.

How longing works: When you go long on a Bitcoin future, you agree to buy at a set price in the future. If the market price goes up, your contract gains value because you’ve locked in a lower purchase price. Here’s an example:

-

Bitcoin is $30,000 and you go long 1 BTC via futures at that price (meaning you agree to buy 1 BTC for $30k in the future).

-

Later, Bitcoin’s price rises to $40,000. You close your futures position by selling 1 BTC contract at the current price of $40k.

-

Effectively, you bought at $30k and sold at $40k, making a $10,000 profit on 1 BTC (again minus fees) because the market moved in your favor.

If Bitcoin’s price falls instead (say to $25,000), your long position would be losing value. Closing it would lock in a loss (buying at $30k but only able to sell at $25k). With high leverage, a big drop could liquidate your long position. So, like shorting, going long with futures carries risk if the market goes the opposite way of your bet.

Advantages of longing via futures:

Longing vs Spot Trading Comparison

-

Leverage for bigger exposure: Futures let you amplify your buying power. For example, with 10x leverage, a $1,000 margin can open a $10,000 long position. If the price moves up 10%, you’d gain $1,000 (a 100% return on your $1k margin). Of course, if price moves down 10%, you’d lose $1,000 (100% of your margin). Leverage can boost profits on longs but also means you can lose your funds quickly on a wrong bet, so it’s for experienced traders who manage risk well.

-

No need for full capital upfront: In spot trading, to buy 1 BTC at $30k, you need $30,000. In futures, you might only need a fraction of that as collateral (depending on leverage and margin requirements). This lowers the entry cost to take advantage of price rallies.

-

Avoiding custody of assets: Some traders prefer not to hold large amounts of cryptocurrency directly (due to security concerns or custody issues). By longing futures, they can gain exposure to Bitcoin’s upside without managing the actual coins. For instance, institutional traders often use futures to speculate on Bitcoin’s price movements instead of dealing with wallets.

-

Quick entry and exit: Bitcoin futures markets are very liquid on major platforms in 2025. Long positions can be opened and closed quickly, which is useful for day trading or short-term strategies. There’s no waiting for blockchain transactions; it’s all within the exchange’s order books.

Longing vs. Buying on Spot:

If your goal is long-term investment (HODLing Bitcoin for years), simply buying on a spot exchange or Phemex spot market might be simpler. Futures longs are generally used for shorter-term trades or to take advantage of leverage. Also, futures positions have maintenance margins and can expire (unless you use perpetual futures which have no expiry but incur funding fees). So, choose the method that fits your strategy. Longing futures is particularly handy when you want short-term bullish exposure with the option of leverage or when you want to hedge other positions.

