Fragmented margin accounts can tie up your capital and limit your trading potential. What if you could unify your assets, offset losses with gains, and trade with more flexibility? Inroducing Phemex Multi-Assets Mode—now live on Phemex Futures for Web and App users. This unified margin system pools assets like BTC and ETH into one balance, boosting efficiency, lowering risks, and offering seamless multi-token collateral. Perfect for retail traders, high-frequency pros, or arbitrage strategists, Multi-Assets Mode is your key to smarter futures trading.

What is Multi-Assets Mode on Phemex?

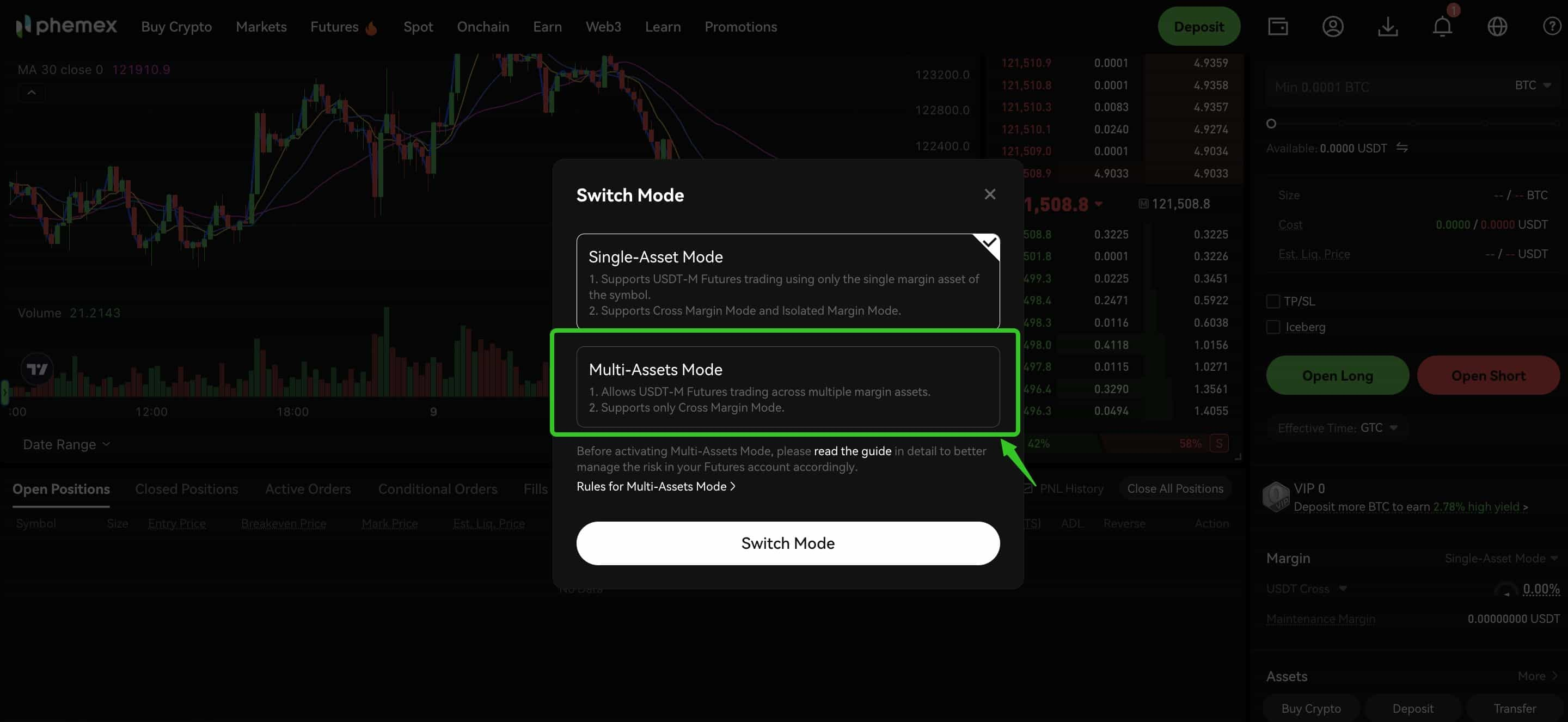

Phemex Futures offers two margin modes: Single-Asset Mode, where only USDT is used as margin for USDT-margined futures, and Multi-Assets Mode, which lets you use multiple currencies like BTC and ETH as collateral. Your margin balances are shared across all USDT cross-margined futures, so profits from one trade can offset losses in another.

Available on Web and App, this unified pool simplifies trading, giving you more control and flexibility.

Key Benefits of Multi-Assets Mode

Multi-Assets Mode is packed with features to level up your trading:

-

Higher Capital Efficiency: Pool all supported assets to maximize your capital—no more idle funds sitting in separate balances.

-

Lower Liquidation Risk: Profits from one position can offset losses in another, creating a safety net against market swings.

-

Multi-Token Collateral: Use BTC, ETH, and more as collateral for USDT-margined futures, perfect for dynamic strategies like hedging or arbitrage.

These perks help you trade smarter, with less hassle and more opportunities.

Why Multi-Assets Mode Matters for Traders

For retail traders, Multi-Assets Mode simplifies managing margins, letting you focus on market moves. For pros—high-frequency traders, institutions, or arbitrage experts—it’s a game-changer. Your portfolio acts as one cohesive unit, enabling complex strategies with confidence while reducing liquidation risks. It’s a new standard for futures trading on Phemex.