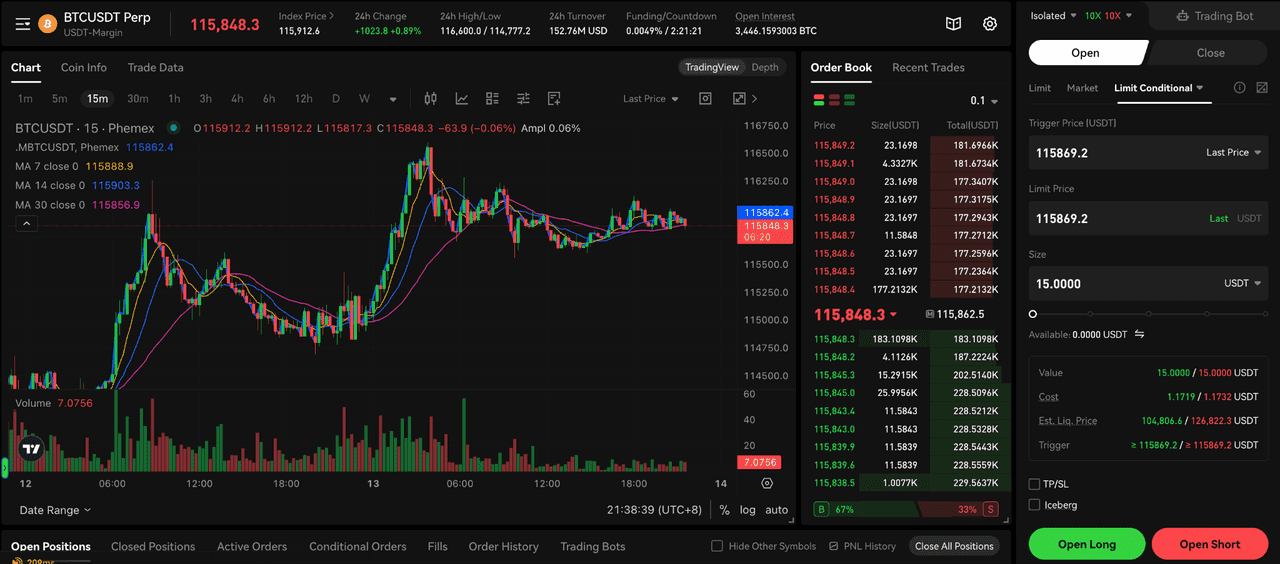

Bitcoin Futures Trading Interface (source)

Hedging with Bitcoin Futures (Protecting Your Risk)

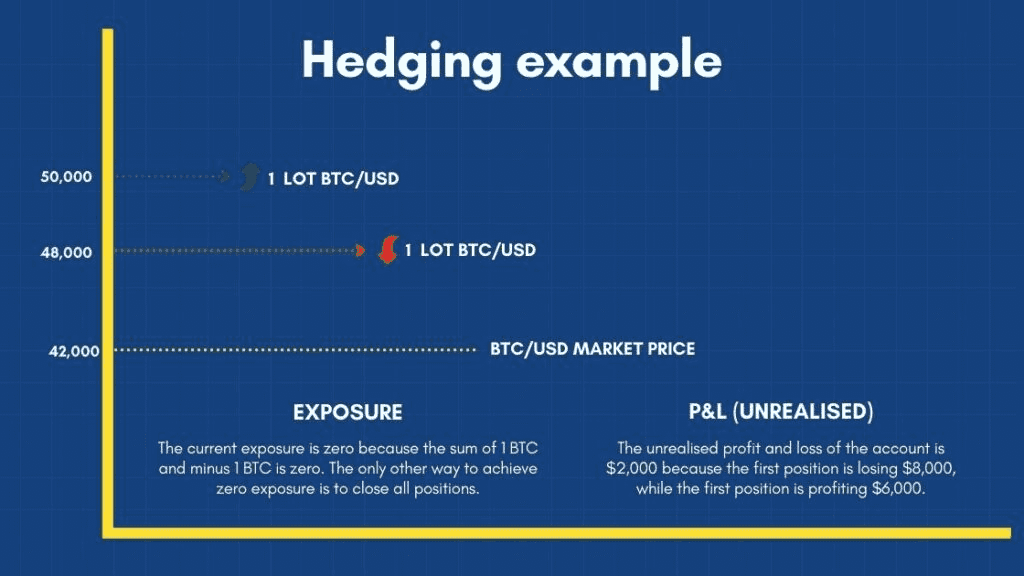

Hedging is a strategy to reduce or manage risk by taking an opposite position to your main exposure. In simpler terms, if you have a lot of Bitcoin or crypto assets and you’re worried about adverse price moves, you can use futures to “insure” against losses. Hedging isn’t about making huge profits; it’s about preventing big losses in case the market moves against you. Bitcoin futures have made hedging much more accessible in crypto.

Why hedge? Imagine you’re a Bitcoin miner or a long-term BTC investor. You believe in Bitcoin’s long-term value, but you’re concerned about short-term volatility – say a potential bearish period or an upcoming event that might crash prices. If the price plunges, miners earn less for their new coins, and investors see portfolio value drop. Hedging allows you to lock in current prices or mitigate the impact of a drop, giving you more certainty.

How to hedge with futures: The basic idea is to take an opposite position in futures to what you hold in the spot market. Two common examples:

Miner Hedging: Locking Future Output Price

-

Miners hedging their output: A Bitcoin miner earns new BTC through mining. Their business costs (electricity, equipment) are in fiat, so they prefer a stable or higher BTC price when selling mined coins. If a miner expects to mine, say, 10 BTC in the next quarter, they worry that by the time they mine and are ready to sell, the market price could be much lower. To hedge, the miner can short 10 BTC worth of futures contracts now at the current price. When those 10 BTC are eventually mined, the miner will sell them in the spot market. If the market price has fallen by then, the spot sale yields less revenue – but the futures short will profit by roughly the same amount, compensating for the loss. Essentially, the miner locks in today’s price for future coins. On the flip side, if the price rises during that period, the miner’s short hedge will incur a loss – but the actual mined BTC can be sold at the higher spot price, netting out. Hedging sacrifices some upside profit in exchange for protection against downside risk.

Investor Hedging: Protecting BTC Holdings

-

Investors hedging holdings: Suppose you hold 5 BTC as a long-term investment. You don’t want to sell them, but you’re uneasy about the market in the next few months (maybe macroeconomic factors or a looming regulation). You can hedge by opening a short futures position equivalent to 5 BTC. If Bitcoin’s price falls, the value loss on your 5 BTC holding might be offset by gains on the 5 BTC short futures. If Bitcoin’s price rises, your futures hedge will lose money, but your 5 BTC spot holdings increase in value – so you still benefit from the upside, just reduced by the hedge losses. In practice, you’d adjust how much of your holdings to hedge based on your risk tolerance.

Hedging with futures is popular because it’s efficient and direct. Prior to futures, crypto users had limited ways to protect against downturns except selling their assets (which many didn’t want to do due to tax implications or long-term strategy). Now, even if you’re a long-term believer in Bitcoin, you can tactically hedge during turbulent times instead of selling and potentially missing a later rebound.

On Phemex, traders can choose between One‑way Mode and Hedge Mode for their BTC futures positions. Hedge Mode allows you to hold long and short positions on the same contract at the same time, which can be useful for more advanced risk‑management strategies. Combined with Multi‑asset Mode and deep liquidity, this gives active futures traders flexible tools to fine‑tune their exposure.

| Feature | Phemex BTC Futures | Other Major Exchanges |

|---|---|---|

| 24h Futures Volume | 5B+ USD | Varies |

| Open Interest | 4B USD | Varies |

| Trading Pairs | 580+ (450+ coins) | 200-500 |

| Futures Types | USDT-M, USDC-M, Coin-M | USDT-M, Coin-M |

| Multi-asset Mode | Unified collateral | Limited |

| Max Leverage | Up to 100x | 50x-125x range |

| Liquidity | Unmatched | Good |

| Learning Tools | Mock Trading + Academy | Varies |

Hedging Costs and Trade-offs

Keep in mind that hedging isn't free. If you use futures, there may be funding fees (for perpetual contracts) or opportunity costs. Also, if the market goes the opposite of your fears (e.g., you hedged for a drop but price skyrockets instead), your hedge will have a cost (the losses on the futures or the missed gains). Think of it like paying an insurance premium - it hurts if you didn't end up needing it, but you may be very glad to have had it if the downturn happens.

BTC Hedging Example (source)

The 2025 Outlook: Futures in a maturing Bitcoin market

As of 2025, Bitcoin futures have grown tremendously since their inception in 2017. Nearly all major crypto exchanges and even traditional financial institutions (through ETFs and regulated markets like CME) offer Bitcoin futures trading. Here are a few trends and points relevant today:

-

High trading volumes: Bitcoin futures markets often see volumes rivaling or exceeding spot markets. This high liquidity means efficient pricing and execution for traders. You can enter large short or long positions with relatively low slippage on reputable exchanges.