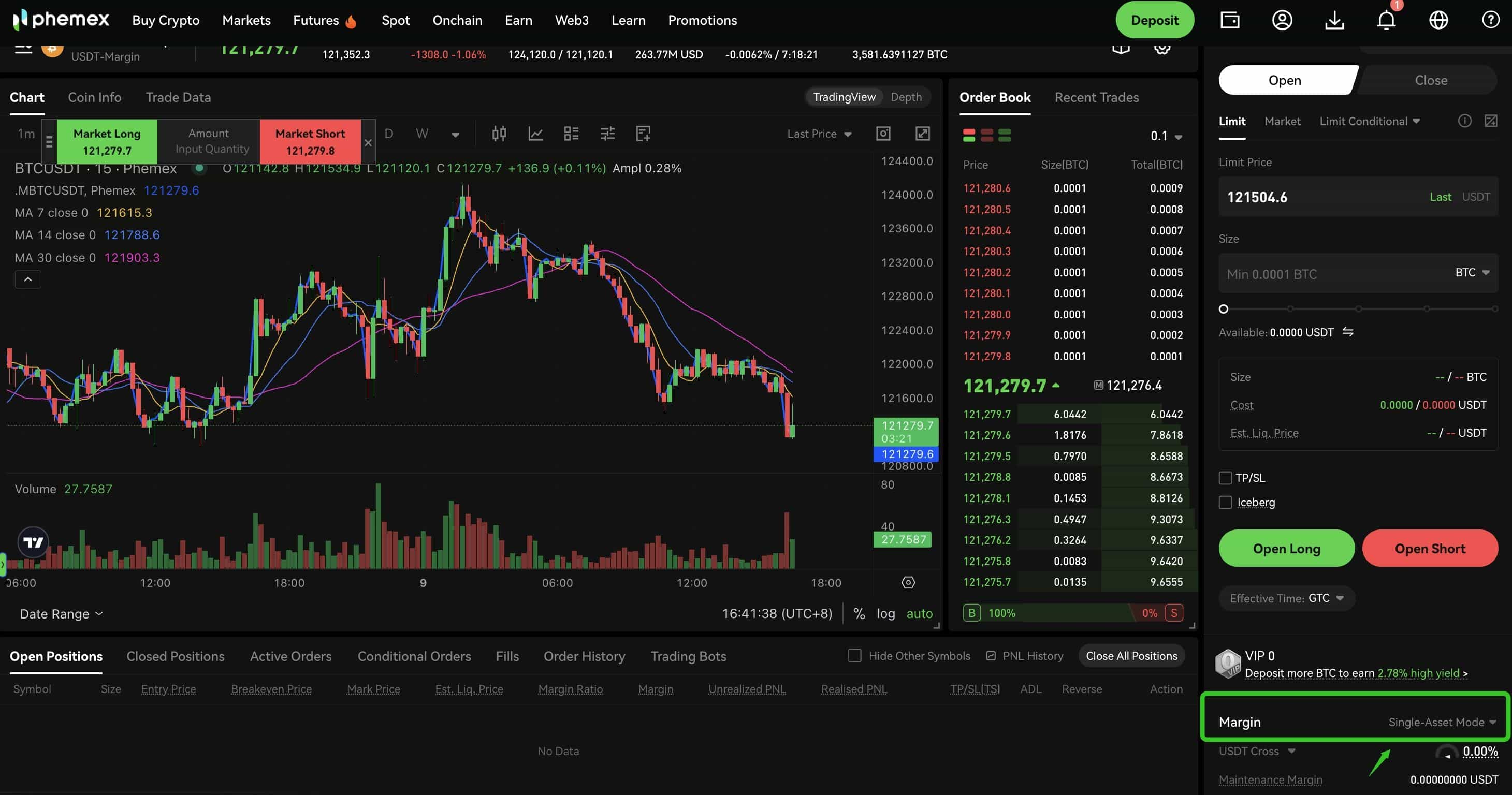

How to Enable Multi-Assets Mode in 4 Simple Steps

Activating Multi-Assets Mode is quick and easy:

-

Log in to Phemex: Sign in via the Web platform or mobile app.

-

Go to Futures Trading: Head to the Futures section in your dashboard.

-

Select Margin Mode: Click the Margin Mode option.

-

Switch to Multi-Assets Mode: Choose it, confirm, and start trading.

Note: Close any open USDT-margined futures positions or orders before switching to avoid issues.

Supported Assets and Eligibility

Multi-Assets Mode supports major assets like BTC and ETH as collateral, drawn from your spot wallet.

Any verified Phemex user with a futures account can use it—no minimum balance or special tiers needed. It’s accessible for beginners and pros alike.

Risks to Understand Before Using Multi-Assets Mode

Multi-Assets Mode is user-friendly, but futures trading has risks. Here’s what to keep in mind:

-

Switching Requirements: Close all USDT-margined positions and orders before enabling to ensure a smooth switch.

-

Market Volatility: While profits can offset losses, sharp market drops may still affect your margin. Monitor your balance closely.

-

Collateral Value: Assets like BTC or ETH are converted to USDT for margin (e.g., 98% for BTC), and volatile prices can impact available margin.

For more details, see Phemex's Multi-Assets Mode Risk Control Guide.

Elevate Your Trading with Multi-Assets Mode Today

Ready to unify your margins and trade with more control? Multi-Assets Mode is live on Phemex Futures, empowering you to seize opportunities with ease. Enable it now and experience smarter crypto trading.

Get Started with Multi-Assets Mode

FAQ About Multi-Assets Mode

What’s the difference between Single-Asset Mode and Multi-Assets Mode?

Single-Asset Mode uses only USDT as margin, while Multi-Assets Mode lets you use assets like BTC and ETH in a shared pool.

Can I switch back to Single-Asset Mode?

Yes, toggle modes in the Margin Mode settings, but close USDT-margined positions first.

Which assets are supported?

BTC and ETH are currently supported.

How does it help with risk management?

Shared margins let profits offset losses, reducing liquidation risks and boosting portfolio stability.