-

Institutional adoption: More institutional players (hedge funds, asset managers, even corporations) are using futures. Some use them to hedge Bitcoin exposure on their balance sheets; others to speculate within a regulatory-compliant framework (since U.S. institutions might prefer CME futures or certain platforms). This has brought more stability and depth to the market.

-

Hedging demand: The volatile swings of past years (like the 2021 bull and 2022 bear markets) taught many participants the value of hedging. By 2025, the availability of futures, options, and other derivatives means even miners and long-term holders are more proactive in risk management. We’ve seen public mining companies disclose using futures to hedge production, for example, to ensure they can cover expenses. The concept of “miner capitulation” during price crashes has been mitigated somewhat by hedging practices – miners don’t have to panic-sell their reserves if they planned ahead with futures.

-

Perpetual swaps dominance: A special type of futures called perpetual contracts (or perpetual swaps) remains extremely popular. Perpetual futures have no expiry date; instead, they use a funding rate mechanism to keep the contract price tethered to the spot price. Traders can hold shorts or longs indefinitely. Most platforms (including Phemex) offer BTC perpetuals. These instruments make shorting/longing very flexible, essentially functioning like margin trading. They can be used for hedging too, but one must account for funding payments in a long-term hedge strategy.

-

Regulation and access: Futures trading has faced increased regulatory scrutiny, especially in some countries, but it continues to thrive globally. Platforms have improved security and transparency. By 2025, users have more choices to trade futures in a safe manner – with some exchanges offering features like insured funds or better risk controls. Always choose a reputable exchange for futures trading due to the leverage involved. With billions of dollars in daily futures trading volume and substantial open interest, Phemex provides the scale, liquidity, and product range that active Bitcoin futures traders look for in 2025.

In this environment, exchanges that specialize in crypto derivatives and provide robust hedging tools, such as Phemex, are increasingly favored by active traders and long‑term holders who want more control over their BTC exposure.

Conclusion

Bitcoin futures empower traders and investors with more ways to engage with the market. Shorting allows you to profit from price drops and manage downside risk. Longing lets you profit from price rises and gain exposure with less upfront capital. Hedging helps protect your Bitcoin holdings or mining income against adverse price moves.

Each strategy serves a different purpose: short and long positions capitalize on market views, while hedging focuses on preservation of value. In practice, a balanced approach using all these tools can help navigate Bitcoin’s notorious volatility. For newcomers, it’s wise to start small and educate yourself – perhaps begin with a simple long or short with low leverage to get familiar with how futures work. If you have substantial crypto assets or run a crypto business, consider learning about hedging to safeguard your investments.

The crypto derivatives market in 2025 is mature and accessible. With careful strategy and risk management, Bitcoin futures trading (whether you’re shorting, longing, or hedging) can be a powerful addition to your financial toolkit. Always remember: never risk more than you can afford to lose, and make use of stop-losses and risk controls.

Phemex offers a secure, derivatives‑focused venue to trade Bitcoin futures, combining deep liquidity, up to 100x leverage, diverse USDT‑margined, USDC‑margined, and coin‑margined contracts, and a Multi‑asset Mode that lets you use multiple assets as unified collateral. With practice on mock trading, clear educational content, and disciplined risk management, you can use short, long, and hedging strategies on Phemex to navigate Bitcoin’s volatility more effectively.

Frequently Asked Questions

What's the difference between Bitcoin spot trading and futures trading?

Spot trading involves buying/selling actual BTC immediately at current prices, while futures let you trade contracts for future delivery with leverage and directional bets.

Can beginners use Bitcoin futures?

Yes, but start with low leverage (1-5x) and practice on demo accounts to understand liquidation risks before using higher leverage.

What happens if my futures position gets liquidated?

If losses exceed your margin, the exchange automatically closes your position to prevent debt. Use stop-loss orders to avoid this.

Are Bitcoin perpetual futures better than traditional futures?

Perpetual futures have no expiry date and use funding rates to track spot prices, making them ideal for short/medium-term strategies.

How much should I risk on a single Bitcoin futures trade?

Never risk more than 1-2% of your total capital per trade to survive volatility and multiple losing trades.